Cheapest Auto Insurance When Unemployed in 2025 (Save Big With These 9 Companies!)

You can find cheap auto insurance when unemployed at Erie, Geico, and State Farm. At Erie, car insurance for unemployed drivers starts at $27 a month. Unemployed drivers may be eligible for low-mileage discounts to lower their rates at Geico, while State Farm has the best unemployed auto insurance for students.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Jul 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage Unemployed

A.M. Best

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage Unemployed

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage Unemployed

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsLooking for the cheapest auto insurance when unemployed? The best rates are at Erie Insurance for $27 a month, followed by Geico and State Farm.

Our Top 9 Company Picks: Cheap Auto Insurance When Unemployed

Company Rank Monthly Rates UBI Discount Best For Jump to Pros/Cons

#1 $27 30% Cheap Rates Erie

#2 $35 30% Online Convenience Geico

#3 $42 30% Young Drivers State Farm

#4 $44 30% Safe Drivers Travelers

#5 $54 30% Budgeting Tools Progressive

#6 $55 20% Bundling Policies American Family

#7 $57 40% Roadside Assistance Nationwide

#8 $68 30% 24/7 Support Farmers

#9 $72 40% UBI Discounts Allstate

Some of the other best auto insurance companies for unemployed drivers are Nationwide and Progressive auto insurance. However, which company is best for you depends on what rates and perks you are looking for.

- Erie has the cheapest auto insurance for unemployed drivers

- State Farm and Geico are also economical choices when unemployed

- Unemployed drivers may be able to get low-mileage discounts

Read on to find cheaper car insurance for unemployed drivers, from the cheapest companies to discount savings. You can also compare quotes from the top insurers by entering your ZIP code above.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Unemployment and Auto Insurance Rates

Does being unemployed affect your car insurance? Not really, which means affordable car insurance for the unemployed isn’t out of reach. Shopping for coverage at one of the companies below will ensure you get the cheapest rate possible.

