Financial Indemnity Auto Insurance Review for 2025 (Rates, Discounts, & Options)

This Financial Indemnity auto insurance review explains why Financial Indemnity stands out for high-risk drivers. Offering tailored coverage through Kemper's network, Financial Indemnity offers flexible options and a starting monthly rate of $100, making it a strong choice in specialized auto insurance.

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: May 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Financial Indemnity Insurance

Average Monthly Rate For Good Drivers

$100A.M. Best Rating:

A-Complaint Level:

HighPros

- Flexible Coverage Options

- Reliable Claim Support

- Competitive Premium Rates

- Strong Financial Stability

- Customizable Policies

Cons

- Limited Discounts Available

- Regional Availability Issues

- Strict Claim Requirements

This Financial Indemnity auto insurance review highlights why Financial Indemnity, part of Kemper Insurance, Financial Indemnity is a top pick for high-risk drivers needing flexible coverage options.

Known for competitive rates starting at $130 per month, The company’s specialized plans, including liability, collision, and comprehensive coverage, cater to drivers who may face higher premiums with other insurers.

Financial Indemnity Auto Insurance Rating

| Rating Criteria | Financial Indemnity |

|---|---|

| Overall Score | 3.6 |

| Business Reviews | 4.0 |

| Claim Processing | 3.4 |

| Company Reputation | 4.0 |

| Coverage Availability | 2.8 |

| Coverage Value | 3.5 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 4.0 |

| Discounts Available | 4.7 |

| Insurance Cost | 4.0 |

| Plan Personalization | 4.0 |

| Policy Options | 2.5 |

| Savings Potential | 4.2 |

Although rates vary, Financial Indemnity provides discounts through Kemper, such as multi-policy and paid-in-full options, making saving easier. Use our quote comparison tool for fast and cheap auto insurance coverage today.

- Financial Indemnity auto insurance offers flexible coverage for high-risk drivers

- Rates start at $130/month, with discounts available through Kemper

- Positive reviews highlight responsive service and tailored policy options

Financial Indemnity Auto Insurance Review

Financial Indemnity, part of the Kemper Corporation, offers a range of auto insurance policies tailored to meet the needs of various drivers.

High-risk drivers often face limited coverage options and higher premiums, but specialized providers like Financial Indemnity offer tailored plans to address these challenges. By leveraging discounts like multi-policy or paid-in-full options, drivers can significantly reduce costs while maintaining comprehensive protection.Tim Bain Licensed Insurance Agent

In this review, we’ll cover the cost of their auto insurance, how their rates compare to competitors, where to compare auto insurance rates, the coverage options they offer, available discounts, customer feedback, business reviews, pros and cons, and a final summary to help you decide if Financial Indemnity is the right fit for your insurance needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Financial Indemnity Insurance Rates Breakdown

Financial Indemnity has no auto insurance rates you can view publicly. Small and even medium-sized auto insurance companies generally don’t show non-specific rates.

Financial Indemnity Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $340 | $420 |

| Age: 16 Male | $370 | $450 |

| Age: 18 Female | $290 | $360 |

| Age: 18 Male | $320 | $400 |

| Age: 25 Female | $170 | $230 |

| Age: 25 Male | $190 | $250 |

| Age: 30 Female | $150 | $200 |

| Age: 30 Male | $160 | $210 |

| Age: 45 Female | $130 | $170 |

| Age: 45 Male | $140 | $180 |

| Age: 60 Female | $110 | $150 |

| Age: 60 Male | $120 | $160 |

| Age: 65 Female | $100 | $140 |

| Age: 65 Male | $110 | $150 |

Auto insurance agents in your area or any other location would instead give a personal insurance quote than rates that aren’t adjusted to your specific situation. An individual insurance quote estimates car insurance costs using your personal information to generate the insurance cost.

It’s best to cover all of our bases. Therefore, we will provide the average monthly rate of all 50 states in the data summary.

