Cheapest Teen Driver Auto Insurance in Alabama for 2025 (Top 10 Low-Cost Companies)

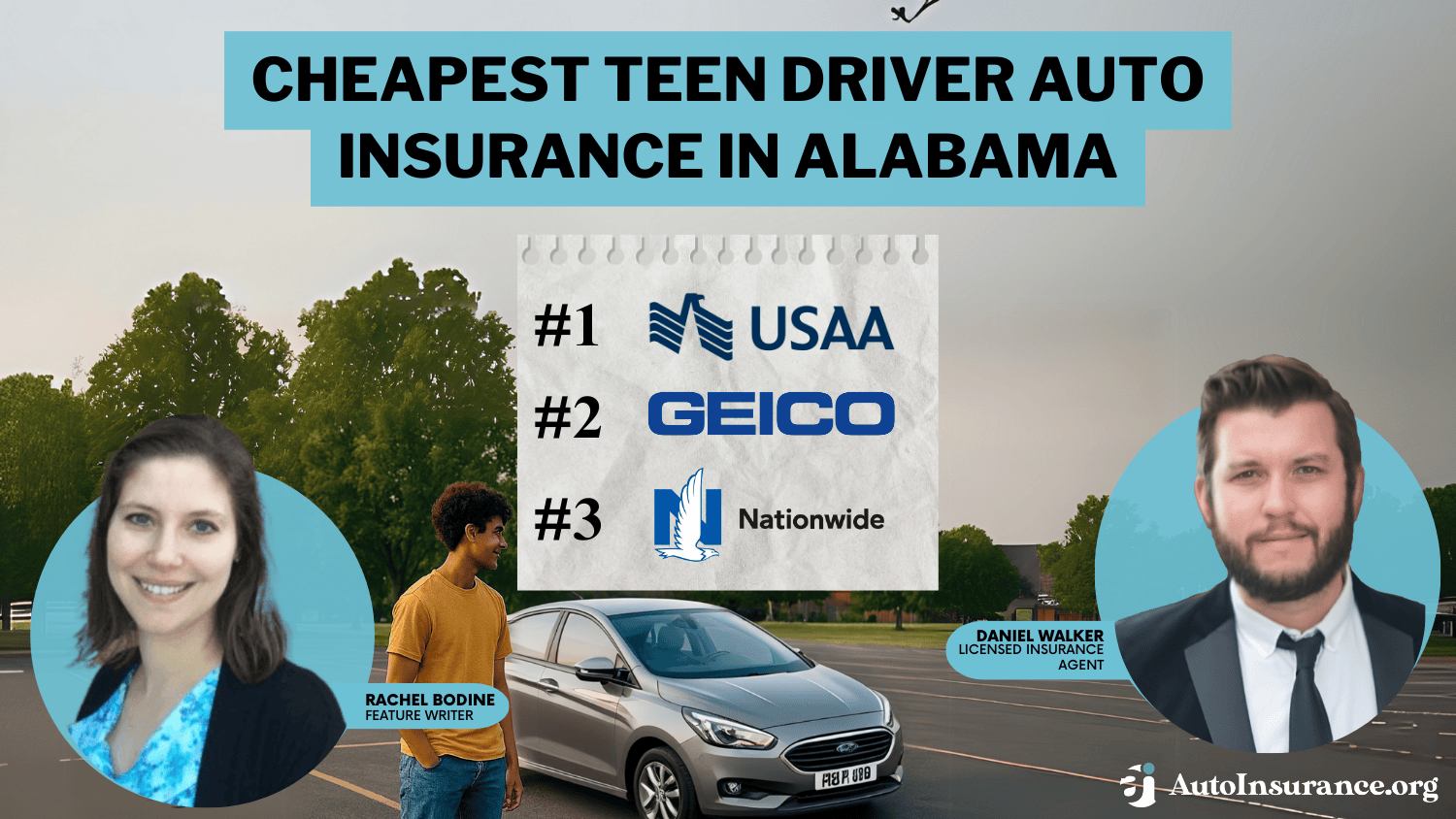

USAA, Geico, and Nationwide offer the cheapest teen driver auto insurance in Alabama, with monthly rates starting at $56. Each insurer offers budget-friendly car insurance for teenage drivers, balancing cost and coverage to support Alabama’s youngest motorists.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Jun 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for AL Teens

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for AL Teens

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage for AL Teens

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews

The top providers for the cheapest teen driver auto insurance in Alabama are USAA, Geico, and Nationwide. These companies offer some of the most competitive rates, as low as $56 a month, tailored specifically for young drivers in Alabama.

