Best Fayetteville, Arkansas Auto Insurance in 2025 (Check Out the Top 10 Companies)

In identifying the best Fayetteville, Arkansas auto insurance, consider our top picks Progressive, Geico, and Liberty Mutual with rates only at $61/mo. These top choices excel due to their strong customer satisfaction and competitive pricing. Explore insurance in Fayetteville, Arkansas, to find the best for you.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Fayetteville AR

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Fayetteville AR

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Fayetteville AR

A.M. Best

Complaint Level

Pros & Cons

The best Fayetteville, Arkansas auto insurance options are Progressive, Geico, and Liberty Mutual, with rates starting at just $61 per month.

Our Top 10 Company Picks: Best Fayetteville, Arkansas Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 12% A+ Customizable Coverage Progressive

#2 22% A++ Affordable Rates Geico

#3 15% A Flexible Policies Liberty Mutual

#4 10% A+ Customer Service Nationwide

#5 15% B Local Agent State Farm

#6 8% A++ IntelliDrive Program Travelers

#7 10% A+ Personalized Service Farmers

#8 10% A+ Accident Forgiveness Allstate

#9 10% A++ Multi-Policy Discount Auto-Owners

#10 12% A+ Dividend Policies Amica

Before you buy Fayetteville, Arkansas auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Fayetteville, Arkansas auto insurance quotes.

- On average, in Arkansas, auto insurance is $61 per month

- Progressive rated as the best auto insurance company in Arkansas

- Teen and young adult drivers pay the most for auto insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Competitive Rates: Progressive often provides some of the lowest premiums for the best Fayetteville, Arkansas auto insurance. Their 12% bundling discount enhances affordability, making it an excellent choice for multiple policyholders. Learn more in our Progressive auto insurance review.

- Discounts: Includes various discounts such as multi-policy and safe driver discounts. This helps make Progressive a top contender for affordable and comprehensive Fayetteville, Arkansas auto insurance.

- Snapshot Program: Potential savings through their Snapshot program based on driving habits. This can help you secure the best Fayetteville, Arkansas auto insurance rates if you exhibit safe driving behaviors.

Cons

- Customer Service: Mixed reviews on customer service and claims handling might affect your experience with the best Fayetteville, Arkansas auto insurance. While the rates are competitive, the service may not always meet expectations.

- Rate Increases: Premiums might increase after an accident or claim, potentially offsetting the initial savings from the best Fayetteville, Arkansas auto insurance rates.

#2 – Geico: Best for Affordable Rates

Pros

- Affordable Premiums: Known for some of the lowest rates available, making it a strong option for the best Fayetteville, Arkansas auto insurance. Their 22% bundling discount further reduces costs.

- Ease of Use: The user-friendly website and mobile app simplify managing your policy and filing claims, ensuring a smooth experience with the best Fayetteville, Arkansas auto insurance.

- Wide Range of Discounts: Offers various discounts like good driver and military discounts. This makes Geico a cost-effective choice for the best Fayetteville, Arkansas auto insurance. Read more through our Geico auto insurance review.

Cons

- Limited Local Agent Interaction: Primarily operates online with less personalized local service, which might be a drawback if you prefer face-to-face interactions for the best Fayetteville, Arkansas auto insurance.

- Coverage Limits: May offer fewer optional coverages compared to competitors, potentially limiting customization for the best Fayetteville, Arkansas auto insurance.

#3 – Liberty Mutual: Best for Flexible Policies

Pros

- Flexible Policies: Customizable coverage options are available, ensuring you get the best Fayetteville, Arkansas auto insurance that fits your unique needs. Their 15% bundling discount further enhances policy affordability.

- Accident Forgiveness: Provides accident forgiveness that prevents your first accident from increasing your rates. This feature helps maintain the best Fayetteville, Arkansas auto insurance rates over time.

- Multi-Policy Discounts: Significant savings when bundling auto insurance with other policies, making Liberty Mutual a great choice for the best Fayetteville, Arkansas auto insurance. Read more through our Liberty Mutual auto insurance review.

