Best Santa Cruz, California Auto Insurance in 2025 (Compare the Top 10 Companies)

For the best Santa Cruz, California auto insurance, our top three best insurers are Geico, State Farm, and Progressive standout as a providers that offer exceptional coverage starting at $60 monthly. These companies consistently deliver value and reliability, making them the top choices for drivers seeking superior protection.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Apr 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Santa Cruz CA

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Santa Cruz CA

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Santa Cruz CA

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsOur top three best Santa Cruz, California auto insurance which are Geico, State Farm, and Progressive required coverage is 15/30/5, can be challenging. Our guide simplifies the process by highlighting key factors that influence rates, such as driving history, credit score, and commute time.

Finding cheap auto insurance in Santa Cruz can seem like a difficult task, but we’ll cover factors that affect auto insurance rates in Santa Cruz, California, including driving record, credit, commute time, and more to help you.

Our Top 10 Company Picks: Best Santa Cruz, California Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | A++ | Competitive Rates | Geico | |

| #2 | 15% | B | Personalized Service | State Farm | |

| #3 | 20% | A+ | Coverage Options | Progressive | |

| #4 | 18% | A+ | Comprehensive Options | Allstate | |

| #5 | 14% | A | Customizable Policies | Farmers | |

| #6 | 17% | A+ | Vanishing Deductible | Nationwide |

| #7 | 13% | A | Affordable Coverage | Mercury | |

| #8 | 16% | A | Customized Coverage | Liberty Mutual |

| #9 | 19% | A+ | AARP Benefits | The Hartford |

| #10 | 22% | A++ | Military Benefits | USAA |

Before you buy Santa Cruz, California auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Santa Cruz, California auto insurance quotes.

