Best Auto Insurance for Bite Squad Delivery Drivers in 2025 (Find the Top 10 Companies Here)

State Farm, Allstate, and Progressive are the best auto insurance for Bite Squad delivery drivers, offering comprehensive coverage at rates starting from $22/month. These top providers ensure Bite Squad drivers get reliable protection tailored to their needs. Shop around to secure the best deal.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Bite Squad Delivery Drivers

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Bite Squad Delivery Drivers

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Bite Squad Delivery Drivers

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

The best auto insurance for Bite Squad delivery drivers are State Farm, Allstate, and Progressive, each offering tailored coverage that addresses the unique risks of food delivery.

State Farm leads with its robust protection and seamless claims process, making it the top pick overall. Allstate shines for its customizable options, while Progressive stands out for competitive pricing paired with reliable customer support. Find out more in our guide titled, “Best Progressive Auto Insurance Discounts.”

Our Top 10 Company Picks: Best Auto Insurance for Bite Squad Delivery Drivers

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Customer Service State Farm

#2 25% A+ Local Agents Allstate

#3 10% A+ Budgeting Tools Progressive

#4 25% A++ Cheap Rates Geico

#5 10% A++ Military Members USAA

#6 20% A Policy Options Farmers

#7 25% A 24/7 Support Liberty Mutual

#8 20% A+ Deductible Options Nationwide

#9 15% A Many Discounts Mercury

#10 25% A+ Filing Claims Erie

These providers deliver comprehensive coverage, ensuring Bite Squad drivers stay protected on every delivery.

Get started on comparing full coverage auto insurance rates by entering your ZIP code above.

- State Farm is the top pick for Bite Squad delivery drivers’ insurance

- Coverage tailored to the unique risks of food delivery

- Ensures Bite Squad drivers have comprehensive protection

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Reliable Customer Service: State Farm excels in providing dependable customer support, vital for Bite Squad delivery drivers needing quick, effective help during emergencies or claims.

- Tailored Insurance Options: Offers customizable coverage specifically designed to address the risks and requirements of Bite Squad delivery drivers, ensuring comprehensive protection.

- Flexible Payment Plans: Bite Squad drivers can benefit from State Farm’s flexible payment options, which help in managing and budgeting their insurance expenses more effectively. Wondering about their level of customer service? Find out in our State Farm auto insurance company review.

Cons

- Moderate Discount on Bundling: The 17% bundling discount offered by State Farm might not be as appealing to Bite Squad drivers compared to higher discounts available with other providers.

- Limited Online Features: Bite Squad delivery drivers may find State Farm’s digital tools less advanced, with fewer options for managing policies online compared to some competitors.

#2 – Allstate: Best for Local Agents

Pros

- High Bundling Discount: Bite Squad delivery drivers can save significantly with a 25% bundling discount, making Allstate an attractive option for those looking to reduce insurance costs.

- Widespread Local Agent Network: Allstate’s extensive network of local agents offers personalized, face-to-face service, which is beneficial for Bite Squad drivers who prefer direct interaction.

- Efficient Claims Processing: The streamlined and efficient claims process helps Bite Squad drivers quickly resolve issues, minimizing downtime and ensuring continuous operation. Read more about this provider in our Allstate auto insurance review.

Cons

- Variability in Customer Service Quality: Customer service experiences may vary depending on the local agent, which could lead to inconsistent support for Bite Squad drivers.

- Limited Mobile App Functionality: Bite Squad delivery drivers might find Allstate’s mobile app lacking in features compared to other insurers, potentially making policy management less convenient.

#3 – Progressive: Best for Budgeting Tools

Pros

- Comprehensive Coverage Options: Progressive offers a wide array of coverage options, including specialized policies tailored to the unique needs of Bite Squad delivery drivers, such as commercial auto insurance.

- Strong Financial Stability: An A+ A.M. Best rating assures Bite Squad delivery drivers of Progressive’s solid financial standing and ability to pay claims reliably. Our complete Progressive auto insurance review goes over this in more detail.

- Advanced Digital Management Tools: Bite Squad delivery drivers can easily handle their insurance policies using Progressive’s sophisticated online tools and mobile app, enhancing convenience and control.

Cons

- Lower Bundling Discount: A 10% bundling discount is less competitive, offering fewer savings for Bite Squad delivery drivers who might benefit more from higher discount rates.

