Cheapest Teen Driver Auto Insurance in Alabama for 2026 (Only $100/mo!)

USAA, Geico, and Nationwide offer the cheapest teen driver auto insurance in Alabama, with monthly rates starting at $56. USAA claims the top spot overall, thanks to exclusive military-family discounts, while Geico is next due to its low-cost options, and Nationwide distinguishes itself with usage-based savings.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated August 2025

Company Facts

Alabama Teen Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Alabama Teen Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Alabama Teen Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

The top providers for the cheapest teen driver auto insurance in Alabama are USAA, Geico, and Nationwide. These companies offer some of the most competitive rates, as low as $56 a month, tailored specifically for young drivers in Alabama.

USAA takes the top spot overall, providing excellent savings for military families, while Geico offers the best rates for budget-conscious families. Nationwide stands out with discounts based on driving habits, making it a great option for families who want to reduce costs even further.

Other great Alabama auto insurance companies for teens are listed below. These companies offer the best overall choice with cheap car insurance rates in Alabama.

Top 10 Companies: Cheapest Auto Insurance for Teen Drivers in Alabama

| Company | Rank | Monthly Rates | Good Student | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $97 | 25% | Military Savings | USAA | |

| #2 | $109 | 15% | Various Discounts | Geico | |

| #3 | $177 | 15% | Usage Discount | Nationwide |

| #4 | $199 | 25% | Many Discounts | State Farm | |

| #5 | $208 | 35% | Add-on Coverages | Allstate | |

| #6 | $288 | 12% | Deductible Reduction | The Hartford |

| #7 | $288 | 12% | Customizable Polices | Liberty Mutual |

| #8 | $347 | 20% | Local Agents | Farmers | |

| #9 | $404 | 8% | Accident Forgiveness | Travelers | |

| #10 | $436 | 10% | Online Convenience | Progressive |

To find cheap auto insurance in Alabama for teen drivers today, compare rates using our free tool.

- USAA offers cheap car insurance for teens in Alabama at $97 a month

- Geico is for budget-conscious families seeking cheap auto insurance in Alabama

- Nationwide offers habit-based discounts that reward safe driving behaviors

With affordable car insurance premiums and extensive discount opportunities, these insurers are ideal for budget-conscious families.

What Alabama Teens Are Charged for Auto Insurance

So, who has the cheapest car insurance in Alabama? Teen drivers in Alabama need to be on top of their insurance game, meeting the state’s bare minimums:

- $25,000 for bodily injury per person,

- $50,000 per accident, and

- $25,000 for property damage per accident.

These aren’t suggestions; they’re the law.

Alabama Teen Driver Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $208 | $513 | |

| $347 | $855 | |

| $109 | $267 | |

| $288 | $711 |

| $177 | $434 | |

| $436 | $1,073 | |

| $199 | $490 | |

| $288 | $670 |

| $404 | $994 | |

| $97 | $239 |

USAA, Geico, and Nationwide emerge as the top choices for the cheapest auto insurance in Alabama, with USAA offering the lowest rates for both minimum and full coverage. As the list progresses, the rates increase, with companies like Progressive and Travelers representing higher-cost options for teen drivers seeking insurance coverage in Alabama.

USAA emerges as the top choice for Alabama teen drivers, offering the lowest rates and comprehensive coverage tailored to their needs.Dani Best Licensed Insurance Producer

Sure, sticking to these basics might get you cheap car insurance for teenagers, but it’s a gamble. With just the minimum coverage, you’re playing a risky game. So, it’s smart for teens to consider beefing up their policies with full coverage. It might cost a bit more, but it’s worth the peace of mind.

Read More: Best Yearly Premium Auto Insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Affect Teen Auto Insurance Rates in Alabama

Teen auto insurance in Alabama tends to be more expensive than for older drivers, largely because of the higher risks associated with inexperience on the road. Several key factors determine how much families can expect to pay:

- Age and Gender: Younger drivers, especially males, typically face higher premiums due to higher accident risks.

- Driving Record: Speeding tickets, accidents, or DUIs can significantly raise insurance costs.

