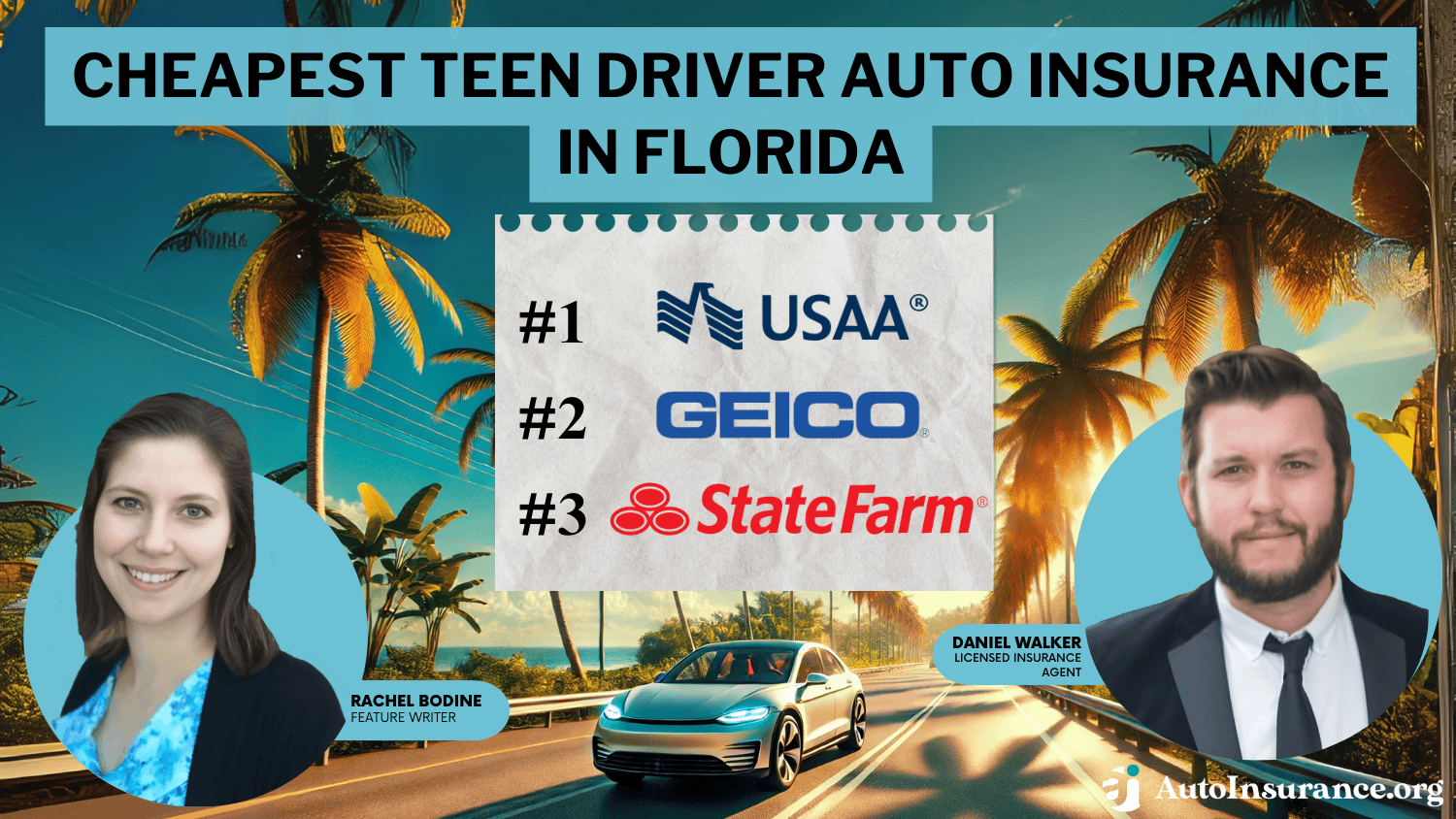

Cheapest Teen Driver Auto Insurance in Florida in 2025 (Top 10 Companies)

USAA, Geico, and State Farm have the cheapest teen driver auto insurance in Florida, with rates starting at $103 per month. USAA offers the best teen driver insurance, while Geico has the cheapest full coverage rates in Florida. For families seeking cheap teen car insurance after an accident, State Farm is a great option.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: May 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for Teens in Florida

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Teens in Florida

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Teens in Florida

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsUSAA, Geico, and State Farm have the cheapest teen driver auto insurance in Florida, with rates starting at $88 per month.

