Cheapest Teen Driver Auto Insurance in Virginia for 2025 (Save With These 10 Companies)

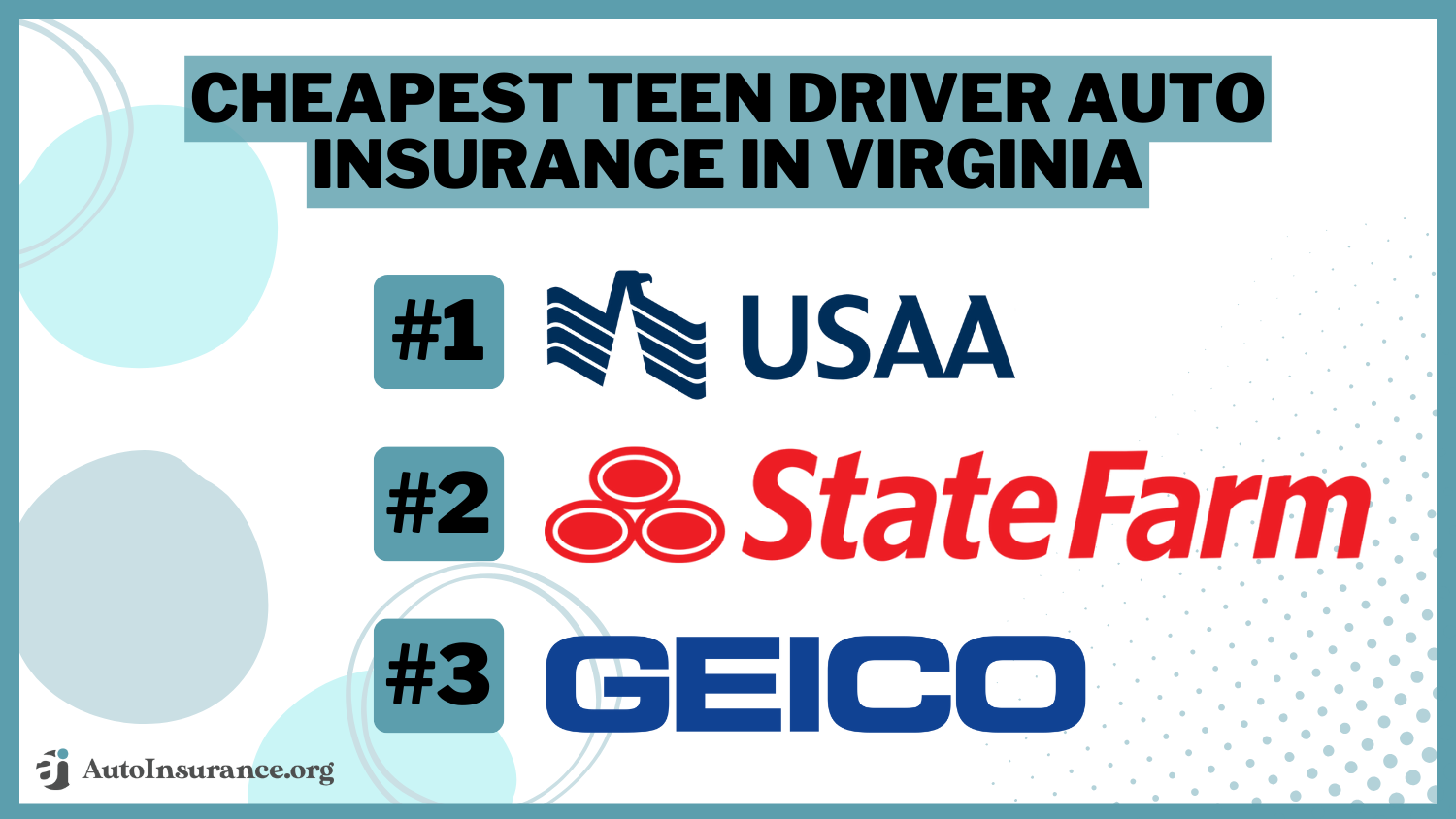

USAA, State Farm, and Geico offer the cheapest teen driver auto insurance in Virginia. Affordable car insurance for young drivers starts at $92/mo with USAA. State Farm has better teen driver auto insurance discounts, adding up to 25% in savings. Keep reading to learn how VA auto insurance laws impact teens.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Apr 4, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 4, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for VA Teens

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for VA Teens

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for VA Teens

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsUSAA, State Farm, and Geico have the cheapest teen driver auto insurance in Virginia. Programs like the TeenSmart driver program can help lower rates for young drivers.

