10 Best Auto Insurance Companies for Telecommuters in 2025

Progressive, USAA, and State Farm stand out among the 10 best auto insurance companies for telecommuters, offering rates as low as $32 per month. Our goal is to help you compare rates from these reputable companies, ensuring you get the best coverage and personalized discounts based on your vehicle.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews

Company Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

Progressive stands out as the premier choice for the 10 best auto insurance companies for telecommuters, providing competitive rates starting at only $32 per month for minimum coverage.

- Progressive provides competitive rates starting at $80 monthly

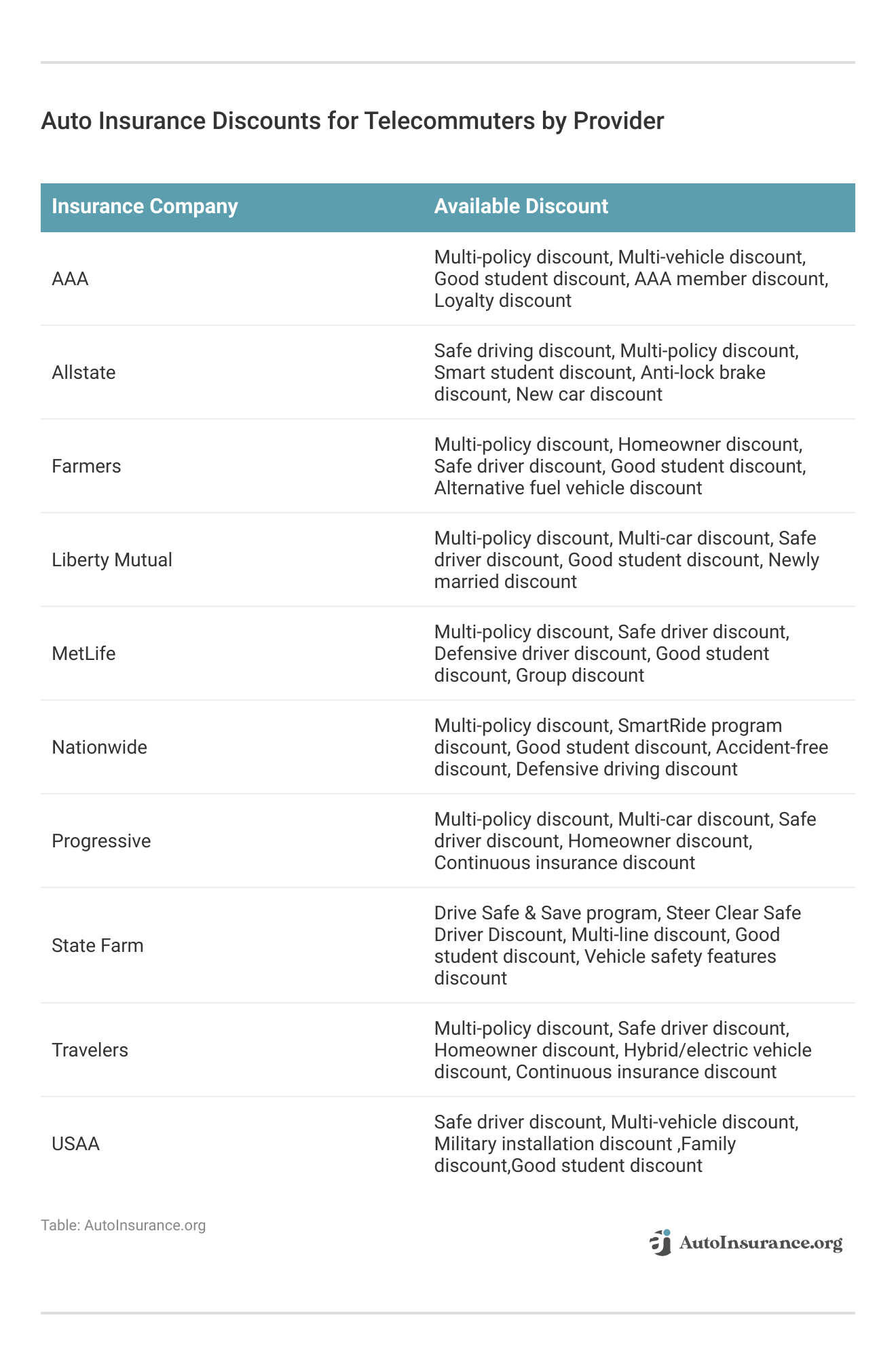

- Leading insurance firms offer potential discounts for telecommuters

- Discount options are available to secure auto insurance for telecommuters

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Customized Policies: In our Progressive auto insurance review, there are customized coverage options.

- Robust Rates: Progressive provides affordable pricing.

- Price Reduction: Progressive offers various discount opportunities.

Cons

- Claims Handling: People may experience delays or complications.

- Limited Discounts: Progressive may not offer as many discounts.

#2 – USAA: Best for Flexible Policies

Pros

- Personalized Coverage: USAA, as mentioned in our USAA auto insurance review, tailors to peoples’ needs.

- Cost-effective Premiums: USAA provides on-a-budget but competitive insurance for cars.

- Discount Availability: USAA provides various offers, including those for car insurances.

Cons

- Limited Availability: USAA mainly functions via local agents.

- Policy Limitations: Specific additional coverage options may not completely meet requirements.

#3 – State Farm: Best for Usage Discounts

Pros

- Discount Opportunities: State Farm presents various discount options.

- Financial Stability: State Farm is supported by a financially secure company.

- Exceptional Customer Service: State Farm is renowned for its responsive and user-friendly service.

Cons

- Coverage Constraints: Driving needs may not be eligible for policy add-ons. Find out more in our State Farm auto insurance review.

- Claims Process: People may encounter delays or complications when processing claims.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Telecommute Coverage

Pros

- Discount Prospects: Allstate provides tailored discount options for people.

