Cheap Auto Insurance After an Accident in 2025 (Save Money With These 10 Providers!)

State Farm, Geico, and Travelers are the top providers of cheap auto insurance after an accident. State Farm has the cheapest rates, starting at $57/mo for minimum coverage. After an accident, you’ll want to know how to find cheap auto insurance, which includes asking about discounts and accident forgiveness.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage After an Accident

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage After an Accident

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage After an Accident

A.M. Best

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsState Farm is our top pick for cheap auto insurance after an accident, followed by Geico and Travelers. While your driving record and claims history affect your rates, you can still find cheap auto insurance after an accident.

One way to save money on insurance after an accident is to look for coverage with accident forgiveness. Even if your auto insurance rates increase after an accident, it doesn’t last forever. Get fast and cheap auto insurance coverage today with our quote comparison tool above.

Our Top 10 Company Picks: Cheap Auto Insurance After an Accident

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $57 A++ Customer Service State Farm

#2 $71 A++ Low Rates Geico

#3 $76 A++ Coverage Options Travelers

#4 $88 A+ Nationwide Reach Nationwide

#5 $94 A Personalized Service American Family

#6 $98 A+ Innovative Technology Progressive

#7 $109 A Policy Options Farmers

#8 $124 A+ Trusted Brand Allstate

#9 $129 A Financial Strength Liberty Mutual

#10 $179 A High-Risk Coverage The General

Typically, accidents raise your car insurance for three to five years. Then, rates return to normal. Keep reading to learn how to get cheapest auto insurance after an accident and keep your rates as low as possible.

- State Farm offers the cheapest auto insurance after an accident

- Each auto insurance company charges different rates after an accident

- Add discounts and take advantage of accident forgiveness to keep rates low

#1 – State Farm: Top Pick Overall

Pros

- Good Customer Service: With an extensive network of agents and 24/7 customer support, State Farm has been consistently praised for its excellent customer service.

- Affordable Rates: State Farm offers one of the lowest prices for auto insurance after an accident. Read more in our full review on State Farm’s auto insurance.

