Best Pay-As-You-Go Auto Insurance in Colorado for 2025 (Top 10 Companies Ranked)

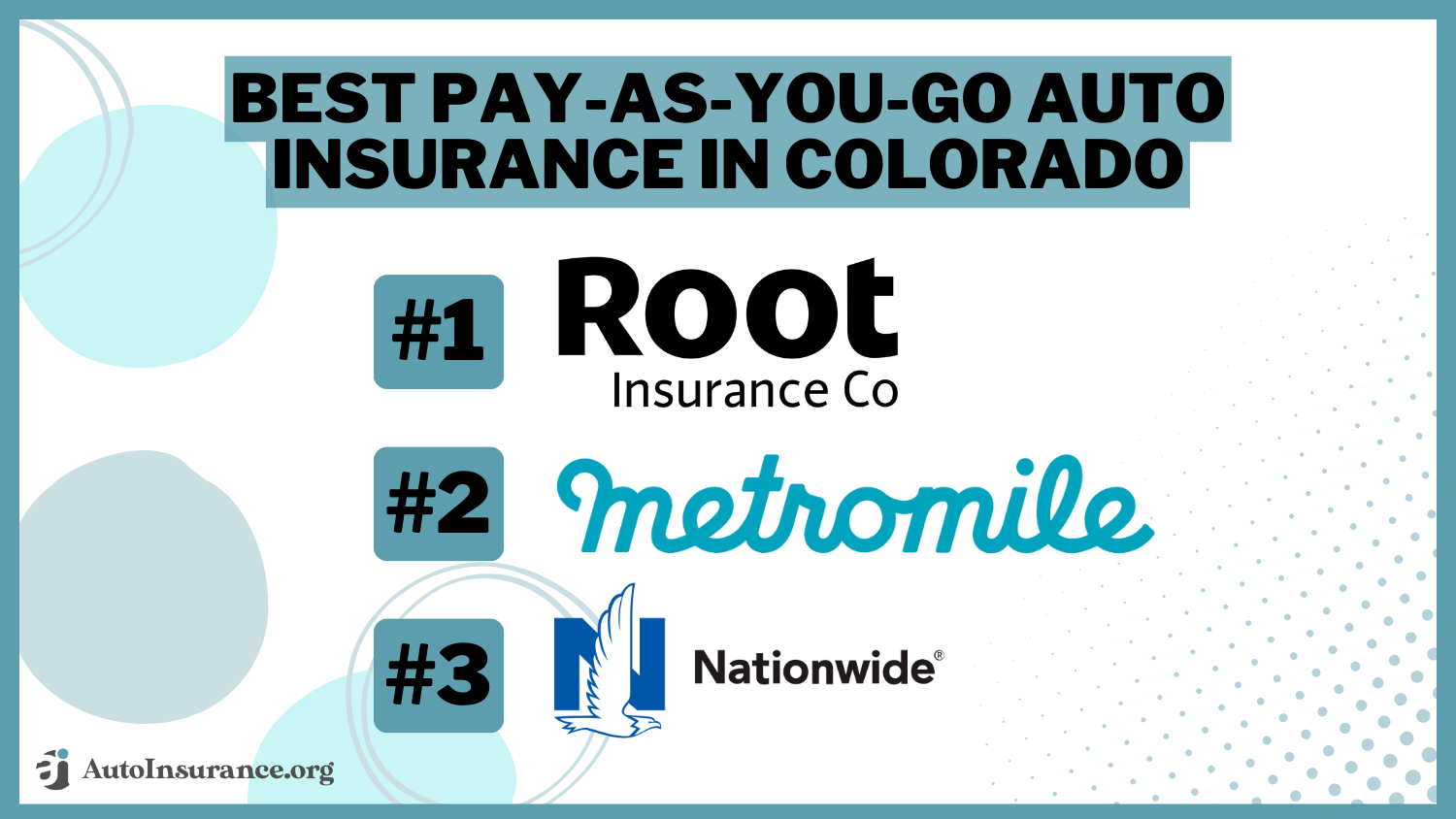

The best pay-as-you-go auto insurance in Colorado comes from Root, Metromile, and Nationwide. The companies offer true pay-per-mile auto insurance, with monthly rates as low as $38 per month. Low-mileage drivers can also save with usage-based insurance programs from standard providers like Allstate.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Mar 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

796 reviews

796 reviewsCompany Facts

PAYG Full Coverage in CO

A.M. Best Rating

Complaint Level

Pros & Cons

796 reviews

796 reviews 150 reviews

150 reviewsCompany Facts

PAYG Full Coverage in CO

A.M. Best Rating

Complaint Level

Pros & Cons

150 reviews

150 reviews 3,071 reviews

3,071 reviewsCompany Facts

PAYG Full Coverage in CO

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsRoot, Metromile, and Nationwide have the best pay-as-you-go auto insurance in Colorado. These companies have the best pay-as-you-go car insurance in Colorado due to affordable prices and excellent coverage options.

