9 Best Auto Insurance Companies for Roadside Assistance in 2025 (Top Providers Ranked)

The best auto insurance companies for roadside assistance are Geico, State Farm, and American Family. Roadside assistance coverage starts at $14 per year. Roadside assistance plans typically include battery jumps, flat tires, towing, and locksmith services.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

UPDATED: Jul 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Roadside Assistance

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Roadside Assistance

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 2,235 reviews

2,235 reviewsCompany Facts

Roadside Assistance

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviewsThe best auto insurance companies for roadside assistance are Geico, State Farm, and American Family because they offer a variety of services at affordable prices.

Our Top 9 Company Picks: Best Auto Insurance Companies for Roadside Assistance

| Company | Rank | Roadside Assistance | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $14 | A++ | Affordable Coverage | Geico | |

| #2 | $15 | A++ | Reliable Service | State Farm | |

| #3 | $20 | A | Budgeting Tools | American Family |

| #4 | $21 | A+ | Personalized Service | Progressive | |

| #5 | $22 | A+ | Older Drivers | AARP | |

| #6 | $35 | A+ | Policy Customization | Nationwide | |

| #7 | $44 | A++ | Military Families | USAA | |

| #8 | $54 | A | Plan Options | AAA |

| #9 | $60 | A+ | Comprehensive Policies | Allstate |

Many drivers might opt to skip roadside assistance, especially when looking for the cheapest auto insurance companies, but it’s usually an affordable coverage option.

In fact, roadside assistance costs start as low as $14 per year. Check out our picks for the best auto insurance companies for roadside assistance below.

- Geico is one of the best auto insurance companies for roadside assistance

- Roadside assistance plans start at just $14 annually

- Roadside assistance typically covers flat tires, dead batteries, and towing

Then, enter your ZIP code into our free comparison tool to find the best roadside assistance plans for your needs and budget.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Roadside Assistance Cost

Roadside assistance is a simple and low-cost add-on to your auto insurance that can really help during car troubles. Whether it’s a dead battery, a flat tire, or getting locked out, knowing what each plan covers and how much it costs helps you pick the right one.