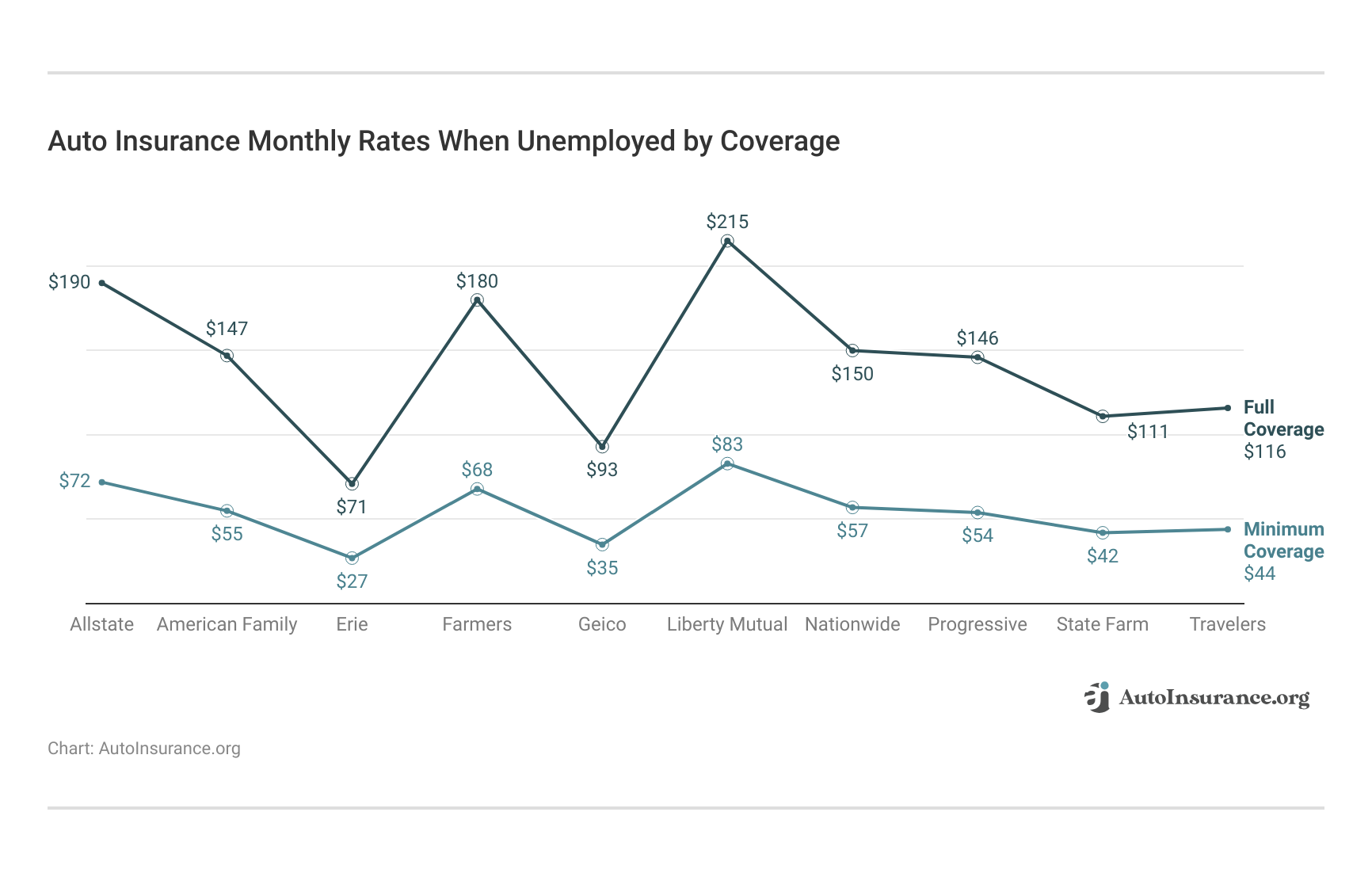

Erie and Geico have the cheapest car insurance when unemployed for both minimum and full coverage policies. How much is insurance when you’re unemployed? Monthly rates start at $27 at Erie Insurance.

Do you need a job to get car insurance? No, your employment status can’t affect your ability to buy insurance. Insurance companies check employment status, but if a provider were to deny coverage or raise rates because applicants were unemployed, the state regulatory officials would penalize them.

Using employment status to qualify a driver is discriminatory. That's why there isn't unemployed auto insurance for someone without a job.Daniel Walker Licensed Auto Insurance Agent

Is there auto insurance for the unemployed in California? Not exactly, but California is one of the few states to offer low-income auto insurance plans.

Credit Scores & Unemployed Auto Insurance Rates

Auto insurance and your credit score are important. If your credit score goes down while you’re unemployed, your rates may go up. A majority of states allow insurance companies to look at your credit when calculating rates, and this table shows how rates change by credit score.

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $145 | $180 | $255 | |

| $135 | $165 | $225 |

| $120 | $150 | $210 |

| $140 | $175 | $245 | |

| $125 | $160 | $230 | |

| $155 | $190 | $270 |

| $130 | $165 | $235 | |

| $135 | $170 | $250 | |

| $115 | $145 | $205 | |

| $140 | $175 | $245 |

Providers use credit and insurance scores, which are calculated by agencies such as FICO or LexisNexis, to assess a person’s likelihood of filing a claim. While delinquencies in credit will affect your score, there are factors that can’t be reported. One of these factors is employment status. Credit-based auto insurance companies can raise your rates at renewal if your credit score has gone down, but not because you lost your job.

How to Save Money on Auto Insurance When Unemployed

Your employment status isn’t a rating factor, but if you go from employed to unemployed, there are a few things you can do to save money on insurance. For instance, your vehicle usage could change when you’re unemployed, and you might qualify for pay-per-mile insurance if you drive less while out of work.

