Cheapest Teen Driver Auto Insurance in Tennessee (Top 10 Companies Ranked for 2025)

Erie, USAA, and Geico have the cheapest teen driver auto insurance in Tennessee starting at $95/mo. One speeding ticket can raise rates by $50. If you need high-risk teen auto insurance after a ticket, Erie has the lowest rates. Teens can get cheap car insurance for teens with good student discounts of 15%.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Apr 4, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 4, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for TN Teens

A.M. Best

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for TN Teens

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for TN Teens

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsErie, USAA, and Geico offer the cheapest teen driver auto insurance in Tennessee. Other companies that offer affordable Tennessee auto insurance to teen drivers are listed below.

Our Top 10 Company Picks: Cheapest Teen Driver Auto Insurance in Tennessee

| Company | Rank | Monthly Rates | Safe Driver Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $95 | 20% | 24/7 Support | Erie |

| #2 | $102 | 20% | Military Savings | USAA | |

| #3 | $125 | 15% | Cheap Rates | Geico | |

| #4 | $146 | 25% | Many Discounts | State Farm | |

| #5 | $147 | 26% | Exclusive Benefits | Safeco | |

| #6 | $157 | 23% | Online Convenience | Safe Auto |

| #7 | $159 | 15% | Deductible Reduction | Mercury | |

| Infinity | #8 | $178 | 20% | Customizable Polices | Infinity |

| #9 | $189 | 15% | Local Agents | AAA |

| #10 | $195 | 10% | Usage Discount | Nationwide |

Finding the best car insurance for teen drivers in Tennessee requires comparing multiple providers. Many families look for Tennessee’s cheap auto insurance options when adding a young driver to their policy.

- Erie has the cheapest Tennessee auto insurance rates for teens

- USAA and Geico also provide cheap car insurance in Tennessee

- Drivers can save on coverage with teen driver safety discounts

Read on to learn more about the top 10 cheapest car insurance companies in Tennessee for teens. You can also quickly compare auto insurance rates in Tennessee by entering your ZIP into our free tool.

#1 – Erie: Top Pick Overall

Pros

- 24/7 Support: Erie offers after-hours numbers for support with claims or roadside assistance.

- Young Driver Discounts: Erie offers discounts geared towards young drivers seeking affordable car insurance in Tennessee.

- Policy Extras: You can get extras like pet injury coverage added for free from its cheap full coverage car insurance in Tennessee. Learn more in our Erie auto insurance review.

Cons

- Availability: If you move out of Tennessee, you may be unable to keep Erie as a provider.

- Number of Discounts: Erie has fewer discounts overall than other companies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Military Savings: For the military seeking cheap car insurance in TN, USAA offers some of the most affordable rates to Tennessee drivers.

- Student Discounts: USAA offers discounts to Tennessee students with good grades. Read our USAA review to learn more about discount options.

- Customer Service: USAA’s Tennessee car insurance customers have highly rated the company.

Cons

- Eligibility: Teens can only get USAA insurance if they are military service members or their parents are military or veterans.

- Limited Physical Locations: USAA doesn’t offer many physical branches in Tennessee.

#3 – Geico: Best for Student Discounts

Pros

- Student Discounts: Geico rewards Tennessee drivers with lower rates if they have a 3.0 GPA or higher, offering cheap car insurance in TN for students.

- Usage-Based Discount: Teens can participate in Geico’s DriveEasy program for a UBI discount, making Geico’s teenage driver insurance cost more affordable. Learn more in our Geico DriveEasy review.

- Coverage Options: Round out your Tennessee auto insurance plans at Geico with coverages like roadside assistance.

Cons

- Physical Locations Limited: Geico doesn’t offer many physical agent locations, as most services are online.

- DUI Rates: Tennessee teens with DUIs will have a harder time finding affordable car insurance for teen drivers at Geico.

#4 – State Farm: Best for Many Discounts

Pros

- Many Discounts: State Farm offers many discounts to help Tennessee drivers save on car insurance for teenagers. Learn more in our State Farm auto insurance review.

- Steer Clear Program: Teen drivers can complete the Steer Clear program at State Farm to get the cheapest insurance for teens in Tennessee.

- Coverage Variety: Add extras like roadside assistance to Tennessee auto insurance policies for teen drivers.

Cons

- No Online Purchases: Tennesse drivers will need to contact an agent to purchase coverage.

