Best Acura NSX Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

State Farm, Progressive, and Geico are the top picks for the best Acura NSX auto insurance, offering rates starting at just $115 monthly. These companies are recognized for providing exceptional coverage and value, specifically tailored to meet the needs of Acura NSX owners, ensuring comprehensive protection.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Acura NSX

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Acura NSX

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Acura NSX

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

The top picks for the best Acura NSX auto insurance are State Farm, Progressive, and Geico, renowned for their superior coverage options and customer service.

These companies excel in providing policies that are perfectly suited to the unique needs of Acura NSX owners, emphasizing both protection and value.

Our Top 10 Company Picks: Best Acura NSX Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Reliable Claims State Farm

#2 14% A+ Competitive Rates Progressive

#3 15% A++ Competitive Premiums Geico

#4 13% A+ Personalized Service Allstate

#5 11% A+ Safe-Driving Discounts Nationwide

#6 12% A Customizable Policies Liberty Mutual

#7 10% A+ Many Discounts Farmers

#8 9% A++ Extensive Coverage Travelers

#9 8% A Multi-Policy Discounts American Family

#10 7% A High-Risk Drivers The General

With varying factors influencing the cost, such as the driver’s age, location, and driving record, choosing the right insurer is crucial. This article explores how each company stands out in the competitive market of luxury sports car insurance.

You can start comparing quotes for Acura NSX car insurance rates from some of the best car insurance companies by using our free online tool now.

- State Farm leads as the top pick for Acura NSX auto insurance

- Coverage options are tailored to the Acura NSX’s high-performance nature

- Insuring an Acura NSX involves considering its unique tech and value

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers a 17% discount for bundling multiple policies, making it an appealing option for Acura NSX owners looking to combine their auto insurance with other coverage.

- High Low-Mileage Discount: Acura NSX owners benefit from State Farm’s substantial discounts for low-mileage usage, ideal for those who reserve their vehicle for special occasions. Discover insights in our guide titled, State Farm auto insurance review.

- Wide Coverage: Offering a variety of coverage options, State Farm ensures that Acura NSX owners can tailor their insurance to meet specific needs, whether it’s for daily use or as a collector’s item.

Cons

- Limited Multi-Policy Discount: While competitive, State Farm’s multi-policy discount of 17% may not be as lucrative compared to some competitors for Acura NSX owners looking for the maximum savings on multiple insurances.

- Premium Costs: Despite available discounts, the premiums for Acura NSX coverage through State Farm may still be higher relative to other insurers, especially considering its B rating from A.M. Best.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Competitive Rates

Pros

- Competitive Multi-Policy Discount: Progressive offers a 14% discount for multiple policies, which can be beneficial for Acura NSX owners who need comprehensive coverage for multiple assets.

- A+ Financial Strength: With an A+ rating from A.M. Best, Progressive ensures robust financial health, giving Acura NSX owners confidence in claims handling and payouts. Delve into our evaluation of Progressive auto insurance review.

- Tailored Rate Reductions: Progressive’s competitive rates are particularly favorable for Acura NSX owners, who may benefit from additional discounts for being safe drivers or having advanced security features.

Cons

- Standard Coverage Options: Despite competitive pricing, the coverage options for an Acura NSX might not be as expansive as those offered by other insurers, potentially leaving some unique risks uncovered.

- Variable Customer Service: Some Acura NSX owners might experience inconsistencies in customer service, which can be a drawback in managing policies or handling claims.

#3 – Geico: Best for Competitive Premiums

Pros

- Outstanding Financial Rating: Geico’s A++ rating from A.M. Best assures Acura NSX owners of superior financial stability for handling claims. Learn more by reading our guide titled, “Geico Auto Insurance Review.”

- Competitive Premiums for Luxury Cars: Geico offers competitive insurance premiums tailored to the needs of high-value vehicles like the Acura NSX, considering factors such as car value and potential repair costs.

