Cheap Auto Insurance With No Down Payment in 2025 (Top 10 Affordable Companies)

USAA, Geico, State Farm are your top options for cheap, no-down payment insurance, with USAA averaging around $32/mo. Many top insurance companies offer cheap auto insurance with no down payment, though there may be an initial payment to secure coverage. Compare the top 10 companies below to help you save.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Apr 8, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 8, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

No Upfront Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

No Upfront Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

No Upfront Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsUSAA, Geico, and State Farm stand out as the top providers of cheap auto insurance with no down payment, with rates as low as $32 per month.

Many seek affordable no-deposit auto insurance to save, though an initial payment is required to activate coverage.

Our Top 10 Picks: Cheap Auto Insurance With No Down Payment

| Insurance Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $32 | A++ | Personalized Service | USAA |

|

| #2 | $43 | A++ | Tight Budgets | Geico | |

| #3 | $47 | B | Easy Accessibility | State Farm | |

| #4 | $56 | A+ | Customizable Policies | Progressive | |

| #5 | $63 | A+ | Claim Satisfaction | Nationwide |

| #6 | $65 | A | Competitive Rates | AAA |

| #7 | $76 | A | Vanishing Deductible | Farmers | |

| #8 | $77 | A | Exceptional Service | The General | |

| #9 | $87 | A+ | Local Agents | Allstate | |

| #10 | $96 | A | Good Drivers | Liberty Mutual |

No-deposit policies allow lump-sum or monthly payments for cheap auto insurance. Paying the entire policy upfront can help save even more.

- A down payment for insurance is the initial charge required to start coverage

- Usually, “buy now pay later car insurance” options cost more in the long run

- Liability coverage offers zero-down car insurance and may be what you need

To acquire free auto insurance quotes for very cheap auto insurance no deposit policies, and get instant auto insurance coverage. To obtain car insurance with no down payment, enter your ZIP code to get free quotes.

#1 – USAA: Top Overall Pick

Pros

- Affordable Rates for Military Members and Families: USAA offers affordable auto insurance rates tailored to military members and their families.

- Specialized Coverage for Military Needs: USAA offers specialized coverage for military members, including deployment and overseas auto insurance. Learn more in our USAA auto insurance review.

- Financial Strength and Stability: USAA has a strong financial rating, providing peace of mind to policyholders that their claims will be handled efficiently and fairly.

Cons

- Limited Eligibility: USAA insurance products are only available to military members, veterans, and their families, which could be a limitation for individuals who do not meet these eligibility criteria.

- Demographics: USAA serves military members, but its rates may not always be the cheapest, especially if you qualify for discounts elsewhere.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Tight Budgets

Pros

- No Down Payment: Geico offers options for auto insurance with no down payment, making it easier for customers to get coverage without a big cost upfront. Learn more in our Geico auto insurance review.

- Competitive Rates: Geico is known for offering competitive rates with no down payment, which is beneficial to those looking for affordable insurance.

- Extensive Discounts: Geico offers discounts like multi-policy, safe driver, and student discounts, along with digital tools to help manage your policy.

Cons

- Availability May Vary. Geico’s no-down-payment can vary depending on the state and specific circumstances, so it’s important to check coverage options and rates in your area.

- Discounts Eligibility: Not all customers may qualify for all of Geico’s discounts, which could impact the policy’s overall affordability.

#3 – State Farm: Best for Easy Accessibility

Pros

- Accident Forgiveness: State Farm’s accident forgiveness program helps maintain rates after an at-fault accident, offering peace of mind and cost savings. Learn more in our State Farm auto insurance review.

- Strong Agent Network: State Farm has a strong agent network, with dedicated agents available to assist customers with their insurance needs and provide ongoing support.

- Personalized Service: State Farm offers personalized service through its network of agents, providing individualized attention and guidance to customers.

Cons

- Online Services May Be Limited: State Farm relies on agents, and its online quoting and policy management may be more limited than other insurers.

- Rates May Be Higher. customers may find that State Farm’s rates are higher compared to other insurers, especially for certain demographics or coverage options.

#4 – Progressive: Best for Customizable Policies

Pros

- No Down Payment Options: Progressive is another company that has options for cheap insurance rates with no down payment.