- DUI Rates: State Farm is not always among the cheapest Tennessee car insurance providers for high-risk drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Safeco: Best for Safe Drivers

Pros

- Safe Drivers: Safeco’s rates are the most affordable for safe Tennessee drivers looking for cheap car insurance for young drivers.

- Coverage Options: Safeco offers a number of Tennessee coverages. Learn more in our Safeco auto insurance review.

- Online Tools: Tennessee drivers with teen car insurance can handle their policies online.

Cons

- Customer Satisfaction: Safeco’s customer satisfaction in car insurance for teenage drivers isn’t always rated well.

- Agent Purchases: Tennessee purchases must be made through an agent.

#6 – Safe Auto: Best for Online Convenience

Pros

- Online Convenience: Safe Auto’s insurance for a teenager makes it easy to go online and make policy updates.

- High-Risk Filing: Safe Auto will file SR-22s for high-risk teens needing cheap car insurance for new drivers. Learn more in our Safe Auto insurance review.

- Coverage Options: Safe Auto offers extras like non-owner auto insurance.

Cons

- Customer Reviews: Safe Auto’s teenage driver’s insurance doesn’t always have great feedback from customers.

- Availability: If you move out of Tennessee, you may be unable to keep Safe Auto as a provider.

#7 – Mercury: Best for Adjustable Deductibles

Pros

- Adjustable Deductibles: Mercury allows customers to change the deductible on their coverages to adjust their Tennessee car insurance for 16-year-olds.

- Coverage Options: Tennessee drivers can choose extras like rideshare coverage. See what else is offered in our Mercury auto insurance review.

- Discount Variety: Teens in Tennessee have plenty of discount options available for cheaper car insurance.

Cons

- Availability: Tennesse drivers who move out of state may have to switch providers.

- Customer Satisfaction: Ratings aren’t as high as other companies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Infinity: Best for Customizable Policies

Pros

- Customizable Policies: Infinity offers easily customized policies to Tennessee customers.

- High-Risk Drivers: Drivers who may not be able to get coverage elsewhere can get the cheapest car insurance in Tennessee from Infinity. Learn more in our Infinity auto insurance review.

- Discount Variety: Infinity offers discounts like good student rate decreases.

Cons

- Availability: Tennessee customers may have to switch coverage if they move out of state.

- Customer Reviews: Infinity has a number of complaints from customers.

#9 – AAA: Best for Local Agents

Pros

- Local Agents: Most Tennessee customers can easily locate an agent to meet in person to get car insurance for young drivers.

- Roadside Assistance: Tennessee drivers can add AAA’s highly-rated roadside assistance to their policy. Read more in our AAA auto insurance review.

- Teen Discounts: There are discounts specialized to young drivers in Tennessee.

Cons

- Membership Fee: You’ll need to buy an AAA membership to buy AAA Tennessee auto insurance.

- Online Tools: AAA’s online tools may not be as functional as those of its competition.

#10 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Nationwide offers a usage-based discount to Tennessee customers.

- Add-On Coverages: Tennessee drivers can benefit from add-ons at Nationwide. See what the company offers in our review of Nationwide auto insurance.

- Good Student Discount: Great for Tennessee drivers with good grades.

Cons

- Online Tools: Nationwide’s online functions may be more limited than those of other companies.

- Telematics Tracking: Nationwide tracks driving data for its usage-based discount.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tennessee Auto Insurance Requirements for Teens

Teens have the same Tennessee auto insurance requirements as adult drivers. Understanding the cheapest car insurance for teens options is essential for parents adding young drivers to their policies.

Tennessee teens should carry full coverage as they are more likely to get into an accident that won't be covered by the limits.Brandon Frady Licensed Insurance Agent

Because coverage is one of the factors that affect auto insurance rates, take a look at the average rates below to see the cost differences between full and minimum limits.

Parents frequently find themselves puzzled about how much car insurance is for teens when budgeting for their child’s driving privileges.

Tennessee Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $165 | $375 |

| 16-Year-Old Male | $155 | $355 |

| 17-Year-Old Female | $145 | $325 |

| 17-Year-Old Male | $175 | $395 |

| 18-Year-Old Female | $135 | $315 |

| 18-Year-Old Male | $145 | $345 |

| 19-Year-Old Female | $125 | $285 |

| 19-Year-Old Male | $165 | $305 |

| 20-Year-Old Female | $115 | $275 |

| 20-Year-Old Male | $135 | $315 |

| 21-Year-Old Female | $105 | $255 |

| 21-Year-Old Male | $125 | $285 |

It is important to note that teen drivers, while they must carry the required coverages, won’t have full driving privileges until they earn their full license under TN’s graduated license program.