Auto Insurance Monthly Rates as a Percentage of Monthly Income by State

| State | Rate | Monthly Income | Percentage of Income |

|---|---|---|---|

| Alabama | $92 | $4,493 | 2% |

| Alaska | $99 | $6,487 | 2% |

| Arizona | $105 | $5,755 | 2% |

| Arkansas | $98 | $4,377 | 2% |

| California | $130 | $7,076 | 2% |

| Colorado | $110 | $6,855 | 2% |

| Connecticut | $115 | $6,981 | 2% |

| Delaware | $120 | $5,924 | 2% |

| Florida | $123 | $5,255 | 2% |

| Georgia | $105 | $5,547 | 2% |

| Hawaii | $84 | $7,071 | 1% |

| Idaho | $81 | $5,539 | 2% |

| Illinois | $97 | $6,017 | 2% |

| Indiana | $85 | $5,229 | 2% |

| Iowa | $78 | $5,467 | 1% |

| Kansas | $92 | $5,344 | 2% |

| Kentucky | $97 | $4,631 | 2% |

| Louisiana | $135 | $4,341 | 3% |

| Maine | $77 | $5,397 | 1% |

| Maryland | $110 | $7,517 | 2% |

| Massachusetts | $125 | $7,470 | 2% |

| Michigan | $140 | $4,060 | 4% |

| Minnesota | $92 | $6,477 | 1% |

| Mississippi | $100 | $4,060 | 3% |

| Missouri | $95 | $5,154 | 2% |

| Montana | $98 | $5,271 | 2% |

| Nebraska | $90 | $5,568 | 2% |

| Nevada | $115 | $5,523 | 2% |

| New Hampshire | $89 | $7,372 | 1% |

| New Jersey | $125 | $7,441 | 2% |

| New Mexico | $102 | $4,499 | 2% |

| New York | $120 | $6,193 | 2% |

| North Carolina | $88 | $5,164 | 2% |

| North Dakota | $87 | $5,543 | 2% |

| Ohio | $86 | $5,189 | 2% |

| Oklahoma | $95 | $4,652 | 2% |

| Oregon | $96 | $5,964 | 2% |

| Pennsylvania | $101 | $5,746 | 2% |

| Rhode Island | $118 | $6,167 | 2% |

| South Carolina | $97 | $4,943 | 2% |

| South Dakota | $88 | $5,512 | 2% |

| Tennessee | $91 | $4,975 | 2% |

| Texas | $109 | $5,580 | 2% |

| Utah | $89 | $6,621 | 1% |

| Vermont | $82 | $6,036 | 1% |

| Virginia | $92 | $6,747 | 1% |

| Washington | $110 | $7,021 | 2% |

| West Virginia | $101 | $4,271 | 2% |

| Wisconsin | $84 | $5,594 | 2% |

| Wyoming | $95 | $5,434 | 2% |

The following sub-section will give you every state’s average auto insurance costs. These rates are based on the average price of auto insurance.

