Amazon Flex Auto Insurance: Rates & Requirements (2025)

Amazon Flex auto insurance is included if you carry a personal policy. Get the best insurance for Amazon Flex with a rideshare policy for as low as $2 monthly. Learn about Amazon Flex commercial insurance, how to meet the company's car insurance requirements, and the average Amazon Flex insurance cost below.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laura D. Adams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Insurance & Finance Analyst

UPDATED: Jun 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Does Amazon offer car insurance? No, but Amazon does provide free commercial auto insurance coverage to drivers actively making deliveries. However, you’ll need a personal policy to get Amazon Flex auto insurance.

We’ll explain how Amazon delivery driver insurance works and outline the Amazon Flex vehicle requirements below.

- Commercial insurance for Amazon Flex drivers is free if you carry personal insurance

- Full coverage protects you when not delivering for Amazon Flex

- Amazon Flex drivers must carry the proper insurance to drive legally in their state

Once you’re ready, enter your ZIP code above to buy the best and cheapest insurance for Amazon Flex drivers.

Commercial Car Insurance For Amazon Flex: How It Works

Do you need car insurance for Amazon Flex? Yes, and Amazon provides its Amazon Flex drivers commercial coverage when delivering packages. Amazon’s commercial car insurance coverage includes:

- Additional liability auto insurance coverage

- Uninsured motorist coverage

- Comprehensive and collision coverage

You’ll need at least a personal liability policy to receive this commercial coverage from Amazon. If you want to drive for Amazon, you should compare auto liability insurance rates.

All drivers in the U.S. must purchase liability coverage. However, Amazon provides its drivers additional protection through its commercial auto insurance policy.Daniel Walker Licensed Auto Insurance Agent

If you work for Amazon Flex but allow someone else to make your delivery, commercial vehicle insurance with Amazon Flex doesn’t cover that individual if an accident occurs. Amazon specifies on its website that commercial coverage only covers Amazon drivers.

So, any Amazon auto claims for passengers will get denied. In addition, Amazon Flex delivery drivers must be actively making a delivery to receive coverage from the company’s commercial policy.

The company also notes that its car insurance for Amazon Flex doesn’t include New York drivers. Instead, these individuals may need to purchase additional commercial coverage to meet delivery requirements if they live in New York (Learn More: New York Auto Insurance).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Comparing Costs for Amazon Flex Driver Insurance

Amazon Flex drivers don’t have to pay for coverage from the company. Instead, they automatically receive coverage from Amazon’s commercial auto insurance policy when driving to pick up or deliver a package if they carry a personal policy.

However, many insurance companies require additional rideshare coverage for your policy to drive for a delivery service. How much is Amazon Flex insurance? Check out the table below to see how much you could pay:

Monthly Rideshare Auto Insurance Rates by Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $32 | $83 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $42 | $110 | |

