Reno, NV Auto Insurance (2024)

The average Reno, NV auto insurance rates are $351 per month. The minimum auto insurance in Reno is at least 25/50/20 in coverage to comply with Nevada auto insurance laws. To find the best cheap auto insurance in Reno, Nevada, compare quotes from multiple companies.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Jun 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Reno City Statistics | |

|---|---|

| Population | 248,853 |

| City Density | 3,601 people per square mile |

| Average Cost of Insurance in City | $3,931.74 |

| Cheapest Car Insurance Companies | USAA and Travelers |

| Road Conditions | Poor share: 23% Mediocre share: 30% Fair share: 13% Good share: 34% |

- The cheapest auto insurance company in Reno is USAA

- The minimum auto insurance required in Reno, Nevada is 25/50/20

- Average auto insurance rates in Reno, NV for senior drivers are $2,310 per year

Reno, Nevada auto insurance requirements are 25/50/20 according to Nevada auto insurance laws. Finding cheap auto insurance in Reno can seem like a difficult task, but all of the information you need is right here. We’ll cover factors that affect auto insurance rates in Reno, Nevada, including driving record, credit, commute time, and more.

Compare auto insurance in Reno to other Nevada cities, including Mesquite auto insurance rates, Fernley auto insurance rates, and North Las Vegas auto insurance rates to see how Reno, Nevada auto insurance rates stack up.

Before you buy Reno, Nevada auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Reno, Nevada auto insurance quotes.

Minimum Auto Insurance in Reno, Nevada

Reno, Nevada auto insurance laws require that you have at least the Nevada minimum auto insurance to be financially responsible in the event of an accident. Take a look at the required auto insurance in Reno, Nevada.

Minimum Required Auto Insurance Coverage in Reno, Nevada

| Liability Insurance Required | Minimum Coverage Limits Required |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person $50,000 per accident |

| Property Damage Liability Coverage | $20,000 minimum |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Cost of Car Insurance in Reno

With car insurance costs rising every year, it can be hard for some drivers to afford coverage. Learn more here: how much does car insurance cost?

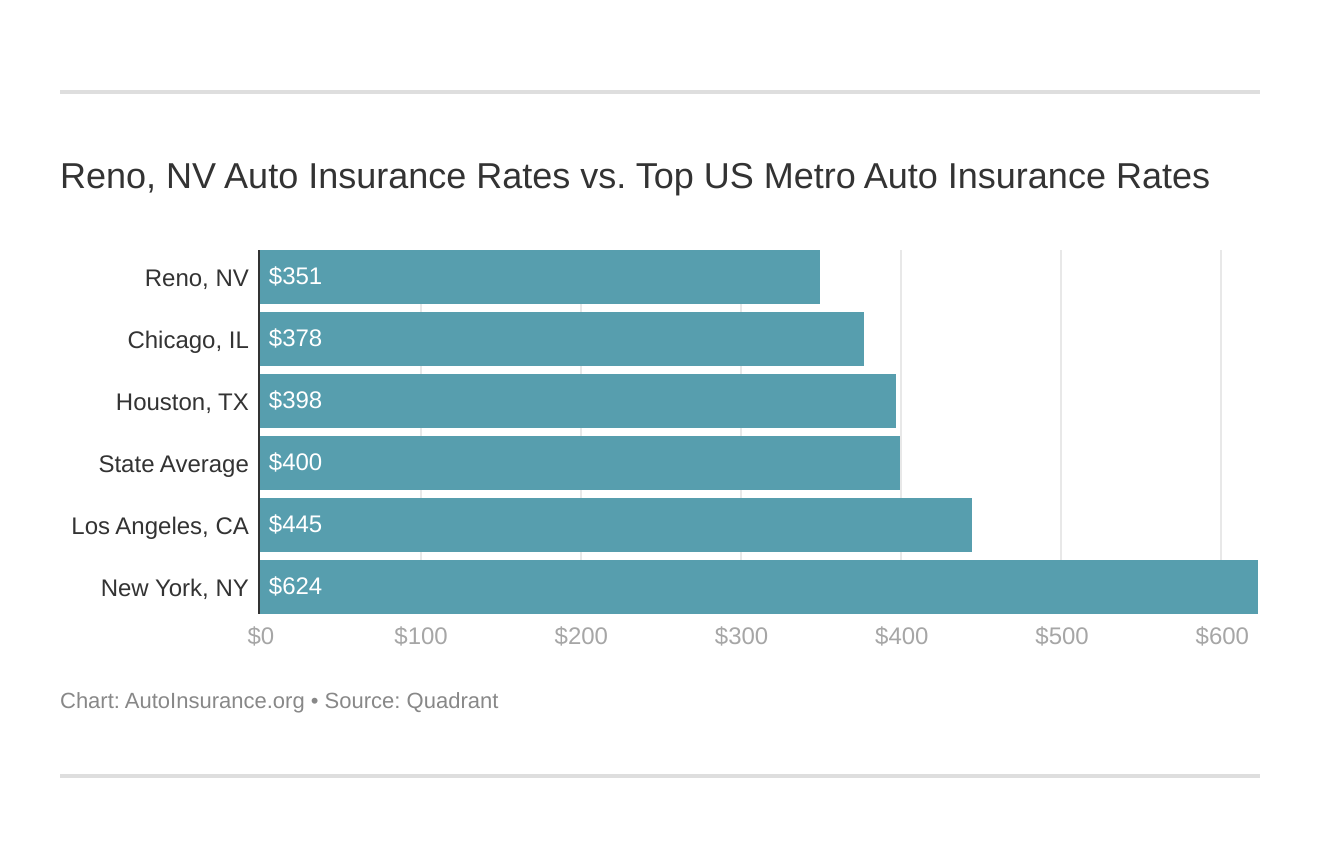

Which city you live in will have a major affect on car insurance. That’s why it’s essential to compare Reno, Nevada against other top US metro areas’ auto insurance rates.

Compared to other cities, however, the average annual price of a premium hovers around $3,931.74. That’s less expensive than in other U.S. cities. Many factors are involved in setting rates, and it helps to know how they affect you to find out where you can get discounts.

Read on to learn more about the factors that determine your auto insurance rates.

Male vs. Female vs. Age

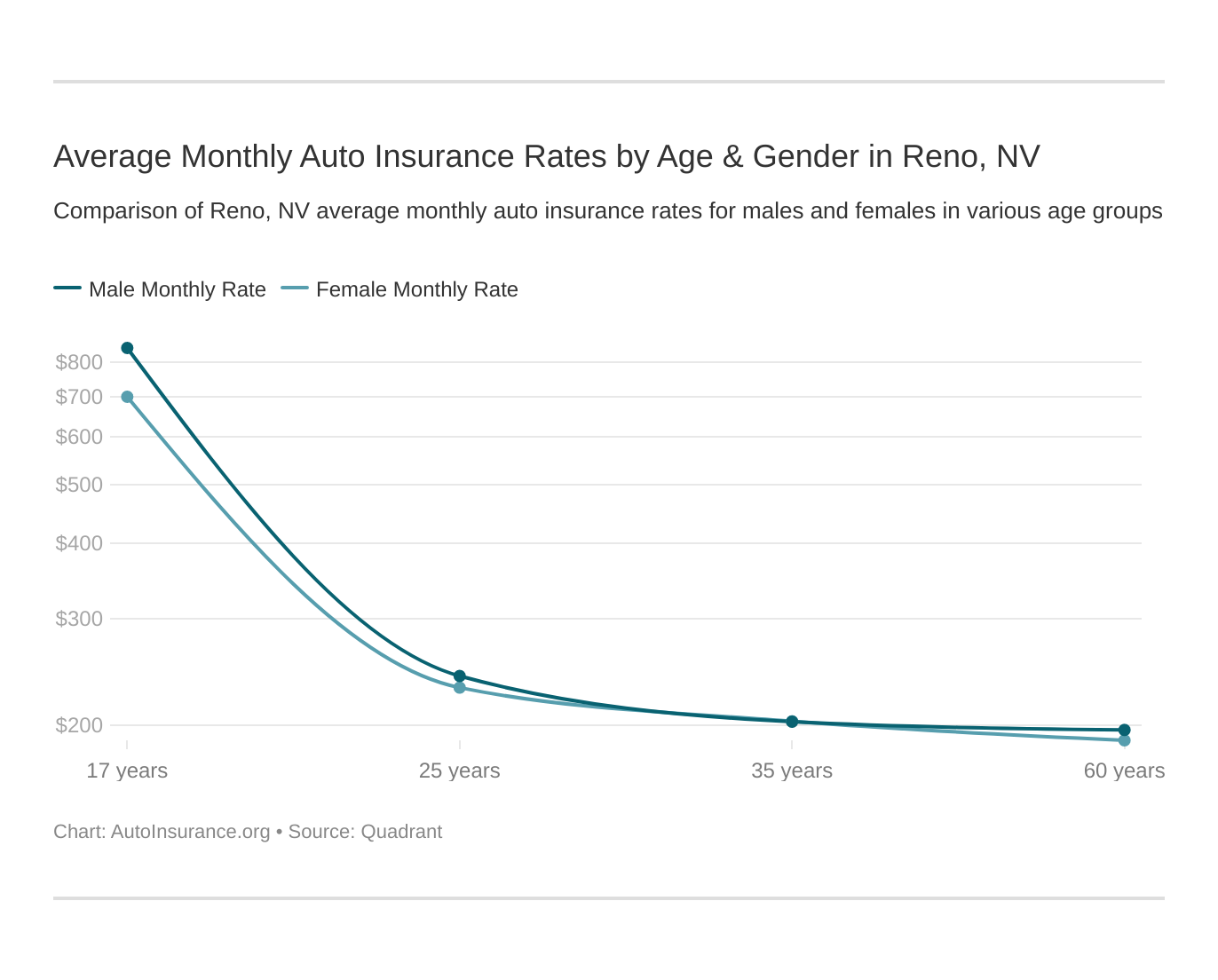

Data USA reports that the median age in Reno is 36, which means many drivers there pay less for auto insurance than their younger colleagues. How do we know? See the chart below.

