The Zebra Review 2025 (Accurate Insurance Quotes?)

Comparing insurance quotes is easy with The Zebra, which partners with 90% of top providers to power its all-in-one platform. User reviews of The Zebra on Trustpilot are mostly positive. Read our unbiased The Zebra review to see what real users say about its quote tool and why we rated it 4.3 out of 5 stars.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Jun 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

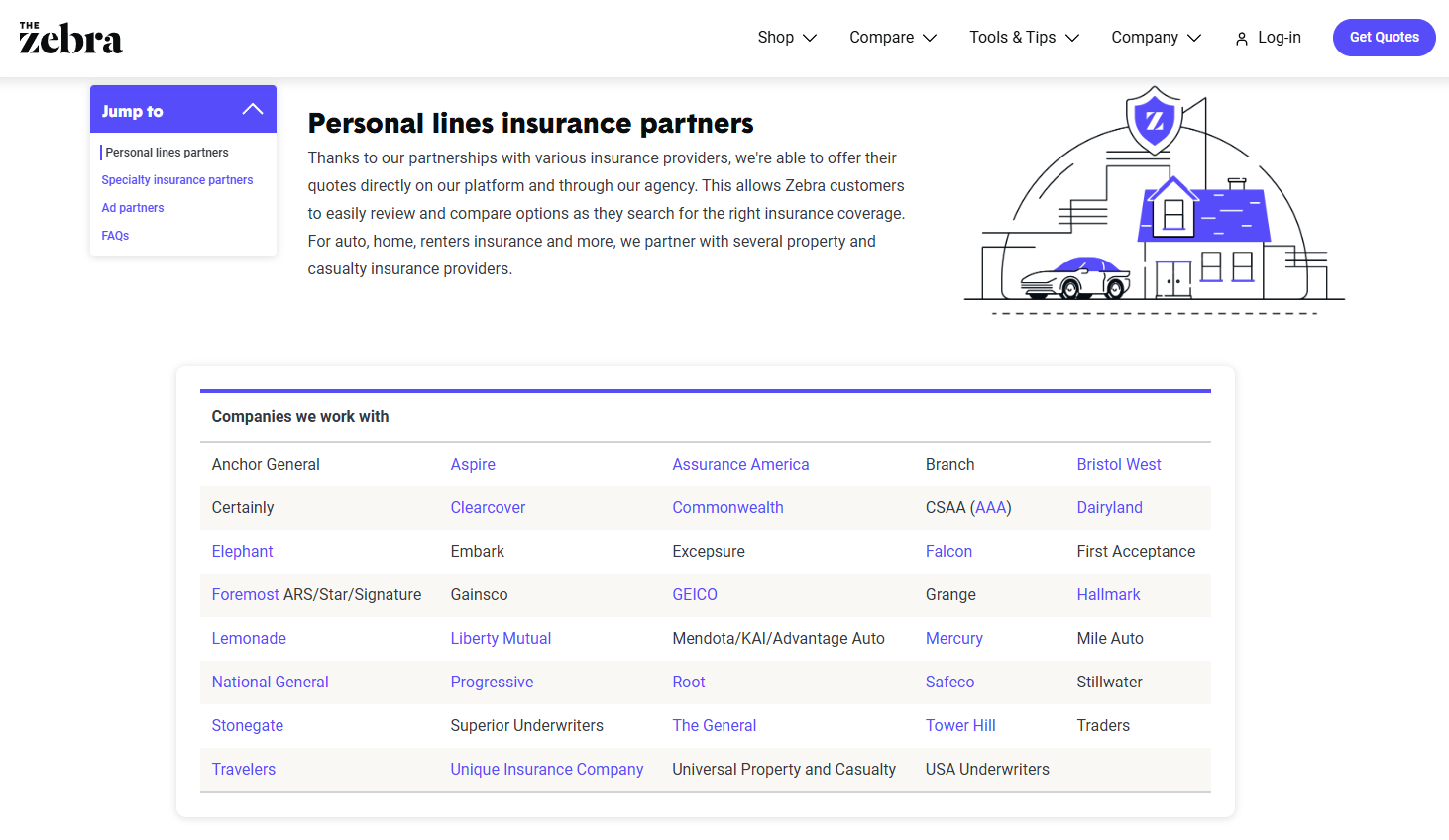

Our unbiased The Zebra review found that it partners with 90% of the best auto insurance companies, making it simple to compare rates instantly in one place.

So, The Zebra car insurance tools are great for lowering auto insurance rates.

