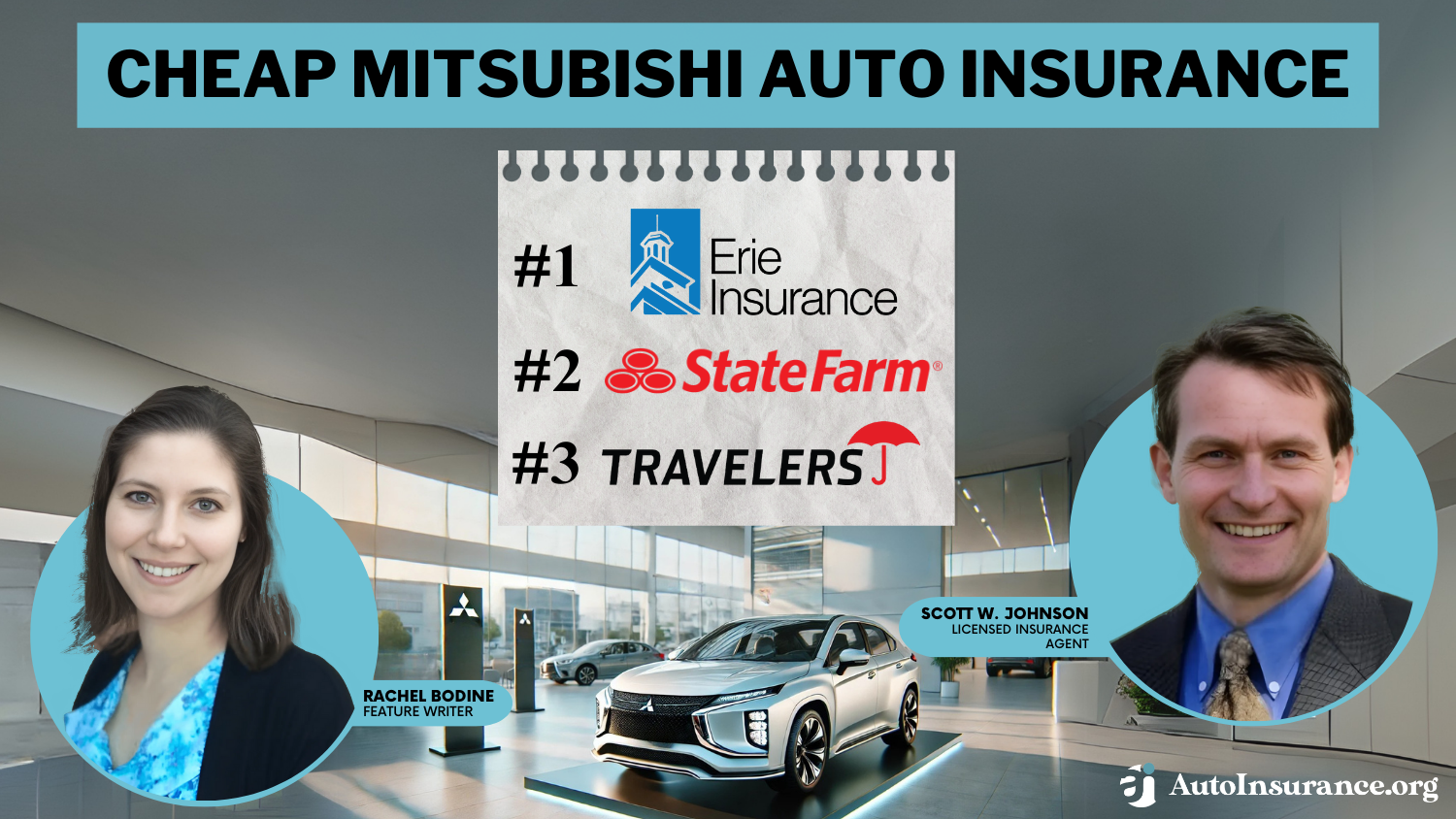

Cheap Mitsubishi Auto Insurance in 2025 (Save Big With These 10 Companies!)