Our Top 10 Company Picks: Cheapest Teen Driver Auto Insurance in Virginia

| Company | Rank | Student Discount | Safe Driving Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | 15% | Military Discounts | USAA | |

| #2 | 25% | 30% | Educational Discounts | State Farm | |

| #3 | 15% | 25% | Competitive Pricing | Geico | |

| #4 | 15% | 10% | SmartRide Discoun | Nationwide |

| #5 | 15% | 15% | Teen Safe | American Family | |

| #6 | 20% | 22% | Drivewise Rewards | Allstate | |

| #7 | 15% | 30% | Distant Student | Farmers | |

| #8 | 10% | 30% | Snapshot Savings | Progressive | |

| #9 | 15% | 25% | Student Discounts | Liberty Mutual |

| #10 | 25% | 25% | Good Student | Travelers |

USAA has the lowest Virginia auto insurance costs for teens, but not everyone qualifies for coverage. If you can’t get USAA insurance, State Farm and Geico is also affordable for many families.

- All drivers in Virginia have to carry a minimum amount of insurance

- Teens in Virginia pay higher rates because they’re considered riskier drivers

- USAA and State Farm have the best teen auto insurance in Virginia

Explore the best Virginia auto insurance companies for teens. Then, enter your ZIP code into our free tool to see how much you might pay for teen coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – USAA: Top Pick Overall

Pros

- Good Student Discount: USAA offers cheap car insurance for teens who maintain a GPA of at least 3.0.

- Family Legacy Discounts: Teens can earn future savings on a USAA policy when they branch off an existing plan, which is helpful for families looking for teenage car insurance with long-term benefits.

- Safe Driver Programs: USAA offers a discount for completing a driver’s education course. See other discount opportunities in our USAA auto insurance review.

Cons

- Eligibility Restriction: USAA car insurance for teen drivers is only available to active or retired military members and their direct families. That includes adopted and stepchildren.

- Limited Physical Locations: USAA doesn’t maintain as many brick-and-mortar locations, so finding affordable Virginia auto insurance can be difficult.

#2 – State Farm: Best for Student Driver Discounts

Pros

- Steer Clear Program: Steer Clear is State Farm’s teen driving program that helps teens drive safely, making it an attractive option for families seeking cheap car insurance for young drivers.

- Good Student Discount: Save up to 25% when shopping for the cheapest car insurance for teens on your State Farm policy for maintaining good grades with the good student discount.

- Accident Forgiveness: Purchase State Farm’s accident forgiveness to gain protection from rate increases after your first accident.

Cons

- Strict Underwriting: State Farm has a more stringent approval process for teen drivers than many other insurance companies.

- Inconsistent Discounts: State Farm discount availability may vary by agent and location. Learn more about discounts in our State Farm auto insurance review.

#3 – Geico: Best for Affordable Rates for the Whole Family

Pros

- Good Student Discount: Geico provides cheap auto insurance for teens if they maintain a good grades can get and by up to 15% discount.

- Driver’s Education Discount: Complete a driver’s education course to get the cheapest car insurance for new drivers from Geico.

- Accident-Free Discount: Another Geico discount that will help you get the cheapest car insurance in VA for young drivers if accident-free.

Cons

- Limited Agent Interaction: Geico manages insurance predominantly online, meaning it offers less personal agent support.

- Customer Service Variability: Geico gets mixed reviews for its customer service responsiveness. See what customers have to say in our Geico auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for UBI Savings

Pros

- SmartRide Program: Enroll in the usage-based insurance program SmartRide which makes it one of the best car insurance for young drivers in Virginia. See if SmartRide is right for you in our Nationwide auto insurance review.

