Cheap Gap Insurance in New York (See the Top 10 Companies for 2025)

Cheap gap insurance in New York starts at $12/month with top providers like USAA, Safeco, and American Family offering the best options. These cheap New York gap insurance companies provide military benefits and great discounts on top of affordable rates on New York auto insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insuranc...

Farmers CSR for 4 Years

UPDATED: Oct 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Gap Insurance in New York

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 1,278 reviews

1,278 reviewsCompany Facts

Gap Insurance in New York

A.M. Best Rating

Complaint Level

Pros & Cons

1,278 reviews

1,278 reviews 2,235 reviews

2,235 reviewsCompany Facts

Gap Insurance in New York

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

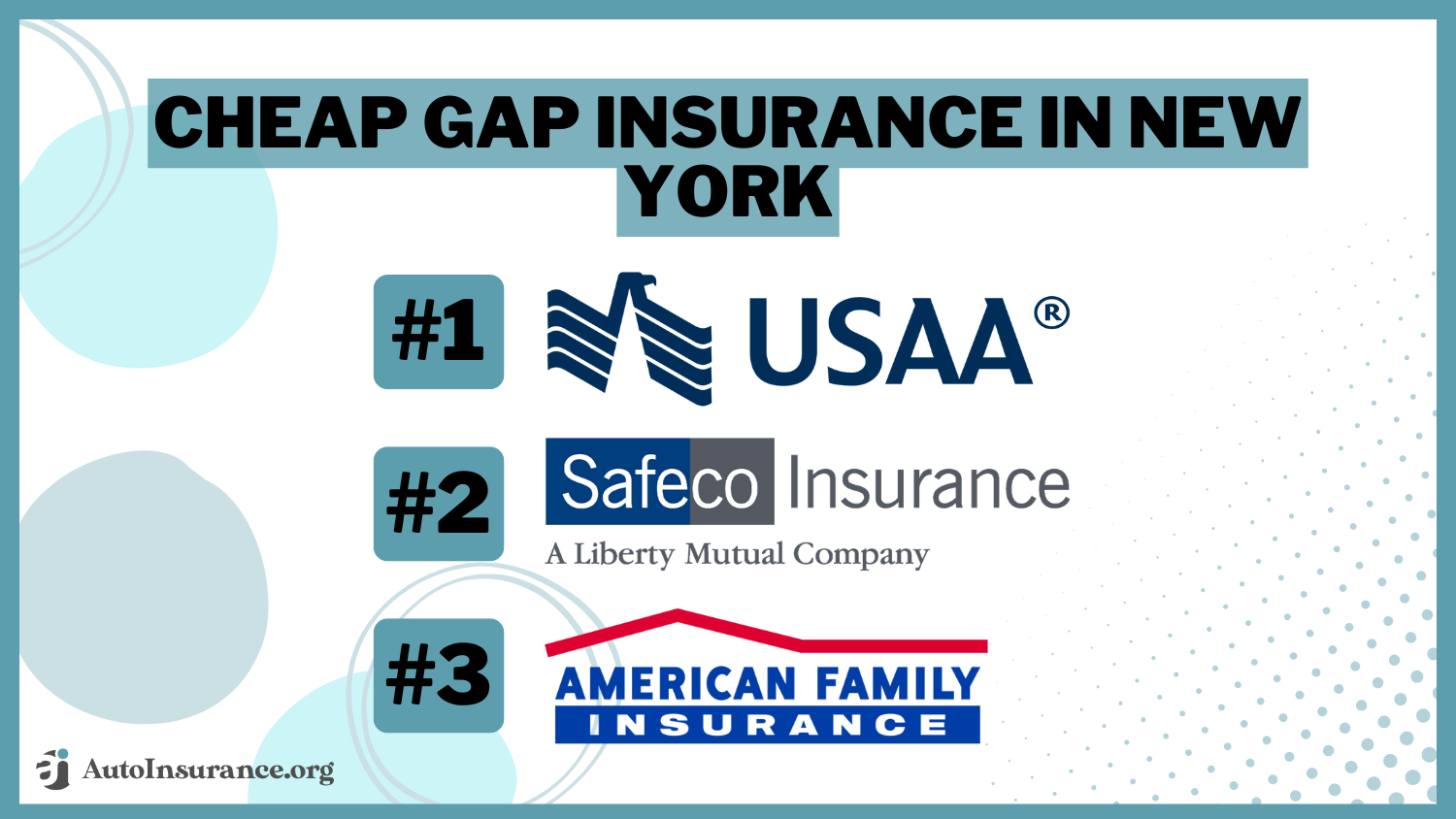

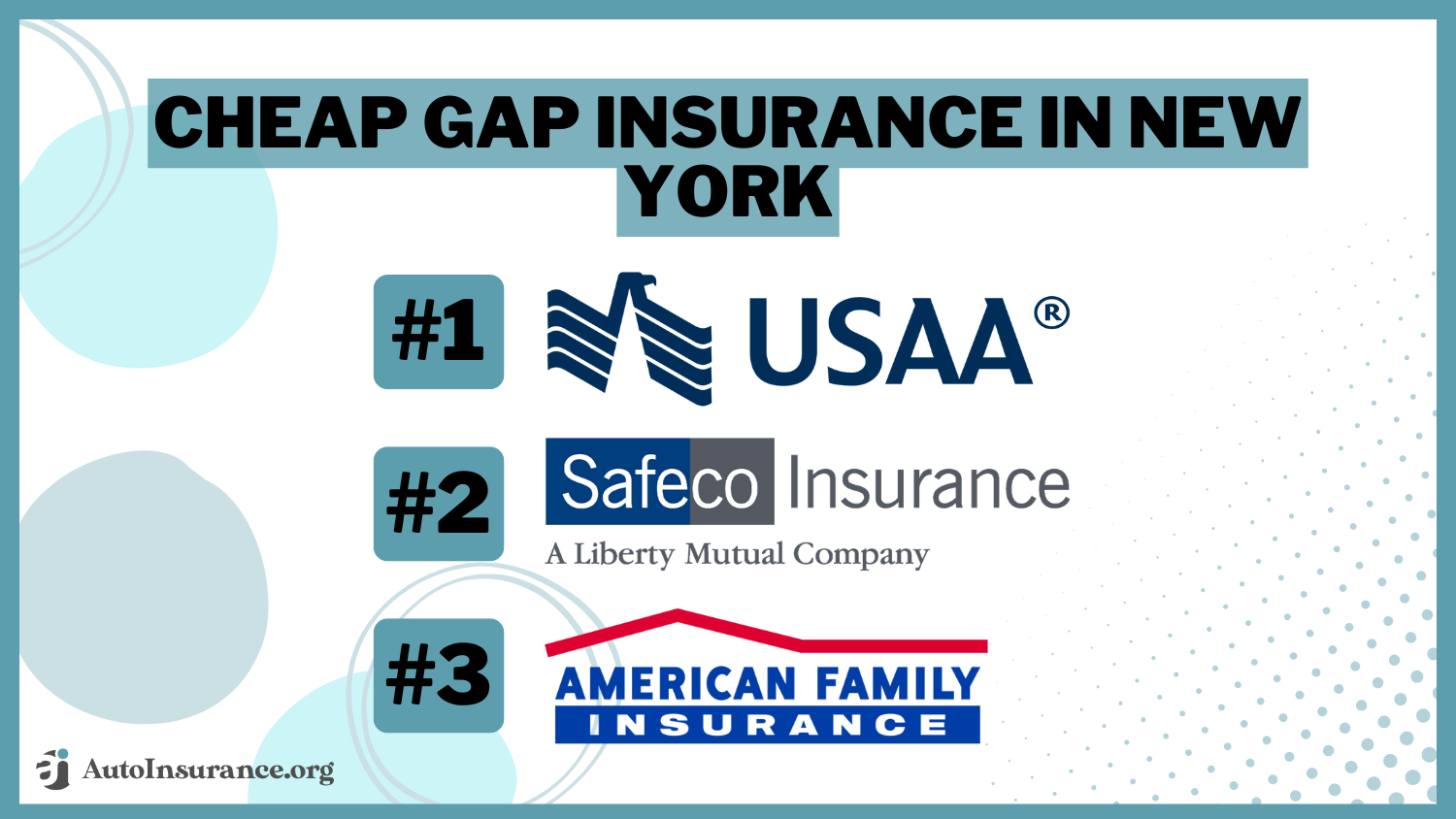

2,235 reviewsThe best picks for cheap gap insurance in New York are USAA, Safeco, and American Family, offering rates starting at $12/month.

USAA stands out as the top pick overall, providing military benefits and exceptional value with the cheapest gap insurance rates for new cars.

Our Top 10 Company Picks: Cheap Gap Insurance in New York

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $12 | A++ | Military Benefits | USAA | |

| #2 | $14 | A++ | Affordable Rates | Safeco | |