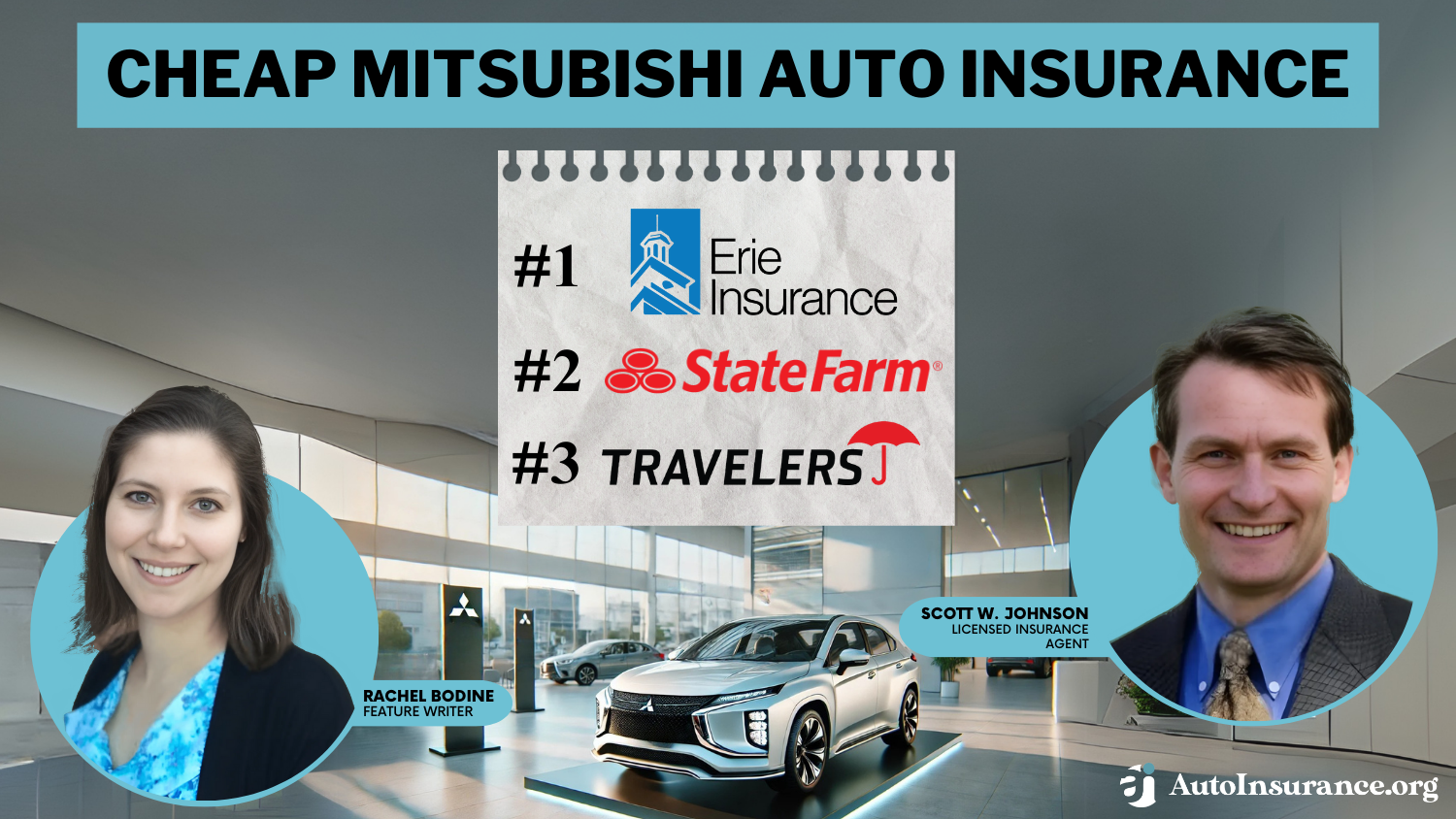

The best providers for cheap Mitsubishi auto insurance are Erie, State Farm, and Travelers, with rates as low as $32 per month. Erie stands out with its accident forgiveness program, helping Mitsubishi drivers avoid premium hikes after their first at-fault accident.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Mar 31, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 31, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Mitsubishi

A.M. Best

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Mitsubishi

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage for Mitsubishi

A.M. Best

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsErie, State Farm, and Travelers stand out as the top providers of cheap Mitsubishi auto insurance, renowned for their competitive rates and comprehensive coverage options.

