Bristol West Auto Insurance Review for 2025 (See if They’re a Good Fit!)

Bristol West, a Farmers Insurance Group of Companies member, offers coverage tailored for high-risk drivers, with rates starting at $58 per month. This Bristol West auto insurance review showcases its agent-assisted claims program for drivers with DUI in managing accidents or violations.

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Feb 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Bristol West Auto Insurance

Monthly Rates:

$58A.M. Best Rating:

AComplaint Level:

HighPros

- Coverage available for high-risk drivers, including DUIs

- Full coverage policies with collision and comprehensive options

- Offers good student, safe driver, and multi-policy discounts

Cons

- Premiums are higher than standard insurance providers

- Numerous complaints about billing and customer service issues

- Bristol West offers non-standard car insurance to high-risk drivers in the U.S.

- The company provides SR-22 filings

- Rates with Bristol West are higher than average

This Bristol West auto insurance review points out the company’s special services for high-risk drivers, which include coverage for DUIs, accidents, and other breaches.

As a Farmers Insurance subsidiary, Bristol West insurance company carries a solid financial strength background and is available in 43 states.

Bristol West Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.6 |

| Business Reviews | 4.0 |

| Claim Processing | 3.4 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.1 |

| Coverage Value | 3.3 |

| Customer Satisfaction | 2.2 |

| Digital Experience | 3.5 |

| Discounts Available | 4.7 |

| Insurance Cost | 3.7 |

| Plan Personalization | 4.0 |

| Policy Options | 2.2 |

| Savings Potential | 4.0 |

Bristol West offers services for drivers who need different kinds of insurance. It is also noticeable because it has specific plans to fulfill special needs.

You should examine its characteristics to determine if Bristol West suits your insurance needs. Find affordable coverage with Bristol West by using our free quote comparison tool.

- Bristol West is best known for serving high-risk drivers

- SR-22 & FR-44 filings available for drivers with a DUI or accident

- Insurance coverage with Bristol West is available in 43 states

Bristol West Insurance Insurance Rates Breakdown

The table compares the monthly fees of Bristol West auto insurance and those of its leading competitors. This includes rates for both minimum coverage level as well as full coverage level.

Bristol West Auto Insurance Monthly Rates vs. Top Competitors by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $92 | $215 | |

| $91 | $208 | |

| $99 | $211 |

| $97 | $220 | |

| $90 | $205 | |

| $100 | $225 |

| $93 | $212 |

| $95 | $210 | |

| $88 | $200 | |

| $96 | $217 |

This demonstrates that Bristol West presents competitive prices, but others, such as State Farm and Geico, usually have somewhat lower rates, mainly for full coverage auto insurance.

Bristol West Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $210 | $400 |

| 16-Year-Old Male | $230 | $425 |

| 18-Year-Old Female | $180 | $350 |

| 18-Year-Old Male | $200 | $375 |

| 25-Year-Old Female | $95 | $180 |

| 25-Year-Old Male | $105 | $195 |

| 30-Year-Old Female | $78 | $160 |

| 30-Year-Old Male | $85 | $165 |

| 45-Year-Old Female | $63 | $125 |

| 45-Year-Old Male | $63 | $125 |

| 60-Year-Old Female | $60 | $115 |

| 60-Year-Old Male | $62 | $120 |

| 65-Year-Old Female | $58 | $110 |

| 65-Year-Old Male | $60 | $115 |

The table above shows changes in Bristol West car insurance costs according to age, gender, and level of coverage. This information shows how the prices differ. The rates are much higher for young drivers, especially males because more high-risk factors are involved.

On the other hand, older drivers with experience have much lower premiums to pay. Also, full coverage is quite expensive than minimum coverage for all ages, reflecting that obtaining better protection brings more significant monetary effects.

Bristol West Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $125 | $155 | $200 | $245 | |

| $110 | $145 | $185 | $225 | |

| $120 | $145 | $180 | $220 |

| $130 | $160 | $210 | $250 | |

| $105 | $140 | $170 | $215 | |

| $135 | $165 | $215 | $260 |

| $115 | $140 | $175 | $220 |

| $115 | $150 | $190 | $230 | |

| $110 | $135 | $160 | $200 | |

| $120 | $150 | $190 | $240 |

The table shows the different monthly rates according to driving history. It points out how tickets, accidents, and DUIs affect costs. Drivers with a good record pay less, while breaches like DUIs result in the highest expenses from all insurance companies.

If you consider firms like Geico or State Farms, their charges are very different, which helps policyholders find cheaper alternatives despite previous defiant acts while driving.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Consumer Agency Scores for Bristol West

The table summarizes the ratings from many agencies, showing financial stability, customer satisfaction, and a review of complaints for Bristol West. Learn how to check if an auto insurance company is legitimate by reviewing its ratings and consumer feedback.

Bristol West Business Insurance Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 812 / 1,000 Below Avg. Satisfaction |

|

| Score: A- Good Business Practices |

|

| Score: 68/100 Fair Customer Satisfaction |

|

| Score: 2.20 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

Even though A.M. Best scores show good financial power with an “A” grade, feedback from consumers shows varied experiences. Scores from J.D. Power and NAIC suggest lower satisfaction than the average and more complaints, giving a detailed perspective of the company’s total performance.