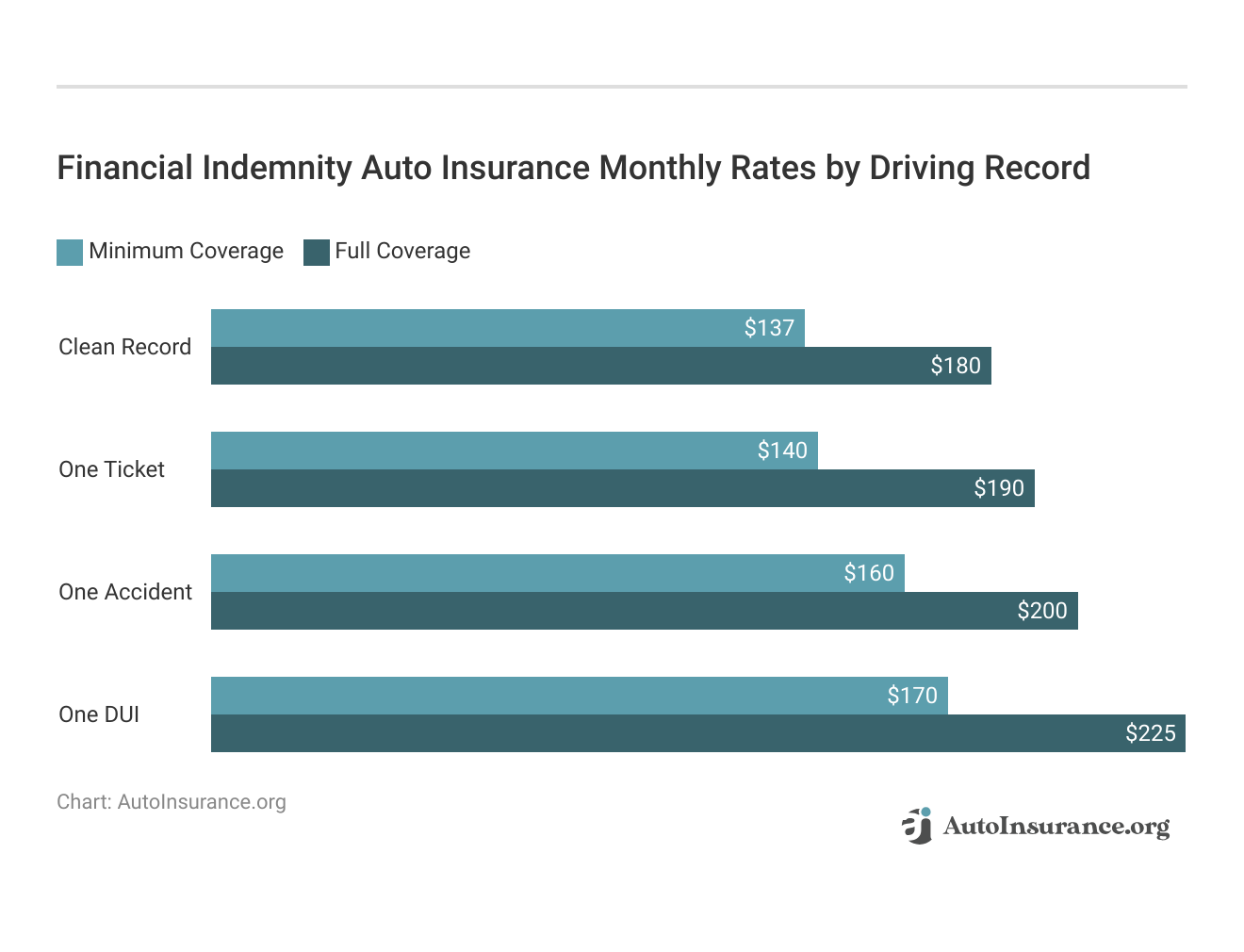

Financial Indemnity Auto Insurance Coverage Cost

The average monthly rate for good drivers with Financial Indemnity is around $130. However, your premium can vary based on your driving history, location, and vehicle type. Due to the company’s risk assessment model, high-risk drivers may see significantly higher rates.

Financial Indemnity Average Cost vs. Competitors

For specific driver profiles, financial indemnity rates are higher than those of significant auto insurance companies. While some competitors, like Geico or Progressive, may offer lower rates for low-risk drivers, Financial Indemnity premiums are often more competitive for drivers with less-than-perfect records.

$130 per month is slightly above the national average for good drivers, but Financial Indemnity may offer more flexibility for high-risk individuals and auto insurance for different drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Financial Indemnity Insurance Coverage Options

Financial Indemnity offers solid car insurance solutions that complement Kemper’s broad portfolio. Its standard services, including coverage for liability, collision, and comprehensive insurance, meet the basic needs of most drivers.

In addition, Financial Indemnity offers niche products for unique consumer needs, such as high-risk auto insurance and specialized coverages for unique vehicle categories.