These states no longer use gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, and North Carolina, Pennsylvania. But age is still a big factor because young drivers are considered high-risk drivers in Reno. Nevada does use gender, so check out the average monthly auto insurance rates by age and gender in Reno, NV.

| 35 | 60 | 17 | 25 | Cheapest Rate | Cheapest Age |

|---|---|---|---|---|---|

| $2,432.95 | $2,310.07 | $9,258.27 | $2,831.55 | $2,310.07 | 60 |

As shown, 60-year-olds — among the most experienced drivers — pay the lowest car insurance rates. Now, let’s explore how gender influences premium costs.

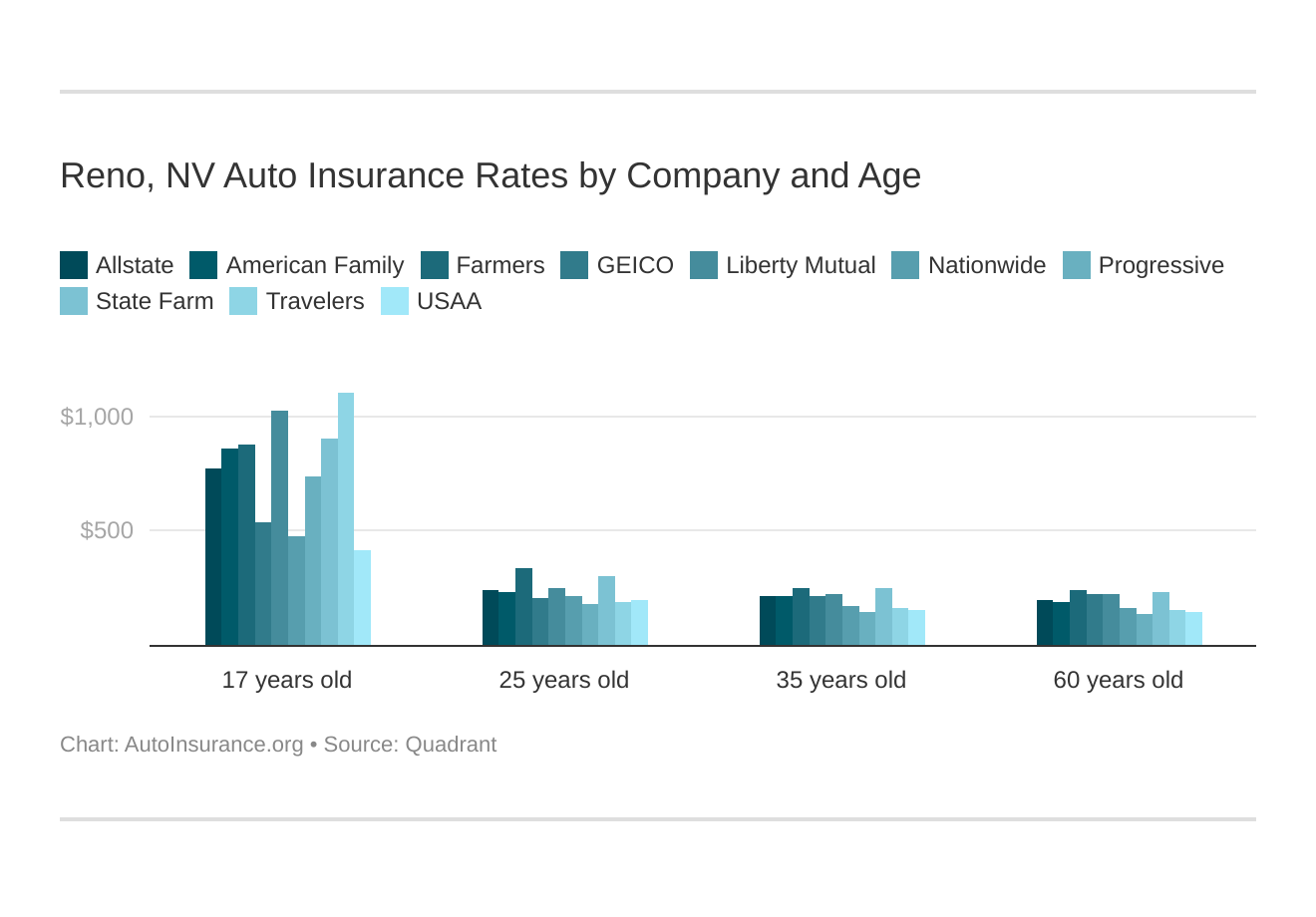

Reno, NV auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

| Male | Female | Cheaper |

|---|---|---|

| $4,208.21 | $3,966.65 | Female |

Females pay less than males in Reno. Because they tend to get into fewer accidents, insurers often find women less risky to insure. On the flip side, as you’ll see later, they also tend to earn less than men and that’s why car insurance rates are higher for males. So, there’s room for some gender equality on both fronts.

Next, here’s how age, gender, and marital status influence car insurance rates.

| Demographic | Rate (Cheapest) |

|---|---|

| Average | $4,208.21 |

| Married 35-year-old female | $2,434.77 |

| Married 35-year-old male | $2,431.14 |

| Married 60-year-old female | $2,264.46 |

| Married 60-year-old male | $2,355.69 |

| Single 17-year-old female | $8,398.58 |

| Single 17-year-old male | $10,117.96 |

| Single 25-year-old female | $2,768.79 |

| Single 25-year-old male | $2,894.30 |

Married 60-year-old females pay less than other drivers, while insurers charge inexperienced 17-year-old males the highest rates.

How does where you live factor into your car insurance rates?

Cheapest ZIP Codes in Reno

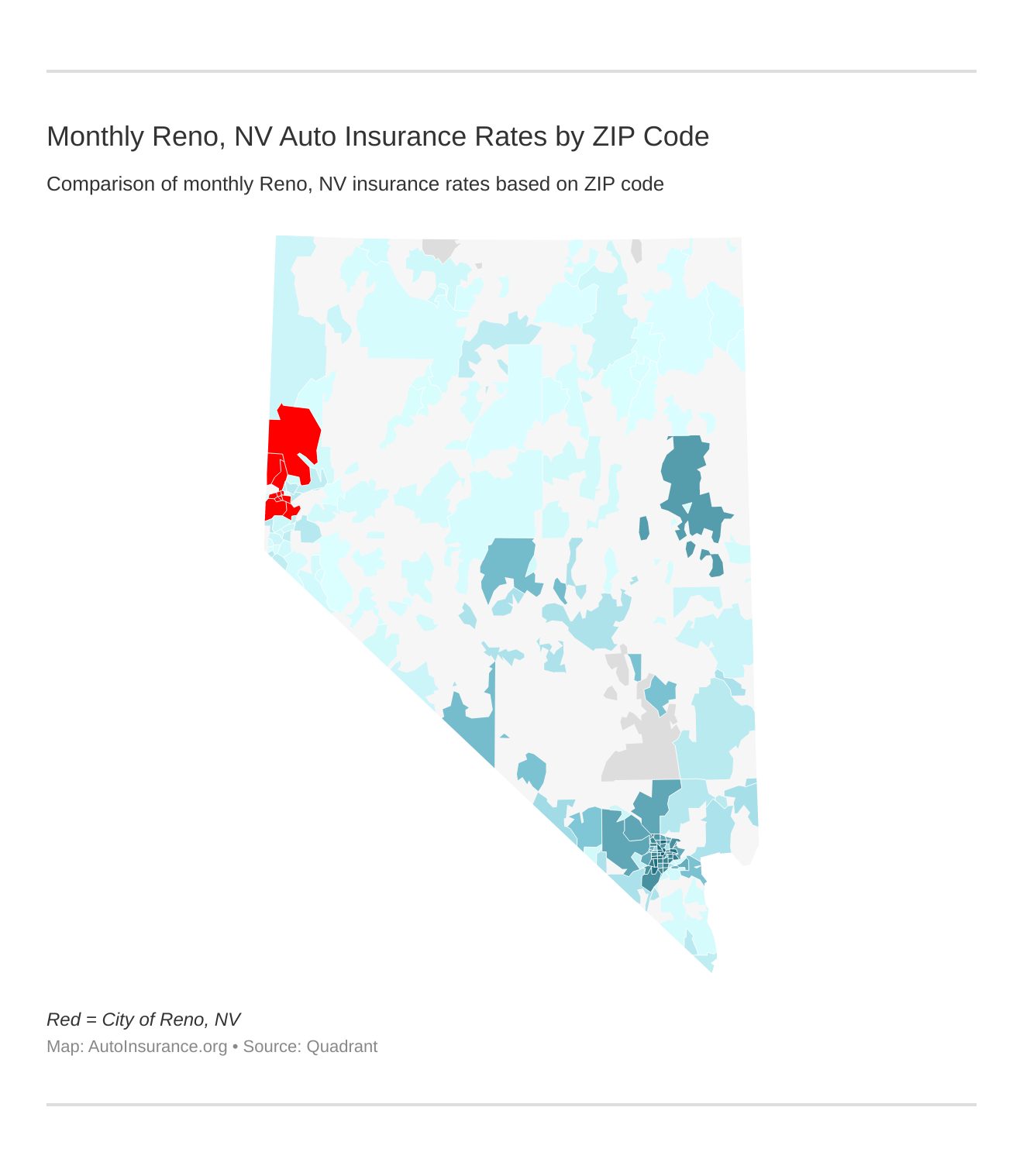

Local crime rates and weather-related claims can affect how much drivers pay for auto insurance in different parts of Reno. Let’s see how rates vary by ZIP code below:

Find more info about the monthly Reno, NV car insurance rates by ZIP Code below:

| Zip | Average Annual Rate |

|---|---|

| 89501 | $4,308.50 |

| 89502 | $4,360.16 |

| 89503 | $4,270.71 |

| 89506 | $4,198.94 |

| 89508 | $4,093.90 |

| 89509 | $4,318.19 |

| 89510 | $3,931.74 |

| 89511 | $4,083.86 |

| 89512 | $4,226.10 |

| 89519 | $4,293.24 |

| 89521 | $4,205.94 |

| 89523 | $4,158.67 |

| 89557 | $4,083.67 |

From 89502 to 89510, depending on where you live, you may pay more or less for your car insurance premiums. Between just those two ZIP codes, the cost difference amounts to over $400.