- Coverage Level: Minimum liability is cheaper, but full coverage offers better protection at a higher cost.

- Location: Teens in urban areas like Birmingham often pay more than those in rural areas due to higher accident and theft rates.

- Vehicle Choice: Driving safer, modestly priced cars lowers premiums, while sports or luxury cars increase costs.

Teen car insurance in Alabama is shaped by a mix of personal factors (age, gender, driving record) and external ones (location, type of car, coverage level). Families can lower costs by shopping around, leveraging discounts, and encouraging teens to maintain safe driving habits.

Read More: Factors That Affect Auto Insurance Rates

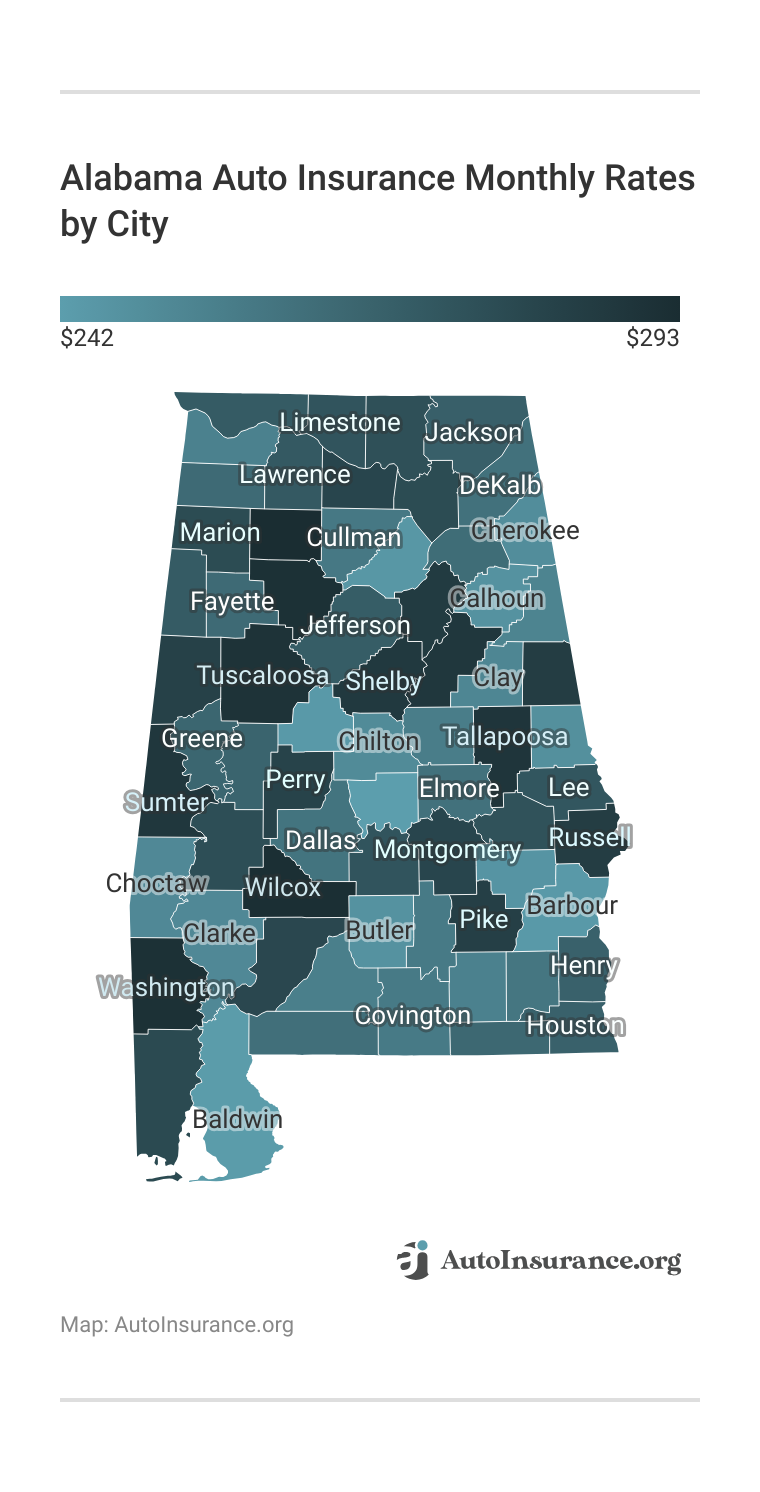

How Location Impacts Teen Car Insurance Rates in Alabama

Location is a crucial determinant of auto insurance rates in Alabama, influencing the premiums paid by drivers. Factors such as population density, crime rates, and traffic congestion can vary significantly from one location to another, thereby impacting insurance costs.