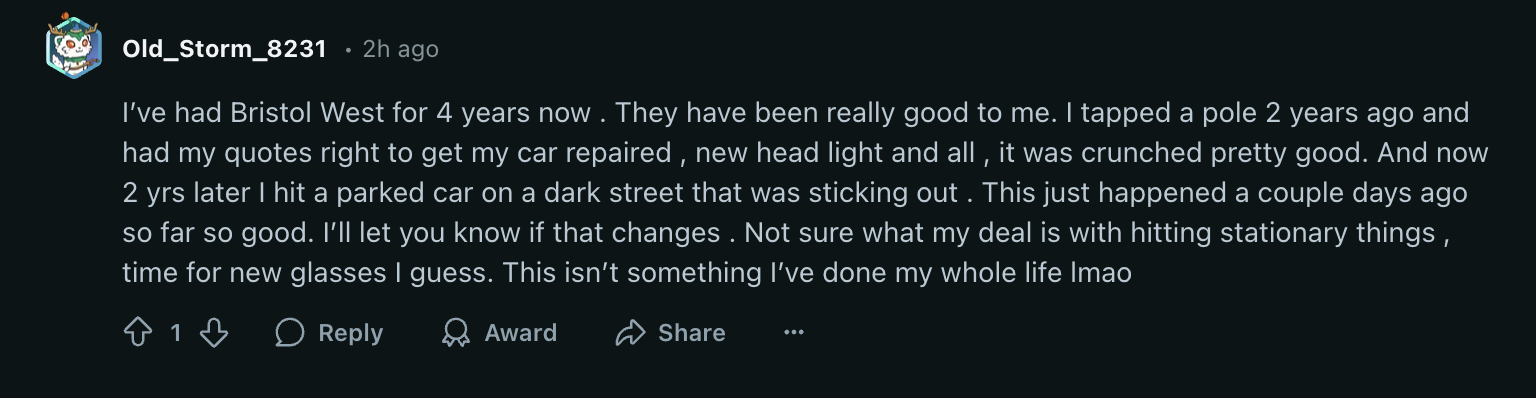

This post on Reddit talks about a good experience with Bristol West auto insurance. It points out how efficiently they handle accident claims over four years. The person writing the post mentions that, yes, there was dependable coverage from them for car repairs after incidents involving still things, and they jokingly hold their bad eyesight responsible for mistakes while driving.

Coverage Options of Bristol West Insurance

Bristol West gives different necessary coverage choices to manage special risks and duties. Bristol West also offers some usual automobile insurance protections, such as:

Bristol West Coverage Options

| Coverage | Description |

|---|---|

| Gap insurance | Covers the difference between your car's value and the loan balance if totaled or stolen. |

| Rental car coverage | Covers rental vehicles, including liability, collision, and comprehensive. |

| Rental car reimbursement | Pays for a rental car while your vehicle is in repair due to a covered claim. |

| Rideshare coverage | Extends your auto insurance while driving for rideshare services like Uber or Lyft. |

| Roadside assistance | Provides towing, flat tire change, jump-starts, and lock-out help. |

| Towing | Covers towing costs when your car can't be driven due to a covered loss. |

| Bodily injury liability | Covers medical bills, lost wages, and legal fees if you cause an injury accident. |

| Medical payments | Covers medical or funeral expenses for you and passengers, regardless of fault. |

| Property damage liability | Covers damage to others' vehicles or property caused by you. |

| Uninsured/underinsured motorist | Covers you if the at-fault driver lacks sufficient insurance. |

Bristol West provides complete coverage policies for collision and comprehensive auto insurance. Also, the company has a variety of additional coverage choices, such as:

Bristol West Additional Coverage Options

| Coverage | Description |

|---|---|

| GAP Insurance | Covers the difference between the actual cash value of your vehicle and the balance still owed on the financing (car loan or lease) if your car is totaled or stolen. |

| Rental Car Coverage | Provides insurance coverage for rental vehicles, often including liability, collision, and comprehensive coverage, protecting you from potential out-of-pocket expenses while using a rental car. |

| Rental Car Reimbursement | Pays for a rental car while your vehicle is being repaired for a covered claim, up to a specified limit. |

| Rideshare Coverage | Extends your personal auto insurance to fill the gaps when you're driving for a rideshare company like Uber or Lyft, covering periods when the rideshare company's insurance may not. |

| Roadside Assistance | Provides services such as towing, flat tire change, battery jump-start, and lock-out assistance when your car breaks down. |

| Towing | Covers the cost of towing your vehicle to a repair shop if it cannot be driven due to a covered loss or mechanical breakdown. |

Bristol West delivers a complete insurance plan covering car accidents and overall auto damage. Besides these main elements, the firm also offers different extra protection choices.

Bristol West Insurance Discounts Available

The Bristol West company table shows many discount choices that Bristol West gives. The most saving possibilities for people who hold policy are displayed, too. Discounts such as Safe Driver Discount (20%) and Multi-Vehicle Discount (25%) present a large decrease in qualified drivers.