Best By Category: Cheapest Auto Insurance in Reno, Nevada

Compare the cheapest auto insurance companies in Reno, Nevada in each category to find the company with the best rates for your personal needs.

Best Annual Auto Insurance Rates by Company in Reno, Nevada

| Category | Insurance Company |

|---|---|

| Teenagers | USAA |

| Seniors | Progressive |

| Clean Record | USAA |

| With 1 Accident | USAA |

| With 1 DUI | Progressive |

| With 1 Speeding Violation | USAA |

What’s the best car insurance company in Reno?

The level of customer service a company offers, together with discounts, coverage options, and reviews, can influence which company you consider the best.

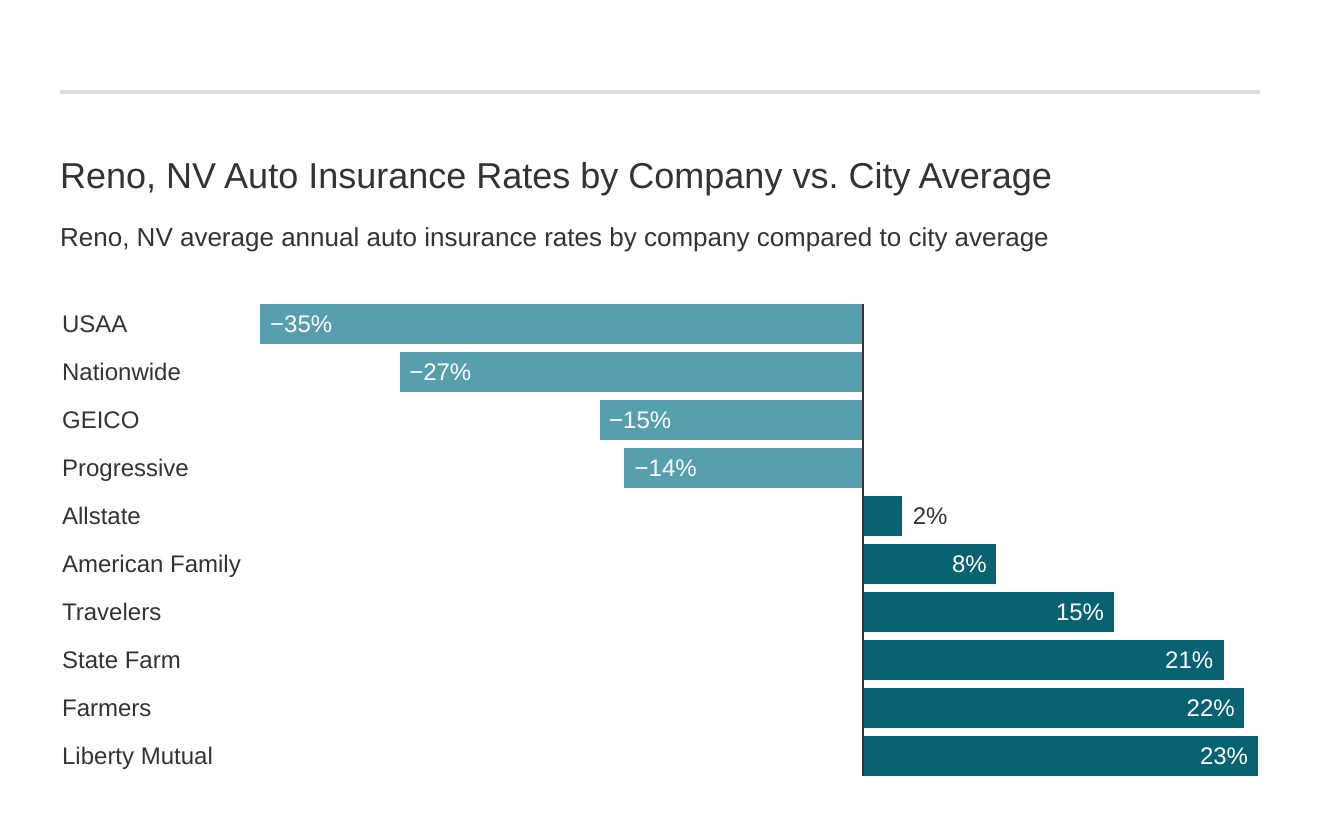

The cheapest Reno, NV auto insurance company can be discovered below. You then might be asking, “How do those rates compare against the average Nevada auto insurance company rates?” We cover that as well.

Let’s explore more factors that can affect your rates and help you in choosing the right auto insurance company for your needs.

– Cheapest Car Insurance Rates by Company

Here’s how rates compare among the top car insurers in Reno:

| Group | Married 35-year-old female | Married 35-year-old male | Married 60-year-old female | Married 60-year-old male | Single 17-year-old female | Single 17-year-old male | Single 25-year-old female | Single 25-year-old male | Average |

|---|---|---|---|---|---|---|---|---|---|

| Allstate | $2,586.94 | $2,580.58 | $2,379.04 | $2,514.34 | $8,444.66 | $10,166.83 | $2,792.03 | $2,987.26 | $4,306.46 |

| American Family | $2,624.11 | $2,624.11 | $2,331.82 | $2,331.82 | $8,951.78 | $11,733.89 | $2,624.11 | $3,055.17 | $4,534.60 |

| Farmers | $3,028.35 | $3,106.58 | $2,751.48 | $3,100.31 | $10,144.55 | $10,801.64 | $4,048.57 | $4,107.89 | $5,136.17 |

| Geico | $2,678.72 | $2,587.33 | $2,696.49 | $2,723.30 | $6,737.92 | $6,172.37 | $2,672.30 | $2,289.00 | $3,569.68 |

| Liberty Mutual | $2,577.93 | $2,780.53 | $2,511.05 | $2,820.74 | $11,672.64 | $12,993.53 | $2,921.55 | $3,071.41 | $5,168.67 |

| Nationwide | $2,089.97 | $2,137.36 | $1,903.84 | $2,017.29 | $5,159.80 | $6,225.91 | $2,488.71 | $2,654.13 | $3,084.63 |

| Progressive | $1,945.95 | $1,685.48 | $1,706.12 | $1,697.79 | $8,451.43 | $9,178.81 | $2,274.16 | $2,113.52 | $3,631.66 |

| State Farm | $3,054.41 | $3,054.41 | $2,764.61 | $2,764.61 | $9,557.59 | $12,205.30 | $3,424.72 | $3,847.28 | $5,084.12 |

| Travelers | $1,917.07 | $1,942.55 | $1,837.17 | $1,831.64 | $10,150.59 | $16,388.48 | $2,129.35 | $2,356.16 | $4,819.13 |

| USAA | $1,844.23 | $1,812.48 | $1,762.96 | $1,755.05 | $4,714.83 | $5,312.88 | $2,312.39 | $2,461.20 | $2,747.00 |

Travelers and USAA, a niche insurer for the military, offer the lowest prices, which amount to hundreds of dollars less than other companies’ rates.

Best Car Insurance for Commute Rates

Nevadans drive an average of 14,084 total miles yearly. As you might have guessed, how far you commute regularly also influences your car insurance rates. Here’s how they can vary for 10- and 25-mile commutes.

| Group | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. | Average |

|---|---|---|---|

| Allstate | $4,306.46 | $4,306.46 | $4,306.46 |

| American Family | $4,473.81 | $4,595.39 | $4,534.60 |

| Farmers | $5,136.17 | $5,136.17 | $5,136.17 |

| Geico | $3,510.98 | $3,628.37 | $3,569.68 |

| Liberty Mutual | $5,168.67 | $5,168.67 | $5,168.67 |

| Nationwide | $3,084.63 | $3,084.63 | $3,084.63 |

| Progressive | $3,631.66 | $3,631.66 | $3,631.66 |

| State Farm | $4,934.25 | $5,233.98 | $5,084.12 |

| Travelers | $4,819.13 | $4,819.13 | $4,819.13 |

| USAA | $2,710.48 | $2,783.52 | $2,747.00 |

Most of the insurers listed above don’t change their rates for 10- to 25-mile commutes. Among the few who do, USAA charges only a $73 difference between the two mileages. With State Farm, the difference amounts to over $300.