While Florida auto insurance for teens is expensive, these companies offer the cheapest car insurance for teens on the market.

Young drivers in Florida often combine good student auto insurance discounts with safe driving programs, potentially saving a lot.

Our Top 10 Company Picks: Cheapest Teen Driver Auto Insurance in Florida

| Company | Rank | A.M. Best | Monthly Rates | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | $88 | Military Drivers | USAA | |

| #2 | A++ | $113 | Online Convenience | Geico | |

| #3 | A++ | $158 | Customer Service | State Farm | |

| #4 | A+ | $198 | Vanishing Deductible | Nationwide | |

| #5 | A | $243 | Safe-Driving Discounts | Liberty Mutual |

| #6 | A+ | $256 | UBI Discount | Progressive | |

| #7 | A+ | $315 | Customized Policies | Allstate | |

| #8 | A | $339 | Claims Service | American Family |

| #9 | A | $523 | Group Discounts | Farmers | |

| #10 | A++ | $632 | Discount Options | Travelers |

If you are ready to find quotes for the best auto insurance for young drivers in Florida, use our free quote tool.

- USAA leads with the cheapest teen car insurance in Florida

- Geico and State Farm follow closely with more teen insurance options

- Joining a parent’s policy is often the cheapest option for teens

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – USAA: Top Overall Pick

Pros

- Military Drivers: USAA offers cheap auto insurance for teenagers from military families starting at $88 a month, including discounts on shopping and traveling.

- Customer Satisfaction: USAA has high customer satisfaction ratings, which you can learn about in our USAA auto insurance review.

- Extensive Coverage: It offers a range of coverage options for teens from military families, such as deployment coverage, military vehicle storage, or travel assistance coverage.

Cons

- Military and Veterans Only: Non-military and non-veteran teen drivers won’t be able to qualify for USAA auto insurance.

- Fewer Physical Locations: USAA doesn’t have many locations for teens to get in-person assistance, relying primarily on virtual communication.

#2 – Geico: Best for Online Convenience

Pros

- Online Convenience: Geico’s website and app provide online convenience for teenagers looking to check their policy or make changes.

- Good Student Discount: Geico offers up to a 15% discount for teen students with a B+ average or higher, as well as several other discounts you can find in our Geico auto insurance review.

- Availability: Geico auto insurance is available countrywide.

Cons

- Few Local Agents: Geico doesn’t offer as many local agents, limiting most communication to virtual.

- Customer Satisfaction: Geico’s J.D. Power ratings are just average.

#3 – State Farm: Best for Customer Service

Pros

- Customer Service: Its local agents are generally easy to find, no matter where you live, so the company has great customer service rankings, which you can learn about in our State Farm auto insurance review.

- Good Student Discount: State Farm offers up to a 25% discount for teen students with a B+ average or higher.

- UBI Program: Teen drivers can earn discounts of up to 30% for safe driving with the Drive Safe & Save UBI program (Learn more: State Farm Drive Safe & Save Review).

Cons

- No Online Purchases: Teen drivers will need to contact a State Farm agent to purchase auto insurance, as it can’t be done online.

- High-Risk Drivers Pay More: Teens with a DUI or other serious driving record incidents may not find the cheapest rate with this company.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Vanishing Deductible

Pros

- Deductible Options: Nationwide’s vanishing deductible program helps teen drivers earn up to $100 off their insurance deductible for every year of safe driving.

- Financial Stability: Nationwide has high financial stability ratings, which you can read more about in our review of Nationwide auto insurance.