- The average commute length in Santa Cruz is 23.5 minutes

- In Santa Cruz, CA, seniors average $2,091 annually for auto insurance

- The cheapest auto insurance company in Santa Cruz is Liberty Mutual

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

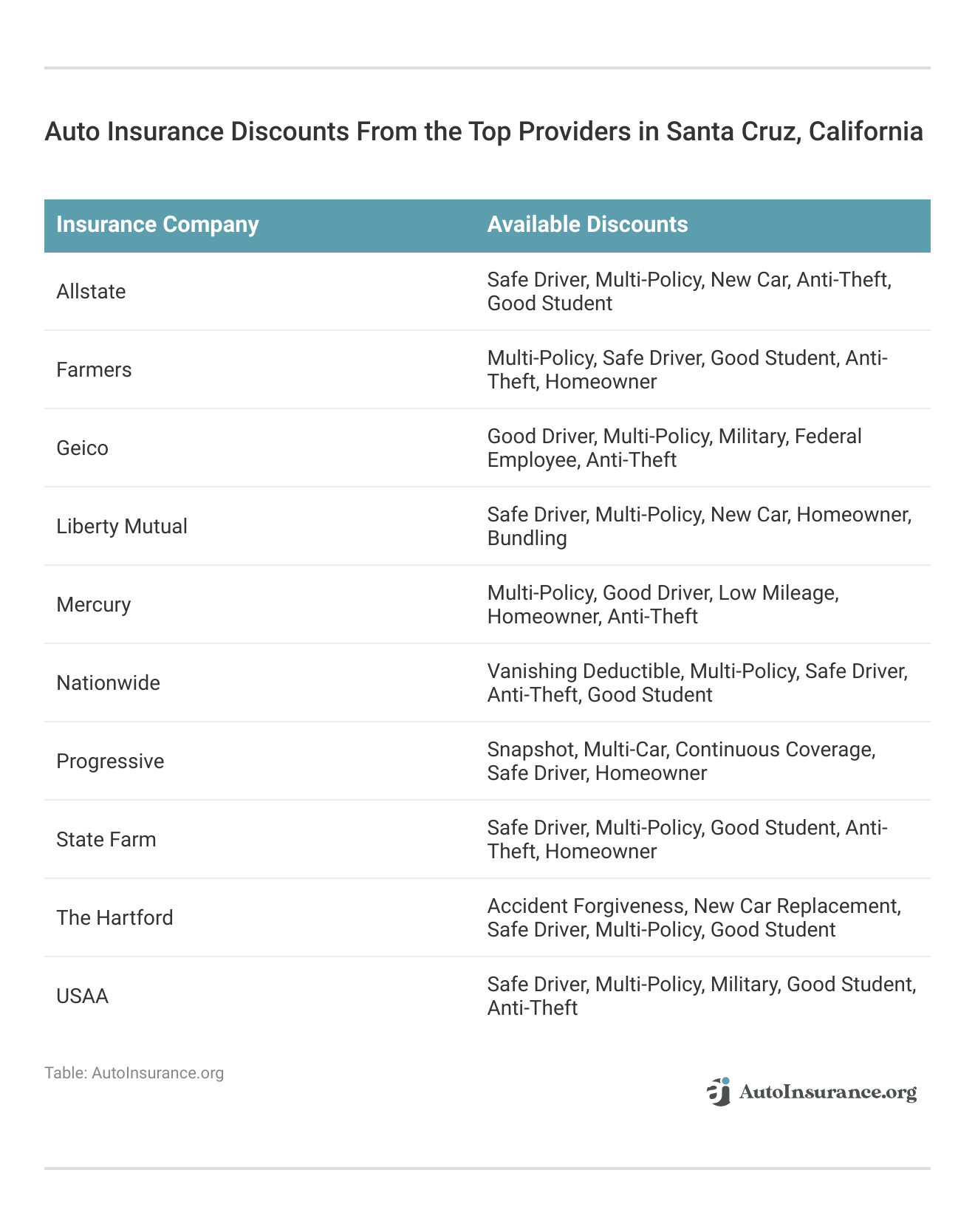

#1 – Geico: Top Overall Pick

Pros

- Value-Priced Rates: Geico offers some of the cheapest Santa Cruz, California auto insurance rates, with premiums starting as low as $127 per month, making it ideal for budget-conscious drivers. This affordability makes Geico a top contender for those seeking the best Santa Cruz, California auto insurance without compromising on coverage.

- Service Member Discounts: As mentioned in our Geico auto insurance review, Geico provides substantial discounts for military personnel, appealing to Santa Cruz residents with a military background. This feature makes Geico one of the best Santa Cruz, California auto insurance options for military families, ensuring they receive both excellent service and significant savings.

- Nonstop Customer Support: With round-the-clock customer service, Geico ensures that Santa Cruz drivers can get assistance anytime, anywhere. This accessibility is crucial for those seeking the best Santa Cruz, California auto insurance, as it guarantees support during emergencies. The 24/7 availability adds peace of mind, knowing help is just a call away.

Cons

- Limited Local Agents: Geico’s focus on online services may be a disadvantage for Santa Cruz drivers who prefer face-to-face interactions. While this may not impact those seeking the best Santa Cruz, California auto insurance through digital means, it could be a drawback for individuals who value personal relationships with local agents.

- Repair Shop Limitations: Geico’s recommended repair shop network may be limited in Santa Cruz, potentially restricting options for those who need immediate repairs. For drivers seeking the best Santa Cruz, California auto insurance, this could mean having to travel further for approved repairs, leading to inconvenience. Additionally, using non-approved shops may result in higher out-of-pocket costs.

#2 – State Farm: Best for Personalized Service

Pros

- Custom-Tailored Care: State Farm is known for its dedicated local agents, offering personalized advice and service tailored to the needs of Santa Cruz residents. For those seeking the best Santa Cruz, California auto insurance, this personal touch ensures a more tailored insurance experience. This service can be particularly valuable for drivers who prefer one-on-one consultations.