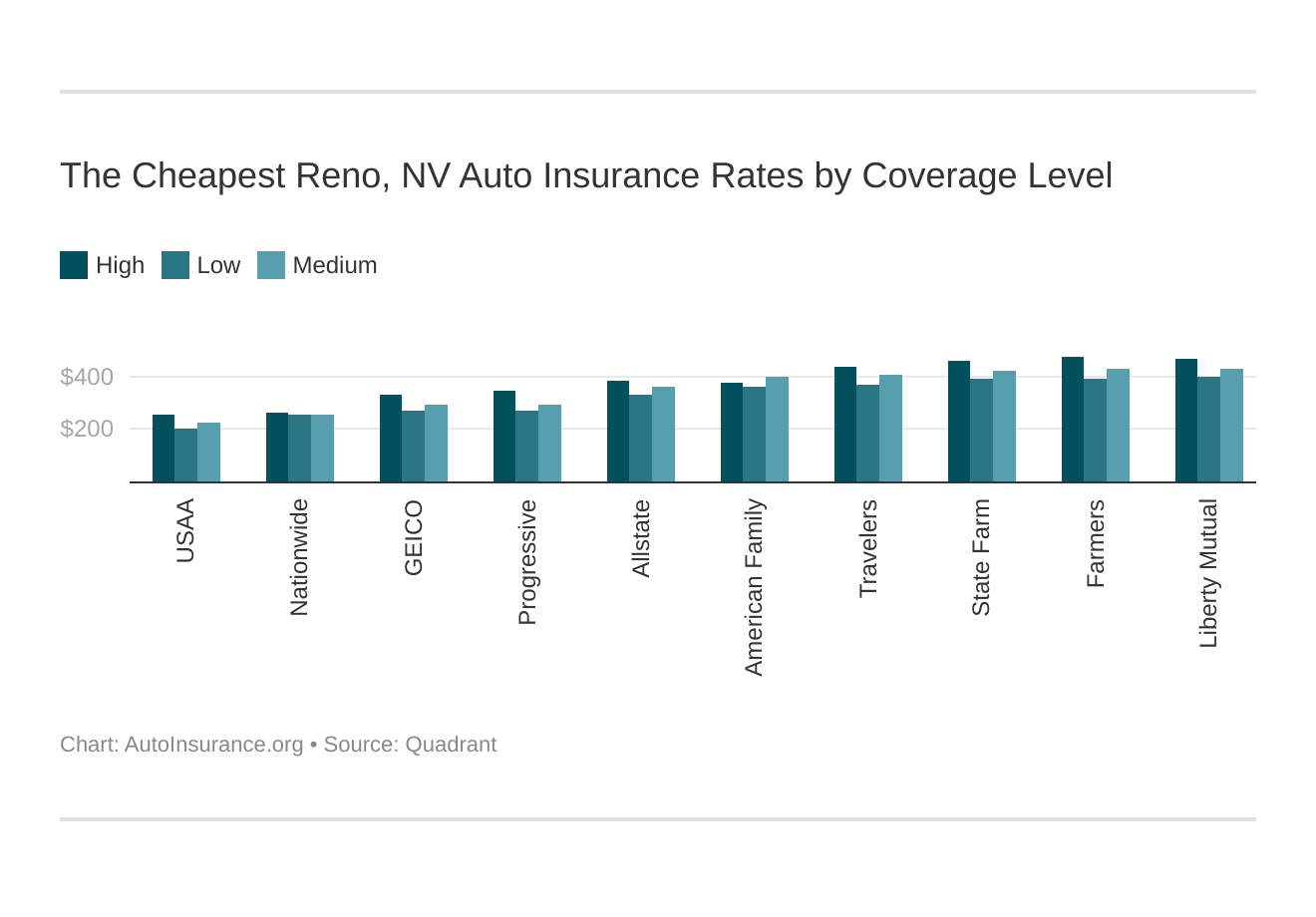

Best Car Insurance for Coverage Level Rates

The amount of car insurance you buy also affects how much you pay, whether you buy the state-required minimum liability insurance, add collision or comprehensive, or get full coverage.

Your coverage level will play a significant role in your Reno, NV auto insurance rates. Find the cheapest Reno, Nevada auto insurance rates by coverage level below:

| Group | High | Low | Medium | Average |

|---|---|---|---|---|

| Allstate | $4,612.80 | $3,957.50 | $4,349.08 | $4,306.46 |

| American Family | $4,448.45 | $4,354.65 | $4,800.71 | $4,534.60 |

| Farmers | $5,673.33 | $4,655.80 | $5,079.39 | $5,136.17 |

| Geico | $3,973.04 | $3,237.31 | $3,498.68 | $3,569.68 |

| Liberty Mutual | $5,611.64 | $4,778.31 | $5,116.06 | $5,168.67 |

| Nationwide | $3,122.16 | $3,050.26 | $3,081.47 | $3,084.63 |

| Progressive | $4,174.17 | $3,207.69 | $3,513.11 | $3,631.66 |

| State Farm | $5,517.68 | $4,666.04 | $5,068.62 | $5,084.11 |

| Travelers | $5,239.62 | $4,378.38 | $4,839.38 | $4,819.13 |

| USAA | $3,056.40 | $2,462.18 | $2,722.42 | $2,747.00 |

With some insurers, the cost difference from the lowest to the highest levels can vary from just over $100 to more than $1,100. So, it can pay to shop around and consider all of your options.

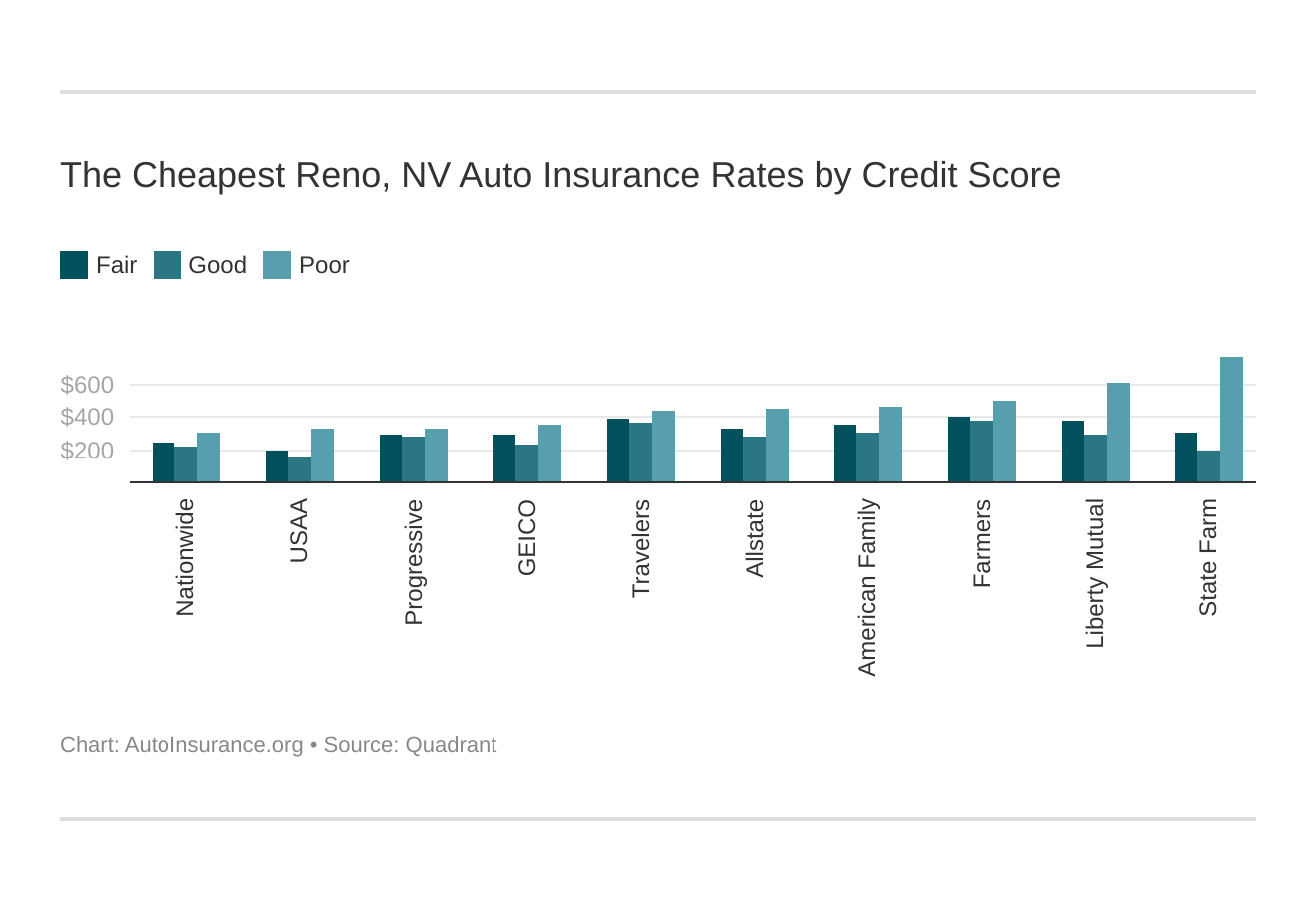

Best Car Insurance for Credit History Rates

Since auto insurance companies use a credit score, your credit history may be a bigger factor than you think in setting your car insurance rates. Let’s see how they can change for drivers with poor to good credit scores.

