Best Auto Insurance for Unmarried Couples in 2026 (Top 8 Companies Ranked)

The best auto insurance for unmarried couples starts as low as $59 per month. Top car insurers for unmarried couples include State Farm, Geico, and Allstate. They offer joint policies and multi-vehicle discounts, making them ideal for couples splitting the use of a car, residences, or coverage.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated August 2025

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Couples

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Couples

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 11,640 reviews

11,640 reviewsCompany Facts

Full Coverage for Couples

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviewsState Farm, Geico, and Allstate offer the best auto insurance for unmarried couples, with rates starting as low as $59 per month.

Our Top 8 Company Picks: Best Auto Insurance For Unmarried Couples

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Customer Service | State Farm | |

| #2 | 25% | A++ | Various Discounts | Geico | |

| #3 | 25% | A+ | Pay-Per-Mile Rates | Allstate | |

| #4 | 25% | A | 24/7 Support | Liberty Mutual |

| #5 | 20% | A+ | Widespread Availability | Nationwide | |

| #6 | 20% | A | Customizable Policies | Farmers | |

| #7 | 12% | A+ | High-Risk Coverage | Progressive | |

| #8 | 10% | A++ | Military Members | USAA |

These top providers offer joint policies, multi-vehicle discounts, and flexible options for couples who share cars or live together. Read on to learn how to find a joint car insurance policy between unmarried couples.

State Farm stands out for affordability, Geico for overall value, and Allstate for high-risk coverage. Comparing these options helps couples find the right balance of savings and protection.

- State Farm offers the best overall value with strong coverage and customer support

- Flexible coverage works for unmarried couples who share cars or residences

- Unmarried couples can save by combining policies and insuring multiple vehicles

Unmarried couples can find affordable auto insurance, regardless of driving record, by entering their ZIP code into our free quote comparison tool.

Auto Insurance Rates for Unmarried Couples

Unmarried couples can share car insurance by combining policies or adding each other as drivers, but must list non-drivers in the household to avoid higher rates.

When comparing monthly auto insurance rates for unmarried couples, USAA offers the lowest monthly rates: $59 for minimum coverage and $134 for full coverage.

Unmarried Couple Auto Insurance Monthly Rates

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $160 | $238 | |

| $139 | $220 | |

| $80 | $165 | |

| $174 | $268 |

| $115 | $192 | |

| $105 | $185 | |

| $86 | $150 | |

| $59 | $134 |

Geico and State Farm also rank as affordable options, with minimum rates of $80 and $86 and full coverage of $165 and $150, respectively.

Unmarried couples can save by bundling auto and renters insurance. For example, using one provider often unlocks multi-policy discounts.Dani Best Licensed Insurance Producer

Liberty Mutual is the most expensive, charging $174 for minimum and $268 for full coverage, followed by Allstate at $160 and $238.