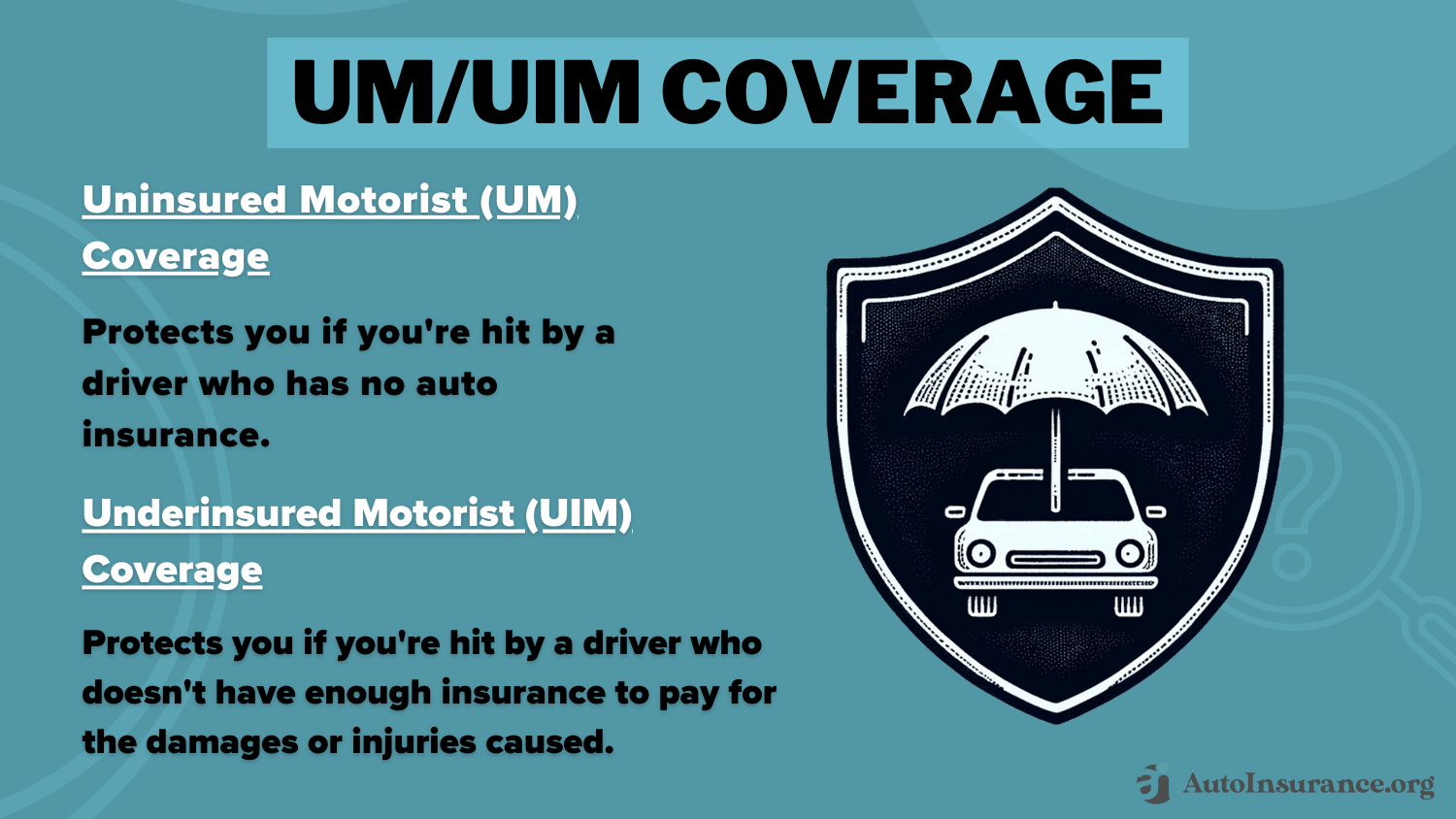

- Wide Coverage Options: State Farm offers various coverage options, including liability, comprehensive, uninsured/underinsured motorist and collision auto insurance.

Cons

- Restrictions on New Policies: Currently not issuing new auto insurance policies in Rhode Island or Massachusetts.

- No Gap Insurance: State Farm does not offer gap insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Low Rates

Pros

- Low Rates: Geico is known for its competitive pricing, offering auto insurance after an accident.

- Learn more about Geico’s rates in our Geico auto insurance company review.

- Fast and Easy Claims Process: Geico’s online and mobile app tools make it quick and convenient to file a claim and track its progress.

- Discounts Available: Geico offers a wide range of discounts, including for good drivers, good students, and military personnel.

Cons

- Fewer Local Agents: Geico primarily relies on online and call center customer service, which may not be ideal for those who prefer a local agent.

- Higher Rates After a DUI: Geico’s rates tend to increase significantly after a DUI conviction.

#3 – Travelers: Best for Coverage Options

Pros

- Comprehensive Coverage Options: Travelers offers a variety of coverage options to protect against accidents, theft, and other incidents.

- Personalized Policies: Customers can work with agents to tailor their policy to fit their specific needs. Read our full review of Travelers insurance for more information.

- Strong Financial Stability: With an A++ rating from AM Best, Travelers is known for its strong financial stability and ability to pay out claims.

Cons

- Higher Rates: Travelers tends to have higher rates compared to other insurance companies, especially for younger drivers.

- Average Claims Satisfaction: Some customers have reported lower satisfaction with their claims experience.

#4 – Nationwide: Best for Nationwide Reach

Pros

- Nationwide Availability: As the name suggests, Nationwide offers coverage in all but three states.

- Multiple Discounts Available: Nationwide offers various discounts, including for safe driving, bundling policies, and being a member of certain organizations. Explore more discount options in our Nationwide auto insurance review.