Your credit score will play a major role in your Reno, NV auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Reno, NV auto insurance rates by credit score below.

| Group | Fair | Good | Poor | Average |

|---|---|---|---|---|

| Allstate | $4,002.33 | $3,419.01 | $5,498.04 | $4,306.46 |

| American Family | $4,286.48 | $3,694.01 | $5,623.32 | $4,534.60 |

| Farmers | $4,841.99 | $4,558.14 | $6,008.38 | $5,136.17 |

| Geico | $3,569.68 | $2,835.16 | $4,304.20 | $3,569.68 |

| Liberty Mutual | $4,537.19 | $3,552.04 | $7,416.78 | $5,168.67 |

| Nationwide | $3,006.81 | $2,609.06 | $3,638.01 | $3,084.63 |

| Progressive | $3,570.99 | $3,342.25 | $3,981.73 | $3,631.66 |

| State Farm | $3,642.55 | $2,306.98 | $9,302.81 | $5,084.11 |

| Travelers | $4,725.42 | $4,461.32 | $5,270.64 | $4,819.13 |

| USAA | $2,362.98 | $1,929.03 | $3,949.00 | $2,747.00 |

With State Farm, drivers who have poor credit can pay more than $7,000 annually compared to those who have good scores.

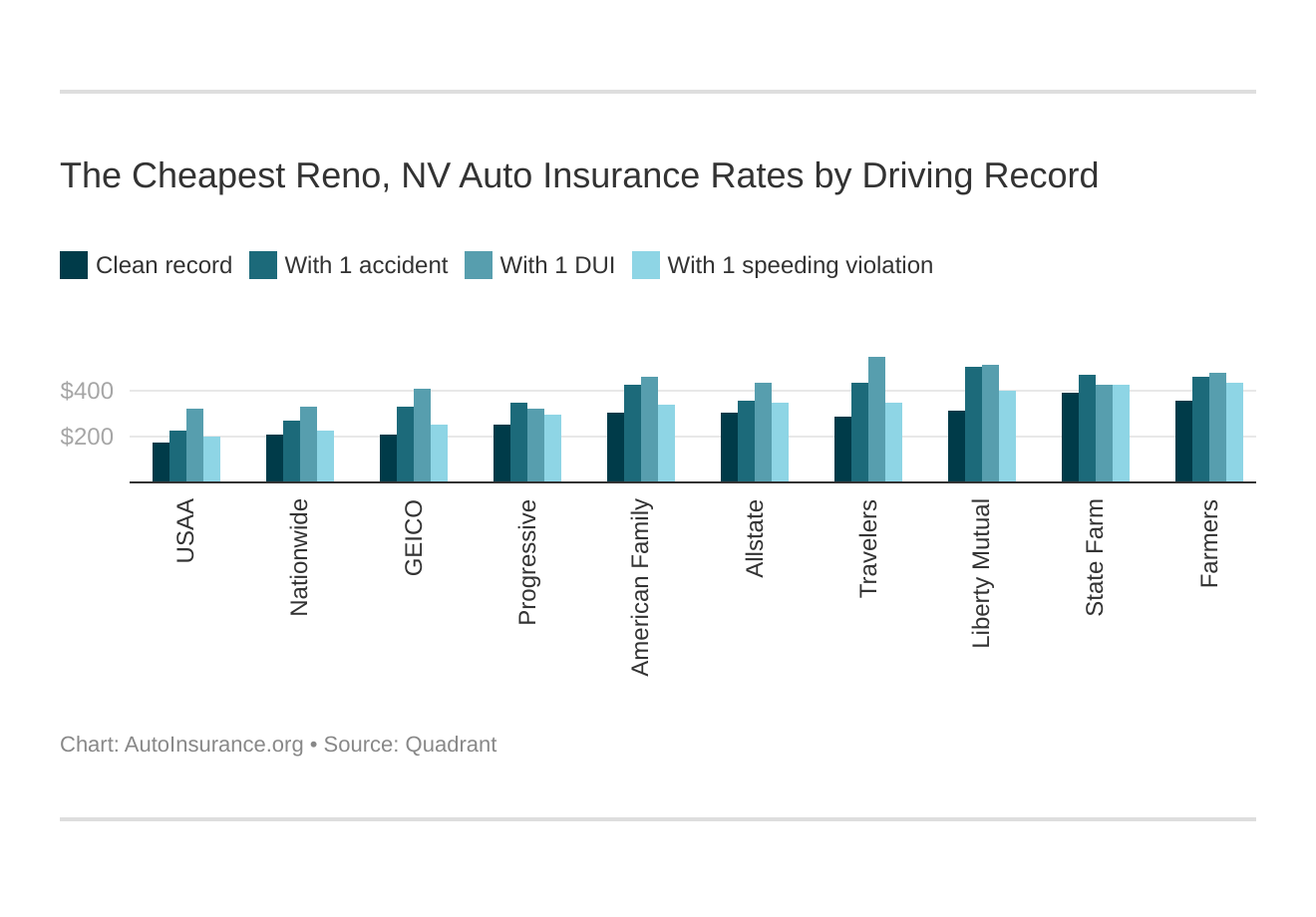

Best Car Insurance for Driving Record Rates

Auto insurance companies check your driving record as well, so this can be another major car insurance factor. Here’s how your rates can change based on common driving penalties in Reno.

Your driving record will affect your Nevada auto insurance rates. For example, a Reno, Nevada DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Reno, Nevada auto insurance rates by driving record.

| Group | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation | Average |

|---|---|---|---|---|---|

| Allstate | $3,653.23 | $4,272.56 | $5,170.76 | $4,129.29 | $4,365.52 |

| American Family | $3,643.36 | $5,052.57 | $5,440.00 | $4,002.47 | $4,711.98 |

| Farmers | $4,283.99 | $5,462.88 | $5,647.33 | $5,150.48 | $5,131.40 |

| Geico | $2,465.05 | $3,954.48 | $4,827.48 | $3,031.70 | $3,749.00 |

| Liberty Mutual | $3,776.07 | $6,037.90 | $6,071.75 | $4,788.96 | $5,295.24 |

| Nationwide | $2,474.80 | $3,183.22 | $3,974.58 | $2,705.90 | $3,210.87 |

| Progressive | $3,032.60 | $4,156.33 | $3,814.38 | $3,523.32 | $3,667.77 |

| State Farm | $4,614.03 | $5,554.21 | $5,084.11 | $5,084.11 | $5,084.12 |

| Travelers | $3,446.59 | $5,144.13 | $6,536.16 | $4,149.64 | $5,042.29 |

| USAA | $2,109.43 | $2,653.41 | $3,842.03 | $2,383.14 | $2,868.29 |

With Liberty Mutual, drivers can pay over $1,000 more for their car insurance premiums if they get even one speeding ticket.

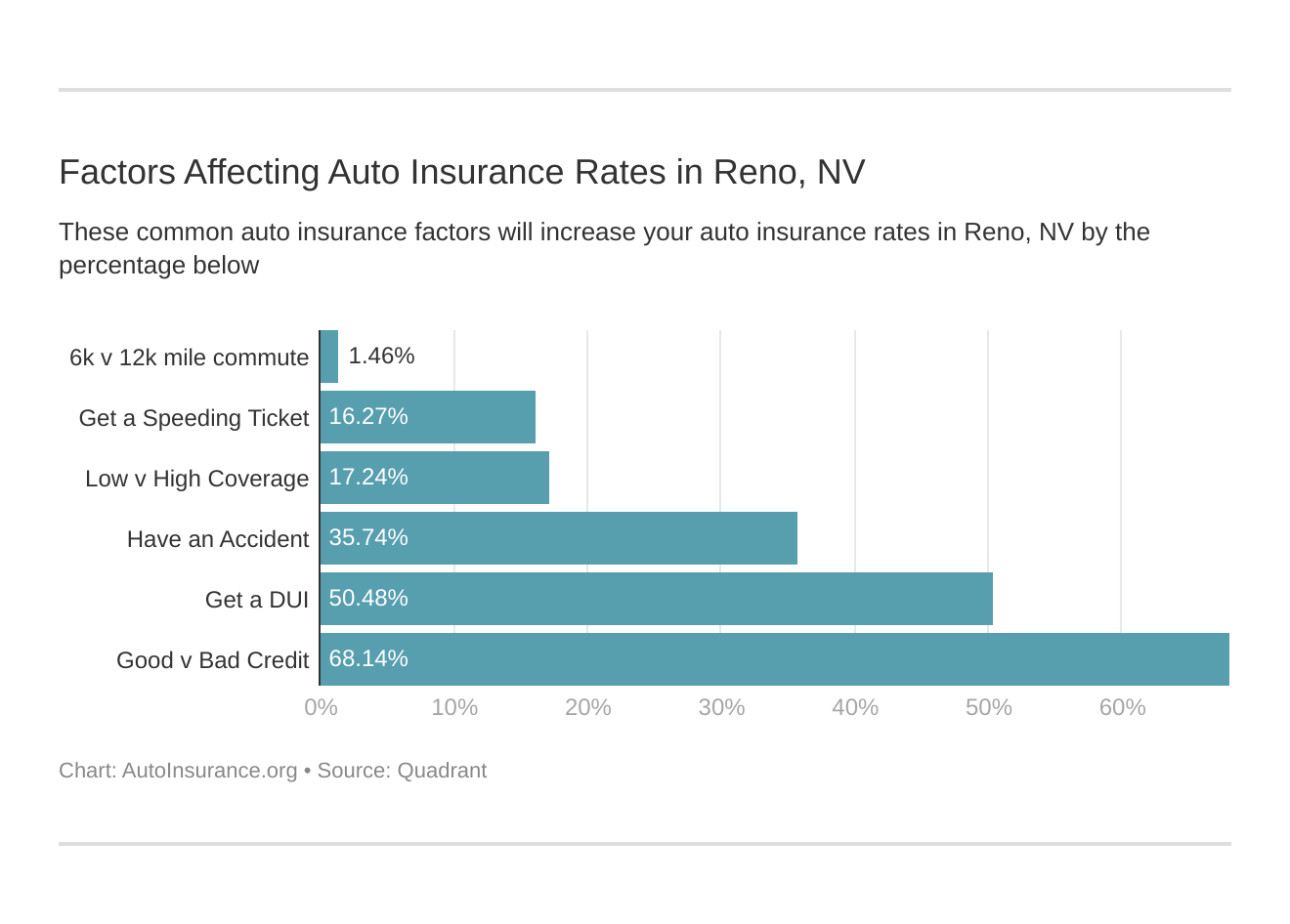

Car Insurance Factors in Reno

We’ve seen how closely some of the major insurance companies look at certain aspects of a driver’s life and habits to adjust their car insurance rates. Now, we’ll explore more factors that influence auto insurance premiums, such as the local economy, your earnings, education level, and job.