- UBI Program: Teens can save with Nationwide’s SmartRide program. Learn more in our Nationwide SmartRide review).

Cons

- Not Sold in All States: Nationwide is widely available, but is still not yet sold in three states.

- No Rideshare Insurance: Teen drivers who want to drive for Uber or Lyft will need to get rideshare insurance elsewhere.

#5 – Liberty Mutual: Best for Safe-Driving Discounts

Pros

- Safe Driving Discounts: Liberty Mutual offers discounts for safe driving, which you can learn more about in our review of Liberty Mutual auto insurance.

- Availability: Liberty Mutual auto insurance is available to teenagers in every US state.

- Add-On Coverages: Liberty Mutual has gap insurance, roadside assistance, and more.

Cons

- Customer Satisfaction: Liberty Mutual has just average ratings for customer satisfaction with customer service and claims handling.

- High Rates for Some Drivers: Liberty Mutual’s rates are best for teen drivers with clean driving records. Other teen drivers may need to shop elsewhere for savings.

#6 – Progressive: Best for UBI Discount

Pros

- UBI Discount: Progressive’s UBI program offers savings of up to 30% for teen drivers. Learn more in our Progressive Snapshot review.

- Budget Tool: Teens can use Progressive’s Name Your Price tool to see how much coverage they can afford.

- Add-On Coverages: Progressive has roadside assistance, loan/lease payoff, and more. Read about its coverage in our Progressive auto insurance review.

Cons

- UBI Can Raise Rates: Progressive may raise car insurance rates for teens if you score poorly on its UBI program.

- Customer Service: Progressive has average ratings from J.D. Power for customer satisfaction.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Allstate: Best for Customized Policies

Pros

- Customized Policies: Allstate offers a variety of coverage options for teen drivers, such as accident forgiveness, vanishing deductibles, and roadside assistance. Learn more in our Allstate auto insurance review.

- Accident Forgiveness: Allstate provides an accident forgiveness program for teen drivers.

- Bundling Discount: Teens who have moved out and are renting can get a bundling discount of up to 20% if they purchase renters and auto insurance.

Cons

- DUI Drivers Charged Higher Rates: Allstate is not one of the cheapest companies for teen drivers with a DUI.

- Customer Reviews Vary: Allstate’s J.D. Power ratings vary from year to year, with Allstate scoring slightly below average on a few occasions for customer satisfaction.

#8 – American Family: Best for Claims Service

Pros

- Claims Service: According to our American Family auto insurance review, the company has good ratings for customer service.

- UBI Program: American Family KnowYourDrive program offers savings of up to 20% for teen drivers who demonstrate safe driving habits.

- Coverage Options: American Family has roadside assistance, rideshare insurance, and more.

Cons

- Availability: American Family is sold in less than half of the U.S. states.

- Rate Competitiveness: American Family’s rates are not always as competitive as larger companies’ rates.

#9 – Farmers: Best for Group Discounts

Pros

- Group Discounts: Farmers offer group discounts of up to 20% for different occupations or associations.

- Availability: Farmers’ auto insurance can be purchased in any US state.

- Diminishing Deductible: Your deductible decreases by $50 every year you maintain a clean driving record without any accidents or claims. Learn more in our Farmers auto insurance review.

Cons

- Higher Rates for High-Risk Drivers: Those with poor driving records may not find the cheapest teen car insurance at Farmers.

- Customer Satisfaction: Farmers has average customer reviews for claims handling and customer satisfaction.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Discount Options

Pros

- Multiple Discount Options: Travelers’ IntelliDrive program can help teens earn savings of up to 30%. If you maintain a clean driving record, you can also qualify for a safe driver discount of up to 23%.

- New Car Replacement: If a teen driver’s new car is totaled within the first five years, it will be replaced with a brand-new model of the same make and model.

- Accident Forgiveness: Accident forgiveness can help keep rates low for safe teen drivers. Read our review of Travelers auto insurance for more info.

