Best Honda HR-V Auto Insurance in 2025 (Find the Top 10 Companies Here)

The best Honda HR-V auto insurance costs starting at $60 a month from State Farm, USAA, and Progressive. Finding Honda HR-V insurance coverage is easy with these top providers. Learn about the best coverage options and the Honda HR-V insurance cost to find the most suitable plan for your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Mar 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Honda HR-V

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Honda HR-V

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Honda HR-V

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

For the best Honda HR-V auto insurance, rates starting at $60 per month with State Farm, USAA, and Progressive leading the way. Discover how much a Honda HR-V costs to insure and compare top coverage options to find the best fit for your needs. State Farm stands out as the top pick overall.

The article also delves into the insurance Honda HR-V details, including factors affecting rates and average auto insurance cost per month.

Our Top 10 Company Picks: Best Honda HR-V Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Comprehensive Coverage State Farm

#2 10% A++ Military Benefits USAA

#3 12% A+ Flexible Policies Progressive

#4 25% A+ Extensive Discounts Allstate

#5 10% A Customizable Plans Liberty Mutual

#6 20% A+ Vanishing Deductible Nationwide

#7 15% A Personalized Service Farmers

#8 15% A Family Focused American Family

#9 10% A+ Senior Benefits The Hartford

#10 13% A++ Hybrid Discounts Travelers

By comparing coverage options from top providers, you can find the most affordable and suitable insurance solutions tailored to your Honda HR-V. Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- Best Honda HR-V Auto Insurance is around $60 per month

- Compare rates for the best coverage options

- State Farm is the top pick for affordable HR-V insurance

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: State Farm offers a monthly rate of $130 for Honda HR-V insurance, making it one of the more affordable options for full coverage. This competitive pricing helps you keep insurance costs down while ensuring comprehensive protection.

- Wide Range of Discounts: State Farm provides various discounts that can lower your Honda HR-V insurance premiums. This includes safe driver discounts and multi-policy savings, which can significantly reduce your overall insurance cost. For discounts read our State Farm auto insurance discounts.

- User-Friendly Online Tools: State Farm offers an intuitive online platform and mobile app for managing your Honda HR-V insurance policy. These tools make it easy to access your information, pay bills, and file claims from anywhere, enhancing convenience for policyholders.

Cons

- Limited Customization: While State Farm offers good basic coverage, it may have fewer options for customizing your policy compared to other insurers. This might not cater to specific needs or preferences for Honda HR-V insurance.

- Higher Rates for Younger Drivers: State Farm’s rates for younger drivers, particularly those in their 20s, may be higher compared to competitors. This can impact the affordability of Honda HR-V insurance for younger policyholders.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Benefits

Pros

- Excellent Pricing: As outlined in USAA auto insurance review, the company provides the lowest monthly rate of $120 for Honda HR-V insurance, which is beneficial for those looking to save on premium costs while maintaining full coverage.

- Generous Discounts: USAA offers attractive discounts such as good student and safe driving discounts, which can further reduce your Honda HR-V insurance rates. These discounts help lower costs for eligible policyholders.

- Top-Tier Customer Satisfaction: With high ratings for customer satisfaction, USAA is renowned for its superior service and support. This is essential for Honda HR-V owners seeking a hassle-free insurance experience.

Cons

- Eligibility Restrictions: USAA insurance is available only to military members and their families. If you don’t meet these criteria, you won’t be able to benefit from their competitive rates for Honda HR-V insurance.

- Limited Physical Locations: USAA operates primarily online and via phone, which may be less convenient for those who prefer face-to-face interactions or need in-person support for their Honda HR-V insurance needs.

#3 – Progressive: Best for Flexible Policies

Pros

- Flexible Coverage Options: As mention in Progressive auto insurance review, Progressive offers various coverage options for the Honda HR-V, including customizable plans and add-ons. This flexibility allows you to tailor your insurance to better fit your specific needs and preferences.

- Snapshot Program: The Snapshot program provides potential discounts based on your driving habits. For Honda HR-V owners who drive safely, this can translate to reduced insurance premiums and cost savings.

- Competitive Rates: At $140 per month, Progressive’s rates are competitive compared to other insurers. This ensures that you receive good value for your Honda HR-V insurance coverage.