Root is our top pick for pay-per-mile auto insurance in Colorado. It may not have the cheapest rates, but its focus on insuring only the best drivers guarantees your rates won’t increase because other drivers are filing too many Colorado auto insurance claims.

Our Top 10 Company Picks: Best Pay-As-You-Go Auto Insurance in Colorado

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 15% | Driven Rates | Root | |

| #2 | 10% | 25% | Mileage Discounts | Metromile | |

| #3 | 15% | 10% | Flexible Premiums | Nationwide |

| #4 | 10% | 10% | User Technology | Farmers | |

| #5 | 20% | 20% | Comprehensive Coverage | Allstate | |

| #6 | 10% | 15% | Personalized Pricing | Liberty Mutual |

| #7 | 10% | 20% | Safe Driving | Progressive | |

| #8 | 25% | 15% | Discounted Rates | Geico | |

| #9 | 17% | 30% | Usage Savings | State Farm | |

| #10 | 10% | 20% | Military Discounts | USAA |

Explore our Colorado pay-per-mile auto insurance guide below to discover which company has the perfect coverage options for your needs. Then, enter your ZIP code into our free comparison tool above to find cheap car insurance in Colorado.

- Companies offer pay-per-mile policies or UBI plans to help low-mileage drivers save

- Pay-as-you-go insurance policies are best if you drive less than 10,000 miles a year

- Root and Metromile have the best pay-per-mile insurance in Colorado

#1 – Root: Top Pick Overall

Pros

- Low Rates: Root offers the best pay-per-mile car insurance in Colorado in part because it has affordable rates. Root doesn’t insure bad drivers, which helps keep rates low.

- Customized Quotes: What you pay for Root car insurance in Colorado is determined by how you drive. Good drivers are rewarded at Root with the cheapest pay-per-mile car insurance rates.

- User-Friendly App: Track your driving habits and manage your policy with Root’s highly-rated mobile app. See what customers say about the app in our Root auto insurance review.

Cons

- Strict Eligibility Requirements: You can only get Root insurance in Colorado if you regularly practice safe driving. If you don’t pass the Root test, your application will be denied.

- Traditional Support Lacking: Finding help from a Root representative can be difficult. Many customers report long waiting times when calling the Root auto insurance phone number.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Metromile: Best Pay-Per-Mile Quotes

Pros

- Transparent Pricing: Metromile offers easy-to-understand transparent pricing. You’ll know right away if Metromile is the cheapest pay-per-mile insurance option in Colorado for you.

- True Pay-As-You-Go Insurance: As one of the only companies that offers only pay-per-mile insurance policies, Metromile specializes in pay-as-you-go coverage.

- User-Friendly App: Manage your Metromile policy with ease on the user-friendly mobile app.

Cons

- More Complaints Than Expected: With almost four times as many complaints as the national average, Metromile does not have the best track record with its customers.

- Limited Coverage Options: Metromile doesn’t offer as many add-ons as some of its competitors. Explore your Metromile full coverage options in our Metromile auto insurance review.

#3 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers a variety of add-ons, including its vanishing deductible which can cover up to $500 of your deductible. Learn how it works in our Nationwide auto insurance review.