- Vanishing Deductible: Customers can earn a $100 reduction in their deductible for every year of safe driving, up to $500.

Cons

- Average Customer Service Ratings: Nationwide has received average ratings for its customer service and claims experience.

- Higher Rates for High-Risk Drivers: For drivers with a DUI or a history of traffic violations, Nationwide’s rates tend to be significantly higher.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – American Family: Best for Personalized Service

Pros

- Customized Coverage Options: American Family is renowned for offering many personalized insurance options and packages. Our complete American Family auto insurance review goes over this in more detail.

- Exceptional Customer Support: American Family provides extensive support and advice to its policyholders.

- Loyalty Rewards: American Family rewards its customers for their loyalty with discounts and benefits, increasing in value the longer you stay insured with them.

Cons

- Limited to Certain States: American Family is not available in all states.

- Variable Rate Consistency: Some customers have noted fluctuations in their premiums and inconsistencies in rate calculations.

#6 – Progressive: Best for Innovative Technology

Pros

- Name Your Price Tool: This tool allows customers to enter their budget and preferences, and Progressive will provide coverage options that fit those criteria.

- Accident Forgiveness: Customers can add accident forgiveness to their policy, meaning one at-fault accident won’t increase their rates.

- Snapshot Program: Progressive offers a usage-based program where customers can earn discounts based on their driving habits. Find more details about this provider in our guide: Progressive Auto Insurance Review.

Cons

- Higher Rates for Some Drivers: Progressive’s rates may be higher for some drivers, particularly those with poor credit scores or a history of accidents.

- Mixed Customer Reviews: While many customers praise Progressive’s technology and discounts, others have reported issues with customer service and claims experience.

#7 – Farmers: Best for Policy Options

Pros

- Wide Range of Coverage Options: Farmers offers a variety of coverage options, including unique offerings such as equipment breakdown coverage.

- Many Discount Opportunities: Farmers offers various discounts to help customers save money on their policies. Take a look at our Farmers insurance company review to learn more.

- Strong Financial Strength Ratings: Farmers has consistently high ratings for financial strength, indicating stability and ability to pay out claims.

Cons

- Mixed Reviews on Customer Service: Some customers have reported issues with the customer service at Farmers, including difficulty reaching representatives and slow response times.

- Potentially Higher Rates for Some Demographics: Drivers in certain demographics, such as younger drivers or those with poor credit, may see higher rates with Farmers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Allstate: Best for Trusted Brand

Pros

- Strong Reputation: Allstate has been in the insurance business for over 90 years and is a well-known and trusted brand.

- Customizable Coverage Options: Allstate offers a variety of coverage options, including add-ons like new car replacement and sound system coverage. Find more information about Allstate’s rates in our review of Allstate insurance.

- Drivewise Program: Similar to Progressive’s Snapshot program, Allstate’s Drivewise program allows customers to earn discounts based on their driving habits.

Cons

- Higher Rates: Allstate’s rates may be higher than other insurance companies, particularly for younger drivers and those with a history of accidents.

- Less Innovative Technology: Allstate’s technology offerings may not be as advanced or user-friendly as other companies.

#9 – Liberty Mutual: Best for Financial Strength

Pros

- Financial Strength: Liberty Mutual has consistently high ratings for financial strength and stability.

- New Car Replacement: In the event of a total loss within the first year of ownership, Liberty Mutual will provide enough money to buy a brand new car of the same make and model.

- Accident Forgiveness: Liberty Mutual offers accident forgiveness to customers who have been with the company for at least five years without any accidents. To see monthly premiums and honest rankings, read our Liberty Mutual review.

Cons

- Limited Local Agents in Some States: Liberty Mutual has a smaller network of local agents compared to other insurance companies

- Low Claims Satisfaction: Liberty Mutual has received lower satisfaction ratings in claims processing compared to some of its competitors.

#10 – The General: Best for High-Risk Coverage

Pros

- High-Risk Coverage Options: The General specializes in providing coverage for high-risk drivers, such as those with a history of accidents or multiple tickets. Learn more about average rates for high-risk auto insurance in our guide: The General Auto Insurance Review.