Cons

- Higher Premiums for Some Drivers: Progressive’s rates can be higher for certain drivers, especially those with a history of traffic violations. This could make Honda HR-V insurance more expensive for drivers with less favorable records.

- Complex Claims Process: Some customers report that Progressive’s claims process can be complex and time-consuming. This might be a drawback for Honda HR-V owners seeking a straightforward claims experience.

#4 – Allstate: Best for Extensive Discounts

Pros

- Broad Coverage Options: Allstate offers a wide range of coverage options for the Honda HR-V, including comprehensive and collision coverage. This variety allows you to choose a policy that meets your specific insurance needs.

- Numerous Discounts: With discounts like safe driver and multi-vehicle savings, Allstate can help reduce your monthly premiums for Honda HR-V insurance. These discounts make it easier to afford quality coverage. Learn more about their discounts in our Allstate auto insurance review.

- Strong Nationwide Presence: Allstate’s extensive network of agents and physical locations ensures that you have access to support and resources wherever you are, which is beneficial for Honda HR-V owners across the country.

Cons

- Higher Monthly Premiums: At $150 per month, Allstate’s rates are on the higher end compared to other insurers. This might not be ideal for those looking for more budget-friendly options for their Honda HR-V insurance.

- Variable Customer Service: Customer service experiences with Allstate can vary widely depending on the location and representative. This inconsistency can affect the overall satisfaction of Honda HR-V owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Customizable Plans

Pros

- Comprehensive Coverage: Liberty Mutual offers extensive coverage options for the Honda HR-V, including roadside assistance and rental car coverage. These features provide added protection and convenience for HR-V owners.

- Discount Opportunities: Liberty Mutual provides various discounts, such as those for bundling multiple policies and installing safety features. These discounts can help lower your overall Honda HR-V insurance premiums.

- Flexible Payment Plans: As mentioned in our Liberty Mutual auto insurance review, the company offers flexible payment options, allowing Honda HR-V owners to choose from various payment plans that fit their budget and financial situation.

Cons

- Higher Insurance Costs: At $145 per month, Liberty Mutual’s rates are higher compared to some other providers. This could be a disadvantage for those seeking more affordable Honda HR-V insurance options.

- Complex Policy Options: Liberty Mutual’s range of policy options can be overwhelming, making it difficult to choose the best coverage for your Honda HR-V without thorough research and comparison.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Affordable Rates: Nationwide offers a competitive monthly rate of $135 for Honda HR-V insurance. This balance between cost and coverage provides value for HR-V owners looking for reasonable premiums.

- Discount Programs: Nationwide provides several discount programs, including those for safe driving and bundling. These discounts help reduce your Honda HR-V insurance costs and reward responsible behavior.

- Good Customer Service: Nationwide is known for its reliable customer service, ensuring that Honda HR-V owners receive prompt and helpful assistance when needed. For more information, read our Nationwide auto insurance review.

Cons

- Limited Customization: Nationwide’s insurance policies may offer fewer customization options compared to other insurers. This can limit your ability to tailor your Honda HR-V insurance to specific needs.

- Higher Rates for Young Drivers: Nationwide’s rates for younger drivers may be higher, which can impact affordability for younger Honda HR-V owners looking for budget-friendly insurance.

#7 – Farmers: Best for Personalized Service

Pros

- Comprehensive Coverage Options: Farmers provides a range of coverage options for the Honda HR-V, including full coverage and additional endorsements. This allows you to select a policy that best fits your needs.

- Discounts for Safe Drivers: Farmers offers discounts for safe driving and good student performance, which can reduce the cost of insuring your Honda HR-V while promoting safer driving habits.

- Strong Reputation: Farmers is well-regarded for its customer service and reliable claims handling, ensuring that Honda HR-V owners receive support and assistance when they need it. Check out this page Farmers auto insurance review to know more details.

Cons

- Higher Premiums: With a rate of $142 per month, Farmers may have higher premiums compared to some competitors. This could be a drawback for those seeking more economical options for their Honda HR-V insurance.

- Complex Policy Details: Farmers’ policy details and options can be complex, potentially making it challenging for Honda HR-V owners to fully understand their coverage and make informed decisions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Family Focused

Pros

- Affordable Coverage: American Family offers competitive rates at $138 per month for Honda HR-V insurance. This makes it a cost-effective option for those seeking good coverage without breaking the bank.