| $63 | $164 |

| $56 | $150 | |

| $38 | $101 | |

| $47 | $123 | |

| $32 | $84 |

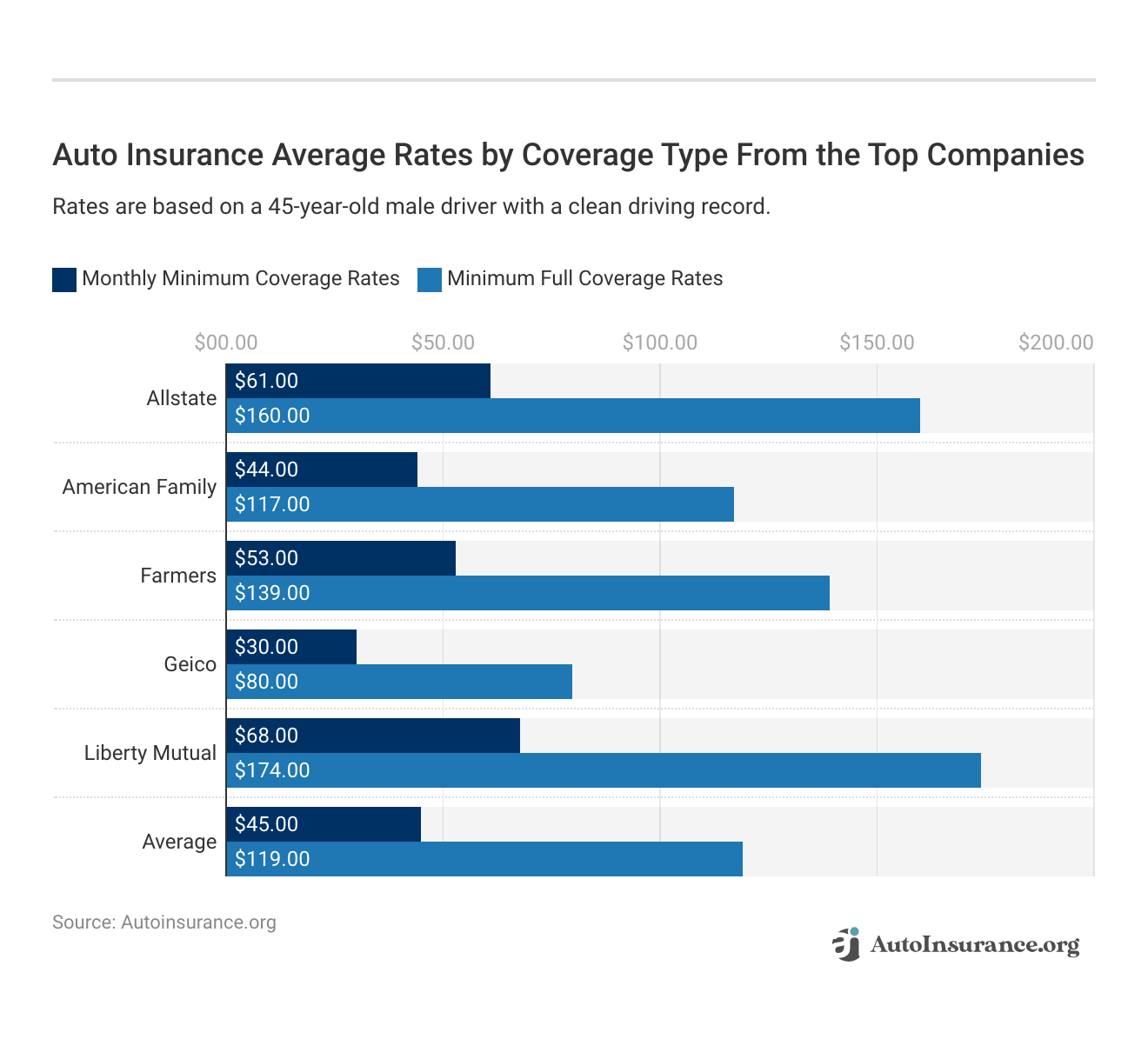

If you only carry liability coverage and have a clean driving record, you can expect to pay little for your auto insurance. The table below shows the average monthly auto insurance rates in the U.S. with different companies based on coverage type.

Depending on where you live, you may pay more or less per year for coverage. However, rates for standard auto insurance coverage vary based on several factors, such as:

- Age: Young drivers are more likely to get into accidents, and older drivers face age-related issues like decreased reaction time. Compare auto insurance rates by age.

- Claims history: If you’ve filed multiple claims, you’ll have higher insurance rates.

- Credit score: Drivers with lower credit scores are more likely to file claims or miss payments. So they’ll pay higher rates. (Read More: Best Auto Insurance Companies for Bad Credit)

- Driving history: Auto insurance companies check your driving record to determine rates. Traffic tickets, accidents, DUIs, and similar charges will raise rates.