The Zebra Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.3 |

| Customer Support | 4.2 |

| Discount Clarity | 4.1 |

| Ease of Use | 4.5 |

| Educational Resources | 4.3 |

| Provider Network | 4.3 |

| Quote Accuracy | 4.2 |

| Quote Speed | 4.4 |

| Savings Potential | 4.3 |

To compare auto insurance with The Zebra, enter personal information such as ZIP code, age, gender, vehicle type, and driving history.

- Compare insurance quotes with The Zebra from multiple companies

- The Zebra car insurance partners with 90% of the top insurers

- The Zebra insurance reviews are good, with an A- rating from the BBB

Want to compare auto insurance quotes right away? AutoInsurance.org offers 25% more coverage options per request. Enter your ZIP code into our free tool to buy auto insurance online instantly from top providers near you.

The Zebra Pros & Cons

| Pros/Cons | |

|---|---|

| ✅ Pros | • Provides real quotes from 90% of top car insurers, including Geico and State Farm. • Offers an easy-to-use quote comparison tool, insurance guides, and company reviews. • Trusted by thousands, with positive user reviews on Trustpilot and the BBB. |

| ❌ Cons | • Not all insurers show instant quotes, so some may require a follow-up or redirecting. • Quotes may be unavailable in areas where local insurers aren't partnered with the platform. |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

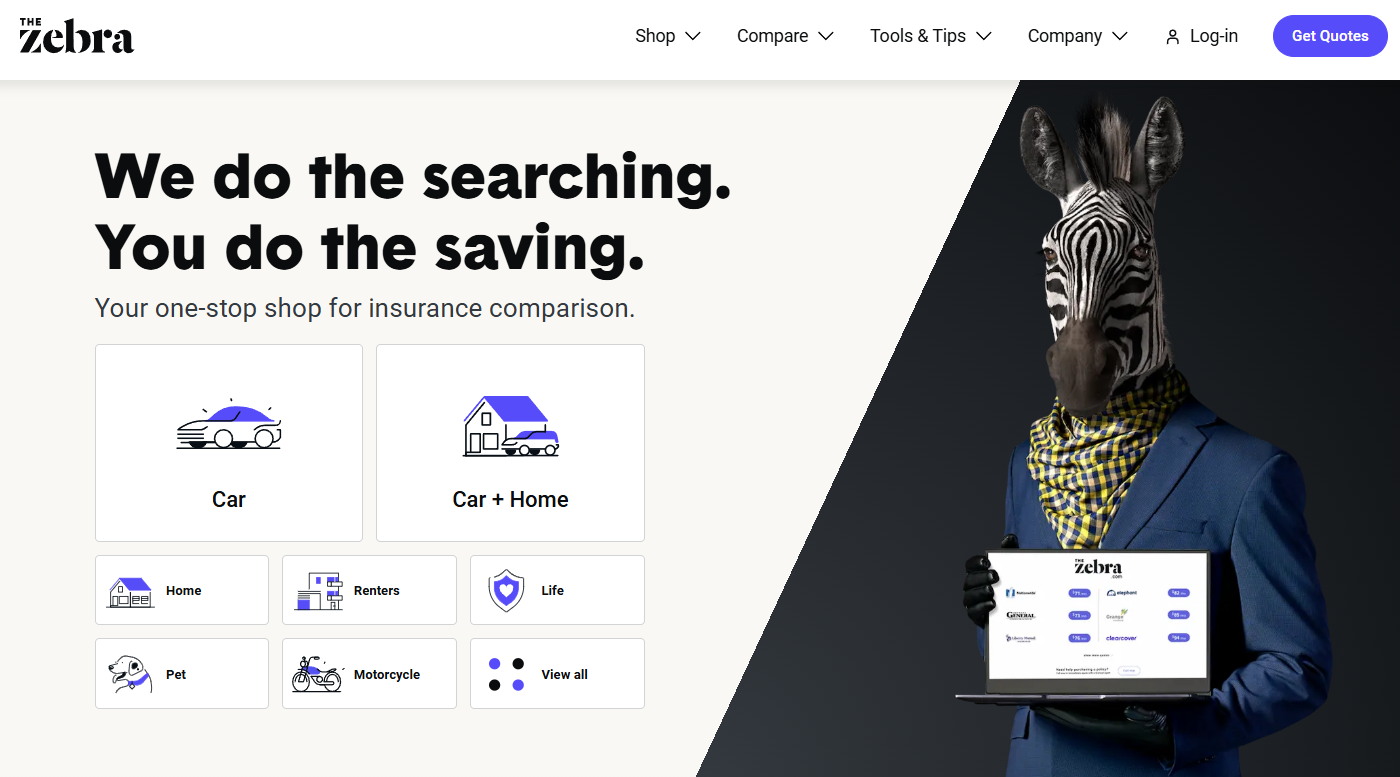

How The Zebra Helps You Compare Insurance Quotes

So, what is The Zebra insurance and how does it work? Founded in 2012, The Zebra is a leading platform that allows users to compare multiple quotes for auto, home, renters, and life insurance in one place from top providers.

