Root Auto Insurance Review in 2025 (See Actual Rates)

Root auto insurance review also offers varied rates, such as as low as $31 per month. Its differentiation is in its telematics technology, which scrutinizes your regular driving behavior, including miles driven, to determine premiums that may benefit good drivers. Read this article to know more information.

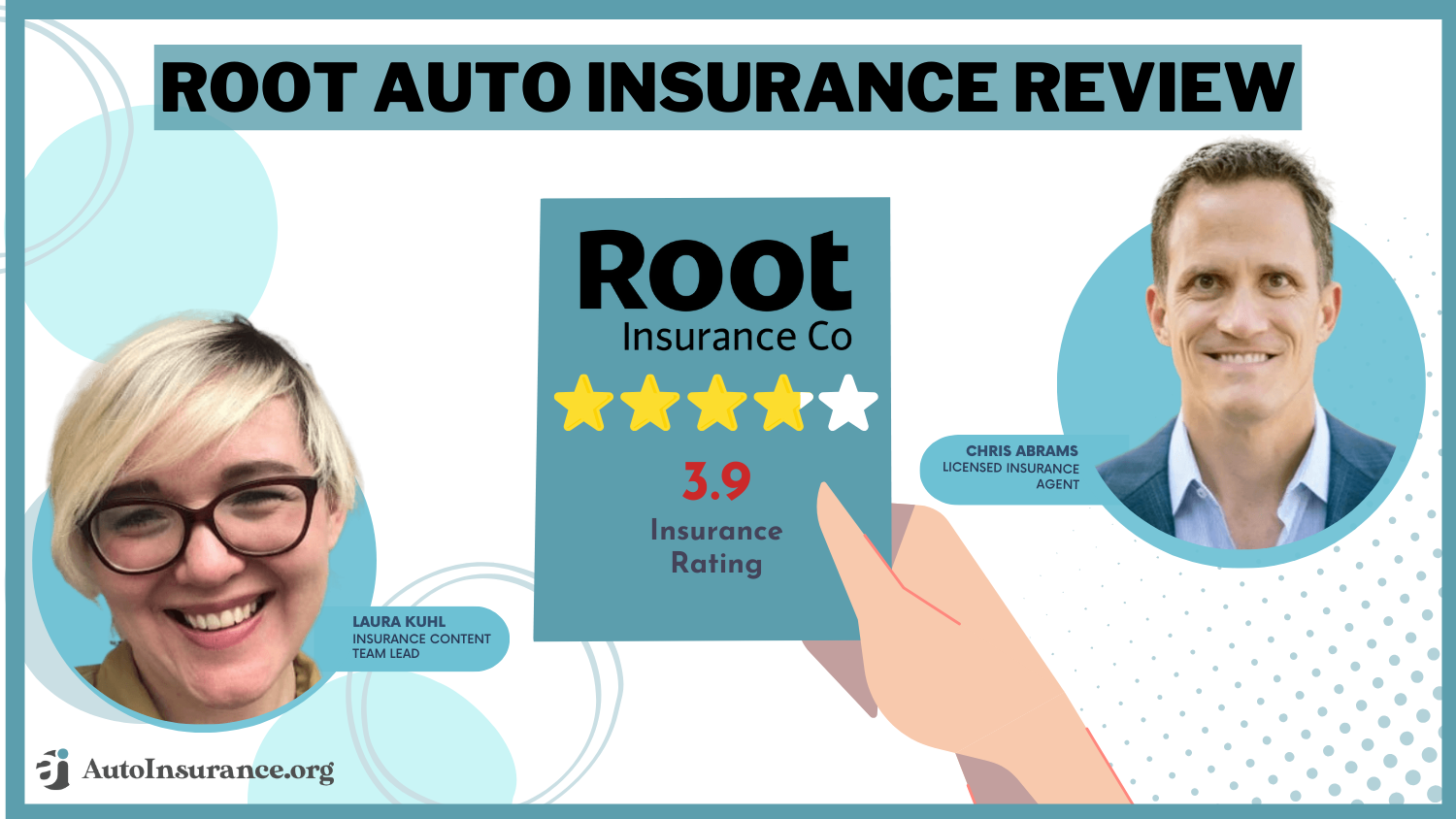

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Feb 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Root

