Best Wisconsin Auto Insurance in 2025 (Find the Top 10 Companies Here!)

State Farm, American Family, and Progressive lead as the best Wisconsin auto insurance providers, offering plans starting at just $21 monthly. Each company provides unique benefits tailored to meet diverse driver needs, ensuring quality and affordability in Wisconsin auto insurance coverage options.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Jul 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Wisconsin

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews

Company Facts

Full Coverage for Wisconsin

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Wisconsin

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

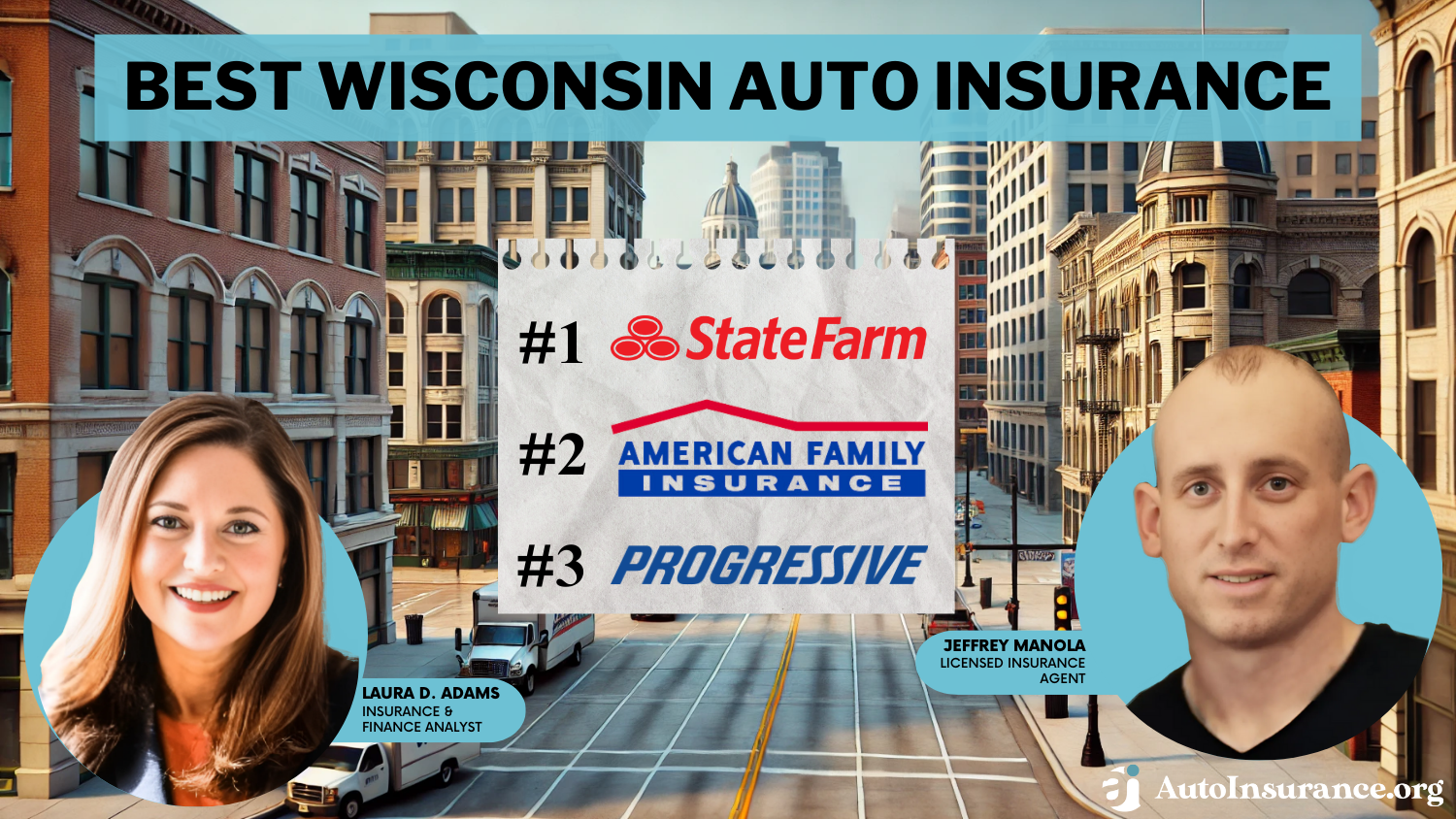

The top picks for the best Wisconsin auto insurance are State Farm, American Family, and Progressive, known for their comprehensive coverage and customer satisfaction.