- Gender: Auto insurance rates are different for men and women. Men tend to pay higher rates than females, as statistics show men get into more accidents. However, insurers can’t consider gender in California, Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania.

- Vehicle model and make: Insurance companies consider safety ratings, crash statistics, and the vehicle’s overall expense when setting rates.

- Coverage types: The cost of insurance will reflect the type and amount of coverage the driver chooses. Compare the different types of auto insurance here.

This should give you a good idea of what you can expect to pay for full coverage auto insurance vs. what you may pay for liability insurance.

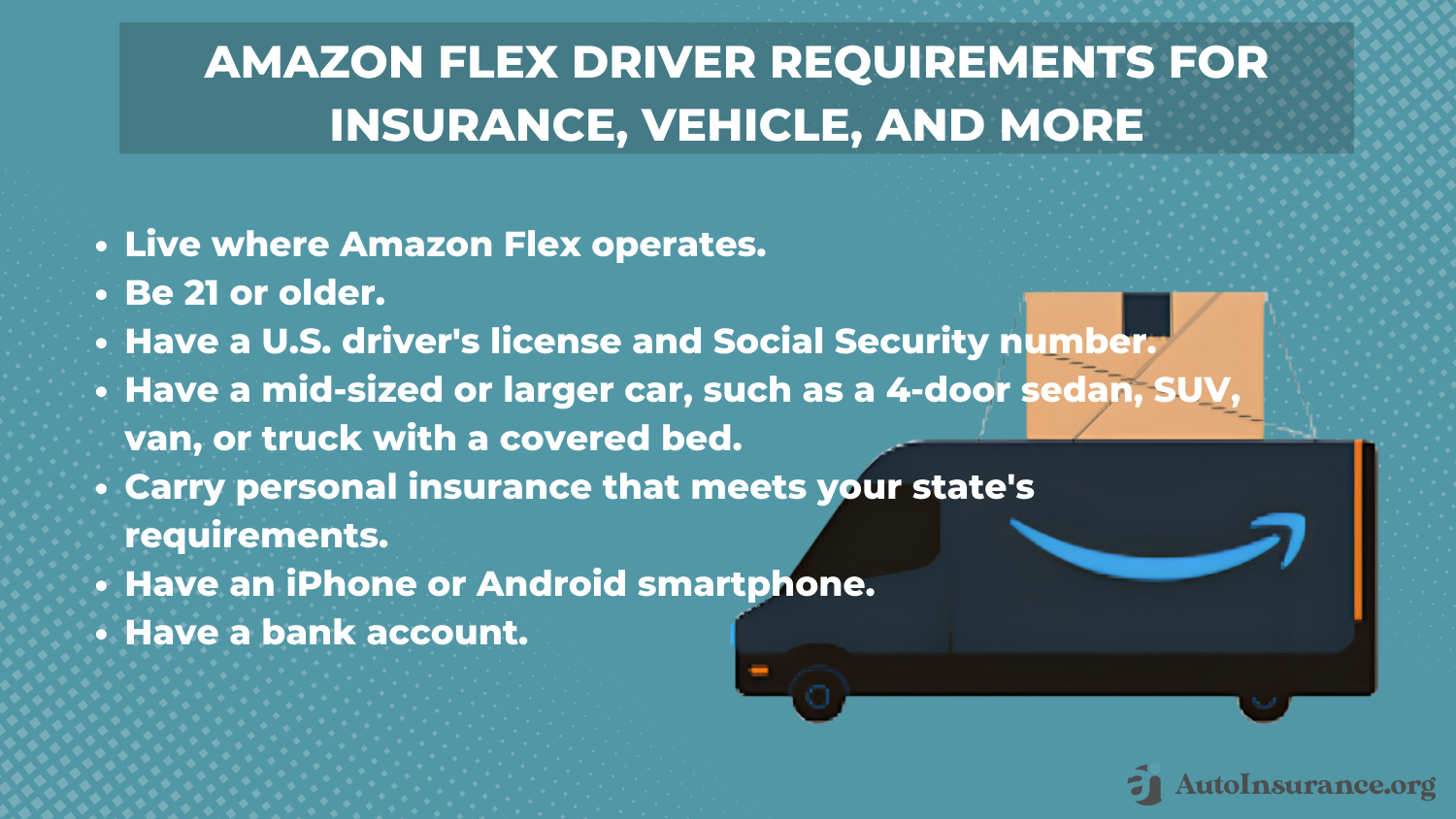

Amazon Flex Insurance Requirements

What kind of insurance do I need for Amazon Flex? Amazon driver insurance requirements say its Flex drivers must carry a liability insurance policy meeting their state requirements, which vary. You’ll also need to meet certain Amazon Flex car requirements.

The table below shows liability coverage requirements in each state. The numbers represent car insurance requirements per thousand dollars of bodily injury liability per person, bodily injury liability per accident, and property damage liability.

