Best Auto Insurance for Law Enforcement in 2025 (Big Savings With These 9 Companies!)

Progressive, State Farm, and Allstate have the best auto insurance for law enforcement. Some companies also offer a first responder discount of 30%. Below, compare average auto insurance rates for law enforcement officers from the top providers and see if you qualify for a law enforcement discount on car insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Jun 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsThe best auto insurance for law enforcement is offered by Progressive, State Farm, and Allstate.

However, Progressive is our top pick for the best car insurance for police officers because of its various ways to lower auto insurance premiums for law enforcement.

Our Top 9 Company Picks: Best Auto Insurance for Law Enforcement Officers

| Company | Rank | First Responder Discount | Occupation Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 30% | 8% | Loyalty Rewards | Progressive | |

| #2 | 20% | 12% | Local Agents | State Farm | |

| #3 | 15% | 15% | Add-On Coverages | Allstate | |

| #4 | 18% | 11% | Bundling Policies | Farmers | |

| #5 | 15% | 7% | Usage-Based Savings | Nationwide | |

| #6 | 12% | 9% | Organization Discount | Liberty Mutual |

| #7 | 10% | 10% | Military Savings | USAA | |

| #8 | 7% | 12% | Roadside Assistance | AAA |

| #9 | 8% | 10% | Police Discounts | Geico |

Many providers offer a commendable incentive known as the first responder auto insurance discount, which provides exclusive benefits to individuals serving as first responders (Read More: Best Auto Insurance for First Responders).

- Progressive offers a first responder discount of 30%

- Allstate offers an occupation discount of up to 15%

- Law enforcement could also benefit from multi-policy or multi-line discounts

Some top insurers also offer law enforcement officers a police auto insurance discount. Enter your ZIP code into our free quote tool to find the best car insurance for law enforcement officers.

Cost of Auto Insurance for Law Enforcement Officers

Many factors affect auto insurance rates for law enforcement officers, including age, gender, vehicle type, location, coverage level, and more. For example, police officers who only get their state’s minimum auto insurance requirements pay cheaper rates.

The auto insurance company you pick also impacts the cost of coverage for first responders. See the table below to compare law enforcement car insurance rates by provider and coverage level:

