American Family vs. State Farm Auto Insurance in 2025 (Head-to-Head Review)

State Farm charges $47 monthly and rewards safe drivers with Drive Safe & Save, while American Family costs $62, benefits poor credit drivers using KnowYourDrive, and offers discounts for air bags. This American Family vs. State Farm auto insurance guide reveals the better fit for your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Mar 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

2,235 reviews

2,235 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsAmerican Family vs. State Farm auto insurance compares key programs and rate factors that impact drivers differently.

State Farm’s Drive Safe & Save helps reduce rates for safe drivers and increases premiums only 13%-29% after violations, while American Family raises rates up to 61%.

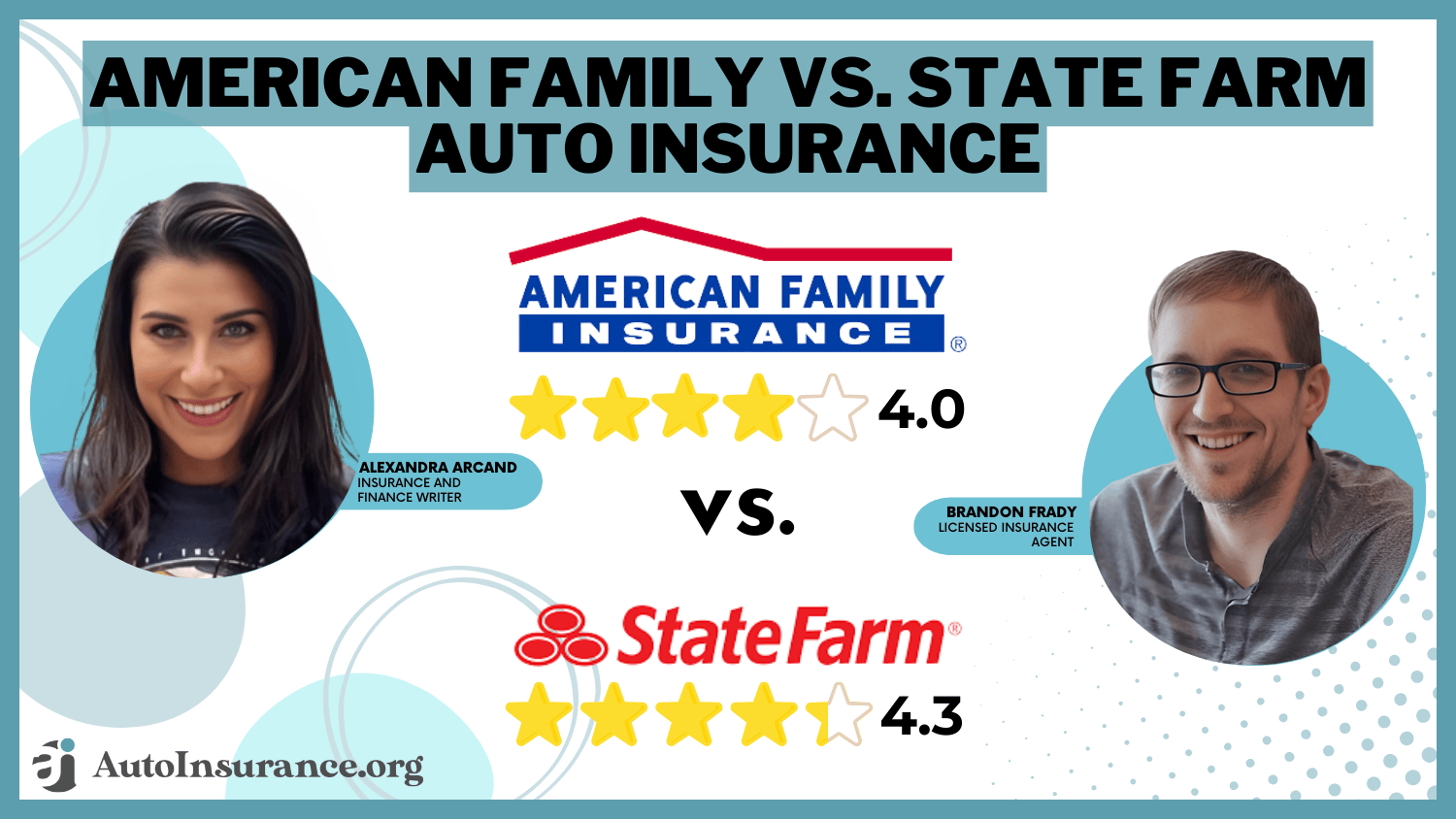

American Family vs State Farm Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.0 | 4.3 |

| Business Reviews | 4.0 | 5.0 |

| Claim Processing | 4.8 | 4.3 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 3.9 | 5.0 |

| Coverage Value | 4.0 | 4.3 |

| Customer Satisfaction | 2.0 | 2.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.8 | 4.0 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.4 | 3.8 |

| Savings Potential | 4.2 | 4.4 |

| American Family Review | Progressive Review |

American Family’s KnowYourDrive favors drivers with poor credit and offers unique discounts for air bags and defensive driving.