- Efficient Online Services: Geico provides streamlined online services that allow Acura NSX owners to easily manage their policies and file claims conveniently.

Cons

- Average Multi-Policy Discount: The 15% discount on multi-policy bundles might not be the most competitive for Acura NSX owners looking for the best possible deal on comprehensive insurance plans.

- Limited Personalized Interaction: Geico primarily operates online, which might limit personalized service options for Acura NSX owners who prefer face-to-face interactions.

#4 – Allstate: Best for Personalized Service

Pros

- Tailored Insurance Options: Allstate provides highly personalized insurance services, allowing Acura NSX owners to customize policies according to their specific needs and driving habits.

- Strong Financial Rating: With an A+ rating from A.M. Best, Allstate offers robust financial reliability, ensuring that claims related to the Acura NSX are managed effectively. Access comprehensive insights into our guide Allstate auto insurance review.

- Dedicated Agent Network: Acura NSX owners can benefit from Allstate’s extensive agent network, providing personalized advice and support tailored to the unique needs of luxury car insurance.

Cons

- Slightly Lower Multi-Policy Discount: At 13%, Allstate’s multi-policy discount is competitive but might not be the highest available for Acura NSX owners looking to bundle various insurance types.

- Premium Pricing: Although the service is personalized, Allstate’s premiums for high-value vehicles like the Acura NSX may be higher, reflecting the tailored and extensive coverage options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Safe-Driving Discounts

Pros

- Substantial Safe-Driving Discounts: Nationwide offers significant discounts for safe drivers, which can benefit Acura NSX owners who maintain a clean driving record.

- Customizable Coverage Options: Acura NSX owners can take advantage of Nationwide’s customizable insurance options, ensuring that their coverage meets the specific demands of insuring a luxury sports car.

- A+ Financial Rating: Nationwide’s strong A+ rating from A.M. Best underscores its financial health and claims-paying ability, giving Acura NSX owners peace of mind. Read up on the Nationwide auto insurance review for more information.

Cons

- Lower Multi-Policy Discount: Nationwide’s 11% discount for bundling policies is lower than some of its competitors, which may be a drawback for Acura NSX owners looking to maximize savings.

- Policy Cost: Despite offering discounts for safe driving, the overall cost of insuring an Acura NSX with Nationwide might still be relatively high due to the intrinsic value and repair costs of the vehicle.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Highly Customizable Policies: Liberty Mutual stands out by offering highly customizable policies, which is ideal for Acura NSX owners who require specific coverages tailored to their vehicle’s unique needs.

- Diverse Discount Opportunities: With various discounts available, Acura NSX owners can significantly reduce their premiums by qualifying for multiple Liberty Mutual discounts.

- Strong Financial Health: With an A rating from A.M. Best, Liberty Mutual assures financial stability and reliable claim support for Acura NSX insurance policies. Discover more about offerings in our complete Liberty Mutual auto insurance review.

Cons

- Moderate Multi-Policy Discount: At 12%, the multi-policy discount is moderate and might not be as attractive to Acura NSX owners seeking to combine several insurance policies under one provider.

- Variable Premiums: The premiums for Acura NSX insurance can vary significantly based on the car’s age, usage, and the owner’s driving history, potentially leading to higher costs than expected.

#7 – Farmers: Best for Many Discounts

Pros

- Extensive Discount Offerings: Farmers offers a wide range of discounts that Acura NSX owners can take advantage of, such as for safe driving, good students, and electronic payments, potentially lowering premiums significantly.

- Specialized Coverage for Luxury Cars: Farmers provides specialized insurance options that cater to the unique needs of luxury vehicles like the Acura NSX, covering everything from agreed value to rare parts replacement.

- A+ Financial Stability: With an A+ rating from A.M. Best, Farmers ensures strong financial backing, important for Acura NSX owners who require reliable and prompt claims service. More information is available about this provider in our Farmers auto insurance review.

Cons

- Lower Multi-Policy Discount: At only 10%, Farmers offers a lower multi-policy discount compared to others, which might be less appealing for Acura NSX owners looking to insure multiple assets.