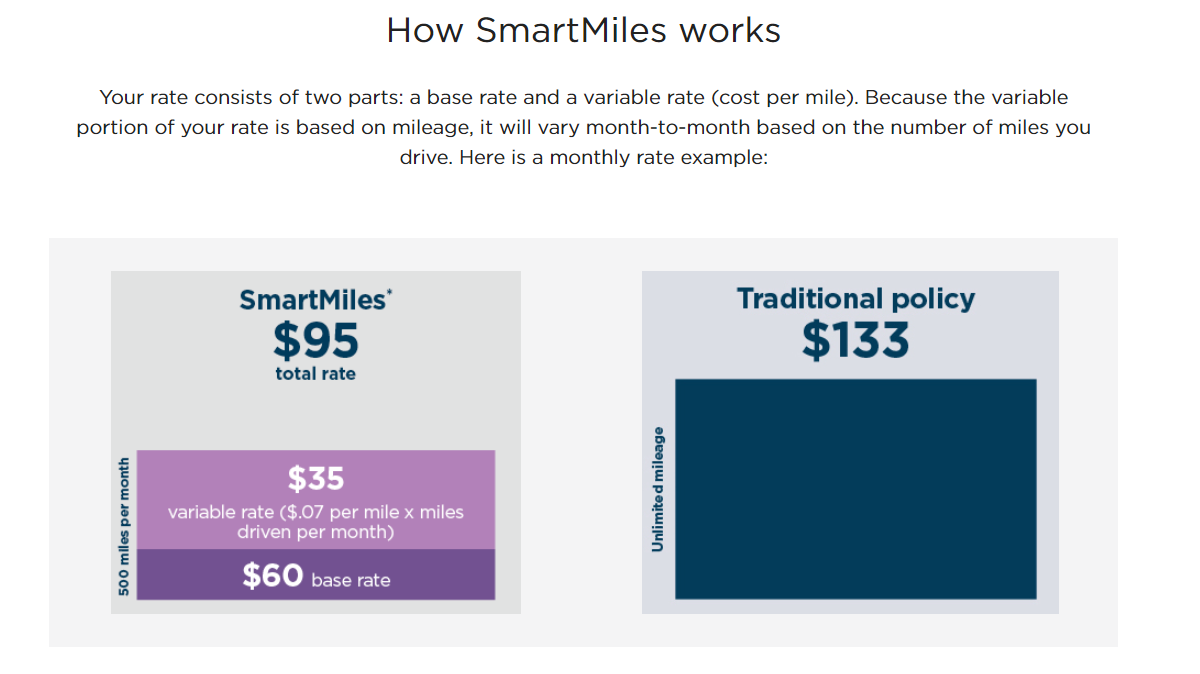

- UBI Programs: Nationwide has two usage-based insurance (UBI) programs. SmartRide offers up to 40% off your insurance for safe driving, while you can get pay-per-mile car insurance with SmartMiles.

- Low Rates for Teens: Young drivers can struggle to find affordable Colorado auto insurance rates, but Nationwide offers cheap quotes for teens.

Cons

- Lacking Coverage Options: Despite being one of the biggest Colorado auto insurance companies, Nationwide doesn’t have the longest list of add-ons.

- Higher Rates: High-risk drivers with speeding tickets, at-fault accidents, or DUIs will likely need to shop somewhere else for cheap Colorado car insurance.

#4 – Farmers: Best List of Auto Insurance Discounts

Pros

- Signal App: Farmers doesn’t offer a true pay-per-mile option, but you can still earn savings for your low-mileage driving with the Signal app. See how in our Farmers auto insurance review.

- Ample Discounts: Farmers offers an impressive 23 discounts for drivers to take advantage of and find the cheapest auto insurance in Colorado.

- Coverage Options: Get the most out of your Nationwide policy by adding things like customized equipment coverage and roadside assistance.

Cons

- Higher Premiums: Farmers is an affordable option when you sign up for Signal, but premiums can be expensive if you don’t participate.

- Rate Increases With Signal: If you don’t drive well enough, Signal is one of the few UBI programs that will increase your rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Full Coverage Service

Pros

- Coverage Options: You’ll find plenty of add-on options to customize your policy with at Allstate. See all your add-on options in our Allstate auto insurance review.

- Milewise: Allstate offers two UBI programs, and the Allstate pay-per-mile option is Milewise. If you prefer a discount for your driving instead, consider Drivewise.

- Daily Mileage Cap: As part of offering the best pay-as-you-drive car insurance, your rates skyrocketing if you take a road trip – Allstate caps the mileage you can be charged for in a single day at 250 miles.

Cons

- Mixed Reviews: Allstate may be one of the largest insurance companies in the country, but it doesn’t always leave customers happy.

- Expensive Premiums: Colorado pay-per-mile insurance reviews say Allstate is affordable for low-mileage drivers, but it’s not usually a good choice for low-income car insurance in Colorado.

#6 – Liberty Mutual: Best for Diverse Coverage Opportunities

Pros

- Unique Coverage Options: Customize your Liberty Mutual policy to get the exact coverage you want with plenty of add-ons to choose from.

- RightTrack: You can save money on auto insurance as a low-mileage driver by enrolling in RightTrack – formally known as Liberty Mutual ByMile. Read more in our Liberty Mutual RightTrack review.

- Specialty Discounts: Get the best auto insurance in Colorado with 17 discounts. Teachers and other educators can get an exclusive discount from Liberty Mutual.