- Complete Coverage Alternatives: State Farm provides a wide range of coverage options, from basic liability to extensive full coverage, catering to various needs. This flexibility makes it a top choice for those looking for the best Santa Cruz, California auto insurance, which you can discover in our State Farm review.

- Incident Forgiveness Benefit: State Farm offers an accident forgiveness program, helping Santa Cruz drivers avoid rate increases after their first at-fault accident. For those searching for the best Santa Cruz, California auto insurance, this can lead to long-term savings. This program is especially beneficial for cautious drivers who occasionally make mistakes.

Cons

- Raised Premium Amounts: State Farm’s personalized service and extensive coverage options can come at a higher price, which may not be ideal for budget-conscious Santa Cruz drivers. This could be a drawback for those looking for the best Santa Cruz, California auto insurance at the lowest cost. The higher premiums might discourage drivers who prioritize savings.

- Limited Online Features: State Farm’s digital tools, while improving, may not be as robust as competitors, potentially making it less convenient for tech-savvy Santa Cruz drivers. Those looking for the best Santa Cruz, California auto insurance with strong digital integration might find this limiting. This could lead to frustrations for customers who prefer managing their insurance online.

#3 – Progressive: Best for Coverage Options

Pros

- Adaptable Insurance Coverage: Progressive allows drivers to tailor their policies, offering various add-ons like roadside assistance and rental car coverage. For Santa Cruz residents seeking the best Santa Cruz, California auto insurance, this flexibility ensures their specific needs are met. The ability to customize policies can lead to more personalized and effective coverage.

- Telematics Program: Progressive’s Snapshot program rewards safe drivers with discounts based on driving behavior. This can be especially beneficial for Santa Cruz drivers looking for the best Santa Cruz, California auto insurance that rewards cautious driving, outlined in our Progressive review.

- Wide Network of Repair Shops: Progressive has a large network of approved repair shops in California, ensuring that Santa Cruz drivers can find a convenient location for repairs. This accessibility is a key factor for those seeking the best Santa Cruz, California auto insurance with minimal hassle during claims. The wide network helps in getting repairs done quickly and efficiently.

Cons

- Rate Increases Post-Claim: Progressive may increase rates significantly after an at-fault accident, which could be a downside for some Santa Cruz drivers. This could be a drawback for those seeking the best Santa Cruz, California auto insurance with stable rates. The potential for higher premiums post-claim could be a deterrent.

- Customer Service Variability: While some customers have positive experiences, others report inconsistencies in Progressive’s customer service. This variability could impact the experience of those looking for the best Santa Cruz, California auto insurance. The inconsistency in service quality might lead to dissatisfaction during crucial moments.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Comprehensive Options

Pros

- Extensive Coverage Choices: Allstate offers a variety of coverage options, including accident forgiveness, new car replacement, and safe driving bonuses. This makes it a strong choice for Santa Cruz drivers seeking the best Santa Cruz, California auto insurance with extensive benefits. The wide range of options ensures that drivers can find a policy that fits their unique needs.

- Accessible Application: Allstate’s mobile app is highly rated for its ease of use, allowing Santa Cruz drivers to manage claims, payments, and coverage details on the go. For tech-savvy individuals seeking the best Santa Cruz, California auto insurance, this app enhances convenience and customer experience. The app’s functionality makes managing insurance simple and straightforward.

- Rate Reduction Options: Allstate offers numerous discounts, such as multi-policy, new car, and good student discounts, helping Santa Cruz drivers save on their premiums. These discounts make Allstate an attractive option for those looking for the best Santa Cruz, California auto insurance with cost-saving potential. The variety of discounts allows drivers to reduce their costs significantly.

Cons

- Elevated Insurance Costs for Youth: Allstate tends to charge higher premiums for young and inexperienced drivers, which may be a deterrent for families in Santa Cruz. This could be a significant downside for those seeking the best Santa Cruz, California auto insurance for younger drivers. Learn more about their discounts in our Allstate auto insurance review.