- Premium Costs Can Be High: Although discounts are available, the base premiums for insuring a high-value vehicle like the Acura NSX at Farmers can be relatively high, reflecting the comprehensive and specialized coverage provided.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Extensive Coverage

Pros

- Wide Range of Coverage Options: Travelers offers an extensive range of coverage options, making it a suitable choice for Acura NSX owners who need specific protections, such as for custom parts and equipment. See more details in our guide titled, “Travelers Auto Insurance Review.”

- High Financial Rating: With an A++ rating from A.M. Best, Travelers stands out for its financial robustness, ensuring that large claims, such as those that might arise from owning an Acura NSX, are handled efficiently.

- Flexible Policy Adjustments: Travelers allows for flexible policy adjustments, which is beneficial for Acura NSX owners as it enables them to modify their coverage as their insurance needs change or as their vehicle ages.

Cons

- Slightly Lower Multi-Policy Discount: At 9%, the discount for bundling policies with Travelers is lower, which might not be as competitive for Acura NSX owners who need comprehensive coverage across multiple domains.

- Higher Premiums for Comprehensive Coverage: The premiums for extensive coverage options, while comprehensive, can be on the higher side for luxury cars like the Acura NSX, reflecting the broad protections offered.

#9 – American Family: Best for Multi-Policy Discounts

Pros

- Competitive Multi-Policy Discounts: American Family offers a good discount rate of 8% for customers who bundle their insurance policies, beneficial for Acura NSX owners looking to insure multiple properties or vehicles.

- Customized Insurance Solutions: American Family provides customized insurance solutions that can be tailored to the specific needs of Acura NSX owners, offering flexibility in coverage features and limits.

- Solid Financial Rating: With an A rating from A.M. Best, American Family ensures financial reliability, important for handling claims related to high-value vehicles like the Acura NSX efficiently. See more details in our guide titled, “American Family Auto Insurance Review.”

Cons

- Limited Discount Opportunities: Aside from the multi-policy discount, there may be fewer opportunities for additional discounts compared to other insurers, which could result in higher overall costs for Acura NSX owners.

- Coverage Limits: Some Acura NSX owners might find the coverage limits provided by American Family less accommodating than those offered by insurers specializing in luxury or high-performance vehicles.

#10 – The General: Best for High-Risk Drivers

Pros

- Specialized Coverage for High-Risk Profiles: The General is well-suited for Acura NSX owners who may have high-risk driver profiles, offering coverage where other insurers might not.

- Flexible Payment Options: The General provides flexible payment plans, which can be particularly beneficial for Acura NSX owners who need to adjust their budgeting to accommodate higher insurance rates typically associated with high-risk insurance.

- A Rating from A.M. Best: The General’s A rating ensures that it is financially stable enough to handle claims reliably, even for high-value vehicles like the Acura NSX. Discover insights in our guide titled, “The General Auto Insurance Review.”

Cons

- Lower Multi-Policy Discount: With only a 7% discount for bundling policies, The General offers the lowest multi-policy discount among the listed companies, which might not be as attractive for Acura NSX owners looking for extensive coverage savings.

- Potentially Higher Premiums: Due to specializing in high-risk insurance, The General might charge higher premiums, especially for a luxury sports car like the Acura NSX, reflecting the increased risk and potential for claims.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Acura NSX Insurance Costs: A Detailed Breakdown

When it comes to insuring an Acura NSX, the cost can vary significantly depending on the level of coverage and the provider you choose. This section explores the monthly rates for both minimum and full coverage across various insurance companies.

Acura NSX Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $130 $315

American Family $118 $297

Farmers $121 $299

Geico $115 $295

Liberty Mutual $127 $312

Nationwide $123 $305

Progressive $125 $310

State Farm $120 $300

The General $135 $320

Travelers $119 $298

The table below provides a clear comparison of monthly insurance rates for the Acura NSX, segmented by minimum and full coverage options from different insurers. Allstate, for instance, offers minimum coverage at $130 and full coverage at $315.