Cons

- More Complaints Than Expected: Liberty Mutual receives a high number of complaints. If you’re looking for the very best Colorado car insurance, Liberty Mutual probably shouldn’t be your top choice.

- Discontinued ByMile: While it once offered a pay-per-mile insurance option, Liberty Mutual canceled its ByMile program to start RightTrack.

#7 – Progressive: Best for Innovative Digital Tools

Pros

- Digital Tools: Progressive offers a variety of digital tools to help drivers looking for a more modern insurance experience. Explore these tools in our Progressive auto insurance review.

- Snapshot: Save up to 30% on your Progressive car insurance in Colorado by enrolling in the UBI program Snapshot and consistently practicing safe driving habits.

- Automatic Discounts: Progressive offers 13 discounts, many of which automatically apply to your account once you qualify.

Cons

- Rate Hikes: Many customers report that their Progressive car insurance in Colorado unexpectedly increased, even when nothing had changed about their policy.

- Low Loyalty: Despite efforts to improve, Progressive still struggles with its customer loyalty ratings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Geico: Best for Affordable Car Insurance Rates

Pros

- Low Rates: Get affordable coverage from Geico, no matter what type of driver you are. Geico car insurance in Colorado is typically one of the cheapest car insurance options for all drivers.

- DriveEasy: Save up to 25% on your insurance by enrolling in Geico’s UBI program, DriveEasy.

- Fewer Complaints: Geico receives fewer customer complaints than many insurance companies of similar size. See how Geico keeps its customers happy in our Geico auto insurance review.

Cons

- Fewer Coverage Options: Geico has a surprising lack of coverage options, including popular add-ons like gap insurance.

- Higher Rates for Some: One of the only groups of people Geico does not offer cheap rates to are drivers with DUIs.

#9 – State Farm: Best for Personalized Service

Pros

- Solid Discounts: Keep your insurance rates low with State Farm’s selection of 13 discounts. See how many you might qualify for in our State Farm auto insurance review.

- Drive Safe & Save: You can’t get State Farm pay-per-mile car insurance in Colorado, but Drive Safe & Save is the next best thing. Safe drivers can save up to 30% by enrolling in the UBI program.

- Extensive Network of Agents: State Farm agents are in every corner of Colorado, so getting personalized service is usually a breeze.

Cons

- Limited Coverage Options: State Farm has great rates and a solid UBI program, but it lacks many of the coverage options you can find at other companies.

- Availability Varies: State Farm’s UBI program and discounts vary by ZIP code. Speak with a representative to see what’s available in your area.

#10 – USAA: Best for Active or Retired Military Members

Pros

- SafePilot: Low-mileage drivers should consider USAA’s UBI program, SafePilot, which offers a maximum savings of up to 30%.

- Low Rates: No matter what type of driver you are or where you live, USAA almost always has the cheapest car insurance in Colorado.

- Superb Customer Service: USAA representatives have a reputation for being professional, friendly, and helpful.

Cons

- No Gap Insurance: USAA offers auto loan services and car insurance, but it doesn’t sell gap insurance. Learn more about the services USAA does offer in our review of USAA auto insurance.

- Eligibility Requirements: You need to be a USAA member to buy auto insurance. Only active or retired military members and their direct families can become USAA members.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