The Zebra Platform Overview

| Details | |

|---|---|

| Real-Time Quotes | Yes |

| Average Quote Time | 3-10 minutes |

| Insurance Types Compared | Auto, home, renters, motorcycle, life |

| Providers Compared | 100+ |

| Shares Contact Info | No, only if you allow it |

| Customer Support | Help from licensed agents |

| Platform Focus | Insurance & expert advice |

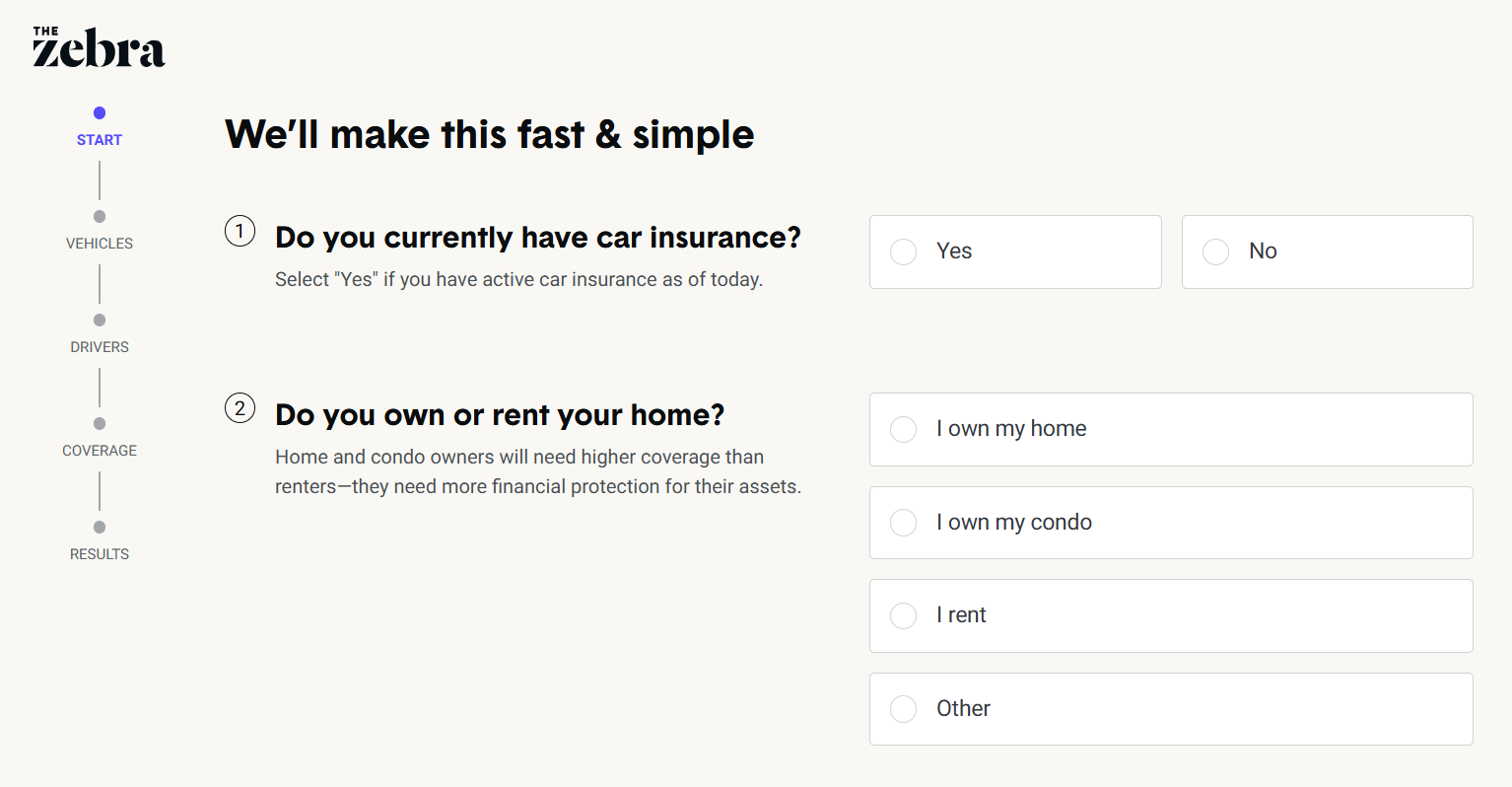

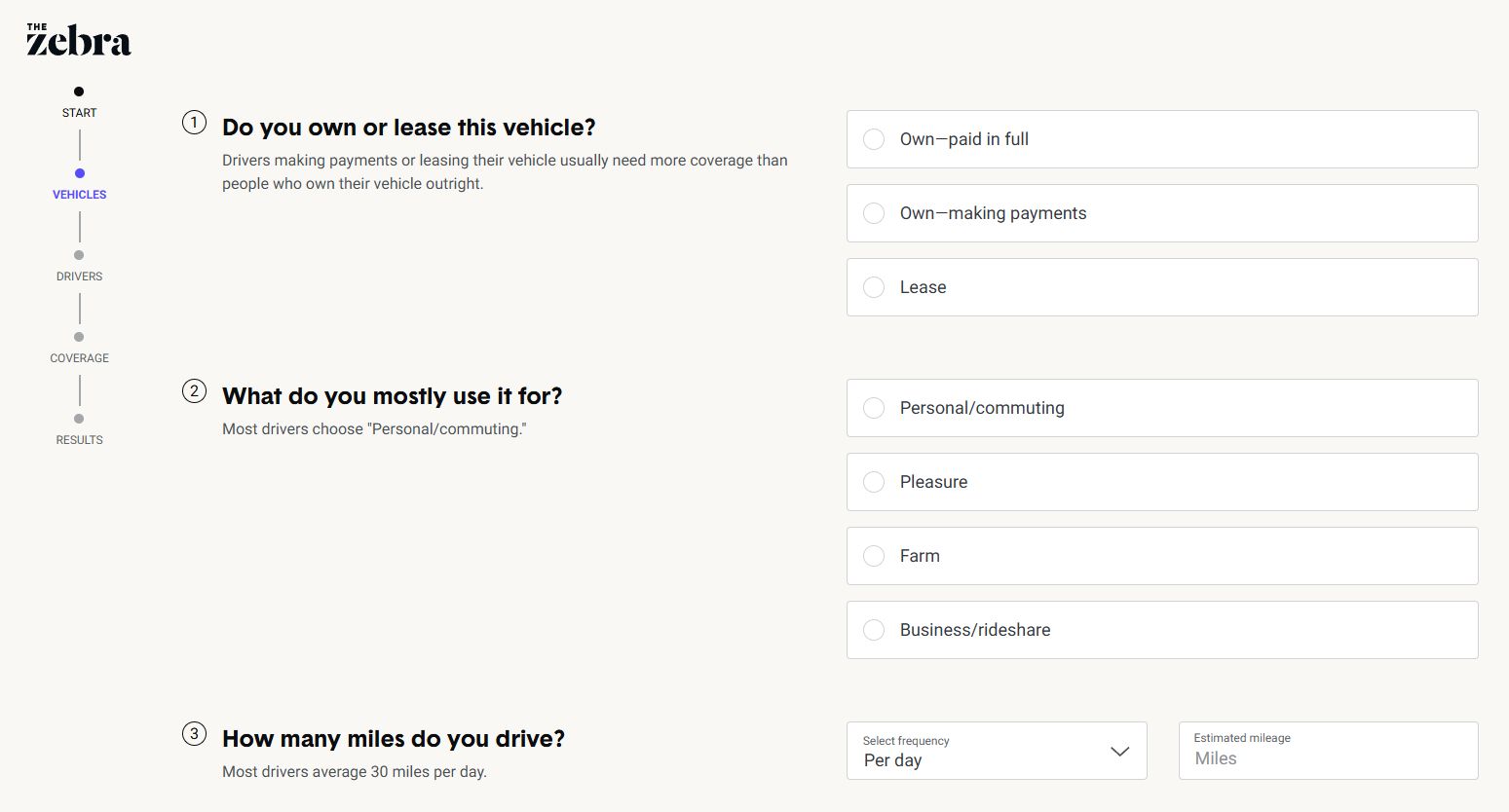

The Zebra auto insurance quote tool will ask you for personal details to create personalized insurance quotes. Here is a list of what it asks for and how they could impact your quotes:

- ZIP Code: The Zebra’s quote tool asks for your ZIP code to customize rates based on state minimums, crime rates, accident trends, and other local factors (Learn More: “Insurance Rates by ZIP Code“).

- Demographics: Factors like age, gender, marital status, credit, and education also influence quotes. For example, married drivers often qualify for cheap car insurance quotes with The Zebra.

- Insurance History: The Zebra quotes may be higher if you have a coverage lapse or claims history, but some insurance companies don’t penalize for a lapse in coverage.