- Inconsistent Customer Experience: Some Bite Squad delivery drivers report varying experiences with customer service, which can affect satisfaction and issue resolution.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Geico: Best for Cheap Rates

Pros

- Extensive Discount Opportunities: Bite Squad delivery drivers can take advantage of various discounts, including safe driver, multi-policy, and good driver discounts, reducing overall costs.

- User-Friendly Online Services: Geico’s intuitive online platform allows Bite Squad drivers to manage their policies, make payments, and file claims easily, streamlining the entire process.

- 24/7 Customer Support: Geico offers round-the-clock customer service, ensuring Bite Squad drivers have access to assistance at any time, day or night. Learn more by reading our Geico auto insurance review.

Cons

- Basic Coverage Options: Geico may not provide as many specialized coverage options as some other insurers, potentially limiting choices for Bite Squad delivery drivers.

- Strict Claims Handling Procedures: Some Bite Squad drivers might experience delays or challenges with Geico’s strict claims process, which can affect the speed of resolution.

#5 – USAA: Best for Military Members

Pros

- Exclusive Military Benefits: USAA provides unique benefits tailored specifically for Bite Squad delivery drivers who are active or former military members, offering specialized coverage.

- Highest A++ Rating for Reliability: With an A++ A.M. Best rating, USAA gives Bite Squad delivery drivers assurance of its strong financial stability and trustworthy claims service. See how USAA’s rates compare to other insurance providers in our USAA auto insurance review.

- Extensive Range of Coverage Options: USAA provides a broad selection of insurance coverages, ensuring Bite Squad delivery drivers have comprehensive protection for all their needs.

Cons

- Restricted Eligibility: USAA’s services are limited to military members and their families, which restricts access for Bite Squad delivery drivers who do not meet these criteria.

- Few Physical Locations: The limited number of physical branches may be inconvenient for Bite Squad drivers who prefer face-to-face interactions for handling their insurance needs.

#6 – Farmers: Best for Policy Options

Pros

- Adaptable Coverage Plans: Farmers provides a broad range of insurance policies, allowing Bite Squad delivery drivers to select coverage that best aligns with their requirements, such as liability and full coverage.

- 20% Savings on Bundling: Bite Squad drivers can achieve significant savings with a 20% discount when combining multiple policies, making Farmers an economical option.

- Availability of Local Representatives: Farmers’ network of local representatives offers personalized service, providing Bite Squad delivery drivers with direct support. Check out our online Farmers auto insurance review for more information.

Cons

- Costly Comprehensive Coverage: Bite Squad delivery drivers might discover that the premiums for extensive coverage options are pricier than those of other providers.

- Limited Digital Features: The online tools and mobile application offered by Farmers may not be as user-friendly, potentially complicating policy management for Bite Squad drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Customer Support: Liberty Mutual provides round-the-clock service, ensuring Bite Squad delivery drivers can receive help whenever needed, day or night. To see monthly premiums and honest rankings, read our Liberty Mutual auto insurance review.

- Substantial Bundling Discount: Bite Squad delivery drivers benefit from a 25% discount when bundling policies, which helps lower overall insurance costs.

- Multiple Claim Filing Options: Liberty Mutual offers several methods for filing claims, including online, by phone, and via mobile apps, making the process convenient for Bite Squad drivers.

Cons

- Higher Premium Rates: Bite Squad delivery drivers might find that Liberty Mutual’s premiums are on the higher side, particularly for comprehensive coverage.

- Generalized Customer Service: With a large customer base, Bite Squad drivers might experience less personalized service compared to smaller, more localized insurers.

#8 – Nationwide: Best for Deductible Options

Pros

- Customizable Deductible Choices: Nationwide allows Bite Squad delivery drivers to pick from various deductible options, giving them flexibility in managing their insurance costs.

- A+ Rating for Reliability: An A+ rating from A.M. Best indicates Nationwide’s strong financial health, giving Bite Squad drivers confidence in the company’s ability to handle claims.

- Significant Savings on Bundling: Offers a 20% discount for bundling, making it cost-effective for Bite Squad delivery drivers to combine multiple insurance products. Learn more about SmartRide in our Nationwide auto insurance review.

Cons

- Moderate Premium Prices: Bite Squad delivery drivers might find Nationwide’s insurance rates to be moderately priced, which could be higher than some other more competitively priced insurers.