| #3 | $15 | A | Discount Availability | American Family | |

| #4 | $16 | A+ | Full Coverage | Progressive | |

| #5 | $17 | A+ | Multiple Vehicles | Nationwide |

| #6 | $18 | A+ | Infrequent Drivers | Allstate | |

| #7 | $19 | A++ | Bundling Policies | Travelers | |

| #8 | $20 | B | Customer Service | State Farm | |

| #9 | $21 | A | Add-on Coverages | Liberty Mutual |

| #10 | $22 | A | Safe Drivers | Farmers |

Safeco is also known for its affordable rates, while AmFam offers great discounts.

Scroll down to compare these providers and find the best gap insurance in New York. Enter your ZIP code above to find the cheapest gap insurance providers for your needs and budget.

- USAA is the top pick for cheap gap insurance in NY

- Affordable gap insurance rates start at $12/month for New York drivers

- American Family provides a variety of discounts on NY gap insurance

#1 – USAA: Top Overall Pick

Pros

- Exclusive Military Perks: USAA provides unique benefits for military members on gap insurance in New York, including specialized coverage options not available elsewhere.

- Competitive Rates for Service Members: USAA has the cheapest gap insurance in New York at $12/month, thanks to tailored pricing for military personnel.

- Highly-Rated Service: Known for excellent service, USAA ensures that gap insurance in New York is managed with a high level of customer satisfaction and efficiency. Learn more in our USAA review.

Cons

- Restricted Eligibility: New York gap insurance through USAA is limited to military families, excluding civilians and non-military individuals.

- Geographical Limitations: While USAA offers great rates, its gap insurance in New York might not be accessible to those who relocate or are outside their primary service areas.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Safeco: Cheapest Gap Insurance Rates

Pros

- Cheap Gap Insurance: Minimum coverage with gap insurance in New York is cheapest with Safeco at $76/month.

- Usage-Based Savings: Read our Safeco RightTrack review to find out how to save up to 30% on New York gap insurance by tracking safe driving habits.

- Positive Claims Reviews: Safeco customers report fast and friendly gap insurance claims service in New York.

Cons

- No Online Quotes: New York drivers must request gap insurance quotes from local agents.

- Limited Online Services: Some customers report issues with the provider’s website, which can make it frustrating when managing New York gap insurance online.

#3 – American Family: Cheapest With Discounts

Pros

- Generous Discount Opportunities: American Family provides a variety of discounts for the cheapest gap insurance in New York.

- Incentives for Vehicle Safety: Vehicles equipped with advanced safety technologies can benefit from additional discounts on gap insurance in New York with American Family.