You must carry Mitsubishi auto insurance to meet your state’s minimum auto insurance requirements. Fortunately, many companies offer affordable Mitsubishi car insurance coverage.

Our Top 10 Company Picks: Cheap Mitsubishi Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $32 | A+ | Customer Service | Erie |

| #2 | $47 | A++ | Agency Network | State Farm | |

| #3 | $53 | A++ | Business-Use Coverage | Travelers | |

| #4 | $56 | A+ | Safe-Driving Discounts | Progressive | |

| #5 | $62 | A | Loyalty Rewards | American Family | |

| #6 | $63 | A+ | Usage-Based Coverage | Nationwide |

| #7 | $65 | A | Roadside Assistance | AAA |

| #8 | $76 | A | Customizable Policies | Farmers | |

| #9 | $87 | A+ | High-Mileage Savings | Allstate | |

| #10 | $96 | A | 24/7 Support | Liberty Mutual |

However, it’s important to know what you’re looking for when you shop for cheap auto insurance so that you can choose a Mitsubishi policy that works best for you.

- Erie offers cheap Mitsubishi insurance starting at $32 a month

- Mitsubishi Lancer insurance costs more than other models

- Compare Mitsubishi insurance quotes to find the best deal

Unlock the lowest available prices for affordable Mitsubishi insurance costs by simply entering your ZIP code into our free quote comparison tool.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Erie: Top Pick Overall

Pros

- Competitive Rates: Erie often offers competitive rates for auto insurance, which can be beneficial for Mitsubishi owners looking for affordable coverage.

- Personalized Service: Erie is known for its personalized customer service, which can be helpful for Mitsubishi owners seeking tailored insurance solutions.

- Multi-Vehicle Discounts: Erie offers discounts for insuring multiple vehicles, including Mitsubishis, under the same policy. Read our Erie auto insurance review to learn more.

Cons

- Limited Network: Erie’s coverage may be limited to certain regions, which could pose challenges for Mitsubishi owners residing outside those areas.

- Limited Specialized Coverage: Erie may have limited options for specialized coverage tailored specifically for Mitsubishi vehicles, such as unique parts replacement or modifications coverage.

#2 – State Farm: Best for Nationwide Coverage

Pros

- Great Customer Service: State Farm is known for providing peace of mind for Mitsubishi owners regarding claims handling. Read more in our State Farm auto insurance review.

- Multiple Policy Discounts: State Farm offers discounts for bundling multiple policies, which can be advantageous for Mitsubishi owners seeking to save on insurance premiums.

- Nationwide Coverage: State Farm provides insurance coverage across the nation, ensuring Mitsubishi owners can access their services wherever they are located.

Cons

- Potentially Higher Rates: While State Farm offers competitive rates, Mitsubishi owners may find premiums to be slightly higher compared to other insurers on the list.

- Limited Specialized Coverage: State Farm may not offer as many specialized coverage options tailored for Mitsubishi vehicles, which could be a drawback for owners seeking comprehensive protection.

#3 – Travelers: Best for Flexible Coverage Options

Pros

- Flexible Coverage Options: Travelers offers flexible coverage options that can be customized to meet the specific needs of Mitsubishi owners.

- Multi-Policy Discounts: Travelers provides discounts for bundling multiple policies, allowing Mitsubishi owners to save on insurance premiums. Dive into our analysis of Travelers auto insurance review.

- Strong Customer Service: Travelers is known for its strong customer service, providing support and assistance to Mitsubishi owners throughout the insurance process.

Cons

- Potentially Higher Premiums: Mitsubishi owners may find Travelers’ premiums to be higher compared to other insurers offering similar coverage.

- Limited Availability of Agents: Travelers’ agents may not be as widely available as some other insurers, which could pose challenges for Mitsubishi owners seeking in-person assistance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive often offers competitive auto insurance rates, which can be advantageous for Mitsubishi owners. Read more in our article, “Progressive Auto Insurance Review.”

