Cheap Online-Only Auto Insurance in 2025 (Secure Low Rates With These 10 Companies!)

State Farm, AAA, and Progressive are going to be the top three choices for cheap online-only auto insurance, with rates starting at $52/month for minimum coverage. Online-only auto insurance lets you purchase a policy via the internet, with companies only requiring a few details before rates are provided.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Mar 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Online Auto Insurance

A.M. Best

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for Online Auto Insurance

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews

Company Facts

Min. Coverage for Online Auto Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

When looking for cheap online-only auto insurance, State Farm, AAA, and Progressive are the top three choices, with rates beginning around $32/month for minimum coverage. Online-only auto insurance is an instant auto insurance option for those who want insurance immediately.

A few years ago, buying a policy required you to call a company over the phone or visit an insurance agent’s office in your area. Today, you can instantly buy cheap auto insurance online by entering some basic information.

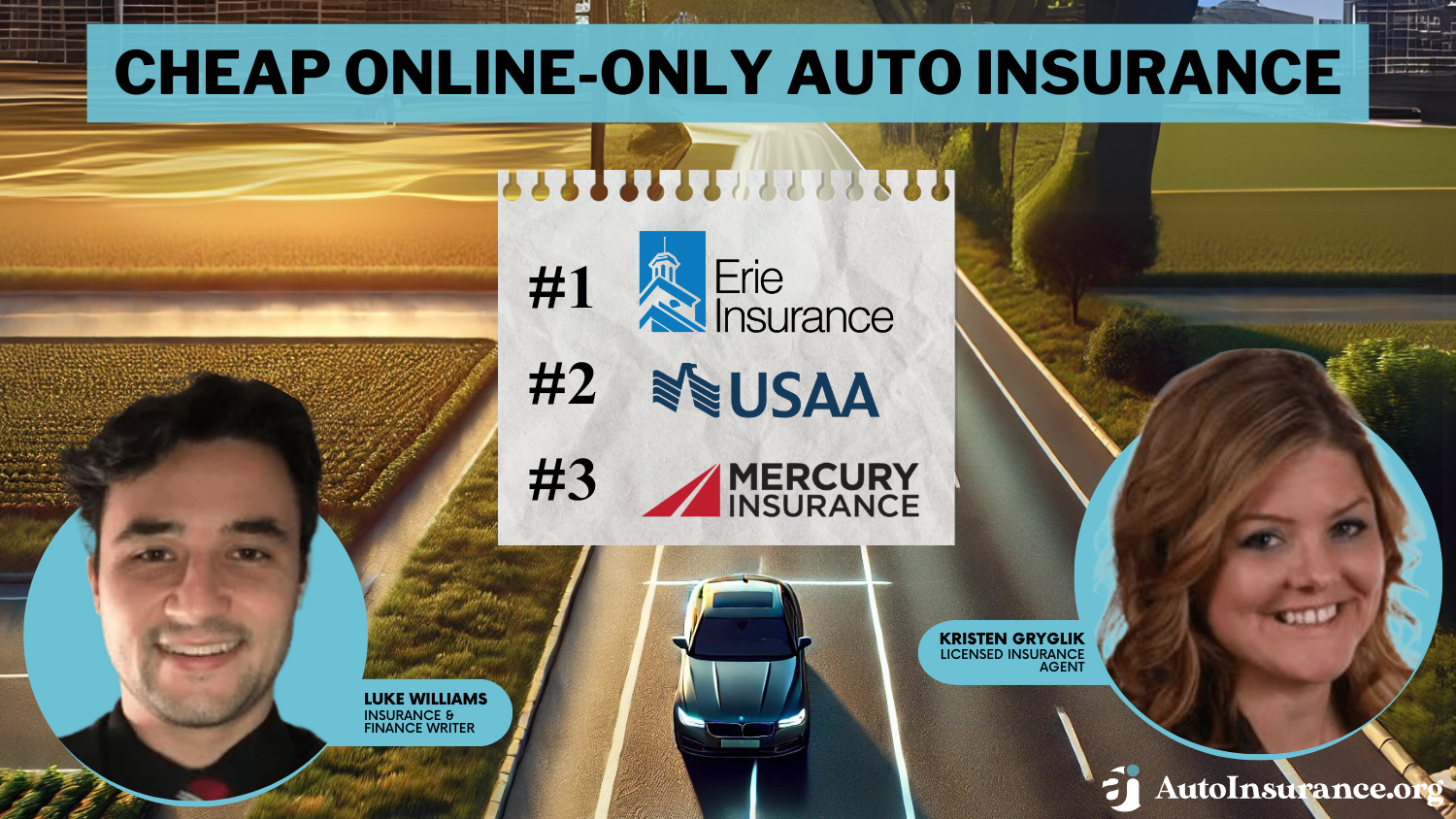

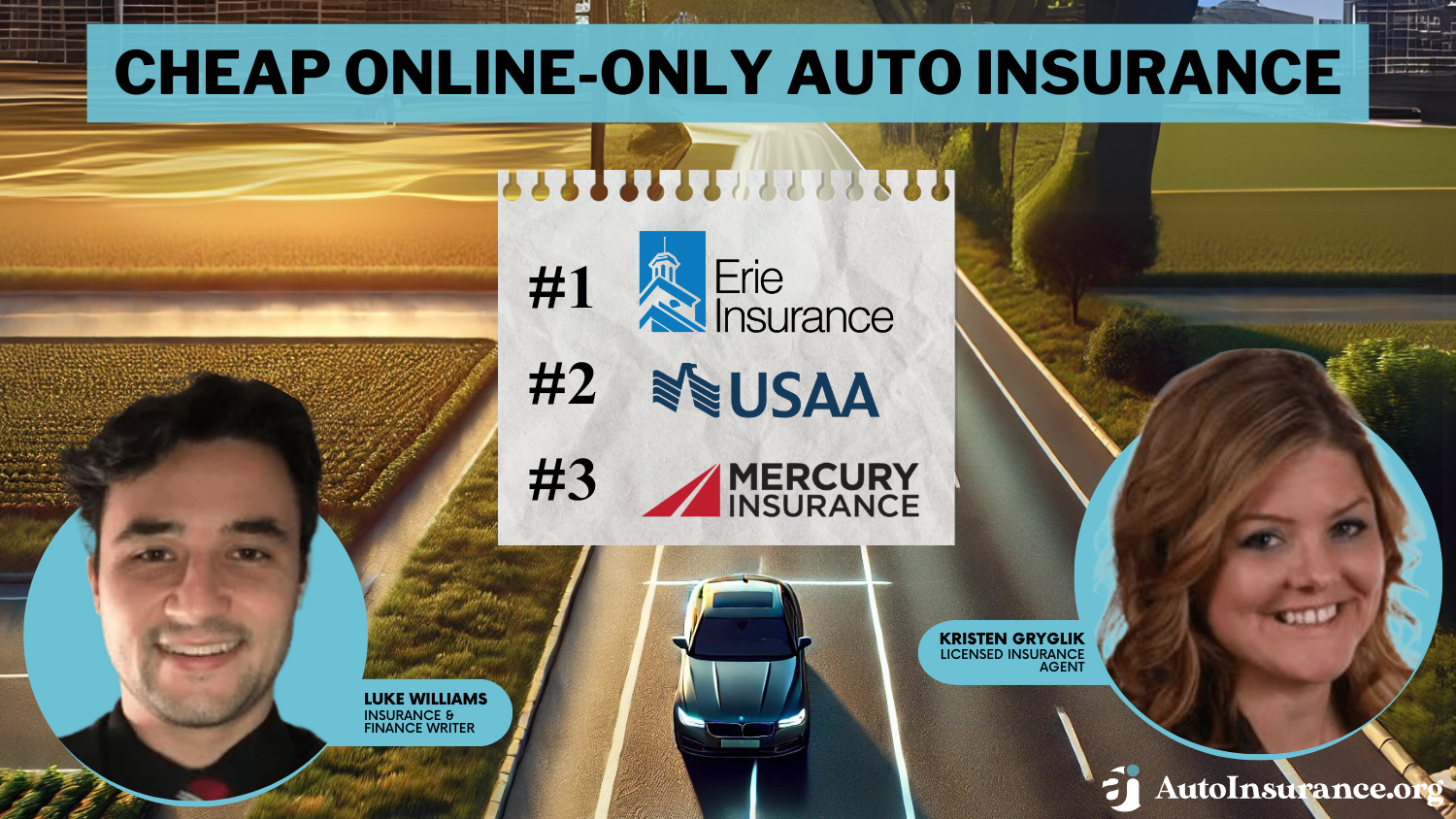

Our Top 10 Company Picks: Cheap Online-Only Auto Insurance

Company Rank Monthly Rates Safe Driver Discount Best For Jump to Pros/Cons

#1 $32 10% 24/7 Support Erie