- Variety of Discounts: American Family provides multiple discount opportunities for Honda HR-V, including those for safe driving and bundling. These discounts can help lower your monthly premiums and make insurance more affordable.

- Good Customer Reviews: American Family has positive customer reviews for its claims process and customer service, ensuring that Honda HR-V owners receive responsive and efficient support. (Read More: American Family Auto Insurance Review).

Cons

- Limited Physical Locations: American Family has fewer physical locations compared to some competitors, which might be inconvenient for those who prefer in-person interactions for their Honda HR-V insurance needs.

- Higher Rates for Newer Vehicles: Insurance rates for newer Honda HR-V models may be higher with American Family, which could be a disadvantage if you own a recent model and are looking for lower premiums.

#9 – The Hartford: Best for Senior Benefits

Pros

- Extensive Coverage Options: The Hartford offers a wide array of coverage options for the Honda HR-V, including comprehensive and collision coverage. This ensures that you can customize your policy to meet your specific needs.

- Discounts for Safety Features: The Hartford provides discounts for vehicles with advanced safety features, which can lower your Honda HR-V insurance premiums if your vehicle is equipped with these technologies.

- Strong Customer Service: The Hartford is known for its excellent customer service and claims support, providing reliable assistance to Honda HR-V owners when they need it. Learn more in our The Hartford auto insurance review.

Cons

- Higher Premiums: At $155 per month, The Hartford’s rates are the highest among the options listed. This can be a significant drawback for those seeking more affordable insurance for their Honda HR-V.

- Limited Discount Availability: While The Hartford offers some discounts, they may not be as extensive as those provided by other insurers, potentially limiting opportunities for reducing your Honda HR-V insurance costs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Honda HR-V Auto Insurance Cost

The table below compares monthly rates for minimum and full coverage car insurance for a Honda HR-V from various providers.

Honda HR-V Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $70 $150

American Family $64 $138

Farmers $67 $142

Liberty Mutual $68 $145

Nationwide $62 $135

Progressive $65 $140

State Farm $60 $130

The Hartford $72 $155

Travelers $66 $143

USAA $55 $120

The average Honda HR-V auto insurance rates are $136 a month. The chart below details how monthly Honda HR-V insurance rates compare to other crossovers like the Nissan Murano, Chevrolet Equinox, and Mazda CX-5.

Honda HR-V Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Audi SQ5 | $38 | $76 | $27 | $152 |

| Chevrolet Equinox | $31 | $53 | $37 | $137 |

| Lincoln MKC | $30 | $58 | $42 | $145 |

| Mazda CX-5 | $32 | $53 | $37 | $138 |

| Nissan Murano | $31 | $53 | $37 | $137 |

| Subaru Crosstrek | $34 | $53 | $32 | $132 |

Understanding the breakdown of monthly insurance costs helps in budgeting and choosing the right coverage for your vehicle. Use these figures to compare and find the most cost-effective options for your Cadillac XTS.

Read More: Cheap Mazda Auto Insurance

Factors Affecting Honda HR-V Auto Insurance Rates

The insurance rates for a Honda HR-V can vary significantly depending on several key factors. The specific trim and model you select can greatly influence the overall cost, as higher trims often come with more expensive features and higher repair costs.

Additionally, the age of the vehicle plays a role; newer models typically incur higher premiums due to their increased value and advanced technology.

Your driving history and location also impact insurance rates, as a clean driving record and living in a low-risk area can lead to lower premiums.Kristen Gryglik LICENSED INSURANCE AGENT

Moreover, the level of coverage you choose, whether it’s basic liability or full coverage, will affect the total insurance cost. Each of these factors contributes to determining the most accurate and cost-effective rate for your Honda HR-V insurance.

Age of the Vehicle

Older Honda HR-V models generally cost less to insure. For example, car insurance for a 2020 Honda HR-V costs $113 monthly, while 2016 Honda HR-V insurance costs are $109.

