NerdWallet Review for 2025 (Reliable Insurance Quotes?)

This unbiased NerdWallet review highlights access to insurers like Allstate, Liberty Mutual, and USAA. It features a 4.8-rated iOS app, weekly TransUnion credit score updates, 100+ credit card comparisons, a net worth tracker, loan calculators, and a debt payoff tool to simplify financial decisions.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Apr 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

This unbiased NerdWallet review explores how its credit-based recommendation engine and loan-matching tools support drivers and small business owners.

The platform combines real-time rate comparisons with spending trackers, asset calculators, and credit score monitoring. It also helps users get free online auto insurance quotes from major insurers.

NerdWallet Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.5 |

| Customer Support | 4.4 |

| Discount Clarity | 4.3 |

| Ease of Use | 4.8 |

| Educational Resources | 4.9 |

| Provider Network | 4.4 |

| Quote Accuracy | 4.5 |

| Quote Speed | 4.4 |

| Savings Potential | 4.6 |

After acquiring Fundera, NerdWallet expanded its reach to over 28 million small businesses, reinforcing its role as a versatile financial resource.

While NerdWallet provides helpful tools, AutoInsurance.org delivers quote results in under 2 minutes and gives users access to over 60 top-rated insurers—more than most platforms in the industry.

- NerdWallet review shows quotes require third-party redirects

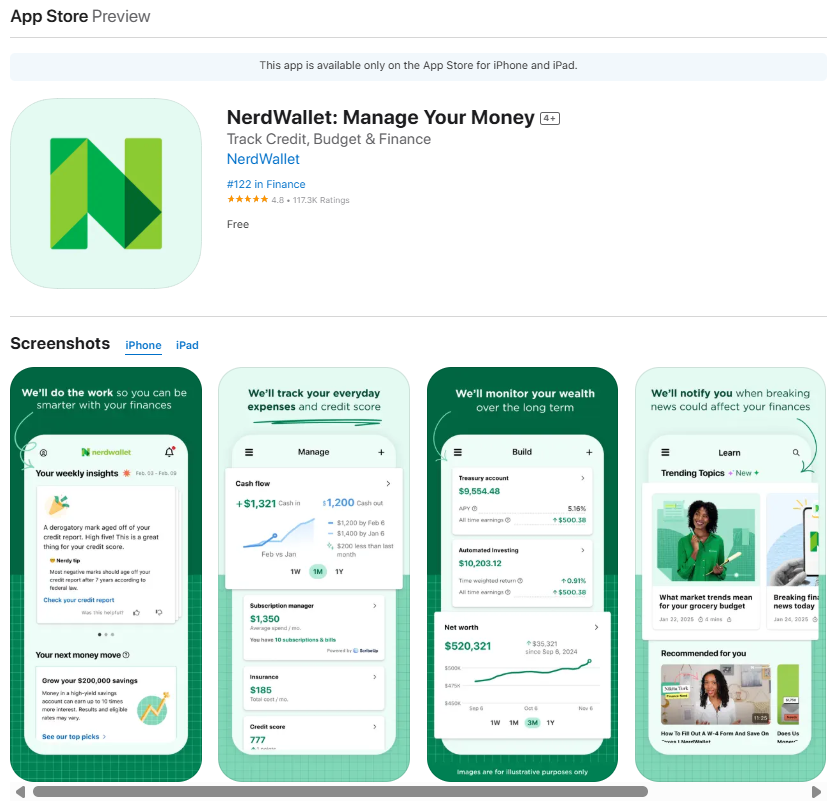

- The Mobile app offers weekly credit scores and loan tools

- No direct claims support or built-in policy customization

This NerdWallet review evaluates its tools without ranking competitors, while AutoInsurance.org offers real-time quotes from top insurers—just enter your ZIP code to begin.

NerdWallet: Pros & Cons

| Pros/Cons | |

|---|---|

| ✅ Pros | • Rated 4.8 by over 115K iOS users. • Get real-time auto quotes from top national insurers. • Track your credit score and compare 100+ cards. |

| ❌ Cons | • NerdWallet redirects you to third-party quote sites. • Rated 1.5 on WalletHub for poor transparency. |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How NerdWallet’s Platform Works

NerdWallet is more than just an insurance comparison site—it’s a full financial toolbox. From tracking your credit score to comparing over 100 credit cards, the platform gives you the tools to make smarter money decisions across banking, loans, mortgages, and small business finance. But if you’re looking for auto insurance, NerdWallet’s quote tool is one of its most useful features.