- Extensive Coverage Options: Progressive provides a wide range of coverage options, including specialized coverage for Mitsubishi vehicles, such as custom parts and modifications.

- User-Friendly Online Tools: Progressive offers user-friendly online tools and resources, making it convenient for Mitsubishi owners to manage their policies and file claims.

Cons

- Limited Agent Support: Progressive’s focus on online services may mean limited availability of agents for Mitsubishi owners who prefer in-person assistance.

- Potential Rate Increases: Progressive’s rates may increase over time, which could result in higher premiums for Mitsubishi owners upon policy renewal.

#5 – American Family: Best for Personalized Service

Pros

- Personalized Service: American Family is known for its personalized customer service, providing support and guidance to Mitsubishi owners throughout the insurance process.

- Comprehensive Coverage Options: American Family offers comprehensive coverage options that can be customized to meet the specific needs of Mitsubishi owners.

- Multi-Vehicle Discounts: American Family provides discounts for insuring multiple Mitsubishi vehicles under the same policy. Check out our article titled “American Family Auto Insurance Review.”

Cons

- Potentially Higher Premiums: Mitsubishi owners may find American Family’s premiums to be higher compared to other insurers offering similar coverage.

- Limited Specialized Coverage: American Family may not offer as many customized coverage options specifically for Mitsubishi vehicles, which could be a con for owners seeking comprehensive protection.

#6 – Nationwide: Best for Strong Financial Stability

Pros

- Wide Range of Coverage Options: Nationwide offers a wide range of coverage options that can be tailored to meet the specific needs of Mitsubishi owners.

- Strong Financial Stability: Nationwide is known for its strong financial stability, providing assurance to Mitsubishi owners regarding claims handling and payout.

- Multiple Policy Discounts: Nationwide provides discounts for bundling multiple policies, allowing Mitsubishi owners to save on insurance premiums. Learn more in our Nationwide auto insurance review.

Cons

- Potentially Higher Premiums: Mitsubishi owners may find Nationwide’s premiums to be higher compared to other insurers offering similar coverage.

- Limited Availability of Agents: Nationwide’s agents may not be as widely available as some other insurers, which could pose challenges for Mitsubishi owners seeking in-person assistance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – AAA: Best for Roadside Assistance

Pros

- Extensive Network: AAA’s extensive network of service providers can be beneficial for Mitsubishi owners needing roadside assistance or repairs.

- Member Discounts: AAA offers benefits to its members, which can help Mitsubishi owners save on insurance premiums and other services. Read our AAA auto insurance review to know more.

- Comprehensive Coverage Options: AAA provides a range of coverage options that can be customized to suit the needs of Mitsubishi owners.

Cons

- Membership Required: AAA requires membership for access to its insurance services, which may not be suitable for Mitsubishi owners who prefer standalone insurance policies.

- Limited Coverage Options: AAA’s coverage options may not be as diverse or flexible compared to some other insurers, which could restrict choices for Mitsubishi owners.

#8 – Farmers: Best for Strong Customer Service

Pros

- Customizable Policies: Farmers offers customizable policies that allow Mitsubishi owners to tailor their coverage to meet their specific needs. Learn more in our Farmers auto insurance review.

- Strong Customer Service: Farmers is known for its strong customer service, providing support and assistance to Mitsubishi owners throughout the insurance process.

- Multi-Policy Discounts: Farmers provides discounts for bundling multiple policies, allowing Mitsubishi owners to save on insurance premiums.

Cons

- Potentially Higher Premiums: Mitsubishi owners may find Farmers’ premiums to be higher compared to other insurers offering similar coverage.

- Limited Availability of Agents: Farmers’ agents may not be as widely available as some other insurers, which could pose challenges for Mitsubishi owners seeking in-person assistance.

#9 – Allstate: Best for User-Friendly Mobile App

Pros

- Comprehensive Coverage Options: Allstate offers comprehensive coverage options to meet the specific needs of Mitsubishi owners. Find more insights in our guide, “Allstate Auto Insurance Review.”