Honda HR-V Auto Insurance Monthly Rates by Age of the Vehicle

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Honda HR-V | $28 | $48 | $34 | $126 |

| 2023 Honda HR-V | $27 | $47 | $33 | $124 |

| 2022 Honda HR-V | $26 | $46 | $32 | $122 |

| 2021 Honda HR-V | $25 | $45 | $31 | $120 |

| 2020 Honda HR-V | $25 | $44 | $31 | $113 |

| 2019 Honda HR-V | $23 | $43 | $33 | $112 |

| 2018 Honda HR-V | $23 | $42 | $33 | $111 |

| 2017 Honda HR-V | $22 | $41 | $35 | $111 |

| 2016 Honda HR-V | $21 | $40 | $36 | $109 |

If you want a lower Honda HR-V car insurance quote, consider purchasing an older model for lower auto insurance rates.

Driver Age

Driver age can have a significant effect on Honda HR-V car insurance rates, making it good to compare average auto insurance rates by age.

Honda HR-V Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $620 |

| Age: 18 | $413 |

| Age: 20 | $256 |

| Age: 30 | $118 |

| Age: 40 | $113 |

| Age: 45 | $109 |

| Age: 50 | $103 |

| Age: 60 | $101 |

As you can see, 30-year-old drivers pay $60 more for Honda HR-V car insurance than 40-year-old drivers. Read how you can find affordable HR-V auto insurance for young adults.

Driver Location

Where you live can have a large impact on Honda HR-V insurance rates. For example, drivers in Jacksonville may pay $68 a month more than drivers in Indianapolis.

Honda HR-V Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $149 |

| Columbus, OH | $94 |

| Houston, TX | $177 |

| Indianapolis, IN | $96 |

| Jacksonville, FL | $164 |

| Los Angeles, CA | $193 |

| New York, NY | $179 |

| Philadelphia, PA | $151 |

| Phoenix, AZ | $131 |

| Seattle, WA | $110 |

Always compare auto insurance rates by ZIP code to find affordable Honda HR-V coverage. Rates vary significantly by ZIP code due to local risk factors like traffic, crime, and accident rates. Comparing rates for your specific ZIP code helps you find the most cost-effective insurance options.

Your Driving Record

Your driving record can have an impact on the cost of Honda HR-V car insurance. Teens and drivers in their 20’s see the highest jump in their Honda HR-V car insurance with violations on their driving record.

Honda HR-V Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $620 | $930 | $1,240 | $775 |

| Age: 18 | $413 | $620 | $830 | $520 |

| Age: 20 | $256 | $385 | $515 | $325 |

| Age: 30 | $118 | $177 | $236 | $149 |

| Age: 40 | $113 | $169 | $225 | $142 |

| Age: 45 | $109 | $163 | $217 | $136 |

| Age: 50 | $103 | $154 | $205 | $128 |

| Age: 60 | $101 | $151 | $201 | $125 |

Finding auto insurance for drivers with a bad driving record might sound difficult, but it’s not impossible if you compare HR-V insurance quotes.

Safety Ratings

Your Honda HR-V car insurance rates are tied to the safety ratings of the Honda HR-V. See the breakdown below:

Honda HR-V Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

Insurance companies offer auto insurance discounts to vehicles with certain safety features like lane assist or daytime running lights.

Honda HR-V Safety Features

Various safety features on your Honda HR-V can help lower your Honda HR-V insurance costs. The Honda HR-V’s safety features include:

- Comprehensive Air bag Coverage: Includes driver, passenger, front head, rear head, and front side air bags for extensive protection.

- Advanced Braking Systems: Features 4-wheel ABS, 4-wheel disc brakes, and brake assist to ensure optimal braking performance.

- Stability and Traction: Equipped with electronic stability control and traction control to enhance vehicle stability and handling.

- Enhanced Safety Features: Daytime running lights and child safety locks provide additional safety for all passengers.

- Integrated Safety Technologies: A combination of advanced safety systems designed to keep occupants secure in various driving conditions.

With these robust safety features, the Honda HR-V not only ensures the security of its passengers but can also help reduce insurance costs. Investing in a vehicle with comprehensive safety measures is a smart choice for both protection and affordability.

Crash Test Ratings

The Honda HR-V’s consistently high crash test ratings across multiple years can contribute to lower car insurance rates. With excellent safety scores, Honda HR-V owners can enjoy both peace of mind and potential cost savings on their insurance premiums.