Law Enforcement Auto Insurance Monthly Rates by Coverage Level

Company Minimum Coverage Full Coverage

$65 $122

$87 $228

$76 $198

$43 $114

$96 $248

$63 $164

$56 $150

$47 $123

$32 $84

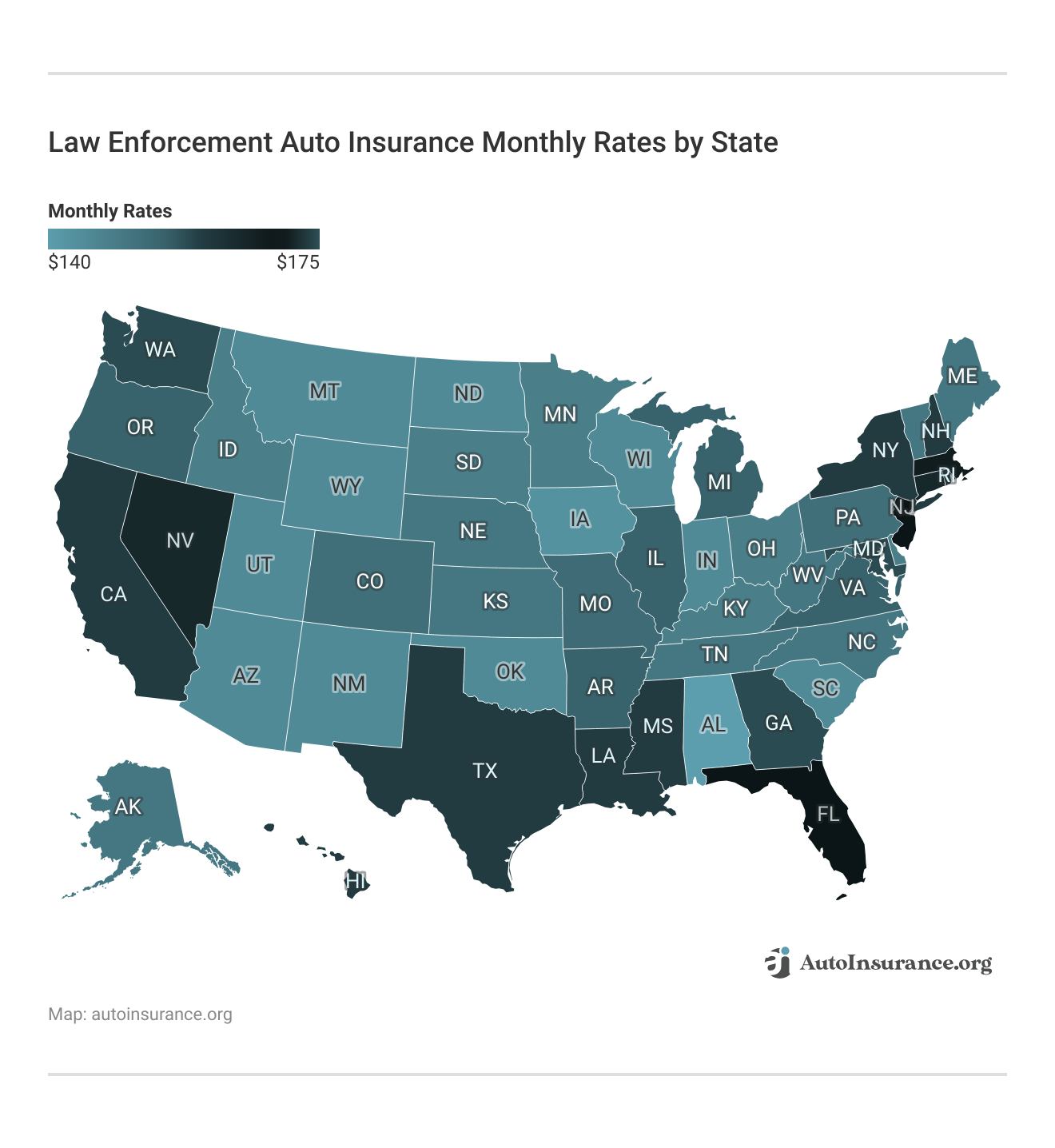

As you can see, USAA has the cheapest auto insurance rates for law enforcement officials, though you must be part of a military family to qualify. In addition, the map below shows average full coverage auto insurance rates for law enforcement officers by state:

Full coverage is important for law enforcement, as it helps cover your vehicle damages and medical bills after an accident.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Law Enforcement Auto Insurance Discounts

If you’re a law enforcement officer researching auto insurance options, look for companies that mark down rates or have affinity programs designed for police officers.

For example, popular companies like Nationwide, Progressive, USAA, Geico, and others almost always offer law enforcement discounts.

Typically, major auto insurance companies offer lower prices for police officers affiliated with the military, a federal agency, or local law enforcement.Laura D. Adams Insurance & Finance Analyst

Check out the table below to see how much you could save with a police auto insurance discount from the top providers:

Law Enforcement Auto Insurance Discounts

| Insurance Company | Savings Potential |

|---|---|

| 12% |

| 15% | |

| 11% | |

| 10% | |

| 9% |

| 7% | |

| 8% | |

| 12% | |

| 10% |

As you can see, you can save up to 15% with State Farm if you’re a law enforcement officer.

On top of law enforcement programs, there are plenty of other ways to obtain auto insurance discounts. Most big auto insurance companies offer several discounts police officers may qualify for, including:

- Low Mileage Auto Insurance Discount

- Defensive Driver Auto Insurance Discount

- Good Driver Auto Insurance Discount

- Driver’s Ed Auto Insurance Discount

- Membership Auto Insurance Discount

- Federal Employee Auto Insurance Discount

- Longevity Auto Insurance Discount

Of course, discount availability and amounts differ by state. To discover whether you qualify for one or more of these discounts and other ways you may be able to save, you can speak to an agent employed by your auto insurance company.

To learn more, read our article on the best auto insurance discounts for police officers.

9 Best Auto Insurance Companies for Law Enforcement

Progressive, State Farm, and Allstate have the best car insurance for law enforcement officers. Check out the pros and cons of these top providers to see why they won:

#1 – Progressive: Top Pick Overall

Pros

- Excellent Loyalty Discounts: Progressive’s multi-car, multi-policy, and continuous insurance discounts allow law enforcement officers to earn savings based on how loyal they are to their insurer. You can also save 30% on your car insurance with Progressive’s first responder discount.