- Strong Financial Stability: Allstate is known for its strong financial stability, providing assurance to Mitsubishi owners regarding claims handling and payout.

- User-Friendly Mobile App: Allstate offers a user-friendly mobile app that allows Mitsubishi owners to manage their policies, file claims, and access roadside assistance easily.

Cons

- Potentially Higher Premiums: Mitsubishi owners may find Allstate’s premiums to be higher compared to other insurers offering similar coverage.

- Limited Availability of Agents: Allstate’s agents may not be as widely available as some other insurers, which could pose challenges for Mitsubishi owners seeking in-person assistance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Multi-Policy Discounts

Pros

- Comprehensive Coverage Options: Liberty Mutual offers comprehensive coverage options that can be tailored to meet the specific needs of Mitsubishi owners.

- Multi-Policy Discounts: Liberty Mutual provides discounts for bundling multiple policies, allowing Mitsubishi owners to save. Dive into our analysis of Liberty Mutual auto insurance review.

- Strong Customer Service: Liberty Mutual is known for its strong customer service, providing support and assistance to Mitsubishi owners throughout the insurance process.

Cons

- Potentially Higher Premiums: Mitsubishi owners may find Liberty Mutual’s premiums to be higher compared to other insurers offering similar coverage.

- Limited Availability of Agents: Liberty Mutual’s agents may not be as widely available as some other insurers, which could pose challenges for Mitsubishi owners seeking in-person assistance.

Navigating Mitsubishi Car Insurance Options

If you’re seeking auto insurance for your Mitsubishi, the process is straightforward. Most insurance providers extend coverage to Mitsubishi owners, albeit with varying rates influenced by specific factors. For Mitsubishi drivers, the key lies in deciding the type of auto insurance that suits their needs.

This entails choosing between a basic liability-only policy, providing minimal coverage, or opting for comprehensive coverage, including collision insurance, within a full coverage policy. To secure the most suitable and affordable Mitsubishi auto insurance, it’s advisable to explore options online.

Explore Mitsubishi Auto Insurance Rates for Better Deals

How much you pay for your Mitsubishi car insurance depends on your model, insurance company, several other factors. However, you’ll pay $64 monthly for Mitsubishi auto insurance on average. You can find cheap auto insurance for your Mitsubishi when you compare quotes from multiple car insurance companies in your area.

Mitsubishi Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $87 | $228 | |

| $62 | $166 | |

| $32 | $83 | |

| $76 | $198 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 |

The table provides a concise overview of monthly auto insurance rates offered by various providers for both minimum and full coverage plans. Mitsubishi owners seeking insurance options can compare rates across different companies to find the most suitable coverage level and provider that aligns with their budget and preferences.

From established names like Allstate and State Farm to newer players like Progressive, each company offers distinct pricing structures for both minimum and full coverage plans. Whether prioritizing affordability or comprehensive protection, this breakdown assists Mitsubishi owners in making informed decisions regarding their auto insurance needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Explore Cost of Car Insurance for Mitsubishi’s by Model

Whether you’re on the hunt for Mitsubishi Lancer car insurance, Mitsubishi Outlander car insurance, or Mitsubishi Mirage car insurance, knowing the factors that influence insurance rates can help you make informed decisions. For those looking for Mitsubishi Lancer Evolution car insurance, renowned for its performance, insurance costs may be influenced by the car’s horsepower and its appeal to certain demographics.

Comprehensive coverage for Mitsubishi owners helps protect against theft, weather, and collisions.Daniel Walker Licensed Auto Insurance Agent

On the other hand, Mitsubishi Galant car insurance rates might be affected by the vehicle’s history of reliability and safety ratings. When considering Mitsubishi Mirage car insurance, factors like the car’s small size and fuel efficiency could play a role in determining premiums. Additionally, the Mitsubishi Outlander insurance cost might vary depending on whether you opt for standard or comprehensive coverage.

It’s essential to explore your options when searching for Mitsubishi motor insurance. Factors such as your driving record, age, and credit score can also impact insurance rates. Comparing quotes from multiple insurers can help you find the most competitive rates for car insurance for Mitsubishi models.