When you commute five days per week for work, you accumulate 10,000 miles or more over the year.Heidi Mertlich Licensed Insurance Agent

It might sound like a silly question, depending on how it’s phrased, but your insurer wants to know whether or not you commute to and from work or school. There are three usage categories. These include business-use and pleasure-use vs. commuter auto insurance. If you go from driving as a commuter or for business, you’ll see your rates drop when you become a pleasure user.

Insurance companies have different mileage rating bands. The higher your annual mileage, the higher your premiums will be. When your annual mileage goes down, you can get low-mileage discounts that help lower premiums and save you money while you’re unemployed.

Auto Insurance Discounts For Unemployed Drivers

After you cut out that commute, your annual mileage will go down. If it goes down enough, you can qualify for a low-mileage discount. There are also other discounts available to unemployed drivers. These discounts vary by provider, but often offer big savings.

Auto Insurance Discounts for Unemployed Drivers by Savings Potential

Discount Average Savings Description

Usage-Based 20% This discount is applied based on monitored driving behavior through telematics devices or mobile apps, allowing insurers to assess driving habits.

Low Mileage 15% Drivers who cover a lower-than-average annual mileage may qualify for this discount.

Pay-Per-Mile 25% Premiums are calculated based on the number of miles driven, ideal for unemployed drivers with limited travel needs.

Safe Driver 17% Awarded to drivers with a clean driving record.

Multi-Car 15% For insuring more than one vehicle on the same policy.

Bundle 15% Offers savings for bundling auto insurance with home or renters insurance.

Defensive Driving 10% Completing an approved defensive driving course can result in reduced premiums.

Good Student 10% Available to young, unemployed drivers maintaining good grades.

Student Away at School 8% For unemployed students who are not actively driving the insured vehicle.

Loyalty 7% Rewards long-term customers staying with the same insurer.

For example, there is a good selection of State Farm auto insurance discounts that young drivers can use to save on unemployed car insurance, including student discounts and taking defensive driving courses online.

Cheap usage-based auto insurance for unemployed drivers is also an affordable option for safe drivers who aren’t on the road often.

Best Occupation For Cheap Car Insurance

Does your job affect auto insurance? For most drivers, employment status does not affect car insurance. Your job will only impact life insurance rates if you have a risky occupation, like a logger or firefighter, but there is no lowest-risk occupation for car insurance. As you can see, auto insurance rates are pretty much the same across the 20 most common careers.

Auto Insurance Full Coverage Monthly Rates for The 20 Most Common Occupations

Occupation Rates

Retail Salesperson $100

Cashier $96

Office Clerk $104

Food Prep Worker $98

Registered Nurse $108

Customer Service Rep $100

Laborer $106

Stock Clerk $103

Janitor $101

Bookkeeper $105

Maintenance Worker 1230

Teacher $102

Truck Driver $107

Sales Rep $108

Nursing Assistant $102

Construction Worker $109

Security Guard $100

Personal Care Aide $101

Secretary $104

Software Developer $117

The cheapest profession for car insurance will be one with a short commute or a job that allows you to work from home. The best jobs for cheap car insurance will qualify for occupation-based discounts, such as educators, first responders, and government employees.

Companies With The Cheapest Auto Insurance When Unemployed

Can you get car insurance if unemployed? Yes, and Erie, Geico, and State Farm have the cheapest auto insurance for the unemployed.

How much is insurance when you’re unemployed? Erie has the lowest rates at $27 per month, but it’s only available in a handful of states. Geico and State Farm Insurance are the top two national companies with the cheapest car insurance when unemployed. Scroll down for the pros and cons of all nine companies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Erie: Top Pick Overall

Pros

- Affordable Rates: Erie has the best cheap car insurance for unemployed drivers, starting at $27 a month for minimum coverage.

- Great Customer Service: Erie has great customer satisfaction ratings, including for claims handling. See full scores and ratings in our Erie auto insurance review.