- Inclusion: Progressive offers competitive rates and options for policies with no down payment, with usage-based insurance programs like Snapshot.

- Safe Driver Discount: Progressive offers discounts for safe drivers and multi-policy holders. Learn more in our Progressive auto insurance review.

Cons

- Discount Eligibility: Discount eligibility criteria may vary per person. Not all customers may qualify for all of Progressive’s discounts, which could impave the overall affordability of the policy.

- Rate Increases: Some customers may experience rate increases over time, especially if they file claims or their driving record changes, leading to potential long-term cost concerns.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Claim Satisfaction

Pros

- Competitive Rates: Nationwide offers competitive rates for auto insurance, which can be attractive to customers looking for cost-effective coverage.

- Wide Range of Coverage Options: Nationwide offers various coverage options, including liability, collision, comprehensive, and extras like roadside assistance and rental car reimbursement.

- Multi-Policy Discounts: offers multi-policy discounts for customers who bundle their auto insurance with other insurance products. Learn more in our Nationwide auto insurance review.

Cons

- Availability and Regional Differences: Nationwide’s rates and availability may vary depending on the region, so customers should check coverage options and rates in their specific area.

- Claims Processing: Nationwide generally receives positive reviews, but occasional complaints about claims processing and communication can impact the customer experience.

#6 – AAA: Best for Competitive Rates

Pros

- Membership benefits: AAA members may receive additional benefits and discounts on insurance premiums, adding value to their membership.

- Strong Customer Service Reputation: AAA is known for its strong customer service reputation, with dedicated agents available to assist customers with all their insurance needs.

- Variety of Coverage Options: AAA offers a range of coverage options, including liability, collision, and comprehensive. Learn more in our AAA auto insurance review.

Cons

- Potential for Membership Requirements: Some AAA insurance products may require membership in AAA, which could be a limitation for customers who are not AAA members.

- Limited Online Quoting and Management Tools: AAA’s online quoting and policy management tools may be more limited compared to some other insurers.

#7 – Farmers: Best for Vanishing Deductible

Pros

- Personalized Coverage Options: Farmers offers personalized coverage, letting customers tailor policies to their needs and budget. Learn more in our Farmers auto insurance review.

- Discounts: Farmers provide various discounts, such as multi-policy, safe driver, and good student discounts, helping customers save money on their premiums.

- Strong Agent Network: Farmers have a strong agent network, providing policyholders with personalized customer service and support.

Cons

- Claims Processing: Farmers receives positive reviews but occasionally faces complaints about claims processing and communication, impacting the customer experience.

- Limited Availability: Farmers’ Insurance may have limited availability in some areas, which could be a limitation for customers seeking coverage in those regions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – The General: Best for Exceptional Service

Pros

- Flexibility: The General may provide options for policies with no down payment for qualifying customers. Learn more in our auto insurance review of The General.

- Easy Online Quotes and Applications. General offers a straightforward online quoting and application process, making it convenient for customers to get insurance quotes and purchase policies.

- Acceptance of High-Risk Drivers: The General specializes in providing insurance coverage for high-risk drivers, including those with poor driving records or prior accidents.

Cons

- Rates May Be Higher for High-Risk Drivers. While The General accepts high-risk drivers, rates for these individuals may be higher than those of other insurers, which could impact affordability.

- Fewer Discounts: General may offer fewer discounts than other insurers, which could affect the overall affordability of the policy.

#9 – Allstate: Best for Local Agents

Pros

- Potential for No Down Payment Policies: Allstate may provide options for policies with no down payment for qualifying customers, making it easier to obtain coverage without a large upfront cost.

- Additional Benefits: Allstate provides additional benefits such as new car replacement coverage, roadside assistance, and rental reimbursement. You can learn more in our Allstate auto insurance review.

- Multi-Policy Discounts: Allstate offers multi-policy discounts for bundling auto with home or life insurance, helping save on premiums.

Cons

- Rates May Vary Significantly. Some customers may find that Allstate’s rates vary significantly based on factors such as location, driving history, and coverage options, leading to potential cost concerns.

- Online Services May Be Limited. Allstate primarily operates through its agent network, and its online services for quoting and policy management may be more limited compared to some other insurers.