- Multi-Policy Bundles: Combining gap insurance with other policies from AmFam in New York can lead to substantial overall savings. Discover our American Family review for a full list.

Cons

- Discount Complexity: The range of available gap insurance discounts in New York might be complex and challenging for some consumers to navigate.

- Premium Variability: The final cost for gap insurance in New York with AmFam may vary widely based on individual circumstances and discount eligibility.

#4 – Progressive: Cheap Full Coverage Options

Pros

- Competitive Full Coverage Rates: If you need cheap full coverage auto insurance in New York with gap, Progressive has the best rates at $180/month.

- Diverse Coverage Options: Progressive gap insurance in New York includes a wide array of coverage choices, allowing for tailored protection based on individual needs.

- Adaptable Terms: Progressive offers flexible terms for NY gap insurance, providing options to adjust coverage as your situation changes, which you can read more about in our Progressive review.

Cons

- Potential Rate Fluctuations: Rates for New York gap insurance with Progressive can fluctuate based on various factors, which might require frequent review.

- Complex Policy Details: The extensive range of options and terms for gap insurance in New York might be overwhelming to some customers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Cheapest for Multiple Vehicles

Pros

- Multi-Vehicle Discounts: New Yorkers who insure more than one car with Nationwide can save up to 20% on gap insurance rates.

- Multi-Policy Savings: Drivers who bundle Nationwide home and auto with gap insurance can lower their New York auto insurance rates by 20%.

- Solid Reputation: Nationwide has a well-established reputation for reliability and customer satisfaction for New York gap insurance, which you can check out in our Nationwide review.

Cons

- Bundling Requirements: To access multi-policy discounts, you might need to meet specific bundling requirements for gap insurance in New York, which could be limiting.

- Higher Standalone Rates: Without discounts, the cost of gap insurance in New York with Nationwide can be higher compared to some other providers.

#6 – Allstate: Cheapest for Infrequent Drivers

Pros

- Discounts for Low-Mileage Drivers: Allstate provides special gap insurance discounts in New York for drivers who use their vehicles infrequently. Read more in our review of Allstate Milewise.

- Additional Savings for Telematics: Allstate usage-based auto insurance and telematics devices can further reduce the cost of gap insurance in New York. Learn how in our Allstate Drivewise review.

- Robust Coverage Choices: Allstate offers a broad range of coverage options for gap insurance in New York, catering to different driver profiles.

Cons

- Premiums for High-Mileage Drivers: Drivers with higher annual mileage might find Allstate gap insurance rate to be less competitive than other New York providers.

- Discount Eligibility Limits: Certain discounts on New York gap insurance might only apply under specific conditions, making them less accessible.

#7 – Travelers: Cheapest With Multi-Policy Bundles

Pros

- Savings Through Policy Bundling: Travelers offers discounts on auto and gap insurance in New York when bundled with other types of insurance, like home or renters.

- Wide Range of Coverage Options: The variety of gap insurance coverage levels provided by Travelers in New York allows for extensive customization. Learn more in our Travelers review.

- Customizable Insurance Plans: Travelers offers the flexibility to adjust your gap insurance coverage in New York to meet specific needs and preferences.

Cons

- Complex Bundling Process: The process of achieving discounts through bundling gap insurance in New York can be complicated.

- Rate Inconsistencies: The cost of gap insurance in New York may vary based on different factors, requiring careful comparison.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – State Farm: Best Customer Service

Pros

- High-Quality Customer Support: State Farm is praised for its excellent customer service regarding gap insurance in New York, offering reliable assistance.

- Accident-Free Record Discounts: State Farm provides incentives for maintaining an accident-free record, which can lower your New York gap insurance costs.

- Extensive Local Network: State Farm’s widespread presence ensures that gap insurance in New York is readily available through many local agents. Read our State Farm review to learn more.

Cons

- Potentially Higher Premiums: Without qualifying for discounts, State Farm gap insurance rates in New York can be higher than some competitors.