This article dives into the essentials of auto insurance in Wisconsin, exploring the factors that influence rates such as age, driving record, and location, while also comparing statewide auto insurance costs.

Our Top 10 Company Picks: Best Wisconsin Auto Insurance

Company Rank Safe-Driving Discount A.M. Best Best For Jump to Pros/Cons

#1 10% B Good Drivers State Farm

#2 15% A Competitive Rates American Family

#3 10% A+ Snapshot Discounts Progressive

#4 20% A++ Online Tools Geico

#5 12% A Customer Satisfaction West Bend

#6 10% A++ Comprehensive Coverage Auto-Owners

#7 15% A+ Affordable Rates Erie

#8 10% A+ Safe-Driving Discounts Nationwide

#9 10% A++ Extensive Coverage Travelers

#10 12% A Extensive Discounts Liberty Mutual

We provide insights into how drivers can navigate the complexities of coverage requirements, SR-22 filings, and how your credit score might affect your premiums. Whether you’re looking for minimum coverage or a full coverage plan, our guide helps Wisconsinites make informed decisions to secure the best auto insurance for their needs.

Keep reading to learn more about the cheapest auto insurance companies in Wisconsin and see what factors affect your rates. Then, enter your ZIP code into our free quote comparison tool above to get started on finding the best auto insurance in Wisconsin.

- State Farm leads as a top pick for best Wisconsin auto insurance

- Factors like age, driving record, and location significantly impact insurance rates

- Minimum coverage requirements may not suffice for all Wisconsin drivers

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: Significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: Substantial discount for low-mileage drivers. Discover insights in our guide titled “State Farm Auto Insurance Review.”

- Wide Coverage Options: Offers a variety of coverage options tailored to different needs.

Cons

- Limited Multi-Policy Discount: Multi-policy discounts are not as competitive as others.

- Premium Costs: Higher premiums for certain coverage levels despite discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – American Family: Best for Competitive Rates

Pros

- Customer Loyalty Discounts: Rewards long-term customers with lower rates.

- Multiple Policy Discounts: Strong incentives for bundling policies. See more details in our guide titled “American Family Auto Insurance Review.”

- Robust Online Management: Efficient online tools for managing policies.

Cons

- Coverage Limitations: Certain coverages are not as comprehensive as competitors.

- Availability Issues: Not available in all states, which might limit accessibility for some.

#3 – Progressive: Best for Snapshot Discounts

Pros

- Snapshot Program: Progressive Insurance offers personalized rates based on actual driving behavior.

- Flexible Policies: Wide range of customizable coverage options. Delve into our evaluation of Progressive auto insurance review.

- Strong Online Presence: Excellent digital tools for policy management.

Cons

- Variable Customer Service: Customer experiences can vary significantly.

- Rate Fluctuations: Premiums may increase significantly at renewal for some customers.

#4 – Geico: Best for Online Tools

Pros

- Competitive Pricing: Geico Insurance is known for generally lower rates across various demographics.

- Advanced Online Tools: Robust digital platforms for claims and policy management.

- High Customer Satisfaction: Consistently high ratings for customer service. Learn more by reading our guide titled “Geico Auto Insurance Review.”

Cons

- Basic Policy Offerings: Fewer unique or niche coverage options compared to others.

- In-Person Service: Fewer local agents, which may affect those preferring face-to-face service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – West Bend: Best for Customer Satisfaction

Pros

- Customized Coverage: Offers tailored insurance solutions for varied needs. More information is available about this provider in our “Where to Compare Auto Insurance Rates.”

- Strong Agent Network: Excellent customer service through a wide network of agents.

- Claim Service Guarantee: Commitment to efficient and satisfactory claims processing.

Cons

- Higher Premiums: Can be more expensive than other regional competitors.

- Limited Availability: Primarily serves only some Midwestern states.

#6 – Auto-Owners: Best for Comprehensive Coverage

Pros

- In-Depth Coverage Options: Extensive range of coverage that can be tailored extensively.

- High Claims Satisfaction: Strong reputation for handling claims effectively. See more details in our guide titled “Auto-Owners Auto Insurance Review.”

- Loyal Customer Discounts: Attractive discounts for long-standing customers.

Cons

- Limited Geographic Reach: Not available in all states, which can be a drawback for some.

- Policy Customization Costs: Customizing policies might lead to higher costs.

#7 – Erie: Best for Affordable Rates

Pros

- Competitive Premiums: Erie Insurance is known for affordable rates, particularly in its operating regions.

- Rate Lock Feature: Offers a rate lock feature to keep premiums stable. Discover insights in our guide titled “Erie Auto Insurance Review.”