Bodily Injury & Property Damage Liability Requirements by State

| State | BIL Per Person | BIL Per Accident | PDL |

|---|---|---|---|

| Alabama | $25,000 | $50,000 | $25,000 |

| Alaska | $50,000 | $100,000 | $25,000 |

| Arizona | $25,000 | $50,000 | $15,000 |

| Arkansas | $25,000 | $50,000 | $25,000 |

| California | $15,000 | $30,000 | $5,000 |

| Colorado | $25,000 | $50,000 | $15,000 |

| Connecticut | $25,000 | $50,000 | $25,000 |

| Delaware | $25,000 | $50,000 | $10,000 |

| Florida | $10,000 (PIP only) | N/A | $10,000 |

| Georgia | $25,000 | $50,000 | $25,000 |

| Hawaii | $20,000 | $40,000 | $10,000 |

| Idaho | $25,000 | $50,000 | $15,000 |

| Illinois | $25,000 | $50,000 | $20,000 |

| Indiana | $25,000 | $50,000 | $25,000 |

| Iowa | $20,000 | $40,000 | $15,000 |

| Kansas | $25,000 | $50,000 | $25,000 |

| Kentucky | $25,000 | $50,000 | $25,000 |

| Louisiana | $15,000 | $30,000 | $25,000 |

| Maine | $50,000 | $100,000 | $25,000 |

| Maryland | $30,000 | $60,000 | $15,000 |

| Massachusetts | $20,000 | $40,000 | $5,000 |

| Michigan | $50,000 | $100,000 | $10,000 |

| Minnesota | $30,000 | $60,000 | $10,000 |

| Mississippi | $25,000 | $50,000 | $25,000 |

| Missouri | $25,000 | $50,000 | $25,000 |

| Montana | $25,000 | $50,000 | $20,000 |

| Nebraska | $25,000 | $50,000 | $25,000 |

| Nevada | $25,000 | $50,000 | $20,000 |

| New Hampshire* | $25,000 | $50,000 | $25,000 |

| New Jersey | $15,000 | $30,000 | $5,000 |

| New Mexico | $25,000 | $50,000 | $10,000 |

| New York | $25,000 | $50,000 | $10,000 |

| North Carolina | $30,000 | $60,000 | $25,000 |

| North Dakota | $25,000 | $50,000 | $25,000 |

| Ohio | $25,000 | $50,000 | $25,000 |

| Oklahoma | $25,000 | $50,000 | $25,000 |

| Oregon | $25,000 | $50,000 | $20,000 |

| Pennsylvania | $15,000 | $30,000 | $5,000 |

| Rhode Island | $25,000 | $50,000 | $25,000 |

| South Carolina | $25,000 | $50,000 | $25,000 |

| South Dakota | $25,000 | $50,000 | $25,000 |

| Tennessee | $25,000 | $50,000 | $15,000 |

| Texas | $30,000 | $60,000 | $25,000 |

| Utah | $25,000 | $65,000 | $15,000 |

| Vermont | $25,000 | $50,000 | $10,000 |

| Virginia | $30,000 | $60,000 | $20,000 |

| Washington | $25,000 | $50,000 | $10,000 |

| West Virginia | $25,000 | $50,000 | $25,000 |

| Wisconsin | $25,000 | $50,000 | $10,000 |

| Wyoming | $25,000 | $50,000 | $20,000 |

As you can see, each state’s requirements can be significantly different from another. In addition, Amazon delivery insurance requirements may include more coverages depending on where you live, since some states require more coverage, such as personal injury protection, medical payments, or uninsured motorist coverage.

So, does Amazon Flex check insurance? Yes, Amazon will check to ensure you carry the proper coverage by requesting proof of insurance before you can drive for them.

Though most insurance companies help drivers ensure they’re following coverage requirements, it’s ultimately your responsibility to ensure you meet Amazon Flex car insurance requirements.

Optional Amazon Flex Driver Coverages