Thanks to @AZCardinals and all our good neighbors for helping us fight food insecurity one meal at a time! Our community raised over $30,000 on the Summer of a Million Meals launch day! Donate at https://t.co/Yv46R3B2RL pic.twitter.com/XN2tw72F5d

— State Farm (@StateFarm) May 18, 2024

On the lower end of the spectrum, Geico provides the most affordable full coverage at $295 and also competitive minimum coverage at $115. This variability highlights the importance of comparing rates to find the best insurance solution for your Acura NSX, balancing cost with the breadth of coverage.

Other notable entries include The General, with the highest full coverage rate at $320, and American Family, which offers a lower-cost alternative at $297 for full coverage.

Learn more by reading our guide: What is full coverage auto insurance?

Acura NSXs Cost to Insure

Comparing the Acura NSX with other prestigious sports cars reveals distinct differences in insurance costs. The chart below illustrates how the insurance rates for the Acura NSX stack up against those for vehicles like the Audi R8, Jaguar F-TYPE, and Porsche 718 Cayman.

Acura NSX Auto Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Audi R8 | $50 | $112 | $33 | $207 |

| Jaguar F-TYPE | $42 | $92 | $33 | $181 |

| Porsche 718 Cayman | $38 | $84 | $33 | $169 |

| Porsche 911 | $40 | $87 | $33 | $173 |

| Audi TTS | $33 | $60 | $28 | $132 |

| Audi RS 7 | $44 | $92 | $33 | $183 |

While the Acura NSX offers a unique blend of performance and luxury, ensuring you find the most cost-effective insurance is key. By analyzing different insurance rates and exploring options online, you can secure the best possible coverage for your Acura NSX at a competitive price.

Read more: Jaguar Auto Insurance

What Impacts the Cost of Acura NSX Insurance

The Acura NSX trim and model you choose can impact the total price you will pay for Acura NSX insurance coverage.

Age of the Vehicle

Exploring insurance costs for the Acura NSX is crucial for potential owners. Below is a breakdown of monthly rates by model year, covering comprehensive, collision, and liability coverages.

Acura NSX Auto Insurance Monthly Rates by Model Year and Coverage Type

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Acura NSX | $52 | $110 | $40 | $215 |

| 2023 Acura NSX | $51 | $108 | $39 | $210 |

| 2022 Acura NSX | $50 | $107 | $38 | $208 |

| 2021 Acura NSX | $49 | $106 | $38 | $206 |

| 2020 Acura NSX | $48 | $105 | $37 | $204 |

| 2019 Acura NSX | $47 | $104 | $37 | $202 |

| 2018 Acura NSX | $46 | $103 | $36 | $200 |

| 2017 Acura NSX | $48 | $104 | $35 | $200 |

| 2016 Acura NSX | $46 | $100 | $36 | $195 |

The monthly insurance rates for the Acura NSX vary slightly between the 2017 and 2016 models. These figures are essential for budgeting and understanding the cost implications of owning this high-performance vehicle.

Driver Age

Driver age can have a significant impact on Acura NSX auto insurance rates. For instance, a 30-year-old driver may pay $105 more each year for Acura NSX auto insurance than a 40-year-old driver.

Driver Location

Where you live can have a large impact on Acura NSX insurance rates. For example, drivers in Houston may pay $1,766 a year more than drivers in Columbus.

Drivers who live in areas with a lot of traffic and theft pay higher rates since their vehicles are more likely to be in an accident or stolen.

Your Driving Record

Your driving record can have an impact on the cost of Acura NSX auto insurance. Teens and drivers in their 20s see the highest jump in their Acura NSX auto insurance rates with violations on their driving records. Avoid speeding tickets, accidents, and DUIs to get the cheapest Acura insurance.

Acura NSX Crash Test Ratings

Not only do good Acura NSX crash test ratings mean you are better protected in a crash, but good crash ratings also mean cheaper Acura NSX auto insurance rates.