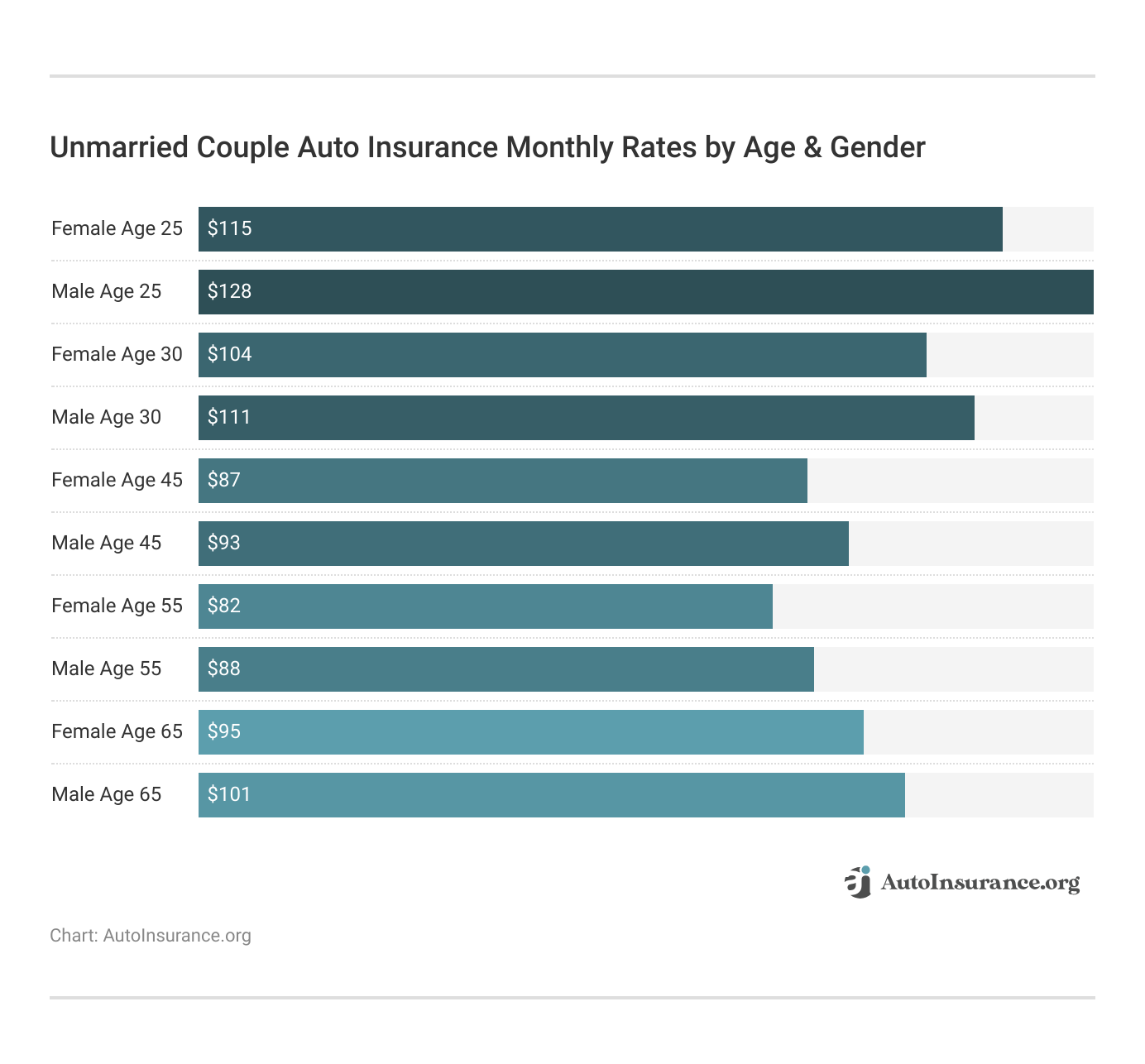

Auto insurance rates for unmarried couples vary by age and gender, with younger drivers paying more and males typically paying slightly higher premiums. At age 25, monthly rates are $115 for females and $128 for males, gradually decreasing with age.

The lowest monthly rates appear at age 55, $82 for females and $88 for males. By age 65, premiums rise slightly to $95 and $101, respectively. Overall, premiums decline with age and show modest gender-based differences.

Farmers, Nationwide, and Progressive offer mid-range pricing, making them balanced choices for coverage and cost, especially when comparing options to find the best car insurance for couples.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Unmarried Couple Car Insurance Rates by Driving History

Auto insurance rates for unmarried couples differ significantly based on driving record, with USAA offering the most affordable rates starting at $59 for a clean record and $108 after a DUI.

Unmarried Couple Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $160 | $188 | $225 | $270 | |

| $139 | $173 | $198 | $193 | |

| $80 | $106 | $132 | $216 | |

| $174 | $212 | $234 | $313 |

| $115 | $137 | $161 | $237 | |

| $105 | $140 | $186 | $140 | |

| $86 | $96 | $102 | $112 | |

| $59 | $67 | $78 | $108 |

State Farm follows closely with rates from $86 for clean driving to $112, offering cheap auto insurance after a DUI. Geico and Progressive also stay competitive, though Geico jumps to $216 after a DUI, while Progressive holds steady at $140.

One partner’s record can raise rates for both. For example, list the cleaner driving record as primary to help lower your joint monthly premium.Justin Wright Licensed Insurance Agent

Liberty Mutual is the most expensive, reaching $313 with a DUI, while Allstate, Farmers, and Nationwide fall in the mid-range. Maintaining a clean driving record offers the best savings, but comparing rates is crucial if infractions are present.

Insurance Options for Unmarried Couples and Roommates

With more people living together outside of marriage, insurers now offer flexible coverage for partners, roommates, and non-relatives, though options like a car insurance marriage discount may not always apply. Here are key definitions of common non-traditional insurance options.

- Domestic Partner Auto Insurance: Car insurance for domestic partners offers joint coverage and possible discounts for unmarried couples living at the same address.

- Non-Married Insurance: A broad term for insurance that covers non-married partners living together, often including auto, health, or renters policies with cohabitation requirements.