Teens with a learner’s permit must always drive with a licensed driver over age 21 before graduating to an intermediate license with driving restrictions.

Once teens have earned a full license, there will be no driving restrictions. However, parents should continue looking for affordable auto insurance options in Tennessee, as rates typically remain higher for less experienced drivers.

Teen Auto Insurance Rates in Tennessee

While Tennessee car insurance can be pricey, the companies with the cheapest teen auto insurance rates will have the best deals on coverage. Parents often wonder, “Is car insurance cheaper in Tennessee?” compared to neighboring states when shopping for teen policies.

TN Auto Insurance for Teen Drivers: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $189 | $465 |

| $95 | $233 |

| $125 | $312 | |

| $178 | $509 | |

| $159 | $391 | |

| $195 | $476 |

| $157 | $385 |

| $147 | $360 | |

| $146 | $349 | |

| $102 | $350 |

However, even at the cheapest companies, your location in Tennessee will slightly impact your rates. For those seeking the cheapest auto insurance rates in Tennessee, it’s worth comparing quotes from multiple providers, as prices can vary for young drivers.

Tennessee Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Chattanooga | Jackson | Knoxville | Memphis | Nashville |

|---|---|---|---|---|---|

| 16-Year-Old Female | $320 | $310 | $330 | $300 | $340 |

| 16-Year-Old Male | $350 | $340 | $360 | $320 | $330 |

| 20-Year-Old Female | $270 | $250 | $260 | $290 | $280 |

| 20-Year-Old Male | $300 | $290 | $310 | $270 | $280 |

| 30-Year-Old Female | $220 | $240 | $210 | $230 | $200 |

| 30-Year-Old Male | $250 | $260 | $230 | $240 | $220 |

| 40-Year-Old Female | $190 | $180 | $200 | $220 | $210 |

| 40-Year-Old Male | $230 | $220 | $240 | $210 | $200 |

| 50-Year-Old Female | $180 | $170 | $190 | $210 | $200 |

| 50-Year-Old Male | $220 | $210 | $230 | $200 | $190 |

| 60-Year-Old Female | $170 | $160 | $180 | $200 | $190 |

| 60-Year-Old Male | $210 | $200 | $220 | $190 | $180 |

| 70-Year-Old Female | $160 | $150 | $170 | $190 | $180 |

| 70-Year-Old Male | $200 | $190 | $210 | $180 | $170 |

Knoxville is one of the more expensive cities to buy auto insurance. Families should specifically look for cheap car insurance in Knoxville, TN that specialize in teen driver discounts.

The start of the new year is a perfect time to do a coverage review and let your agent know if you’ve moved or added a vehicle. 🏡🚗 https://t.co/XbC9EQaWMl

— Erie Insurance (@erie_insurance) January 25, 2024

For families on a budget, exploring affordable car insurance programs in Tennessee that offer good student discounts, driver education credits, and family policy bundling can substantially reduce premium costs for newly licensed drivers.

High-Risk Auto Insurance for Teens

Teens are already considered high-risk because of their driving experience, so any incidents on their driving record will automatically make insurance very expensive.

Tennessee Auto Insurance Monthly Rates by Age, Gender, & Driving Record

| Age & Gender | Clean Record | Speeding Ticket | At-Fault Accident | DUI/DWI |

|---|---|---|---|---|

| 16-Year-Old Female | $210 | $260 | $320 | $400 |

| 16-Year-Old Male | $225 | $275 | $340 | $420 |

| 17-Year-Old Female | $200 | $250 | $310 | $390 |

| 17-Year-Old Male | $220 | $270 | $330 | $410 |

| 18-Year-Old Female | $190 | $240 | $300 | $380 |

| 18-Year-Old Male | $205 | $255 | $315 | $395 |

| 19-Year-Old Female | $180 | $230 | $290 | $370 |

| 19-Year-Old Male | $210 | $260 | $320 | $400 |

| 20-Year-Old Female | $170 | $220 | $280 | $360 |

| 20-Year-Old Male | $200 | $250 | $310 | $390 |

| 21-Year-Old Female | $160 | $210 | $270 | $350 |

| 21-Year-Old Male | $190 | $240 | $300 | $380 |

Teens will have to pay more for high-risk auto insurance if they have an accident, ticket, or DUI on their record. In some cases, teens may even have to get SR-22 auto insurance.