- Rate Increases After Claims: Like many insurers, Allstate may raise premiums after a claim, which could be concerning for some Santa Cruz drivers. This potential for higher rates could be a drawback for those looking for the best Santa Cruz, California auto insurance with stable pricing. The possibility of rate increases might lead to financial strain after an accident.

#5 – Farmers: Best for Customizable Policies

Pros

- Modifiable Coverage Plans: Farmers offers highly customizable auto insurance policies, allowing Santa Cruz drivers to choose coverage that best suits their needs. For those seeking the best Santa Cruz, California auto insurance, this flexibility is a significant advantage. The ability to personalize coverage ensures that drivers only pay for what they need.

- Unique Coverage Options: Farmers offers unique coverage options such as original equipment manufacturer (OEM) parts coverage, appealing to those who value their vehicle’s authenticity. For Santa Cruz drivers seeking the best Santa Cruz, California auto insurance with specific benefits, this is a notable feature. The option for OEM parts ensures that repairs are done with high-quality materials.

- Green Discounts: Farmers offers discounts for environmentally friendly drivers, such as those driving hybrid or electric vehicles. This makes it an attractive option for eco-conscious Santa Cruz residents looking for the best Santa Cruz, California auto insurance. Check out this page Farmers auto insurance review to know more details.

Cons

- Elevated Premium Costs: Farmers tends to have higher premiums compared to other insurers, which might not be ideal for budget-conscious Santa Cruz drivers. This could be a significant downside for those seeking the best Santa Cruz, California auto insurance at the lowest cost. The higher premiums might deter drivers who are focused on affordability.

- Complex Policy Options: The wide range of customizable options can be overwhelming for some Santa Cruz drivers, making it harder to choose the best policy. This complexity might be a drawback for those looking for the best Santa Cruz, California auto insurance without the hassle of navigating too many options. The potential confusion could lead to suboptimal policy choices.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Gradual Deductible Decrease: Nationwide offers a vanishing deductible program, where your deductible decreases by $100 for each year of safe driving. This benefit is especially appealing to Santa Cruz drivers looking for the best Santa Cruz, California auto insurance with rewards for maintaining a clean driving record.

- On Your Side Review: Nationwide provides an “On Your Side” review, which is a free consultation to ensure that your coverage is up-to-date and that you’re taking advantage of all available discounts. This personalized service is valuable for Santa Cruz residents seeking the best Santa Cruz, California auto insurance with ongoing support and optimization, as elaborated in our Nationwide review.

- SmartRide Program: Nationwide’s SmartRide program offers discounts based on your driving habits, providing real-time feedback to help you drive safer. This program is ideal for Santa Cruz drivers looking for the best Santa Cruz, California auto insurance with incentives for safe driving. The SmartRide program can lead to substantial savings for cautious drivers while promoting safer road behavior.

Cons

- Mixed Reviews on Claims Handling: Some customers have reported less-than-stellar experiences with Nationwide’s claims handling process, which could be a concern for Santa Cruz residents. This inconsistency might be a drawback for those seeking the best Santa Cruz, California auto insurance with reliable claims service.

- Enhanced Premiums for Full Insurance: Nationwide’s full coverage options can be more expensive than some competitors, which might not be ideal for budget-conscious Santa Cruz drivers. This could be a significant downside for those seeking the best Santa Cruz, California auto insurance at a more affordable rate. The higher premiums might deter drivers from choosing full coverage with Nationwide.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Mercury: Best for Affordable Coverage

Pros

- Comparative Pricing: Mercury Insurance is known for offering some of the most competitive rates in the industry, especially for good drivers. This makes it an attractive option for Santa Cruz residents seeking the best Santa Cruz, California auto insurance with a focus on affordability. The lower premiums provide excellent value without compromising on coverage quality.

