Best Windshield Replacement Coverage in Nevada (Top 10 Companies in 2025)

Allstate, State Farm, and Geico offer the best windshield replacement coverage in Nevada, with premiums beginning at just $70 per month. We aim to assist you in comparing quotes from these trusted insurers, helping you secure the ideal coverage and take advantage of personalized discounts for your vehicle.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: May 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage Windshield Replacement in Nevada

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage Windshield Replacement in Nevada

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage Windshield Replacement in Nevada

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews- Allstate offers attractive rates beginning at $70 per month

- Top insurance providers offer options for windshield replacements

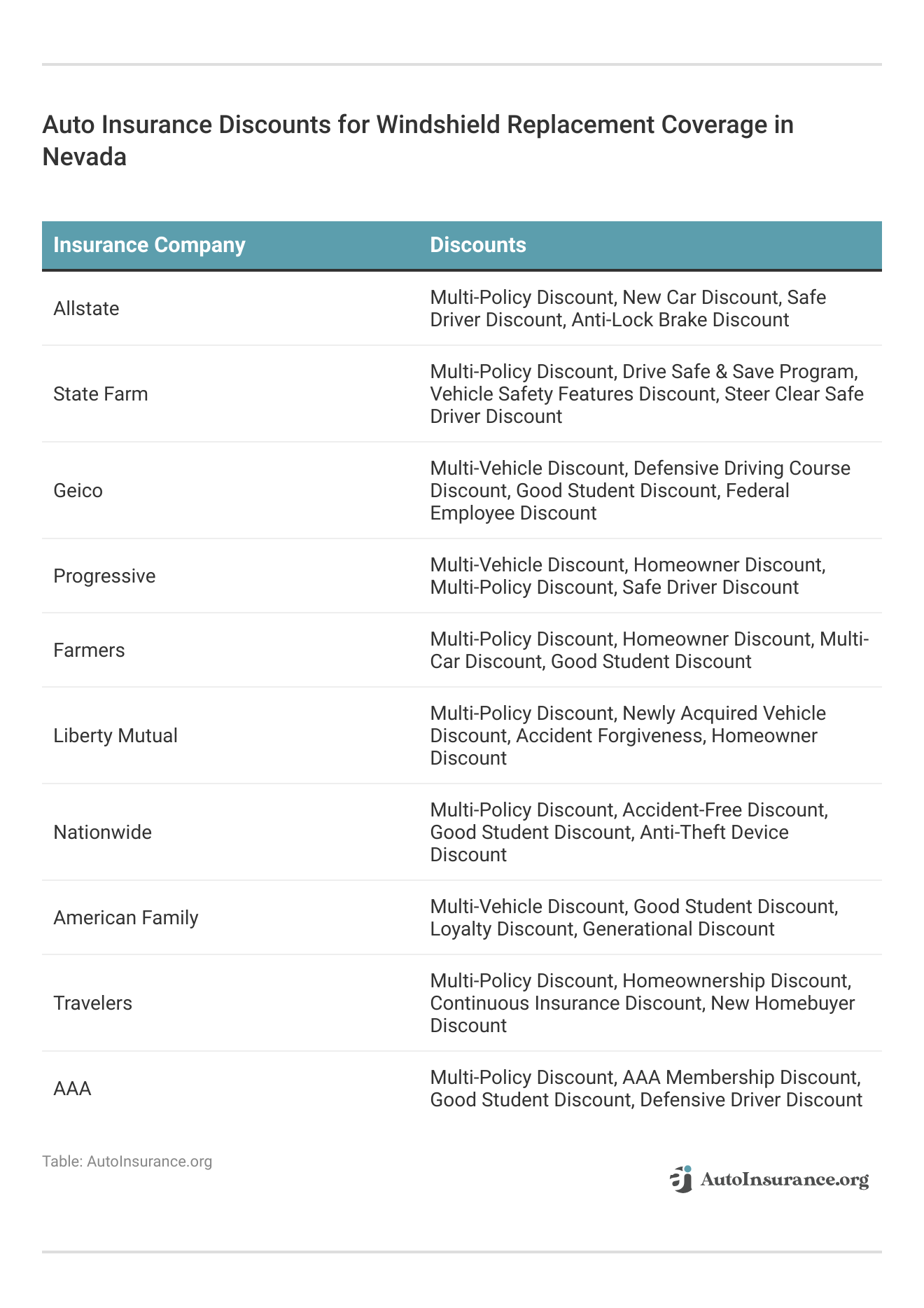

- Various discount options are available for windshield replacement coverage

#1 – Allstate: Top Overall Pick

Pros

- Comprehensive Coverage Options: Allstate offers a wide array of coverage options, including windshield replacement coverage, allowing customers to tailor their policies to their specific needs. Use our Allstate auto insurance review as your guide.

- Excellent Customer Service: Known for its reliable customer service, Allstate provides assistance and support to policyholders throughout the claims process, ensuring a smooth experience.

- Competitive Premiums: Allstate offers competitive premiums, starting at just $70 per month for windshield replacement coverage in Nevada, making it an affordable option for many drivers.