Average Monthly Rate For Good Drivers

$31A.M. Best Rating:

NRComplaint Level:

HighPros

- Affordable rates for low-mileage drivers

- Customizable policies

- User-friendly app

Cons

- Frequently rejects applications

- Limited Support

- No A.M. Best Rating

This Root auto insurance review will detail how the company has offered personal rates through telematics—with some quotes as low as $31 per month.

Root differentiates itself by using an app to monitor behind-the-wheel habits, so if you log fewer miles or prove to be a better driver, you can get cheaper rates. Uncover more by delving into our article entitled “What is auto insurance?“

Root Auto Insurance Rating

Rating Criteria

Overall Score 3.9

Business Reviews 3.0

Claim Processing 4.5

Company Reputation 4.0

Coverage Availability 4.4

Coverage Value 3.8

Customer Satisfaction 3.3

Digital Experience 4.0

Discounts Available 3.7

Insurance Cost 4.1

Plan Personalization 4.0

Policy Options 3.4

Savings Potential 3.9

Root allows you to customize your coverage and roadside assistance, is backed by Progressive, and has an A+ BBB rating. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

Compare Root Auto Insurance Rates to Top Providers

Safe drivers typically get lower rates through Root car insurance than traditional insurers. We compare Root Insurance Company to its most frequent competitors here:

Root vs. Top Competitors: Minimum Coverage Auto Insurance Monthly Rates

Insurance Company Monthly Rates

$47

$33

$43

$52

$42

$48

$34

$51

$38

$49

$32

Root’s telematics-based pricing could make It a better choice than other insurance companies for some low-mileage or safe drivers, but risky behind-the-wheel types may find more affordable quotes in any other case. Explore further in our article titled “What are auto insurance benefits?“

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Root Auto Insurance Review

On the other hand, Root Auto Insurance is a new insurance company that utilizes telematics technology to follow your driving behaviors and provide personalized rates. This Root auto insurance review provides information on the cost of coverage, how it compares to competitors in the marketplace, discounts available, and customer feedback.

Before deciding if Root car insurance suits your needs, here’s everything you need to know. Delve into the specifics in our article “Auto Insurance for Different Types of Drivers.”

Root Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

Root auto coverage bases insurance rates on individual driving behavior. Root tracks your driving habits, watching how you drive and the time of day with a smartphone app.

Root Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

Age & Gender Minimum Coverage Full Coverage

Age: 16 Female $200 $500

Age: 16 Male $220 $550

Age: 18 Female $180 $450

Age: 18 Male $210 $525

Age: 25 Female $95 $250

Age: 25 Male $105 $270

Age: 30 Female $80 $210

Age: 30 Male $90 $230

Age: 45 Female $50 $140

Age: 45 Male $53 $139

Age: 60 Female $45 $127

Age: 60 Male $47 $130

Age: 65 Female $42 $120

Age: 65 Male $44 $125

This model allows better drivers to get lower rates based on usage. Our article, “Best Auto Insurance for Good Drivers,” dives into the details.

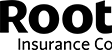

Root Coverage Options

Root vehicle insurance offers standard coverage options similar to most major auto insurers:

- Liability Coverage: This covers bodily injury and property damage you may cause to others in an accident.

- Collision Coverage: Pays for damages to your car in a collision.

- Comprehensive Coverage: Covers non-collision incidents, such as theft or weather damage.

- Uninsured/Underinsured Motorist: Protects you if an uninsured or underinsured driver hits you.

- Roadside Assistance: All policies include services like towing and tire changes.