NerdWallet Platform Overview

| Details | |

|---|---|

| Real-Time Quotes | No, often redirects |

| Average Quote Time | 5-15 minutes |

| Insurance Types Compared | Auto, home, renters, life, pet, health |

| Providers Compared | 700+ |

| Shares Contact Info | Yes, may share with partners |

| Customer Support | Self-serve guides only |

| Platform Focus | Finance, credit cards, loans, insurance |

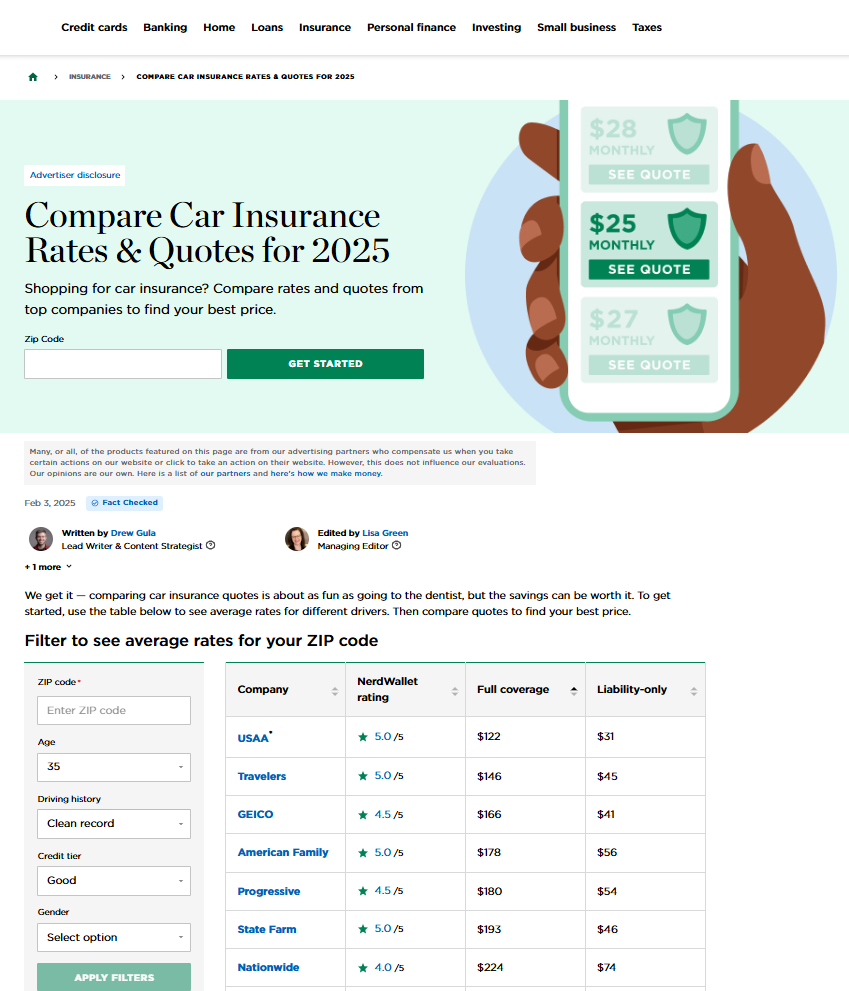

To get started, you fill out a quick form with basic info like your ZIP code, vehicle type, and driving history. NerdWallet then connects you to top insurers like Allstate, Liberty Mutual, Progressive, and USAA.

While it doesn’t deliver quotes directly, it routes you to each insurer’s site to view and finalize real-time monthly rates. Yes, it adds a step—but it gives you access to trusted providers, making it easier to evaluate multiple auto insurance quotes side-by-side.

You won’t find built-in bundling or claim filing features, but NerdWallet does guide you through standard coverages like liability, collision, and comprehensive auto insurance. It also helps you compare insurer options so you can make a more informed choice before buying.

Outside of insurance, NerdWallet offers weekly TransUnion credit score updates, a net-worth tracker, loan and debt payoff calculators, and access to cashback rewards and travel bonus card offers. With a 4.8-star iOS app and over 160 million users annually, it’s clear the platform is built for convenience and scale.

Thanks to its acquisitions of Fundera and On the Barrelhead, NerdWallet now supports 28 million small businesses and delivers credit-based recommendations that tailor financial products to your unique profile. It’s based in San Francisco, employs 758 people, and generates $538.9 million in revenue—all while keeping the platform free to use.

So whether you’re here to track your finances or get multiple auto insurance quotes, NerdWallet makes it simple to compare what matters most—all in one place.