Roadside Assistance Plans: Cost & Coverage Details

| Company | Annual Rates | Covered Distance | Calls per Year |

|---|---|---|---|

| $54 | 200 miles | 4 |

| $22 | 200 miles | 7 | |

| $60 | 10 miles | 5 | |

| $20 | $100 per use | Unlimited |

| $14 | 20 miles | 5 | |

| $35 | 100 miles | 6 | |

| $21 | 15 miles | 5 | |

| $15 | 10 miles | Unlimited | |

| $44 | 50 miles | 5 |

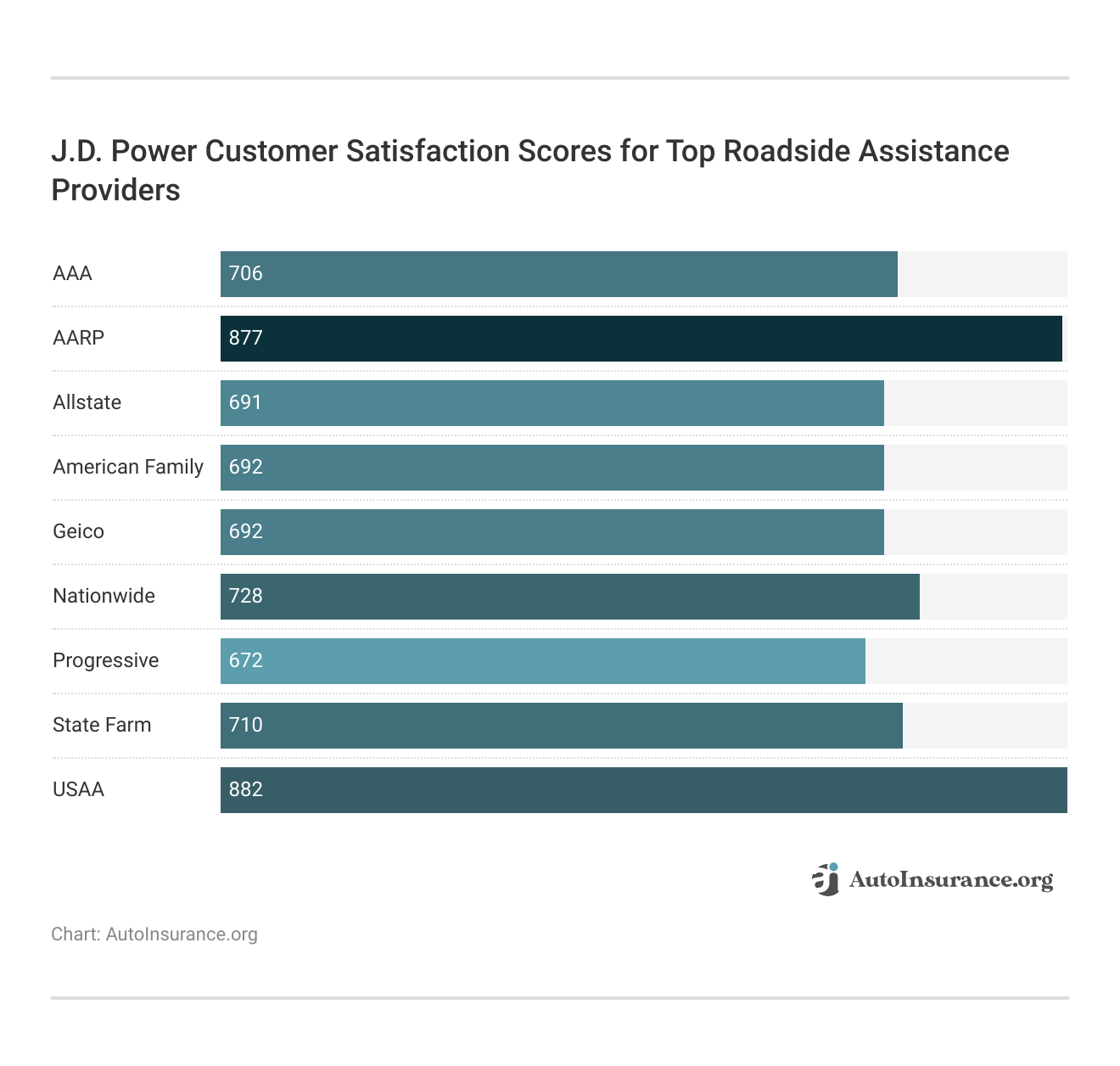

You may be wondering, “What is the best roadside assistance company?” When bundled with auto insurance, plans from top providers like State Farm, Geico, Progressive, and American Family can cost as little as $1 to $6 per month. These low-cost add-ons are a great option for drivers seeking affordable roadside assistance without compromising reliability.

Factors such as age and location impact the price of roadside coverage. For example, drivers in rural areas or with older cars may experience slightly higher prices.

Providers like AAA and AARP offer plans ranging from $2 to $11 per month, with benefits such as towing for up to 200 miles, battery jump-starts, lockout help, and more. These companies are often considered among the best roadside assistance company choices available today.

Read more: Auto Insurance Laws

Roadside Assistance Coverage Options

Knowing what’s included in your plan can help you choose the best-rated roadside assistance for your needs. Many top providers offer the best roadside assistance service with helpful features like towing, jump-starts, fuel delivery, lockout help, and more.

If you’re looking for the best roadside service company, it’s important to understand how each type of coverage works so you can get the right support when you need it most.

Towing

Towing is a crucial component of a roadside assistance plan. It’s helpful when your car breaks down, won’t start, or is involved in an accident, and you can’t drive it. Most plans will tow your car to the closest repair shop. Some allow you to choose where it goes, as long as it’s within a certain number of miles.