- Limited Discount Applicability: Some gap insurance discounts may only be available under certain conditions in New York, affecting their overall value.

#9 – Liberty Mutual: Cheapest Add-on Coverages

Pros

- Enhanced Protection Options: Liberty Mutual offers additional coverages for gap insurance in New York, providing options for more comprehensive protection.

- Flexible Policy Customization: The ability to customize your gap insurance in New York with various add-ons allows for tailored coverage. Find out more in our Liberty Mutual review.

- Wide Availability: Liberty Mutual gap insurance in New York is accessible to a broad spectrum of drivers, ensuring widespread availability.

Cons

- Higher Costs for Add-Ons: The additional coverages available may come with higher costs, potentially increasing the overall expense of New York gap insurance rates.

- Policy Complexity: The range of add-on options might make it difficult for some customers to choose the most cost-effective gap insurance in New York.

#10 – Farmers: Cheapest for Safe-Drivers

Pros

- Discounts for Safe Driving: Farmers provides valuable discounts on gap insurance in New York for drivers with a clean driving record. For a complete list, read our Farmers review.

- Variety of Coverage Options: Farmers offers a range of gap insurance coverage levels in New York, allowing for selection based on specific needs.

- Bundled Savings Opportunities: Additional savings are available when combining gap insurance with other policies through Farmers in New York.

Cons

- Higher Initial Rates: The base gap insurance rates in New York may be higher before applying any Farmers discounts.

- Discount Availability: Safe-driving discounts may not be available to all drivers in New York, impacting the affordability of gap insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Comparing Gap Insurance Rates in New York

This table provides a breakdown of monthly rates for gap insurance offered by various providers in New York. Gap insurance helps cover the difference between your car’s actual value and what you still owe on your loan in the event of a total loss.

Gap Insurance Monthly Rates in New York by Provider & Coverage Level

| Insurance Company | Monthly Rates |

|---|---|

| $18 | |

| $15 | |

| $22 | |

| $21 |

| $17 |

| $16 | |

| $14 | |

| $20 | |

| $19 | |

| $12 |

The rates listed below allow you to compare affordable coverage options from leading companies, with prices ranging from $12 to $19 per month. Whether you’re looking for the cheapest option or evaluating based on reputation, this comparison can help you make an informed decision.

Check the terms of your auto loan or lease as it might require you to carry full coverage car insurance in New York, which could raise your gap insurance rates.

Read More: When to Buy More Than Minimum Auto Insurance

Most Auto Insurance Claims and Accident Trends in New York

Understanding the most common auto insurance claims in New York can help drivers better prepare for potential risks on the road. The table below highlights the five most frequently reported claim types, their portion of total claims, and the average cost per claim.

5 Most Common Auto Insurance Claims in New York

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Collision | 32% | $4,100 |

| Comprehensive | 24% | $2,800 |

| Property Damage | 18% | $4,500 |

| Bodily Injury Liability | 16% | $18,000 |

| Personal Injury Protection (PIP) | 10% | $9,200 |

From collision and comprehensive claims to liability and personal injury protection auto insurance, these figures provide valuable insights into the financial impact of various incidents and the importance of adequate coverage.

This table provides a snapshot of the number of accidents and insurance claims reported annually in various cities across New York. Understanding these figures can help drivers and policymakers assess risk and improve safety measures.

New York Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Albany | 3,200 | $2,500 |

| Buffalo | 4,800 | $3,600 |

| New York City | 15,000 | 11,500 |

| Rochester | 4,200 | $3,200 |

| Syracuse | 3,700 | $2,900 |

The data reflects both the number of accidents and the corresponding claims made per year, offering insight into the relationship between accidents and insurance activity in key urban areas such as Albany, Buffalo, New York City, Rochester, and Syracuse.

Effective Ways to Lower Your New York Gap Insurance Costs

To reduce the cost of gap insurance in New York, start by comparing quotes from different providers. Most top companies offer online tools to compare policy quotes, or you can use our free comparison tool above and get quotes from multiple New York insurance companies at once.