Cons

- Availability: Travelers’ auto insurance is not yet sold in all 50 states.

- Customer Satisfaction: J.D. Power has only given Travelers average ratings for claims satisfaction.

Comparing Teen Driver Auto Insurance Costs in Florida

How much is car insurance for a minor? When you shop among Florida’s cheapest insurance for teens, you will see rate differences depending on your coverage choice.

Below, you can see how much a teen car insurance policy costs by age and gender.

Teen Auto Insurance Monthly Rates in Florida by Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $287 | $1,001 |

| 16-Year-Old Male | $334 | $747 |

| 17-Year-Old Female | $243 | $840 |

| 17-Year-Old Male | $257 | $679 |

| 18-Year-Old Female | $222 | $616 |

| 18-Year-Old Male | $286 | $2,090 |

| 19-Year-Old Female | $321 | $790 |

| 19-Year-Old Male | $286 | $720 |

In general, male drivers pay more on average than female drivers. For those wondering, “Can a 17-year-old get car insurance?” Yes, they can, though they may need a parent or guardian as a co-signer.

While minimum coverage typically offers the cheapest insurance in Florida for young drivers, it only protects against damage to others’ property. For those wondering, “What is the best auto insurance for teenage drivers?” consider that full coverage provides more comprehensive protection.

Florida teens should carry full coverage if it fits their budget, as it covers damages and injuries from collisions, weather, and more.Dani Best Licensed Insurance Producer

Full coverage is optional in Florida, but it covers more situations than minimum coverage.

USAA stands out as the most affordable option for teen drivers looking for auto insurance in Florida. However, USAA is available exclusively to military families.

Teens of military families can get minimum coverage starting at just $88 a month and full coverage at $233 per month.

Florida Teen Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $315 | $831 | |

| $339 | $894 | |

| $523 | $1,379 | |

| $113 | $298 | |

| $243 | $640 |

| $198 | $522 |

| $256 | $673 | |

| $158 | $416 | |

| $632 | $1,668 | |

| $88 | $233 |

Travelers is the most expensive insurer for teenagers, with rates reaching up to $632 per month for minimum coverage and $1,668 per month for full coverage.

Florida Minimum Car Insurance Requirements

In addition, to legally operate a vehicle, drivers in Florida must carry:

- $10,000 in Personal Injury Protection (PIP): Covers 80% of medical expenses and 60% of lost wages for the policyholder and passengers, regardless of fault.

- $10,000 in Property Damage Liability (PDL): Pays for damage you cause to another person’s property.

Failure to comply with Florida minimum coverage requirements can result in penalties, including suspension of your driver’s license and vehicle registration.

Tips for Florida Teens to Get the Cheapest Auto Insurance

As a teen driver in Florida, auto insurance can be expensive. However, there are several ways that can help reduce premiums:

- Stay on a Parent’s Policy: Insuring a teen on a parent’s policy is generally much cheaper than purchasing an individual policy for them.

- Get Good Grades: If a teen maintains a B average or higher, they may be eligible for a Good Student Discount, which can reduce rates by up to 25%.

- Take Driver’s Ed: Many insurers offer discounts to teens who have successfully finished a certified driver’s ed program.

- Pick a Safe Car: Choose a vehicle with a good safety rating and a lower likelihood of being involved in an accident.

In addition, to make auto insurance for teenagers more affordable, explore discounts offered by various providers, like Allstate’s student driver insurance discount. See the table below:

Auto Insurance Discounts for Florida Teens From Top Providers

| Insurance Company | Anti-Theft | Bundling | Good Driver | Good Student | Safe Driver |

|---|---|---|---|---|---|

| 10% | 25% | 25% | 22% | 18% | |

| 25% | 25% | 25% | 20% | 18% | |

| 10% | 20% | 30% | 15% | 20% | |

| 25% | 25% | 26% | 15% | 15% | |

| 35% | 25% | 20% | 12% | 20% |

| 5% | 20% | 40% | 18% | 12% |

| 25% | 10% | 30% | 10% | 10% | |

| 15% | 17% | 25% | 35% | 20% | |

| 15% | 13% | 10% | 8% | 17% | |

| 15% | 10% | 30% | 10% | 10% |

The cheapest car insurance in Florida for young drivers often comes with special programs for new drivers. Auto insurance discounts in Florida range from good student to multi-car discounts.