- Policy perks: Erie offers perks in its standard coverages that aren’t typical at most providers, such as pet injury coverage of up to $500 per pet ($1,000 total) if your pet is injured in an accident.

Cons

- Availability is Limited: Erie is not available in every state, so some unemployed drivers may not be able to get coverage at Erie.

- Stricter Eligibility Process: Erie’s low rates are partly due to its stricter underwriting process, which means it may be harder for high-risk drivers to qualify for Erie Insurance with SR-22.

#2 – Geico: Cheapest Online Rates

Pros

- Affordable Online Quotes: Geico offers multiple types of coverage to meet unemployed drivers’ budgets, starting at $35 per month. Compare rates and coverage options in our Geico Insurance review.

- Mobile-Friendly: Geico insurance apps are well-rated, and its website is easy to navigate, making it simple for drivers to manage their policies when unemployed.

- Multiple Discounts: There are plenty of Geico auto insurance discounts for unemployed drivers to choose from, including low-mileage and safe driving.

Cons

- Mixed Claims Reviews: Geico has some negative claims handling customer service reviews, although this is typical of any large auto insurance company.

- Location Rates Vary: Geico is generally one of the cheapest auto insurance companies available, but in some states, it’s more expensive.

#3 – State Farm: Cheapest For Young Drivers

Pros

- Cheap Young Driver Rates: Generally, State Farm offers affordable rates for younger drivers, particularly for high school and college students who are unemployed while in school.

- Local Agent Network: State Farm is well-known for its local agents, which is helpful for unemployed drivers who want in-person assistance with lowering their rates.

- Multiple Coverages: Unemployed drivers can pick and choose how much coverage they want. Learn more about your policy options in our State Farm auto insurance review.

Cons

- Variable Customer Service: State Farm has a few negative customer service reviews, so drivers may have a negative experience working with a specific agent.

- Fewer High-Risk Options: State Farm is not the best company for high-risk unemployed drivers, as it may deny coverage or charge high rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Travelers: Cheapest For Safe Drivers

Pros

- Responsible Driver Plans: Travelers offers two policy tiers for safe drivers with clean records who may have lost their jobs, which include accident forgiveness and deductible waivers.

- Usage-Based Discounts: Travelers offers a good selection of discounts to unemployed drivers, including a 30% usage-based discount. Learn how it works in our Travelers IntelliDrive app review.

- Strong Financial Stability: Travelers has superior A++ A.M. Best ratings and is well-established to pay out auto insurance claims, which you can learn more about in our Travelers review.

Cons

- Limited Local Agents: Travelers doesn’t have as many local agents as companies like State Farm, so unemployed drivers may not be able to find in-person help.

- Regional Rates Vary: Travelers’ rates vary by region, so it may not be the most cost-effective choice in some states.

#5 – – Progressive: Best Budgeting Tools

Pros

- Name Your Price Tool: Unemployed drivers can use the online Name Your Price Tool to choose coverage that matches their budget if they’re experiencing job loss.

- Usage-Based Program: Drivers can save on unemployment car insurance with Progressive’s Snapshot program. Learn how to get the biggest discount in our Progressive Snapshot review.

- User-Friendly Apps: Progressive insurance apps and website are easy to use, making policy management easy for unemployed drivers.

Cons

- Mixed Customer Service Reviews: Progressive has some negative reviews regarding claims handling and customer service. Learn more in our Progressive auto insurance review.

- Accident Rate Increases: Progressive is a more expensive company for unemployed drivers with accidents.

#6 – American Family: Cheapest For Bundling Policies

Pros

- Bundling Discounts: American Family bundling discounts can help unemployed drivers save. Read about other available discounts in our American Family Insurance review.

- Great Customer Service: AmFam has received good customer service ratings in most states and an average claims satisfaction rating, which is higher than its competitors.