Factors affecting auto insurance rates in Reno, NV may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Reno, Nevada auto insurance.

Metro Report – Growth and Prosperity

Reno has recently shown signs of a strong economy, with an unemployment rate of under 4 percent and a job market increase of about 5 percent. Sperling’s Best Places predicts that in the next decade, job growth there will reach 51 percent, which is nearly 20 percent higher than the U.S. average.

According to the McKinsey Global Institute, Reno is among their “small powerhouses” with the fastest-growing economy and population.

In its Future of Work in America report, McKinsey singled out 11 smaller cities that are home to fewer than 2 percent of Americans and have less than half the average population of high-growth hubs.

For its growth in tech companies, the city also made The Milken Institute’s list of the Best-Performing Cities.

The news segment below covers how Reno rebounded from the Great Recession:

Let’s see how the economy drives Reno residents’ incomes, occupations, and levels of homeownership.

Median Household Income

According to Data USA, in 2017, the median household income in Reno grew to $52,106 from the previous year’s average of $48,815. These rates were lower than the U.S. average annual income of $60,336.

Based on the $52,106 annual income and the average annual cost of car insurance in Reno ($3,931.74), 8 percent of drivers’ wages pay for car insurance.

Homeownership in Reno

Homeownership shows a driver may be more reliable and able to pay car insurance premiums. Owning a home affects car insurance – you could pay less for car insurance than if you rent. To save more, homeowners can also bundle their car and home insurance.

In 2017, 48 percent of the housing units in Reno were owner-occupied. Data USA statistics show that this rate grew from 46 percent the previous year. The percentage of owner-occupation is much lower than the national average of 64 percent.

On the other hand, the median property value in Reno rose to $265,600 in 2017 from the previous year’s value of $235,800.

Education in Reno

In 2016, universities in Reno awarded 7,133 degrees. Data USA has found that the largest schools by the number of degrees granted are the University of Nevada-Reno (4,309 or 60 percent), Truckee Meadows Community College (2,431 or 34 percent), and Carrington College-Reno (165 or 2 percent).

Community colleges, which award several degrees and certificates in a range of fields, are a lower-cost alternative to traditional schools. Truckee Meadows Community College provides degrees and certificates in many of the fields with the highest employment rates in the city.

The most popular majors in Reno are other science technologies (382 or 5 percent), liberal arts and sciences (288 or 4 percent), and registered nursing (282 or 4 percent).

Wage by Race and Ethnicity in Common Jobs

In 2017, whites were the highest paid race/ethnicity of Nevada workers. Data USA reveals that they were paid 1.1 times more than Asians, who earned the second-highest salary of any race/ethnicity.

Here’s how much the top three highest-earning races and ethnicities made and the percentage of their incomes that paid for car insurance:

| Race or Ethnicity | Average Salary | Percentage of Income Going to Car Insurance |

|---|---|---|

| White | $49,115 | 8.01% |

| Asian | $44,438 | 8.85% |

| Native American and Alaska Native tribes specified, or Native American or Alaska Native, not specified and no other races | $39,307 | 10% |

From the highest earners, whites, to Native American and related races, 8 to 10 percent of their wages paid for car insurance.

Wage by Gender in Common Jobs

In 2017, full-time male employees in Nevada made 1.29 times more than females. Data USA figures show that male workers there earned $57,432 on average annually, while females made $44,567.

Together with the wage gap, there was a disparity in how much each gender paid for car insurance. It amounted to 7 percent for males and 9 percent for females.

Poverty by Age and Gender

Sixteen percent of the population in Reno lives below the poverty line, higher than the national average of 13 percent. The largest demographic living in poverty are females ages 18-24, followed by males 18-24, and females 25-34.

The U.S. Census Bureau uses a set of money income thresholds that vary by family size and composition to determine who classifies as impoverished. If a family’s total income falls below their limits, the Census Bureau classifies that family and every family member as living in poverty.

Poverty by Race and Ethnicity

Data USA says that the most common racial or ethnic group living below the poverty line in Reno is white, followed by Hispanic and other.

Employment by Occupations

From 2016 to 2017, employment in Reno grew at a rate of 3 percent.

Data USA stats show that the most common job groups, by the number of people living in Reno, are office and administrative support occupations (16,249 people), sales and related jobs (14,188 people), and management occupations (10,903 people).

Driving in Reno

The roads in Reno may present drivers with many challenges. Whether they result from the crumbling pavement, congested traffic, or other woes, they can cause frustration and delays.

This section will look at the major routes in Reno, the traffic levels, popular road trips, and other parts of life on the highway.

So keep reading to find out what you may face in your travels.

Roads in Reno

Here you’ll learn all about Reno’s roads and the rules you should follow when you drive on them.

Major Highways

Nevada has six active highways that span 623.79 miles.

The major highways in the city include:

- I-580

- U.S. 50

- I-80

- U.S. Route 395 Business (US 395 Bus.) — a north-south state highway that follows Virginia Street. U.S. 395 is also designated as State Route 430 (SR 430) from its intersection with SR 659 (McCarran Boulevard) to its northern end at US 395.

- State Route 659 (SR 659) — follows McCarran Boulevard, a connector road that serves Reno and Sparks. The route provides access to many businesses and residential areas in the Truckee Meadows.

The video below shows the route from Interstate 80 to U.S. 395 and downtown Reno:

Popular Road Trips/Sites

Reno offers a variety of recreational opportunities for everyone, whether you want to dine out, take a day trip, or are merely looking for something different. Check out these ideas:

- The Best Restaurants in Reno — From the Rattlesnake Club to Casale’s Halfway Club, these are among the top eateries in the city.

- Actually Cool Things to Do in Reno Right Now — If anything from rock climbing to art museums sounds like fun, you’ll enjoy this list of attractions.

- More Affordable Alternative to Visiting Las Vegas — Here’s why you should consider Reno for your budget-friendly vacation.

- The Most Hippie Town in Nevada — If your tastes tend to the unconventional, this lists offers signs of counterculture life that focus on Reno.

- Thirteen Very Best Day Trips — This list features some decent getaways in and around Reno.

For even more choices, watch this travel video for advice:

Road Conditions

Below are pavement conditions and vehicle operating costs in Reno from TRIP, a national transportation research group:

| Poor Share | Mediocre Share | Fair Share | Good Share | Vehicle Operating Costs (VOC) |

|---|---|---|---|---|

| 23% | 30% | 13% | 34% | $564 |

Most roads are in good to mediocre condition. Vehicle Operating Costs (VOC) for repairs related to road safety conditions, such as tires, are below $600 and are less than in other cities, reflecting the relative stability of the highways.

Does Reno use speeding or red light cameras?

According to the Insurance Institute for Highway Safety (IIHS), the City of Reno doesn’t use red light or speeding cameras.

Vehicles in Reno

Below, we’ll cover the most popular vehicles owned in the area, car ownership, and crime rates (including vehicle thefts).

Most Popular Vehicles Owned

According to KAYAK, the most frequently booked rental vehicle type in Reno is an intermediate car, such as the Hyundai Elantra.

Consumer Reports ranks the 2020 Hyundai Elantra 67th out of 100 overall, based on safety, road tests, reliability, and owner satisfaction. The vehicle also made #11 on its list of 23 compact cars.

The publication said the car “delivers the roominess and fuel economy to compete in this crowded segment, but it fell short in refinement and performance when this generation debuted. For 2020, it received a round of improvements that improved ride comfort and reduced engine noise.”

CR believes the car has an impressive fuel economy at an overall 33 miles per gallon. In crash tests, the IIHS gave the car good ratings, and the National Traffic Highway Safety Administration (NHTSA) gave it four and five stars.

How Many Cars Per Household

Data USA stats show that the largest share of households in Reno owns two cars, followed by one car. These figures match the national averages.

Households Without a Car

The table below reveals how many Reno households on average own and don’t own cars.

| 2015 Households Without Vehicles | 2016 Households Without Vehicles | 2015 Vehicles Per Household | 2016 Vehicles Per Household |

|---|---|---|---|

| 5.00% | 2.90% | 2.22 | 2.32 |

From 2015 to 2016, the percentage of households that don’t own cars dropped a few percentage points, yet the number of vehicles owned in Reno stayed about the same, at just over two.

Speed Traps in Reno

Speedtrap.org keeps track of speed traps all across the United States, as voted by its users. Reno ranked third on the site’s list of the worst speed trap cities in Nevada.

Among the Reno roads visitors have debated as truly speed traps, the following received the most votes:

- Boomtown on Interstate 80 West and East

- North Virginia Street

- I-80 eastbound entering Reno

If you’re in those areas, you should obey speed limits to avoid worrying about speed traps and potential penalties. And, best of all, you’ll help keep yourself and others safe.