Understanding Mitsubishi Auto Insurance Coverage

Whether you’re a proud owner of a Mitsubishi vehicle or considering purchasing one, understanding your insurance options is crucial. The standard types of auto insurance coverage include:

- Property Damage Liability: Covers you if you cause an accident and damage someone’s car or other personal property. Most states require property damage liability. Find the best property damage liability insurance companies here.

- Bodily Injury Liability: Covers you if you cause an accident and one or more people are injured. Most states require bodily injury liability.

- Personal Injury Protection (PIP): Helps if you or a passenger are injured and need medical care. PIP covers medical bills and may also cover lost wages and funeral costs.

- Medical Payments: Is similar to PIP but only covers medical bills associated with a covered accident.

- Uninsured/Underinsured: Helps if someone causes an accident and damages your vehicle but does not carry the proper insurance. Your insurance company will pay for the repairs to your vehicle.

- Collision: Helps if you’re in a car accident and your car is damaged. Without Mitsubishi collision insurance, you could pay for the repairs to your vehicle out of pocket.

- Comprehensive: Pays for damage to your car if inclement weather, wild animals, theft, or vandalism causes it.

As you embark on your journey with your Mitsubishi, remember that the right insurance coverage can provide the safety net you need in times of uncertainty.

Whether it’s protecting against property damage, bodily injury, or unforeseen accidents, ensuring you have the appropriate coverage tailored to your needs is key. Drive confidently, knowing you’re prepared for whatever the road may bring.

Maximize Your Savings with Mitsubishi Auto Insurance Discounts

Mitsubishi drivers have the opportunity to reduce their auto insurance costs through various discounts offered by insurers. Common avenues for savings include bundling insurance policies, opting for a usage-based auto insurance program, raising the deductible on the policy, maintaining a clean driving record, limiting annual mileage, and utilizing safety features in the vehicle.

These measures can potentially lead to savings of up to 25% on the car insurance policy for Mitsubishi vehicles. By taking advantage of these discounts, Mitsubishi owners can ensure both protection for their vehicles and financial savings on their insurance premiums.