#10 – Liberty Mutual: Best for Good Drivers

Pros

- Additional Benefits: Liberty Mutual provides additional benefits such as new car replacement coverage, roadside assistance, and rental car reimbursement, enhancing the overall value of their policies.

- Customizable Coverage Options: Liberty Mutual provides customizable coverage options, allowing customers to tailor their policies to meet their specific needs and budget.

- Strong Financial Stability: Liberty Mutual’s strong financial rating ensures claims are handled efficiently and fairly. Learn more in our Liberty Mutual auto insurance review.

Cons

- Discount Eligibility: Not all customers may qualify for all of Liberty Mutual’s discounts, which could impact the overall affordability of the policy.

- Rates May Be Higher for Certain Demographics. Some customers may find that Liberty Mutual’s rates are higher compared to other insurers, especially for certain demographics or coverage options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top No Down Payment Car Insurance Options

If you want affordable or cheap no down payment car insurance, you won’t need to look further than USAA. This insurance company has a long history of providing great insurance coverage at excellent rates to active-duty servicemembers, veterans, and their families.

Geico is another top option for affordable no down payment car insurance. Serving drivers since 1936, Geico also has an A++ rating from A.M. Best. You can even use the Geico mobile app to manage your claims, review your coverages, and make insurance payments.

When you bundle, you don’t have to pick 😉 #NFLDraft pic.twitter.com/LL0aBcY0Dm

— GEICO (@GEICO) April 27, 2023

Founded in 1922, State Farm has earned an A++ rating from A.M. Best, so you can rest assured that this company will be able to get you the funds you would need to fix your car should anything happen to it. State Farm also offers a 24-hour customer service line where you can make changes to your policy after your local agent has closed up shop for the day.

Another financially strong company, Progressive, has been helping drivers protect themselves and their vehicles since 1937 and has an A+ rating from A.M. Best. With Progressive’s mobile app, you can access your insurance documents anytime and review your policy from home, amongst many other features.

Nationwide has been on your side for over 90 years and can boast an A+ rating from A.M. Best. Not only that but client convenience is taken seriously at this company. If you need to file an auto insurance claim outside of business hours, you can log into your online account and start the claims process whenever needed.

AAA is another option for auto insurance that you may want to learn about. AAA offers coverage options in many states, but unfortunately, not all. More discounts may be available if you are a AAA policyholder, which could be beneficial or advantageous.

Founded in 1928, Farmers still provides excellent insurance products to this day. You can even add rental car reimbursement to your policy. So, if you were in a collision and had to send your primary vehicle to the mechanic, you could still get to work and run errands with ease and without breaking the bank. Farmers also have an A- A.M. Best Rating.

Allstate has been in business since 1931 and has earned an A+ rating from A.M. Best. This illustrious company also offers accident forgiveness to eligible drivers so you won’t have to worry about your rates increasing after an accident.

Liberty Mutual is another strong contender, offering customizable coverage options and additional benefits such as new car replacement coverage, roadside assistance, and rental car reimbursement. Liberty Mutual has a strong financial rating, providing confidence to policyholders that their claims will be handled efficiently and fairly.

Understanding No-Deposit Auto Insurance

If you’ve been searching the internet for “car insurance with no money down,” or “cheapest car insurance companies with no down payment, you’ll be happy to know that you can find insurance companies that don’t require a down payment option right from your smartphone or personal computer.

You can usually switch to no-deposit auto insurance, but check with your provider for any fees or requirements.Dani Best Licensed Insurance Provider

If you do a quick search for “zero down payment car insurance”, “get insurance today pay later”, ” no money down auto insurance”, or “buy now pay later car insurance,” you’ll be provided with dozens of results that do nothing to clear up the confusion about what policies may be out there for you to choose from.

Let’s take a look at some important terms to help clarify the differences:

- Zero-Down Deposit: A zero-down deposit is the acquisition of car insurance without paying a deposit. Some companies offer this as a gimmick to entice consumers into buying less-than-quality auto insurance.

- No Down Payment: No money down payment car insurance is often confused with zero down deposit but can be differentiated by the fact that the payment isn’t a deposit but the first month of an auto insurance policy.