USAA takes the top spot overall, providing excellent savings for military families, while Geico offers the best rates for budget-conscious families. Nationwide stands out with discounts based on driving habits, making it a great option for families who want to reduce costs even further.

Other great Alabama auto insurance companies for teens are listed below. These companies offer the best overall choice with the lowest rates and excellent customer service, though it’s exclusive to military families.

Our Top 10 Company Picks: Cheapest Teen Driver Auto Insurance in Alabama

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $97 | A++ | Military Savings | USAA | |

| #2 | $109 | A++ | Cheap Rates | Geico | |

| #3 | $177 | A+ | Usage Discount | Nationwide |

| #4 | $199 | B | Many Discounts | State Farm | |

| #5 | $208 | A+ | Add-on Coverages | Allstate | |

| #6 | $235 | A+ | Deductible Reduction | The Hartford |

| #7 | $288 | A | Customizable Polices | Liberty Mutual |

| #8 | $347 | A | Local Agents | Farmers | |

| #9 | $404 | A++ | Accident Forgiveness | Travelers | |

| #10 | $436 | A+ | Online Convenience | Progressive |

To find cheap auto insurance in Alabama for teen drivers today, compare rates using our free tool.

- USAA, Geico, and Nationwide offer the cheapest teen driver auto insurance

- USAA offers the best rates for military families in Alabama

- Shopping around will help you find the best insurance for teen drivers

With affordable car insurance premiums and extensive discount opportunities, these insurers are ideal for budget-conscious families.

Alabama Auto Insurance Rates for Teen Drivers

So, who has the cheapest car insurance in Alabama? Teen drivers in Alabama need to be on top of their insurance game, meeting the state’s bare minimums: $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage per accident. These aren’t suggestions; they’re the law.

Teen Driver Auto Insurance in Alabama: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $208 | $513 | |

| $347 | $855 | |

| $109 | $267 | |

| $288 | $711 |

| $177 | $434 |

| $436 | $1,073 | |

| $199 | $490 | |

| $235 | $576 |

| $404 | $994 | |

| USAA | $56 | $180 |

USAA, Geico, and Nationwide emerge as the top choices for budget-conscious teen drivers, with USAA offering the lowest rates for both minimum and full coverage. As the list progresses, the rates increase, with companies like Progressive and Travelers representing higher-cost options for teen drivers seeking insurance coverage in Alabama.

USAA emerges as the top choice for Alabama teen drivers, offering the lowest rates and comprehensive coverage tailored to their needs.Dani Best Licensed Insurance Producer

Sure, sticking to these basics might save a few bucks, but it’s a gamble. With just the minimum coverage, you’re playing a risky game. So, it’s smart for teens to consider beefing up their policies with full coverage. It might cost a bit more, but it’s worth the peace of mind.

Alabama Auto Insurance Monthly Rates by Age, Gender & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $192 | $556 |

| 16-Year-Old Male | $216 | $600 |

| 17-Year-Old Female | $177 | $471 |

| 17-Year-Old Male | $201 | $529 |

| 18-Year-Old Female | $161 | $385 |

| 18-Year-Old Male | $185 | $457 |

| 19-Year-Old Female | $146 | $300 |

| 19-Year-Old Male | $170 | $386 |

| 20-Year-Old Female | $130 | $214 |

| 20-Year-Old Male | $154 | $314 |

| 21-Year-Old Female | $115 | $129 |

| 21-Year-Old Male | $139 | $243 |

The table shows monthly auto insurance rates in Alabama categorized by age, gender, and coverage level. Rates vary significantly based on these factors. For example, a 16-year-old female can expect to pay around $192 monthly for minimum coverage, while a 21-year-old male might pay $139 for the same coverage.