10 Largest Alabama Cities: Teen Driver Auto Insurance Premiums

| City | Monthly Rate |

|---|---|

| Dothan | $242 |

| Decatur | $245 |

| Hoover | $250 |

| Madison | $252 |

| Huntsville | $255 |

| Tuscaloosa | $263 |

| Auburn | $263 |

| Montgomery | $278 |

| Mobile | $285 |

| Birmingham | $293 |

Urban areas, characterized by higher population densities and increased vehicular traffic, often present greater risks of accidents, theft, and vandalism, leading to higher insurance premiums. On the other hand, rural areas typically have lower insurance rates due to fewer accidents and lower incidences of theft or vandalism.

Additionally, specific neighborhoods within a city may have varying risk levels, further influencing insurance pricing.

Therefore, when assessing auto insurance rates in Alabama, it’s essential to consider the geographical location and its associated risk factors alongside age, gender, and driving record.

How Age & Gender Impacts Teen Car Insurance Rates in Alabama

The table shows monthly auto insurance rates in Alabama categorized by age, gender, and coverage level. Rates vary significantly based on these factors. For example, a 16-year-old female can expect to pay around $192 monthly for minimum coverage, while a 21-year-old male might pay $139 for the same coverage.

Alabama Teen Driver Auto Insurance Monthly Rates by Age

| Insurance Company | Age: 16 | Age: 17 | Age: 18 | Age: 19 | Age: 20 |

|---|---|---|---|---|---|

| $243 | $226 | $208 | $190 | $172 | |

| $405 | $376 | $347 | $318 | $289 | |

| $126 | $118 | $109 | $101 | $92 | |

| $336 | $312 | $288 | $264 | $240 |

| $206 | $192 | $177 | $163 | $148 | |

| $507 | $472 | $436 | $401 | $365 | |

| $232 | $216 | $199 | $183 | $166 | |

| $335 | $312 | $288 | $265 | $241 |

| $470 | $437 | $404 | $371 | $338 | |

| $113 | $105 | $97 | $89 | $81 |

Full coverage rates also differ, with premiums generally higher for younger drivers and males across all age groups. As you can see, the rates for Alabama auto insurance for a 15-year-old are going to be different from the rates for Alabama auto insurance for a 16-year-old, as age affects rates.

Read more in our article: Cheapest Liability-Only Auto Insurance.

How Your Driving Record Impacts Teen Car Insurance Rates in Alabama

One of the reasons auto insurance costs more for young drivers is a lack of driving experience, as teens are more likely to get into accidents. Teens with poor driving records will have much higher Alabama car insurance rates.

Alabama Teen Driver Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $208 | $281 | $364 | $250 | |

| $347 | $468 | $607 | $416 | |

| $109 | $147 | $191 | $131 | |

| $288 | $389 | $504 | $346 |

| $177 | $239 | $310 | $212 | |

| $436 | $589 | $763 | $523 | |

| $199 | $269 | $349 | $239 | |

| $288 | $389 | $504 | $346 |

| $404 | $545 | $707 | $485 | |

| $97 | $131 | $170 | $116 |

This data presents monthly auto insurance rates for different age groups, genders, and driving records in Alabama. Rates vary significantly based on factors like age, gender, and driving history. For instance, insurance rates for new drivers typically face higher premiums, with males generally paying more than females.

Additionally, those with a history of speeding tickets, at-fault accidents, or DUI/DWI offenses face increased insurance costs. As drivers mature, rates generally decrease, reflecting a presumed decrease in risk.

For additional details, explore “Cheap Auto Insurance for Teens After an Accident.”