#2 $34 18% Military Savings USAA

#3 $42 10% Customizable Polices Mercury

#4 $43 17% Cheap Rates Geico

#5 $47 13% Many Discounts State Farm

#6 $53 15% Accident Forgiveness Travelers

#7 $56 15% Online Convenience Progressive

#8 $63 15% Usage Discount Nationwide

#9 $65 10% Local Agents AAA

#10 $76 15% Local Agents Farmers

Most companies will have multiple options, but the choice to have an online-only experience is one that many people prefer. Explore your auto insurance options by entering your ZIP code into our free comparison tool above today.

- Online-only auto insurance lets you buy a policy over the internet

- Computer logic lets a company price a car insurance policy instantly

- Online-only car insurance allows a company to reduce overhead

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Bundling Available: You can bundle a wide variety of coverage with your auto insurance, including farm and motorcycle coverage. Learn more with our State Farm auto insurance review.

- Drive Safe & Save: This program is usage-based, and provides drivers who practice safe habits a discount on coverage, up to 50% off in some cases.

- Steer Clear App: This is a program offered to drivers under 25-years-old and will provide a discount based on habits, as well as teaches young drivers the rules of the road.

Cons

- Missing Gap Coverage: Guaranteed asset protection saves you from paying off any amount still owed on a vehicle after it’s in an accident.