Honda HR-V Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Honda HR-V SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2024 Honda HR-V SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Honda HR-V SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Honda HR-V SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Honda HR-V SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Honda HR-V SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Honda HR-V SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Honda HR-V SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Honda HR-V SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Honda HR-V SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Honda HR-V SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Honda HR-V SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Honda HR-V SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Honda HR-V SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Honda HR-V SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Honda HR-V SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2016 Honda HR-V SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2016 Honda HR-V SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

Of course, you can compare crash test ratings of other vehicle models against a Honda HR-V to find one with better ratings.

Ways to Save on Honda HR-V Auto Insurance

Although it may seem like your Honda HR-V car insurance rates are set, there are a few measures that you can take to secure the best Honda HR-V car insurance rates possible. Take a look at the list below if you’re curious how to lower your HR-V auto insurance:

- Check for organization-based discounts, like alumni or employer discounts.

- Ask about seasonal insurance for your Honda HR-V.

- Pay your Honda HR-V auto insurance upfront.

- Reduce modifications on your Honda HR-V.

- Buy a dashcam for your Honda HR-V.

- Reduce unnecessary HR-V auto insurance coverages.

There are always ways to save on Honda HR-V auto insurance rates. For example, if you have an older HR-V, you could drop full coverage auto insurance and only carry liability auto insurance.