- Exceptional Customer Service: Frequently praised for customer support and local agent networks.

Cons

- Limited Scope of Operation: Primarily available in the Northeast and Midwest.

- No Online Claims: Claims must be handled through agents, not online.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Safe-Driving Discounts

Pros

- SmartRide Discount: Discounts for safe driving through a telematics program.

- Wide Range of Products: Offers a broad array of insurance and financial products.

- Strong Financial Stability: Robust financial health for long-term reliability. Read up on the Nationwide auto insurance review for more information.

Cons

- Premium Variability: Premiums can vary widely based on personal profiles.

- Complexity in Policy Options: Sometimes complex policy options can be confusing for users.

#9 – Travelers: Best for Extensive Coverage

Pros

- Broad Insurance Offerings: Provides a wide range of coverage options.

- Discount Opportunities: Multiple discounts are available for various customer profiles.

- Green Home Discount: Offers discounts for certified green homes. See more details in our guide titled “Travelers Auto Insurance Review.”

Cons

- Pricing: Generally higher premiums compared to some major competitors.

- Customer Satisfaction: Some reports of below-average customer satisfaction in certain areas.

#10 – Liberty Mutual: Best for Extensive Discounts

Pros

- Customizable Policies: Highly customizable policy options.

- Accident Forgiveness: Offers accident forgiveness plans. Discover more about offerings in our complete Liberty Mutual auto insurance review.

- Variety of Discounts: An extensive range of discounts available.

Cons

- Inconsistent Customer Service: Some reports of inconsistent customer service experiences.

- Rate Increases: Some customers report significant rate increases at policy renewal.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