Acura NSX Crash Test Ratings by Model Year

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Acura NSX | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Acura NSX | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Acura NSX | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Acura NSX | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Acura NSX | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Acura NSX | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Acura NSX | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Acura NSX | 5 stars | 5 stars | 5 stars | 4 stars |

While the Acura NSX has not been rated in recent crash tests, understanding the impact of such ratings on insurance costs is important for prospective and current owners. Good crash test ratings typically lead to lower insurance premiums, highlighting the dual benefits of safety and affordability in vehicle insurance.

Acura NSX Safety Features

The numerous safety features of the Acura NSX help contribute to lower insurance rates. The 2020 Acura NSX has the following safety features:

- Emergency Brake Assist

- Rain-Sensing Windshield Wipers

- Automatic High-Beam Headlights

- Corner and Rear Parking Sensors

- A Multi-Angle Rearview Camera With Dynamic Guidelines

Many auto insurance companies provide discounts for vehicle safety features. Be sure to compare discounts as well as rates when looking for Acura NSX insurance. Unlock details in our guide titled, “What is the average auto insurance cost per month?”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Acura NSX Finance and Insurance Cost

When financing an Acura NSX, most lenders will require you to carry higher Acura NSX coverage options including comprehensive coverage, so be sure to shop around and compare Acura NSX car insurance rates from the best companies using our free tool below. To find out more, explore our guide titled “Where to Buy Auto Insurance Online.”

Ways to Save on Acura NSX Insurance

Reducing the cost of auto insurance for your Acura NSX can be achieved through several strategic approaches. Here are five effective ways to potentially lower your premiums and save money.

- Install an aftermarket anti-theft device for your Acura NSX.

- Ask about farm and ranch vehicle discounts.

- Save money on young driver Acura NSX Insurance by mentioning grades or GPA.

- Consider ride-sharing services to lower your Acura NSX mileage.

- Move to an area with a lower cost of living.

To ensure you are getting the best possible rate on your Acura NSX insurance, it’s essential to compare quotes from different insurers. Exploring various discounts and adjusting your coverage to suit your needs can lead to significant savings over time. Compare rates from multiple companies to find your best deal. See more details in our guide titled, “How to Lower Your Auto Insurance Rates.”

Top Acura NSX Insurance Companies

Several top car insurance companies offer competitive rates for the Acura NSX rates based on factors like discounts for safety features. Take a look at this list of top car insurance companies that are popular with Acura NSX drivers organized by market share.

Top Acura NSX Car Insurance Companies

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9.1% |

| #2 | Geico | $46,358,896 | 6.4% |

| #3 | Progressive | $41,737,283 | 5.7% |

| #4 | Allstate | $39,210,020 | 5.4% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3.4% |

| #8 | Chubb | $24,199,582 | 3.3% |

| #9 | Farmers | $20,083,339 | 2.8% |

| #10 | Nationwide | $18,499,967 | 2.5% |

The diversity in insurance rates among the leading providers underscores the importance of comparing quotes to secure the most economical coverage for an Acura NSX.

Choosing State Farm ensures Acura NSX owners receive coverage that matches the prestige of their vehicle.Daniel Walker Licensed Insurance Agent

Each company has its pricing strategy, so prospective buyers should carefully evaluate multiple quotes to find the best deal. To find out more, explore our guide titled, “Cheap Acura Auto Insurance.”

Save on your Acura NSX car insurance rates by taking advantage of our free comparison tool below.

Frequently Asked Questions

Why do I need auto insurance for my Acura NSX?

Auto insurance for your Acura NSX is essential as it provides financial protection in case of accidents, theft, or other unexpected events. It helps cover the cost of repairs, medical expenses, and potential liabilities, ensuring you are financially safeguarded.

Learn more by reading our guide titled, “What are the benefits of auto insurance?“

What types of auto insurance coverage are available for my Acura NSX?