- Strong Online Presence: Progressive has an excellent website and one of the best auto insurance mobile apps for police officers who value convenient policy management. (Read More: Progressive Auto Insurance Review)

- Snapshot Program: Progressive Snapshot can save law enforcement up to 20% on their coverage for safe driving. (Read More: Progressive Snapshot Review)

Cons

- Limited Agent Presence: Law enforcement officers seeking personalized assistance with their auto insurance may be disappointed with Progressive since it doesn’t have many local agents.

- Potential Rate Increases: You could see higher rates with Progressive after an accident, a potential drawback since police officers have high-risk jobs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Agency Network

Pros

- Vast Network of Agents: State Farm has over 19,000 agencies throughout the United States. So, law enforcement officers who want personalized assistance with their auto insurance can speak with an agent in-person (Read More: State Farm Auto Insurance Review).

- Various Discounts: You can get a 25% car insurance discount for police officers with State Farm. In addition, State Farm’s accident-free, defensive driving, anti-theft, multi-policy, and multi-vehicle auto insurance discounts may help police officers get cheap car insurance rates.

- Financial Strength: State Farm has an A++ rating from A.M. Best, indicating a strong financial outlook.

Cons

- No Gap Insurance: Law enforcement officers with new cars may be disappointed to hear that State Farm doesn’t offer gap insurance coverage.

- Doesn’t Have Accident Forgiveness: Unfortunately, State Farm doesn’t offer an accident forgiveness program, so you could see higher rates after an accident.

#3 – Allstate: Best Add-On Coverages

Pros

- Various Coverage Options: Law enforcement officers can get accident forgiveness, new car replacement, and rideshare coverage with Allstate (Read More: Allstate Auto Insurance Review).

- Great Savings for Law Enforcement: Allstate offers a 25% law enforcement auto insurance discount. In addition, Allstate’s Drivewise program, new car discount, anti-lock discount, safe driving bonus, and Deductible Rewards program could all benefit police officers (Read More: Allstate Drivewise Review).

- Local Agents: Allstate has a large network of local agents for a personalized customer service experience.

Cons

- Poor Customer Satisfaction: While Allstate has an A+ from the Better Business Bureau (BBB), its customer reviews have 1.1 out of 5 stars of 1,056 reviews.

- Higher Rates: Often, Allstate may have higher rates than some of its competitors.

#4 – Farmers: Best for Bundling Policies

Pros

- Great Specialized Coverages: For law enforcement officers seeking unique coverages, Farmers sells the following policies: personal umbrella, spare parts, and glass coverages (Read More: Farmers Auto Insurance Review).

- Good Customer Satisfaction: Farmers has a low complaint index score from the National Association of Insurance Commissioners (NAIC) and an A rating from A.M. Best.

- Several Discount Options: Farmers offers a sizeable discount list to help law enforcement save.

Cons

- Not Available Nationwide: Unfortunately, police officers can’t get a Farmers auto insurance policy in Alaska, Delaware, Hawaii, Maine, New Hampshire, Rhode Island, Vermont, West Virginia, and Washington, D.C.

- Limited Online Tools: Farmers doesn’t have the best online resources, so you may want to consider another company if you want a tech-savvy insurer.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Usage-Based Discount

Pros

- Good Usage-Based Program: Nationwide SmartRide, the company’s telematics program, boasts a maximum savings of 40% for safe driving, which could benefit police officers. Learn more about how to save with UBI in our Nationwide SmartRide app review.

- Vanishing Deductible: Nationwide offers a vanishing deductible program that reduces your deductible by $100 for every year of safe driving (Read More: Nationwide Auto Insurance Review).

- Great Customer Service: Nationwide touts an A+ from the Better Business Bureau, indicating positive customer satisfaction.

Cons

- Not Available in All States: You can’t get Nationwide car insurance for law enforcement officers in Alaska, Hawaii, or Louisiana.

- Not the Cheapest: Other competitors, such as State Farm and Geico, generally have cheaper rates and better customer service.

#6 – Liberty Mutual: Best for Organization Discount

Pros

- Police Discount: If you purchase your policy online, Liberty Mutual offers a 12% discount to members of the Fraternal Order of Police, an organization consisting of law enforcement officers (Read More: How to Instantly Buy Auto Insurance Online).