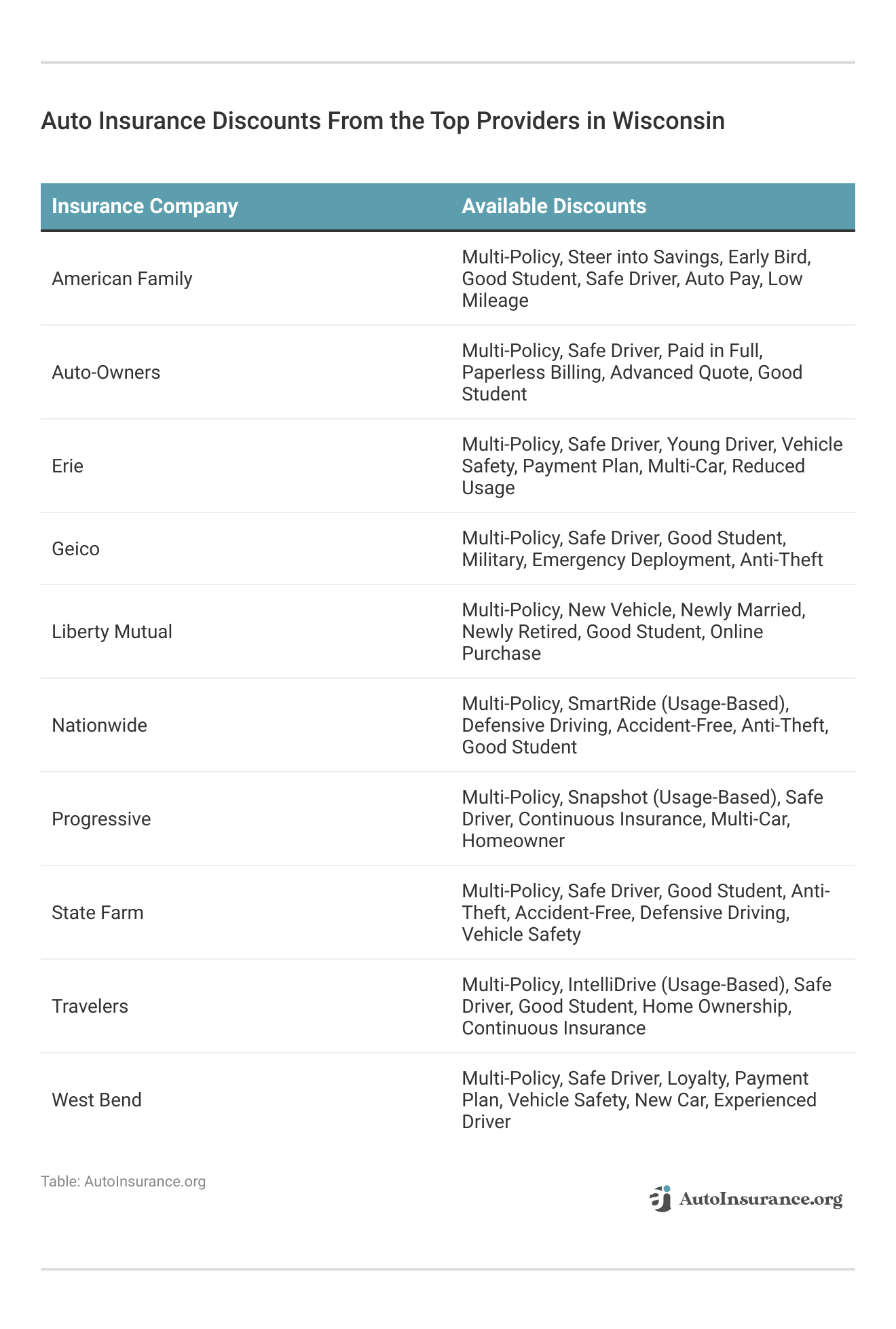

Comparative Monthly Rates for Wisconsin Auto Insurance Providers

Understanding the cost dynamics of auto insurance in Wisconsin can help you make a more informed choice when selecting a policy. The following section provides a snapshot of how monthly rates vary between minimum and full coverage across different insurance providers.

Wisconsin Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

American Family $22 $63

Auto-Owners $33 $87

Erie $22 $58

Geico $22 $62

Liberty Mutual $30 $84

Nationwide $80 $226

Progressive $33 $94

State Farm $21 $58

Travelers $26 $72

West Bend $24 $68

The table below indicates that State Farm offers the most affordable minimum coverage at $21 per month, while Erie and State Farm tie for the cheapest full coverage at $58 per month.

On the other end of the spectrum, Nationwide charges the highest rates for both minimum and full coverage, at $80 and $226 respectively. Other providers like American Family, Auto-Owners, and Liberty Mutual offer competitive rates that vary moderately between minimum and full coverage.

This variation in pricing showcases the importance of comparing rates to ensure you get the best deal for your insurance needs. Access comprehensive insights into our guide titled “What are the recommended auto insurance coverage levels?“