- Affordable Rates: The General’s rates are often more affordable than other insurance companies.

- Same-Day Coverage: In some cases, The General can provide same-day coverage for drivers who need immediate insurance.

Cons

- Limited Coverage Options: The General only offers basic coverage options and may not have the same level of customization as other companies.

- Poor Customer Service: The General has received low ratings for customer service and claims satisfaction.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Finding Cheap Auto Insurance After an Accident

Many factors affect your auto insurance rates, such as age, vehicle, and ZIP code. However, one of the most significant factors is your driving record. Drivers with accidents, tickets, and DUIs pay much higher insurance rates than drivers with a clean record. This means that the best accident insurance companies will vary depending on each individual driver.

Whether you’re at fault in an accident also affects your rates. For example, your rates might not increase if someone else caused your accident. However, if the other driver was uninsured and you don’t have uninsured motorist coverage, you’ll have to file a claim on your own policy. Learn how to file an auto insurance claim in our guide.

Some states require drivers to pay for their own damages regardless of fault. Therefore, if you live in a no-fault state, your auto insurance rates may increase since you must file a claim on your insurance.

The number of accidents on your driving record also affects your rates. For example, your rates should stay low if you’ve only had one minor fender bender in the last few years. However, your rates will significantly increase if you’ve caused multiple accidents.

If you ask us, there’s no such thing as too many Dougs. pic.twitter.com/s5o0940Bwz

— Liberty Mutual (@LibertyMutual) November 6, 2023

Fortunately, accidents only affect your insurance rates for a short period. Typically, most states only allow your rates to increase for three to five years after an accident. So, your rates won’t be high forever, even if you have an accident on your record.

Remember, there are things you can do to keep your rates as low as possible. Keep reading to learn ways to get the cheapest auto insurance rates available.

Best Auto Insurance Companies After an Accident

Fortunately, some insurers still offer cheap coverage if you have accidents on your driving record.

As mentioned above, the best auto insurance companies after an accident vary by driver. Each company looks at your accident history differently and offers different rates. So while one company may raise your rates for one accident, another company may choose to ignore your fender bender.

This table shows how one accident affects your auto insurance rates from top companies.

Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $228 | $268 | $321 | $385 | |

| $166 | $194 | $251 | $276 | |

| $198 | $247 | $282 | $275 | |

| $114 | $151 | $189 | $309 | |

| $248 | $302 | $335 | $447 |

| $164 | $196 | $230 | $338 |

| $150 | $199 | $265 | $200 | |

| $123 | $137 | $146 | $160 | |

| $331 | $396 | $467 | $607 | |

| $141 | $192 | $199 | $294 |

One accident can raise your rates by around $80 a month. So, while adding accident forgiveness to your policy costs a little extra, it’s typically much cheaper than paying higher rates for years.

Definition of Accident Forgiveness

So, what is accident forgiveness? If you’re likely to be in an accident, look for accident forgiveness. Although specifics vary by insurer, accident forgiveness ensures your rates don’t go up after an accident.

Remember that accident forgiveness only applies to collision coverage, not comprehensive. So, if you hit another car, accident forgiveness kicks in. However, if someone steals your vehicle, coverage doesn’t apply, and rates may increase.

There’s typically an additional charge of up to 10% to add accident forgiveness to your policy.

Still, you may be able to keep your safe driver discount after an accident. The cost and length of time you must be accident-free to add the feature varies by company.

In addition, high-risk drivers won’t qualify. So if you have multiple accidents, tickets, or DUIs, most insurance companies won’t allow you to add accident forgiveness. Young or inexperienced drivers also may not be covered. Get more information in our top 10 provider ranking of the best auto insurance companies for high-risk drivers.

Some states like California don’t allow auto insurance companies to offer accident forgiveness. Learn more about California auto rates in our California auto insurance in our guide.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Value of Accident Forgiveness

Is accident forgiveness worth it? Unfortunately, there’s no definite answer.