If your engine dies on the way to work, roadside assistance can send a tow truck to a nearby repair shop with no added cost beyond your plan.Schimri Yoyo Licensed Agent & Financial Advisor

For example, the Geico roadside assistance towing mileage limit only covers towing to the nearest repair location, which may not work for everyone. When doing a roadside assistance comparison, be sure to check how far your car can be towed and if you get to pick the shop.

Many drivers look at the top roadside assistance companies, like AAA, Progressive, or Allstate, to find better options. If you want more control and help when it counts, go with the best roadside assistance for towing that fits your driving needs.

Learn More: Do you need auto insurance to be towed?

Battery Jump-Start

If your car battery dies, the best roadside assistance plans in the U.S. will send someone to jump-start it for you. It’s a fast and easy way to get back on the road without calling a tow truck.

Some insurance companies also offer battery testing or even replacement, but it may cost extra.

AAA roadside assistance is a popular choice for this kind of help because they’re known for showing up quickly. If you live in a hot state like Florida, having the best roadside assistance is crucial, as heat can cause car batteries to wear out faster.

There are many companies that offer roadside assistance, and it helps to check a list of them to see which ones include battery jump-starts in their plans. This small service can save you time, money, and stress when your car won’t start.

Flat Tire Change

If you get a flat tire, most roadside assistance plans will send someone to change it using your spare tire. This is a common part of roadside auto coverage, helping you avoid doing it yourself on the side of the road. If you don’t have a good spare, the provider may tow your car to a repair shop instead.

American Family roadside assistance includes this service, which is helpful if you want a plan that handles flat tires quickly. Many drivers also look for the best roadside service to make sure they’re covered in these situations. Having this kind of help gives peace of mind and makes dealing with a flat tire a lot easier.

Read more: Does auto insurance cover flat tires?

Winching

Winching is a service that helps if your car gets stuck in mud, snow, sand, or a ditch. Most roadside assistance plans send one truck to pull your car out. Some may send extra help if you’re near a paved road. Many plans with 24/7 roadside assistance include winching, which is great if you drive in the country or in bad weather.

If you’re looking for the best roadside recovery service, make sure winching is part of the plan. Some of the best-rated breakdown cover plans offer quick help and clear rules on how far they’ll go to reach you. It’s smart to know what your plan covers so you’re not stuck with surprise costs when you need help the most.

Read more: The Three-Tire Rule Defined

Lockout Service

Locking your keys inside your car can happen to anyone. Most roadside assistance plans in the U.S. will send someone to help unlock your vehicle so you can get back on the road.

Some providers also help pay part of the cost for a locksmith or a new key, up to a set amount. If you’re checking the best roadside assistance reviews, lockout service is one of the top features drivers look for.

AAA Annual Cost and Coverage for Roadside Assistance Plans

| Plan | Cost | Information |

|---|---|---|

| Classic | $54 per year ($20 fee for new members) | Towing, lockout, dead battery, flat tire, fuel delivery, 3-mile towing limit , Discounted rates on rental cars |

| Plus | $90 per year $20 fee for new members) | Includes all Classic plan services, 100-mile towing limit, free emergency fuel, vehicle locksmith services ($100 limit) |

| Premier | $127 per year $20 fee for new members) | Includes all Plus plan services, 1 tow up to 200 miles, remaining tows up to 100 miles, free 1-day car rental with tow, home lockout service |

You’ll also find it in many of the best roadside assistance deals from companies like Geico, AAA, and Allstate. Not all plans cover the same things, so it’s a good idea to read the details before signing up. Having lockout service included in your plan gives you peace of mind, especially when you’re in a hurry and lock your keys in by mistake.

Find out if auto insurance covers bullet holes to understand what’s covered and choose the right protection for your car.

Fuel Delivery or Electric Vehicle (EV) Charging

If you run out of gas or your EV loses power, roadside assistance can bring fuel or tow your car to the nearest gas station or charging station. Some companies also offer mobile charging for electric vehicles. Depending on your plan, the fuel or electricity might be free, or you may just pay for what you use.

When looking at Nationwide roadside assistance vs. AAA, it’s important to see which one offers better fuel or EV help. Some plans give more coverage, while others have limits.