- Driving Record: You must share details such as accidents, tickets, or DUIs to The Zebra’s tool, as these affect your quote (Read More: How Auto Insurance Companies Check Driving Record).

- Vehicle Type: Some vehicles are safer or cheaper to repair. So, The Zebra asks for your car’s make and model to compare auto insurance rates.

The Zebra auto insurance comparison quote form asks questions about these categories to set your rates. If you’re having trouble, The Zebra insurance phone number for customer service is 1-888-419-3716.

The Zebra compares quotes, coverages, and deductibles from 100+ top providers like Liberty Mutual and Geico to help users find the best value.Scott W. Johnson Licensed Insurance Agent

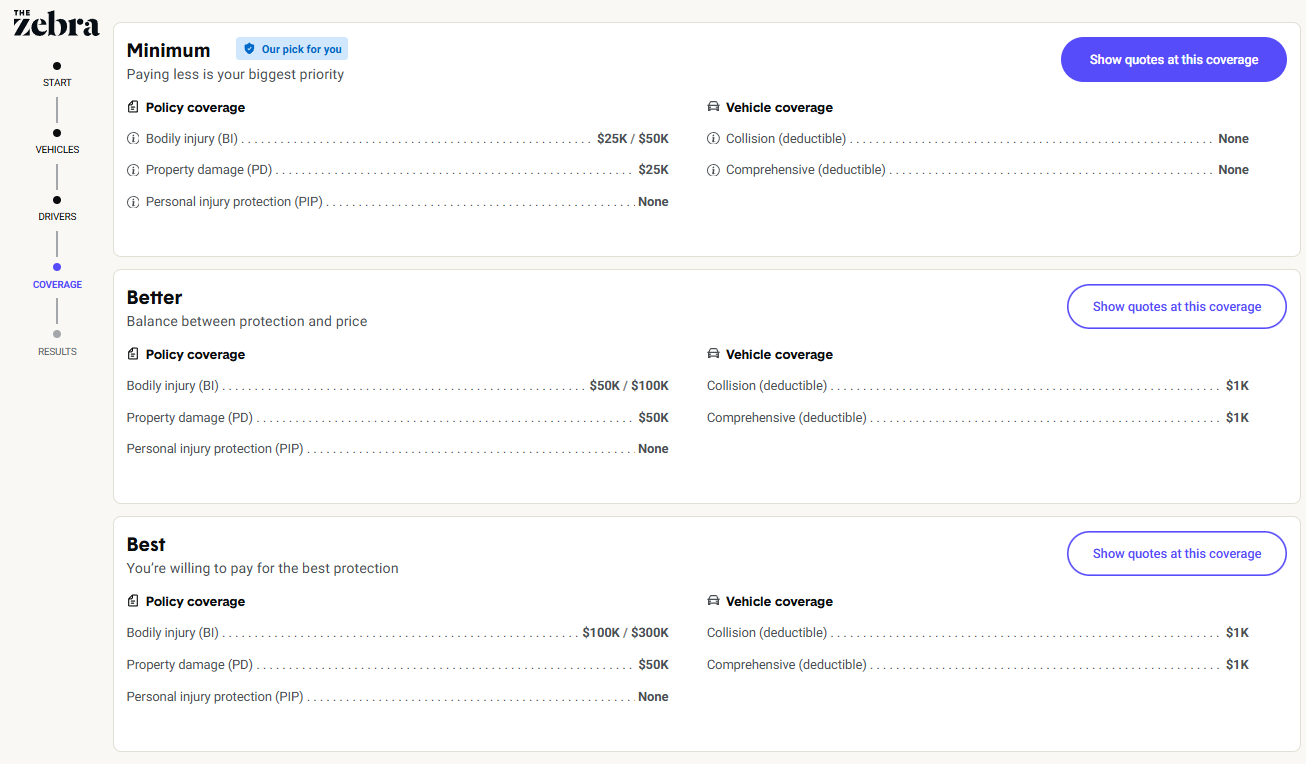

The Zebra divides its coverage recommendations into tiers: Minimum, Better, Best, and Customize It. The Minimum option shows you state insurance requirements for liability, which offer the cheapest rates but no protection for your car.

Better and Best provide full coverage quotes, including liability, collision, and comprehensive, though Best features higher liability limits for extra protection. The Customize It option allows you to modify coverages, deductibles, liability limits, and more to see quotes aligned with your needs and preferences.

If you’re considering a Geico policy but want the best deal, The Zebra’s car insurance quote comparison tool lets you compare what you’d pay with Geico vs. other insurers. See our Geico auto insurance review to compare its cost, coverage options, and discounts.