State Farm gives broader savings, including 30%–50% off for short commutes, safer driving, and newer vehicles.

- State Farm raises rates 13%-29% after violations vs. 61% with AmFam

- American Family is best for poor credit and uses KnowYourDrive

- State Farm offers 30%-50% off for short commutes and new vehicles

Though both are financially stable, State Farm has fewer complaints and stronger A.M. Best ratings. Ready to save on auto insurance? Use our free comparison quote now.

Best Rates by Age: American Family vs. State Farm

This table show American Family compare to State Farm for auto insurance full coverage monthly costs by age and gender. It reveal which company usually has lower prices for various types of drivers.

American Family vs. State Farm Full Coverage Auto Insurance Monthly Rates

| Age & Gender | ||

|---|---|---|

| 16-Year-Old Female | $590 | $444 |

| 16-Year-Old Male | $726 | $498 |

| 30-Year-Old Female | $165 | $133 |

| 30-Year-Old Male | $195 | $147 |

| 45-Year-Old Female | $164 | $123 |

| 45-Year-Old Male | $166 | $123 |

| 60-Year-Old Female | $148 | $108 |

| 60-Year-Old Male | $150 | $108 |

State Farm is cheaper in every category, but the biggest gap shows up with teen drivers—16-year-old males pay $726 with American Family and only $498 with State Farm. That’s a $228 monthly difference.

Female drivers also pay less with State Farm across all ages, including just $108 monthly at age 60 compared to $148 with AmFam. Even 30-year-old males save nearly $50 with State Farm. No matter your age, State Farm consistently offers lower full coverage auto insurance rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

DUI Rates Compared: American Family vs. State Farm

This table breaks down American Family vs. State Farm auto insurance monthly rates for full coverage based on driving records. It highlights how violations like speeding or DUI directly affect what you pay.

American Family vs State Farm Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $166 | $123 |

| Not-At-Fault Accident | $251 | $146 |

| Speeding Ticket | $194 | $137 |

| DUI/DWI | $276 | $160 |

Among the factors that affect auto insurance rates, driving history plays a major role. Drivers with a clean record pay $166 with American Family and just $123 with State Farm, a $43 monthly difference. After a not-at-fault accident, American Family’s rate spikes to $251, while State Farm’s increases to only $146—a $105 savings.

A speeding ticket raises American Family’s rate to $194, but State Farm stays lower at $137. The most dramatic gap shows up after a DUI: American Family charges $276 per month, while State Farm charges $160. If you’ve had a violation, State Farm keeps your premium increases far more manageable.

Comparing Discount Types to Maximize Savings

This table lays out State Farm vs. American Family auto insurance discounts, showing exactly how much each company knocks off based on how you drive, how often, and what you qualify for.

Auto Insurance Discounts for American Family vs. State Farm

| Discount | ||

|---|---|---|

| Anti-Theft | 25% | 15% |

| Bundling | 25% | 17% |

| Defensive Driving | 5% | 15% |

| Early Signing | 10% | 10% |

| Good Student | 20% | 35% |

| Low Mileage | 20% | 30% |

| Multi-Vehicle | 20% | 20% |

| Safe Driver | 18% | 20% |

| Safety Features | 18% | 20% |

| Distant Student | 10% | 25% |

State Farm gives students the biggest break, with a 35% discount for good grades and 25% if they’re away at school—way more than American Family’s 20% and 10%. If you don’t drive much, State Farm offers 30% off for low mileage, while AmFam caps it at 20%.

State Farm also leads in auto insurance discounts for good drivers, offering 15% off for defensive driving compared to American Family’s 5%. Conversely, American Family beats State Farm in anti-theft and bundling savings, offering 25% in both categories compared to 15% and 17%.