While Root auto coverage provides these basic options, some coverage types, such as rental car coverage or gap insurance, may only be available in some states. For a comprehensive understanding, consult our article, “Do all auto insurance companies offer the same thing?“

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

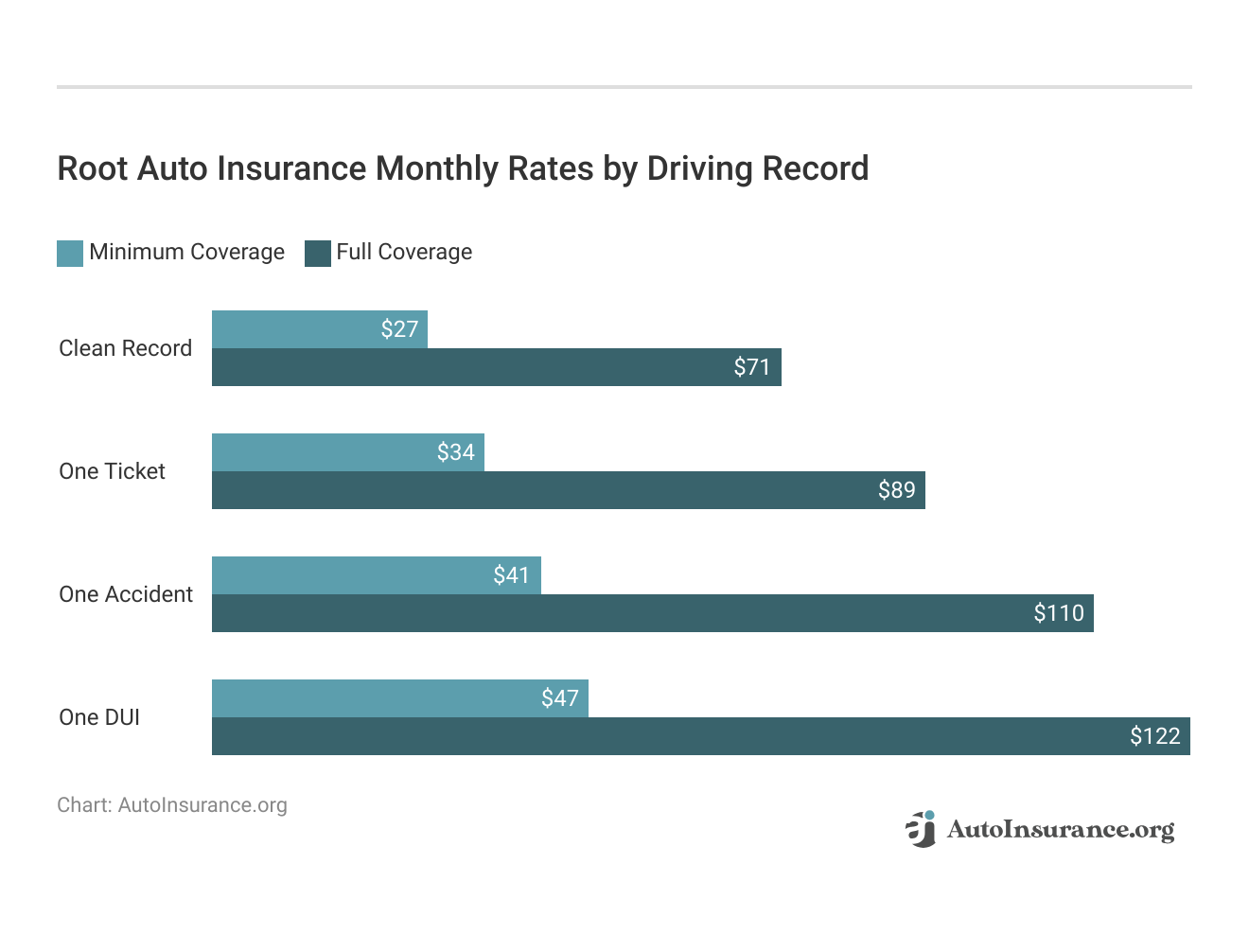

Root Auto Insurance Monthly Rates by Driving History

Root Auto Insurance adjusts its monthly rates based on your driving history. Factors like accidents, DUIs, and tickets can increase premiums, while a clean record results in the lowest rates.