Roadside assistance is a simple and low-cost add-on to your auto insurance that can really help during car troubles.Jeffrey Manola Licensed Insurance Agent

Many people ask, What is the best roadside assistance? The answer depends on your car and how often you drive. This service can give you peace of mind so you’re not stuck without help.

Roadside assistance gives drivers peace of mind by covering common car problems like breakdowns, dead batteries, flat tires, and more. Understanding your coverage options helps you choose a plan that fits your needs and keeps you protected when you’re stuck on the road.

Read more: Best Auto Insurance Discounts for Electric Vehicles

How to Find the Best Roadside Assistance Plan

To find the best car roadside assistance, compare the number of service calls allowed per year, towing limits, and extra features like fuel delivery or flat tire changes. Companies such as Nationwide, Allstate, and USAA offer different coverage levels to suit various needs, making them strong contenders for the best breakdown cover company and best breakdown service.

Choosing the right roadside assistance plan means finding a good balance between cost and coverage. Whether you just need basic help or want the most reliable service, comparing plans helps ensure you get the protection you need when it really counts.

For fast and reliable service, review the plan’s coverage and check out customer reviews before selecting a provider.

Read more: Best Auto Insurance Discounts

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Roadside Assistance Coverage

You can save money on roadside assistance by checking for discounts from different providers. Some companies offer lower prices for students, safe drivers, or when you bundle roadside help with your auto or home insurance. If you rent cars a lot, it’s smart to look for the most reliable roadside assistance for rental cars, so you’re not stuck with high rental fees.

If you take road trips, it’s a good idea to choose a plan that offers top-rated roadside help for long drives, so you’re covered far from home. Drivers who rent cars should consider top-rated car rental roadside assistance for enhanced support while traveling.

It also helps to compare State Farm roadside assistance vs. AAA to find out which plan offers the best value for your money. Many companies offer the best roadside assistance for seniors, making it easier and more affordable for older drivers to stay safe on the road.

Read more: How to Evaluate Auto Insurance Quotes

9 Best Auto Insurance Companies for Roadside Assistance

Geico, State Farm, and American Family are top picks for reliable roadside help, offering services like towing, jump-starts, and lockout support. If you’re wondering, “What is the best roadside assistance?”, these providers offer trusted options at affordable rates. Comparing their plans can help you find the best fit for your needs.

#1 – Geico: Top Pick Overall

Pros

- Low Cost: Geico roadside assistance begins at only $14, so it is a low-cost option. Explore potential rates in our Geico auto insurance review.

- Covers Essentials: Includes towing (up to 20 miles), battery jump-starts, lockouts, and flat tire service.

- Easy Access via App: You can request roadside help fast through the mobile app without calling.

Cons

- Limited Services: Its roadside help doesn’t cover as much as some other companies.

- No Trip Reimbursement: Doesn’t include help with travel costs if your car breaks down far from home.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Reliable Service

Pros

- Nationwide Coverage: Offers roadside help in all 50 states, making it dependable for drivers who travel often.

- Agent-Backed Service: You can contact your local State Farm agent directly for roadside assistance.

- Strong Response Record: Known for fast and reliable emergency service among top roadside providers. Learn more about its services in the State Farm auto insurance review.

Cons

- Separate Add-On Required: Roadside help isn’t included automatically—you have to ask for it when building your policy.

- Limited App Features: The app doesn’t include real-time tracking for service calls.

#3 – American Family: Best for Smart Budgeting Tools

Pros

- Budget-Friendly Price: Roadside coverage costs $20 per year, a good value among affordable plans. The American Family auto insurance review provides more price details.

- Track Spending in App: Their app lets you monitor roadside costs and manage service requests easily.

- Covers Basic Needs: Includes towing, fuel delivery, battery service, and lockouts.

Cons

- Not Available Everywhere: American Family’s roadside plans aren’t offered in all U.S. states.

- No Advanced Features: The plan doesn’t offer things like trip coverage or towing beyond local range.