Read More: Auto Insurance Companies Pulling Out of Florida

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Affecting Teen Driver Auto Insurance Costs in Florida

The cost of car insurance for teenage drivers in Florida will vary based on the teen’s driving record. Accidents, DUIs, and tickets will raise teens’ rates by hundreds of dollars on average, making it harder to find cheap Florida auto insurance for insuring a teen driver.

Florida Teen Minimum Coverage Auto Insurance Monthly Rates by Driving Record

| Age & Gender | One Ticket | One Accident | One DUI |

|---|---|---|---|

| 16-Year-Old Female | $245 | $275 | $420 |

| 16-Year-Old Male | $285 | $320 | $489 |

| 17-Year-Old Female | $220 | $245 | $385 |

| 17-Year-Old Male | $255 | $290 | $445 |

| 18-Year-Old Female | $190 | $215 | $350 |

| 18-Year-Old Male | $225 | $260 | $410 |

| 19-Year-Old Female | $175 | $195 | $320 |

| 19-Year-Old Male | $205 | $230 | $370 |

Rates will also vary based on where you are located in Florida. The table below shows Miami’s dense traffic and high accident rates make it one of the most expensive cities for teen drivers insurance.

Florida Teen Minimum Coverage Auto Insurance Monthly Rates by City

| Age & Gender | Fort Lauderdale | Jacksonville | Miami | Orlando | Tampa |

|---|---|---|---|---|---|

| 16-Year-Old Female | $300 | $270 | $330 | $290 | $300 |

| 16-Year-Old Male | $345 | $310 | $375 | $330 | $340 |

| 17-Year-Old Female | $275 | $245 | $305 | $270 | $280 |

| 17-Year-Old Male | $315 | $280 | $350 | $310 | $320 |

| 18-Year-Old Female | $250 | $225 | $280 | $250 | $260 |

| 18-Year-Old Male | $290 | $260 | $330 | $290 | $300 |

| 19-Year-Old Female | $230 | $205 | $255 | $225 | $235 |

| 19-Year-Old Male | $265 | $240 | $305 | $270 | $280 |

Remember that the cheapest insurance for young drivers isn’t always the best option, make sure to balance cost with adequate coverage protection. Parents and teens should carefully evaluate coverage options while considering their specific needs and risk factors.

Learn more: Cheap Auto Insurance for Teens After an Accident

Adding Your Teen Driver to Florida Auto Insurance

If you want affordable auto insurance for teens in Florida, the best option is to add teen drivers to a family policy rather than have teens purchase their own. Parents searching for cheap car insurance for teenage drivers often find that family policies offer significant savings compared to separate policies.

Florida Teen Minimum Coverage Auto Insurance Monthly Rates for Individual vs. Family Plan

| Age & Gender | Teen Only | Teen on Parent’s Policy |

|---|---|---|

| Age: 16 Female | $245 | $120 |

| Age: 16 Male | $285 | $145 |

| Age: 17 Female | $220 | $105 |

| Age: 17 Male | $255 | $130 |

| Age: 18 Female | $190 | $90 |

| Age: 18 Male | $225 | $110 |

| Age: 19 Female | $175 | $80 |

| Age: 19 Male | $205 | $100 |

Parents can keep teen drivers on their insurance for as long as they still reside with them. Find the best auto insurance for families.

Insurers offer great discounts when more than one vehicle is covered under the same policy. Expect to save anywhere from 10% to 20%.Jeff Root Licensed Insurance Agent

When choosing the best car insurance for teen drivers, consider factors like driver education programs, academic performance discounts, and safe vehicle choices that can help reduce premium costs. Auto insurance for minors typically costs more, but combining policies with experienced drivers can lead to substantial savings.