- Monthly Payment: Monthly payments are based on a year-long insurance policy and then divided into 12 equal installments.

Some companies offer low down payment car insurance without requiring an upfront payment. Providers may advertise a product as “buy now pay later car insurance,” “no down payment insurance,” or “no-deposit insurance,” but it all means the same. Does it work out cheaper, though?

Why do insurance companies require a down payment? Most insurance companies charge a deposit or down payment to express good faith, usually a percentage of the annual premium and not an extra charge.

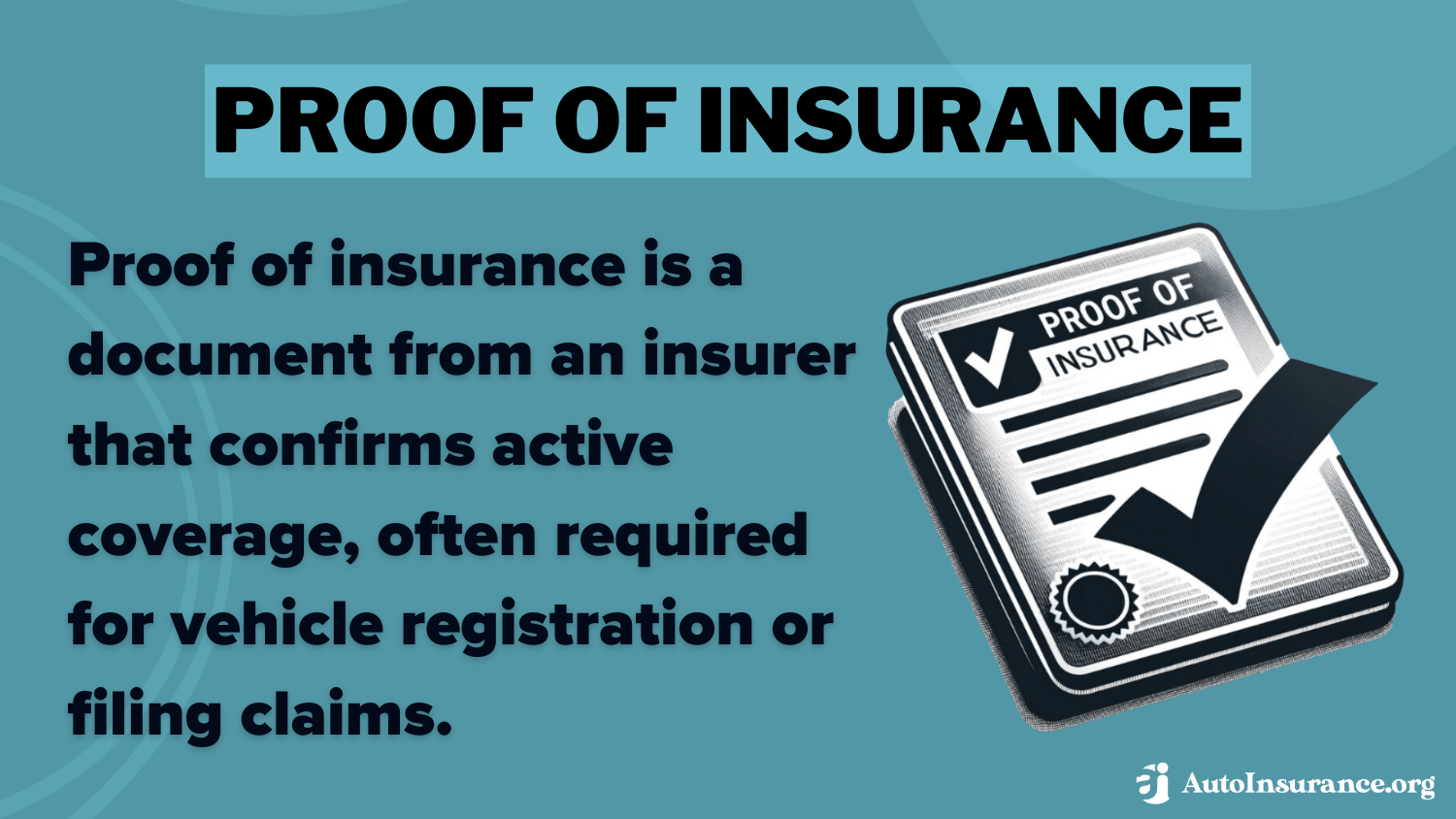

This practice protects the insurer from drivers who may only purchase one month to get proof of auto insurance but default on later payments since companies offering no-money-down auto insurance assume a risk.