Cons

- Limited Availability: Allstate may not be available in all areas, limiting access to its coverage options for some drivers.

- Potential Rate Increases: While Allstate offers competitive premiums initially, there’s a possibility of rate increases over time, especially after filing claims for windshield replacements.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Student Savings

Pros

- Strong Financial Stability: State Farm boasts a strong financial stability rating, providing assurance to policyholders that their claims will be honored, including windshield replacements.

- Multiple Discount Opportunities: State Farm offers various discounts, including those for safe driving, bundling policies, and student savings, helping customers save on their premiums.

- Flexible Policy Options: State Farm provides flexible policy options, allowing customers to customize their coverage according to their individual needs and budget. Find out more in our State Farm auto insurance review.

Cons

- Potentially Higher Premiums: While State Farm offers comprehensive coverage and discounts, its premiums may be higher compared to some competitors, especially for drivers with less-than-perfect driving records.

- Limited Digital Tools: State Farm’s digital tools and online interface may not be as robust or user-friendly as some other insurance providers, which could impact customer experience.

#3 – Geico: Best for Cost Savings

Pros

- Cost Savings: Geico is known for its cost-saving initiatives, offering competitive premiums and discounts to help customers save money on their auto insurance, including windshield replacement coverage.

- User-Friendly Online Experience: Geico provides a user-friendly online experience, allowing customers to easily manage their policies, file claims, and access resources through its website and mobile app.

- Quick Claim Processing: Geico prioritizes efficient claim processing, aiming to resolve claims, including those for windshield replacements, promptly to minimize inconvenience for policyholders.

Cons

- Limited Coverage Options: While Geico offers competitive pricing, its coverage options may be more limited compared to some other insurance providers, potentially leaving customers with fewer choices. Read more in our Geico auto insurance review.

- Potential for Customer Service Issues: Despite its emphasis on digital tools, Geico’s customer service may receive mixed reviews, with some customers reporting challenges in reaching representatives or resolving issues promptly.

#4 – Progressive: Best for Budgeting Tools

Pros

- Advanced Technology and Tools: Progressive offers innovative tools and technology, such as Snapshot, which tracks driving behavior to potentially lower premiums, and Name Your Price® tool, allowing customers to customize their coverage based on their budget.

- Transparent Pricing: In our Progressive auto insurance review, Progressive is known for its transparent pricing structure, providing clear information about premiums and discounts, helping customers make informed decisions.

- Comprehensive Coverage Options: Progressive offers a wide range of coverage options, including windshield replacement coverage, giving customers flexibility to tailor their policies to their needs.

Cons

- Potential for Rate Increases: While Progressive may initially offer competitive premiums, rates could increase over time, particularly after filing claims for windshield replacements or other damages.

- Customer Service Concerns: Some customers have reported mixed experiences with Progressive’s customer service, citing issues with responsiveness and claims handling, which could impact overall satisfaction.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Farmers: Best for Insurance Discounts

Pros

- Strong Claims Handling: Farmers is known for its efficient and effective claims handling process, providing prompt assistance and reimbursement for covered damages, including windshield replacements.

- Customizable Coverage: Farmers offers customizable coverage options, allowing customers to tailor their policies to their specific needs and preferences.

- Educational Resources: Farmers provides educational resources and tools to help customers understand their coverage options, make informed decisions, and navigate the claims process with ease.

Cons

- Potentially Higher Premiums: Farmers, as mentioned in our Farmers auto insurance review, may have higher premiums compared to some other providers, especially for drivers with less-than-perfect driving records or specific coverage needs.

- Limited Online Tools: While Farmers offers personalized service through its network of agents, its online tools and digital interface may be less robust compared to some competitors, potentially limiting convenience for customers who prefer self-service options.

#6 – Liberty Mutual: Best for Safe-Driving Discounts

Pros

- Safe-Driving Discounts: Liberty Mutual offers various discounts for safe driving habits, rewarding customers for maintaining good driving records and reducing the risk of accidents. For further insights, refer to our Liberty Mutual auto insurance review.

- Wide Range of Coverage Options: Liberty Mutual provides a diverse selection of coverage options, including windshield replacement coverage, giving customers flexibility to customize their policies to suit their individual needs.

- Convenient Mobile App: Liberty Mutual’s mobile app offers convenient features for policy management, claims filing, and roadside assistance, enhancing customer experience and accessibility.

Cons

- Potentially Higher Premiums: While Liberty Mutual offers comprehensive coverage options, its premiums may be higher compared to some competitors, particularly for drivers with certain risk factors or coverage needs.

- Mixed Customer Service Reviews: Some customers have reported mixed experiences with Liberty Mutual’s customer service, including issues with responsiveness and claims processing, which could affect overall satisfaction.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide, as mentioned in our Nationwide insurance review, offers a vanishing deductible option, allowing customers to lower their deductible over time for every year of safe driving without an accident, incentivizing safe driving behavior.

- Multiple Discount Opportunities: Nationwide provides various discount opportunities, including those for bundling policies, safe driving, and loyalty, helping customers save on their premiums.