- Good Driver Discount: Mercury offers significant discounts for good drivers, which can lead to substantial savings for Santa Cruz drivers with clean driving records. This feature is particularly appealing for those seeking the best Santa Cruz, California auto insurance with incentives for safe driving. For additional information, see our Mercury auto insurance review on this page.

- Mechanical Breakdown Insurance (MBI): Mercury provides Mechanical Breakdown Insurance, which is similar to an extended warranty for your vehicle, covering repairs and parts. This added coverage is ideal for Santa Cruz residents seeking the best Santa Cruz, California auto insurance with protection against costly repairs.

Cons

- Limited Online Tools: Mercury’s online tools and mobile app are less advanced compared to some competitors, which could be a drawback for tech-savvy Santa Cruz drivers. This limitation might be a concern for those seeking the best Santa Cruz, California auto insurance with comprehensive digital services.

- Mixed Customer Service Reviews: Mercury has received mixed reviews regarding its customer service, with some customers reporting less-than-satisfactory experiences. This could be a concern for Santa Cruz residents who prioritize excellent customer support when selecting the best Santa Cruz, California auto insurance.

#8 – Liberty Mutual: Best for Customized Coverage

Pros

- Lifetime Repair Guarantee: Liberty Mutual offers a lifetime repair guarantee on covered repairs, as long as you own the vehicle. This is a significant benefit for Santa Cruz drivers seeking the best Santa Cruz, California auto insurance with long-term protection, as mentioned in our Liberty Mutual auto insurance review.

- New Car Replacement: Liberty Mutual provides new car replacement coverage, which pays for a brand-new car if yours is totaled within the first year of ownership. This is an attractive feature for Santa Cruz drivers looking for the best Santa Cruz, California auto insurance with added security for their new vehicle. The peace of mind that comes with this coverage is invaluable for new car owners.

- Discounts for Multiple Policies: Liberty Mutual offers discounts for bundling auto insurance with other types of insurance, such as home or renters insurance. This can result in substantial savings for Santa Cruz drivers seeking the best Santa Cruz, California auto insurance with multi-policy discounts. The bundling discounts make Liberty Mutual a cost-effective option for those with multiple insurance needs.

Cons

- Above-Average Premiums: Liberty Mutual tends to have higher-than-average premiums, which might not be ideal for budget-conscious Santa Cruz drivers. This could be a drawback for those seeking the best Santa Cruz, California auto insurance at a lower cost. The higher premiums might deter drivers focused on affordability.

- Mixed Customer Service Reviews: Liberty Mutual has received mixed reviews for its customer service, with some customers reporting dissatisfaction. This inconsistency could be a concern for Santa Cruz residents looking for the best Santa Cruz, California auto insurance with reliable support. The variable customer service experience might lead to frustration in resolving claims or issues.

#9 – The Hartford: Best for AARP Benefits

Pros

- AARP Auto Insurance Program: The Hartford offers an exclusive auto insurance program for AARP members, which includes benefits like RecoverCare, which helps with home services if you’re injured in a car accident. This program is particularly appealing for Santa Cruz seniors seeking the best Santa Cruz, California auto insurance with additional benefits tailored to their needs.

- Lifetime Renewability: The Hartford guarantees policy renewal for as long as you can legally drive, regardless of age. This is a significant advantage for Santa Cruz seniors looking for the best Santa Cruz, California auto insurance with long-term security. The lifetime renewability ensures that aging drivers don’t have to worry about losing coverage.

- 24/7 Roadside Assistance: The Hartford provides 24/7 roadside assistance, ensuring that help is available whenever you need it. This service is crucial for Santa Cruz residents looking for the best Santa Cruz, California auto insurance with reliable emergency support, as mentioned in our The Hartford auto insurance review.

Cons

- Higher Premiums for Younger Drivers: The Hartford tends to have higher premiums for younger drivers, which could be a downside for Santa Cruz residents who are under the age of 50. This could be a significant drawback for younger drivers seeking the best Santa Cruz, California auto insurance at an affordable rate.