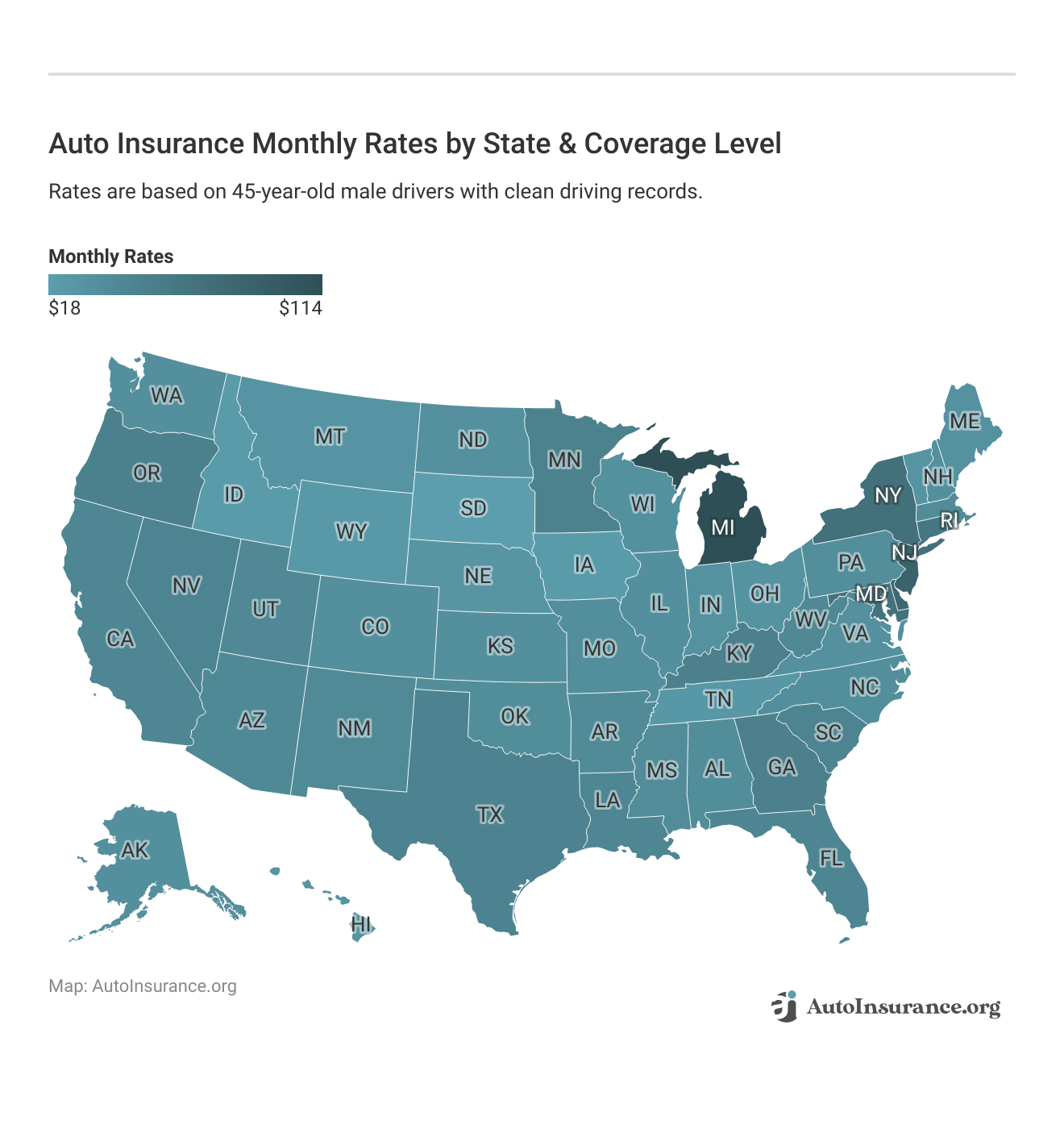

Comparing Wisconsin Auto Insurance Rates

While car insurance in Wisconsin is much lower than the national average, many factors that affect auto insurance rates. Each car insurance company weighs your factors differently, and insurers’ rates vary.

Your coverage amount significantly impacts your insurance rates. While Wisconsin’s mandatory auto insurance requirements are low, they might not offer you adequate protection.

The table below shows how average Wisconsin auto insurance rates compare with other states for liability-only coverage:

Liability Auto Insurance Monthly Rates by State

State Rates

Alabama $37

Alaska $47

Arizona $48

Arkansas $36

California $45

Colorado $49

Connecticut $59

Delaware $69

Florida $76

Georgia $55

Hawaii $39

Idaho $32

Illinois $40

Indiana $34

Iowa $27

Kansas $32

Kentucky $47

Louisiana $73

Maine $30

Maryland $55

Massachusetts $52

Michigan $72

Minnesota $39

Mississippi $41

Missouri $38

Montana $34

Nebraska $33

Nevada $64

New Hampshire $35

New Jersey $76

New Mexico $44

New York $71

North Carolina $31

North Dakota $25

Ohio $35

Oklahoma $40

Oregon $53

Pennsylvania $43

Rhode Island $68

South Carolina $50

South Dakota $26

Tennessee $37

Texas $49

U.S. Average $48

Utah $45

Vermont $30

Virginia $38

Washington $53

Washington D.C. $58

West Virginia $43

Wisconsin $33

Wyoming $29

Wisconsin only requires a small amount of liability insurance to cover bodily injuries and property damage to others. Full coverage includes Wisconsin requirements plus collision and comprehensive coverage to pay for your vehicle damages.

Here’s how Wisconsin full coverage car insurance stacks up with the rest of the United States:

USAA auto insurance typically offers the cheapest rates for each coverage type, but it’s only available to military members and their families. Geico auto insurance offers the most affordable insurance to all drivers in Wisconsin for all coverage types. While full coverage is more expensive than liability coverage, you’ll pay less out of pocket to repair your vehicle.

Wisconsin Auto Insurance Rates by Age

Your age also affects your rates since young drivers lack experience and are more likely to be in accidents. Conversely, older, more experienced drivers typically see much lower rates.

The table displays average car insurance rates in Wisconsin from top companies, segmented by age and gender, demonstrating how premiums can vary based on these factors. It serves as a valuable resource for consumers to understand how their demographic characteristics influence their insurance costs.