You can find the best no-deposit car insurance online that doesn’t require you to pay money that essentially is being held in reserve if you were to miss a payment.

Auto Insurance With No Down Payment Discounts From Top Providers

| Insurance Company | Safe Driver | Bundling | Anti Theft | Good Student | Accident-Free |

|---|---|---|---|---|---|

| 10% | 15% | 15% | 14% | 20% |

| 18% | 25% | 10% | 20% | 22% | |

| 20% | 20% | 10% | 15% | 23% | |

| 15% | 25% | 25% | 15% | 22% | |

| 20% | 25% | 35% | 15% | 20% |

| 10% | 20% | 5% | 15% | 18% |

| 10% | 10% | 25% | 10% | 17% | |

| 8% | 17% | 15% | 25% | 25% | |

| 17% | 18% | 15% | 20% | 19% | |

| 10% | 10% | 15% | 10% | 20% |

Insurance companies base rates on a risk-to-reward principle, meaning the risk gets offset some other way. Ultimately, it also means paying more for “cheap” insurance.

Imagine you receive two quotes for similar policies with different payment structures. The first gives the impression to be a good deal, costing $134 a month to insure your car. This policy includes a 20% deposit, an estimated $320 due upfront.

On the other hand, the “buy now, pay later” policy has monthly rates of $150 but requires no down payment or deposit. So, in reality, no-deposit car insurance can become more expensive in the long run.

No-Deposit Auto Insurance Coverage Options

Insurance companies are different, so you must talk to your agent to determine what you can afford. However, no-deposit car insurance likely won’t offer more than liability coverage.

Each state has minimum auto insurance requirements, but it only covers damages to the other party and their vehicle after an accident up to a certain amount. The only way to protect yourself and cover all damages, no matter who is at fault, is to purchase full-coverage auto insurance.

The best no-deposit auto insurance companies offer flexible payment options, competitive rates, and reliable customer service.Eric Stauffer Licensed Insurance Agent

Some types of auto insurance that offer increased coverage are:

- Collision Coverage: Collision auto insurance covers the cost of damages to your vehicle if it’s involved in most types of collisions.

- Comprehensive Coverage: Comprehensive auto insurance pays for non-collision damages to your vehicle.

- Personal Injury or Medical Coverage: Personal injury protection auto insurance and medical payments auto insurance policies cover the medical expenses for the driver and passengers, regardless of fault

You likely won’t get full coverage auto insurance if you want zero-down auto insurance, but you can look for ways to lower your rates for auto insurance with no upfront payment and find the coverage you need. Read more about collision vs. comprehensive auto insurance.