- Limited Availability for Non-AARP Members: The Hartford’s auto insurance is primarily geared toward AARP members, which limits its availability for the general population. This restriction could be a concern for Santa Cruz drivers who are not eligible for AARP membership but are seeking the best Santa Cruz, California auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – USAA: Best for Military Benefits

Pros

- Superior Client Satisfaction: As outlined in USAA auto insurance review, USAA consistently ranks at the top for customer satisfaction, making it a strong choice for Santa Cruz military families seeking the best Santa Cruz, California auto insurance with reliable service. The high customer satisfaction ensures that members receive excellent support whenever they need it.

- Aggressive Pricing: USAA offers highly competitive rates, particularly for military members and their families, making it a cost-effective option for Santa Cruz residents. This affordability makes USAA a top contender for the best Santa Cruz, California auto insurance with excellent value for money. The competitive rates ensure that members receive quality coverage without overpaying.

- Economic Resilience: USAA’s strong financial ratings ensure that it can meet its claims obligations, providing peace of mind to its members. This financial stability is crucial for Santa Cruz military families seeking the best Santa Cruz, California auto insurance from a reliable provider. The assurance of financial strength ensures that members are well-protected.

Cons

- Membership Restrictions: USAA is only available to military members, veterans, and their families, which limits its accessibility to the general public. This exclusivity could be a drawback for non-military Santa Cruz residents seeking the best Santa Cruz, California auto insurance. The limited membership might exclude some potential customers who are not eligible.

- Digital-Only Support for Some Services: While USAA offers robust online and mobile support, some members may prefer more traditional, in-person service, which is less available. This reliance on digital support could be a downside for Santa Cruz military families seeking the best Santa Cruz, California auto insurance with face-to-face interaction.

Minimum Auto Insurance in Santa Cruz, California

Cheap Santa Cruz, California Auto Insurance by Age, Gender, and Marital Status

Auto insurance rates in Santa Cruz, California, are influenced by factors such as age, gender, and marital status, significantly affecting the monthly cost of insurance.

For example, a married 35-year-old female might pay about $196 per month with Allstate, while a single 17-year-old female could face costs of approximately $550 per month from the same company.

Senior drivers also experience varied rates; a married 60-year-old female typically pays around $144 per month with Allstate for cheap auto insurance for drivers over 60, compared to a married 60-year-old male who pays $145.

Teen drivers face challenges in finding affordable insurance, with Geico offering a rate of about $437 per month for a single 17-year-old female.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheap Santa Cruz, California Auto Insurance By Driving Record

Driving record significantly impacts auto insurance rates. For instance, monthly auto insurance rates in Santa Cruz, California, vary depending on whether you have a clean record or past infractions.

For a clean record, rates start at $162 per month with Geico and can go up to $186 per month with Liberty Mutual. If you have one accident, rates increase to around $251 per month with Geico and $263 per month with State Farm. To learn how to get a good driver auto insurance discount, consider comparing these options.

A DUI dramatically raises rates, with monthly premiums ranging from $215 with Liberty Mutual to $631 with Nationwide. Auto insurance costs also vary by ZIP code in Santa Cruz.

For ZIP code 95060, the average rate is about $354 per month, whereas in ZIP code 95064, it’s approximately $397 per month. Commute length affects rates as well. A 10-mile commute results in rates around $210 per month with Geico, while a 25-mile commute can push rates to $253 per month with Farmers.

Coverage levels further impact rates. For basic coverage, monthly rates start at $208 with Geico and can rise to $290 with Nationwide for high coverage.

This demonstrates how factors such as driving record, location, commute, and coverage level all play a role in determining your auto insurance rates in Santa Cruz, California.

The Cheapest Santa Cruz, California Auto Insurance Companies

Nationwide’s rate is higher at $417 per month, whereas Progressive’s average rate is $259. State Farm’s average monthly premium is $304, Travelers charges $268, and USAA provides a competitive rate of $245. By comparing these rates, you can find the best option that fits your budget and coverage needs.

