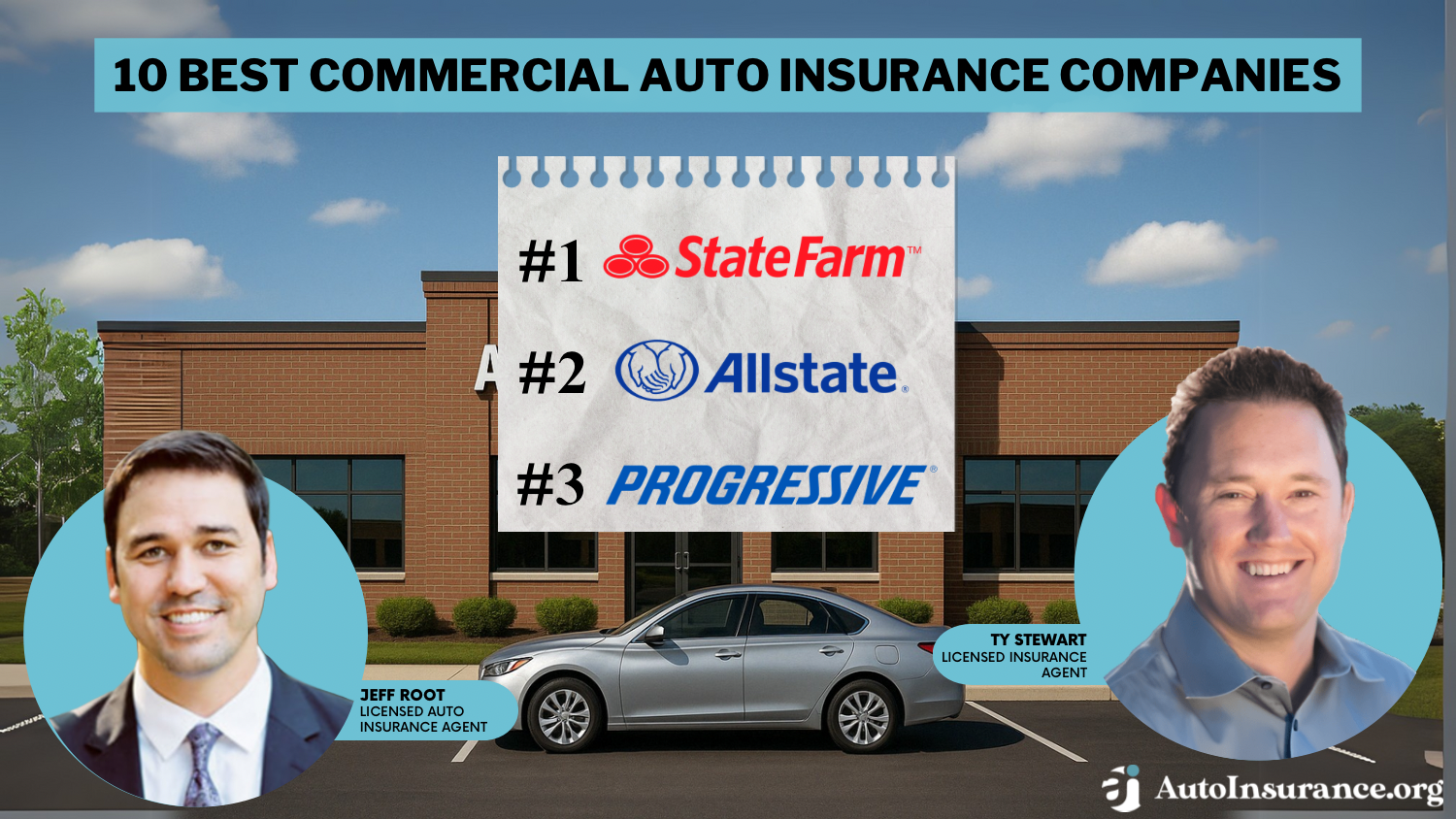

10 Best Commercial Auto Insurance Companies in 2025 (Check Out These Providers)

State Farm, Allstate, and Progressive are the best commercial auto insurance companies on the market. At State Farm, minimum rates for commercial insurance average $47/mo. The best insurance companies for commercial vehicles provide discounts and complete coverage packages for business owners.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Apr 21, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 21, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,733 reviews

1,733 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsState Farm, Allstate, and Progressive are the best commercial auto insurance companies.

Commercial auto insurance providers know that your business cannot move forward without properly insured vehicles for the delivery of products or transporting your employees and guests to those necessary destinations. Our top 10 commercial auto insurance companies are below.