- Financial Stability: Allstate is supported by a financially stable corporation.

- Excellent Customer Service: Allstate is renowned for its prompt and easily accessible service.

Cons

- Coverage Limitations: Certain additional policy features might not completely meet the needs of people. Use our Allstate auto insurance review as your guide.

- Claims Handling: People may encounter delays or challenges during the claims procedure.

#5 – Liberty Mutual: Best for Worker Benefits

Pros

- Tailored Policies: Liberty Mutual offers customized coverage options for car insurances.

- Competitive Prices: Liberty Mutual provides affordable rates.

- Exceptional Customer Service: Liberty Mutual is widely recognized for its prompt and easy-to-use service.

Cons

- Restricted Membership: Liberty Mutual membership is limited to military members.

- Limited Availability: Liberty Mutual’s availability may vary by location. Check other details through our Liberty Mutual auto insurance review.

#6 – Farmers: Best for Virtual Workspace

Pros

- Personalized Coverage: Farmers, as mentioned in our Farmers auto insurance review, tailors to peoples’ needs.

- Cost-effective Premiums: Farmers offers affordable car insurance.

- Discount Availability: Farmers provides various offers.

Cons

- Limited Availability: Farmers mainly functions via local agents, potentially inaccessible in some regions.

- Policy Limitations: Specific additional coverage options may not completely meet requirements.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Office Coverage

Pros

- Wide Range of Coverage Options: Nationwide offers a comprehensive selection of coverage options, allowing customers to tailor policies to their needs.

- Vanishing Deductible Feature: The Vanishing Deductible program rewards safe driving by reducing deductibles over time.

- Member Discounts: Nationwide provides discounts for various affiliations and memberships, enhancing affordability for certain groups.

Cons

- Average Customer Satisfaction: Customer satisfaction ratings vary, as mentioned in our Nationwide insurance review with some customers reporting average experiences.

- Varied Premiums: Premiums may vary based on location and individual profiles, potentially impacting overall affordability.

#8 – Travelers: Best for Telecommuting Endorsements

Pros

- Competitive Rates: Our Travelers auto insurance review reveals competitive rates that are budget-friendly.

- Comprehensive Coverage Options: Travelers provides customizable policies.