Telematics discounts work best when you avoid hard braking, night driving, and excessive speed—so consistency behind the wheel pays off.Justin Wright Licensed Insurance Agent

These numbers show that State Farm prioritizes usage and driving behavior, while American Family focuses more on vehicle safety and policy bundling.

American Family vs. State Farm Monthly Costs by Credit Score

When looking at American Family Insurance vs. State Farm auto insurance, your credit score has a real effect on your monthly rate. The differences aren’t huge at first—but they add up fast.

Full Coverage Insurance Monthly Rates by Credit: American Family vs. State Farm

| Credit Score | ||

|---|---|---|

| Good Credit (670-739) | $98 | $92 |

| Fair Credit (580-669) | $117 | $110 |

| Bad Credit (300-579) | $150 | $138 |

If you’ve got good credit, you’ll pay $98 with American Family and $92 with State Farm—a small $6 difference. Those with fair credit save more with State Farm ($110 versus $117 with American Family).

For poor credit, the discrepancy widens: American Family charges $150, while State Farm charges $138. Over a year, the difference is $144. This clearly demonstrates how credit score affects auto insurance prices, with State Farm constantly giving better deals to drivers when their credit score declines. American Family’s rates, on the other hand, climb more sharply as scores go down.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Coverage Comparison Between American Family and State Farm

When looking at American Family and State Farm auto insurance, both companies provide essential coverages. They both offer liability, collision, and comprehensive insurance—so they help with the damage you make to others, damage to your car, and things like theft or weather problems such as fire or storms.

Auto Insurance Coverage Offered by American Family & State Farm

| Coverage Type | ||

|---|---|---|

| Liability Coverage | ✅ | ✅ |

| Collision Coverage | ✅ | ✅ |

| Comprehensive Coverage | ✅ | ✅ |

| Uninsured/Underinsured Motorist | ✅ | ✅ |

| Medical Payments (MedPay) | ✅ | ✅ |

| Personal Injury Protection (PIP) | ✅ | ✅ |

| Roadside Assistance | ✅ | ✅ |

| Rental Car Reimbursement | ✅ | ✅ |

| Rideshare Insurance | ✅ | ✅ |

| Gap Insurance | ✅ | ❌ |

| Custom Equipment Coverage | ✅ | ✅ |

They both also include uninsured and underinsured motorist protection, along with Medical Payments (MedPay) and Personal Injury Protection (PIP), which help cover medical costs regardless of fault. Additional coverages like roadside assistance, rental car reimbursement, rideshare insurance, and custom equipment coverage are also available through both companies.

The big difference is that only American Family offers gap insurance. It covers the difference between what your car’s worth and what you still owe if it gets totaled. That’s a lifesaver if you’re leasing or just bought a new ride since depreciation can leave you upside down on your loan.

While both companies provide broad protection, gap insurance gives American Family an extra edge for drivers with newer vehicles or long-term loans.

American Family Insurance and State Farm: Mobile App Tools That Fit Your Driving Style

Regarding mobile apps, American Family and State Farm both provide good solutions that simplify and rapid management of your auto insurance. Right from your phone, you may review your policy, change information, submit claims, and pay bills. American Family’s MyAmFam App gives you access to your entire account while also letting you track driving habits if you’re enrolled in their KnowYourDrive program.

On the flip side, State Farm gives drivers two app-based options: the Drive Safe & Save mobile app, which tracks driving behaviors like speed, braking, and mileage to offer potential discounts, and the Steer Clear app, aimed at younger drivers looking to improve their skills and earn savings at the same time.

American Family Mutual Insurance Company has come a long way since it started in 1927, originally providing auto insurance to Wisconsin farmers. Now, it covers everything from home to life insurance and serves millions nationwide—all while staying community-focused.

State Farm, meanwhile, operates through various subsidiaries. State Farm Indemnity handles auto insurance in New Jersey, State Farm General offers property and casualty coverage mainly in California, and State Farm Motorcycle Insurance takes care of two-wheeled vehicles under the State Farm Mutual umbrella.

So whether you’re checking your account or tracking your driving for a discount, both insurers bring strong mobile tools to the table—but the programs they offer through those apps may help you decide which fits your lifestyle better.

State Farm and American Family Consumer Reports Scores Revealed

When comparing American Family vs. State Farm auto insurance, third-party ratings make it easier to see how they compare—especially when it comes to customer satisfaction, complaints, and financial strength.