Cons

- Higher Premiums: May have higher base rates compared to competitors, which might be a concern if you’re seeking the lowest initial cost for the best Fayetteville, Arkansas auto insurance.

- Complex Policies: Policies can be complicated, making it harder to fully understand your coverage options with the best Fayetteville, Arkansas auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Customer Service

Pros

- Excellent Customer Service: Known for high customer satisfaction, Nationwide’s A+ rating reflects their dedication to providing the best Fayetteville, Arkansas auto insurance service.

- Vanishing Deductible: Deductible decreases over time with a claim-free record, helping to keep your costs lower for the best Fayetteville, Arkansas auto insurance. For more information, read our Nationwide auto insurance review.

- Wide Range of Coverage Options: Provides various types of coverage to suit different needs, helping you find the best Fayetteville, Arkansas auto insurance policy that fits your requirements.

Cons

- Higher Rates for Some: Premiums may be higher for those with poor credit or a history of claims, which could make it less competitive for the best Fayetteville, Arkansas auto insurance.

- Limited Discounts: Fewer discount opportunities compared to other providers might limit potential savings on the best Fayetteville, Arkansas auto insurance.

#5 – State Farm: Best for Local Agent

Pros

- Local Agents: Access to a vast network of local agents for personalized service, making State Farm a solid choice for the best Fayetteville, Arkansas auto insurance with customized support.

- Drive Safe & Save Program: Potential discounts based on driving behavior, helping you secure the best Fayetteville, Arkansas auto insurance rates if you demonstrate safe driving. Learn more through our State Farm auto insurance review.

- Bundling Discount: Offers a 15% discount for bundling multiple policies, which helps lower overall costs for the best Fayetteville, Arkansas auto insurance.

Cons

- Higher Premiums for Certain Drivers: May not be the most affordable for high-risk drivers, potentially making it less ideal for some seeking the best Fayetteville, Arkansas auto insurance.

- Limited Online Features: Fewer online tools compared to more digital-focused competitors, which may impact ease of managing your policy for the best Fayetteville, Arkansas auto insurance.

#6 – Travelers: Best for IntelliDrive Program

Pros

- IntelliDrive Program: Offers discounts based on driving data, which can help you secure the best Fayetteville, Arkansas auto insurance rates if you exhibit safe driving habits.

- Broad Coverage Options: Includes a wide range of coverages such as gap insurance, ensuring comprehensive protection and the best Fayetteville, Arkansas auto insurance.

- Discount Opportunities: Provides discounts for bundling and safety features in your vehicle, making it easier to find the best Fayetteville, Arkansas auto insurance. Read more though our Travelers auto insurance review.

Cons

- Customer Service: Some reports of slower claims processing times might impact your experience with the best Fayetteville, Arkansas auto insurance.

- Complex Pricing Structure: Pricing can be complex and less transparent, which may make it harder to understand how your premium is determined for the best Fayetteville, Arkansas auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Known for offering tailored customer service, making Farmers a top choice for the best Fayetteville, Arkansas auto insurance with personalized support.

- Flexible Coverage Options: Provides various coverage options to suit your needs, ensuring you receive the best Fayetteville, Arkansas auto insurance tailored to your situation.

- Multi-Policy Discounts: Offers discounts for bundling auto with other policies, helping to reduce overall costs and secure the best Fayetteville, Arkansas auto insurance. See more details in our page titled Farmers auto insurance review.

Cons

- Higher Premiums: Some drivers might find their base rates to be higher compared to competitors, which could affect affordability for the best Fayetteville, Arkansas auto insurance.

- Limited Online Tools: Fewer online resources for managing your policy might be a drawback for those seeking the best Fayetteville, Arkansas auto insurance with a strong digital experience.

#8 – Allstate: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Offers accident forgiveness that prevents your first accident from affecting your rates, helping maintain the best Fayetteville, Arkansas auto insurance rates.