- No New Vehicle Replacement: This coverage provides a vehicle if you lose yours form an accident, but isn’t offered by State Farm.

#2 – AAA: Cheapest with Membership

Pros

- Roadside Assistance: Most famously associated with this coverage, AAA offers this with all policies.

- Financial Strength: AAA currently has an A+ rating with A.M. Best.

- Membership Perks: If drivers are AAA members they can access various perks. Learn more with our AAA auto insurance review.

Cons

- Claim Handling: Claim satisfaction is low.

- Availability: AAA auto insurance is not offered in all states.

#3 – Progressive: Cheapest High-Risk Coverage

Pros

- Progressive App: Drivers can report claims, access insurance cards, and request roadside assistance right through the app.

- Affordable High-Risk Coverage: If you have been labeled as a high-risk driver, you’ll still be able to find cheaper than average rates. Learn more with our Progressive auto insurance review.

- Discount Options: You can get discounts for e-signing your documents, having continuous coverage, and by bundling your insurance.

Cons

- Snapshot: Progressive’s reward program, but it may increase your rates if your driving habits aren’t the greatest.

- Customer Service: Claims from drivers state that satisfaction with much of the customer service provided.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Erie: Cheapest Additional Coverage

Pros

- Discount Opportunities: You can get a discount on auto insurance for vehicle safety features, having coverage bundled, and purchasing an annual policy.