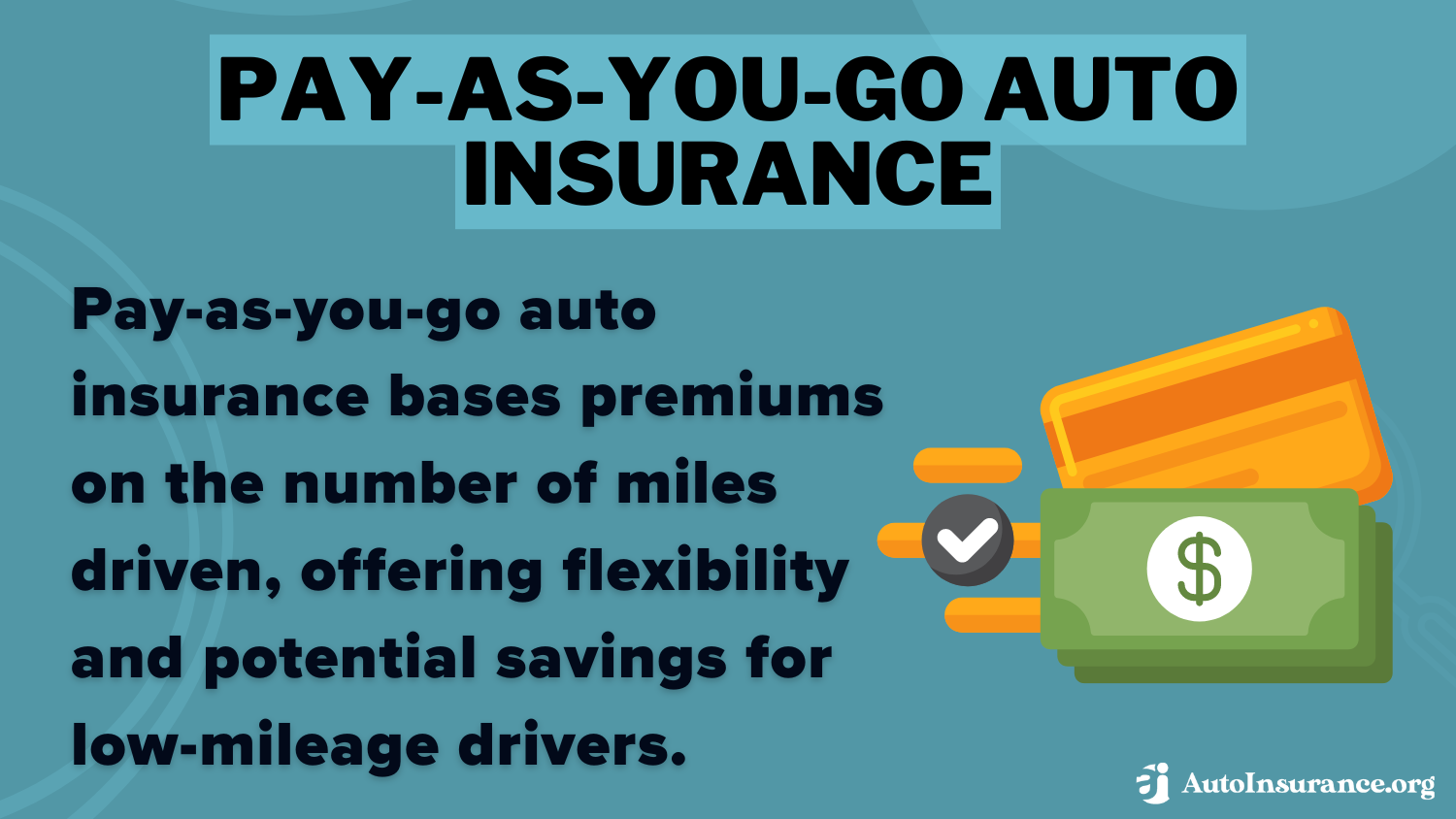

Learn How Colorado Pay-As-You-Go Auto Insurance Works

Understanding how pay-as-you-go or pay-per-mile auto insurance works may seem confusing, but these plans are actually quite simple.

Standard policies and pay-as-you-go auto insurance plans work in almost the same way. For example, you can get pay-per-mile auto insurance with no deposit, just like you usually skip a deposit with a standard policy. The one exception to these similarities is how your rates are calculated.

Pay-per-mile insurance places less significance on traditional factors that affect your premiums, like how many accidents happen in your area.Brandon Frady Licensed Insurance Producer

Pay-by-mile car insurance companies determine how much you’ll pay in two parts. The first is your monthly base fee, which is what you’ll pay even if you don’t drive at all. Then, the company will determine your fee per mile, which is usually a few cents.

The best pay-as-you-go auto insurance companies offer a great way to find affordable insurance for infrequent drivers. However, not everyone will benefit from pay-by-mile auto insurance plans. If you put more than 10,000 miles on your car every year, a standard policy is probably a better option.

Why Colorado Auto Insurance Rates Keep Going Up

While many things influence car insurance prices — including the top seven factors that affect auto insurance rates — it seems like everyone is paying more for coverage these days.

Before we delve into why rates are high, take a look below to see how much the average driver pays in your state.

Colorado Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $230 | $460 |

| 16-Year-Old Male | $250 | $500 |

| 20-Year-Old Female | $180 | $360 |

| 20-Year-Old Male | $200 | $400 |

| 30-Year-Old Female | $140 | $280 |

| 30-Year-Old Male | $150 | $300 |

| 40-Year-Old Female | $130 | $260 |

| 40-Year-Old Male | $135 | $270 |

| 50-Year-Old Female | $120 | $240 |

| 50-Year-Old Male | $125 | $250 |

| 60-Year-Old Female | $115 | $230 |

| 60-Year-Old Male | $120 | $240 |

| 70-Year-Old Female | $120 | $240 |

| 70-Year-Old Male | $125 | $250 |

Insurance rates have been increasing for a variety of reasons. In Colorado, some of the primary culprits are denser traffic, more claims, and a larger population of drivers on the road. There are also personal reasons. For example, if you get temporary car insurance in Colorado and don’t maintain it, you’ll likely pay higher rates later for having a lapse in coverage.