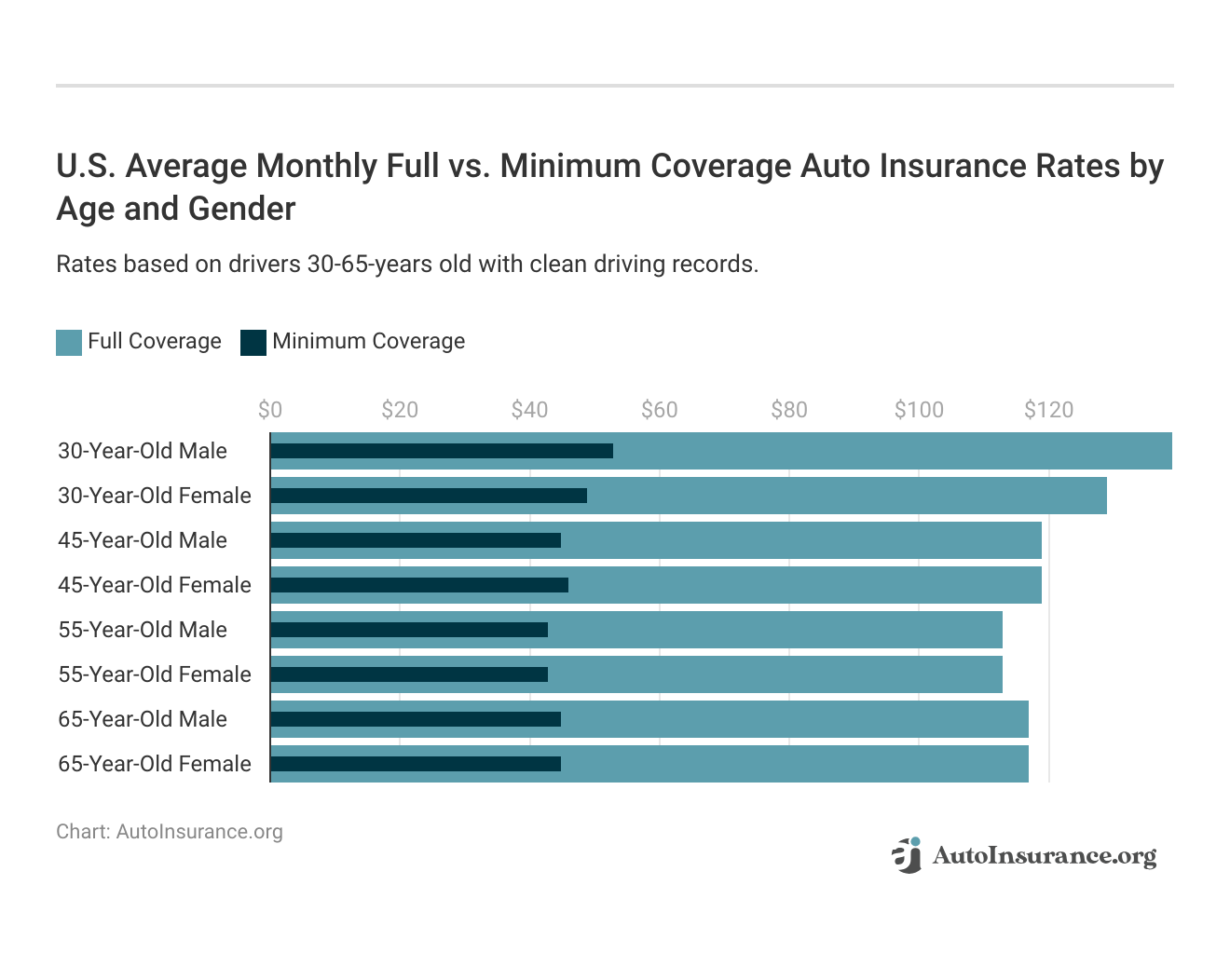

The chart below compares the average U.S. monthly auto insurance rates between full vs. minimum coverage.

Geico, State Farm, and Progressive offer the lowest rates for minimum and full coverage insurance.

Read more: Should I buy more than the minimum auto insurance?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Who Might Not Be Eligible to Buy Zero Down Auto Insurance

Since insurance companies are on the line to pay claims, high-risk drivers might have to put a deposit down. The most common types of drivers who need to pay a deposit on their insurance policy include:

- Sports or luxury car owners

- Drivers with an SR-22 auto insurance requirement

- People with poor credit

- Applicants with multiple infractions on their driving records

- Drivers charged with a DUI

Most high-risk insurance policies request a down payment due to the inherent riskiness of the drivers. Once you make your first payment, your car insurance immediately becomes active.

States That Require Insurance With No Down Payment

While most states in the U.S. allow insurance companies to request a down payment, a few have banned the practice. These states include:

- Arizona

- California

- Florida

- Georgia

- New York

- Oklahoma

- Washington

If you live in one of these states, insurance companies can’t ask you for a down payment in addition to your first month’s bill. However, they can raise your rates if they consider you a risky driver. For those searching for cheap car insurance in GA with no down payment, this policy could be a helpful option.

Read More: Which states have the cheapest auto insurance rates?

Cheap No-Deposit Auto Insurance Rates

You can find the cheapest car insurance now and pay later by comparing rates from various companies offering it. The cost for no upfront deposit auto insurance varies for several reasons, including company, demographics, and driving profile. You’ll pay about 22% more for zero-down auto insurance than car insurance with a deposit.