Wisconsin Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 16 Male | Age: 16 Female | Age: 30 Male | Age: 30 Female | Age: 45 Male | Age: 45 Female | Age: 55 Male | Age: 55 Female | Age: 65 Male | Age: 65 Female |

|---|---|---|---|---|---|---|---|---|---|---|

| Allstate | $481 | $430 | $191 | $180 | $177 | $168 | $160 | $162 | $152 | $153 |

| American Family | $458 | $419 | $172 | $160 | $137 | $116 | $117 | $115 | $111 | $109 |

| Auto-Owners | $425 | $387 | $161 | $150 | $145 | $135 | $125 | $125 | $118 | $115 |

| Farmers | $512 | $460 | $193 | $182 | $160 | $154 | $133 | $134 | $126 | $127 |

| Geico | $350 | $310 | $147 | $135 | $87 | $90 | $80 | $80 | $76 | $76 |

| Liberty Mutual | $550 | $495 | $208 | $195 | $200 | $174 | $174 | $171 | $165 | $162 |

| Nationwide | $425 | $380 | $158 | $148 | $136 | $124 | $115 | $113 | $109 | $107 |

| Progressive | $437 | $390 | $162 | $150 | $136 | $131 | $105 | $112 | $100 | $106 |

| State Farm | $401 | $359 | $148 | $137 | $103 | $94 | $86 | $86 | $82 | $82 |

| Travelers | $442 | $398 | $165 | $154 | $132 | $125 | $119 | $117 | $114 | $113 |

| West Bend | $430 | $390 | $160 | $150 | $135 | $120 | $120 | $118 | $112 | $110 |

Auto insurance for teens and young drivers is the most expensive. Young Wisconsin drivers pay almost 300% more than older drivers. In addition, unmarried male drivers also pay higher rates than married female drivers. Unmarried or male drivers tend to take more risks and are more likely to be in accidents.

Wisconsin Auto Insurance Rates With an Accident

Your driving record significantly impacts car insurance rates. Accidents and tickets indicate you’ll likely cost the insurance company money. As a result, your rates are much higher than drivers with a clean driving record. With average rates of just over $790 a year, American Family auto insurance has the lowest rates for Wisconsin drivers with an at-fault accident on their records.

Cheap auto insurance after an accident is more difficult to find. This table shows how much an accident affects your car insurance rates in Wisconsin.

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| $122 | $189 |

| $225 | $363 | |

| $164 | $247 | |

| $138 | $196 | |

| $330 | $621 | |

| $106 | $153 | |

| $397 | $496 |

| $169 | $238 |

| $133 | $219 | |

| $162 | $254 | |

| $161 | $235 |

| $194 | $308 | |

| U.S. Average | $165 | $244 |

Although drivers with accidents on their driving records pay higher rates, it’s not forever. Accidents and tickets stop affecting insurance rates after three to five years in Wisconsin. So, even if your car insurance rates are higher because of an accident, they go down in five years if you avoid adding more infractions.

Wisconsin Auto Insurance Rates With a DUI

A DUI affects car insurance rates much more than an accident or ticket. In addition, a DUI stays on your record for up to 10 years, meaning your rates are significantly higher for a decade. State Farm is likely to be your best bet for cheap auto insurance for drivers with a DUI in Wisconsin, with average monthly rates of $112.

This table shows average rates for drivers with a DUI from top car insurance companies in Wisconsin.

Auto Insurance Monthly Rate Increases: Clean Record vs. One DUI

| Insurance Company | Clean Record | One DUI | Rate Increase |

|---|---|---|---|

| $87 | $152 | 75% | |

| $62 | $104 | 68% |

| $76 | $105 | 38% | |

| $43 | $117 | 172% | |

| $96 | $178 | 85% |

| $63 | $129 | 105% | |

| $56 | $75 | 34% | |

| $47 | $65 | 38% | |

| $53 | $112 | 111% | |

| $32 | $58 | 81% |

Each car insurance company weighs a DUI differently and offers different rates. While you can expect significantly higher rates regardless, you may be able to find affordable coverage by shopping around.

Wisconsin Auto Insurance Rates With a Ticket

Just like being at fault in an accident or having a DUI, speeding tickets affect your car insurance rates.Again, State Farm looks to be the best option for drivers with a ticket. Just like a DUI, the average monthly rate in Wisconsin is $96.

Full Coverage Auto Insurance Monthly Rates by Provider: One Ticket vs. Clean Record

| Insurance Company | One Ticket | Clean Record |

|---|---|---|

| $154 | $122 |

| $268 | $228 | |

| $194 | $166 |

| $150 | $124 | |

| $170 | $138 | |

| $100 | $83 |

| $247 | $198 | |

| $151 | $114 | |

| $302 | $248 |

| $196 | $164 |

| $199 | $150 | |

| $137 | $123 | |

| $396 | $331 | |

| $194 | $161 |

| $192 | $141 | |

| $148 | $118 | |

| U.S. Average | $203 | $165 |

As you can see, keeping your driving record clean can help you save money on car insurance.

Wisconsin Auto Insurance Rates by Credit Score

Many drivers aren’t aware that their credit score affects car insurance rates. Insurance companies use a credit score to determine car insurance rates because they believe drivers with poor credit are more likely to file a claim and be unable to pay for damages out of pocket.