How Teen Drivers Can Save on Auto Insurance in Alabama

A lot of big auto insurance companies offer programs for young drivers, including discounts for good grades, safe driving, and even low mileage. Below are the top auto insurance discounts for teen drivers in Alabama and how each company rewards good behavior and lifestyle choices.

Top Auto Insurance Discounts for Teen Drivers in Alabama

Company Anti-

TheftGood

StudentLow

MileageSafe

DriverUsage

Based

10% 35% 30% 18% 40%

10% 20% 10% 20% 30%

25% 15% 30% 15% 25%

35% 12% 30% 20% 30%

5% 15% 40% 12% 40%

25% 10% 30% 10% 20%

15% 25% 30% 20% 30%

10% 12% 10% 8% 20%

15% 8% 20% 17% 30%

15% 25% 20% 10% 30%

As you can see, discounts vary by company and program. Nationwide and Allstate offer up to 40% for usage-based insurance programs, while Liberty Mutual and Geico offer big savings for low-mileage drivers. Families who combine multiple discounts (good student and safe driver) can see big reductions in their teens’ premiums.

Adding a Teen Driver to Your Alabama Auto Insurance Policy

Adding a teen driver to your existing auto insurance policy can be a straightforward process, often accessible through various channels provided by your insurance company. Many insurers offer the convenience of adding a new driver, including teens, directly through their online platforms or mobile apps.

With just a few clicks or taps, you can update your policy to include your teenage driver. Alternatively, if you prefer a more personal touch or have specific questions, reaching out to your insurance provider via phone allows you to speak directly with a representative who can guide you through the process.

Alabama Auto Insurance Monthly Rates by Age, Gender, & Policy Type

| Age & Gender | Individual | Parent's Policy |

|---|---|---|

| 16-Year-Old Female | $312 | $332 |

| 16-Year-Old Male | $352 | $349 |

| 17-Year-Old Female | $393 | $320 |

| 17-Year-Old Male | $471 | $335 |

| 18-Year-Old Female | $473 | $305 |

| 18-Year-Old Male | $545 | $334 |

| 19-Year-Old Female | $393 | $318 |

| 19-Year-Old Male | $471 | $333 |

| 20-Year-Old Female | $238 | $351 |

| 20-Year-Old Male | $238 | $369 |

| 21-Year-Old Female | $374 | $320 |

| 21-Year-Old Male | $392 | $335 |

It’s important to anticipate that adding a teen driver to your policy will likely result in an increase in your insurance premiums. However, despite the higher rates associated with insuring young drivers, incorporating them into your existing policy helps you get a more cheap insurance in Alabama than having the teen obtain their separate insurance coverage.

Additionally, by being included in a family policy, teen drivers can benefit from the collective driving experience and history of the household, potentially leading to the cheapest Alabama auto insurance.

To learn more, explore our comprehensive resource: “Does the car a teen drives affect auto insurance rates?”

Grace Period for Insuring a Teen Driver in Alabama

The grace period refers to the time a teen has to join an auto insurance policy after getting their driver’s license. The grace period varies by company, but it is important for families to add a new driver as quickly as possible to avoid the teen driving without insurance. To gain further insights, read our comprehensive guide “Helping Teen Drivers Get Their First License.”

Therefore, families are encouraged to contact their insurance provider as soon as possible after their teen receives their driver’s license. In most cases, the provider will issue an insurance endorsement—a formal adjustment to the existing policy—to add the new driver. This ensures seamless integration into the coverage and provides peace of mind and comprehensive protection for everyone on the road.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

10 Cheapest Teen Driver Auto Insurance Companies in Alabama

When it comes to securing affordable insurance for teen drivers in Alabama, USAA, Geico, and Nationwide emerge as top contenders, consistently offering some of the most competitive rates in the market. These insurance providers not only prioritize affordability but also provide a range of beneficial features tailored specifically to teen drivers.

#1 – USAA: Top Overall Pick

Pros

- Exclusive Military Savings: USAA offers some of the most affordable teen driver auto insurance in Alabama, but only for military families. SafePilot can cut costs by up to 30%.