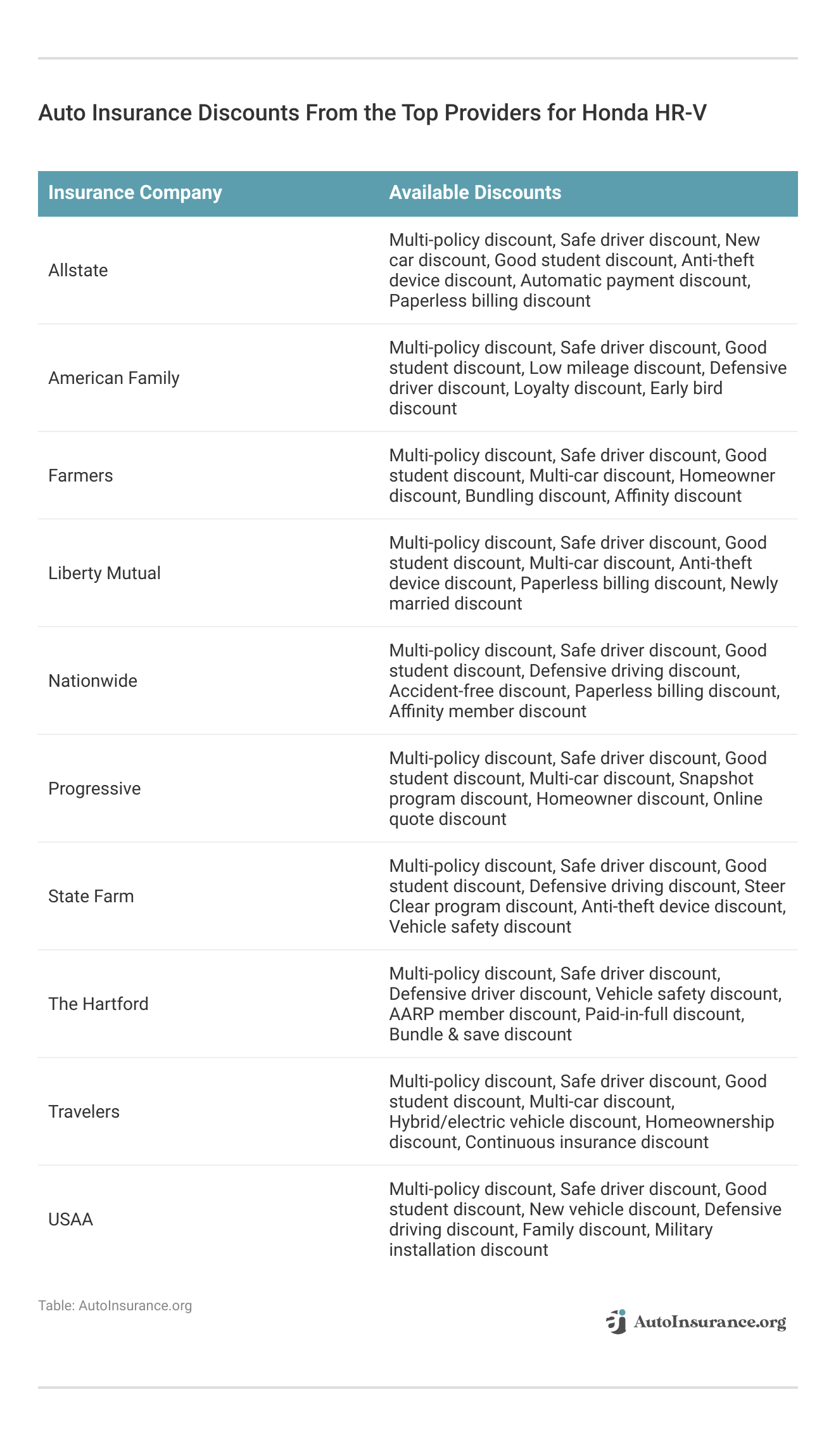

These discounts from top insurance providers for the Honda HR-V offer valuable opportunities to reduce premiums while ensuring comprehensive coverage and enhanced safety features.

By taking advantage of these savings, car owners can enjoy lower rates without sacrificing protection or the peace of mind that comes with well-rounded insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Honda HR-V Auto Insurance Companies

Several insurance companies offer competitive rates for the Honda HR-V based on factors like discounts for safety features. Below is a list of the best auto insurance companies for Honda HR-V drivers organized by market share:

Top 10 Honda HR-V Auto Insurance Providers by Market Share

| Rank | Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 milllion | 9% |

| #2 | Geico | $46.1 milllion | 7% |

| #3 | Progressive | $39.2 milllion | 6% |

| #4 | Liberty Mutual | $35.6 milllion | 5% |

| #5 | Allstate | $35 milllion | 5% |

| #6 | Travelers | $28 milllion | 4% |

| #7 | USAA | $23.4 milllion | 3% |

| #8 | Chubb | $23.3 milllion | 3% |

| #9 | Farmers | $20.6 milllion | 3% |

| #10 | Nationwide | $18.4 milllion | 3% |

Choosing the best auto insurance for your Honda HR-V involves evaluating both competitive rates and market share to find the most suitable provider. Leading companies like State Farm, Geico, and Progressive stand out with their substantial market presence and attractive insurance offerings.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

Frequently Asked Questions

What Honda HR-V auto insurance coverages should I consider?

Experts recommend you carry full coverage auto insurance consisting of liability, collision, and comprehensive coverage. However, if your car is older, you could find cheaper HR-V insurance premiums.

How can I get affordable Honda HR-V auto insurance?

Compare HR-V insurance rates, increase your deductible, and locate auto insurance discounts if you want cheap Honda HR-V auto insurance quotes.

Why does Honda HR-V trim affect auto insurance rates?

Newer HR-V models and trim levels affect auto insurance rates, since these cars may have higher repair or replacement costs.

How does my credit score affect Honda HR-V auto insurance rates?

You’ll pay higher Honda HR-V auto insurance rates if you have poor credit. So, if you want affordable Honda HR-V insurance quotes, improve your credit score. Learn more about the best auto insurance companies that use credit scores.

Are there specific auto insurance discounts for Honda HR-V drivers?

Honda’s are safe cars, so there could be safety feature discounts available to find a more affordable Honda HR-V insurance policy.

Can I transfer my current insurance policy to a new Honda HR-V?

Yes, call your auto insurance company to transfer your Honda HR-V insurance policy to a new vehicle. Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

How much does it cost to insure a Honda HR-V?

The cost of insurance for a Honda HR-V can vary based on several factors, including your location, driving history, age, coverage options, and the insurance provider you choose. It is best to request quotes from multiple insurers to get an accurate estimate of the cost.

What happens if I let my Honda HR-V insurance policy lapse?

Driving without Honda HR-V auto insurance could result in penalties like fines, license suspension, and difficulty obtaining insurance.

Read More: What You Should Do If Your Auto Insurance Expired Yesterday

Is auto insurance mandatory for a Honda HR-V?

Yes, auto insurance is generally mandatory for all vehicles, including the Honda HR-V, in most jurisdictions. The specific requirements may vary depending on your location, but liability insurance is typically required as a minimum.

Will my Honda HR-V insurance cover me if I travel out of state or internationally?

Your Honda HR-V insurance coverage will generally follow you if you travel out of state. However, it typically doesn’t extend to international travel.

Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.