- Erie Auto Plus: This add-on allows drivers to get additional coverage such as maximized coverage limits and diminishing deductibles. Learn more with our Erie auto insurance review.

- Accident Forgiveness: If you go three years without an accident, your rates will not increase after your first accident.

Cons

- Availability: Erie auto insurance is not offered in most states.

- Customer Satisfaction: Drivers have reportedly complained about the offered customer service.

#5 – Farmers: Cheapest Sign-On

Pros

- Farmers App: By using the app, drivers can get quotes and report claims easily.

- Farmers Signal: Safe drivers will get 5% for signing up and then an additional 15% depending on driving habits.

- Claim Process: The level of satisfaction with the claim process is higher than average. Learn more with our Farmers auto insurance review.

Cons

- Availability: Auto insurance isn’t available in every state.

- Expensive Policies: Drivers will pay more than average for auto insurance.

#6 – Geico: Cheapest with Discounts

Pros

- Discounts: There are over a dozen ways to save money including being accident free, being a federal employee, or being a good driver. You can learn more with our Geico auto insurance review.

- Rates for Safe Drivers: Clean record drivers will see rates start around $80/month for minimum coverage.

- Bundling Options: You can also get motorcycle, homeowner, renter, landlord, flood, life, travel, business, and commercial auto insurance.

Cons

- Lack of Policy Options: Many drivers have reported a lack of satisfaction with customizing their policies.

- High Risk, High Rates: Drivers who have DUIs will be paying more than the average.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Cheapest for Long-Distance Drivers

Pros

- High Rank with A.M. Best: Travelers has an A++ rating, based off excellent customer service and financial ratings.

- Rental Car Insurance: This is important for drivers who travel often. Travelers has multiple add-ons available. Learn more with our Travelers auto insurance review.

- At-Fault Rates: Drivers with tickets or at-fault accidents on record will still be able to get affordable coverage, with rates being less than the national average.

Cons

- InteillDrive Program: Usage based program that will end up raising your rates if your driving habits aren’t safe enough.

- No SR-22 Coverage: Sometimes high-risk drivers need extra coverage, which will not be available with Travelers.

#8 – USAA: Cheapest for Military

Pros

- SafePilot: Drivers will be able to save up to 30% on auto insurance based off their driving habits. Learn more with our USAA auto insurance review.

- Affordable Military Insurance: USAA provides auto insurance for military members, veterans, and their families.

- 24/7 Customer Support: There is always a way to get assistance via the website, app, or over the phone.

Cons

- No Gap Coverage: This add-on helps you pay off a loan that exists on your car should it get totaled in an accident.

- Availability: USAA is only available to military, veterans, and their family.

#9 – Liberty Mutual: Cheapest for Older Drivers

Pros

- RightTrack Program: You can save up to 30% on your auto insurance based on your driving habits. You can learn more with our Liberty Mutual auto insurance review.

- Lifetime Replacement Guarantee: Repairs done at an approved shop will get a lifetime guarantee.

- Gap Coverage: Provides the difference between what you owe on your vehicle and what it’s worth should you get into an accident where it’s totaled.

Cons

- Claim Satisfaction: Drivers have reported being unhappy with the way claims are handled and paid out.

- Teen Drivers Pay More: Younger drivers will pay more than the national average.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Nationwide: Best for UBI

Pros

- SmartMiles: Usage-based that can help drivers save 18% off auto insurance based on monthly mileage.

- Financial Stability: Has a superior rating with A.M. Best.

- Coverage Options: Drivers can get gap coverage, rental car coverage, or medical payment coverage.

Cons

- Availability: Auto insurance with Nationwide is not offered in every state.

- Claim Process: Drivers have reported claim handling takes too long.

Purchasing an Online Auto Insurance Policy

Online-only car insurance is different from traditional car insurance when it comes to the application process, but it’s the same when it comes to coverage.