Bristol West Auto Insurance Discounts by Savings Potential

| Discount Type |  |

|---|---|

| Safe Driver | 20% |

| Multi-Policy | 15% |

| Paid-in-Full | 12% |

| Multi-Vehicle | 10% |

| Good Student | 10% |

| Defensive Driving | 10% |

| Homeowner | 5% |

| Anti-Theft | 5% |

| Automatic Payment | 5% |

| Paperless Billing | 3% |

Smaller savings, like getting 5% off for billing without paper or using devices that prevent stealing, can increase when put together. These offers make insurance less expensive, too. It is good to look at these possibilities to get the most out of savings for different kinds of driving and payment habits.

Read more: Best Auto Insurance Discounts

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What You Should Know About Bristol West Insurance

Bristol West insurance company is a subsidiary of the Farmers Insurance Group of Companies. Bristol West offers agent-based insurance quotes in most states. So, anyone interested in purchasing a policy with Bristol West may have to contact a company agent to get started. Find out what makes the company stand out for drivers in this Farmers auto insurance review.

Fortunately, with an insurance agent, you have a contact person if you need to file a claim, make a payment, or ask policy questions. Unfortunately, many agent-based companies offer pricier policies than those without agents. Interested individuals can sometimes find Bristol West auto insurance quotes online. Still, this option varies based on location and isn’t always accurate.

Making an Informed Insurance Choice With Bristol West

Bristol West, a Farmer Insurance subsidiary, is designed for drivers with high risks and special needs. It offers customized coverage options, such as SR22 insurance, and complete policies to provide more security.

Bristol West services are available in 43 states, ensuring broad access to non-standard insurance options.Dani Best Licensed Insurance Producer

Although the cost could be higher than others, they focus on tailored service through their agents helping with claims support, making them a dependable choice for drivers dealing with difficulties.

Learn more by checking out our guide: High-Risk Auto Insurance

By looking at the discounts and comparing prices with other companies, people with policies can see if Bristol West suits their specific needs. Financial stability mixed with specialized services shows that it is a reliable choice for non-standard insurance.

Get detailed insights with this Bristol West insurance review. Enter your ZIP code to find competitive auto insurance quotes and save on your premium.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is Bristol West a good insurance company for high-risk drivers?

Yes, Bristol West is a good insurance company for high-risk drivers. It offers specialized coverage options like SR22 insurance and support for drivers with violations. Discover the best auto insurance companies for high-risk drivers offering tailored policies.

What do Bristol West insurance reviews on BBB and Yelp highlight?

Bristol West insurance reviews on Yelp focus on policy experiences and pricing, while BBB often mentions customer service and claims handling.

What does Bristol West Insurance offer for rental cars?

Bristol West Insurance provides optional car coverage, which can cover the rental cost while your vehicle is being repaired after a covered claim. Find out how to dispute an auto insurance claim with confidence and clarity.

Does Bristol West insurance include roadside assistance?

Yes, Bristol West Insurance offers optional roadside assistance coverage, which includes towing, battery jump-starts, fuel delivery, and flat tire changes. Compare Bristol West rates using our free quote tool and enter your ZIP code.

How can I get cheap car insurance with Bristol West?

To get cheap Bristol West car insurance, consider their discounts for safe drivers, multi-policy bundles, or installing safety features in your car.

What is the Bristol West roadside assistance phone number?

Bristol West’s insurance phone number for roadside assistance is 1-800-274-7865. For help with breakdowns, towing, or other emergencies, call 1-800-274-7865.

What do Bristol West car insurance reviews from consumer reports say?

Bristol West car insurance reviews in consumer reports highlight its specialization in high-risk drivers, noting higher premiums and helpful agent-assisted services.

What is the Bristol West auto insurance rating?

J.D. Power and A.M. Best ratings highlight Bristol West’s financial strength, and our rating of 3.6 reflects its commitment to non-standard coverage for high-risk drivers.

Does Bristol West Insurance have lawsuits against it?

Bristol West Insurance has faced lawsuits primarily related to customer service and claims disputes, which are common in the insurance industry.

Is Bristol West insurance available in Colorado?

Yes, Bristol West Insurance operates in Colorado, offering coverage options for high-risk drivers, including SR22 insurance and flexible policies tailored to unique needs. Learn about the best Colorado auto insurance providers and save more.

Can I get SR22 insurance in Bristol, CT, through Bristol West?

Bristol West offers SR22 insurance in Bristol, CT, to help high-risk drivers meet state financial responsibility requirements. Explore Bristol West insurance options by entering your ZIP code using our free comparison tool today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Buzarsmichelle_gmail_com

Worst company ever

Miichelle

Ripoff

Phoenix-Fire

This is straight up theft!

Bristol_Scam

Bristol West is a scam

grumpygringo

Bad insurance company shady practices.

Jtobiasson_

Bad business practices

Muhammad_Abdullahi

Charging extra Money!

Ayoub_Khan

Horrible Experience with company.

Lexabshi03

Don’t even bother…

bkelly66

poor customer service