If Tennessee teens can’t find an insurance company willing to insure them, they must apply for the Tennessee automobile insurance plan. Tennessee high-risk auto insurance costs are expensive, but the state plan insures drivers who cannot get coverage at normal companies.

Read more: Auto Insurance Companies for High-Risk Drivers

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Adding a Teenager to Your Auto Insurance Policy

It is usually always cheaper adding a driver to auto insurance, especially if the driver is a teenager. Families searching for cheap car insurance for 18-year-olds often find that adding teens to an existing policy costs significantly less than purchasing separate coverage.

Tennessee Auto Insurance Monthly Rates by Age, Gender, & Policy Type

| Age & Gender | Individual Policy | Parent's Policy |

|---|---|---|

| 16-Year-Old Female | $315 | $205 |

| 16-Year-Old Male | $335 | $215 |

| 17-Year-Old Female | $305 | $195 |

| 17-Year-Old Male | $325 | $205 |

| 18-Year-Old Female | $295 | $185 |

| 18-Year-Old Male | $315 | $195 |

| 19-Year-Old Female | $275 | $175 |

| 19-Year-Old Male | $295 | $185 |

| 20-Year-Old Female | $255 | $165 |

| 20-Year-Old Male | $275 | $175 |

| 21-Year-Old Female | $235 | $155 |

| 21-Year-Old Male | $255 | $165 |

Teens can stay on a parents’ policy for as long as they share a permanent residence. This arrangement helps Tennessee families secure cheap full coverage car insurance rates while ensuring young drivers have proper protection.

For households wondering can a minor get car insurance on their own, the answer is generally no—most insurance companies require a parent or guardian to co-sign policies for drivers under 18.