An online auto insurance purchase doesn’t require speaking to agents over the phone or in person at all. Car insurance companies have set up a system which they can use to assess your risk as a driver and provide instant online auto insurance quotes.

Online-Only Insurance: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$65 $122

$32 $83

$76 $198

$43 $114

$96 $248

$63 $164

$56 $150

$47 $123

$53 $141

$34 $84

These quotes will provide rates based off full coverage auto insurance or minimum amounts of coverage you can then use to determine what you would like included with your policy. The good news is that just about everyone can get online-only car insurance.

Information Required to Purchase Auto Insurance Online

With an online-only car insurance policy, you’re going to be answering a variety of questions as you proceed from one screen to the next on the company’s website.

These are the steps in the process:

- Provide Driver and Car Details: These details will be the major factors that will determine your car insurance rates and can include location, age, and type of vehicle you drive.

- Select Coverage Options: Most states have a certain amount of coverage that is mandatory for drivers, but it might be in your best interest to add additional coverages, like collision and comprehensive.

- Request Discount Information: Discounts can really reduce your auto insurance rates, but not all companies offer the same discounts. You’ll need to let companies know which discounts you qualify to have added onto your policy.

- Choose Company: You can complete the process all online and get your proof of insurance right away.

Providing all of this information will allow the company to put you through their modeling system and provide you with a rate. This allows you to instantly buy auto insurance online.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Finding Cheap Insurance Online

When online auto insurance became a thing, the biggest companies made sure that online-only car insurance quotes were available to potential customers faster. In this case State Farm, AAA, and Progressive are going to be the top three choices for cheap online insurance policies.

Always make sure you're providing accurate, up-to-date information when buying auto insurance online so that you're given precise rates.Michelle Robbins Licensed Insurance Agent

There are quite a few different factors that affect auto insurance rates. By giving accurate information, you’ll be able to find the best online auto insurance, thus removing any need to call the company or visit a physical store.

How to Use Auto Insurance Companies Online

You are able to buy auto insurance online instantly with companies that offer this option. In most cases, once you decide on the car insurance company you want, the process doesn’t take very long. From the company home page, you’re directed to enter a few pieces of information, such as your ZIP code and the type of coverage you want. This is because there are minimum auto insurance requirements by state, so your coverage is going to be based off where you live.

From there you’re directed to answer questions and enter personal information, which results in an online auto quote. As stated above, it’s important to provide concise information in order to receive the best rates.

What to Expect When You Purchase Online Auto Insurance

Everything is going to be handled online from a policy servicing perspective. This means that most companies will have not just a website, but an app as well. This allows drivers to have access to their coverage details on the road. With auto insurance company apps, you will typically be able to access your policy, download a digital copy of your insurance card, and even file a claim.

We’re all about the bundles! 🙌 https://t.co/D2gZ2KJVMa

— Progressive (@progressive) July 29, 2023

The best auto insurance apps will allow you to do a wide variety of things. You can also do simpler things such as changing your billing information, setting up automatic payments for the rate you’re charged monthly, etc. All of this policy servicing done in the online arena makes things that much faster and simpler.

Why Insurance Companies Prefer Online Only Auto Insurance

Insurance companies make the online move in order to reduce overhead. Overhead is the cost of running a business and can include building maintenance and utilities. This can cut into profit, which is something that all companies make a priority in order to remain in business.

Find an auto insurance company that is able to pay out for a claim in the event of an accident, so that you're not put into financial duress.Schimri Yoyo Licensed Agent & Financial Advisor

By moving to internet auto insurance rather than having customers go to a physical store or call up an agent, companies can focus on financial stability, which translates to better claim handling for drivers in the event they will need to file an auto insurance claim, as well as cheap auto insurance quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Why You Should Consider Purchasing Auto Insurance Online

Purchasing auto insurance online can be convenient, efficient, and transparent. It’s also going to be easier to compare rates between companies. There are a few things you’ll want to compare when online shopping for coverage:

- Rates: You’ll want to ensure they are fair and accurately priced.