Find the Most Affordable Car Insurance for Teenage Drivers in Florida

When shopping for the cheapest teen driver auto insurance in Florida, consider the companies’ rates, coverages, and discounts. Learn how to find low-income car insurance in Florida.

The best auto insurance companies in Florida will have reasonable rates and offer opportunities for teens to save on insurance with top car insurance discounts in Florida. Ready to shop for cheap insurance for teens. Use our free quote tool to find teen car insurance quotes in Florida.

Frequently Asked Questions

What are the minimum auto insurance requirements in Florida?

Florida minimum auto insurance coverage requirements include:

- Personal Injury Protection (PIP): $10,000

- Property Damage Liability (PDL): $10,000

How much is auto insurance for a minor in Florida?

The minimum coverage for a 16-year-old driver in Florida is an average of $232 per month. However, you can get the cheapest auto insurance rates in Florida by shopping around. Finding cheap car insurance for teens requires comparing multiple providers to get the best rates.

What is the cheapest full coverage insurance for new drivers in Florida?

Allstate has the cheapest full coverage car insurance in Florida for teen drivers, offering competitive teenage car insurance rates.

What is the best auto insurance for first-time drivers in Florida?

The best auto insurance in Florida for new drivers is full coverage, as it covers a wide range of accident claims.

Is Geico or Progressive cheaper for teen driver auto insurance in Florida?

On average, Progressive has the cheapest insurance for teenage drivers in Florida compared to Geico. Geico teenage driver insurance costs $113 a month, while Progressive charges $256 a month.

Compare cheap car insurance in Florida for young drivers using our free quote tool.

Can a 16-year-old get their own auto insurance in Florida?

Yes, teenagers can get their own auto insurance policy, but car insurance for minors is typically the cheapest when added to a parent’s policy.

Do I need to add my 15-year-old to my car insurance?

A 15-year-old with a learner’s permit does not need a separate policy. However, they should be covered under their parents’ or guardians’ auto insurance policy.

How much is teen driver auto insurance for a 17-year-old in Florida?

The average cost of minimum coverage for 17-year-olds in Florida is $210 per month. It is best to join a parent’s policy to get cheap auto insurance for 17-year-olds in Florida.

How much is auto insurance in Florida for a 16-year-old?

Teenage car insurance average cost per month for minimum coverage in Florida is $232 per month.

What is the cheapest Florida insurance for an 18-year-old?

Allstate’s teenage car insurance has the cheapest auto insurance for 18-year-olds.

At what age does your car insurance go down in Florida?

When insuring teen drivers, rates often stay high until drivers turn 20. Then, the best Florida auto insurance rates will start dropping if drivers keep a clean driving record. You can learn more about this in our article on auto insurance for drivers under 25.

Can a 17-year-old drive with passengers in Florida?

Permit holders can’t drive alone and will have passenger restrictions, although 17-year-olds with a full license won’t have passenger restrictions (Read more: Can you drive alone with a permit?).

How much does it cost to add a permit driver to insurance in Florida?

The cost of adding a driver to car insurance depends on the insurance company. Some insurance companies won’t increase rates until the driver has their full license. Find out how you can help teen drivers get their first licenses.

How can I save on my teen driver’s auto insurance in Florida?

To save on auto insurance for teenagers, shop with companies offering the cheapest teen rates.

What is the cheapest way to get car insurance for a teenager?

The best way to get cheap car insurance for young drivers in Florida is to stay on their parents’ policy. Most insurers offer discounts for adding a teen driver.

What is the cheapest car to insure for a 17-year-old?

The most affordable auto insurance for teenagers in Florida typically comes with Honda Civic, Toyota Corolla, and Mazda 3 models, averaging 20-30% lower rates than other vehicles.

Which insurers offer cheap car insurance in Florida with a low down payment?

Some insurers that offer cheap car insurance in Florida with low down payment options are: Geico, Progressive, Mercury, and DirectAuto.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.