Look for discounts such as bundling with other policies, maintaining a clean driving record, and insuring multiple vehicles. Allstate offers savings for telematics and multi-policy plans, while American Family provides discounts for safety features and multi-car policies.

Auto Insurance Discounts From the Top Providers for Gap in New York

| Insurance Company | Available Discounts |

|---|---|

| Telematics Discount, Anti-Theft Device Discount, Paperless Billing Discount, Multi-Policy Discount | |

| Vehicle Safety Equipment Discount, Defensive Driving Discount, Multi-Car Discount, Safe Driver Discount | |

| Accident-Free Discount, Automatic Payments Discount, Safety Features Discount, Bundled Insurance Discount | |

| Anti-Theft Device Discount, Multi-Vehicle Discount, Automatic Payments Discount, Safe Driver Discount |

| Bundled Insurance Discount, Defensive Driving Discount, Safety Features Discount, Telematics Discount |

| Multi-Car Discount, Automatic Payments Discount, Safe Driver Discount, Vehicle Safety Features Discount | |

| Safe Driving Program Discount, Multi-Policy Discount, Telematics Discount, Vehicle Safety Equipment Discount | |

| Accident-Free Discount, Drive Safe & Save Discount, Multi-Policy Discount, Anti-Theft Device Discount | |

| Paperless Billing Discount, Safety Features Discount, Safe Driving Course Discount, Multi-Car Discount | |

| Telematics Discount, Bundled Insurance Discount, Defensive Driving Discount, Vehicle Safety Equipment Discount |

Explore top auto insurance discounts in New York. Farmers and USAA have savings for accident-free records and bundled insurance. Learn how to save money bundling insurance policies, and check for special programs like military benefits and membership rewards. You can also improve your credit score to qualify for additional discounts.

This report highlights the most common auto insurance discounts available to drivers in New York, evaluating each based on potential savings and availability across different providers.

New York Report Card: Auto Insurance Discounts

| Discount Name | Grade | Savings | Participating Providers |

|---|---|---|---|

| Good Driver | A | 25% | Geico, Allstate, Progressive, State Farm |

| Good Student | A | 20% | State Farm, Allstate, Liberty Mutual |

| Bundling | A- | 20% | Nationwide, Liberty Mutual, USAA |

| Defensive Driving | B+ | 15% | Allstate, Geico, Travelers |

| Low Mileage | B | 10% | Progressive, Nationwide, Liberty Mutual |

From good driver and multi-policy discounts to defensive driving and low mileage options, this comparison gives you an at-a-glance view of how much you could save and which companies offer these benefits. Use this report to make informed decisions and maximize your savings when shopping for auto insurance in New York.

This report card provides a snapshot of how auto insurance premiums in New York compare across various categories. The state earns a solid overall performance, with slightly above-average premiums and a wide availability of discounts.

New York Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Discount Availability | A- | Premiums above average, especially in urban areas |

| Customer Satisfaction | B+ | Higher rates for accidents or violations |

| Average Premiums | B | Discounts for safe drivers, students, and multi-policy holders |

| Regional Variation | B- | Urban rates higher than rural |

| Premiums for High-Risk Drivers | C+ | Positive overall, claims handling needs improvement |

However, high-risk drivers face steeper costs, and there are notable differences in rates between urban and rural areas. Customer satisfaction remains positive overall, though improvements could be made in the claims process. Here’s a breakdown of New York’s auto insurance performance by category, including grades and explanations for each aspect.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Case Studies: Finding the Right Gap Insurance Solution in New York

Finding the right gap insurance in New York can be tricky. These case studies of John, Lisa, and Alex show how different strategies helped them secure the best coverage for their needs:

- Case Study #1 – Maximizing Savings With USAA Military Benefits: John, an active-duty Army sergeant in New York, needs gap insurance on a tight budget. He chooses USAA for its $12/month rate and military benefits, offering the best value and service for his needs.