Full coverage rates also differ, with premiums generally higher for younger drivers and males across all age groups. As you can see, the rates for Alabama auto insurance for a 15-year-old are going to be different than rates for Alabama auto insurance for a 16-year-old, as age affects rates. Read more in our article: Cheapest Liability-Only Auto Insurance.

Read More: Best Yearly Premium Auto Insurance

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Alabama Auto Insurance Grace Period for Teen Drivers

The grace period refers to the time a teen has to join an auto insurance policy after getting their driver’s license. The grace period varies by company, but it is important for families to add a new driver as quickly as possible to avoid the teen driving without insurance. To gain further insights, read our comprehensive guide “Helping Teen Drivers Get Their First License.”

Therefore, families are encouraged to contact their insurance provider as soon as possible after their teen receives their driver’s license. In most cases, the provider will issue an insurance endorsement—a formal adjustment to the existing policy—to add the new driver. This ensures seamless integration into the coverage and provides peace of mind and comprehensive protection for everyone on the road.

Comparing Teen Driver Auto Insurance Rates in Alabama

One of the reasons auto insurance costs more for young drivers is a lack of driving experience, as teens are more likely to get into accidents. Teens with poor driving records will have much higher Alabama car insurance rates.

Alabama Auto Insurance Monthly Rates by Age, Gender & Driving Record

| Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $175 | $210 | $245 | $320 | |

| $185 | $230 | $265 | $340 | |

| $160 | $195 | $235 | $310 | |

| $190 | $230 | $275 | $350 |

| $170 | $210 | $240 | $325 | |

| $165 | $200 | $235 | $315 | |

| $155 | $180 | $210 | $290 | |

| $180 | $215 | $250 | $330 |

| $170 | $205 | $240 | $320 | |

| $140 | $165 | $190 | $270 |

This data presents monthly auto insurance rates for different age groups, genders, and driving records in Alabama. Rates vary significantly based on factors like age, gender, and driving history. For instance, insurance rates for new drivers typically face higher premiums, with males generally paying more than females.

Additionally, those with a history of speeding tickets, at-fault accidents, or DUI/DWI offenses face increased insurance costs. As drivers mature, rates generally decrease, reflecting a presumed decrease in risk.

For additional details, explore “Cheap Auto Insurance for Teens After an Accident.”

Location is a crucial determinant of auto insurance rates in Alabama, influencing the premiums paid by drivers. Factors such as population density, crime rates, and traffic congestion can vary significantly from one location to another, thereby impacting insurance costs.

Alabama Auto Insurance Monthly Rates by Age, Gender & City

| Age & Gender | Birmingham | Huntsville | Mobile | Montgomery | Tuscaloosa |

|---|---|---|---|---|---|

| 16-Year-Old Female | $186 | $159 | $181 | $172 | $169 |

| 16-Year-Old Male | $205 | $175 | $199 | $189 | $186 |

| 17-Year-Old Female | $177 | $151 | $172 | $163 | $161 |

| 17-Year-Old Male | $194 | $166 | $189 | $180 | $177 |

| 18-Year-Old Female | $167 | $143 | $163 | $155 | $152 |

| 18-Year-Old Male | $184 | $157 | $179 | $170 | $167 |

| 19-Year-Old Female | $158 | $135 | $154 | $146 | $144 |

| 19-Year-Old Male | $174 | $149 | $169 | $161 | $158 |

| 20-Year-Old Female | $149 | $127 | $145 | $138 | $135 |

| 20-Year-Old Male | $164 | $140 | $159 | $151 | $149 |

| 21-Year-Old Female | $140 | $119 | $136 | $129 | $127 |

| 21-Year-Old Male | $153 | $131 | $149 | $142 | $139 |

Urban areas, characterized by higher population densities and increased vehicular traffic, often present greater risks of accidents, theft, and vandalism, leading to higher insurance premiums. On the other hand, rural areas typically have lower insurance rates due to fewer accidents and lower incidences of theft or vandalism.

Additionally, specific neighborhoods within a city may have varying risk levels, further influencing insurance pricing. Therefore, when assessing auto insurance rates in Alabama, it’s essential to consider the geographical location and its associated risk factors alongside age, gender, and driving record.