Do I need special insurance for Amazon Flex, such as full coverage? Amazon Flex drivers should consider carrying more than a liability-only policy to ensure they have the proper protection in the event of an accident.

Liability insurance only covers other people and their vehicles if you’re in an accident, but you and your car don’t receive any help from a liability policy.

Amazon Flex Insurance Coverage

| Coverage Type | Description | Who Qualifies? |

|---|---|---|

| Auto Liability | Covers damages to other people or property when you are at fault while making deliveries | All Amazon Flex drivers when making deliveries (while logged into the Amazon Flex app) |

| Contingent Comprehensive & Collision | Covers damage to your vehicle (up to $50,000) while making deliveries, but only if you have your own personal comprehensive and collision coverage | Available to Amazon Flex drivers who carry their own comprehensive and collision insurance |

| Delivery-Only | Insurance only applies during active deliveries, meaning once you complete your deliveries or log out of the app, your personal insurance takes over | Amazon Flex drivers must be logged into the app and actively delivering to qualify for this coverage |

| Excess Liability Coverage | Provides additional liability protection up to $1,000,000 for Amazon Flex drivers when delivering, above the limits of any personal insurance policy | All Amazon Flex drivers when logged into the app and actively delivering packages |

| Medical Payments/Personal Injury Protection (PIP) | Covers medical expenses for you and your passengers if you're injured in an accident, regardless of fault, while making deliveries | Amazon Flex drivers, with coverage varying by state |

| Uninsured/Underinsured Motorist | Provides protection if you’re involved in an accident with an uninsured or underinsured driver while making deliveries | Amazon Flex drivers, coverage applies while delivering packages |

Collision coverage helps in an accident, and coverage extends to you and your vehicle even if you’re at fault. In addition, comprehensive coverage is helpful when your car gets damaged by theft, vandalism, inclement weather, or other incidents unrelated to an accident.

If your car is stolen, you won't be happy😡. That's an understatement. But will you be able to recover? Comprehensive auto 🚗insurance is what you need, and https://t.co/27f1xf1ARb has compiled a guide to help you through the process. Find out more here👉: https://t.co/GkLRGTslyx pic.twitter.com/XfJHky4ab5

— AutoInsurance.org (@AutoInsurance) September 24, 2023

Combining collision and comprehensive coverage into a full coverage policy offers protection that can help you in most scenarios. Anyone who drives frequently or for work as a delivery driver should consider purchasing these coverages and a liability policy.

How to Get Cheap Amazon Auto Insurance for Flex

Do you need commercial insurance for Amazon Flex? Amazon Flex auto insurance covers drivers while actively making deliveries, but Amazon delivery driver insurance requirements say you need a personal policy, which may include rideshare coverage depending on your insurer. Read about delivery driver auto insurance to learn what insurance you need for Amazon Flex.