- Strong Financial Stability: Nationwide boasts a strong financial stability rating, assuring customers that their claims, including those for windshield replacements, will be honored promptly and reliably.

Cons

- Limited Availability of Local Agents: Nationwide’s network of local agents may be more limited compared to some other providers, potentially impacting accessibility for customers who prefer in-person assistance.

- Complex Claims Process: Some customers have reported challenges with Nationwide’s claims process, citing complexity and delays, which could lead to frustration and inconvenience.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Discount Availability

Pros

- Discount Availability: American Family offers a wide range of discounts, including those for safe driving, bundling policies, and loyalty, helping customers save on their premiums.

- Flexible Policy Options: American Family provides flexible policy options, allowing customers to customize their coverage to suit their individual needs and budget. Find out more through our American Family auto insurance review.

- Responsive Customer Service: American Family is known for its responsive customer service, with knowledgeable agents available to assist policyholders with questions, claims, and policy management.

Cons

- Potentially Higher Premiums: While American Family offers comprehensive coverage and discounts, its premiums may be higher compared to some competitors, particularly for drivers with specific risk factors or coverage needs.

- Limited Availability: American Family may have limited availability in certain areas, potentially limiting access to its coverage options for some drivers.

#9 – Travelers: Best for Business-Use Coverage

Pros

- Business-Use Coverage: Travelers offers specialized coverage options for business use, providing protection for vehicles used for business purposes, including windshield replacement coverage.

- Discount Opportunities: Travelers provides various discount opportunities, such as those for safe driving, bundling policies, and multi-vehicle policies, helping customers save on their premiums.

- Flexible Payment Options: Travelers offers flexible payment options, allowing customers to choose from various payment plans to accommodate their budget and preferences.

Cons

- Limited Coverage Options for Personal Vehicles: Our Travelers auto insurance review reveals that while Travelers offers robust coverage options for business vehicles, its coverage options for personal vehicles may be more limited compared to some other providers.

- Mixed Customer Service Reviews: Some customers have reported mixed experiences with Travelers’ customer service, including issues with responsiveness and claims processing, which could impact overall satisfaction.

#10 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA offers comprehensive roadside assistance coverage, providing peace of mind to customers in the event of emergencies such as flat tires, dead batteries, or lockouts.

- Member Benefits: AAA members enjoy exclusive benefits and discounts on various services, including insurance premiums, travel, and automotive services.

- Extensive Network: AAA has an extensive network of service providers, including repair shops and towing companies, ensuring prompt assistance and service for members in need.

Cons

- Limited Availability: AAA membership and insurance coverage may not be available in all areas, potentially limiting access to its benefits for some drivers. Find out more through our AAA auto insurance review.

- Potentially Higher Premiums: While AAA offers valuable benefits and discounts, its premiums may be higher compared to some other providers, especially for non-members.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Windshield Glass Laws in Nevada

Rules Insurance Companies Have About Repairing Auto Glass in Nevada

Filing a Claim for Windshield Damage in Nevada

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Final Thoughts on the Nevada Windshield Laws

Frequently Asked Questions

What are the windshield glass laws in Nevada?

The Nevada government does not have specific laws regarding windshield damage. However, the regulation number NRS 484D.435 states that windshields and windows must be unobstructed. While the regulation does not mention cracks or chips, if they obstruct your view, authorities may consider it a violation.

What rules do insurance companies have about repairing auto glass in Nevada?

If you have comprehensive auto insurance coverage, you can make a comprehensive claim for auto insurance to cover a cracked windshield caused by debris or impact. However, it’s important to read the fine print as not all comprehensive coverage automatically includes full glass replacement. Enter your ZIP code now.

What about a deductible when replacing a windshield in Nevada?

Do I need to repair or replace a windshield in Nevada?

If the damage is in front of the driver and may obstruct their vision, it is usually recommended to replace the windshield. Some types of damage, such as “star” or “bull’s-eye” patterns, can be repaired depending on the speed and trajectory of the object that hit the windshield.

Should I file a claim with my car insurance for windshield damage in Nevada?

Whether to file a claim or pay for the repairs out of pocket depends on various factors. Consider the deductible you would need to pay and the potential impact on your insurance rates. Assess the overall cost of replacing or repairing the windshield to determine if it’s economically viable for you to file a claim. Enter your ZIP code now to start.

What are the top three insurance companies offering the best windshield replacement coverage in Nevada?

What is the starting premium for windshield replacement coverage offered by Allstate in Nevada?

The starting premium for windshield replacement coverage offered by Allstate in Nevada is $70 per month.

Does Nevada require insurers to offer zero deductible options for windshield repairs?

No, Nevada does not require insurers to offer zero deductible options for windshield repairs. Enter your ZIP code now to start.

What factors should drivers consider when deciding whether to repair or replace a windshield in Nevada?

What is the vanishing deductible option offered by Nationwide, and how does it work?

The vanishing deductible option offered by Nationwide allows customers to lower their deductible over time for every year of safe driving without an accident, incentivizing safe driving behavior.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.