Bodily Injury & Property Damage Liability Requirements by State

| State | BIL Per Person | BIL Per Accident | PDL |

|---|---|---|---|

| Alabama | $25,000 | $50,000 | $25,000 |

| Alaska | $50,000 | $100,000 | $25,000 |

| Arizona | $25,000 | $50,000 | $15,000 |

| Arkansas | $25,000 | $50,000 | $25,000 |

| California | $15,000 | $30,000 | $5,000 |

| Colorado | $25,000 | $50,000 | $15,000 |

| Connecticut | $25,000 | $50,000 | $25,000 |

| Delaware | $25,000 | $50,000 | $10,000 |

| Florida | $10,000 (PIP only) | N/A | $10,000 |

| Georgia | $25,000 | $50,000 | $25,000 |

| Hawaii | $20,000 | $40,000 | $10,000 |

| Idaho | $25,000 | $50,000 | $15,000 |

| Illinois | $25,000 | $50,000 | $20,000 |

| Indiana | $25,000 | $50,000 | $25,000 |

| Iowa | $20,000 | $40,000 | $15,000 |

| Kansas | $25,000 | $50,000 | $25,000 |

| Kentucky | $25,000 | $50,000 | $25,000 |

| Louisiana | $15,000 | $30,000 | $25,000 |

| Maine | $50,000 | $100,000 | $25,000 |

| Maryland | $30,000 | $60,000 | $15,000 |

| Massachusetts | $20,000 | $40,000 | $5,000 |

| Michigan | $50,000 | $100,000 | $10,000 |

| Minnesota | $30,000 | $60,000 | $10,000 |

| Mississippi | $25,000 | $50,000 | $25,000 |

| Missouri | $25,000 | $50,000 | $25,000 |

| Montana | $25,000 | $50,000 | $20,000 |

| Nebraska | $25,000 | $50,000 | $25,000 |

| Nevada | $25,000 | $50,000 | $20,000 |

| New Hampshire* | $25,000 | $50,000 | $25,000 |

| New Jersey | $15,000 | $30,000 | $5,000 |

| New Mexico | $25,000 | $50,000 | $10,000 |

| New York | $25,000 | $50,000 | $10,000 |

| North Carolina | $30,000 | $60,000 | $25,000 |

| North Dakota | $25,000 | $50,000 | $25,000 |

| Ohio | $25,000 | $50,000 | $25,000 |

| Oklahoma | $25,000 | $50,000 | $25,000 |

| Oregon | $25,000 | $50,000 | $20,000 |

| Pennsylvania | $15,000 | $30,000 | $5,000 |

| Rhode Island | $25,000 | $50,000 | $25,000 |

| South Carolina | $25,000 | $50,000 | $25,000 |

| South Dakota | $25,000 | $50,000 | $25,000 |

| Tennessee | $25,000 | $50,000 | $15,000 |

| Texas | $30,000 | $60,000 | $25,000 |

| Utah | $25,000 | $65,000 | $15,000 |

| Vermont | $25,000 | $50,000 | $10,000 |

| Virginia | $30,000 | $60,000 | $20,000 |

| Washington | $25,000 | $50,000 | $10,000 |

| West Virginia | $25,000 | $50,000 | $25,000 |

| Wisconsin | $25,000 | $50,000 | $10,000 |

| Wyoming | $25,000 | $50,000 | $20,000 |

Every U.S. state has its liability coverage limits and requirements; as such, liability coverage is the minimum requirement for auto insurance. We compiled a data table with minimum liability requirements by state as provided by the Insurance Information Institute.

Financial Indemnity Discounts Available

Can you get a discount from Financial Indemnity auto insurance? Financial Indemnity will have discounts available from their parent company, Kemper. Kemper lists its auto insurance discounts, which are:

- Anti-Theft Devices

- Away at School

- Driver Training Course

- Good Student

- Multiple Coverages

- Package

- Passive Restraint or Passenger Airbags

Here are some other Kemper auto insurance discounts that will help you save money.

- Paid in Full Discount

- Prior Insurance Discount

- Residence Discount

- Multi-Car Discount

The paid-in-full discount applies when you pay the balance in full at the start of the auto insurance policy period. The prior insurance discount happens when you keep your current Kemper or Financial Indemnity Company auto insurance policy active.

Got hit with someone with Kemper Insurance. Are they always this hard to reach?

byu/JCrusty inInsurance

In addition to auto insurance, Kemper home insurance reviews also suggest high customer satisfaction with home coverage. Homeowners with a Financial Indemnity or Kemper auto insurance policy can receive a discount. If you need to insure multiple vehicles, lower your auto insurance rates by including multiple drivers and cars on your policy.

Financial Indemnity Customer Reviews

Customer reviews for Financial Indemnity are mixed. Many appreciate the company’s tailored approach for high-risk drivers and find the claims process straightforward. However, some customers have reported higher-than-expected rates and occasional customer service response times delays.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Financial Indemnity Business Reviews

Financial Indemnity has an A+ rating with the Better Business Bureau (BBB), indicating that, from a business perspective, it takes customer complaint resolution and relationship-building with policyholders very seriously.

Financial Indemnity Insurance Business Ratings & Consumer Reviews

| Agency | Financial Indemnity Insurance |

|---|---|

| Score: B+ Positive Business Practices |

|

| Score: 2.00 More Complaints Than Avg. |

|

| Score: A- Strong Financial Strength |

Though less widely known than some more extensive national options, Financial Indemnity has built a reputation as a solid choice for a niche market.

Financial Indemnity Pros and Cons

Kemper Specialty specializes in car insurance for high-risk drivers, providing attractive rates and a versatile discount program. This is great to have, and although sometimes it will be hard to find—it’s not uncommon—it makes it possible when you need it most.

Pros

- Business Description: Attractive rates for high-risk drivers: Kemper Specialty provides low prices to drivers with rough records, making it a good option for risky drivers.

- Various Coverage Options: Drivers can customize policies to cover what matters most, including specialized coverages that high-risk drivers often need.

- Low-Cost Premiums: Kemper offers discounts to lower premiums if you have something like a safe driver or bundling discount, which is excellent for cost-minded customers.