Accident forgiveness is worth it for drivers who think they may be in an accident. However, you may be paying for a benefit you never need.

Some insurers offer free accident forgiveness to drivers with a clean driving record. However, most insurance companies charge for the added coverage. Each insurance company also sets requirements for drivers to qualify for accident forgiveness and its cost.

For example, Geico offers accident forgiveness for free once you’ve been with the company for three years and remain accident-free. However, Travelers charges for the coverage, and you must be accident-free for five years.

It’s really up to you and your budget. While accident forgiveness is an extra expense, it’s typically cheaper than paying higher insurance rates for three years.

However, you may want to skip accident forgiveness if you’ve rarely been in an accident and no one on your policy is likely to cause an accident.

Tips for Getting Cheap Auto Insurance After an Accident

First, avoid any dings to your driving record, though accidents come off your driving record after a few years. So even if you have an accident, you’ll only see higher insurance rates for a limited time unless you have more accidents.

Next, take a defensive driving course.

Not only will a defensive driving course make you a safer driver, but it also earns you a discount on your auto insurance.Ty Stewart Licensed Insurance Agent

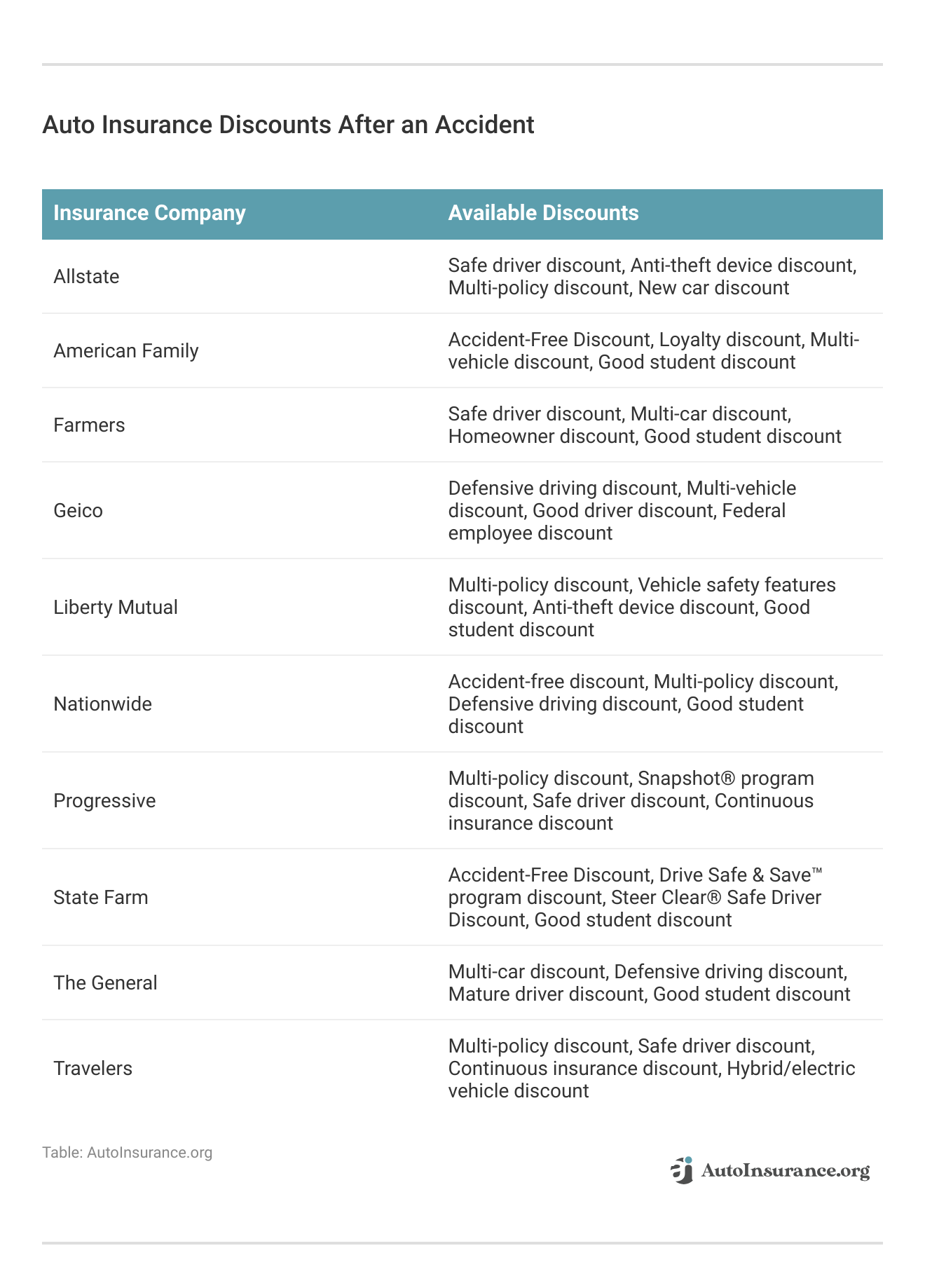

Some states also remove points from your driver’s license after attending class. You should also ask about auto insurance discounts. Even if you don’t qualify for a safe driver discount after an accident, you may be eligible for other savings, including good student, multi-car, and other discounts.

The table below shows various insurance companies and the types of discounts they offer.

Then, take a close look at your policy. Can you reduce coverage or raise your deductibles? Consider removing extra coverages like roadside assistance or opt for a higher deductible. While this means more out-of-pocket costs, your overall rates are lower.

Finally, shop around for the cheapest coverage. Every company evaluates your personal factors differently. So while one company may charge higher rates after an accident, another won’t. You may even be able to find a cheaper insurance company offering accident forgiveness.

Cheap Auto Insurance After an Accident: The Bottom Line

While your auto insurance rates will likely increase after an accident, there are ways to lower your rates.

Consider adding accident forgiveness to your policy.

While adding the feature costs less than 10% of your rate, your rates won’t go up after an accident. However, it isn’t available in all states, and some drivers won’t qualify.