Our Top 10 Company Picks: Best Commercial Auto Insurance Companies

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A++ | Accident Forgiveness | Travelers | |

| #2 | 19% | A++ | Military Savings | USAA | |

| #3 | 15% | A+ | Add-on Coverages | Allstate | |

| #4 | 15% | A++ | Cheap Rates | Geico | |

| #5 | 15% | A | Student Savings | American Family | |

| #6 | 15% | A | Customizable Polices | Liberty Mutual |

| #7 | 12% | A++ | Many Discounts | State Farm | |

| #8 | 12% | A+ | Online Convenience | Progressive | |

| #9 | 12% | A | Local Agents | Farmers | |

| #10 | 10% | A+ | Usage Discount | Nationwide |

Read on to learn more about what companies offer commercial auto insurance, types of commercial auto insurance to consider, such as the best commercial general liability insurance, and more.

You can also enter your ZIP code into our free auto insurance comparison tool to find cheap commercial auto insurance now.

- State Farm has the best commercial vehicle insurance

- Allstate and Progressive are also top commercial auto insurance companies

- All business owners need some form of commercial coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Many Discounts: State Farm has multiple discounts that can be applied to commercial insurance.

- Agent Network: Local support is widely available for customers. Learn more in our State Farm review.

- Reliable Claims: Claim reliability is rated well by most customers.

Cons

- Financial Stability: Ratings for State Farm have recently dropped.

- High-Risk Rates: Rates will be more expensive for risky policyholders.

#2 – Allstate: Best for Add-On Coverages

Pros

- Add-On Coverages: Allstate sells add-ons in addition to basic commercial coverage. Find out more in our review of Allstate.

- Multiple-Vehicle Discount: Allstate offers a lower rate if customers are insuring multiple commercial vehicles.

- Online Convenience: Customers can use Allstate’s app to monitor and make changes to their commercial policy.

Cons

- Claims Processing: Some complaints about the processing of Allstate claims.

- Higher Rates: Allstate can be more expensive for some customers.

#3 – Progressive: Best for Online Convenience

Pros

- Online Convenience: Progressive’s app is convenient for customers who want to manage commercial coverage online.

- Custom Parts Coverage: Commercial cars with modifications will benefit from this coverage.

- 24/7 Service: Support is always accessible to Progressive customers. Find out more in our Progressive review.

Cons

- Claim Ratings: Claims processing has a few poor reviews.

- Rates Vary: Progressive can be very expensive for some customers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Geico: Best for Cheap Rates

Pros

- Cheap Rates: Geico has some of the cheapest commercial auto insurance rates. Learn more in our Geico review.

- Online Management: Customers can use Geico’s app to manage their policies.

- Multiple Discounts: Bundle policies or insure multiple commercial vehicles for cheaper rates.

Cons

-

- Local assistance: Limited availability of agents limits personalized assistance.

- Customer Ratings: Most customers rate their experiences as average.

#5 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Some commercial customers will be forgiven an accident.

- Financial Stability: Ratings are strong for Travelers.

- 24/7 Support: Learn about Travelers support in our Travelers review.

Cons

- Customer Service: Experiences with representatives are considered just average.

- Higher Rates: Travelers is one of the pricier companies for commercial insurance.

#6 – American Family: Best for Student Savings

Pros

- Student Savings: Commercial customers who are students can save with a good student discount.

- Customer Satisfaction: American Family scored well. Learn more in our American Family review.

- Loyalty Discount: Commercial customers may see lower rates if they stick with the company.

Cons

- Availability: Some regions don’t sell insurance from the company.

- New Customer Rates: New customers may have slightly higher rates as they don’t get a loyalty discount.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Local Agents

Pros

- Local Agents: Personalized support is easily accessible at Farmers.

- Discount Options: Farmers has good options for savings. Learn more in our review of Farmers.

- Customizable Coverages: Commercial policies can be customized.

Cons

- Claims Processing: Considered slow by some customers.

- Higher Rates: Farmers’ commercial coverage can be a little more expensive.

#8 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Good drivers can get a usage discount if they participate in Nationwide’s good driver program.

- Accident Forgiveness: Rate increases may be avoided by some customers after an accident.

- Bundling Discount: Commerical coverage can be bundled with other insurance. Find out more in our Nationwide review.

Cons

- Availability: Nationwide has limited availability in some states.

- Customer Reviews: Reviews are average from most Nationwide customers.