Choosing the right auto insurance coverage for your Acura NSX ensures you are protected in various driving situations.

- Liability Coverage: This covers bodily injury and property damage to others if you’re at fault in an accident.

- Collision Coverage: Pays for repairs or replacement if your Acura NSX is damaged in a collision.

- Comprehensive Coverage: Protects against non-collision incidents like theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Provides coverage if you’re in an accident with a driver who doesn’t have enough insurance or any insurance.

Securing comprehensive insurance for your Acura NSX covers a broad range of potential risks, safeguarding your investment in the event of unforeseen incidents.

Will insuring an Acura NSX be more expensive compared to other vehicles?

Yes, insuring an Acura NSX may be more expensive than other vehicles due to its high value, performance capabilities, and repair costs. However, insurance rates can vary between companies, so it is essential to compare quotes to find the best options for your Acura NSX.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Are there any specific insurance considerations for the Acura NSX due to its unique features?

Yes, the Acura NSX’s advanced technology, powerful engine, and exotic car status may impact insurance considerations. It’s important to ensure that your insurance policy adequately covers these features and provides sufficient coverage for the vehicle’s high value.

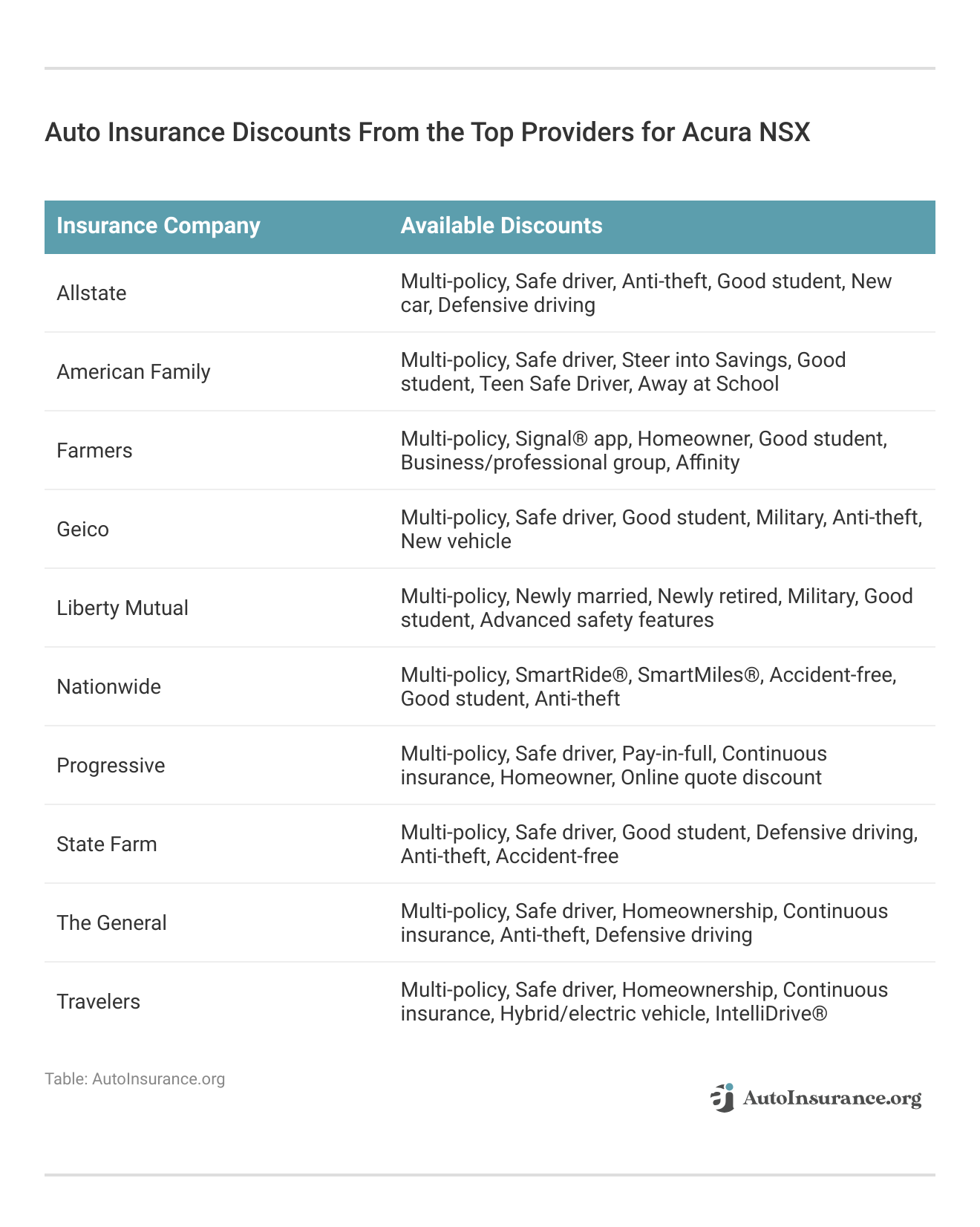

Are there any insurance discounts available for Acura NSX owners?

Acura NSX owners can take advantage of various insurance discounts that help reduce their premiums and enhance their coverage.

- Safe Driver Discounts: For maintaining a clean driving record.

- Multi-Vehicle Discounts: If you insure multiple vehicles with the same company.

- Bundling Discounts: For combining your auto insurance with other policies, such as home insurance.

- Anti-Theft Device Discounts: If your Acura NSX has advanced security features.

- Membership Discounts: Offered through professional organizations or clubs.

Exploring these discount options is a smart way for Acura NSX owners to ensure they receive the most cost-effective insurance coverage tailored to their unique needs.

For additional details, explore our comprehensive resource titled, “How to Get a Membership Auto Insurance Discount.”

How much does Acura ILX insurance cost typically?