- Better Car Replacement Coverage: If a law enforcement officer’s car is less than a year old with fewer than 15,000 miles on it, Liberty Mutual will send them the money to get a replacement car that’s one model year newer.

- Customizable Policies: Liberty Mutual’s Coverage Customizer tool allows you to get discounts and coverage recommendations (Read More: Liberty Mutual Auto Insurance Review).

Cons

- Poor Customer Service: Liberty Mutual’s NAIC complaint index score is 3.09, or three times higher than average, indicating the company receives several customer complaints.

- Higher Rates: Liberty Mutual tends to have higher rates than many of its competitors.

#7 – USAA: Best for Military Families

Pros

- Serves Military Families: USAA offers coverage specifically for military families. Since many law enforcement officers have military backgrounds, USAA could be a great fit for them (Read More: Cheap Auto Insurance for Military and Veterans).

- Various Discounts: Police officers who served in the military could benefit from USAA’s discount for storing a vehicle on a military base. In addition, the company offers savings for good driving, anti-theft features, or being a good student.

- Great Service & Claims Handling: In a 2023 J.D. Power study, USAA received the second-highest customer service score of all major insurance companies. So, law enforcement can trust that USAA will handle their claims efficiently (Read More: USAA Auto Insurance Review).

Cons

- Non-Military Won’t Qualify: You must be a military member, veteran, or family member of one to qualify for USAA insurance coverage. So, law enforcement officers who weren’t in the military can’t get USAA.

- Few Physical Branches: You won’t find many USAA auto insurance offices to get in-person customer service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – AAA: Best for Roadside Assistance

Pros

- Various Insurance Products: Alongside AAA’s extensive roadside assistance coverage, you can get life, home, renters, and condo insurance.

- AAA Membership Discount: Law enforcement will get a discount on their auto insurance simply for having an AAA membership.

- Membership Perks: AAA’s membership grants police officers access to discounts on travel, shopping, dining, hotels, auto repair, and more.

Cons

- Must Pay Membership Fee: Having to pay a membership fee to get AAA may deter some law enforcement officers from getting coverage with the company (Read More: AAA Auto Insurance Review).

- Limited Offerings: AAA is primarily known for roadside assistance. Unfortunately, some states may not offer the specific coverage you need, so check with a representative to be sure.

#9 – Geico: Best Police Discounts

Pros

- Great Police Discounts: Emergency deployment, multi-vehicle, federal employee, membership, and defensive driving course discounts with Geico could benefit law enforcement officers. In addition, police officers can save 15% with Geico’s police car insurance discount. (Read More: Geico Auto Insurance Review)

- Cheap Rates: Geico is well-known for their affordable car insurance rates for many drivers, including law enforcement.

- 24/7 Customer Service: Geico’s around-the-clock customer service accomodates police officers who work non-traditional hours.

Cons

- Few Local Agents: Primarily, Geico operates online and on the phone. So, law enforcement officers who prefer in-person assistance with their insurance policy may find that Geico isn’t right for them.

- No Rideshare or Gap Insurance: Police officers who need rideshare auto insurance or gap insurance for their financed vehicle can’t get them with Geico.

Finding the Best Auto Insurance for Law Enforcement

Progressive, Geico, and Farmers have the best car insurance for law enforcement. With Geico, police officers can enjoy tailored discounts, while Progressive policyholders can participate in loyalty programs and manage their policy online.

However, you might find another car insurance company is a better fit for you — for example, you could save 25% with State Farm’s law enforcement discount. Enter your ZIP code into our free quote comparison tool to find the best rates from top providers near you in minutes.

Frequently Asked Questions

Are there any special considerations for auto insurance coverage for law enforcement officers?

Yes, auto insurance for law enforcement officers may involve certain special considerations. Given the nature of their work, law enforcement officers often have unique insurance needs. It’s essential to understand these considerations to ensure proper coverage.

How do discounted auto insurance rates for law enforcement officers work?

Insurance companies offer discounts to low-risk drivers and consider police officers some of the safest drivers on the road. If you’re in law enforcement, insurance companies assume you’re less likely to file a claim or violate traffic laws. So, law enforcement officers pay lower rates as low-risk auto insurance policyholders.

Are there specific discounts available for law enforcement officers?