- Substantial Student Benefits: Teen drivers who maintain good grades can qualify for a 15% discount as a good student. Learn more in our USAA car insurance review.

- Accident Forgiveness Protection: Some of USAA’s policies include accident forgiveness that helps prevent rate hikes after a first accident.

Cons

- Eligibility Limits: Coverage is restricted to military members and their families, excluding most households in Alabama.

- Limited Local Access: With fewer in-person offices than State Farm or Allstate, most interactions must be conducted online.

#2 – Geico: Best for Various Discounts

Pros

- Anti-Theft Savings: Geico offers a 25% anti-theft discount, helping Alabama parents insure teen drivers with safer, newer cars.

- Responsible Driving Discounts: Teen drivers earn up to a 15% safe driver discount plus a 10% low mileage discount.

- Stackable Savings: Geico allows combining discounts, including multi-policy and good student, for additional savings. Learn more about Geico’s rates in our Geico auto insurance company review.

Cons

- Lower Usage-Based Discounts: Maximum telematics savings are capped below Nationwide’s 40% SmartRide.

- Agent Availability: Geico has fewer local Alabama agents, limiting personal guidance compared to State Farm.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#3 – Nationwide: Best for Usage-Based Discounts

Pros

- SmartRide Program: Teen drivers can save up to 40% with usage-based discounts, among the highest in Alabama.

- Academic Savings: A 15% good student discount rewards teens who maintain strong grades.

- Accident Forgiveness Option: Helps families avoid drastic premium increases after a first accident claim. You can learn more in our Nationwide auto insurance review.

Cons

- Small Anti-Theft Discount: Nationwide offers only 5% savings on anti-theft devices, which is a bit lower than Liberty Mutual’s 35%.

- Tech Reliance: A full 40% telematics discount is available, but it requires teens to enroll in SmartRide, which may not be preferred by all families.

#4 – State Farm: Best for Many Discounts

Pros

- Strong Student Incentives: Offers a 25% discount for good students, among the highest available in Alabama.

- Drive Safe & Save Program: Usage-based discounts up to 20% reward safe driving habits for teens.

- Agent Support: One of the largest local agent networks in Alabama, giving families in-person help. Read more in our full review of State Farm’s auto insurance.

Cons

- Moderate Telematics Savings: The Maximum 20% Drive Safe & Save discount is lower than Allstate’s or Nationwide’s 40%.

- Premium Spikes: Multiple at-fault accidents can sharply increase teen driver rates in Alabama.

#5 – Allstate: Best for Add-on Coverages

Pros

- Highest Student Discount: Allstate offers a 35% good student discount, the best among major insurers in Alabama.

- Drivewise Telematics: Offers up to 40% in savings, matching Nationwide’s teen driver usage-based discounts.

- Claim Protection: Accident forgiveness is available to shield families from sudden rate hikes. Read more about this provider in our Allstate auto insurance review.

Cons

- Higher Base Premiums: The average monthly costs for teen drivers in Alabama often exceed those of Geico and State Farm.

- Costly Add-Ons: Extras like new car replacement and accident forgiveness can definitely increase premiums.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#6 – The Hartford: Best for Deductible Reduction

Pros

- Unique Senior Focus: Strong for families where grandparents co-own policies, offering AARP member discounts.

- Anti-Theft Savings: Up to 10% discount for cars equipped with security systems. Explore more discount options in our Nationwide auto insurance review.

- Solid Policy Protections: Includes lifetime car repair assurance and accident forgiveness in many Alabama policies.

Cons

- Lowest Telematics Benefit: Usage-based discounts only 20%, trailing Allstate and Nationwide at 40%.

- Weak Student Incentives: Only a 12% good student discount, offering less relief for families insuring teens.

#7 – Liberty Mutual: Best for Customizable Policies

Pros

- Best Anti-Theft Discount: Liberty Mutual leads with a 35% anti-theft discount. This helps parents insure newer or safer cars.

- Solid Low Mileage Perks: Teen drivers can enjoy a 30% low mileage discount, making it a valuable option for occasional drivers.

- Strong Safe Driver Incentives: Up to 20% off for maintaining a clean driving record. To see monthly premiums and honest rankings, read our Liberty Mutual insurance review.