Insurance Business Ratings & Consumer Reviews: American Family vs State Farm

| Agency | ||

|---|---|---|

| Score: 692 / 1,000 Avg. Satisfaction | Score: 710 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 78/100 Positive Customer Feedback | Score: 75/100 Positive Customer Feedback |

|

| Score: 0.77 Fewer Complaints Than Avg. | Score: 0.78 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A++ Superior Financial Strength |

State Farm takes the lead with an A++ from A.M. Best, showing it has stronger financial backing than American Family’s A rating. J.D. Power scores put State Farm above average, while American Family lands at 692 out of 1,000.

State Farm also edges out AmFam on the NAIC complaint index with a slightly better 0.77 score vs. 0.78. The NAIC complaint index shows fewer complaints for State Farm at 0.77 compared to 0.78 for American Family, indicating slightly better customer experiences.

Consumer Reports rates American Family at 78/100 and State Farm at 75/100, both showing solid customer feedback. Overall, State Farm shows better financial backing and lower complaint levels, while American Family holds a slight lead in consumer survey scores.

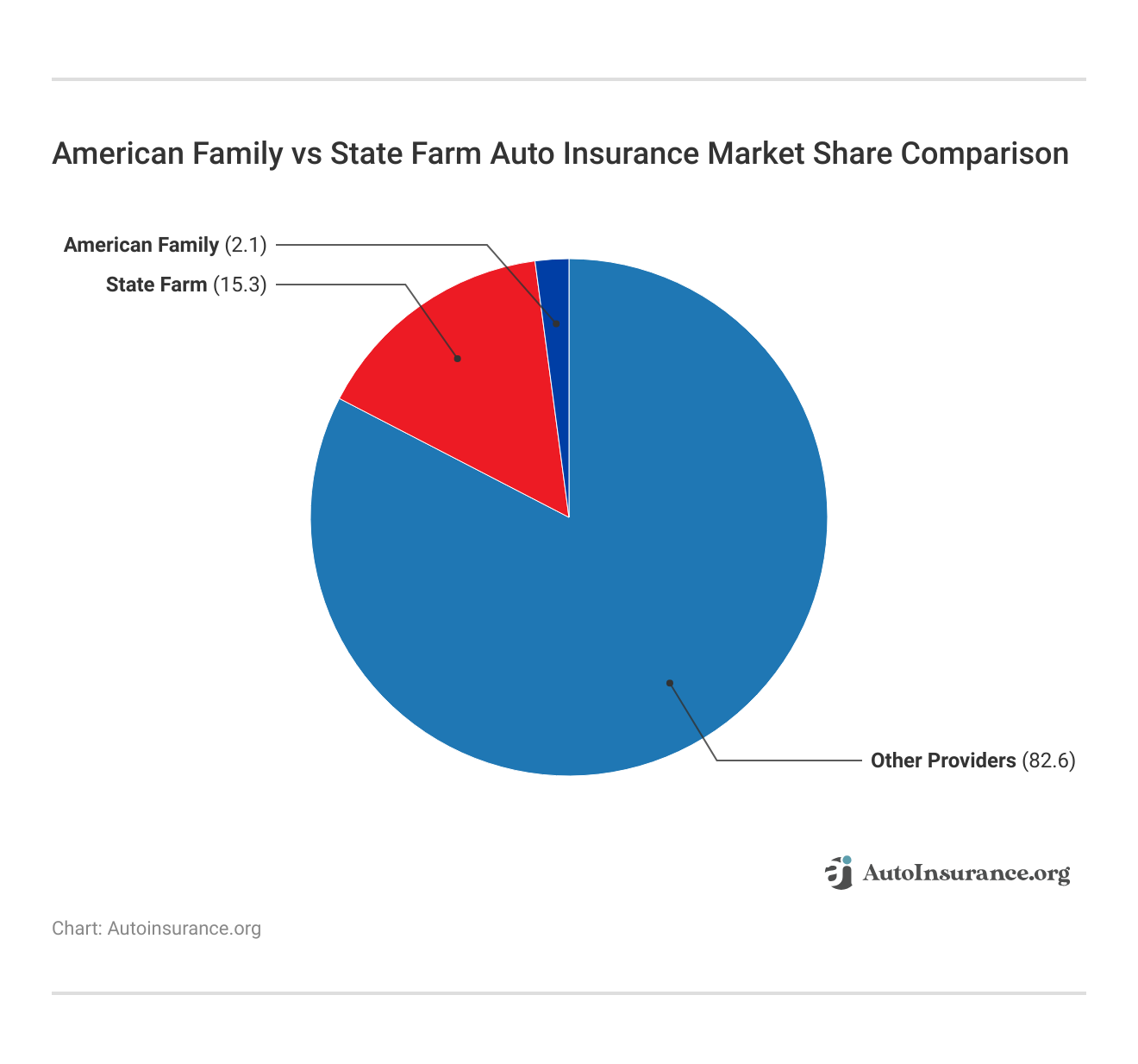

State Farm is commanding 15.3% of the total auto insurance market, showing its reach as one of the largest insurers in the U.S. American Family owns only 2.1%, representing a 13.2 percentage point differential and a substantially smaller national impact.