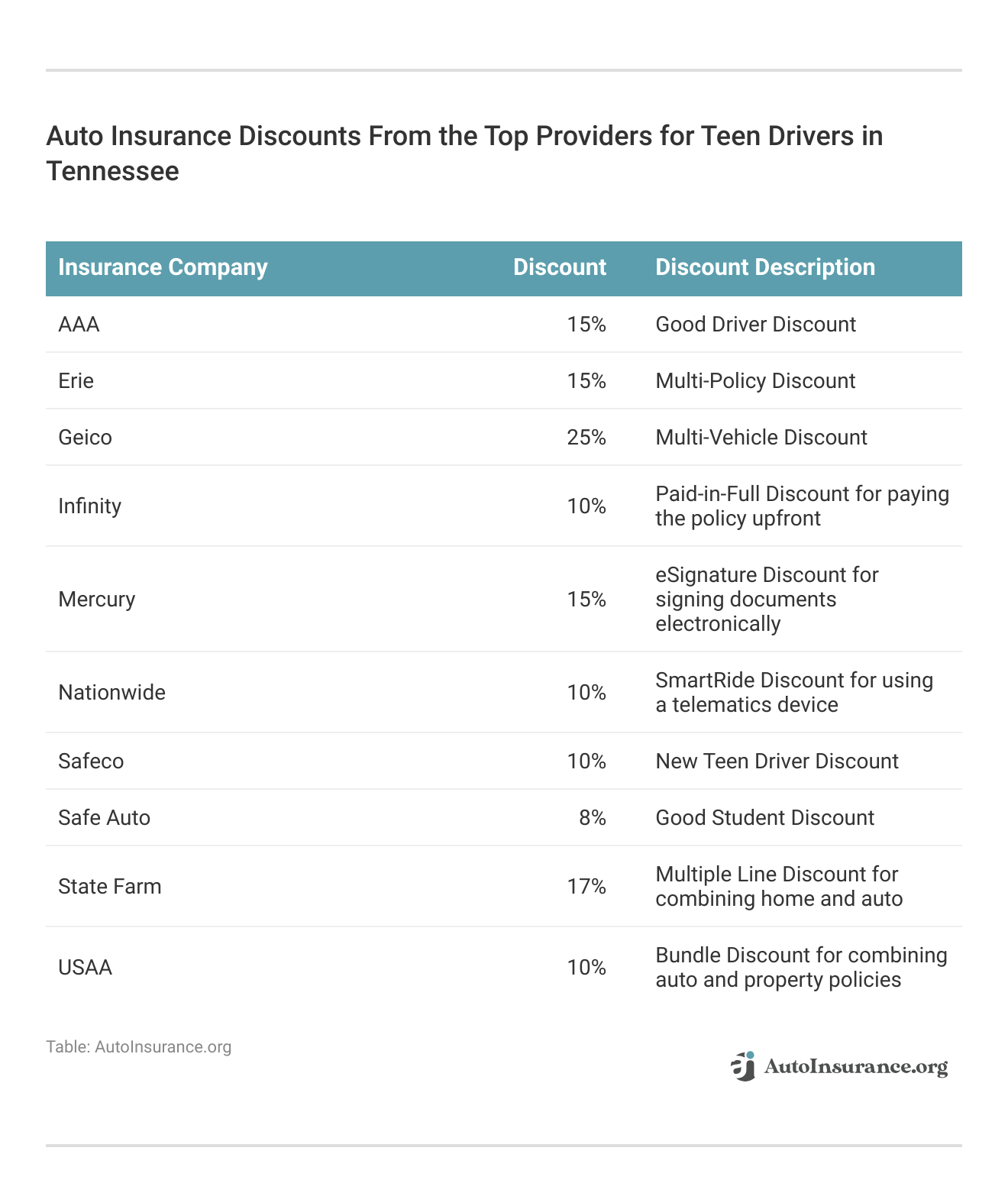

Tennessee Auto Insurance Discounts for Teens

When shopping for cheap auto insurance for families with multiple drivers, watch for multi-policy discounts and teen driver safety rewards.

Tennessee auto insurance discounts vary from company to company, but most Tennessee companies offer at least a few discounts to families.

Get the Cheapest Teen Driver Auto Insurance in Tennessee

You will find cheap auto insurance for 16-year-olds and up with Erie, USAA, and Geico. The cheapest companies offer plenty of discounts for teenagers, as well as comprehensive coverage options.

It is important to shop around and get quotes from each company to see which will be the cheapest for you. Looking for the cheapest full coverage insurance in Tennessee for teens? Enter your ZIP to compare car insurance quotes in Tennessee today.

Frequently Asked Questions

Is car insurance expensive in Tennessee?

Tennessee car insurance is expensive for drivers who have filed multiple Tennessee high-risk auto insurance claims or for new teenage drivers.

Who has the cheapest car insurance rates in Tennessee?

Erie has the cheapest rates on average.

How much is monthly auto insurance for a 16-year-old in Tennessee?

Minimum coverage is an average of $160/mo for 16-year-old drivers in Tennessee. Parents looking for cheap car insurance for first-time drivers may find better rates by adding teens to existing family policies.

Who has the cheapest Tennessee insurance for a 17-year-old?

Cheap auto insurance for 17-year-olds can be found at Erie, USAA, or Geico. Those seeking the cheapest car insurance for 17-year-old males should request quotes from all three companies.

Is Geico cheaper than Progressive teen auto insurance in Tennessee?

For TN’s affordable insurance, Geico is cheaper on average than Progressive.

Is Allstate cheaper than Geico teen auto insurance?

No, Geico is cheaper on average than Allstate (learn more: Allstate vs. Geico Auto Insurance).

Is Allstate cheaper than Progressive teen auto insurance?

Allstate and Progressive have similar rates. You should read Tennessee auto insurance reviews and get quotes to see which is cheaper for you. Compare auto insurance quotes in Tennessee now by entering your ZIP into our free tool.

What is the minimum auto insurance for Tennessee drivers?

Tennessee drivers need to have liability auto insurance to drive.

What is the cheapest liability insurance in Tennessee?

Erie has some of the cheapest liability rates in Tennessee. However, the cheapest company for you may vary based on your driving record and location (read more: Cheapest Liability-Only Auto Insurance).

Do permit drivers need auto insurance in Tennessee?

A parent’s policy will usually cover permit drivers until they get their license. It’s also best to add auto insurance for young drivers in a parent’s policy.

Can a 16-year-old own a car in Tennessee?

Teens can’t own their car in Tennessee, with a few exceptions, until they are 18. Make sure to also get the cheapest cars to insure in Tennessee to avoid higher costs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.