#9 – USAA: Best for Military Savings

Pros

- Military Savings: USAA’s low rates make it one of the cheapest commercial options for military and veterans.

- Customer Service: USAA customers rank service highly. Read more in our USAA review.

- Flexible Payment Options: USAA offers several different payment options.

Cons

- Eligibility Restrictions: USAA customers are limited to veteran and military families.

- Local Branches: Personalized, local agent assistance is rarely available.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Commercial policies can be customized. Learn more in our Liberty Mutual review.

- Custom Parts Coverage: This is useful if your commercial vehicle has modifications.

- Discount Options: Commercial policy rates can be reduced with discounts.

Cons

- Customer Reviews: Reviews are average for the most part.

- Higher Rates: Liberty Mutual’s rates for commercial insurance could be higher for some drivers.

Top Commercial Auto Insurance Provider

State Farm is our top choice, as it offers a variety of options that are budget-friendly. As one of the largest auto insurance companies in the U.S., State Farm offers coverage to suit the needs of your business, whether it’s for private passenger care, delivery vans, or certain vehicles that are used to run your other businesses.

What do I need to know about State Farm auto insurance? The characteristics of State Farm auto insurance make them able to offer discounted rates when you bundle your other insurance needs with them.

When contacting State Farm, you must be prepared to give relative information about your business and the purposes of the vehicles you wish to insure. A policy may be obtained at State Farm that specifically covers cars used for business.Dani Best Licensed Insurance Producer

It is called “Employer Non-Owned Car Liability Coverage.” This type of policy protects your business revenue in case of legal judgments incurred by an employee and prevents any financial loss for which you could be liable.

Other Commercial Insurers

Some other companies you might see come up for commercial insurance include Progressive, Geico, and GMAC. While GMAC is not on our list of the best auto insurance companies for commercial insurance, it does offer commercial insurance in some locations to businesses.

Progressive Commercial Insurance

Progressive promotes ease in managing your business with commercial auto insurance discounts and payment options. Based on the information you provide about your business, they will generate a free quote that suits the characteristics of your business.

As a sole proprietor, Progressive understands your need to protect those vehicles that are used to run your business.

It is important to be properly insured when that vehicle is driven by various workers in your business.

The Progressive Employer’s Non-Ownership insurance will protect your business when situations occur with vehicles of which you do not have ownership. Progressive also provides coverage for contractors, landscapers, and any other skilled tradesperson.

The coverage includes:

- Liability Insurance

- Physical Damage Coverage

- Uninsured or Underinsured Motorist Insurance

When seeking a quote online, Progressive offers a user-friendly process for obtaining the best possible quotes.

You can also use a quote comparison tool if you want to get quotes from multiple companies, not just Progressive.

Geico Commercial Insurance

In order to keep your business flowing in a positive direction, careful choices in commercial auto insurance are of the greatest importance. Geico offers protection for the vehicles that operate under the name of your business.

How do you know which auto insurance company best fits your needs?🚗 Choosing the right company doesn’t have to be scary.😱 Comparing multiple quotes in one spot: 👉 https://t.co/27f1xf131D. Need more info on how to make your decision? 👉https://t.co/KuwqsN8fdm pic.twitter.com/ftlfq9cilY

— AutoInsurance.org (@AutoInsurance) March 7, 2023

In the occurrence of an accident or situation that results in damages to your business property, Geico can provide outstanding service at the best possible price.

Geico has a claims department that can reduce your downtime when a vehicle is not operational.

GMAC Commercial Insurance

At GMAC the commercial auto insurance rates are very competitive as compared to other companies that offer this type of insurance. Medical payments, comprehensive, liability, and collision are offered as coverage options.

You can rest assured that you won’t have to be concerned with expensive repair costs.

You are encouraged to read all clauses associated with an insurance contract before signing.

GMAC provides a convenient quote comparison tool to assist you in measuring the pros and cons prior to making an insurance purchase from any one company. Their dedicated commercial car insurance specialists are always available, which saves you time and money.

Learn more: GMAC Auto Insurance Review

As a business owner, you are not always present to see that repairs are done properly on your business vehicles. SmartInspect is a free service offered at GMAC where an independent inspection is performed on your vehicles to assure that repairs were done accurately.

GMAC also offers a host of discounts that help tailor coverage that is suitable for your business. The options include the following:

- Occupational discounts

- GM and GMAC affiliation discounts

- Transfer discounts

GMAC provides commercial auto insurance with a “Claims Service Satisfaction Guarantee.” If the service is not up to par, your deductible will be waived up to $2,501.00.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Types of Coverage for Commercial Vehicles

In your pursuit of commercial auto insurance, you must get coverage that is customized to your business needs and cost-effective. Commercial insurance is generally sold as minimum or full coverage policies, which differ in cost.