- Good Student Discount: Get the best car insurance in Virginia for young drivers with an academic performance discount.

- Accident Forgiveness: Purchase Nationwide’s accident forgiveness, and there will be no rate increases for car insurance for young drivers.

Cons

- Limited Local Agents: Fewer Nationwide agents in some areas means fewer opportunities for personalized service.

- Coverage Restrictions: Allstate will need to confirm specific coverage options for teen drivers before it will apply certain types of coverage.

#5 – American Family: Best for Teen Safe Driver Program

Pros

- Teen Safe Driver Program: American Family offers cheap auto insurance for teenagers who complete the Teen Safe Driver program.

- Under 21 Discounts: American Family offers cheap car insurance for first-time drivers under 21, especially for teens who volunteer at least 40 hours every year.

- Generational Discounts: Teens can get a loyalty discount for separating from a parent or guardian’s American Family policy and starting a new one.

Cons

- Limited Availability: American Family is only available in 19 states. See if your state is covered in our American Family auto insurance review.

- Customer Service: American Family has mixed reviews for its customer service quality.

#6 – Allstate: Best for Full Coverage Auto Insurance

Pros

- Drivewise Program: Agree to let Allstate track your driving habits with Drivewise and get the cheapest insurance for young drivers. Learn more about Drivewise in our Allstate auto insurance review.

- Good Student Discount: Allstate offers a few discounts for teens, including savings of up to 25% for being a good student.

- Full Coverage Options: Get the best insurance for teen drivers with Allstate’s add-ons. Valuable coverage options for teens include roadside assistance and new car replacement insurance.

Cons

- Higher Initial Rates: Base premiums with Allstate are usually higher than the national average before discounts.

- Claim Satisfaction: Allstate has mixed reviews on its claims handling and customer service ratings, an important factor for parents seeking reliable teen car insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best Selection of Teen Driver Discounts

Pros

- Young Driver Discount: Farmers helps you find the cheapest auto insurance in VA for young drivers by offering specific savings for teens.

- Good Student Discount: Car insurance for teenage drivers can also be reduced with good grades. Get a full list of discounts and find affordable auto insurance for teen drivers in our Farmers auto insurance review.

- Personalized Service: Get access to Farmers’ local agents for personalized assistance, which can be especially helpful for inexperienced teen drivers

Cons

- Digital Experience: Most customers agree that Farmers’ online tools and mobile app could be improved.

- Claim Handling Time: Farmers offers cheap young driver auto insurance, but it’s plagued by reports of slower claims processing.

#8 – Progressive: Best for a Digital Auto Insurance Experience

Pros

- Snapshot Program: Sign up for Progressive’s UBI program Snapshot to save up to 30% on your Virginia insurance.

- Good Student Discount: Progressive offers several teen driver auto insurance discounts, including savings for good academic performance.

- Multi-Policy Discounts: Progressive sells a variety of insurance products. If you buy more than one type of coverage, you’ll get a discount on your Progressive Virginia auto insurance rates.

Cons

- Usage-Based Pricing Variability: Progressive is not very transparent about how much you can save with Snapshot. Read more in our Progressive auto insurance review.

- Customer Service Concerns: Some customers report dissatisfaction with Progressive’s service responsiveness.

#9 – Liberty Mutual: Best for Diverse Coverage Options

Pros

- New Driver Discount: Parents and guardians can save by adding a new teen driver to an existing Liberty Mutual auto insurance review.

- Student Discounts: Earn additional savings on your Virginia auto insurance quotes with Liberty Mutual’s discounts for maintaining good grades.

- Diverse Coverage Options: Liberty Mutual offers diverse coverage options to help you get the best Virginia State auto insurance policy.

Cons

- Premium Variability: Liberty Mutual rates can vary significantly based on individual factors like credit score, at-fault accidents, and speeding tickets.

- Customer Service: Some customers love Liberty Mutual, while others say you’ll get better quality service elsewhere for your Virginia auto insurance coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Teen Driving Resources

Pros

- Good Student Discount: Travelers rounds out our top 10 cheapest auto insurance companies for teens as another provider that offers students discounts.