How NerdWallet Collects Its Information

Now that you know how NerdWallet makes its money, it’s time to discuss in more detail where NerdWallet’s information comes from. As we stated before, NerdWallet insurance operates through affiliate partnerships. Currently, NerdWallet is partnered with the following list of car insurance companies:

- Allstate

- Esurance

- Liberty Mutual

- Progressive

- USAA

This is a short list compared to other quote comparison companies, but to be fair, NerdWallet’s main focus is credit cards, not auto insurance. If you’ve ever heard ads or seen commercials like the one below, then you know that NerdWallet promotes credit card comparison, not auto insurance comparison. Most of them are among the top auto insurance companies.

That said, it still works with some major players in the industry. Many of these are considered among NerdWallet’s best auto insurance partners, including well-known names like Liberty Mutual and USAA. While the platform may not cover as many providers as others, it does give users access to quotes from a few of the top insurers in the country.

Insurance Comparisons Require Extra Steps

For people who wish to organize their finances, NerdWallet is a good selection. It provides simple-to-use tools such as weekly updates of your credit score, a tracker for net worth, and comparisons on the same page for credit cards and loans. If you desire a more understandable image of your financial situation, starting here would be wise.

When it comes to auto insurance, though, it’s not as smooth. You can see quotes from big names like Liberty Mutual and USAA, but you’ll usually get sent to other websites to wrap things up. That means retyping your info more than once, which can make the whole process feel a bit clunky—especially if you’re trying to figure out where to compare auto insurance rates all in one place.

Redirect-heavy quote systems can create gaps in information, so verify coverage details directly with the provider before purchasing.Michelle Robbins Licensed Insurance Agent

AutoInsurance.org is a much better fit if your main goal is to shop for auto insurance. It’s designed specifically for that purpose and gives you access to over 60 top-rated insurers. The quote process is quick—usually under two minutes—and users often find more coverage options in a single search. On average, drivers save about $540 a year on full coverage.

With a 98% satisfaction rate and savings that can be up to 40% higher than other tools, AutoInsurance.org stands out for speed, variety, and ease of use. If you’re looking for a simple way to compare auto insurance and actually save money, AutoInsurance.org is the better choice.

NerdWallet Reviews and User Insights

User reviews offer real insight into how these platforms perform beyond features and speed. The table below compares NerdWallet, Insurify, and LendingTree based on customer ratings from trusted third-party sites.

NerdWallet vs. Insurify vs. LendingTree: Third-Party Platform Customer Ratings

| Review Platform | |||

|---|---|---|---|

| 4.8 / 5 115k+ reviews | 3.4 / 5 141 reviews | 4.8 / 5 37k+ reviews |

|

| A+ | A+ | A+ | |

| NA | 3.8 / 5 130+ reviews | NA | |

| 4.5 / 5 29.9k reviews | 3.4 / 5 141 reviews | 4.3 / 5 9k+ reviews |

|

| 4 / 5 | NA | 3.3 / 5 | |

| 3.7 / 5 3k+ reviews | 4.7 / 5 2k+ reviews | 4.2 / 5 14k+ reviews |

NerdWallet’s app receives high marks, with a 4.8 rating on the App Store from over 115,000 users and 4.5 on Google Play. However, outside of mobile experience, it scores a higher average of 3.7 on TrustPilot and doesn’t have a Clearsurance rating. NerdWallet reviews complaints often mention confusion during the quote process and frustration with frequent redirects to third-party sites.

Insurify does not stand out in app stores—both iOS and Android users rank it 3.4—but it is rated 4.7 on TrustPilot and 3.8 on Clearsurance, indicating that consumers enjoy its quote speed and simplicity when selecting an auto insurance company.

LendingTree holds its own with a 4.8 App Store score from 37,000+ users, a 4.2 on TrustPilot, and a 3.3 on PCMag. Overall, NerdWallet wins on mobile usability, but Insurify earns more consistent praise for its quote process and overall customer satisfaction.

There are also NerdWallet reviews on Reddit, where users often compare it to tools like Mint. One Reddit user pointed out that while NerdWallet is great for tracking spending and monitoring credit, it falls short when it comes to monthly budgeting or detailed expense tracking.

NerdWallet is a solid (free) Mint replacement for people who don’t care about bills and budgeting

byu/redkemper inmintuit

If budgeting isn’t your top priority, though, it’s still a solid pick for checking your credit, seeing where your money goes, and comparing your overall financial picture.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Side-by-Side Breakdown of Insurance Comparison Site Features

Not all insurance comparison sites work the same. If you’re wondering how long it takes to compare auto insurance quotes, the answer depends on the platform. Here’s how Insurify, NerdWallet, and LendingTree stack up when it comes to speed and savings.