Factors that affects auto insurance rates in Santa Cruz, California

Auto insurance rates in Santa Cruz, California, are influenced by various local factors, impacting costs compared to other areas. A key factor is vehicle theft, with 261 auto thefts reported, which raises premiums as insurers face more claims.

To counter this, consider exploring the cheapest auto insurance companies that offer competitive rates in high-risk areas like Santa Cruz.

Another important factor is commute time. Cities where drivers have longer average commutes generally see higher auto insurance rates. In Santa Cruz, the average commute time is 23.5 minutes, as reported by City-Data.

If you’re wondering how to lower your auto insurance rates, reducing your daily commute or avoiding peak traffic times could help. Longer commutes can lead to a higher likelihood of accidents, thereby increasing insurance premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Compare Santa Cruz, California Auto Insurance Quotes

Compare quotes to quickly find the best auto insurance for your needs and budget. A few moments of comparison can lead to significant savings and a better policy.Jeff Root Licensed Insurance Agent

By comparing quotes, you can find a policy that offers the right balance of coverage and affordability tailored to your specific needs. To simplify this process, enter your ZIP code below to receive free and personalized auto insurance quotes for Santa Cruz.

Frequently Asked Questions

What factors influence auto insurance rates in Santa Cruz, California?

Auto insurance rates in Santa Cruz are influenced by factors such as driving history, credit score, commute length, and vehicle theft rates. These elements can significantly affect the cost of premiums in the area.

How does driving record impact auto insurance premiums in Santa Cruz?

A clean driving record generally leads to lower insurance premiums, while a history of accidents or violations can increase rates. Insurance companies view a clean record as a sign of lower risk, resulting in reduced costs. Enter your ZIP code to get free quotes.

What are the minimum auto insurance coverage requirements in Santa Cruz, California?

In Santa Cruz, the minimum required coverage includes bodily injury liability of $15,000 per person and $30,000 per accident, and property damage liability of $5,000. These requirements ensure financial responsibility in the event of an accident.

How does commute length affect auto insurance rates in Santa Cruz?

What are some tips for finding affordable auto insurance in Santa Cruz, CA?

To find affordable auto insurance, compare quotes from multiple providers, look for discounts, and consider adjusting coverage levels. Shopping around and taking advantage of discounts can help reduce overall insurance costs. Start comparing your quotes by entering your ZIP code now.

How does vehicle theft impact insurance premiums in Santa Cruz?

High rates of vehicle theft in Santa Cruz can lead to higher insurance premiums as insurers anticipate more claims. Insurance companies adjust rates to account for the increased risk of theft in the area.

What are the average monthly auto insurance costs for different age groups in Santa Cruz?

Monthly auto insurance costs vary by age, with younger drivers typically facing higher rates due to increased risk. For example, a single 17-year-old female might pay around $550, highlighting the importance of finding the best auto insurance for drivers under 25, while a married 60-year-old female might pay about $144.

How can having a clean driving record affect my auto insurance rate in Santa Cruz?

A clean driving record can result in lower insurance premiums as it signals lower risk to insurers. Discounts for safe driving are often available, leading to reduced costs for those with no recent accidents or violations. Get free quote today by entering your ZIP code.

What is the impact of a DUI on auto insurance rates in Santa Cruz?

A DUI significantly raises auto insurance rates due to the increased risk associated with impaired driving. Premiums can increase dramatically, with some insurers charging significantly higher rates for drivers with a DUI conviction.

How does the ZIP code in Santa Cruz influence auto insurance rates?

Insurance rates can vary by ZIP code due to differences in factors like vehicle theft rates and traffic conditions. For instance, rates may be higher in ZIP codes with higher crime or accident rates. to start, enter your ZIP code to get free quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.