- Driver Training Discount: Complete a driver’s education or defensive driving class to earn discounts for teenage driver insurance.

- Teen Driver Resources: Understanding car insurance can be tricky, especially when you’re new to driving. Travelers offers an excellent teen guide to auto insurance through its helpful representatives.

Cons

- Digital Tools: Travelers has fewer robust online and mobile tools compared to some competitors.

- Claim Processing Time: Many Travelers report that the claims processing times can be long. Learn more about Travelers’s claims process in our Travelers auto insurance review.

Virginia Auto Insurance Requirements for Teens

Until recently, there were no Virginia minimum auto insurance requirements. If you wanted to skip coverage, you simply had to pay an uninsured fee. However, that’s no longer the case.

Starting July 1, every Virginia car owner will be required to purchase auto insurance, thanks to a new law passed in 2023.https://t.co/kGLXHGYaIi

— The Virginian-Pilot (@virginianpilot) April 20, 2024

For those looking for cheap car insurance in Chesapeake, VA or anywhere else in the state, understanding these new requirements is essential. Today, Virginia requires drivers to carry the following coverage:

- 30/60/20 liability insurance

- 25/50/20 uninsured motorist coverage

Virginia recently passed a law requiring all drivers to carry insurance, and the minimum amounts listed above will increase soon. Those seeking car insurance options for teens should prepare for these upcoming changes.

While an increase in minimum requirements will likely lead to Virginia auto insurance rate increases, you can check average prices below.

Virginia Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $82 | $247 |

| 16-Year-Old Male | $91 | $274 |

| 17-Year-Old Female | $78 | $235 |

| 17-Year-Old Male | $88 | $261 |

| 18-Year-Old Female | $73 | $218 |

| 18-Year-Old Male | $83 | $249 |

| 19-Year-Old Female | $68 | $204 |

| 19-Year-Old Male | $78 | $231 |

| 20-Year-Old Female | $63 | $189 |

| 20-Year-Old Male | $73 | $215 |

| 21-Year-Old Female | $58 | $174 |

| 21-Year-Old Male | $68 | $202 |

Many factors affect rates, but one of the most impactful is your age. Teens have a much harder time finding affordable coverage in Virginia compared with older, more experienced adults. Check the prices of insurance at our top companies to see how much you might pay.

Virginia Auto Insurance Monthly Rates for Teens by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $198 | $439 | |

| $163 | $362 | |

| $252 | $558 | |

| $142 | $315 | |

| $264 | $585 |

| $149 | $330 |

| $255 | $567 | |

| $123 | $272 | |

| $304 | $675 | |

| $92 | $204 |

There are also laws teen drivers should be aware of that don’t apply to older drivers. Understanding Virginia driving laws can be confusing, but it’s integral that teens follow the rules when they get behind the wheel of a car, especially for those with 17-year-old car insurance needs.

Virginia state laws dictate that drivers under 18 need to have their permit for nine months before getting their license.Kristen Gryglik Licensed Insurance Agent

When you’re in the process of getting a license, avoiding infractions is crucial. Not only can driving infractions affect your ability to get a license, but they’ll also increase your rates, making it even harder to find cheap car insurance for new drivers in Virginia.

How to Compare Virginia Teen Auto Insurance Rates

Even though you have a list of the companies with the cheapest teen auto insurance rates in Virginia here, you should still compare personalized quotes. If you don’t compare rates, you’ll likely overpay for your insurance, especially if you’re looking for cheap car insurance for 18-year-olds or other young driver categories.

To get an idea of why comparing quotes is so important, take a look at the rates below based on teens with clean driving records and those with traffic infractions. Those searching for cheap auto insurance for their teen will see different rates between companies.