- Comprehensive Coverage Options: Includes a wide range of coverages to suit various needs, ensuring you get the best Fayetteville, Arkansas auto insurance tailored to your requirements.

- Discount Opportunities: Provides discounts for bundling policies and safe driving, making Allstate a strong contender for the best Fayetteville, Arkansas auto insurance. Learn more through our Allstate auto insurance review.

Cons

- Higher Premiums: Premiums may be higher compared to some competitors, which could make it less ideal for those seeking the lowest cost for the best Fayetteville, Arkansas auto insurance.

- Complex Policies: Policies can be complex and may require careful review, which might complicate understanding the best Fayetteville, Arkansas auto insurance options.

#9 – Auto-Owners: Best for Multi-Policy Discount

Pros

- Multi-Policy Discount: Offers a 10% discount for bundling multiple policies, helping you save on the best Fayetteville, Arkansas auto insurance when combining with other coverage.

- Strong Financial Ratings: Known for high financial strength ratings, which provides assurance that Auto-Owners is a reliable choice for the best Fayetteville, Arkansas auto insurance.

- Comprehensive Coverage: Includes various types of coverage to ensure broad protection, making Auto-Owners a great option for the best Fayetteville, Arkansas auto insurance. Read more through our Auto-Owners auto insurance review.

Cons

- Limited Discounts: May offer fewer discount opportunities compared to other providers, potentially affecting savings for the best Fayetteville, Arkansas auto insurance.

- Higher Rates for Some Drivers: Premiums may be less competitive for drivers with certain risk profiles, which could impact the affordability of the best Fayetteville, Arkansas auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Amica: Best for Dividend Policies

Pros

- Dividend Policies: Offers dividend policies that can return a portion of your premium based on the company’s performance, providing a potential financial benefit with the best Fayetteville, Arkansas auto insurance.

- High Customer Satisfaction: Known for excellent customer service and high satisfaction rates, making Amica a top choice for the best Fayetteville, Arkansas auto insurance. Read more through our Amica auto insurance review.

- Flexible Coverage Options: Provides a range of coverage options to suit different needs, ensuring you can find the best Fayetteville, Arkansas auto insurance policy that meets your requirements.

Cons

- Higher Premiums for New Customers: New customers might experience higher initial premiums compared to long-term policyholders, which could impact the overall cost for the best Fayetteville, Arkansas auto insurance.

- Limited Local Agent Network: Fewer local agents available compared to competitors, which might be a drawback if you prefer personalized service for the best Fayetteville, Arkansas auto insurance.

Cheap Fayetteville, Arkansas Auto Insurance by Age, Gender, and Marital Status

Auto insurance rates in Fayetteville, Arkansas, can vary significantly based on demographic factors such as age, gender, and marital status. Understanding the benefits of auto insurance is crucial, as it provides financial protection tailored to these demographics.

Fayetteville, Arkansas Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $67 $155

Amica $63 $140

Auto-Owners $62 $140

Farmers $66 $150

Geico $62 $140

Liberty Mutual $64 $150

Nationwide $63 $145

Progressive $65 $145

State Farm $61 $140

Travelers $64 $145

Younger drivers, particularly teenagers, often face higher premiums due to their lack of experience and higher risk of accidents, but they can still benefit from coverage that safeguards them against potentially costly incidents.

Gender can also play a role, with male drivers typically paying more than female drivers, especially in younger age groups, due to statistically higher accident rates.

Fayetteville, Arkansas Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $223 | $272 | $113 | $118 | $105 | $109 | $97 | $100 |

| Farmers | $227 | $282 | $118 | $123 | $108 | $112 | $100 | $104 |

| Geico | $135 | $144 | $91 | $95 | $85 | $89 | $80 | $83 |

| Liberty Mutual | $386 | $386 | $245 | $245 | $160 | $160 | $150 | $150 |

| Nationwide | $335 | $439 | $220 | $220 | $165 | $165 | $155 | $155 |

| Progressive | $245 | $289 | $134 | $140 | $113 | $118 | $105 | $109 |

| State Farm | $96 | $108 | $101 | $115 | $89 | $93 | $70 | $70 |

| Travelers | $244 | $244 | $120 | $120 | $97 | $99 | $92 | $92 |

| USAA | $115 | $134 | $77 | $95 | $69 | $70 | $62 | $62 |

Marital status is another influential factor; married individuals often benefit from lower insurance rates compared to their single counterparts, as they are perceived to be more responsible and less likely to engage in risky driving behaviors.