Commercial Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

What does commercial car insurance cover? It depends on how much coverage you purchase. Listed below are some areas you should have covered in your online auto insurance quote:

- Auto liability

- Payment of medical costs incurred as a result of an accident

- Collision auto insurance

- Comprehensive auto insurance

- Coverage for underinsured and uninsured drivers

- Coverage for those employees who utilize their personal vehicles for your business

Choose a company that takes pride in protecting your business vehicles and settling claims for damages in the quickest way possible.

How to Save on Commercial Auto Insurance

Most of the largest commercial auto insurance companies offer discounts to help businesses save. Some discounts to look for are:

Auto Insurance Discounts From the Top Providers for Best Commercial

| Insurance Company | Discount Percentage | Discount Details |

|---|---|---|

| 15% | Safe driving & multi-policy | |

| 15% | Multi-policy & smart ride | |

| 11% | Multi-policy & safe driving | |

| 12% | Good student & safe driver | |

| 10% | Good driver & multi-policy |

| 10% | Multi-policy & homeowner |

| 12% | Safe driving & multi-policy | |

| 10% | Safe driving & good students | |

| 15% | Multi-policy & good student | |

| 15% | Safe driving & Military |

In addition to discounts, understanding commercial auto insurance policies and shopping around for quotes will help businesses find the best deal on commercial car insurance (read more: How to Lower Your Auto Insurance Rates).

Finding the Best Insurance Companies for Commerical Vehicles

State Farm, Allstate, and Progressive are some of the best commercial auto insurance companies available to meet the needs of your business. Don’t make the mistake of having poorly insured vehicles and get auto insurance to cover your vehicle properly. Your company doesn’t compromise on anything else, so why should they compromise on auto insurance coverage and prices?

Now that you’ve had commercial auto insurance explained, are you wondering how to find cheap commercial auto insurance near me? Enter your ZIP code into our free auto insurance comparison tool to find good commercial auto insurance rates now.

Frequently Asked Questions

What is commercial auto insurance coverage?

The commercial auto insurance definition is insurance coverage that is specifically for business-owned vehicles. It works similarly to normal auto insurance coverage.

What does commercial auto insurance cover?

Commercial auto insurance covers property damages and injuries, as well as legal fees. The benefits of commercial auto insurance more than makeup for the price, as it will protect your business from the financial aftermath of accidents.

How does commercial auto insurance work?

Commercial auto insurance works the same as regular auto insurance. After purchasing a policy, you pay a monthly fee, and the auto insurance company will protect you financially if you get into an accident with your business vehicle (learn more: What is auto insurance?).

Which are the top commercial auto insurance companies in the US?

Five of the top 10 commercial auto insurance companies in the US are State Farm, Allstate, Progressive, Geico, and Travelers. Shop for commercial auto insurance quotes today by entering your ZIP into our free comparison tool.

Who has the best commercial auto insurance?

State Farm has the best commercial auto insurance.

What does State Farm offer in terms of commercial auto insurance?

State Farm offers a variety of options that are budget-friendly. They provide coverage for private passenger cars, delivery vans, and other vehicles used for business purposes. They also offer “Employer Non-Owned Car Liability Coverage” to protect your business in case of legal judgments incurred by an employee (learn more: Cheap Non-Owner Auto Insurance).

What types of coverage does Nationwide provide for commercial vehicles?

Nationwide Insurance offers various types of coverage for commercial vehicles, including auto liability, payment of medical costs resulting from accidents, collision coverage, comprehensive coverage, coverage for underinsured and uninsured drivers, and coverage for employees who use their personal vehicles for business purposes.

Are there any exclusions in commercial auto insurance coverage?

Yes, commercial auto insurance policies may have certain exclusions. Common exclusions include intentional acts, damage caused by unapproved drivers, vehicles used for illegal activities, and vehicles with excessive modifications not disclosed to the insurer.

Is commercial auto insurance required by law?

Yes, in most states, commercial auto insurance is mandatory for businesses that use vehicles for their operations. The specific auto insurance laws may vary by state, so it’s important to check the regulations in your jurisdiction.

Can I customize my commercial auto insurance coverage?

Yes, commercial auto insurance policies can often be customized to meet your business’s specific needs. You can choose the types and levels of coverage you require, such as liability, comprehensive, collision, and additional endorsements.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.