Virginia Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Alexandria | Chesapeake | Richmond | Stafford | Virginia Beach |

|---|---|---|---|---|---|

| 16-Year-Old Female | $150 | $140 | $145 | $155 | $160 |

| 16-Year-Old Male | $160 | $150 | $155 | $165 | $170 |

| 20-Year-Old Female | $120 | $110 | $115 | $125 | $130 |

| 20-Year-Old Male | $130 | $120 | $125 | $135 | $140 |

| 30-Year-Old Female | $100 | $90 | $95 | $105 | $110 |

| 30-Year-Old Male | $110 | $100 | $105 | $115 | $120 |

| 40-Year-Old Female | $90 | $80 | $85 | $95 | $100 |

| 40-Year-Old Male | $100 | $90 | $95 | $105 | $110 |

| 50-Year-Old Female | $80 | $70 | $75 | $85 | $90 |

| 50-Year-Old Male | $90 | $80 | $85 | $95 | $100 |

| 60-Year-Old Female | $70 | $60 | $65 | $75 | $80 |

| 60-Year-Old Male | $80 | $70 | $75 | $85 | $90 |

| 70-Year-Old Female | $60 | $50 | $55 | $65 | $70 |

| 70-Year-Old Male | $70 | $60 | $65 | $75 | $80 |

One of the factors with the biggest influence on your auto insurance rates is your driving record. Teens are already considered high-risk drivers because of their age and inexperience. You don’t want to add to the problem by getting speeding tickets, causing accidents, or driving recklessly.

Check the average quotes below to get an idea of how big a factor your driving record is in your auto insurance rates.

Virginia Auto Insurance Monthly Rates by Age, Gender, & Driving Record

| Age & Gender | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| 16-Year-Old Female | $115 | $145 | $195 | $285 |

| 16-Year-Old Male | $125 | $155 | $205 | $295 |

| 17-Year-Old Female | $105 | $135 | $185 | $275 |

| 17-Year-Old Male | $112 | $142 | $192 | $282 |

| 18-Year-Old Female | $95 | $125 | $175 | $265 |

| 18-Year-Old Male | $102 | $132 | $182 | $272 |

| 19-Year-Old Female | $85 | $115 | $165 | $255 |

| 19-Year-Old Male | $92 | $122 | $172 | $262 |

| 20-Year-Old Female | $75 | $105 | $155 | $245 |

| 20-Year-Old Male | $82 | $112 | $162 | $252 |

| 21-Year-Old Female | $65 | $95 | $145 | $235 |

| 21-Year-Old Male | $72 | $102 | $152 | $242 |

If you can keep your driving record clean during your teen years, auto insurance rates tend to lower by age 25. If you do get a traffic citation or cause an accident, your rates won’t stay high forever. Make sure to avoid more infractions so your insurance prices can gradually return to normal.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