Driving history significantly impacts Root Auto Insurance rates, with clean drivers enjoying lower premiums and those with violations paying more for coverage. Enhance your knowledge by reading “Is auto insurance per car or person?“

Root Available Discounts

Though Root does not advertise many traditional discounts like other insurance companies, the most significant “discount” comes from driving safely. Since Root car insurance bases your rates on how you drive, maintaining good driving habits can significantly reduce your premium.

Root Auto Insurance Discounts by Potential Savings

Discount

Safe Driver 20%

Telematics or Usage-Based 20%

Multi-Vehicle 15%

Good Student 12%

Bundling 10%

Low Mileage 10%

Paid in Full 8%

Green or Hybrid Vehicle 7%

Occupation-Based 7%

Renewal or Loyalty 7%

Safety Feature 7%

Senior Driver 6%

Root’s pricing model acts as its primary discount system, unlike traditional insurers. Our article “Auto Insurance Premium” will help you better understand the topic.

Root Customer Reviews

Customer reviews for Root Insurance Company are mixed. While many customers appreciate the affordability and ease of managing policies through the app, there are frequent complaints about poor customer service, prolonged claims processing, and difficulty reaching support.

Root holds an “A+” rating with the Better Business Bureau (BBB) but has a high volume of complaints related to similar issues, reflecting overall concerns with customer satisfaction. Despite the strong BBB rating, the company’s customer service and responsiveness remain problematic, with a complaint level higher than the industry average.

Expand your understanding with our article, “How to Get Fast and Free Auto Insurance Quotes.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Root Business Review

Commercially, Root Insurance Company is a new player in the insurance game that uses telematics to disrupt traditional coverage models. Nevertheless, the company’s customer service remains a sore point. Root has yet to receive a rating from A.M. Best, one of the largest credit-rating agencies in the U.S.

Root Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 850 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 78/100 Good Customer Feedback |

|

| Score: 0.85 Fewer Complaints Than Avg. |

That, combined with its higher-than-average complaint amount, points to policyholders’ problems getting claims or customer service issues straightened out. Root’s mobile app has long been lauded for its simplicity despite these hurdles regarding a next-gen insurance product.

It allows customers to manage their policy, keep tabs on how they’re driving, and file claims all in one place. For additional insights, refer to our “How to Buy Auto Insurance Online Instantly.”

Pros and Cons of Root Auto Insurance

Root Auto Insurance offers affordable rates for safe drivers with its app-based, telematics-driven model. However, it has limitations in customer support and availability.

Pros

- Affordable for Safe Drivers: Root’s telematics-based pricing can result in significant savings for those with good driving habits.

- App-Based Experience: Root’s mobile app makes managing policies and tracking your driving easy.

- Roadside Assistance Included: All policies include roadside assistance, which can be a bonus for frequent travelers.

Cons

- Limited Customer Support: Numerous complaints about poor customer service and slow claim processing.

- High Rejection Rate: If Root’s telematics data labels you as a risky driver, you may be denied coverage.

- Only available in some states: Potential customers should verify availability in their state.

Root Insurance is excellent for safe drivers seeking low premiums, but customer service issues and limited availability could be drawbacks. Our article “Can a private auto insurance company meet my needs?” will help you gain a deeper understanding.

Understanding Root Auto Insurance Review

Based on this Root auto insurance review, the company is worth considering if you are a safe driver looking for reasonable, individualized coverage. Its telematics, or pay-as-you-go model, could save those who deserve it a lot of money.

Although Root auto coverage offers favorable rates and the convenience of an app, it could improve in terms of customer service complaints and a higher reject rate for high-risk drivers.