Other factors that affect your rates include your age, driving record, credit score, the car you drive, and even your marital status.Michelle Robbins Licensed Insurance Agent

While rates are high, however, it doesn’t mean you can’t find affordable prices. One way to save on your insurance is to compare rates with multiple companies. Check below to see how much our top pay-as-you-go companies charge on average.

Pay-As-You-Go Insurance in CO: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $74 | $245 | |

| $72 | $240 | |

| $42 | $139 | |

| $41 | $135 |

| $38 | $120 | |

| $48 | $158 |

| $54 | $178 | |

| $45 | $150 |

| $42 | $140 | |

| $35 | $115 |

Rates also vary based on where you live. For example, car insurance from GoAuto is often very affordable but is unavailable in Colorado. Compare the rates below to see what the average driver pays for insurance in some of Colorado’s largest cities.

Colorado Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Aspen | Aurora | Colorado Springs | Denver | Pueblo |

|---|---|---|---|---|---|

| 16-Year-Old Female | $260 | $280 | $270 | $290 | $250 |

| 16-Year-Old Male | $280 | $300 | $290 | $310 | $270 |

| 20-Year-Old Female | $220 | $240 | $230 | $250 | $210 |

| 20-Year-Old Male | $240 | $260 | $250 | $270 | $230 |

| 30-Year-Old Female | $170 | $190 | $180 | $200 | $160 |

| 30-Year-Old Male | $180 | $200 | $190 | $210 | $170 |

| 40-Year-Old Female | $160 | $180 | $170 | $190 | $150 |

| 40-Year-Old Male | $165 | $185 | $175 | $195 | $155 |

| 50-Year-Old Female | $150 | $170 | $160 | $180 | $140 |

| 50-Year-Old Male | $155 | $175 | $165 | $185 | $145 |

| 60-Year-Old Female | $145 | $165 | $155 | $175 | $135 |

| 60-Year-Old Male | $150 | $170 | $160 | $180 | $140 |

| 70-Year-Old Female | $150 | $170 | $160 | $180 | $140 |

| 70-Year-Old Male | $155 | $175 | $165 | $185 | $145 |

As you can see, rates can be high for some drivers in Colorado. For example, it would be easier to find the cheapest SR-22 insurance in Colorado Springs than it would in Denver. However, there are additional steps you can take to get lower rates, especially when you’re a low-mileage driver.

How Pay-As-You-Go Lowers Colorado Auto Insurance Rates

Pay-as-you-go insurance can help you save significantly as long as you’re a low-mileage driver. Low-mileage drivers can see their rates reduced by half or more by switching to a pay-per-mile plan.

🚗Root Auto Insurance tracks your driving habits through an app that you have to “test drive” before they will offer you coverage.😳 Learn more about the company here:https://t.co/v5bvS8dk5J.🖥️ Compare rates from Root and other insurance providers at https://t.co/27f1xf131D. pic.twitter.com/m6iOwOm3O4

— AutoInsurance.org (@AutoInsurance) March 21, 2023

Check the rates below to get an idea of how annual mileage affects your auto insurance rates.

Colorado Auto Insurance Monthly Rates by Age, Gender, & Annual Mileage

| Age & Gender | 6,000 Miles | 10,000 Miles | 12,000 Miles | 15,000 Miles |

|---|---|---|---|---|

| 16-Year-Old Female | $265 | $280 | $290 | $305 |

| 16-Year-Old Male | $285 | $300 | $310 | $325 |

| 20-Year-Old Female | $225 | $240 | $250 | $265 |

| 20-Year-Old Male | $245 | $260 | $270 | $285 |

| 30-Year-Old Female | $175 | $185 | $195 | $205 |

| 30-Year-Old Male | $185 | $195 | $205 | $215 |

| 40-Year-Old Female | $165 | $175 | $180 | $190 |

| 40-Year-Old Male | $170 | $180 | $185 | $195 |

| 50-Year-Old Female | $155 | $160 | $165 | $175 |

| 50-Year-Old Male | $160 | $165 | $170 | $180 |

| 60-Year-Old Female | $150 | $155 | $160 | $170 |

| 60-Year-Old Male | $155 | $160 | $165 | $175 |

| 70-Year-Old Female | $155 | $160 | $165 | $175 |

| 70-Year-Old Male | $160 | $165 | $170 | $180 |

Low-mileage drivers can benefit greatly from signing up for a pay-per-mile auto insurance policy. Most pay-per-mile companies offer a Colorado pay-as-you-drive insurance calculator to help you determine how much you might pay for coverage. If you need help, you can always contact the provider you’re interested in. For example, you can call the Root insurance Company phone number for help with Root rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ways to Get Cheaper Colorado Auto Insurance Quotes

Aside from signing up for pay-per-mile insurance, there are plenty of ways to lower your quotes.