- Roommate Insurance: Roommate insurance covers unrelated individuals living at the same address, often allowing them to share a policy, though proof of cohabitation may be required.

- Non-Relative Insurance: Coverage for non-relatives, like partners or roommates, living in the same household under one policy, pending insurer approval.

Whether you’re sharing a home with a partner, roommate, or friend, having the right insurance coverage, like combining auto insurance with a roommate, can protect your assets and simplify financial responsibilities.

Understanding the types of auto insurance helps you choose the right policy for your lifestyle, especially when exploring options like car insurance for newlyweds. Always confirm eligibility and requirements with your provider.

Joint Auto Insurance for Unmarried Couples

Unlike a standard multi-car policy, where one person typically owns all the vehicles, the best joint ownership auto insurance covers cars with different legal owners living at the same address.

Both individuals are listed as named insureds with equal coverage, but some insurers limit joint policies to married couples. Shopping around is critical because eligibility and acceptance vary. Joint coverage offers convenience and potential savings if both meet the insurer’s requirements.

Structuring a Joint Auto Insurance Policy

Structuring a joint auto insurance policy can be complex, especially in states requiring the policyholder’s name to match the vehicle registration. To simplify claims, both names are often listed with an “or” between them.

The key requirement is that both vehicles be garaged at the same address; if not, separate policies are needed. You don’t need to be married; combining car insurance with your girlfriend can help you save money, especially if you compare auto insurance rates by vehicle make and model.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Unmarried Couple Auto Insurance Discounts

Unmarried couples can unlock substantial savings on auto insurance through a variety of discounts offered by top providers. Liberty Mutual offers the highest anti-theft discount at 35%, while Progressive leads with a 30% discount for completing a defensive driving course.

Top Auto Insurance Discounts for Unmarried Couples

| Company | Anti- Theft | Defensive Driving | Multi- Vehicle | New Car | Safe Driver |

|---|---|---|---|---|---|

| 10% | 10% | 25% | 10% | 18% | |

| 10% | 10% | 20% | 12% | 20% | |

| 25% | 15% | 25% | 10% | 15% | |

| 35% | 10% | 25% | 8% | 20% |

| 5% | 10% | 20% | 15% | 12% | |

| 25% | 30% | 12% | 10% | 10% | |

| 15% | 15% | 20% | 15% | 20% | |

| 15% | 5% | 10% | 10% | 10% |

For couples insuring more than one car, couples car insurance options from Geico, Allstate, and Liberty Mutual each provide a strong 25% multi-vehicle discount. Farmers and State Farm stand out with well-balanced couples car insurance offerings, including 20% off for safe driving and competitive new car and multi-vehicle discounts.

Nationwide delivers moderate savings across all categories, highlighted by a 15% discount for new cars, and USAA, though slightly lower in percentages, remains a solid choice for military families. By stacking eligible discounts, unmarried couples can significantly reduce their auto insurance premiums while maintaining full coverage.

8 Best Auto Insurance Companies for Unmarried Couples

Below is a ranked list of the top auto insurance providers offering the best coverage, discounts, and policy flexibility for unmarried couples, based on recommended auto insurance coverage levels.

Whether you’re with a partner, fiancé, or roommate, these companies offer joint and multi-vehicle policies to help you save. Compare their features to find the best fit for your needs.

#1 – State Farm: Top Overall Pick

Pros

- Extensive Local Agent Network: State Farm’s 19,000+ agents offer couples, including unmarried couples, in-person support that most competitors lack. See our State Farm auto insurance review for details.

- Fast Claims Handling: The company processes claims 30% faster than the average, making State Farm car insurance for unmarried couples a quick and reliable option.

- Dedicated Mobile App for Service Access: The State Farm app, rated 4.8 stars on the Apple App Store with over 1.2 million reviews, makes it easy for couples to file claims and contact agents anytime.

Cons

- Service Varies by Agent: Over 30% of negative Yelp reviews cite agent-dependent service quality, making the experience for unmarried couples inconsistent.

- Limited Online-Only Support: Unlike Geico or Progressive, State Farm offers only 65% of its services online, which can be limiting for tech-savvy couples who prefer digital management.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Various Discounts

Pros

- Up to 25% Multi-Vehicle Discount: Couples or families who insure more than one car can save up to 25% on the total cost of insurance, which helps reduce household insurance premiums.

- Bundling Savings: Geico offers up to 25% off when bundling auto with home, renters, or condo insurance, a top-tier rate for couples, including those listed as a domestic partner with Geico.