- Case Study #2 – Balancing Affordability and Discounts: Lisa, a single mother in New York, seeks affordable gap insurance with potential discounts. She selects American Family for its discounts on safety features, multi-car policies, and accident-free records, lowering her overall cost.

- Case Study #3 – Finding Competitive Rates: Alex, a young professional in New York, seeks affordable gap insurance with good coverage. He needs a provider with competitive rates and reliable coverage. Alex chooses Safeco for its budget-friendly rates and straightforward coverage.

Different providers offer unique advantages depending on your needs and priorities. That’s why it’s important to compare the best auto insurance companies in New York at once to see which is the best fit for you.

The Top Gap Insurance Companies in New York

We’ve compared the top insurance providers, and USAA, Safeco Insurance, and American Family have the best cheap gap insurance in New York.

USAA stands out as the top choice for gap insurance in New York, offering unparalleled value and benefits, especially for military members.Jeff Root Licensed Insurance Agent

USAA has the best New York gap insurance for military members, while Safeco has the lowest gap insurance rates for New Yorkers not in the military. However, American Family has the best auto insurance discounts in New York to get even cheaper rates for drivers who qualify.

You can find affordable gap insurance near you by entering your ZIP code below in our free quote comparison tool. Start comparing multiple New York auto insurance companies today.

Frequently Asked Questions

How much is gap insurance in New York?

Gap insurance in New York typically costs between $20-$40 per year, raising minimum coverage rates to around $12 per month. Rates can vary based on the provider, coverage level, and individual factors such as your driving history and vehicle type.

Is gap insurance allowed in New York?

Yes, gap insurance is allowed in New York. It is an optional coverage that helps pay off the difference between what you owe on your car loan or lease and the actual cash value of the vehicle if it’s totaled or stolen.

Does Geico offer gap insurance in New York?

Does Geico offer gap insurance? No, it does not offer gap insurance in New York or anywhere else in the U.S.

What does a gap plan cover?

A gap plan covers the difference between the remaining balance on your car loan or lease and the amount your insurance company pays out for your totaled or stolen vehicle. This coverage helps prevent financial loss if your vehicle’s value is less than what you owe.

What is the best type of gap insurance in New York?

The best type of gap insurance in New York depends on your specific needs. Generally, policies offered by reputable providers like USAA, Safeco, and American Family are highly recommended for their competitive rates and comprehensive coverage. Get the best auto insurance rates possible on gap coverage by entering your ZIP code below into our free comparison tool today.

Will gap insurance cover a blown engine in New York?

Gap insurance typically does not cover mechanical failures like a blown engine. It is designed to cover the difference between the loan balance and the vehicle’s actual cash value in the event of a total loss.

Will gap insurance cover negative equity in New York?

Yes, gap insurance is specifically designed to cover negative equity. If you owe more on your car loan or lease than the vehicle’s value, gap insurance will pay the difference if the car is totaled or stolen. Find out if it’s a good time to refinance an auto loan.

Is gap insurance mandatory in New York?

No, gap insurance is not mandatory in New York. It is an optional coverage that you can choose to purchase based on your financial situation and the value of your vehicle. Learn the minimum insurance requirements by state here.

Is New York gap coverage the same as insurance?

No, gap coverage in New York is a specific type of insurance designed to cover the gap between your car’s loan balance and its actual cash value. It is not the same as standard auto insurance, which covers liability, collision, and comprehensive damages.

Is umbrella insurance the same as gap coverage?

No, umbrella insurance is not the same as gap insurance. Umbrella insurance provides additional liability coverage beyond the limits of your existing auto or home insurance policies, while gap insurance specifically covers the difference between your vehicle’s loan balance and its actual cash value in the event of a total loss.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insuranc...

Farmers CSR for 4 Years

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.