- Basic Mobile App Functionality: Bite Squad delivery drivers may find that Nationwide’s mobile app lacks some of the advanced features available with other insurance companies.

#9 – Mercury: Best for Many Discounts

Pros

- Wide Range of Discounts: Mercury offers various discount options, such as for safe driving and multiple vehicles, helping Bite Squad delivery drivers save on premiums. See if Mercury has affordable rates near you in our Mercury auto insurance review.

- Strong A Rating: With an A rating from A.M. Best, Mercury shows its financial dependability, assuring Bite Squad drivers that it can handle claims effectively.

- Focused Personal Service: Mercury emphasizes personalized customer service, providing Bite Squad drivers with dedicated support from local representatives.

Cons

- Limited Online and Mobile Tools: Mercury’s online services may not be as comprehensive, potentially making it more difficult for Bite Squad drivers to manage their policies digitally.

- Higher Rates for Broad Coverage: Bite Squad delivery drivers might find that Mercury’s rates for full coverage options are higher than those offered by some other insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Erie: Best for Filing Claims

Pros

- Generous Savings with Bundling: Offers a 25% discount on bundling, helping Bite Squad drivers significantly cut down on their total insurance expenses. Dive into our in-depth Erie auto insurance review to find the best policy for your needs.

- Variety of Coverage Options: Erie provides numerous insurance options, ensuring Bite Squad delivery drivers can find coverage that meets their unique needs.

- Personalized Agent Support: Erie’s network of local agents delivers personalized assistance, beneficial for Bite Squad drivers who prefer face-to-face interactions.

Cons

- Higher Costs for Riskier Drivers: Bite Squad drivers with less-than-perfect driving histories might face higher premiums with Erie compared to other insurers.

- Basic Online Service Offerings: Bite Squad delivery drivers might find Erie’s online tools less robust, offering fewer options for managing their insurance policies digitally.

Comparing Monthly Insurance Costs for Bite Squad Delivery Drivers

As a Bite Squad delivery driver, choosing the right auto insurance means knowing how rates vary between insurance companies and coverage categories. This section provides Bite Squad drivers with a clear assessment of their options by outlining the monthly rates for both basic and comprehensive coverage from top insurance providers.

Bite Squad Delivery Driver Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $61 $160

Erie $22 $58

Farmers $53 $139

Geico $30 $80

Liberty Mutual $68 $174

Mercury $29 $77

Nationwide $44 $115

Progressive $39 $105

State Farm $33 $86

USAA $22 $59

The table displays a variety of auto insurance costs for Bite Squad delivery drivers, with basic coverage starting at just $22 per month from USAA and Erie, making them the most budget-friendly options. Explore more coverage options in our guide titled, “Best Delivery Driver Auto Insurance.”

In contrast, comprehensive coverage can go up to $174 per month with Liberty Mutual, indicating the extensive protection provided. Allstate’s prices are on the higher side, with basic coverage at $61 and comprehensive coverage at $160 per month.

For drivers looking for a middle ground, Geico provides competitive prices of $30 for basic coverage and $80 for comprehensive coverage. Each insurer offers different rates, enabling Bite Squad drivers to select coverage that fits their financial plan and safety requirements.

Coverage Options for Bite Squad Delivery Insurance

The requirements to be hired by Bite Squad are fairly basic. A clean driving record combined with valid insurance and driver’s license reflects three obvious requirements. Learn more in our detailed analysis titled, “Can I keep auto insurance with a revoked driver’s license?”

What might not be so obvious to the driver is whether his or her current insurance would truly be “valid” in the eyes of the insurance company.

In order to be covered for any accident while delivering for Bite Squad, the driver must carry a commercial/business policy.

A personal policy won’t pay on losses incurred when using the vehicle for business. Anyone hired by Bite Squad after submitting a copy of proof of personal auto insurance has to switch over to a commercial policy right away.

Bite Squad drivers can rely on State Farm's extensive agent network for quick, personalized support.Kristen Gryglik Licensed Insurance Agent

A driver’s lack of awareness about the difference between commercial and personal coverage won’t help matters.

The driver is responsible for reporting any changes to the insurance company in order to update the policy.

Switching from the occasional use of a vehicle to driving 10 hours per day delivering food reflects a big change.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Importance of Commercial Auto Insurance for Bite Squad Drivers

Delivering food with your car or truck means the vehicle is being used for commerce. Engaging in commerce also comes with additional and unavoidable risks. Be sure to compare Bite Squad car insurance options.