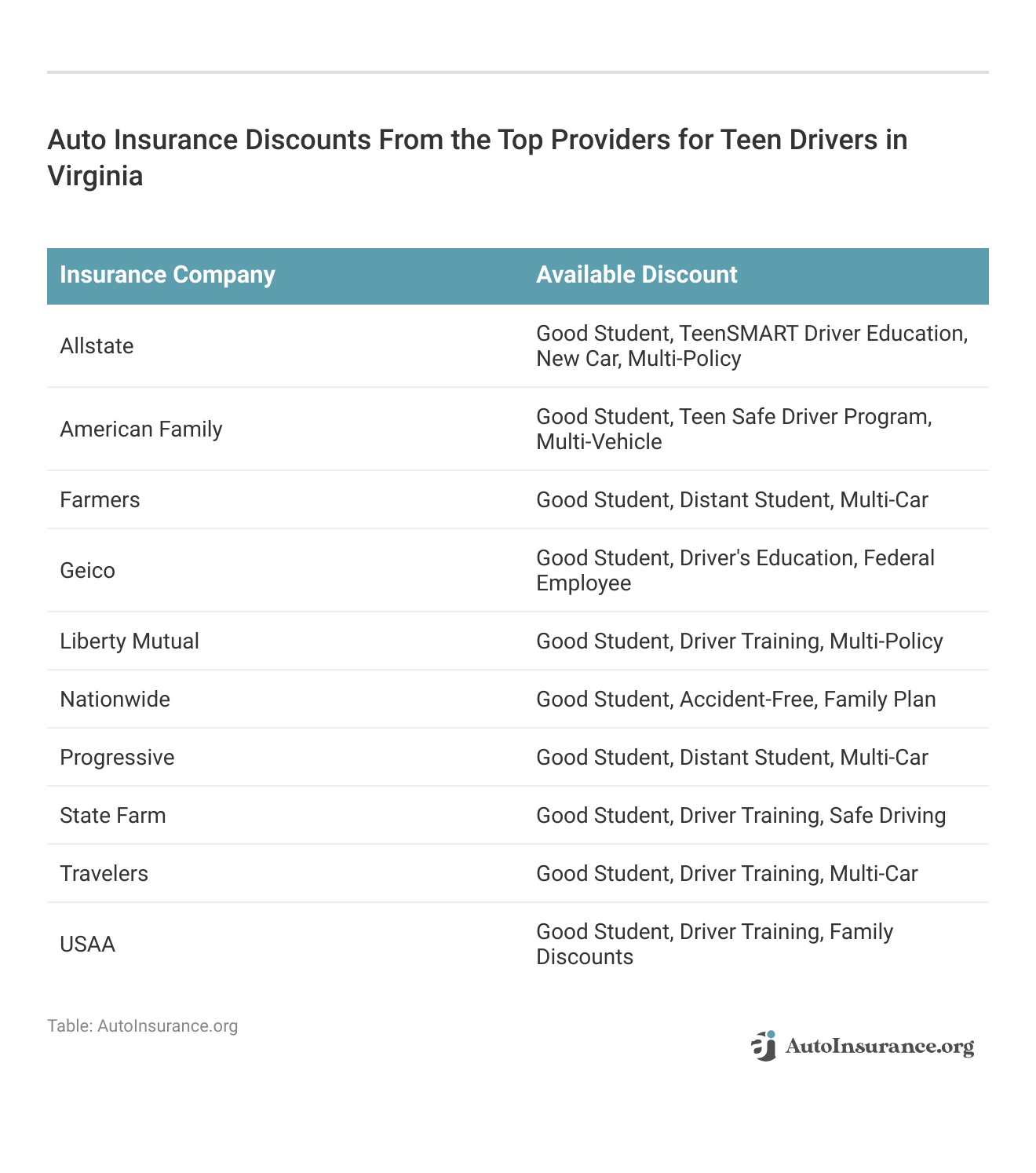

Ways to Save on Teen Auto Insurance in Virginia

Finding cheap auto insurance for 17-year-olds and other teens in Virginia is more difficult than it is for older adults, but it’s not impossible. If you need the cheapest coverage possible, the following tips can help you save on your car insurance premiums.

First of all, you should try to find as many discounts you qualify for as possible. Many parents wonder how much is State Farm’s good student discount compared to other insurers. Check below to see discount options for teens from our top companies.

Another crucial step in finding affordable coverage as a teen in Virginia is to compare auto insurance rates with as many companies as possible. Most insurance companies offer a quote request form on their homepage.

If you don’t want to fill out forms at each company you’re interested in, you can get a list of rates from a quote comparison tool to compare multiple quotes at once. This is essential when looking for the cheapest cars to insure in Virginia for young drivers.

Other ways to get Virginia’s cheapest auto insurance include lowering the amount of coverage in your policy, increasing your deductible, and joining a family plan.

Adding a Teen to Virginia Auto Insurance

Adding a driver to your auto insurance policy is one of the easiest ways to get cheap car insurance costs. On average, a parent or guardian can save a teen 50% on their insurance.

Virginia Auto Insurance Monthly Rates by Age, Gender, & Policy Type

| Age & Gender | Individual Policy | Parent's Policy |

|---|---|---|

| 16-Year-Old Female | $200 | $170 |

| 16-Year-Old Male | $220 | $190 |

| 17-Year-Old Female | $190 | $160 |

| 17-Year-Old Male | $210 | $180 |

| 18-Year-Old Female | $180 | $150 |

| 18-Year-Old Male | $200 | $170 |

| 19-Year-Old Female | $170 | $140 |

| 19-Year-Old Male | $190 | $160 |

| 20-Year-Old Female | $160 | $130 |

| 20-Year-Old Male | $180 | $150 |

| 21-Year-Old Female | $150 | $120 |

| 21-Year-Old Male | $170 | $140 |

While you don’t always have to add a teen driver to your policy, you should check with a representative from your insurance company. Most companies require you to include any licensed driver living in the same house in your policy.