The remaining 82.6% is shared among all other carriers, demonstrating that, while State Farm is a large participant, the rest of the market is highly fragmented. While American Family operates on a more regional or targeted basis, this data confirms State Farm’s substantial nationwide distribution and vast client base.

A user discusses their experience with American Family Insurance following a claim submission in this Reddit post. They mentioned their father-in-law accidentally drove their RV into a tree while on vacation, and AmFam covered the repair without any hassle—no rate hike, no drama.

Comment

byu/sodak748 from discussion

inhomeowners

What stands out is that this person works in insurance and still thinks the coverage is solid for what they’re paying. That says a lot. Overall, this Reddit post shows that American Family seems to handle claims pretty smoothly and doesn’t overcomplicate things, even for unusual situations like RV damage on a trip.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of American Family

Pros

- Easier on Drivers With Dropping Credit: If your credit score isn’t great, American Family charges $150 per month—just a bit more than State Farm—but doesn’t hike rates as sharply when your score dips.

- Highest Anti-Theft and Bundling Discounts: Offers 25% off for both bundling and anti-theft devices, topping State Farm’s 17% and 15%—ideal for drivers maximizing safety features and policy packages.

- Higher Consumer Reports Rating: Scored 78/100 in Consumer Reports’ satisfaction survey, outperforming State Farm and indicating better policyholder experiences in areas like claims and service.

Cons

- Severe Rate Hikes After Violations: Drivers with a DUI can see premiums rise to $276 per month—$116 more than State Farm’s $160—making it costlier for high-risk drivers.

- J.D. Power Score Falls Below Average: Received 692 out of 1,000 in J.D. Power’s customer satisfaction study, below the segment average and State Farm’s above-average performance. Learn more in our American Family insurance review.

Pros and Cons of State Farm

Pros

- Lower Post-Violation Increases: After a DUI, speeding ticket, or accident, State Farm raises rates by only 13%–29%, while American Family hikes premiums by as much as 61%.

- Leading Student Discounts: Offers a 35% discount for good students and 25% for students away at school—nearly double American Family’s 20% and 10% in the same categories.

- Massive Market Reach: With 15.3% of the auto insurance market, State Farm covers way more drivers than American Family’s 2.1%, making it one of the most trusted names nationwide.

Cons

- Weaker Bundling Perks: You’ll only get a 17% discount for bundling with State Farm, while American Family gives a stronger 25%. Get more details in our State Farm auto insurance review.

- Slightly Lower Customer Scores: State Farm got a 75/100 from Consumer Reports, a bit behind American Family’s 78/100, so not everyone is wowed.

Comparing Value: American Family vs. State Farm Auto Insurance

American Family vs. State Farm auto insurance presents two well-rounded choices with different strengths depending on your situation. State Farm is a strong pick for drivers with violations—raising rates only 13% after a speeding ticket—while American Family may work better for drivers with poor credit, offering $150 per month compared to State Farm’s $138.

State Farm benefits safe and student drivers with up to 35% in good student auto insurance discounts, while American Family stands out for providing gap insurance, which State Farm doesn’t offer at all. A key data point: State Farm charges just $160 per month after a DUI, while American Family jumps to $276.

To find the best fit, always compare rates from several auto insurance companies online before choosing your policy. No matter what’s on your driving record, you can still get affordable auto insurance by using our free quote tool.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Which is better for full coverage on a budget—American Family or Safe Auto?

American Family averages $139 per month for full coverage and includes valuable perks like bundling and gap insurance. Safe Auto focuses on high-risk drivers but typically charges over $170 per month and offers fewer discounts.

What should you consider when choosing between American Family and Safeco?

American Family offers gap insurance and 25% bundling discounts, while Safeco stands out for features like diminishing deductibles. American Family is better for personalized support; Safeco is ideal for flexible policy management online.

Is Safeco or State Farm better for drivers looking for long-term value?