Cons

- Weak Student Discounts: Only a 12% good student discount, far below Allstate’s 35%.

- Higher Baseline Premiums: Alabama families often pay more for teen coverage even before discounts.

#8 – Farmers: Best for Local Agents

Pros

- Balanced Student Incentives: Farmers provides a 20% discount for good students, rewarding teens who maintain good grades.

- Safe Driver Savings: Families with responsible teen drivers can earn up to a 20% discount for being safe drivers. Take a look at our Farmers Insurance Company review to learn more.

- Strong Coverage Add-Ons: Options like accident forgiveness and new car replacement help families protect investments.

Cons

- Lower Telematics Value: Usage-based discounts max at 30%, lower than Allstate or Nationwide’s 40%.

- Premium Costs: Alabama families often report that Farmers’ base premiums for teens are higher than those of State Farm or USAA.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#9 – Travelers: Best for Accident Forgiveness

Pros

- Low Mileage Rewards: Teen drivers benefit from a 20% low mileage discount, helping families with limited driving teens.

- Safe Driver Program: Up to 17% savings for consistent safe driving records. Read our full review of Travelers insurance for more information.

- Substantial Usage-Based Discount: The IntelliDrive telematics program provides up to 30% in savings.

Cons

- Small Student Discounts: A good student discount is available, limited to 8%, which is among the lowest in Alabama.

- Moderate Anti-Theft Savings: At 19%, Travelers’ anti-theft discount lags behind Liberty Mutual and Progressive.

#10 – Progressive: Best for Online Convenience

Pros

- Snapshot Telematics Program: Offers up to a 30% usage-based discount for safe teen drivers. Our complete Progressive review goes over this in more detail.

- Substantial Anti-Theft Savings: Provides a 25% discount, second only to Liberty Mutual.

- Competitive Add-Ons: Progressive policies include accident forgiveness and optional gap insurance.

Cons

- Lower Student Discounts: Good student savings capped at 10%, less than half of Allstate’s 35%.

- Rate Variability: Premiums can jump sharply after a single at-fault accident or claim in Alabama.

3 Case Studies: Strategies for Affordable AL Teen Driver Auto Insurance

Below is an in-depth section presenting three case studies that illustrate how families in Alabama have successfully tackled the challenge of getting cheap insurance for teens. Each case study highlights practical strategies—from bundling policies to leveraging usage-based programs and customizing coverage—all aimed at securing the cheapest car insurance for teenagers.

Case Study 1: Maximizing Savings Through Family Bundling

In this case study, the Johnson family focused on the benefits of bundling their home and auto policies to secure the lowest premiums possible. By leveraging available discounts, they were able to add a teen driver without a significant premium increase.

The process of adding a 16-year-old to insurance was streamlined, and their strategy was driven by the need to understand the 16-year-old boy’s car insurance cost as well as 17-year-old driver insurance considerations.

They capitalized on being part of a broader family policy, ensuring access to affordable car insurance in Alabama while maintaining comprehensive coverage for all family vehicles. This approach also targeted the best car insurance for 16-year-olds in the market, helping the family optimize savings.

Learn here: What an Auto Insurance Specialist Says About Bundling Rates

Case Study 2: Leveraging Usage-Based Discounts for New Drivers

The Smith family demonstrated how participation in a cheap usage-based auto insurance program can significantly lower premiums for young drivers. Their daughter enrolled in a telematics program that tracked her driving behavior, resulting in a commendable discount on her policy.

This case highlights the importance of looking for affordable car insurance for teens and understanding the factors behind the cheapest auto insurance for teenagers. By actively tracking her driving, the family was also able to secure cheap auto insurance for new drivers, benefiting from programs that reward safe driving habits.

They adopted the idea of low-cost auto insurance in Alabama, resulting in better rates for car insurance for teenagers.

Case Study 3: Customizing Policies for Optimal Coverage

The Brown family’s approach was centered on customizing their teen driver’s policy. After careful research on car insurance for teen drivers, they decided to tailor the coverage to fit the specific needs of a new driver. This customization involved a detailed evaluation of the policy options, highlighting new driver insurance and the impact of the teen auto insurance rates on their budget.