The insurance cost for an Acura ILX typically ranges from approximately $117 to $150 per month, varying by driver age, location, and the level of coverage selected.

What is the general Acura insurance cost?

The general Acura insurance cost varies widely based on the model, but owners might expect to pay between $100 and $208 per month on average.

How do Acura insurance rates compare to other luxury cars?

Acura insurance rates are generally more affordable compared to other luxury car brands, thanks to Acura’s good safety ratings and lower repair costs.

Are Acuras expensive to insure?

Acuras are not typically expensive to insure compared to other luxury brands, due to their strong safety features and relatively lower repair costs.

To learn more, explore our comprehensive resource on “What documents do you need to get auto insurance?“

How do critics and owners generally review the Acura NSX?

The Acura NSX is generally well-received for its blend of hybrid efficiency and supercar performance, though it may face criticism for its high price point compared to competitors.

Where can I insure my Acura NSX?

You can insure your Acura NSX through insurance companies that specialize in luxury and performance cars, or through any major auto insurance provider.

What is the typical insurance cost for a 2002 Acura NSX?

The insurance cost for a 2002 Acura NSX varies widely but typically falls in the higher range due to its status as a luxury sports car. Factors like the car’s condition, mileage, and location will affect the premium.

How can I find the best insurance deal for a 2005 Acura NSX T?

To find the best insurance deal for a 2005 Acura NSX T, compare quotes from insurers that offer specialized coverage for sports cars, or use online comparison tools to evaluate different policies.

Access comprehensive insights into our guide titled, “How to Find Affordable Auto Insurance Rates Online.”

What factors affect the insurance rates for a new Acura NSX?

Insurance rates for a new Acura NSX are influenced by the car’s high purchase price, repair costs, and performance characteristics. Additional factors include the driver’s history, the amount of coverage selected, and the vehicle’s safety features.

Is a 1995 Acura NSX more expensive to insure?

Insuring a 1995 Acura NSX may be more expensive than average due to its classic status and potential for higher repair costs. Insurance premiums can also be influenced by the scarcity of replacement parts.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.