Add discounts and shop around to get the cheapest car insurance after an accident. Each auto insurance company weighs your personal factors differently and offers different rates. Compare multiple companies to find the lowest rates for you after an accident.

Read More: Where to Compare Auto Insurance Rates

The good news is that your rates will eventually go down. Accidents typically only raise your rates for three to five years. Then, provided you don’t have any other accidents, your rates should return to normal. Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Frequently Asked Questions

What is accident forgiveness coverage?

Accident forgiveness is a feature offered by some auto insurance companies that allow your rates to stay the same after an accident. Although you do have to pay for the benefit, it’s typically cheaper than higher insurance rates for years. Learn more about the best auto insurance companies for accident forgiveness.

Can I buy insurance after an accident?

Yes, you can buy insurance after an accident. However, it’s important to note that your rates may be higher, and the policy will not cover accidents that have already happened. To secure the most affordable policy, obtaining several car insurance quotes after an accident is highly advised, as rates can vary significantly between providers.

How long does an accident stay on your insurance record?

Generally, an accident will stay on your insurance record for three to five years. During that time period, your rates may be higher due to the accident. After the three to five year period, the accident should no longer impact your insurance rates.

How do you get accident forgiveness?

Every insurance company has different requirements. However, drivers usually must be accident-free for at least three years to qualify. While some insurance companies offer the feature to safe drivers, others can pay to add it to their policy.

Can you get cheap insurance with an accident on your record?

Yes, it is possible to get cheap insurance even with an accident on your record. Some insurance companies specialize in providing cheap car insurance for drivers who have had accidents. Our high-risk auto insurance guide can help you find the right provider for your needs.

What is the best insurance company for accident forgiveness?

Geico is the best insurance company for accident forgiveness. Customers who have been with the company for three years and have no accidents may be eligible for free accident forgiveness. Other top insurance companies for accident forgiveness include Allstate, State Farm, and Nationwide.