#4 – Progressive: Best for Personalized Service

Pros

- Flexible Coverage Options: Lets you choose the services and towing limits that fit your needs.

- Simple Digital Requests: The Progressive app allows quick roadside service without phone calls.

- Good for Bundling: Save more when combining roadside with other discounts or programs. Learn more about bundling through our guide Progressive auto insurance review.

Cons

- Higher Annual Cost: Roadside assistance costs about $21 per year, more than most budget options.

- Service May Vary: Some users report slower or less consistent service in certain areas.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – AARP: Best for Older Drivers

Pros

- Senior-Focused Features: Includes roadside help, towing, and trip interruption coverage made for older drivers.

- Extra Perks for Members: Benefits include accident forgiveness and new car replacement for eligible drivers.

- Reliable Partner: AARP is known for dependable roadside help. The AARP auto insurance review highlights its reliability, especially for older drivers in emergencies.

Cons

- Membership Required: You must pay for an AARP membership to get access to their roadside program.

- Slightly Higher Price: The plan starts at $22 per year, which is more than basic plans from other companies.

#6 – Nationwide: Best for Policy Customization

Pros

- Customizable Roadside Help: Choose towing distance, trip coverage, and extra services when building your policy.

- Covers More Situations: Includes towing, jump-starts, fuel delivery, and trip interruption.

- Trusted Insurance Brand: The Nationwide auto insurance review highlights its A+ rating, showing strength and reliability in emergency roadside situations.

Cons

- Higher Cost: It is more costly than most other competitors who provide comparable roadside protection at $35 per year.

- Too Many Options: Plan setup can be confusing for drivers who aren’t sure what they need.

#7 – USAA: Best for Military Families

Pros

- Military-Focused Plan: One of the best auto insurance companies for roadside assistance for active military, veterans, and families.

- Full Coverage for Emergencies: As one of the top providers for roadside help, USAA includes towing, lockout service, jump-starts, and fuel delivery in its roadside assistance.

- Strong Reputation: USAA is routinely one of the top-rated auto insurance providers for roadside service based on its well-respected service and reliable response times

Cons

- Not Open to Everyone: Unlike most of the auto insurance companies for roadside assistance, USAA only serves military members and their families, limiting its availability.

- Higher Cost: USAA auto insurance review shows that its roadside assistance is priced higher than average.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – AAA: Best Roadside Assistance Plans

Pros

- Military-Focused Plan: One of the best auto insurance companies for roadside assistance for active military, veterans, and families. Learn more about this plan in our AAA auto insurance review.

- Extra Member Benefits: Includes hotel discounts, travel planning, and DMV services.

- Nationwide Trusted Service: Long history of dependable roadside help with wide U.S. coverage.

Cons

- Most Expensive Option: Starts at $54 per year, making it the priciest choice on this list.

- Membership Required: You must join AAA and pay a yearly fee, even if you only want roadside coverage.

#9 – Allstate: Best for Comprehensive Coverage

Pros

- No Policy Needed: You can buy roadside help from Allstate even if your car insurance is with another company.

- Pay-Per-Use Available: Great for drivers who only want to pay when they actually need help.

- Covers Wide Range of Problems: Includes towing, battery service, lockouts, fuel delivery, and even help with tech issues in some plans.

Cons

- Highest Annual Cost: At $60 per year, it’s the most expensive roadside option on this list. See how much you might pay in our Allstate auto insurance review.

- Service Delays in Some Areas: Some drivers say response times can be slow, especially in rural locations.

How to Choose the Best Roadside Assistance Plan

Choosing the right roadside assistance plan depends on how often you drive, where you go, and what kind of help you might need in an emergency. If you drive long distances or live in a rural area, you’ll want a plan that includes towing, fuel delivery, and fast service. Start by doing an emergency roadside assistance comparison to see what each provider includes.