A driver using a vehicle for “normal” purposes faces risks, but not at the same volume of risk someone driving a car for business does. So, the insurance company must increase the premiums on the driver to cover potential losses associated with business use.

Las Vegas is one of the major cities Bite Squad operates. Driving down the Las Vegas Strip during lunch and dinner hours puts the driver in close proximity to many commuters and pedestrians.

The chance for an accident increase. And the driver makes several back-and-forth trips on busy streets for several hours a day and several days per week.

The potential for causing an accident creates the possibility of inflicting bodily injury. Sadly, delivery drivers have seriously hurt and killed people due to speeding or ignoring traffic laws. Only the right amount of valid auto liability coverage can save the driver financially. Explore your high-risk insurance options in our article titled, “Bodily Injury Liability Auto Insurance Defined.”

Challenges in Obtaining Commercial Insurance for Bite Squad Drivers

The insurance company can choose to accept or decline an application from a delivery driver. Normally, if the applicant has a clean driving record and few insurance claims, approval won’t be too difficult but a rate increase is unavoidable.

A good driver probably will remain careful on the road even when delivering food. Regardless, he/she faces more risks.

When initially purchasing an auto insurance policy, the would-be Bite Squad driver said “no” when asked about using the vehicle for business. The minute the car conducts business, the insurance company should be contacted. Explore more ways to save in our article titled, “Best Auto Insurance Companies.”

The policy returns to underwriting for a change in status and an unavoidable rate increase. Commercial auto insurance is usually more costly than personal insurance.

Lowering Insurance Costs for Bite Squad Drivers

The simple answer here is not necessarily. Each individual applicant for a personal or commercial auto insurance policy has a different background. While switching to a commercial policy leads to a rate increase, the amount might not be much.

