Do auto insurance companies need your Social Security number? (Details for 2025)

If you're wondering do auto insurance companies need your Social Security number, the answer is yes. In most states, auto insurers use SSNs to check drivers' credit histories and criminal records to set auto insurance rates. Bad credit scores can raise full coverage rates to an average of $226/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Apr 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Do auto insurance companies need your Social Security number? In most states, auto insurance companies require your Social Security number (SSN). However, you can still get car insurance without a Social Security number because some states don’t allow or require companies to use it, although providing a Social Security number might help you get a lower insurance rate

Keep reading to learn why auto insurance companies use Social Security numbers and how it impacts the cost of car insurance. If you’re ready to buy auto insurance without an SSN, check out our guide to the best auto insurance companies that don’t ask for a Social Security number. Then, compare rates with our free quote tool to find the best insurance quotes.

- Companies use your Social Security number to review your credit

- If you don’t provide your SSN, you may have to pay higher rates

- Some states, such as California, don’t require your Social Security number

Why Auto Insurance Companies Need Your Social Security Number

You use your SSN to open bank accounts, buy a car, purchase a home, and more. When applying for auto insurance, you might be wondering, do car insurance companies need your social security number or can you get car insurance without a social security number? Why do insurance companies need your social security number?

Don’t be alarmed if you have an insurance company asking for a social security number. Auto insurers in most states use your Social Security number to check your credit history and criminal record to help determine your insurance rates.

Based on your criminal background check, the insurance company will be able to see whether you’ve ever committed insurance fraud, vehicular manslaughter, or other crimes that might impact your auto insurance rates. If you have a criminal record, you might need to purchase high-risk insurance. Learn more about how a criminal record affects auto insurance rates.

Providing your Social Security number allows insurance companies to check your credit score. Your rates will vary based on your credit score, as you can see from the rates below.

Full Coverage Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 | |

| $90 | $110 | $130 | |

| U.S. Average | $123 | $148 | $226 |

Drivers with poor credit are more likely to pay higher rates since companies consider them more likely to file a claim. If the insurance company thinks you’re at high risk for filing claims, your auto insurance rates will be higher to compensate for the expense it’ll eventually incur.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Get Auto Insurance Without a Social Security Number

So, you want to know, can I get car insurance without a social security number? If you want the best possible rates, you’re going to have to provide your Social Security number to the auto insurance company from which you plan on purchasing a policy.

Kristen Gryglik

Licensed Insurance Agent

While you don’t have to provide your Social Security number during the quote process, your rate may change if you do provide it when you buy the policy.

While not all auto insurance companies require your Social Security number, most of them will. Even if a company doesn’t ask for your SSN, auto insurance will be easier to get if you provide your Social Security number. It’s also the easiest way to prove your identity, and most top insurance companies like Geico, Progressive, and State Farm require it.

Are you an SSI recipient?? https://t.co/27f1xf1ARb research shows that AAA has the best🥇 car insurance rates on average for SSI recipients. So, if you haven’t checked them out🔎, it’s time⏱️! Find out about other top contenders here👉: https://t.co/gZMg79r7br pic.twitter.com/GzN6NP3Ctn