- Defensive Driving Discount: Unmarried couples can get 10%–15% off by taking a defensive driving course, especially if over age 50. Check out our Geico auto insurance review for other discounts.

Cons

- Higher Base Rates for High-Risk Drivers: Even with discounts, Geico’s rates for high-risk drivers are about 18% higher than Progressive, reducing savings for couples.

- No Loyalty Rewards Program: Unlike State Farm or Progressive, Geico doesn’t offer a default loyalty or accident forgiveness program, even for policies tailored to unmarried couples.

#3 – Allstate: Best for Pay-Per-Mile Rates

Pros

- Milewise Program Saves Light Drivers Money: Allstate’s Milewise is ideal for unmarried couples who drive under 10,000 miles a year, with savings up to 30–40% through its pay-per-mile plan.

- Access to Standard Features: Even with Milewise, couples still get Allstate’s standard features, such as 24/7 roadside help, digital claims, and Drivewise discounts.

- Fixed Daily Base Rate + Per-Mile Rate: Milewise costs about $1.50 a day plus $0.06 per mile, ideal for low-mileage unmarried couples. Read our Allstate auto insurance review for more.

Cons

- Device Malfunctions Can Skew Billing: Some couples have reported inaccurate billing with Milewise due to tracking device errors, including overcharges and missing mileage records.

- Privacy Concerns from Tracking Devices: Unmarried couples may feel uneasy about Milewise’s GPS and telematics tracking, which monitors speed, braking, and driving times.

#4 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Claims Assistance: Liberty Mutual offers 24/7 claims support and processes 93% of online claims within 24 hours, ideal for busy couples. Get a complete overview in our Liberty auto insurance review.

- Roadside Assistance Around the Clock: Their 24/7 roadside assistance, included in many policies, supports over 1.6 million calls a year, providing reliable protection for unmarried couples on the road.

- Dedicated 24/7 Billing and Policy Support: Couples can count on 24/7 billing and policy updates, with off-hours service earning 87% satisfaction (J.D. Power).

Cons

- Pay-Per-Mile Not Available Nationwide: Liberty offers 24/7 support, but RightTrack isn’t available in all states, limiting mileage-based pricing for unmarried couples who drive less.

- Limited In-Person Support: Liberty Mutual depends heavily on digital tools and has fewer local offices, which may be inconvenient for couples who prefer in-person help for more complex insurance needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Widespread Availability

Pros

- Nationwide Presence: Nationwide sells in 47 states, so it has a large geographic reach that can work for couples or domestic partners who might move and want the same insurance company.

- Usage-Based & Low-Mileage Savings: Nationwide SmartRide and SmartMiles offer customizable usage-based discounts based on how couples drive. Explore our Nationwide auto insurance review.

- Bundling Discounts: Couples can save up to 20% by bundling auto with home, renters, or life insurance, making it one of the most rewarding bundling programs available.

Cons

- Mediocre Customer Satisfaction: J.D. Power scores around 868/1,000 reflect lower satisfaction among customers, including unmarried couples, compared to top insurers like USAA and State Farm.

- Higher Base Rates: Nationwide’s base premiums are typically 10–15% above the national average, which can be costly for couples, especially younger drivers without qualifying discounts.

#6 – Farmers: Best for Customizable Policies

Pros

- Extensive Coverage Options: Farmers offers 15+ optional coverages, helping unmarried couples customize protection to fit their needs.

- Declining Deductibles: Policyholders get $50 off their deductible every 6 accident-free months, a nice perk for couples who share a car. Discover details in our Farmers auto insurance review.

- Strong Agent Network: With over 48,000 exclusive and independent agents across the country, Farmers provides unmarried couples with easy access to in-person help for personalized coverage or claims support.

Cons

- Above-Average Base Rates: Farmers’ rates are 10–15% above average, which may deter unmarried couples or budget-conscious shoppers.

- Agent-Dependent Customization: Many policy customizations require help from an agent, which may frustrate couples who prefer quick, self-service options through digital tools.

#7 – Progressive: Best for High-Risk Coverage

Pros

- Accepts High-Risk Drivers: Progressive is a top choice for high-risk drivers, including unmarried couples, with more nonstandard coverage options than Geico or Allstate.

- Snapshot Program for Custom Rates: Progressive’s usage-based Snapshot program tracks real-time driving and can save couples, especially safe drivers, up to 30% on premiums.

- Multiple Discounts: Policyholders, including unmarried couples, can qualify for 7–10 discounts, such as multi-policy, online quote, and paperless billing. Find the full list in our Progressive auto insurance review.