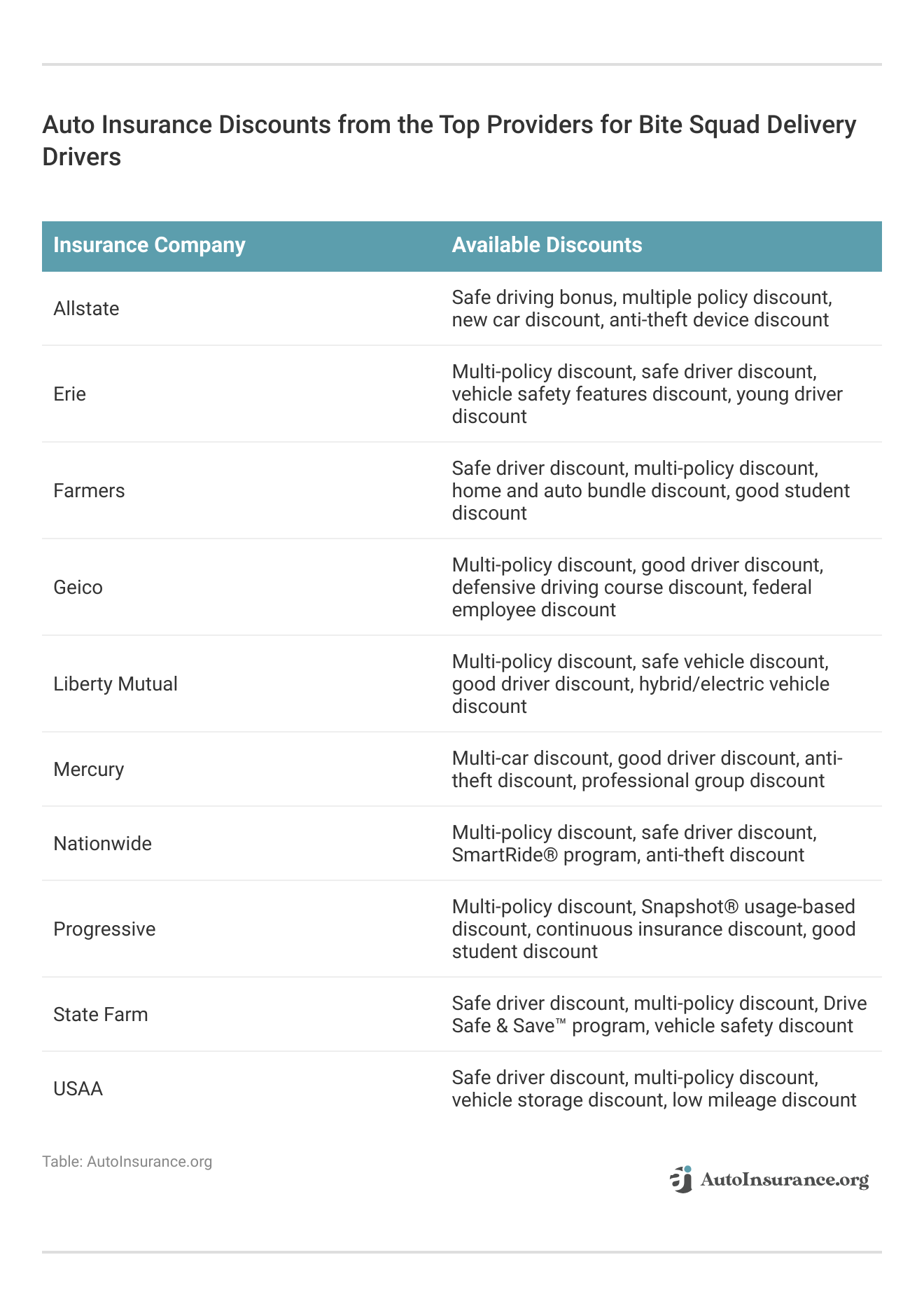

Reviewing a number of different quotes may reveal surprisingly competitive rates. Discounts and bundles could save even more money.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Leading Choices for Bite Squad Commercial Insurance Coverage

Requesting quotes online would be the easiest way to check out rates on commercial auto insurance. Don’t just request one or two.

Ask for four or more and look at both price and, more importantly, what the policy actually delivers.

Continue to review quotes every six months even after purchasing a policy. As a rule, you always want the best deal on effective coverage. Delve into our evaluation of our guide titled, “Do you have to add your child to your insurance policy?”

Use our free quote tool below to make sure you are getting the best rate for your coverage.

Frequently Asked Questions

Do Bite Squad drivers need auto insurance?

Yes, Bite Squad drivers are required to have auto insurance. As independent contractors, Bite Squad drivers are responsible for maintaining their own auto insurance coverage.

For additional details, explore our comprehensive resource titled, “How to Get a Good Driver Auto Insurance Discount.”

What type of auto insurance coverage do Bite Squad drivers need?

Bite Squad drivers typically need to have commercial auto insurance coverage. Commercial auto insurance provides coverage for drivers who use their vehicles for business purposes, such as food delivery.

Are there specific insurance requirements for Bite Squad drivers?

Yes, Bite Squad has specific insurance requirements for their drivers. While these requirements may vary by location, drivers generally need to carry liability insurance with minimum coverage limits set by Bite Squad. It’s best to consult with Bite Squad directly to understand the specific insurance requirements in your area.

What are the typical minimum liability coverage limits for Bite Squad drivers?

The minimum liability coverage limits required by Bite Squad may vary, but commonly, drivers are required to carry at least $1 million in liability coverage. These higher limits are to ensure adequate protection in case of accidents or incidents that occur while on the job.

To find out more, explore our guide titled, “How long does an accident stay on your record?”

Do Bite Squad drivers need additional coverage beyond liability insurance?

Bite Squad drivers may benefit from additional coverages beyond liability insurance. Optional coverages such as comprehensive and collision coverage, uninsured/underinsured motorist coverage, and medical payments coverage can provide additional protection for the driver and their vehicle.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Are there any specific insurance providers recommended for Bite Squad drivers?

While Bite Squad may not endorse specific insurance providers, they may have partnerships or recommendations for insurance companies that offer suitable commercial auto insurance coverage for their drivers. It’s recommended to reach out to Bite Squad for any preferred insurance provider information they may have.

How much does Bite Squad auto insurance cost?

The cost of Bite Squad auto insurance can vary based on factors such as the driver’s location, driving record, vehicle type, coverage limits, and the insurance provider chosen. Commercial auto insurance tends to be more expensive than personal auto insurance due to the increased risks associated with business use.

Access comprehensive insights into our guide titled, “How Auto Insurance Companies Check Driving Records.”

What kind of insurance do I need as a delivery driver?

Delivery drivers need commercial auto insurance that covers them while driving for business purposes.

What is auto insurance for delivery drivers?

Auto insurance for delivery drivers provides coverage for accidents or damages that occur while the driver is delivering goods or food.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.