You may not always get an instant quote from The Zebra and may instead be redirected to the carrier’s website. This often requires the user to fill in additional information or repeat details already provided to The Zebra.

On the other hand, you can get instant quotes from over 60 top-rated providers near you with AutoInsurance.org. Enter your ZIP code to see how much you could save with our free comparison tool.

Real Customer Feedback and Ratings for The Zebra

Is The Zebra legit? The Zebra reviews and complaints from customers are mixed. Check out The Zebra reviews from BBB and other third parties to see how real customers rate their experiences:

The Zebra Third-Party Customer Ratings

| Review Platform | |

|---|---|

| A- | |

| 3.86 / 5 400+ reviews |

|

| 4.6 / 5 1.2k+ reviews |

|

| 4.3 / 5 |

As you can see, The Zebra ratings from platforms like the Better Business Bureau and Trustpilot show strong customer satisfaction. In addition, The Zebra Google reviews average 4.5 out of 5 stars, with over 500 reviews.

While The Zebra isn’t an insurance company, many users trust TheZebra.com for car insurance quote comparison. However, The Zebra reviews on Reddit complain that it doesn’t offer direct quotes, instead connecting you with a provider and earning a commission for the referral.

Has anyone actually used The Zebra? I don’t understand what service they provide

byu/belleayreski2 inDonutMedia

Read More: Auto Insurance Companies With the Best Customer Service

The Zebra auto insurance reviews and ratings suggest most customers are satisfied. Still, many complaints question the platform’s practice of redirecting users to the insurance company’s website to obtain quotes.

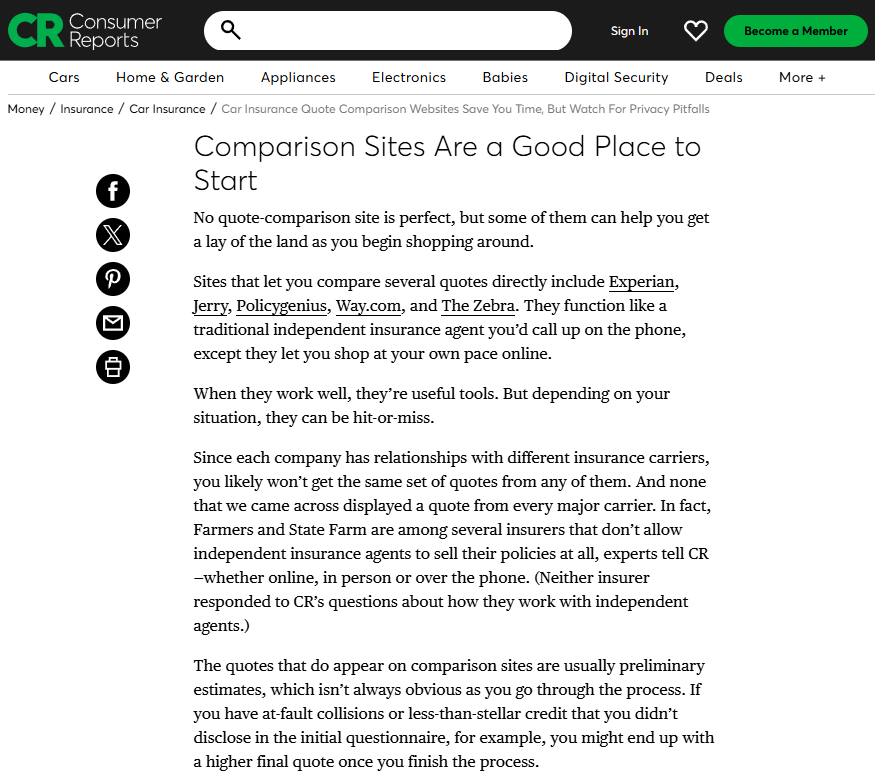

According to The Zebra reviews on Consumer Reports, comparison sites like The Zebra can be useful, but they often provide preliminary estimates that may change when finalizing your quote.

For example, Consumer Reports notes that carriers like Farmers and State Farm don’t allow independent brokers, including comparison sites, to sell policies at all.

Always check out The Zebra Trustpilot reviews, or other platforms such as Consumer Reports and Reddit, to see what actual customers and third parties say. You can also explore our guide on the best auto insurance companies according to Reddit.

Customers who compare insurance with The Zebra have mostly positive experiences. Meanwhile, AutoInsurance.org boasts a 98% customer satisfaction score, indicating that more users are satisfied with its savings compared to other competitors. Enter your ZIP code to compare quotes now.

How The Zebra Insurance Finder Makes Money

How do free The Zebra car insurance quotes make the company money? The Zebra works similarly to an auto insurance broker, as it contracts with various insurance providers to provide you quotes.