How much do insurance rates increase after an accident?

The amount that your insurance rates will increase after an accident varies depending on several factors, such as the severity of the accident and your driving history. However, studies have shown that the average increase is around 42%. Keep in mind that this is just an estimate and your actual rate increase may differ.

Who needs accident forgiveness?

Accident forgiveness might be worth it if you have a high-risk driver on your policy, such as young drivers or drivers who have been in accidents in the past.

However, it may not be worth the added cost if you’re the only driver on your policy and have a safe driving record.

How much does Geico insurance go up after an accident?

Customers can expect an average rate increase of 40% after one at-fault accident. However, this may vary depending on factors such as your driving history and location. It’s always best to contact your insurance provider directly to get an accurate estimate of how much your rates may increase after an accident.

Can you get accident forgiveness after you’ve been in an accident?

You can’t have an accident and then accident forgiveness to your policy to get you out of higher rates. The feature doesn’t cover accidents you’ve had before adding the benefit. However, you can add it in the future.

How long do you have to wait for accident forgiveness?

Every company has different requirements for accident forgiveness. Typically, you must be accident-free for three to five years to qualify. Read More: How long does an accident stay on your record?

Will my insurance policy be canceled if I have an accident?

Generally, an insurance company will not cancel your policy solely based on one accident. However, if you have a history of multiple accidents or engage in risky driving behavior, the insurance company may choose not to renew your policy once it expires. It is essential to maintain a good driving record to avoid policy cancellations.

Should you change insurance companies after an accident?

Switching insurance companies after an accident may not always be the best option. While some companies may offer lower rates for high-risk drivers, others may charge even higher rates. It’s important to compare quotes from multiple providers and weigh your options before making a decision.

Can I still get insurance if I have a history of DUI or DWI convictions?

While it may be more challenging to obtain insurance with a history of DUI or DWI convictions, it is still possible. Some insurance companies specialize in providing coverage for high-risk drivers, including those with DUI or DWI convictions. However, expect higher premiums and potentially stricter policy terms. Read More: DWI vs. DUI: What’s worse and what do they mean?

How can I reduce my auto insurance rates after an accident?

Here’s how to lower your insurance after an accident:

- Take a defensive driving course to demonstrate your commitment to safe driving.

- Maintain a clean driving record going forward to show improved risk.

- Consider increasing your deductibles, which can lower your premiums.

- Shop around and compare quotes from different insurance companies to find the best rate available.

These are a few ways to lower your car insurance after an accident. You can learn more in our guide on how to lower your auto insurance rates.

Should I report every accident to my insurance company, even if it was minor?

It is generally recommended to report every accident to your insurance company, even if it was minor. Failure to report an accident, regardless of its severity, can lead to complications later on, especially if the other party involved decides to file a claim. Your insurance company can provide guidance and support during the claims process.

When does car insurance go down after accident?

Car insurance rates start to go down three years after an accident. However, this may vary depending on the severity of the accident and your driving history. It’s good to continue practicing safe driving habits in order to maintain lower insurance rates in the future.

Is Allstate accident forgiveness worth it?

Allstate accident forgiveness may be worth it for some drivers, especially those who have a history of accidents or are worried about potential rate increases. It can protect you from a rate increase after your first at-fault accident.

Can I bargain car insurance after an accident?

It is possible to negotiate with your insurance company for lower rates after an accident, but it’s not always guaranteed. It’s important to have a good understanding of your policy and be prepared with evidence such as driving records or quotes from other providers. Read More: Can you negotiate car insurance rates?

Can I switch car insurance companies if my rates increase after an accident?

Yes, you can switch insurance companies if your rates increase after an accident. It’s always a good idea to shop around for insurance policies, especially after a significant life event like an accident. Keep in mind that some insurance companies may still consider your accident history and adjust your rates accordingly. Learn how to switch auto insurance companies in our guide.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.