Understanding how these demographics impact the monthly cost of insurance can help Fayetteville residents find the most affordable coverage options tailored to their specific profiles.

Cheap Fayetteville, Arkansas Auto Insurance Rates by ZIP Code

Frequently Asked Questions

Can I purchase additional coverage beyond the minimum requirements?

Yes, you can purchase additional coverage beyond the minimum requirements to provide more extensive protection.

Additional coverage options include collision coverage, comprehensive coverage, medical payments coverage, uninsured/underinsured motorist coverage, and more.

How are auto insurance premiums determined in Fayetteville, AR?

Auto insurance premiums in Fayetteville, AR are determined based on various factors, including your driving record, age, gender, type of vehicle, coverage limits, deductibles, and the area where you live.

Insurance companies also consider the local risk factors, such as accident rates and crime rates, when calculating premiums. Enter your ZIP code now to begin.

How can I find affordable auto insurance in Fayetteville, AR?

To find affordable auto insurance in Fayetteville, AR, it is recommended to compare quotes from multiple insurance companies.

Consider factors such as coverage options, deductibles, discounts, and customer service reputation.

Working with an independent insurance agent can also help you find competitive rates and suitable coverage.

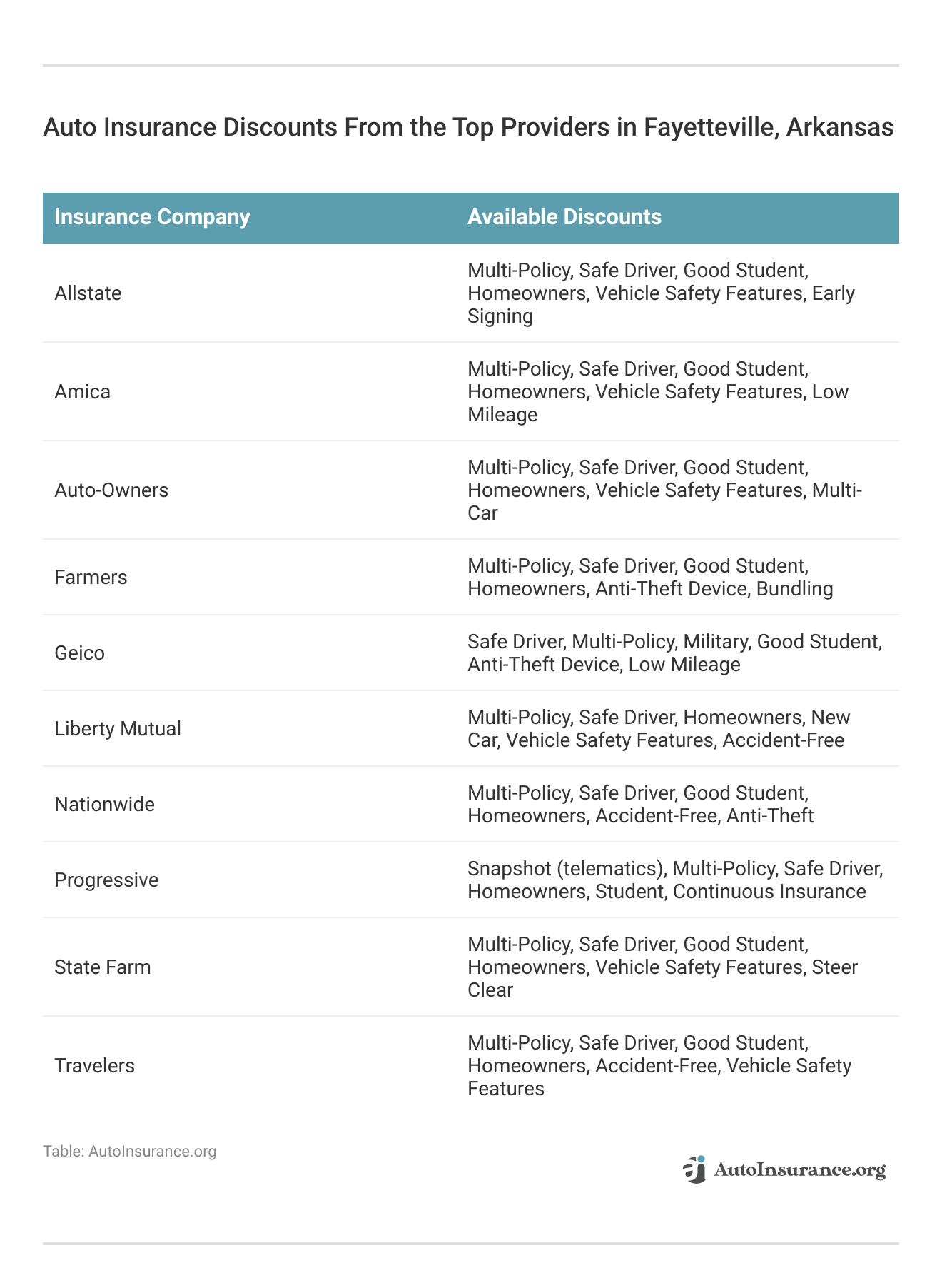

Are there any discounts available for auto insurance in Fayetteville, AR?

Yes, many insurance companies offer various discounts that can help you save on auto insurance premiums in Fayetteville, AR.

Common discounts include safe driver discounts, good student discounts, multi-policy discounts, anti-theft device discounts, and more. It’s best to check with your insurance provider to see which discounts you may qualify for.

What is the primary advantage of Progressive’s Snapshot program for those seeking the best Fayetteville, Arkansas auto insurance?

Progressive’s Snapshot program offers personalized discounts based on driving behavior, rewarding safe driving with lower rates.