Insurify vs. NerdWallet vs. LendingTree: Compare Top Insurance Sites

| Feature | |||

|---|---|---|---|

| Savings Potential | 30% | 20% | 25% |

| Annual Savings | $420 | $300 | $250 |

| Fastest Quote Time | 2 minutes | 5 minutes | 3 minutes |

| Providers Compared | 120+ | 700+ | 50+ |

| Customer Satisfaction | 94% | 89% | 90% |

Insurify leads with 2-minute quote times, $420 in average annual savings, and access to 35 coverage options per request across 40 insurers. NerdWallet, while strong in overall finance tools, averages $300 in savings, takes 5 minutes for quotes, and connects you with just 20 insurers.

NerdWallet car insurance reviews often reflect this slower process, especially when users have to re-enter information on third-party sites. LendingTree offers slightly better savings at $350 and faster quotes at 3 minutes, but with only 25 insurers. For speed, variety, and better real-time results, Insurify clearly delivers more value.

NerdWallet vs. LendingTree

If you’re wondering which platform people actually like using, these third-party reviews lay it all out. From app ratings to quote tools, NerdWallet car insurance comparison and LendingTree get mixed feedback depending on where users are logging in.

NerdWallet vs. LendingTree: Third-Party Customer Ratings

| Review Platform | ||

|---|---|---|

| 4.8 / 5 115k+ reviews | 4.8 / 5 37k+ reviews |

|

| A+ | A+ | |

| 4.5 / 5 29.9k reviews | 4.3 / 5 9k+ reviews |

|

| 4 / 5 | 3.3 / 5 | |

| 3.7 / 5 3k+ reviews | 4.2 / 5 14k+ reviews |

NerdWallet gets a strong 4.8 out of 5.0 on the App Store with over 115,000 reviews—LendingTree matches the score, but with only 37,000 reviews, so NerdWallet has more weight behind it. On Google Play, NerdWallet edges out again at 4.5 with nearly 30,000 ratings, while LendingTree trails slightly at 4.3 from just 9,000 users.

PCMag gives NerdWallet a solid 4.0, calling out its clean layout and easy-to-use tools, which makes it easier to evaluate insurance quote options and financial products in one place. LendingTree drops to 3.3 due to slow page loads and more aggressive pop-ups.

TrustPilot flips things—LendingTree scores 4.2 for quick results, while NerdWallet trails at 3.7 due to redirect complaints. So, if you’re into clean tools and mobile apps, NerdWallet wins—but if you just want fast results and less browsing, LendingTree might be your speed.

NerdWallet vs. Insurify

When comparing coverage tools, user reviews reveal big differences in how NerdWallet insurance comparison and Insurify perform across devices and platforms. The table below breaks down real user feedback to see where each platform stands.

NerdWallet vs. Insurify: Third-Party Customer Ratings

| Review Platform | ||

|---|---|---|

| 4.8 / 5 115k+ reviews | 3.4 / 5 141 reviews |

|

| A+ | A+ | |

| 4.5 / 5 29.9k reviews | 3.4 / 5 141 reviews |

|

| 4 / 5 | NA | |

| 3.7 / 5 3k+ reviews | 4.7 / 5 2k+ reviews |

NerdWallet pulls ahead on mobile, scoring 4.8 out of 5.0 from 115,000+ App Store users and 4.5 from nearly 30,000 on Google Play. Insurify, by comparison, earns just 3.4 on both platforms with only 141 reviews—indicating far less mobile traction and app usage. NerdWallet also holds a 4.0 from PCMag, while Insurify has no rating listed there.

On TrustPilot, however, the Insurify review scores a strong 4.7 from over 2,000 users. It’s praised for delivering quotes in under 2 minutes and showing real-time side-by-side results.

NerdWallet sits at 3.7, with users mentioning frustration over multiple redirects before they can evaluate insurance quote offers. So if app design and extra tools matter more, NerdWallet’s the choice—but for speed, fewer steps, and faster quote access, Insurify clearly takes the win.

NerdWallet Delivers Streamlined Quote Comparisons

This NerdWallet review breaks down what the platform actually does well, who it’s good for, and why some users might find it more frustrating than helpful. It’s great for browsing tools but not ideal if you want fast, direct auto insurance quotes. Suppose you’re into tracking your credit score or comparing credit cards, NerdWallet’s solid.

But when it comes to getting car insurance quotes, NerdWallet insurance quotes send you to other sites where you’ll have to re-enter all your info. There’s no way to customize your policy or bundle coverages upfront.