State Farm offers stronger claims satisfaction and up to 30% savings with Drive Safe & Save. Safeco includes accident forgiveness and 24/7 claims filing but may lack the local support and financial strength of State Farm.

How does Amica compare to State Farm for customer-focused drivers?

Amica excels in service with a 94% retention rate and offers dividend policies, while State Farm offers broader access through 19,000+ agents and strong digital tools, ideal for drivers who prefer convenience and in-person help.

What’s the better option for regional coverage—American Family or Erie?

Erie provides locked-in rates and lower pricing in the Midwest, averaging $110 per month for full coverage. American Family, available in more states, includes gap insurance and bundling savings for broader flexibility.

Which insurer is better for military families—American Family or USAA?

USAA offers exceptional value with full coverage averaging $88 per month and exclusive military perks tailored to active-duty and veteran members. American Family serves the general public and includes gap insurance along with its telematics program, KnowYourDrive.

Based on the American Family Insurance KnowYourDrive review, drivers can earn discounts up to 20% for safe driving habits, making it a smart choice for families looking to save without military eligibility.

Should you choose American Family or Farmers for coverage customization?

Farmers allows more policy customization, including enhanced accident forgiveness. American Family offers stronger bundling discounts (up to 25%) and gap insurance, making it better for budget-conscious drivers with financed vehicles.

Is American Family or The General better for high-risk drivers?

The General offers quick approval for high-risk drivers but averages over $200 per month. American Family has more robust coverage and may be a better long-term option for those working to improve their record.

What’s the better deal for tech-savvy drivers—Allstate or American Family?

Allstate’s Drivewise program can cut costs by up to 40%, with full coverage averaging around $160 per month. The Allstate Drivewise review claims that the software attracts tech-savvy users by rewarding safe driving practices, including steady speed and smooth braking.

American Family is the best option for drivers with newer or financed cars who want robust coverage at a reduced cost because it is less expensive ($139 per month) and includes gap insurance.

How do rates and driver programs compare between State Farm and Safe Auto?

State Farm averages $123 per month for full coverage and increases rates only 13%–29% after violations. Safe Auto, while accessible for high-risk drivers, tends to offer limited coverage with higher rates.

Which insurer offers more for everyday drivers—American Family Insurance or State Farm?

State Farm provides better teen-driver programs and wider availability, while American Family stands out with 25% bundling discounts, gap insurance, and strong mobile tools for daily policy management.

Should high-risk drivers choose State Farm or Infinity?

Infinity insures high-risk drivers but offers fewer discount programs and higher monthly rates, often exceeding $200. State Farm combines reliable service with usage-based savings through Drive Safe & Save and earns higher marks for claims satisfaction.

When reviewing the best auto insurance companies for high-risk drivers, State Farm stands out for offering better long-term value and more opportunities to lower premiums as driving records improve.

Which is better for homeowners—State Farm or American Family homeowners insurance?

More comprehensive endorsements, such as earthquake and inflation guard, are provided by State Farm. American Family offers extras that are perfect for home systems and maintenance, such as matching siding and equipment failure protection.

Should you choose Mercury or State Farm for affordability and support?

Mercury may offer lower premiums in California and Florida, but State Farm delivers stronger customer service, more discounts, and better mobile access for managing policies.

What do drivers gain by choosing AAA or State Farm?

AAA includes travel discounts and roadside assistance plans as part of its membership benefits, making it ideal for those who want extra perks beyond auto insurance. State Farm offers consistent national pricing, strong mobile tools, and up to 30% savings through Drive Safe & Save, appealing to drivers who prefer integrated digital features with reliable coverage.

What are the key differences between American National Insurance and State Farm?

American National offers cashback and multi-policy savings but lacks strong digital support. State Farm provides better mobile tools, local agents, and teen-driver savings programs.

Which provider is better for rural drivers—Farm Bureau or State Farm?

Farm Bureau offers great local service and membership perks in rural areas. State Farm provides broader availability, better mobile tools, and competitive pricing across all regions.

How does Progressive compare to State Farm auto insurance in terms of savings and tools?

Progressive’s Name Your Price tool and Snapshot telematics appeal to online shoppers looking for flexible pricing. According to the Progressive Snapshot review, drivers can earn personalized discounts based on habits like hard braking, speed, and time of day.

State Farm offers a stronger agent network and up to 30% savings with Drive Safe & Save, making it a great option for consistent, safe drivers who prefer more personalized support.

Get the best auto insurance rates for any coverage level by entering your ZIP code into our comparison tool now.

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.