— AutoInsurance.org (@AutoInsurance) February 5, 2024

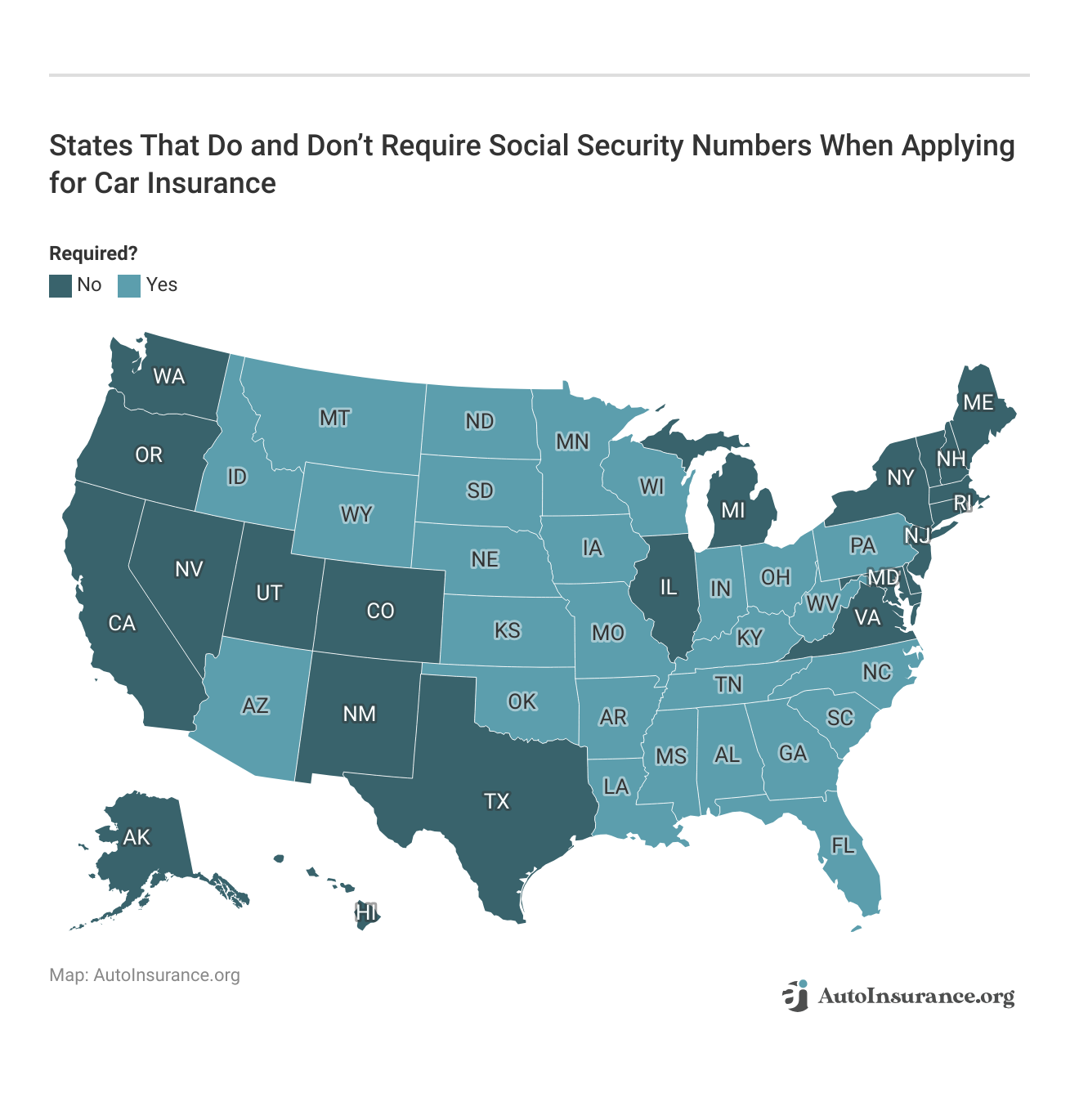

However, not all states require your Social Security number to get insurance. If you live in one of the states below, you aren’t required to provide your Social Security number when applying for insurance.

In some of these states, your credit record can’t be used to calculate your rates, either. Ready to find affordable auto insurance? Compare auto insurance rates by state to find the most affordable coverage in your area.

What You Need to Buy Auto Insurance

All you really need to do is fill out an application and provide some basic information about you, the vehicle you are insuring, and your driving history. You might wonder, how far back do insurance companies check your driving record? And the answer to that really depends on the insurance company; make sure you find out when comparing insurance quotes.

You can get quotes directly from company sites like Geico or use a quote comparison tool.

Here’s a brief car insurance checklist to help ensure you have everything you need to apply for car insurance:

- Age & Gender

- Driving Record & Annual Mileage

- Location

- Named Drivers

- Make, Model, & Year

- Safety Features

- Vehicle Identification Number (VIN)

Gather all the documents you need to buy auto insurance prior to applying and provide it to your auto insurance company when it’s requested.

The Final Word: Do auto insurance companies need your Social Security number?

Why do insurance companies ask for your social security number is a pretty common question. Most companies need your Social Security number to set auto insurance rates, but these providers take precautions to protect private information from potential threats.

But should you give your social security number over the phone? If you are talking to an actual insurance provider, you should be fine (read more: How to Check if an Auto Insurance Company Is Legitimate). However, always be careful when providing sensitive information, such as giving out your Social Security number.

So, do insurance companies ask for your social security number? Yes, and you should keep in mind that you can probably obtain cheaper auto insurance if you’re willing to share your SSN than if you don’t. However, it would help if you also remembered that finding car insurance without an SSN isn’t impossible.

Use our comparison tool to start comparing free auto insurance quotes today.

Frequently Asked Questions

Why does auto insurance ask for SSN?

Do insurance companies need social security numbers? In most cases, yes, Providing your SSN helps insurance companies verify your identity, check your driving record for insurance rates, and assess your creditworthiness. It also assists in accurately pricing your insurance policy. Buying car insurance without an SSN could result in higher rates.

What does SSN mean for auto insurance?

Auto insurance companies need your SSN or Social Security number to confirm your identity and set your car insurance rates.

Why does Allstate auto insurance need my Social Security number?

Allstate needs your SSN to set your auto insurance rates based on your criminal and credit history (read more: Allstate auto insurance review). However, be on the lookout for Allstate insurance scams, among other companies, before you give out your social security number.