One of the easiest ways to save money on auto insurance is to look for discounts you qualify for.Luke Williams Insurance and Finance Writer

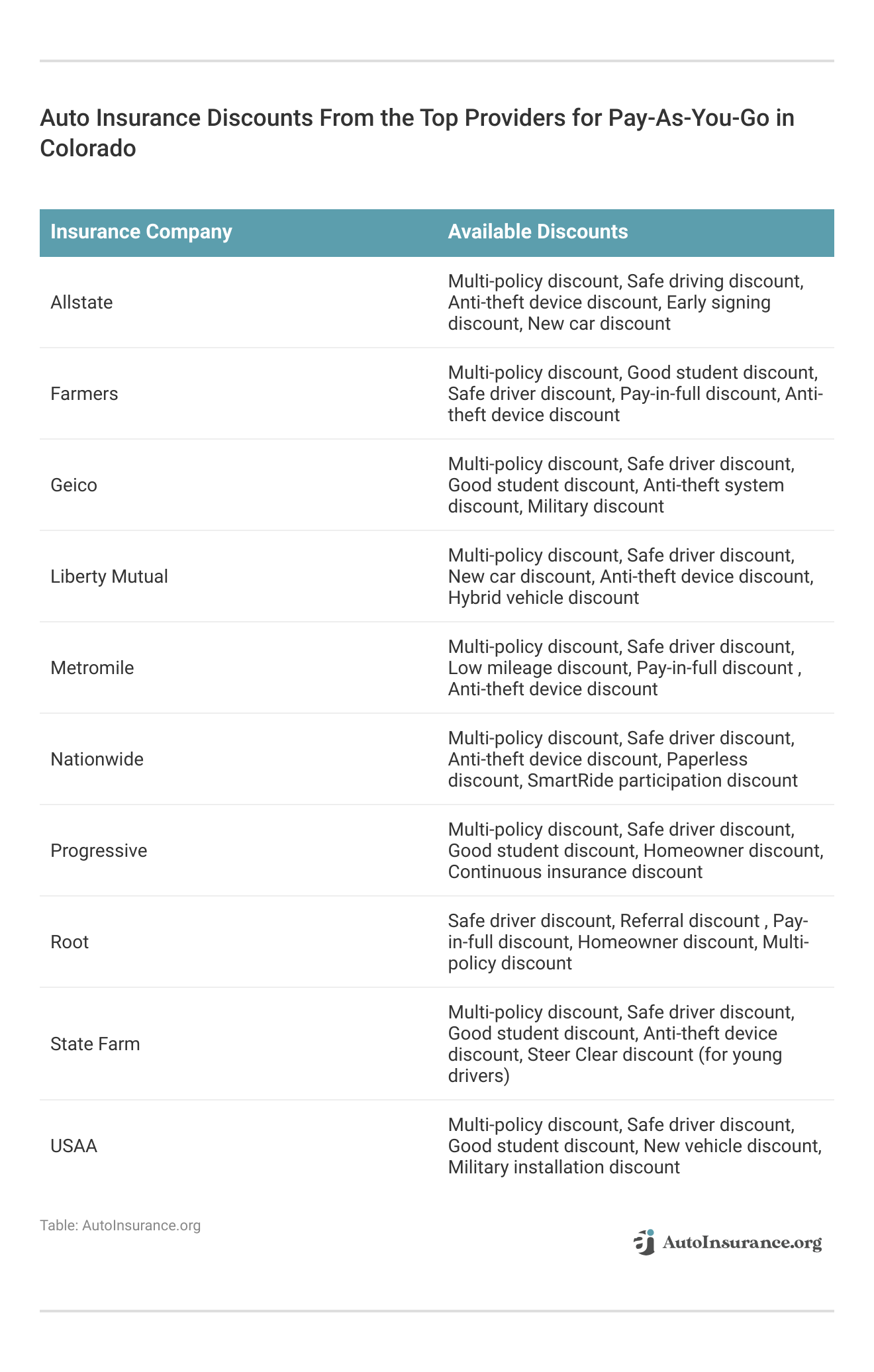

Consider the discounts from our top companies below.