- Affordable High-Risk Rates: Unemployed drivers under 25 or those with DUIs find cheaper rates at American Family than with other companies.

Cons

- Limited Availability: American Family does not sell auto insurance in every state, so its availability is limited to unemployed drivers.

- Poor UBI Reviews: American Family usage-based insurance is not as streamlined as its competitors, and Nationwide and State Farm have bigger UBI discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Cheapest For Roadside Assistance

Pros

- Comprehensive Roadside Assistance: Nationwide roadside assistance includes winching, locksmith services, jumpstart, gas delivery, and tire changes for less than $5 per month.

- Strong Financial Stability: Nationwide has strong financial ratings, which you can learn more about in our Nationwide auto insurance review.

- Low-Mileage Savings: Drivers can lower their auto insurance when unemployed if they drive less than 8,000 miles a year with Nationwide SmartMiles pay-as-you-go.

Cons

- Limited Availability: Nationwide auto insurance and roadside assistance for unemployed drivers are only available in 46 states.

- Mixed Customer Reviews: Nationwide has some mixed customer service reviews, like most larger companies, so read local reviews for more accurate ratings.

#8 – Farmers: Cheapest 24/7 Support

Pros

- 24/7 Assistance: Farmers offers 24/7 assistance with claims and policies so that unemployed drivers can get help at any time of the day.

- Good Customer Service Reviews: Farmers has good customer service reviews regarding claims satisfaction (read more in our Farmers auto insurance review).

- Multiple Discounts: There is a good selection of discounts to choose from at Farmers, including a usage-based discount through the Farmers’ Signal program (read more: Farmers Signal review).

Cons

- Rates Vary by Location: Farmers may not be the best choice for cheap car insurance for unemployed drivers in some states.

- No Gap Insurance: Farmers has a great selection of coverages and add-on coverages, but it is missing gap insurance.

#9 – Allstate: Best Usage-Based Discounts

Pros

- Usage-Based Discount: Allstate offers Drivewise, a usage-based program that can help unemployed drivers save on their auto insurance coverage (read more in our Allstate Drivewise review).

- Local Agent Availability: Allstate has local agents in some areas, so some unemployed drivers may be able to get in-person assistance with decreasing rates.

- Multiple Coverages: Allstate’s coverage options are diverse, allowing drivers to carry as much or as little coverage as they wish.

Cons

- Higher Rates for Some Demographics: Allstate’s rates are more expensive for high-risk drivers, so it may not be the most economical choice.

- Mixed Customer Reviews: Allstate has mixed customer service reviews, which you can learn more about in our Allstate auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Get Personalized Auto Insurance For Unemployed Drivers

Erie, Geico, and State Farm have the cheapest auto insurance when unemployed, but your costs will vary based on your unique situation. Auto insurance rates are personalized. This is why you, your friends, and your family members all pay very different premiums.

Auto insurance carriers use rating factors to come up with a custom price for the coverage that you select when getting a quote from their website. Each factor is related to the policyholder’s hypothetical probability of filing a claim. Some factors are beyond your control, and others aren’t. Here are the most common:

- Age, gender, and marital status

- Driving record and claim history

- Credit score (only in some states)

- Vehicle size, claims data, and safety features

- Mileage and vehicle usage (learn how annual mileage affects insurance rates)

Garaging ZIP code and claims reported in your city and state also impact rates, as well as local weather-related risks. If you’re looking to lower your insurance costs, it’s important to shop around for the best rates for your budget.

View this post on Instagram

Can you get car insurance without a job? When it comes to car insurance, occupation or being unemployed won’t impact your rates too much. If you’re ready to find the cheapest car insurance when unemployed, enter your ZIP code to compare rates from multiple companies near you.

Frequently Asked Questions

Can I still get auto insurance if I am currently unemployed?

Do you need a job to get car insurance? You can still get auto insurance even if you are currently unemployed. Employment status is not typically a determining factor for eligibility. However, insurance providers may consider other factors such as your driving record, credit history, and other personal details when determining your insurance rates.