Wisconsin drivers with poor credit pay significantly higher rates. Fortunately, drivers can lower car insurance rates by improving their credit scores.

Wisconsin Auto Insurance Rates by City

Where you live also affects insurance rates. Drivers living in a city with a high theft rate or a large traffic volume see higher rates since they’re more likely to file a claim. For example, auto insurance in Milwaukee, WI is much higher than in rural areas.

Choosing State Farm means opting for a trusted partner that prioritizes customer satisfaction and cost efficiency.Jeffrey Manola Licensed Insurance Agent

Although Milwaukee auto insurance quotes are the most expensive, you can find the cheapest coverage in Ashwaubenon. Areas with lower crime and traffic also tend to see lower rates.

How Much Is Car Insurance in Wisconsin

Analyze the disparities in auto insurance pricing among different cities in Wisconsin. Take advantage of the opportunity to select your city from the list below, enabling you to gain insights into the specific insurance costs relevant to your area.

Wisconsin Auto Insurance Cost by City

Exploring the differences in auto insurance rates among different cities in Wisconsin can help you choose the most suitable coverage that meets the unique requirements of your locality, ensuring you find cheap car insurance in Wisconsin.

Wisconsin Auto Insurance Requirements and Laws

Experts recommend drivers carry full coverage — including Wisconsin’s minimum requirements, comprehensive auto insurance, and collision auto insurance — to protect their vehicles.

In addition, consider medical payments, rental car reimbursement, roadside assistance, and underinsured or uninsured motorist insurance bodily injury coverages for the most protection. While adding coverage raises your rates, you’ll pay less out of pocket if your car gets damaged.

Driving Without Wisconsin Auto Insurance

Car insurance is mandatory in Wisconsin, and failing to carry at least the minimum coverage leads to hefty fines. Fines related to no proof of car insurance include:

- $500 fine for operating a motor vehicle without insurance

- $10 fine for drivers and owners who can’t show proof of insurance at the time of the accident or traffic stop

- Up to a $5,000 fine for offering fraudulent proof of insurance

According to the State of Wisconsin Department of Transportation, you don’t have to show proof of car insurance when getting a license or registering your vehicle. However, you’ll have to show proof of insurance if you’re stopped by the police or have an accident. You must also show proof of insurance when reinstating a suspended or revoked driver’s license.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Get SR-22 Auto Insurance in Wisconsin

SR-22 auto insurance is available in Wisconsin. SR-22 is a form filed by your car insurance company showing the state of Wisconsin you have at least the minimum amount of car insurance required. Drivers with a DUI, multiple accidents, a car insurance lapse, or too many points on their driver’s license may need SR-22 insurance. While the form is inexpensive, car insurance rates skyrocket for drivers with SR-22 insurance.

SR-22 insurance is easy to obtain since many top insurance companies offer coverage. However, not all companies provide SR-22, so you may have to shop around to find an insurer. If you don’t currently have car insurance, it may be trickier to find SR-22 insurance. Not only will you have to find a company to insure you, but you’ll also see even higher rates with a continuous car insurance history.

Drivers who need SR-22 insurance and don’t have a vehicle may consider non-owner SR-22 auto insurance coverage. This coverage allows you to meet the Wisconsin minimums and legally drive, but car damage isn’t covered if you’re in an accident.

Getting Cheap Auto Insurance in Wisconsin

While Wisconsin auto insurance is cheaper than the national average, rates vary by driver. Coverage amounts, age, driving record, credit score, and location affect your rates.

Wisconsin only requires drivers to carry 25/50/10 in liability coverage and 25/50 in uninsured motorist coverage, but coverage limits are very low, and don’t pay for your vehicle damages. So consider full coverage auto insurance in Wisconsin to protect your car adequately.

If you crash your car🚘, will your insurance cover it? With only liability coverage, you're out of luck😟. With full coverage, you're set👍. https://t.co/27f1xf1ARb has a guide to help you decide if full coverage is right for you. Check it out here👉: https://t.co/ZzJApDghSE pic.twitter.com/TKIDrrTjhC

— AutoInsurance.org (@AutoInsurance) September 25, 2023

Whether you have a spotless driving record or need SR-22 insurance, shop around to find the best car insurance in Wisconsin. Every company offers different rates, so compare the best auto insurance companies for cheap Wisconsin coverage.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Frequently Asked Questions

What are the average monthly auto insurance rates in Wisconsin?