This feature can help you secure the best Fayetteville, Arkansas auto insurance by providing tailored savings. Enter your ZIP code now to begin.

How does Geico’s 22% bundling discount affect its affordability compared to other providers for the best Fayetteville, Arkansas auto insurance?

Geico’s 22% bundling discount significantly enhances affordability by reducing the overall cost when combining multiple policies.

This discount makes Geico a strong contender for the best Fayetteville, Arkansas auto insurance in terms of cost-effectiveness.

Additionally, with Geico, you can find a good deductible for auto insurance that balances affordability and coverage, ensuring that your out-of-pocket expenses are manageable while still providing comprehensive protection.

What is a notable feature of Liberty Mutual’s accident forgiveness policy when looking for the best Fayetteville, Arkansas auto insurance?

Liberty Mutual’s accident forgiveness policy ensures that your first at-fault accident won’t raise your premium, which is beneficial for maintaining stable rates. This feature adds value when considering the best Fayetteville, Arkansas auto insurance options.

How does Nationwide’s vanishing deductible benefit policyholders in maintaining the best Fayetteville, Arkansas auto insurance rates?

Nationwide’s vanishing deductible reduces your deductible amount for every year of safe driving, lowering out-of-pocket costs after an accident.

This can help keep your overall expenses manageable, contributing to the best Fayetteville, Arkansas auto insurance experience. Enter your ZIP code now to begin.

What makes State Farm’s local agent network a significant factor for those seeking personalized service in the best Fayetteville, Arkansas auto insurance?

How does Amica’s dividend policy offer potential financial benefits for those choosing the best Fayetteville, Arkansas auto insurance?

Amica’s dividend policy offers potential refunds based on the company’s performance, which can provide additional savings on top of standard discounts.

This feature enhances the value of Amica’s policies for those seeking the best Fayetteville, Arkansas auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.