Check out the table below to compare no-deposit car insurance quotes from the best car insurance companies:

Auto Insurance Monthly Rates by Provider & Deposit Amount

| Insurance Company | No Deposit | 10% Deposit | 20% Deposit |

|---|---|---|---|

| $318 | $286 | $255 | |

| $224 | $202 | $180 | |

| $288 | $260 | $231 | |

| $179 | $161 | $143 | |

| $398 | $358 | $318 |

| $229 | $206 | $183 |

| $283 | $254 | $226 | |

| $235 | $212 | $188 | |

| $287 | $259 | $230 | |

| $161 | $145 | $129 |

As you can see, USAA auto insurance offers the cheapest no-down payment car insurance rates, averaging $161 monthly, though only military members and their families qualify for coverage. The next most affordable no-deposit car insurance company is Geico auto insurance, with average monthly rates of $179.

Compare auto insurance quotes with no down payment by company to find the cheapest no-deposit car insurance.

Read more: Factors That Affect Auto Insurance Rates

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ways to Get Cheap Auto Insurance With No Down Payment

There are several ways for policyholders to locate very cheap car insurance with no down payment. Follow the tips below if you’re looking to lower your no-money-down car insurance rates:

- Ask for auto insurance discounts from your insurer.

- Enroll in safe driving programs.

- Buy an affordable vehicle to insure.

- Learn how to save money by bundling insurance policies.

When it comes to auto insurance discounts, most insurance companies offer a wide variety of insurance that drivers can utilize to save money on their policies. Check out our article, which cars have the lowest auto insurance premiums?

You can see an extensive summary of the discounts offered by the companies on this list and others here:

Top Auto Insurance Discounts by Company

| Insurance company | Bundling | Safe Driver | Good Student | Anti-Theft Device | Loyalty |

|---|---|---|---|---|---|

| 15% | 10% | 14% | 8% | 12% |

| 25% | 18% | 22% | 10% | 15% | |

| 20% | 20% | 15% | 10% | 12% | |

| 25% | 15% | 15% | 25% | 10% | |

| 25% | 20% | 12% | 35% | 10% |

| 20% | 12% | 18% | 5% | 8% |

| 10% | 10% | 10% | 25% | 13% | |

| 17% | 20% | 35% | 15% | 6% | |

| 18% | 12% | 20% | 15% | 9% | |

| 10% | 10% | 10% | 15% | 11% |

Remember to review your quotes carefully as you fill them out. Failing to do so could mean you miss adding on a discount that could potentially save you quite a bit of money.

Getting the Best No-Deposit Auto Insurance Companies

Cheap no-deposit auto insurance doesn’t always work out to be more affordable in the long run. So, it’s important to do the math when comparing rates online for the “get car insurance now pay later” option to ensure you’re actually not paying more.

You definitely don't want to overspend 💰on auto insurance, and you probably wish you didn't have to buy it at all. At https://t.co/27f1xf131D, we crunched the numbers to help you save🤑. Check this out if you want to find the cheapest coverage 👉: https://t.co/933zXMWCxl pic.twitter.com/qBnsPMVoC0

— AutoInsurance.org (@AutoInsurance) June 5, 2023

Car insurance companies are required to report to the state Department of Motor Vehicles when a new driver signs up for auto insurance coverage or when a driver decides to cancel an insurance policy.

The car insurance company has very little incentive to provide you with proof of coverage upfront if you do not pay some sort of deposit to them.

You will always need to make a payment to purchase an insurance policy; however, many companies will not require you to pay a deposit to be held in reserve. When shopping for quotes for no-deposit car insurance online, you can find top-of-the-line companies that can get you insurance, especially if you need car insurance now, and pay later with no deposit.

Consider the long-term benefits of increased coverage if you can afford it, and do what you can to lower your rates so you have increased options. The bottom line is that you can find the balance of great coverage at affordable rates. Don’t forget to make sure that every discount you are eligible for has been applied to your quotes so that you can get the best rate option possible.

Enter your ZIP code to get free, very cheap auto insurance, no deposit policy quotes from insurance companies near you today.

Frequently Asked Questions

Are there insurance companies that offer no-deposit auto insurance?