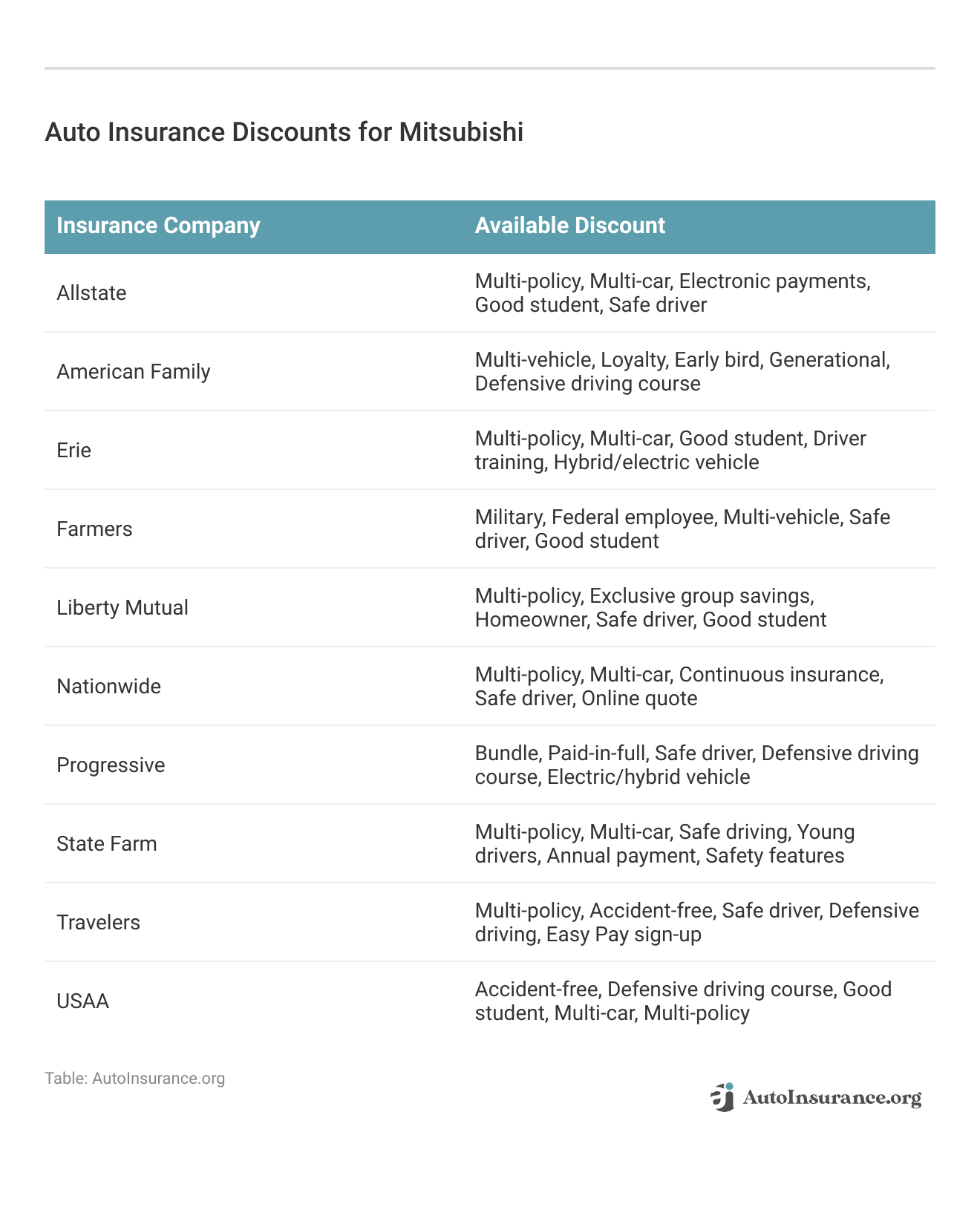

Mitsubishi owners can save on auto insurance with a range of discounts offered by leading insurers. Allstate provides multi-policy and safe driver discounts, while American Family offers loyalty and defensive driving course benefits. Erie rewards multi-policy holders and hybrid vehicle owners.

Farmers caters to military personnel and good students. Liberty Mutual extends homeowner and safe driver discounts. Nationwide offers incentives for multi-policy holders and continuous insurance coverage. Progressive provides savings for bundling policies and safe drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

3 Case Studies: Insuring Your Drive With Mitsubishi Auto Insurance

From budget-friendly options to comprehensive coverage for family vehicles and high-performance cars, these stories showcase the importance of making informed decisions when it comes to protecting what matters most.

- Case Study #1 – Smart Savings: John, a recent college graduate with tight finances, sought affordable insurance for his Mitsubishi Mirage. He diligently compared quotes online and found Erie Insurance offering comprehensive coverage at $83 per month, easing his financial burden while ensuring adequate protection.

- Case Study #2 – Protecting the Family Ride: Sarah, a busy mom, seeks comprehensive insurance for her Mitsubishi Outlander from State Farm, ensuring protection for her family without overspending. She secures a full coverage policy at $123 per month, offering peace of mind amid her hectic schedule.

- Case Study #3 – Insuring Performance: Alex, a Mitsubishi Lancer Evolution owner, faces high insurance costs due to its sports car status. He diligently researches and finds Progressive Insurance, offering tailored coverage for performance vehicles, ensuring his prized possession is protected during track days and beyond.

From smart savings to family protection and insuring high-performance vehicles, their journeys highlight the importance of thorough research and informed decision-making in securing the right coverage. Check out our ranking of the top providers: Cheap Auto Insurance for Older Vehicles

This emphasis on informed decision-making serves as a guiding principle for anyone seeking insurance, demonstrating that taking the time to explore options and understand policy details can lead to better outcomes and greater confidence in one’s insurance choices.

Finding the Best Mitsubishi Auto Insurance for Your Budget

This guide provides a comprehensive overview of Mitsubishi auto insurance options, highlighting top providers like Erie, State Farm, and Travelers. It covers factors influencing insurance rates, including vehicle models and driver demographics, and offers insights into coverage types and potential discounts.