Vehicle Theft in Reno

The Federal Bureau of Investigation (FBI) reports that in 2017, 1,432 vehicle thefts occurred in Reno.

Neighborhood Scout also tracks crime statistics for U.S. cities. Below is their map of the safest districts in Reno, which includes the neighborhood of Cheyenne Drive / S. Virginia Street.

The site gives the city a crime index of 13, which means it’s 13 percent safer than other U.S. cities. In Reno, your chances of becoming a victim of violent crime are one in 151. Statewide, however, they decrease slightly to one in 185. In the city and across the state, these chances are quite high.

Further, per 1,000 residents, nearly 7 percent are victims of violent crimes. In Nevada, that figure drops to about 6 percent. Per square mile, 76 crimes occur in Reno, yet only 22 happen statewide (much of the state is rural). Nationally, an average of 31 crimes are reported for every square mile.

For a closer look at the crimes that occur in Reno, below is a chart showing figures from 2017:

| Reno Annual Crimes | VIOLENT | PROPERTY | TOTAL |

|---|---|---|---|

| Number of Crimes | 1700 | 7976 | 9676 |

| Crime Rate (per 1,000 residents) | 6.83 | 32.05 | 38.88 |

Roughly 82.5 percent of the crimes that occurred in Reno, whether they were vandalism or thefts, involved property.

Traffic

Car insurers also explore traffic patterns in an area to see how congested they are — the more cars on the road, the more accidents will happen.

Below, we’ll cover traffic congestion in Reno, the busiest highways, and the safety of its streets and roads.

Traffic Congestion in Reno

Transportation in metropolitan areas and traffic congestion go hand-in-hand. Like other states, Nevada has its share of peak traffic times that may lead to travel delays.

Let’s see how two of the biggest cities in Nevada rank for levels of traffic congestion based on the INRIX 2018 Global Traffic Scorecard.

| City | Hours Lost in Congestion (2018) | Cost of Congestion (Per Driver) | Inner City Travel Time (Minutes) |

|---|---|---|---|

| Reno | 52 | $724 | 3 |

Reno is the second-most traffic-congested city in The Silver State, and it ranks 51st in the country. In 2018, Reno residents spent 52 hours in traffic.

In the morning and evening rush hours, average speeds reached 29 mph. At “off-peak” times, they increased to 38 mph and rose to almost 50 mph in free-flowing traffic.

Transportation-related costs averaged under $1,000 yearly per driver.

Transportation

According to Data USA, on average, Reno commuters spend less time on the road, 18.7 minutes, than the typical U.S. worker (25.1 minutes). Also, just over 1 percent of the Reno workforce has a super commute longer than 90 minutes.

Regarding the most popular types of commuter transportation, many Reno commuters drove alone (76 percent), followed by those who carpooled (12 percent), and walked (4 percent).

Busiest Highways

This map of current highway traffic shows that stretches of I-80 and I-395 are among Reno’s busiest routes.

How safe are Reno streets and roads?

In this section, you’ll find out how many fatal accidents happened on Washoe County roads in 2018, courtesy of the National Highway Traffic Safety Administration (NHTSA). We’ll cover everything from the total fatalities by the county to vehicle and railroad accidents.

Total fatalities by county:

- Fatalities (all crashes) — 44 total

- Fatalities in crashes involving an alcohol-impaired driver (BAC = .08+) — 8

- Single-vehicle crash fatalities — 22

- Fatalities in crashes involving speeding — 5

- Fatalities in crashes involving a roadway departure — 8

- Fatalities in crashes involving an intersection (or intersection related) — 15

- Passenger car occupant fatalities — 11

- Pedestrian fatalities — 11

- Pedal cyclist fatalities — 1

Many of the accidents involved single vehicles and intersections.

Next, the figures below show the fatalities by road type and function class in Nevada.

| Nevada Road Type | Fatal Crashes |

|---|---|

| Freeway and Expressway | 6 |

| Rural Interstate | 16 |

| Urban Interstate | 22 |

| Local | 31 |

| Collector Arterial | 23 |

| Minor Arterial | 87 |

| Unknown | 6 |

| Other | 99 |

| Total Crashes | 2,922 |

Statewide, most of the accidents involved local and minor arterial roads. An arterial road is a high-capacity urban road.

Depending on the amount of traffic, the arterial road may be classified as a highway or a minor arterial road. A collector road gathers traffic from local roads and takes drivers to arterial roads.

Based on U.S. Department of Transportation (DOT) data, the table below shows the number of railroad and highway crash incidents that happened in Washoe County from 2012 to 2016:

| Calendar Year | County | Highway | Highway User Type | Rail Equipment Type | non suicide fatality | non suicide injury | City |

|---|---|---|---|---|---|---|---|

| 2013 | WASHOE | SUTRO STREET | Pedestrian | Freight Train | 0 | 1 | RENO |

| 2016 | WASHOE | GALLETTI WAY | Pedestrian | Freight Train | 0 | 0 | SPARKS |

Fortunately, during the five years, few train/vehicle accidents occurred.

Allstate America’s Best Drivers Report

Allstate America’s Best Drivers Report tracks the numbers of accident claims drivers make nationwide. According to Allstate claims data, the average driver in the United States will experience a collision once every 10.57 years.

In 2019, Reno ranked 25th out of 200 major cities on the report, up from 29th the prior year. The chart below shows the residents’ insurance claim statistics.

| Average Years Between Collisions | 2018 Best Drivers Report Ranking | Change in Ranking From 2018 to 2019 | Relative Claim Likelihood (Compared to National Average) | Drivewise® Hard Braking Events per 1,000 Miles |

|---|---|---|---|---|

| 11.26 | 29 | +4 | -0.061 | 21.9 |

Drivers in Reno went an average of 11 years between accident claims, and they were much less likely to file a claim compared to the national average. Unlike other cities nationwide, Reno drivers file fewer claims, and that shows in the city’s ranking on the report.

Ridesharing

Beyond regular taxi rides, below are the ridesharing services available in Reno.

- Blacklane — Blacklane luxury vehicles seat one to five people.

- Carmel — This company gives users the choice of riding in a sedan, a minivan, a stretch limousine, an SUV, or an SUV super-stretch limo.

- Lyft — This lowest cost Lyft service will grant you a request for a regular four-seat car.

- Lyft Plus — This is the best Lyft option for larger groups. A Lyft Plus car can seat six or more passengers. Fare prices tend to run higher than a regular Lyft ride to compensate van and SUV drivers for their higher vehicle running costs.

- Lyft Premier — Lyft’s luxury service. A request for a Lyft Premier will grant you a high-end four-seat car.

- Uber X — This budget service gives riders a regular-size car that seats four.

- Uber XL — Uber’s service for larger groups will seat up to six passengers.

E-star Repair Shops

A program from Esurance, E-star helps drivers find the best repair shops in their areas. According to E-star, these are the top six repair shops within 50 miles of Reno:

- Caliber – Carson City

405 Moses St.

Carson City, NV 89701

email: [email protected]

Phone: (775) 887-9099

Fax: (775) 883-3406 - Caliber – Reno

935 Harvard Way

Reno, NV 89502

email: [email protected]

Phone: (775) 324-1082

Fax: (775) 324-0785 - Caliber – Sparks

2201 Glendale Ave.

Sparks, NV 89431

email: [email protected]

Phone: (775) 353-4400

Fax: (775) 353-4410 - Diamond Auto Body

150 S. Meadows Pkwy.

Reno, NV 89511

email: [email protected]

Phone: (775) 329-4090

Fax: (775) 329-4096 - Welcome Auto Body – Minden

2589 Wildhorse Lane

Minden, NV 89423

Phone: (775) 267-9000 - Welcome Auto Body – Lake Tahoe

1772 D St.

South Lake Tahoe, CA 96150

email: [email protected]

Phone: (530) 544-6622

Fax: (530) 541-5492

When your car needs repair, check out EStar shops to ensure you get quality service.

Weather

U.S. Climate Data reveals the average temperature in Reno to be 54 degrees, which means it doesn’t get too hot or too cold there. The city receives little rainfall yearly, but it sees some snow.

| Reno weather | Averages |

|---|---|

| Annual high temperature: | 67.6°F |

| Annual low temperature: | 40.1°F |

| Average temperature: | 53.85°F |

| Average annual precipitation - rainfall: | 7.39 inches |

| Days per year with precipitation - rainfall: | 50 days |

| Annual hours of sunshine: | 3,483 hours |

| Av. annual snowfall: | 22 inches |

City-Data shows that Washoe County averages 25 natural disasters yearly, which exceeds the U.S. average of 13. Every year, an average of four natural disasters lead to emergency declarations and three are presidential declarations.

Below is a breakdown of the causes of disasters. Note: Some incidents may be assigned to more than one category.

- Fires: 18

- Floods: 4

- Storms: 4

- Snowstorms: 2

- Hurricanes: 1

Most of the natural disasters that hit Reno involve fires, floods, and storms. Given the risks involved, it makes sense to buy comprehensive car insurance for protection from these and other hazards that can damage your vehicle.

Public Transit

The major form of public transportation available in North Las Vegas is the Regional Transportation Commission of Washoe County (RTC) Transit bus service.

At the regular fare price, a single bus ride costs $2. Riders can pay for their fares on the bus before they board. Day passes cost $3, and seven-day passes are $14.50. The RTC website offers more details about the costs of seven-day, 15-day, and 30-day passes.

Children age 5 and younger ride free and an adult must accompany them. Youths age 6 to 18, seniors, veterans, and people with disabilities may receive discounted fares if they show a valid identification (ID) when they board.