Yes, you can purchase no-deposit car insurance online from companies like USAA, Geico, State Farm, Progressive, Nationwide, AAA, Farmers, The General, Allstate, and Liberty Mutual.

These providers offer very cheap car insurance with no deposit options, making it easier to get coverage without a large upfront payment.

Does car insurance require a down payment?

You’ve probably seen advertisements for companies that offer cheap auto insurance with no down payment, but that claim is a little misleading. While insurance companies usually don’t require a down payment, you will need to pay for at least your first month to activate your policy. Check out some of the best ways to get auto insurance discounts.

What is no-down-payment auto insurance?

No-down-payment car insurance refers to an insurance policy that allows policyholders to start their coverage without making an initial payment or down payment. Instead, the premium is typically divided into monthly installments. This is ideal for those who need car insurance now and want to pay later.

How does no-down-payment auto insurance work?

With no-down-payment auto insurance, the insurance company allows you to begin your coverage without paying an upfront premium. Instead, you will be required to pay the premium in monthly installments over your policy term.

If you’re searching for $20 down payment car insurance or cheap full coverage auto insurance with no down payment, enter your ZIP code to get free quotes.

Are there insurance companies that offer no-deposit auto insurance?

Yes, there are insurance companies that offer no-deposit auto insurance policies. These companies understand that not everyone can afford to pay a lump sum upfront, so they provide options for monthly payment plans without a deposit. Check out all the different types of auto insurance.

Are no-deposit auto insurance policies more expensive than traditional policies?

No, not necessarily. The cost of a no-deposit auto insurance policy can vary depending on various factors, such as your driving history, the type of vehicle you own, and the coverage options you choose. While some providers may charge slightly higher premiums for no-deposit policies, others may offer competitive rates comparable to traditional policies.

Can I cancel a no-deposit auto insurance policy if I change my mind?

Yes, in most cases, you can cancel a no-deposit auto insurance policy if you change your mind. However, it’s important to review the terms and conditions of the policy and understand any potential cancellation fees or penalties that may apply. Contact your insurance provider directly to discuss the cancellation process and any associated costs.

Do all insurance companies offer no-deposit auto insurance?

No, not all insurance companies offer no-deposit auto insurance. It’s important to research and compare different providers to find those that offer this type of policy. You may also consider reaching out to insurance brokers or agents who can help you find suitable options based on your specific needs and preferences. Here’s how to compare auto insurance quotes.

Are there any advantages to choosing no-down-payment auto insurance?

Yes, there are a few potential advantages to selecting no-down-payment auto insurance. It allows you to start your coverage without a large upfront payment, which can be beneficial if you’re facing financial constraints. Additionally, it provides the convenience of spreading your premium payments over time.

Are there any drawbacks to choosing a no-deposit auto insurance policy?

While no-deposit auto insurance policies can be convenient for those who prefer to pay monthly, there are a few considerations to keep in mind. Some insurance companies may charge slightly higher premiums for these policies, and there may be administrative fees or interest charges associated with the installment payments.

Additionally, failing to make the monthly payments on time may result in policy cancellation or other penalties.

Can I switch from a no-down-payment policy to a traditional policy with an upfront payment?

In most cases, you can switch from a no-down-payment auto insurance policy to a traditional policy with an upfront payment. However, it’s crucial to consult with your insurance company to understand the process, any potential fees, and the impact on your coverage and premium.

Is it necessary to have a good credit score to qualify for a no-deposit auto insurance policy?

While a good credit score can be beneficial when applying for any type of insurance, not all insurance companies require a good credit score to qualify for a no-deposit auto insurance policy.

Some providers may consider other factors, such as driving record and previous insurance history when determining eligibility and premiums. Check out auto insurance companies that don’t use credit scores.

Who is cheaper, Geico or Progressive?

Geico has lower rates overall, but high-risk drivers usually get better rates with Progressive.

Who normally has the cheapest car insurance?

Auto-Owners, Geico, Travelers, and USAA are among the providers that have the most affordable auto insurance.

Who has the cheapest full coverage insurance?

State Farm usually has the most affordable auto insurance if you’re seeking full coverage. Coverage that fits your budget: learn more about where to find cheap full coverage auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.