Typically, monthly premiums for auto insurance in Wisconsin vary between $30 and $60, influenced by the specific coverage selected. Nonetheless, quotes can differ greatly from one driver to another due to diverse personal factors.

See more details in our guide titled “Factors That Affect Auto Insurance Rates.”

Do you have to have auto insurance in Wisconsin?

Indeed, Wisconsin mandates that drivers maintain the minimum required liability and uninsured motorist coverage. Although the 25/50/10 requirements are more cost-effective, opting for full coverage provides enhanced protection for your vehicle, which is essential for comprehensive car insurance in Wisconsin.

What auto insurance coverages does Wisconsin require?

In Wisconsin, the law mandates that drivers must have minimum liability insurance coverage split into 25/50/10: $25,000 per individual for bodily harm, $50,000 per incident for bodily injury, and $10,000 per incident for property damage.

Moreover, holding uninsured motorist coverage of 25/50 is compulsory to ensure protection against drivers without insurance. This requirement is essential when searching for cheap Wisconsin auto insurance.

Can you get SR-22 insurance in Wisconsin?

Yes, SR-22 insurance is available in Wisconsin. SR-22 is a form filed by your car insurance company to demonstrate that you have at least the minimum required insurance coverage. Drivers with certain violations, such as DUIs or a lapse in coverage, may be required to have SR-22 insurance.

Can I get insurance coverage for a rental car in Wisconsin?

Yes, you can typically obtain insurance coverage for a rental car in Wisconsin. Before renting a car, check with your insurance provider to see if your policy extends coverage to rental vehicles. If not, you may need to purchase additional coverage from the rental car company or explore standalone rental car insurance options.

For additional details, explore our comprehensive resource titled “Does my auto insurance cover rental cars?“

What options are available for affordable auto insurance in Milwaukee?

Milwaukee offers several affordable auto insurance options with companies like State Farm and American Family providing competitive rates.

Where can I find affordable auto insurance in Wisconsin?

Affordable auto insurance in Wisconsin is widely available through providers such as Geico, State Farm, and Progressive, known for their cost-effective policies.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Which are the leading auto insurance companies in Wisconsin?

Leading auto insurance companies in Wisconsin include State Farm, American Family, and Progressive, all offering a range of coverage options.

How can I get auto insurance quotes online in Wisconsin?

You can obtain auto insurance quotes online in Wisconsin by visiting the websites of major insurers like Geico, and Progressive, or using comparison tools to find the best rates.

To find out more, explore our guide titled “Where to Buy Auto Insurance Online.”

What are the auto insurance requirements for Wisconsin?

Wisconsin requires drivers to have minimum liability coverage of 25/50/10 and uninsured motorist coverage of 25/50.

What is the average cost of auto insurance in Wisconsin?

The average cost of auto insurance in Wisconsin typically ranges from $30 to $60 per month, depending on various factors like coverage level and driver history.

What does average full-coverage car insurance include?

Average full coverage car insurance includes liability, collision, and comprehensive coverages, providing a full spectrum of protection against various incidents.

Which company offers the best auto insurance in Wisconsin?

State Farm is often considered the best provider of auto insurance in Wisconsin due to its affordability, customer service, and comprehensive coverage options.

For additional details, explore our comprehensive resource titled “Cheapest Auto Insurance Companies.”

Who provides the best Milwaukee auto insurance?

The best Milwaukee auto insurance is typically offered by American Family and State Farm, known for their local customer service and competitive rates.

Where can I find cheap auto insurance in Milwaukee?

Cheap auto insurance in Milwaukee can be found with providers like Erie and Progressive, known for their budget-friendly policies.

How can I get cheap auto insurance in Wisconsin?

To get cheap auto insurance, compare car insurance quotes in Wisconsin from several insurers, look for discounts, and consider adjusting your coverage levels.

Do you have to have car insurance in Wisconsin?

Yes, it is mandatory to have car insurance in Wisconsin, with minimum liability and uninsured motorist coverages required by law.

For additional details, explore our comprehensive resource titled “What is the average auto insurance cost per month?“

Does Wisconsin have uninsured motorist coverage?

Yes, Wisconsin requires all drivers to carry uninsured motorist coverage to protect against damages caused by uninsured or underinsured drivers.

What options are there for high-risk insurance in Wisconsin?

High-risk drivers in Wisconsin can obtain insurance through the Wisconsin Automobile Insurance Plan, which ensures all drivers can receive coverage.

Is there low-income car insurance available in Wisconsin?

While Wisconsin does not have a specific low-income car insurance program, some insurers offer reduced rates and discounts that can help lower-income drivers afford coverage.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.