The University of Nevada-Reno and Truckee Meadows Community College students, faculty, and staff ride free.

Alternate Transportation

Lime, a bike and electric scooter rental company that operates in big cities nationwide, offers service in Reno. Costs average 15 cents per minute. You can use their mobile app to find the nearest scooter.

The company encourages renters to ride responsibly and obey local laws, which include the following:

- Riding a bicycle on the sidewalk in downtown Reno is illegal.

- In downtown Reno, please ride on the right side of the road.

- Ride with traffic and follow traffic laws.

- Follow posted speed limits.

- Always yield to pedestrians.

- Please refer to the Washoe County RTC’s website for a map of pathways and bikeways in the region where riding bikes is legal.

Whether you drive a car, a bike, or a scooter, make sure that you ride safely and obey the law.

Parking in Metro Areas

Reno offers metered parking throughout the city. The meters accept coins and credit/debit cards. They generally have a two-hour limit and are enforced Monday through Saturday, from 9 a.m. to 6 p.m. Sundays and holidays are free.

Several parking lots and garages are available throughout Reno, too.

ChargeHub lists electric car charging stations within 10 miles of Reno. Most of them are Level 2. However, some Level 3 charging stations are also available. The main charging networks are Tesla and ChargePoint.

Air Quality in Reno

Pollution from vehicle exhaust has been linked to health issues and even climate change. The pollution not only goes directly into the earth’s atmosphere, but it also reacts with other pollutants, which makes the situation worse.

Children and people with chronic illnesses can be most sensitive to the effects.

Below are the Environmental Protection Agency (EPA) air quality levels for Washoe County from 2016 to 2018. The EPA calculates the Air Quality Index (AQI) for four major air pollutants under the Clean Air Act: ground-level ozone, particle pollution, carbon monoxide, and sulfur dioxide.

For each of these pollutants, the EPA has established national air quality standards to protect public health.

| Details | 2016 | 2017 | 2018 |

|---|---|---|---|

| Days With Air Quality Index (AQI) | 366 | 365 | 365 |

| Good Days | 234 | 202 | 213 |

| Moderate Days | 125 | 159 | 133 |

| Days Unhealthy for Sensitive Groups | 7 | 4 | 19 |

| Unhealthy Days | 0 | 0 | 0 |

| Very Unhealthy Days | 0 | 0 | 0 |

The AQI measurements stayed about the same during the three years. However, the number of days unhealthy for sensitive groups more than doubled.

Vehicle emissions tests are required in Reno, Sparks, Washoe Valley, and most of the area west of Washoe Valley. Testing is also needed north and east of Reno between Interstate 80 and the 40th degree of north latitude about halfway through Pyramid Lake.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Military/Veterans

If you’re an active member of the military or a veteran, you may find it hard to get a deal on car insurance. With all the information at your fingertips, it can be frustrating to find a good starting place.

Look no further. We’ve gathered all the information you need about military discounts here. We’ve also included some details about the local military, such as the number of veterans by service period and average insurance rates.

Veterans by Service Period

Data USA reports that Reno has a large population of military personnel who served in Vietnam (5,480), which is two times greater than any other conflict. They were followed by veterans of the most recent Gulf War.

These numbers are slightly higher than the national average.

Military Bases Within an Hour

No military bases are within an hour of Reno.

Military Discount by Providers

If you are or were in the U.S. military, most car insurance companies will want to give back by serving you. Many of them offer military discounts.

Below is a list of known providers who give military discounts. We excluded those who offer military discounts only to certain states.

| Insurance Company | Savings Amount |

|---|---|

| Farmers | 5% |

| Geico | 15% |

| Liberty Mutual (must be active duty) | 4% |

| MetLife | 15% |

| USAA | 60% off when deployed 15% for garaging on base |

*USAA gives a 15 percent military garage discount for garaging cars on a military base.

USAA Available in State

USAA provides car insurance only to U.S. military personnel and their families. The company’s insurance premiums tend to cost less than those of standard insurers.

Below, you’ll see how USAA’s and other insurers’ rates compare to the average annual full-coverage premiums in Nevada.

| GROUP | Monthly PREMIUM | COMPARED TO STATE AVERAGE (+/-) | COMPARED TO STATE AVERAGE (%) |

|---|---|---|---|

| Allstate | $447.64 | $42.49 | 0.87% |

| American Family | $453.43 | $48.29 | 0.99% |

| Farmers | $466.30 | $61.16 | 1.26% |

| Geico | $305.17 | -$99.97 | -2.06% |

| Liberty Mutual | $516.80 | $111.65 | 2.30% |

| Nationwide | $289.76 | -$115.38 | -2.37% |

| Progressive | $338.55 | -$66.59 | -1.37% |

| State Farm | $483.03 | $77.89 | 1.60% |

| Travelers | $446.70 | $41.56 | 0.86% |

| USAA | $255.76 | -$149.39 | -3.07% |

As shown, USAA offers the best rates in Nevada, at 37 percent less than the cost of the annual state average premium.

Unique City Laws

Every city has its own laws, and Reno is no different. The tough part is keeping track of all of them.

In this section, we cover everything from hands-free laws to food trucks, tiny homes, and parking regulations.

Keep reading to find out about some of the most important laws in Reno.

Hands-Free Laws

In the state of Nevada, all drivers are prohibited from using handheld devices while they’re behind the wheel. Nevada also bans all drivers from texting.

Texting, using the internet, and operating handheld devices while driving has been illegal in Nevada since 2011. Drivers can talk on the phone with hands-free devices. Violators face a $50 fine for their first conviction in seven years, $100 for a second offense, and $250 for all other infractions.

Fines may double if the distracted driving event occurred in a work zone. First offenses are not seen as moving violations. For more details, see the Nevada DMV’s distracted driving manual.

Food Trucks

In Reno, food truck operators must obey the following rules:

- All mobile vendors involved in the sale or handling of any type of food must carry a license from the city and maintain a valid Washoe County Health District permit.

- The city requires a separate license for any mobile vending activity. A business owner can’t operate a mobile vending vehicle or unit under an existing business license.

- A mobile vendor may have more than one vehicle or unit under one business license. However, each vehicle must be named as a part of the business description on the application with the Vehicle Identification Number (VIN) and the license plate. Each truck will have a separate license printout with these unique identifiers. The city doesn’t allow copies of the license to be placed in additional vehicles.

Anyone who violates these regulations may face penalties.

Tiny Homes

Tiny homes appeal to people who want to simplify their lives. Before you abandon standard housing, you should be aware that tiny homes often must follow specific regulations.

The Reno city council has expressed interest in encouraging more tiny homes to be built to relieve homelessness, but building costs, including sewer hookups, remain high. The city is looking into creating zoning codes for small homes.

Parking Laws

Reno requires vehicles to be parked parallel to the edge of the roadway facing traffic, with the right wheels within 18 inches of the curb or side of the road (except on one-way streets and in culs-de-sac).

Frequently Asked Questions

Is auto insurance mandatory in Reno, NV?

Yes, auto insurance is mandatory in Reno, NV, as it is in most states. The minimum required coverage in Nevada includes liability insurance to cover bodily injury and property damage caused to others in an accident.

What is the cheapest car insurance in Reno?

The cheapest car insurance providers in Reno can vary depending on individual factors. USAA and Travelers are mentioned as affordable options, but it’s best to compare quotes from multiple providers.

What is the Nevada evidence of insurance card?

The Nevada evidence of insurance card is a document provided by your insurance company that serves as proof of insurance coverage.

What kind of car insurance is required in Reno?

Reno requires drivers to have minimum liability insurance coverage: $25,000 bodily injury per person, $50,000 bodily injury per accident, and $20,000 property damage per accident.

What types of auto insurance coverage are available in Reno, NV?

In addition to liability coverage, there are various types of auto insurance coverage available in Reno, NV, including collision coverage (for damage to your vehicle in an accident), comprehensive coverage (for non-accident-related damage), uninsured/underinsured motorist coverage (protection if you’re hit by someone without insurance or insufficient coverage), and medical payments coverage (to cover medical expenses).

What factors can affect my auto insurance premium in Reno, NV?

Several factors can influence your auto insurance premium in Reno, NV, including your driving record, age, gender, location, type of vehicle, coverage options, deductibles, and credit history.

Are there any discounts available for auto insurance in Reno, NV?

Yes, insurance companies often offer various discounts for auto insurance in Reno, NV. These discounts can vary between insurance providers but may include safe driver discounts, multi-policy discounts, good student discounts, and discounts for safety features in your vehicle.

How can I find affordable auto insurance in Reno, NV?

To find affordable auto insurance in Reno, NV, it’s recommended to shop around and compare quotes from multiple insurance providers. You can also consider raising your deductibles, maintaining a good driving record, and bundling your auto insurance with other policies for potential discounts.

What should I do in case of an auto accident in Reno, NV?

In case of an auto accident in Reno, NV, first ensure your safety and the safety of others involved. Then, report the accident to the police and exchange information with the other parties. Contact your insurance provider as soon as possible to report the incident and initiate the claims process.

Can I use my auto insurance coverage outside of Reno, NV?

Most auto insurance policies provide coverage outside of Reno, NV, as long as you’re within the United States or its territories. However, it’s recommended to review your policy or consult with your insurance provider to understand the specific details of your coverage when traveling.

How often should I review my auto insurance policy in Reno, NV?

It’s a good practice to review your auto insurance policy in Reno, NV at least once a year or whenever significant changes occur in your life, such as buying a new vehicle, moving, or experiencing changes in your driving habits. Regularly reviewing your policy ensures that your coverage aligns with your current needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.