Why does Progressive ask for a Social Security number?

Before you become a Progressive car insurance customer, the company will run a credit and criminal background check to determine your risk and rates. So don’t be surprised by Progressive asking for SSNs when you apply for insurance. Ready to find affordable SSN car insurance today? Enter your ZIP in our free quote tool.

Should I give my Social Security number to an insurance company?

Auto insurance companies are legally required to protect your personal information, including your SSN. Reputable insurance companies have safeguards in place to secure customer data.

Exercise caution and verify the credibility of the insurance provider before sharing sensitive information. Ensure you’re dealing with a licensed and trustworthy insurance company.

What should I do if I’m uncomfortable sharing my Social Security number with an auto insurance company?

If you’re uncomfortable providing your SSN, ask the insurance company about alternative ways to verify your identity and assess your eligibility for coverage. Some companies may offer alternative options, such as requesting additional documentation or using other identification numbers.

You will be able to get a car insurance quote without a social security number, but keep in mind that your rates may be higher if you’re looking for car insurance with no social security number (learn more: How to Get an Auto Insurance Quote Without Giving Personal Information).

Can an auto insurance company deny coverage if I refuse to provide my Social Security number?

Auto insurance companies have the right to deny coverage if you refuse to provide requested information, such as your Social Security number. You might be able to find car insurance with an ITIN number.

However, it’s important to understand that requirements may vary depending on the insurance company and state regulations. Please review the terms and conditions of the insurance policy and consult with the company directly to understand their specific requirements.

How can I protect my Social Security number when dealing with auto insurance companies?

To protect your Social Security number when interacting with auto insurance companies:

- Verify the legitimacy of the insurance company before sharing any personal information.

- Only provide your Social Security number if you feel confident in the company’s credibility and the necessity of the request.

- Use secure communication channels when transmitting sensitive information, such as encrypted online forms or secured mail.

- Regularly monitor your credit reports for any suspicious activity or signs of identity theft.

- Be cautious of phishing attempts or scams posing as insurance companies. Always verify the source and contact the company directly if in doubt.

Following the above tips will help you protect your SSN.

How does credit score affect auto insurance rates?

You might wonder does car insurance pull your credit? And typically the answer is yes. Your price of car insurance and credit score are closely related (learn more: How Credit Scores Affect Auto Insurance Rates).

Someone with a lower-than-average credit score might pay more than someone with an average credit score. That’s because, in the eyes of the insurance company, someone with a late payment history or fewer accounts in good standing is more likely to miss payments and file more claims.

But if you’re also wondering, do car insurance quotes affect credit score, that answer is usually no. Insurance companies perform soft inquiries on your credit, which usually do not affect your score.

How do I avoid using my Social Security number for auto insurance?

If you are looking for auto insurance without a SSN, shop for coverage with car insurance companies that don’t check Social Security numbers and leave the form blank when it asks for your SSN.

And if you plan to sign up for car insurance online, be careful about entering your social security number unless it is a verified, reputable company.

What should I do if someone has my Social Security number?

File a police report with your local authorities. If you have identity theft protection, file a claim with your insurance company immediately. You may also want to report the crime to the Federal Trade Commission’s Identity Theft via its website.

Why do insurance companies ask for Social Security numbers?

So exactly why do car insurance companies ask for social security numbers? You will find that auto insurance companies will ask for your social security number for a variety of reasons including for verifying your identity and checking your credit.

Sometimes a social security number is required when adding a driver to auto insurance, but you should check with your insurance provider to find out exactly when they need your SSN.

Does GEICO ask for a social security number?

If you’re considering getting a GEICO auto insurance quote and are wondering about GEICO asking for your social security number, remember that most car insurance companies ask for a social security number.

When you’re comparing a GEICO car insurance quote, you may want to check out GEICO identity protection reviews and consider bundling the coverage.

Does State Farm require a social security number?

Although being required to give out your social security number may bring fears of State Farm insurance scams, keep in mind that most insurance providers require social security numbers before offering coverage.

So, does State Farm ask for a Social Security number? Yes, State Farm will most likely ask for your social security number when offering you an SSN auto insurance quote.

Do car dealerships need your Social Security number?

So you want to know, do car dealers need your Social Security number? Simply put, yes, you can, but it is more complicated. Can you finance a car without a Social Security number? Again, yes, but it will be more challenging.

Suppose you are at a dealership asking for a social security card. In that case, you will probably find it easier to provide that documentation in order to purchase the vehicle or test drive it (learn more: Do you need insurance to test drive a car at the dealership?).

Before you go to a dealership to buy a new car, you should make sure you know what documents are needed for a car purchase.

Can I buy a car without a Social Security number?

The simple answer is yes, there are ways you can buy a car without providing your SSN, such a paying in cash. However, buying a car without a social security number can make the process more complicated and drawn out.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.