Many insurance companies offer special law enforcement auto insurance discounts as a way to recognize their dedication and lower their insurance premiums. These discounts can vary, so it’s advisable to inquire with insurance providers about any available discounts for law enforcement professionals.

What type of coverage should law enforcement officers consider for their vehicles?

Law enforcement officers should consider comprehensive coverage, collision coverage, and liability coverage for their vehicles. Comprehensive insurance protects against damage from non-collision incidents, such as theft or natural disasters. Collision coverage covers damage resulting from collisions, and liability coverage provides financial protection in case of damage caused to others.

Ready to purchase car insurance? Simply enter your ZIP code into our free tool below to compare law enforcement car insurance quotes from top providers near you.

Can law enforcement officers add equipment coverage to their auto insurance policy?

Yes, law enforcement officers can often add equipment coverage to their auto insurance policy. Given the specialized equipment carried in police vehicles, such as radios, computers, and other law enforcement tools, it’s crucial to have coverage for these items in case of theft or damage. Check with your insurance provider to understand the specific options available.

Read More: Best Auto Insurance Companies That Offer OEM Parts Coverage

Does auto insurance cover law enforcement officers while on duty?

Auto insurance typically covers law enforcement officers while they are on duty, just like any other driver. However, it’s important to review your insurance policy to confirm that it includes coverage while on duty. Some policies may have specific exclusions or limitations for certain on-duty activities.

What happens if a law enforcement officer gets involved in a pursuit or high-speed chase?

Engaging in a pursuit or high-speed chase can introduce additional risks and complexities for auto insurance coverage. It’s crucial for law enforcement officers to inform their insurance provider about any pursuit-related incidents. Each insurance company may have different policies and procedures for handling such situations, so it’s important to clarify this with your provider.

Can personal auto insurance be used if law enforcement officers use their personal vehicles for work purposes?

Generally, personal auto insurance policies may not cover accidents or incidents that occur while using a personal vehicle for work purposes, including law enforcement duties. It’s advisable for law enforcement officers to inform their insurance company about their work-related vehicle usage and explore options for appropriate coverage, such as a commercial auto insurance policy.

Should law enforcement officers notify their insurance company about their profession?

Yes, it’s important for law enforcement officers to notify their insurance company about their profession. Providing accurate information about your occupation ensures that your insurance coverage aligns with your specific needs as a law enforcement professional. It may also help in determining eligibility for any specialized discounts or coverage options.

Are there any insurance considerations for off-duty law enforcement officers?

Off-duty law enforcement officers should review their auto insurance policy to ensure it provides adequate coverage when they are not on duty. It’s important to consider personal use, potential liability, and other relevant factors when assessing the coverage needs for off-duty situations.

Should law enforcement officers compare quotes from different insurance providers?

Yes, it is highly recommended for law enforcement officers to compare quotes from different insurance providers. Insurance rates and offerings can vary significantly between companies. By obtaining multiple quotes, law enforcement officers can find the best coverage options that meet their specific needs at the most competitive rates.

Learn More: Where to Compare Auto Insurance Rates

How are individuals recognized as law enforcement personnel for car insurance purposes?

Most auto insurance companies classify the policyholders’ jobs via a rating method based on personnel type. This rating system is vital since almost all auto insurance companies apply a unique risk rating contingent on your occupation.

As an officer of law enforcement, your low-risk class can earn you less expensive insurance rates than many other professions.

Additionally, almost all police officers use a vehicle covered by their law enforcement agency when on the job. Most auto insurance companies offer lower insurance rates if you put fewer miles on your personal vehicle. So, officers usually end up paying lower rates for the cars they own.

How much vehicle coverage do police officers require?

Law enforcement officers must carry their state’s minimum auto insurance requirements.

Do law enforcement personnel have to purchase auto insurance as on-duty officers?

Most people in any profession require auto insurance to protect themselves while completing daily errands. As a law enforcement officer, your auto insurance won’t apply while on duty. When working, your agency covers you through the department’s insurance policy.

Personal auto insurance is unique to the individual since any transaction between a consumer and an insurance company is private. On the other hand, law enforcement agencies cover any vehicle driven by employees. In other words, a commercial auto insurance policy applies to the car you drive at work.

Any costs stemming from damage to an agency vehicle gets covered by your employer’s insurance. However, under certain circumstances, officers may be liable.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.