Adding a Teen Driver to Your Alabama Auto Insurance

Adding a teen driver to your existing auto insurance policy can be a straightforward process, often accessible through various channels provided by your insurance company. Many insurers offer the convenience of adding a new driver, including teens, directly through their online platforms or mobile apps.

With just a few clicks or taps, you can update your policy to include your teenage driver. Alternatively, if you prefer a more personal touch or have specific questions, reaching out to your insurance provider via phone allows you to speak directly with a representative who can guide you through the process.

Alabama Auto Insurance Monthly Rates by Age, Gender & Policy Type

| Age & Gender | Individual | Parent's Policy |

|---|---|---|

| 16-Year-Old Female | $312 | $332 |

| 16-Year-Old Male | $352 | $349 |

| 17-Year-Old Female | $393 | $320 |

| 17-Year-Old Male | $471 | $335 |

| 18-Year-Old Female | $473 | $305 |

| 18-Year-Old Male | $545 | $334 |

| 19-Year-Old Female | $393 | $318 |

| 19-Year-Old Male | $471 | $333 |

| 20-Year-Old Female | $238 | $351 |

| 20-Year-Old Male | $238 | $369 |

| 21-Year-Old Female | $374 | $320 |

| 21-Year-Old Male | $392 | $335 |

It’s important to anticipate that adding a teen driver to your policy will likely result in an increase in your insurance premiums. However, despite the higher rates associated with insuring young drivers, incorporating them into your existing policy typically remains more cost-effective than having the teen obtain their separate insurance coverage.

Additionally, by being included in a family policy, teen drivers can benefit from the collective driving experience and history of the household, potentially leading to more favorable rates compared to obtaining an individual policy.

To learn more, explore our comprehensive resource: “Does the car a teen drives affect auto insurance rates?”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

3 Case Studies: Strategies for Affordable AL Teen Driver Auto Insurance

Below is an in-depth section presenting three case studies that illustrate how families in Alabama have successfully tackled the challenge of high auto insurance costs for teen drivers. Each case study highlights practical strategies—from bundling policies to leveraging usage-based programs and customizing coverage—all aimed at securing the cheapest car insurance for teenagers.

Case Study 1: Maximizing Savings Through Family Bundling

In this case study, the Johnson family focused on the benefits of bundling their home and auto policies to secure the lowest premiums possible. By leveraging available discounts, they were able to add a teen driver without a significant premium increase.

The process of adding a 16-year-old to insurance was streamlined, and their strategy was driven by the need to understand the 16-year-old boy’s car insurance cost as well as 17-year-old driver insurance considerations.

They capitalized on being part of a broader family policy, ensuring access to affordable car insurance in Alabama while maintaining comprehensive coverage for all family vehicles. This approach also targeted the best car insurance for 16-year-olds in the market, helping the family optimize savings.

Learn here: What an Auto Insurance Specialist Says About Bundling Rates

Case Study 2: Leveraging Usage-Based Discounts for New Drivers

The Smith family demonstrated how participation in a cheap usage-based auto insurance program can significantly lower premiums for young drivers. Their daughter enrolled in a telematics program that tracked her driving behavior, resulting in a commendable discount on her policy.

This case highlights the importance of looking for affordable car insurance for teens and understanding the factors behind the cheapest auto insurance for teenagers. By actively tracking her driving, the family was also able to secure cheap auto insurance for new drivers, benefiting from programs that reward safe driving habits.

They adopted the idea of low-cost auto insurance in Alabama, resulting in better rates for car insurance for teenagers.

Case Study 3: Customizing Policies for Optimal Coverage

The Brown family’s approach was centered on customizing their teen driver’s policy. After careful research on car insurance for teen drivers, they decided to tailor the coverage to fit the specific needs of a new driver. This customization involved a detailed evaluation of the policy options, highlighting new driver insurance and the impact of the teen auto insurance rates on their budget.

They explored a range of discounts, such as the teen driver discount, and reached out directly to direct auto insurance in Huntsville AL to negotiate a plan that satisfied their unique requirements. This effort resulted in securing affordable car insurance for teens while positioning themselves to find the cheapest auto insurance for teens that met all their practical needs.

These case studies highlight how families in Alabama are successfully navigating the insurance market by focusing on strategic approaches such as bundling policies, leveraging usage-based discounts, and customizing coverage.