Affordable insurance options can lower teen driver premiums by up to 35%, helping Alabama families save while ensuring coverage.Michelle Robbins Licensed Insurance Agent

They explored a range of discounts, such as the teen driver discount, and reached out directly to Direct Auto Insurance in Huntsville, AL, to negotiate a plan that satisfied their unique requirements. This effort resulted in securing affordable car insurance for teens while positioning them to find the cheapest auto insurance for teens that met all their practical needs.

These case studies highlight how families in Alabama are successfully navigating the insurance market by focusing on strategic approaches such as bundling policies, leveraging usage-based discounts, and customizing coverage.

By doing so, they gain access to add a 16-year-old to insurance solutions and ensure they receive affordable auto insurance for teenagers. Ultimately, these strategies offer valuable insights into securing affordable insurance in Alabama, making it possible to meet the high demands of car insurance for teenage drivers at competitive rates.

Want to find the cheapest car insurance for teenage drivers in Alabama today? Enter your ZIP code into our free quote tool to get Alabama car insurance quotes.

Check out our ranking of the top providers: 10 Best Companies for Bundling Home and Auto Insurance

Frequently Asked Questions

How much does car insurance cost in Alabama per month?

There are multiple factors that affect auto insurance rates in Alabama, so what drivers pay can vary widely. For teen drivers, especially 16-year-olds, the average cost of car insurance in Alabama is about $204 per month for minimum coverage.

What is the cheapest way to get auto insurance for teenagers in Alabama?

Adding teens to a parent’s policy is the best way to get the lowest-cost auto insurance for teens.

What are the cheapest cars to insure in Alabama?

The cheapest cars to insure in Alabama are the Subaru Crosstrek, Chevrolet Trailblazer, Kia Soul, Subaru Forester, Dodge Grand Caravan, and Honda Odyssey due to their excellent safety ratings and low repair costs.

What is the cheapest insurance for a 16-year-old?

USAA offers cheap car insurance for 16-year-olds at $97 a month for minimum coverage. Geico follows at $109 a month, while Nationwide provides affordable options at $177 a month for Alabama teen drivers.

How much is auto insurance for a 16-year-old in Alabama?

How much is car insurance for a 16-year-old per month in AL? Alabama auto insurance averages $204 a month for 16-year-olds purchasing their own policy. It is easier to get cheap auto insurance for 16-year-olds if the teen joins a parent’s policy.

How much is auto insurance for a 19-year-old in Alabama?

Auto insurance averages $158 per month in Alabama for 19-year-olds. Compare quotes with our free tool to get the best auto insurance for young drivers in Alabama.

What is the cheapest auto insurance for a 16-year-old in Alabama?

The cheapest Alabama car insurance companies charge an average of $97 per month for teens who need minimum coverage. If you’re shopping for car insurance for a 16-year-old, rates can vary significantly depending on the provider, driving history, and whether the teen is added to a parent’s policy.

What is the cheapest auto insurance for a 17-year-old?

Rates for Alabama auto insurance for a 17-year-old will vary by driver, so the best way to find cheap auto insurance for 17-year-olds is to shop around for quotes at the cheapest companies.

What type of Alabama auto insurance should a 19-year-old college student have?

USAA, Geico, and Nationwide offer cheap car insurance for new drivers under 21 as well as comprehensive coverage options. The best auto insurance for drivers under 25 is full coverage.

Is it cheaper for teen drivers in Alabama to be on their parents’ auto insurance?

Yes, it is generally cheaper for Alabama teens to remain on their parents’ auto insurance rather than obtain separate policies. This arrangement often allows families to access car insurance discounts in Alabama and group rates, making it easier to secure cheap car insurance for young drivers while benefiting from lower overall premiums and more comprehensive coverage options.

Why is auto insurance so expensive in Alabama?

What is the penalty for not having auto insurance in Alabama?

What is the grace period for auto insurance in Alabama?

Can you go to jail for driving without insurance in Alabama?

How many uninsured drivers are in Alabama?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.