Mitsubishi drivers can lower premiums by bundling policies or choosing higher deductibles. For example, combining home and auto can cut costs.Michelle Robbins Licensed Insurance Agent

Whether seeking minimum liability or full coverage, Mitsubishi owners can use this resource to make informed decisions and find affordable insurance solutions. First, determine the car insurance policy you need for your Mitsubishi.

Read more in our article: Cheapest Liability-Only Auto Insurance

Once you determine the coverage you’re looking for, enter your ZIP code to compare auto insurance rates from Mitsubishi dealers in your area to find the best Mitsubishi auto insurance for you.

Frequently Asked Questions

How much is auto insurance for Mitsubishi Mirage?

Auto insurance for a 2023 Mitsubishi Mirage costs $125 per month. Learn more in our article “Best Auto Insurance Companies That Offer Cash Back for Safe Drivers.”

Are there any discounts available for Mitsubishi auto insurance?

Yes, Mitsubishi drivers may be eligible for various auto insurance discounts, such as safe driver discounts or multi-policy discounts.

Are Mitsubishi cars expensive to insure?

Mitsubishi owners pay $134 each month for car insurance on average. Still, you can compare Mitsubishi car insurance quotes by entering your ZIP code above to find more affordable rates.

How much does insurance cost for a Mitsubishi Lancer?

The Mitsubishi Lancer is one of the most expensive models to insure. You’ll pay around $152 per month for Lancer car insurance.

How much is Mitsubishi Outlander auto insurance?

Mitsubishi Outlander auto insurance costs $134 monthly, the same as the overall average rates for Mitsubishi car insurance (to learn more, see our review about “Factors That Affect Auto Insurance Rates”).

What factors affect Mitsubishi’s auto insurance rates?

Mitsubishi auto insurance rates vary based on factors such as the insurance company, driver characteristics, location, and more.

What is the average monthly cost of Mitsubishi auto insurance?

On average, Mitsubishi auto insurance costs $134 per month.

Is Mitsubishi a good car?

Mitsubishi is known for affordability and fuel efficiency, but reliability depends on the model. Research your specific model to ensure it meets your needs.

Why are Mitsubishi Evos so expensive to insure?

Mitsubishi Evos are sports cars, which will always be more expensive to insure. Not only do they cost more to repair or replace, but sports cars are faster, making them more prone to accidents. Get expert insights on securing the best auto insurance for sports cars while keeping costs low.

What types of coverage are available for Mitsubishi auto insurance?

You can choose from various types of coverage, including liability coverage, comprehensive coverage, collision insurance, and add-on coverage.

How much does Mitsubishi Outlander Sport car insurance cost?

Mitsubishi Outlander Sport car insurance costs about $132 per month, but your rate depends on your location, driving history, and coverage level.

Is Mitsubishi Lancer Sportback car insurance expensive?

Yes, Mitsubishi Lancer insurance averages $148 per month due to its sporty design and higher repair costs compared to standard models.

What is the average monthly rate for Mitsubishi Mirage G4 car insurance?

Mitsubishi Mirage G4 auto insurance costs around $119 per month, making it one of the most affordable Mitsubishi models to insure.

Do you need Mitsubishi GAP insurance?

Mitsubishi GAP insurance is useful if you owe more on your loan than your car’s value. It covers the difference if your vehicle is totaled.

Is Mitsubishi i-MiEV car insurance cheaper than gas-powered models?

Yes, Mitsubishi i-MiEV car insurance is typically lower, averaging $125 per month, due to its electric design and lower maintenance costs.

Where can you find a Mitsubishi dealer near you?

You can find a Mitsubishi dealer near you by using Mitsubishi’s official dealer locator or searching online for authorized dealerships in your area.

What is the Mitsubishi Insurance Group?

Mitsubishi Insurance Group includes insurers that offer coverage for your Mitsubishi, including liability, collision, and comprehensive auto insurance options.

Can I find more affordable Mitsubishi auto insurance rates?

Yes, you can compare Mitsubishi car insurance quotes from different companies by entering your ZIP code to find more affordable rates that suit your budget.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.