Suppose you’re into tracking your credit score or comparing credit cards, NerdWallet’s solid. But when it comes to getting car insurance quotes, NerdWallet insurance quotes send you to other sites where you’ll have to re-enter all your info.

There’s no way to customize your policy or bundle coverages upfront. If you’re just looking for fast, real quotes in one place, AutoInsurance.org is a better alternative. It connects you with top insurers, delivers quotes in under two minutes, and avoids the back-and-forth. Skip the hassle—use AutoInsurance.org’s tool to compare real rates and find coverage that fits your needs and budget.

Learn how to check if an auto insurance company is legitimate before sharing personal details. Want faster, more accurate auto insurance quotes? AutoInsurance.org delivers results in under 2 minutes, helps drivers save up to $540 per year, and offers 25% more coverage options. Enter your ZIP code to compare real rates from 60+ top insurers—faster than NerdWallet.

Frequently Asked Questions

How can you use NerdWallet to compare auto insurance quotes?

You can use NerdWallet auto insurance to compare quotes from providers like Allstate, Liberty Mutual, and USAA, but you’ll need to finish the process on third-party sites after being redirected.

Is NerdWallet legit for car insurance?

Yes, NerdWallet is legit for car insurance—it holds an A+ BBB rating and lists quotes from top insurers by market share, though reviews on WalletHub rate it just 1.5 out of 5.0 due to redirect issues.

What does the NerdWallet Compare car insurance tool help you do?

The NerdWallet Compare car insurance tool lets you view monthly quotes from companies like Progressive and Esurance, but it requires re-entering info on external platforms for final pricing—something often mentioned in an Esurance auto insurance review.

How can I benefit more from NerdWallet vs. AutoInsurance.org when choosing coverage?

AutoInsurance.org delivers quotes in under 2 minutes, offers 25% more coverage options, and helps users save an average of $540 per year. Unlike NerdWallet, which redirects you to third-party sites, AutoInsurance.org shows real-time results from over 60 top-rated insurers—making it faster and more effective.

Prefer fewer steps and clearer choices? AutoInsurance.org gives you direct access to top insurers with more real-time options—all in one place. Enter your ZIP code to begin.

How does the NerdWallet best insurance list benefit you?

The NerdWallet best insurance list features providers with strong mobile app ratings, such as a 4.8/5.0 score from 115,000+ App Store reviews, helping you prioritize companies with the best user experience.

What are the benefits of using NerdWallet?

You can track your credit score weekly, compare over 100 credit cards, access mortgage, and loan calculators, and get free auto insurance quotes online from providers like Allstate and USAA—frequently praised in a USAA auto insurance review for military-focused benefits and low monthly rates.

Is it safe to give NerdWallet my bank info?

Yes, NerdWallet connects your bank accounts through Plaid with read-only access, meaning it can track spending but can’t move or transfer money.

Does NerdWallet charge a fee?

No, NerdWallet doesn’t charge you anything—it earns commissions from partners when you sign up for products like insurance or credit cards through its platform.

Which is better, Credit Karma or NerdWallet?

Credit Karma updates credit scores more often—sometimes daily—while NerdWallet offers deeper product comparisons, like showing side-by-side monthly insurance rates from Liberty Mutual, Esurance, and Progressive, which is often noted for flexible coverage in a Progressive auto insurance review.

How do you get rid of NerdWallet?

By going to Settings > Close Account, you can completely remove your account. NerdWallet deletes your associated login history and financial information.

Does NerdWallet sell your info?

No, NerdWallet doesn’t sell your personal information. It shares your data only with select partners to display real-time rates and personalized financial offers.

Does NerdWallet hurt your credit score?

No, checking your credit through NerdWallet is a soft pull and won’t impact your score. It’s visible only to you—not to lenders or insurers.

What is the primary purpose of NerdWallet?

NerdWallet is designed to help you make smarter financial choices by offering tools to compare loans, credit cards, and auto insurance with real-time monthly quotes, though you won’t be able to get auto insurance quotes without giving personal information like your ZIP code and vehicle details.

Is NerdWallet safe?

Yes, NerdWallet is safe. It uses 256-bit SSL encryption—the same level trusted by banks—to secure user data. The platform doesn’t require sensitive details like your full SSN to access tools, and it’s backed by partnerships with top financial institutions. NerdWallet also doesn’t share or sell your personal data without consent.

While some sites may show few options, AutoInsurance.org gives you access to various real-time quotes from the best insurance companies. To begin comparing rates from reputable local insurers, enter your ZIP code.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.