- Uncomplicated Claims Process: With a simplified process, policyholders have less to stress about, and filing a claim is faster.

- Additional Trust From a Surprisingly Respected Insurance Group (Kemper): Kemper Specialty services automatically bring a touch of prestige simply because an entire well-run insurance organization backs them.

Cons

- Not Competitive on Low-Risk Drivers: Kemper Specialty’s rates can’t compete with those of low-risk drivers, who may be able to find cheaper rates with another auto insurance company.

- Availability is Limited to Some States: Kemper is not a national provider, so they may not be an option in every state, restricting options for some drivers.

- Mixed Reviews on Customer Service: Many complain that Kemper Specialty is unreliable when paying claims. However, customer service experiences are diverse; some may care more about support quality than anything else.

Overall, Kemper Specialty is an excellent option for high-risk drivers who want competitive rates and various coverage options. That said, better rates may be available for people without a record and those who learn how to lower their auto insurance rates.

Financial Indemnity’s Affiliation with Kemper

Financial Indemnity is a much-needed addition to Kemper Specialty, a cash cow due to its market strength and financial fortitude.

The relationship allows Financial Indemnity to continue delivering the best service while keeping prices competitive. This is due to its extensive, naturally developed insurance knowledge, reflected in its A.M. Best ratings and overall carrier standing in its space.

For more information, read “Kemper Direct Auto Insurance Review.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Financial Indemnity Final Overview

While Financial Indemnity auto insurance is a suitable option for drivers with difficulty finding reasonably priced coverage elsewhere, such as high-risk drivers or those with less-than-perfect driving records, its insurance plans are relatively low-priced and don’t offer much in-depth research.

Choosing the right auto insurance requires balancing affordability with sufficient coverage, especially for high-risk drivers. Financial Indemnity’s flexible solutions and competitive starting rates make it a valuable option, but always compare quotes across multiple providers to ensure you’re getting the best value.Heidi Mertlich Licensed Insurance Agent

They offer various options, including full-coverage auto insurance and good driver discounts, although their rates are occasionally the lowest. Their customer service and business reviews are generally favorable, although not stellar, especially regarding service responsiveness.

Financial Indemnity might be well-suited for high-risk drivers or those who want flexible coverage. Still, shopping around through other carriers for lower-risk drivers might be more economical. Use our free comparison tool to see what auto insurance quotes look like in your area.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What types of coverage does Financial Indemnity offer?

Financial Indemnity offers liability, collision, comprehensive, and specialized high-risk driver insurance through Kemper. Read our article on comparing cheap online auto insurance quotes to learn more.

What is the average monthly rate for Financial Indemnity auto insurance?

The average monthly rate starts at $130, though rates vary depending on your driving history and location.

Does Financial Indemnity offer discounts?

Yes, we offer a range of discounts, including multi-policy, paid-in-full, and others, through Kemper’s network. Depending on your eligibility and the policies you choose, these discounts can significantly reduce your monthly premium.

Who benefits most from Financial Indemnity auto insurance?

High-risk drivers benefit the most due to tailored options and flexible coverage. Discover our auto insurance premium for further insights.

How can I file a claim with Financial Indemnity?

You can file claims online through our user-friendly portal or by phone with our dedicated claims team. Most customers report a straightforward process, with clear instructions and prompt responses. Get the right car insurance at the best price — enter your ZIP code to shop for coverage from the top insurers.

What do customer reviews say about Financial Indemnity?

Reviews are mixed, providing a comprehensive view of the company’s performance. Many appreciate its flexibility for high-risk drivers, though some note higher premiums and slow customer service.

Is Financial Indemnity Part of Kemper Insurance?

Financial Indemnity is a subsidiary of Kemper, which provides auto insurance through its network. Read our auto insurance guide to learn more.

Are Financial Indemnity’s rates competitive compared to other insurers?

Financial Indemnity rates are competitive, particularly for high-risk drivers, making you feel valued and catered to. However, they may be higher than larger companies for low-risk profiles.

How can I pay my premiums with Financial Indemnity?

Kemper EZPay allows for automated monthly payments, making it easy to manage your bills. Enter your ZIP code into our free comparison tool to see how much car insurance costs in your area.

What is Financial Indemnity’s BBB rating?

Financial Indemnity holds an A+ rating with the BBB, indicating strong customer service and business practices. For more information, check out our guide on whether auto insurance is a waste of money.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

no image available 0 reviews