By doing so, they not only gain access to add a 16-year-old to insurance solutions but also ensure they receive cheap auto insurance for teenagers. Ultimately, these strategies offer valuable insights into securing affordable insurance in Alabama, making it possible to meet the high demands of car insurance for teenage drivers at competitive rates.

Check out our ranking of the top providers: 10 Best Companies for Bundling Home and Auto Insurance

Affordable Auto Insurance Options for Teen Drivers in Alabama

When it comes to securing affordable insurance for teen drivers in Alabama, USAA, Geico, and Nationwide emerge as top contenders, consistently offering some of the most competitive rates in the market. These insurance providers not only prioritize affordability but also provide a range of beneficial features tailored specifically to teen drivers.

Affordable insurance options can lower teen driver premiums by up to 35%, helping Alabama families save while ensuring coverage.Michelle Robbins Licensed Insurance Agent

By choosing USAA, Geico, or Nationwide, teen drivers in Alabama not only gain access to affordable insurance but also benefit from the peace of mind that comes with comprehensive coverage, personalized auto insurance discounts, and a commitment to promoting safe driving behaviors.

Want to find affordable Alabama teen insurance today? Enter your ZIP code into our free quote tool to get Alabama car insurance quotes.

Frequently Asked Questions

How much is auto insurance in Alabama per month?

There are multiple factors that affect auto insurance rates in Alabama, so what drivers pay can vary widely. For teen drivers, especially 16-year-olds, the average cost of car insurance in Alabama is about $204 per month for minimum coverage.

What is the cheapest way to get auto insurance for teenagers in Alabama?

Adding teens to a parent’s policy is the best way to get the lowest-cost auto insurance for teens.

How much is auto insurance for a 16-year-old in Alabama?

How much is car insurance for a 16-year-old per month in AL? Alabama auto insurance averages $204/mo for 16-year-olds purchasing their own policy. It is easier to get cheap auto insurance for 16-year-olds if the teen joins a parent’s policy.

How much is auto insurance for a 19-year-old in Alabama?

Auto insurance averages $158 per month in Alabama for 19-year-olds. Compare quotes with our free tool to get the best auto insurance for young drivers in Alabama.

What is the cheapest auto insurance for a 16-year-old in Alabama?

The cheapest Alabama car insurance companies charge an average of $97 per month for teens who need minimum coverage. If you’re shopping for car insurance for a 16-year-old, rates can vary significantly depending on the provider, driving history, and whether the teen is added to a parent’s policy.

What is the cheapest auto insurance for a 17-year-old?

Rates for Alabama auto insurance for a 17-year-old will vary by driver, so the best way to find cheap auto insurance for 17-year-olds is to shop around for quotes at the cheapest companies.

What type of Alabama auto insurance should a 19-year-old college student have?

The best auto insurance for drivers under 25 is full coverage.

Is it cheaper for teen drivers in Alabama to be on their parents’ auto insurance?

Yes, it is generally cheaper for Alabama teens to remain on their parents’ auto insurance rather than obtain separate policies. This arrangement often allows families to access discounts and group rates, making it easier to secure cheap car insurance for young drivers while benefiting from lower overall premiums and more comprehensive coverage options.

Why is auto insurance so expensive in Alabama?

Rates may be high due to driver factors, such as a poor driving record. If you are having trouble finding cheap car insurance in Alabama, make sure to shop at the companies with the cheapest teen auto insurance.

What is the penalty for not having auto insurance in Alabama?

You could face fines, suspended licenses, and more if you don’t meet Alabama car insurance requirements.

What is the grace period for auto insurance in Alabama?

The Alabama car insurance grace period depends on the company, but Alabama auto insurance laws do require all licensed drivers to have auto insurance, so it is wise to add a teen driver right after they get their license.

Can you go to jail for driving without insurance in Alabama?

Yes, failing to meet Alabama car insurance laws may result in possible jail time for repeat offenders or require the purchase of high-risk auto insurance.

How many uninsured drivers are in Alabama?

The latest study by III determined that over 14% of Alabama drivers are uninsured, so make sure to carry cheap full coverage insurance to protect yourself.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.