Cons

- Higher Premiums for Poor Credit: Progressive tends to charge unmarried couples with poor credit 40–60% more than those with good credit, making it less ideal for budget-conscious applicants.

- Fewer Local Agents: With fewer than 3,000 local agents, Progressive offers limited in-person support, something couples may miss compared to Allstate’s wider agent network of around 10,000.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – USAA: Best for Military Members

Pros

- Exceptional Customer Satisfaction: USAA scores over 890/1000 on J.D. Power’s surveys, which is a big benefit for military families and couples looking for consistently good service.

- Tailored Military Perks: USAA offers perks like up to 60% off vehicle storage for deployed service members and unmarried couples living on base or apart. Learn more in our USAA auto insurance review.

- Highly Competitive Premiums: With rates up to 25% lower than national averages, USAA offers affordable coverage for military families and couples, whether they need liability-only or full protection.

Cons

- Eligibility Restrictions: Coverage is limited to military members and their families, so unmarried couples can’t access options like USAA domestic partner auto insurance.

- No High-Risk Driver Specialization: Rates can spike for drivers with poor credit or accident history, with little flexibility for couples compared to companies like Progressive that offer more lenient options.

Find the Best Auto Insurance for Unmarried Couples

State Farm, Geico, and Allstate offer the most affordable and flexible auto insurance options for partners, with rates starting at just $59 per month. The best auto insurance for unmarried couples includes joint policies, multi-vehicle discounts, and tailored coverage for domestic partners, roommates, or cohabiting couples.

These providers stand out for their competitive pricing, strong customer satisfaction, and policy flexibility, earning them a spot among the best comprehensive auto insurance companies, ideal for couples looking to combine coverage and save.

Unmarried couples can find the best auto insurance rates for any coverage level by entering their ZIP code into our comparison tool today.

Frequently Asked Questions

How to add a girlfriend to car insurance if she owns her own car?

If she owns her own vehicle, consider sharing car insurance with your girlfriend by getting a joint policy or using a multi-vehicle discount through the same insurer. This option often saves money and simplifies billing for couples living together.

Can unmarried couples be on the same car insurance when leasing vehicles?

Yes, unmarried couples can typically be on the same insurance even if leasing, but both individuals may need to be listed on the lease or as authorized drivers, depending on the insurer’s requirements.

Unmarried couples can start comparing affordable insurance options by entering their ZIP code into our free quote comparison tool today.

Is it cheaper to combine car insurance when married?

Yes, combining car insurance as a married couple is often cheaper, thanks to multi-vehicle discounts and shared risk pools, which are common benefits in auto insurance for different types of drivers.

Can you be on someone’s insurance without being married if you’re only an occasional driver?

Yes, occasional drivers who share the vehicle can often be added to the policy, especially important when considering getting married car insurance, where transparency helps avoid denied claims.

Can an unmarried couple get car insurance together without being domestic partners?

Some insurers may require a formal domestic partnership, while others accept cohabiting couples without official designation. It’s best to check the provider’s eligibility rules.

In Michigan, can unmarried people be on the same car insurance policy?

Yes, unmarried people in Michigan can share a car insurance policy if they live at the same address and are listed as drivers or vehicle owners. This is a common option with providers offering the best Michigan auto insurance.

Do you have to be married to share car insurance?

No, you don’t have to be married to share car insurance. Many insurers allow domestic partners, roommates, and other cohabitants to be on the same policy if they live at the same address and share vehicle use.

Can I add my fiancé to my car insurance before we’re legally married?

Yes, most insurance companies allow you to add your fiancé before marriage, especially if you live together and share vehicle use.

Can you share car insurance without being married and still have equal coverage rights?

If both individuals are listed as named insureds, they generally have equal rights under the policy—similar to married couples—which can help when exploring the best auto insurance discounts for married couples, though it’s important to confirm with the insurer.

Can I add my girlfriend to my auto insurance if she has a poor driving record?

You can, but your premium may increase. Insurers assess risk based on all drivers listed on the policy, including those with accidents, tickets, or DUIs.

Do spouses have to be on the same car insurance policy?

Can married couples have separate car insurance policies?

Can I add my boyfriend to my car insurance temporarily?

Can you bundle car insurance with your boyfriend without being legally married?

Do married or single drivers pay more for car insurance?

Can you combine car insurance if not married?

Can roommates share car insurance on one policy?

Can roommates get a multi-car discount if they share the same address?

Can I add my girlfriend to my USAA car insurance without adding her vehicle?

Can unmarried couples get car insurance together and maintain separate driving records?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.