If a The Zebra customer goes on to buy auto insurance from one of the contracted companies on their website, The Zebra will make money. In some states, The Zebra is even licensed to sell insurance for companies, meaning you can purchase coverage directly from them.

The Zebra blog also helps customers by offering information and advice on insurance.

So, why do customers prefer The Zebra over visiting insurers’ websites directly? With The Zebra auto quotes, you only need to enter your information once to compare quotes from multiple companies, saving time and money (Learn More: Why to Get Multiple Auto Insurance Quotes).

The Zebra's platform makes comparing quotes easy, saving users time and helping them find affordable coverage without contacting multiple providers.Tim Bain Licensed Insurance Agent

Read more in our TheZebra.com review about the pros and cons of using the service and discover other top sites that compare auto insurance rates.

For instance, AutoInsurance.org helps you save $540 annually on car insurance, which is more than most other competitors. Enter your ZIP code to get started with a free quote.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top Alternatives to The Zebra

The Zebra isn’t your only option if you’re shopping for multiple car insurance quotes. Here are some other trusted platforms that help drivers compare quotes fast:

Insurance Comparison Site Features

| Comparison Site | Savings Potential | Annual Savings | Quote Time | Providers Compared | Customer Satisfaction |

|---|---|---|---|---|---|

| 25% | $400 | 3 minutes | 100+ | 91% | |

| 40% | $540 | 2 minutes | 80+ | 98% | |

| 30% | $420 | 2 minutes | 120+ | 94% | |

| 20% | $300 | 5 minutes | 700+ | 89% | |

| 15% | $250 | 4 minutes | 12+ | 88% |

As you can see, The Zebra offers quotes in as little as 3 minutes, which is slightly longer than Insurify’s quote time.

However, AutoInsurance.org helps users save 40% more on average than most competitors — enter your ZIP code to get a quote in under 2 minutes.

The Zebra vs. Insurify

Unlike Insurify, reviews on TheZebra.com for auto insurance found that it doesn’t require as much personal information to get a quote, which may alleviate privacy concerns. On the other hand, Insurify may provide more quotes or options with the additional details.

With Insurify and TheZebra.com, compare car insurance instantly to get free quotes side by side, though drivers seeking more more quotes or a personal touch should consider the other best insurance comparison sites. Learn more in our Insurify review.

The Zebra vs. NerdWallet

While both are excellent platforms for comparing quotes, The Zebra focuses primarily on its car insurance comparisons. Meanwhile, NerdWallet has a broader financial platform with resources for credit cards, loans, and more.

The Zebra vs. NerdWallet: Third-Party Customer Ratings

| Review Platform | ||

|---|---|---|

| A- | A+ | |

| 3.86 / 5 400+ reviews | NA | |

| 4.6 / 5 1.2k+ reviews | 3.7 / 5 2k+ reviews |

Of course, many customers enjoy The Zebra’s ability to get quick quotes without entering their phone number. However, you’ll need to provide this information to NerdWallet’s quote tool. Check out our review of NerdWallet for more details.

The Zebra: A Reliable Comparison Tool With Some Limitations

The Zebra has a solid reputation for its quote comparison and user-friendly platform. It also offers convenient resources to inform shoppers about the types of auto insurance coverage and ways to save on TheZebra.com insurance rates.

3, 5, 10? Can you get TOO many car insurance quotes📰? Probably not, but you can get too few. You won’t know if you got the best deal if you can’t compare it🔍. https://t.co/27f1xf1ARb has put in the work to find you cheap insurance. Check it out here👉: https://t.co/wKUJsuX6su pic.twitter.com/uPH3dCk5nz

— AutoInsurance.org (@AutoInsurance) January 16, 2024

However, some customers have reported receiving spam emails or calls from partners, which can be frustrating for those concerned about privacy. To protect your information, check out our step-by-step guide titled, “How to Get an Auto Insurance Quote Without Giving Personal Information.”

In addition, The Zebra doesn’t always provide a direct quote, often redirecting users to the insurer’s website to complete the process.

Ready to compare The Zebra car insurance rates? Many drivers turn to The Zebra insurance to compare quotes from top carriers and lower their auto insurance rates (Read More: Where to Get an Instant Auto Insurance Estimate).

AutoInsurance.org helps drivers save $540 annually on their premiums, which is more than The Zebra. So, if you’re wondering whether your TheZebra.com auto insurance quotes are truly the best deal, enter your ZIP code into our free comparison tool today to see how much you could save.

Frequently Asked Questions

Is The Zebra insurance legit?