Many drivers skip roadside assistance to save money, but it’s usually a low-cost add-on worth considering.Daniel Walker Licensed Auto Insurance Agent

If you’re thinking about State Farm, reading our State Farm roadside assistance review can help you learn what other drivers think. Some people also ask,” Is State Farm roadside assistance available 24/7?” Yes, most plans from them offer around-the-clock help. It’s smart to look into the top roadside assistance plans to see which ones are the most trusted.

You can also check the top 4 online roadside assistance platforms to compare prices and features. When asking, “Which recovery service is the best?” pick the one that fits your needs and provides help when it really matters.

Read more: What are the recommended auto insurance coverage levels?

Now that you know the best roadside assistance options, enter your ZIP code to compare plans today.

Frequently Asked Questions

Does auto insurance cover roadside assistance?

No, traditional auto insurance policies typically do not cover roadside assistance. However, you can purchase supplemental insurance specifically for roadside assistance either from your current auto insurance company or from a third-party provider.

What is roadside assistance coverage in auto insurance?

Roadside assistance coverage is an optional add-on to auto insurance policies that provides assistance and services when your vehicle breaks down or experiences a mechanical failure. It typically covers services like towing, battery jump-start, fuel delivery, tire change, and lockout assistance.

Find the cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

Why is roadside assistance coverage important?

Roadside assistance coverage can be beneficial in situations where your vehicle becomes disabled due to various reasons, such as a flat tire, a dead battery, or engine failure. Having this coverage can provide you with peace of mind and help you get back on the road quickly without incurring significant out-of-pocket expenses.

Read more: Types of Auto Insurance Coverage

Which auto insurance companies offer the best roadside assistance coverage?

Several auto insurance companies offer reliable and comprehensive roadside assistance coverage. While individual preferences may vary, here are some well-regarded companies known for their roadside assistance programs:

- AAA

- Allstate

- Geico

- Progressive

- State Farm

What factors should I consider when evaluating roadside assistance coverage?

When evaluating roadside assistance coverage, consider the following factors:

- Services Offered: Check what services are included, such as towing distance limits, battery jump-starts, fuel delivery, tire changes, lockout assistance, and more.

- Coverage Limits: Review the coverage limits for each service, such as the number of tows allowed per year or the maximum reimbursement amount.

- Availability: Determine if the coverage is available 24/7 and whether it extends across multiple locations or only within a limited range.

- Cost: Compare the cost of adding roadside assistance coverage to your policy and any deductibles or additional fees associated with the service.

- Customer Reviews: Research customer feedback and ratings to gauge the quality and reliability of the company’s roadside assistance program.

Can I add roadside assistance coverage to my existing auto insurance policy?

In most cases, yes. Many auto insurance companies allow you to add roadside assistance coverage to your existing policy for an additional premium. Contact your insurance provider to inquire about adding this coverage and to understand the associated costs and terms.

Read more: What are the benefits of auto insurance?

Is roadside assistance coverage worth the cost?

Whether roadside assistance coverage is worth the cost depends on your individual needs, preferences, and the potential risks you may encounter while driving. If you frequently travel long distances, have an older vehicle, or want the convenience of professional assistance in case of breakdowns, then roadside assistance coverage can be valuable.

How do I use roadside assistance coverage if I need help?

If you require roadside assistance, contact your insurance company’s designated helpline or emergency assistance number. Provide them with details about your location, the issue you’re facing, and any other relevant information they may require. They will dispatch a service provider to assist you based on the terms and coverage of your policy.

Will using roadside assistance affect my insurance rates?

In general, using roadside assistance coverage provided by your insurance company should not directly impact your insurance rates. Roadside assistance claims are typically classified separately from traditional auto insurance claims, and they are not typically considered when determining your premium.

However, it’s always a good idea to consult with your insurance provider to understand their specific policies regarding this matter.

Read more: Factors That Affect Auto Insurance Rates

Will my traditional auto insurance policy provide roadside assistance following an accident?

Your traditional auto insurance policy may provide roadside assistance if the need for it arises from a situation in which a valid claim is filed. For example, if your car needs towing after a collision and you have collision coverage, your insurance should cover the cost of the tow truck.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.