Amazon Flex drivers have commercial coverage from Amazon when delivering goods if they carry a personal policy. Unfortunately, drivers living in New York aren’t covered by Amazon.Leslie Kasperowicz Farmers CSR for 4 Years

If you drive for Amazon Flex, you should consider purchasing more than your state’s liability requirements. Additional Amazon driver insurance coverage ensures you and your vehicle have adequate protection in case of an accident or damage.

Don’t let expensive Amazon car insurance rates for Flex drivers hold you back. Enter your ZIP code into our free comparison tool below to instantly compare Amazon delivery insurance quotes from the top providers near you.

Frequently Asked Questions

Does Amazon Flex have insurance?

Does Amazon have car insurance? Amazon offers its Flex drivers commercial auto insurance in most states. For example, it offers liability, collision, and comprehensive coverages after a driver accepts a delivery if they have a personal policy. Amazon Flex auto insurance coverage also includes uninsured motorist coverage.

Does Amazon Flex ask for proof of insurance?

Does Amazon Flex check your insurance? Yes, drivers must prove they carry a personal policy with at least the minimum liability coverage required in their state to qualify for Flex. Learn how to get instant proof of your auto insurance policy.

What insurance do you need for Amazon Flex?

So, does Amazon offer car insurance for employees? While Amazon provides free commercial auto insurance to Flex drivers while on the clock, you’ll need a personal liability policy to receive that coverage. In addition, some companies may require you to get rideshare insurance if you drive for Flex. The company’s commercial coverage doesn’t extend to NY drivers.

Does Amazon pay for Flex Driver delivery insurance?

Yes, Amazon’s commercial auto insurance policy covers Flex drivers while on the clock at no cost. So, does Amazon Flex require car insurance even though they offer a free commercial policy? Yes, you’ll still need to get a personal policy to get its commercial coverage.

What happens if I get into an accident as an Amazon Flex driver?

You have 90 days to reach out to call the Amazon auto insurance claims phone number at 888-281-6909 to file a claim. Gather photographs, witness testimony, and the police report regarding the accident to help reinforce your claim (Read More: Cheap Auto Insurance After an Accident).

Who insures Amazon delivery vehicles?

Amazon provides Flex auto insurance coverage through Acko General Insurance.

Does Amazon sell car insurance?

While there isn’t exactly an “Amazon auto insurance company,” it began offering car insurance in 2020 in India through a partnership with Acko General Insurance. If you need auto insurance today, enter your ZIP code to start comparing local companies for free.

Is Amazon Flex worth it?

Amazon Flex can be worth it for some drivers, but it depends on factors such as your financial needs, work preferences, and location. With Flex, drivers have flexible scheduling, and the company advertises that most drivers earn between $18 and $25 hourly.

What does Amazon Flex insurance cover?

What does auto insurance cover? Amazon’s commercial policy provides up to $1 million in liability coverage, contingent comprehensive and collision coverage, and additional uninsured/underinsured motorist insurance.

Does Amazon Flex cover accidents?

Yes, but Amazon Flex auto insurance only applies to drivers on delivery who have a personal policy, meaning passengers won’t be covered. Your personal policy will apply if you get into an accident off the clock.

What is the Amazon Flex driver support phone number?

Call 1-888-281-6906 for support, or send an email to [email protected]

What insurance do I need for Amazon Flex?

What insurance is needed for Amazon Flex? Amazon Flex drivers must have a liability insurance policy that meets the minimum coverage requirements of their state. Each state has specific liability coverage limits for bodily injury and property damage (Learn More: What is needed for adequate auto insurance coverage?).

Is Amazon self-insured?

Yes, Amazon is self-insured, so it manages its own insurance policies rather than getting coverage from a third party.

What is hire and reward insurance with Amazon Flex?

“Hire and reward insurance” is another term for Amazon’s commercial car insurance policy. Enter your ZIP code if you need to find affordable commercial car insurance today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Laura D. Adams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Insurance & Finance Analyst

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.