Get the Cheapest Teen Driver Auto Insurance in Virginia

USAA, State Farm, and Geico top the list for the cheapest teen driver auto insurance in Virginia. USAA offers exceptional student discounts, State Farm’s teen driver insurance offers a comprehensive Steer Clear program, and Geico features family-friendly, affordable rates.

Explore programs like TeenSmart and driver’s education courses, which can get cheap car insurance for first-time drivers over 25 while still meeting Virginia’s minimum coverage requirements.

Teen auto insurance coverage in Virginia may be expensive, but the price is worth it — driving without auto insurance now comes with serious consequences. However, shopping at the cheapest teen driver auto insurance companies in Virginia will help you save.

Now that you have an idea of which companies might best serve your teen driver insurance needs, your next step is to compare rates. Enter your ZIP code into our free comparison tool to get started.

Frequently Asked Questions

How much is auto insurance in Virginia per month?

Many factors affect auto insurance rates in Virginia, but teenage car insurance rates average $194 per month for minimum coverage.

Who has the lowest auto insurance rates in Virginia?

Our research shows that USAA, Geico, and State Farm rates have the cheapest auto insurance rates in Virginia. By comparing quotes, you will sure know how to get cheaper car insurance.

How much is auto insurance for an 18-year-old in Virginia?

Finding cheap auto insurance for 18-year-olds is a little easier than for younger teens because companies consider them a little less risky to insure. The cheapest insurance for teenage drivers costs $78 per month for minimum coverage and $233 per month for full coverage.

How much does car insurance cost for a 16-year-old in Virginia?

In Virginia, the average car insurance for 16-year-olds costs $86 per month for minimum coverage and $260 per month for full coverage. Finding cheap auto insurance for 16-year-olds can be difficult, but comparing quotes and finding discounts can help you get the cheapest insurance for teenagers.

Who is cheaper for teen auto insurance in Virginia, Geico or Progressive?

Geico’s teenage driver insurance costs the lowest for most drivers. However, you should always compare insurance rates in Virginia to ensure you find the lowest personalized quotes and avoid the most expensive car insurance companies.

Enter your ZIP code into our free comparison tool to see if Geico or Progressive has cheaper rates for you.

What type of insurance is required for you to drive a car in Virginia?

The Virginia Auto Insurance Regulatory Commission now requires drivers to carry a minimum amount of liability and uninsured motorist coverage.

Do I need insurance to drive someone else’s car in Virginia?

If you’re borrowing a friend’s car once, their insurance will cover you if anything happens on the road. However, you’ll need coverage if you regularly drive their vehicle. In most cases, the easiest way to get coverage in this situation is to have the other person add you to their policy.

Which gender pays more for Virginia auto insurance?

Generally speaking, men pay more for women for insurance for a few reasons, primarily having to do with risky driving habits. Regardless of your gender, there are plenty of ways to save. Learn how to get a student auto insurance discount, lower your coverage, and increase your deductible.

Are you required to have auto insurance in Virginia?

While Virginia has long been a state that doesn’t require insurance, mandatory coverage laws took effect in 2023. Luckily, there are also Virginia auto insurance cancellation laws that say companies can’t cancel your coverage without letting you know, so you won’t have to worry about driving illegally without your knowledge.

What is the new Virginia auto insurance law?

The new Virginia auto insurance law requires all drivers looking for teenager’s car insurance to carry a 30/60/20 liability coverage plan and 25/50/20 for uninsured motorist coverage.

What happens if you drive without insurance in Virginia?

Driving without insurance comes with serious consequences, including a $600 fee, the loss of your license and car registration, and the requirement to file SR-22 or FR-44 insurance in Virginia.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.