Besides getting a low-mileage auto insurance discount, there are other ways to save. Consider the following methods to save:

- Choose a higher deductible

- Lower your coverage

- Keep your driving record clean

- Improve your credit score

Of course, one of the most important ways to find low rates is to compare quotes. Most major insurance companies offer free quote request forms on their websites.

If you want to save time, use a quote comparison tool to look at multiple rates at once. Choosing this method will help you find affordable coverage quickly.

Get The Best Pay-As-You-Go Auto Insurance in Colorado

Whether you need the cheapest SR-22 insurance in Colorado or a full coverage policy with collision and comprehensive auto insurance, pay-as-you-go auto insurance can help low-mileage drivers save. There are two main ways to get low-mileage savings. First, make sure to compare pay-as-you-go companies like Metromile vs. Root car insurance. Then, compare those rates to traditional providers that offer a UBI discount, like Progressive and Nationwide.

Now that you know which companies offer the best pay-as-you-drive auto insurance in Colorado, your next step should be comparing rates. Enter your ZIP code into our free comparison tool below to compare auto insurance rates in Colorado.

Frequently Asked Questions

Is auto insurance more expensive in Colorado?

Colorado auto insurance is more expensive than in some states but cheaper than others. For example, pay-per-mile in California is a bit more expensive on average than in Colorado. Additionally, rates vary based on the driver. Drivers with at-fault accidents or who want to add Colorado medical payment coverage will pay more than good drivers who want minimum insurance.

What car insurance coverage should I have in Colorado?

For starters, you need to meet Colorado auto insurance requirements before you can drive, which is a 25/50/15 liability plan. Beyond that, the right amount of coverage for you depends on the type of vehicle you drive and your unique insurance needs.

Who has the cheapest pay-as-you-go auto insurance in Colorado?

The cheapest pay-as-you-go auto insurance in Colorado comes from Metromile. When it comes to car insurance, pay-as-you-go rates vary from company to company in the same way standard policies do. You might find cheaper personalized rates elsewhere, so make sure to compare quotes.

You may also find cheaper rates with local companies, like Mile High Insurance. Make sure to compare rates with as many providers as possible to find the best rates for you.

What is the best mileage for cheap pay-as-you-go auto insurance?

When you sign up for a pay-as-you-go insurance plan, it’s best to drive the fewest number of miles possible. In general, pay-as-you-go insurance is a good option for drivers who put 10,000 miles or fewer per year on their car.

How do Colorado pay-as-you-go insurance companies verify mileage?

It depends on the company, but most companies verify your daily mileage through either a tracking device or a mobile app. If you have an issue with your mileage, there are several ways to contact your company. For example, if you’re insured by Root and you think your mileage is incorrect, you can call the Root car insurance phone number or visit the website for help.

Is pay-as-you-go insurance worth it?

Pay-as-you-go insurance can be worth it if you’re a low-mileage driver and you need cheap auto insurance in Colorado. Insurance providers determine rates using a variety of factors, so the best way to tell if pay-as-you-go insurance is right for you is to compare quotes.

Is Metromile pay-as-you-go insurance in Colorado?

Yes, you can purchase a Metromile pay-as-you-go insurance plan in Colorado. Make sure to compare Metromile with both pay-as-you-go companies and providers that offer a UBI discount. For example, a good pair of providers to look at is Metromile vs. Geico, because both offer low rates. To see other pay-per-mile options in Colorado, enter your ZIP code into our free comparison tool today.

Is Progressive pay-as-you-go insurance available in Colorado?

Progressive doesn’t offer a true pay-as-you-go plan. Instead, it offers cheap usage-based auto insurance through Snapshot, which rewards low-mileage drivers with a discount.

What is the penalty for not having car insurance in Colorado?

Driving without insurance in Colorado is considered a class 1 misdemeanor. The maximum penalty for driving without insurance is a fine of at least $1,000, an eight-month license suspension, a year in jail, 40 hours of community service, and four points on your license.

However, you’ll likely see your sentence greatly reduced if you quickly rectify not having insurance.

Do I need uninsured motorist coverage in Colorado?

Uninsured motorist coverage is not required in Colorado. However, uninsured motorist coverage is one of several types of auto insurance that experts recommend for the best protection.

What is the best car insurance for seniors in Colorado?

The best auto insurance for seniors depends on the driver. However, our top picks for the best car insurance in Colorado for seniors are AARP, Geico, and State Farm.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.