Many insurance shoppers wonder, “Is The Zebra legit?” Yes, you can compare car insurance with The Zebra, as it partners with 90% of the top U.S. providers.

How does The Zebra make money?

The Zebra makes money by having contracts with various insurance providers. When a customer purchases auto insurance from one of the contracted companies through The Zebra’s website, they earn a commission.

Does The Zebra run your credit?

You may be wondering, “Does The Zebra pull your credit?” No, since The Zebra isn’t an insurance company, using Zebra to compare insurance quotes won’t affect credit. However, once you choose an insurance company, it may check your credit.

Does The Zebra charge a fee?

No, like most of the best insurance comparison sites, The Zebra doesn’t charge for its services. Instead, The Zebra makes money through commisions from insurance providers after users purchase a policy.

Who owns The Zebra insurance?

The Zebra was founded in 2012 by Adam Lyons and Joshua Dziabiak. Currently, a group of investors own The Zebra, such as Silverton Partners, Ballast Point Ventures, and Accel.

Why do customers choose to go through The Zebra rather than directly to insurers’ websites?

Customers choose The Zebra because it allows them to fill out quote information once and receive personalized quotes from multiple different companies. This saves time and helps customers find a company that fits their budget and insurance needs.

In addition, our The Zebra car insurance review finds that most customers are satisfied with the platform.

Where does The Zebra get its quotes and how does it work?

The Zebra partners with over 100 companies, including major insurers like Geico, Liberty Mutual, and State Farm, to provide auto insurance quotes. Customers can easily compare quotes from these companies using The Zebra’s comparison tool.

Learn More: Where to Compare Auto Insurance Rates

How often should you shop around for auto insurance?

It is recommended to shop around for auto insurance at least once a year. Rates and coverage options can change, so comparing quotes from different insurers ensures that you are getting the best possible rates for your needs.

AutoInsurance.org maintains a user satisfaction of 98%, consistently outperforming other sites like Insurify and The Zebra. Enter your ZIP code into our free comparison tool to compare The Zebra insurance quotes vs. other providers.

How long does an auto insurance quote from The Zebra last?

Auto insurance quotes from The Zebra typically last for a month or two before expiring. If you don’t act upon the quote within that time, you may need to fill out a new quote form to get an updated quote.

What is The Zebra’s Insurability Score?

The Zebra’s Insurability Score™ is a free tool that helps customers find out what their insurance risk is and how to fix it. It calculates risk with the same formula insurers use (your car, how you drive, etc.) and shows you what you can do to lower your rate and start saving on auto insurance.

Check out The Zebra car insurance reviews online before deciding to compare quotes on the platform.

What is the Zebra Fintech?

Fintech provides advice on technology and finance.

Does getting an auto insurance quote affect credit?

No, getting an auto insurance quote doesn’t hurt your credit score. Insurers take what is called a soft pull on credit to assign rates. While a soft pull may show up on your next credit statement, it has no bearing on your score.

However, your credit score will affect auto insurance rates. Drivers with good or excellent credit can sometimes pay over $1,000 less than drivers with poor credit.

How many auto insurance quotes should you compare?

The Insurance Information Institute (III) recommends that you compare at least three insurance quotes. This allows you to view a wider range of prices and coverages in your area so you can pick the best one.

Filling out multiple quote forms can be time-consuming, so we recommend going through a quote comparison tool first. Once you have quotes from a comparison tool, you can pick the top insurers and get individual quotes from each one. This will ensure that your quotes are as accurate as possible.

How do The Zebra’s rates stack up?

The Zebra is a quoting service, and the rates come directly from the insurance companies. That means that you should see the same quotes from The Zebra as you would if you got a quote directly from an insurance provider.

Quotes may sometimes differ across quoting sites if one asks for different information than another. More accurate quotes come from those with the most detailed questions.

Is there a Zebra app for insurance comparison?

No, unfortunately, there is no car insurance mobile app to compare quotes on Zebra. So, you’ll have to visit its website if you decide to use Zebra for car insurance comparison.

How does Insurify vs. Zebra compare?

Many readers have asked, “What’s the difference between The Zebra and Insurify?” While Insurify offers insurance comparison for various coverage types, Zebra focuses primarily on car insurance.

However, both are legitimate websites, as many drivers go to The Zebra insurance for comprehensive comparisons.

What is The Zebra’s car insurance phone number?

If you have questions about your quote, call The Zebra customer service at 1-888-255-4364 for help.

Is The Zebra a credible source?

Is Zebra car insurance legit? Yes, The Zebra partners with several top insurers and is a trusted source for auto insurance quotes. Simply enter your personal information to instantly compare The Zebra car insurance rates from providers near you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.