- Coverage Choices: Your policy must meet the minimum required amount of coverage for your state.

- Auto Insurance Discounts: Always enter in as much personal information as allowed so that you can be given qualifying discounts.

- Customer Service: While this doesn’t apply directly to your policy, in the event you do need help, you’ll want a company that has excellent customer support available.

Having a policy accessible online will allow you the flexibility of being able to change it whenever you need, as well as utilizing apps and other tools provided by your insurance company.

This is what happens when you think about insurance before bed 💤 pic.twitter.com/vUpEDJ4bDT

— Progressive (@progressive) August 14, 2023

With regards to being able to purchase insurance online, drivers should also take into consideration the fact that it is convenient and easily accessible. Many people don’t have the ability to go to a physical store, so online-only auto insurance can be incredibly efficient. Companies will often provide discounts to drivers who are willing to sign documents online, as this helps keep phone lines open for emergencies and claims.

Ultimately you’ll need to decide for yourself if you like the idea of an online-only car insurance policy. Even if you think you might need help over the phone or in person at a later date, those options will be available, but if you’re in a rush or need immediate coverage, consider looking into your online options.

Saving Money on Online-Only Auto Insurance

You will also be given more options to save money when you purchase online-only auto insurance, especially if you bundle coverage. Some companies will even provide a discount for e-signing an insurance policy, especially if you’re going to bundle a few different policies together.

Here are another few ways to ensure you’re saving the most on your auto insurance:

- Update Your Information: Always make sure your company is aware of major life changes such as an increase in your credit score, if you’ve moved, or if you’ve gotten married.

- Buy Accurate Coverage: The older your car gets, the more likely you are to be overpaying for coverage. Reevaluate your policy as time goes on so that you don’t end up with a policy you don’t need. For example, if you have an older car you may want to consider having comprehensive auto insurance instead of a full coverage policy.

- Compare Rates: The great deal you got two years ago might not be the best deal out there now. Compare quotes to see if you are still getting a great deal or if there are better deals available now.

Check out the rates offered by some of these insurers and decide if online-only auto insurance is the right choice for you. Enter your ZIP code below to explore which companies have the cheapest auto insurance rates for you.

Frequently Asked Questions

Can I buy auto insurance online?

Yes, many companies prefer drivers to purchase auto insurance online, since it’s easy to do and doesn’t cost the company any extra time or money.

Can I get online-only auto insurance if I’m a new driver or have limited driving experience?

Yes, online-only auto insurance is available for new drivers, but they may face higher premiums. Avoid expensive auto insurance premiums by entering your ZIP code below to see the cheapest rates for you.

Can I get online-only auto insurance for leased or financed vehicles?

Yes, you can get online-only auto insurance for leased or financed vehicles. You will just want to look into add-ons such as gap insurance are available should you need more coverage.

Can I get online-only auto insurance for multiple vehicles?

Yes, online-only auto insurance often covers multiple vehicles, and you can customize coverage for each one. You can also potentially save money by bundling your coverage together.

Are claims handled differently with online-only auto insurance companies?

Claims handling processes vary among online-only auto insurance companies.

Can I get roadside assistance with online-only auto insurance?

Many online-only auto insurance companies offer optional roadside assistance coverage.

What is the best online insurance for cars?

In this case, State Farm, AAA, and Progressive are going to be the best options.

How can I find the cheapest online auto insurance?

Price matching is a great way to start, since you can then compare prices and see what fits your budget the best. To do this you begin by comparing online auto insurance companies and the coverage offered.

What does online-only insurance mean?

Online-only insurance often translates to being able to purchase auto insurance online without having to speak to an agent in person or over the phone.

Can I bundle online-only insurance?

The answer depends on the company you’re researching, but most companies will provide you the option to bundle policies for life, home, renters, and auto insurance. Bundling insurance policies can save you money in the long term.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.