- Discounts: Travelers offers various discounts, including those tailored for cars.

Cons

- Limited Local Agents: Travelers operates primarily online and over the phone.

- Coverage Limitations: Some policy add-ons may not fully meet cars’ needs.

#9 – AAA: Best for Work Deductibles

Pros

- Personalized Policies: AAA provides premium and DIY coverage only made for your car.

- Competitive Pricing: AAA provides rates that is on a budget. AAA auto insurance review is your affordability guide.

- Discount Opportunities: AAA provides big deduction for cars.

Cons

- Restricted Availability of Local Agents: AAA primarily operates through local agents, which may not be universally accessible.

- Restrictions: Certain improvements in policies might not fully meet the requirements of automobiles.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – MetLife: Best for Telecommuter Savings

Pros

- Personalized Policies: MetLife provides personalized coverage options for cars.

- Competitive Pricing: MetLife offers affordable rates. Your affordability guide starts with our MetLife auto insurance review.

- Discount Opportunities: MetLife offers discounts, including ones for cars.

Cons

- Restricted Availability of Local Agents: MetLife primarily operates through local agents, which may not be universally accessible.

- Coverage Restrictions: Some policy enhancements may not completely address cars’ needs.

The 10 Best Auto Insurance Providers for Remote Employees

Full Results: Insurance Companies Ranked for Telecommuters

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance for Telecommuters: Saving Money on Coverage

Methodology: Ranking Providers by Telecommuter Auto Insurance

Frequently Asked Questions

Is car insurance cheaper if you work remotely?

Yes, if you don’t drive often, you can find save up to 60% on car insurance as a remote worker by enrolling in pay-per-mile or usage-based programs.

What is auto insurance for telecommuters?

Auto insurance for telecommuters refers to insurance coverage specifically designed for individuals who primarily work from home or have a minimal commute. It takes into account the reduced amount of driving typically associated with telecommuting and offers tailored coverage options. Enter your ZIP code now.

Why is it important for telecommuters to choose the right auto insurance company?

What are the best auto insurance companies for telecommuters?

While individual preferences may vary, here are some top auto insurance companies known for their offerings and benefits to telecommuters:

- Progressive: Offers significant discounts for low mileage and usage-based insurance programs, such as Snapshot.

- Allstate: Provides pay-per-mile insurance options like Milewise, which can benefit telecommuters with reduced driving.

- Metromile: Specializes in pay-per-mile insurance, making it ideal for telecommuters who rarely drive.

- State Farm: Offers usage-based programs like Drive Safe & Save, which can help telecommuters save on premiums by tracking their driving habits.

What factors should telecommuters consider when choosing an auto insurance company?

Telecommuters should consider the following factors:

- Discounts for Low Mileage: Look for insurance companies that offer discounts specifically for reduced driving.

- Usage-Based Programs: Consider companies that provide programs to track and reward safe driving habits and low mileage.

- Coverage Options: Ensure the policy covers any unique needs or potential risks related to telecommuting.

- Customer Service: Evaluate the company’s reputation for customer support, especially for handling claims efficiently.

Enter your ZIP code now for further information.

Can telecommuters save money on auto insurance?

How can telecommuters prove their reduced mileage to insurance companies?

Insurance companies typically require some form of proof for reduced mileage. This can be accomplished through methods such as providing odometer readings, submitting commuting logs, or using mileage-tracking apps.

Are there any downsides to consider when choosing auto insurance as a telecommuter?

While telecommuters can benefit from tailored insurance options, there are some potential downsides to consider:

- Limited Coverage for Business-Related Driving: Some policies may not cover accidents or incidents that occur during work-related travel or when using your vehicle for business purposes. Ensure your policy covers such scenarios.

- Reduced Flexibility: Specialized programs like pay-per-mile insurance may come with certain restrictions, such as limited mileage caps or higher rates for occasional long-distance trips. Evaluate the flexibility of the policy to determine if it aligns with your needs.

Enter your ZIP code to start comparing.

What are the 10 best auto insurance providers for remote employees?

How to save money from coverage?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.