If insurance companies and their assessment parametric options confuse you, or if other holistic players are too expensive for your type of driving, then maybe Root, a new kind of car insurance, is the sort of offer that may suit (and save on) what it takes to drive around safely.

Some may prefer more options in comprehensive support and coverage elsewhere; you should look into some of the bigger guys. Find out more by reading our “Types of Auto Insurance.” Get fast and cheap auto insurance coverage today with our quote comparison tool.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What do Root insurance reviews say about the company’s coverage?

Root reviews highlight competitive pricing but mention limited coverage areas. Broaden your knowledge with our article, “Understanding Auto Insurance.”

How does Root car insurance compare to State Farm?

Root focuses on app-based, personalized rates, while State Farm offers broad coverage and in-person agents.

Are Root car insurance reviews generally positive?

Root is praised for affordability, but some reviews note mixed customer service experiences.

How do I get a Root car insurance quote?

Download the Root app, complete a driving test, and receive a personalized quote. Explore further with our article, “Is auto insurance a waste of money?“

Is Root good insurance for safe drivers?

Yes, Root rewards safe driving with customized, lower rates.

What do customer reviews say about Root car insurance?

Customers appreciate the app’s ease of use but have mixed reviews on claims handling.

How does Root vs. State Farm car insurance compare in terms of price?

Root often offers lower rates for safe drivers, while State Farm may have broader discounts. To gain insights, read our article “Best Auto Insurance Companies.“

Which is better: Root or USAA car insurance?

USAA offers robust coverage for military families, while Root may have lower rates based on driving habits.

How does Root vs. Progressive compare?

Progressive provides more coverage options, but Root may have lower rates for good drivers. Enter your ZIP code to start comparing total coverage auto insurance rates.

Is Root car insurance good for new drivers?

Root may be beneficial if the driver has safe driving habits but lacks coverage options for high-risk needs. Our article “How to Manage Your Auto Insurance Policy” will deepen your understanding.

What does a Root insurance review say about claims?

Reviews suggest Root has a simple claims process, though some customers report delays.

How does Root vs. Geico car insurance compare?

Geico is known for affordable coverage options, while Root targets safe drivers with app-based pricing.

How does Root Insurance compare to Allstate?

Allstate offers more policy types and discounts, whereas Root focuses on usage-based rates. For further details, consult our article named “Auto Insurance Laws.”

How does Root vs. Nationwide compare in terms of customer satisfaction?

Nationwide often rates higher in customer service, while Root is praised for innovative, lower-cost options.

Can I get a Root insurance quote without downloading the app?

No, the Root quote requires downloading the app and completing a driving test.

Which is better: Metromile vs Root car insurance?

Root uses driving behavior for pricing, while Metromile offers pay-per-mile rates, ideal for low-mileage drivers. Discover more by reading our article “How to Choose an Auto Insurance Company.”

How does Nationwide vs. Root car insurance compare for families?

Nationwide has more family-friendly discounts, while Root might offer lower rates to safe-driving individuals.

Is Root vs. USAA a good comparison for military families?

USAA is tailored for military needs, while Root is best for safe drivers seeking app-based insurance.

How does Progressive vs. Root car insurance compare on claims satisfaction?

Progressive has extensive claims support, while Root’s app-based approach appeals to tech-savvy drivers. Get a better grasp of the topic by reading our article “How to Evaluate Auto Insurance Quotes.”

Is Root good insurance for budget-conscious drivers?

Root is affordable for safe drivers, but coverage options are more limited than some significant insurers. Uncover affordable auto insurance rates from the top providers by entering your ZIP code.

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

MRub_

Fast, efficient, inexpensive

miss_gaby

Quick and easy

TEDIVA

Great Company

Roman_S

Great job

Jakearrr

Fantastic Experience

Texasgirl63

Auto insurance

Xan52

Fraud! Beware!

Frustratedashell

Money for nothing

Karolina_pilvyte

Easy sign up and affordable pricing

Kay_street

Insurance for the people