Who has the cheapest auto insurance when unemployed?

Erie Insurance offers the most affordable car insurance for the unemployed, but it’s only available in 12 states. Who is the absolute cheapest auto insurance nationwide? Geico and State Farm have the lowest unemployed car insurance rates in all 50 states. Enter your ZIP code to find the cheapest company near you.

Who is cheaper when unemployed, Geico or Progressive?

Geico is usually cheaper for unemployed drivers than Progressive. Compare Geico vs. Progressive auto insurance for more accurate quotes.

Does being unemployed affect auto insurance rates?

Does employment status matter for car insurance? Being unemployed itself does not directly result in higher auto insurance rates. Insurers primarily consider your driving record, the type of vehicle you drive, your location, and other risk-related factors when calculating premiums.

Is car insurance more expensive if you are unemployed?

Your premiums won’t automatically go up if you lose your job, but understanding how credit scores affect auto insurance rates can help you avoid rate hikes if your financial situation changes and your credit drops.

Is car insurance cheaper for students than the employed?

Is car insurance cheaper for a student or employed driver? Students are often considered high-risk drivers due to their young age and inexperience behind the wheel, making it more expensive than car insurance for unemployed drivers.

What employment status gets the cheapest auto insurance?

Unemployed drivers can get lower rates with occupation and professional membership discounts, but unemployment doesn’t affect auto insurance costs unless your credit score drops.

Can I adjust my coverage to reduce auto insurance costs while I’m unemployed?

Yes. Learn how to manage your auto insurance policy to reduce costs while unemployed. You may consider raising deductibles, reducing coverage limits, or removing optional coverages that aren’t essential. However, it’s important to ensure that you still have sufficient coverage to meet legal requirements and protect yourself financially in case of an accident.

Are there any discount programs available for unemployed drivers?

Some insurance providers may offer discounts or programs specifically designed for individuals experiencing unemployment or financial hardship. These discounts or programs may vary depending on the insurance company and the state. It is recommended to inquire with insurance providers about any available discounts or assistance programs.

What do I do when I can’t afford car insurance?

If you’re wondering how to get auto insurance with no money, read our guide on what to do if you can’t pay your auto insurance. Car insurance for unemployed people doesn’t have to be expensive, and you can get lower rates by reducing coverage.

Should I notify my insurance company if I become unemployed?

It is not necessary to notify your insurance company solely because of unemployment. However, it is important to inform them of any significant changes in your circumstances that may impact your ability to pay premiums, such as a substantial decrease in income. They may be able to offer guidance or provide options to help you manage your payments during this time.

How does being unemployed affect car insurance?

Does unemployment affect car insurance? Your unemployment status will only affect auto insurance if your credit score changes. Your premiums will remain steady if you maintain a good credit score and clean driving record while between jobs.

Can I suspend my auto insurance when unemployed if I’m not using my vehicle?

If you do not plan to use your vehicle at all while unemployed, you may have the option to suspend auto insurance for a month. However, it is important to check with your insurance provider, as some states have mandatory insurance requirements even if the vehicle is not being used. Additionally, if your vehicle is financed or leased, the lender may require continuous coverage.

What is the lowest you can pay for auto insurance when employed?

You must maintain the state minimum requirements for car insurance if you intend to drive, even if you’re unemployed. The cheapest temporary car insurance for unemployed drivers is liability-only auto insurance.

Is auto insurance cheaper if used for work?

It depends on how often you drive a car for work. A better question is, is car insurance cheaper for commute or pleasure? If you’re unemployed and qualify for pleasure use of a vehicle because your mileage went down, it will be cheaper to insure your car than if you use it to drive to work.

Can I get auto insurance now and pay later?

Yes, both Geico and State Farm have cheap auto insurance with no down payment, so you can get coverage right away if you lose your job.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.