Best States for Affordable DUI Auto Insurance (2025)

The best states for affordable DUI auto insurance have low rates and numerous options to choose from if you need to buy high-risk auto insurance. It can be hard to find cheap DUI auto insurance, but the best states have options from both standard and non-standard insurers. As part of the penalties for a DUI, your auto insurance rates will go up, but shopping around can help keep rates affordable.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

A DUI conviction brings with it a host of penalties, including fines, license suspension, and even jail time. Your current insurer, and any other auto insurance company you may be looking, at will label you as a high-risk driver. This means a loss of your clean driving record as well as higher costing auto insurance policies. All of the penalties will vary depending on where you live, including how much your auto insurance will go up. The best states for affordable DUI auto insurance make it a little easier to make up for your DUI.

No matter where you live, your car insurance rates will definitely go up after a DUI. While there are a lot of factors that affect auto insurance rates, few of them affect what you pay more than your driving record. A DUI places you in a high-risk category for insurance companies, and as a result, they will charge you more.

Fortunately, even for drivers who have a DUI on their record, there are still many ways to save on auto insurance. You may have to do some research to find cheap car insurance, but there are insurance carriers out there willing to work with someone who doesn’t have a clean driving record. One of the best ways to save money and find a decent average rate is to compare live quotes from different insurance companies.

Whether you have a DUI or perfect driving record, enter your ZIP code into our free online quote comparison tool to start saving today. You don’t want any sort of lapse in coverage on your vehicle, especially after a DUI. So if you’re thinking of switching providers because your current insurer is charging you too much, you’ll want to find competitive rates on insurance premiums, and fast.

There are a lot of different rules for a DUI conviction from state to state, and some places are better for riding out a DUI than others. We’ve gathered information on insurance rates, high-risk auto insurance companies, and state DUI requirements like SR-22 filings to determine which states are best for drivers with a DUI.

While your best bet is to be extra cautious in avoiding a DUI (it doesn’t take much alcohol to be over the limit in most states) by finding a different way to get home if you’re planning to drink, it does happen. And below you will find the best places to ride out the penalties.

18,155 reviews

18,155 reviewsCompany Facts

Monthly Rate

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Monthly Rates:

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 2,235 reviews

2,235 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews- DUI auto insurance is more expensive because insurance companies take on a higher risk of a claim

- If you have more than one DUI or a DUI combined with other violations, you may need high-risk insurance

- DUI insurance rates may go down on each renewal as long as you have no additional convictions in the meantime

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Best States for Cheap High-Risk Auto Insurance

DUI auto insurance is expensive. The NHTSA calculates that there are an average of of 28 deaths each day in the U.S. due to drunk driving, which means DUI drivers present a huge risk to insurance companies. There’s no way around the increase in rates, but some places have it worse than others. We looked at the average cost of car insurance for a driver with a DUI in each state to determine which states are more affordable.

Of course, rates differ from company to company with a DUI as well, so we listed the cheapest company in each state. If it’s your first DUI, odds are good you will be able to get insurance with one of the top insurance companies, even if you need an SR-22 or similar filing.

Drivers with more than one DUI or other driving record issues in addition to a DUI may need to get insurance from a non-standard insurance company specializing in high-risk drivers.

How long a DUI will affect your record depends on the insurance company and your state laws. Can you get car insurance after a DUI? Yes, but on average, you can expect your rates to be higher for three years. Some companies may reduce the surcharge for the DUI each year until your rates return to normal. Shopping around and asking questions about rating practices is key to making DUI insurance affordable.

What state has the lowest car insurance rates for someone with a DUI? Read on to find out.

The Top 10 Most Affordable States for Drivers After a DUI

These states have lower average rates for drivers with a DUI, even from the top car insurance companies we compared. USAA auto insurance is sometimes the most affordable option for drivers with a DUI. For those who don’t qualify for USAA membership, we’ve listed the second-cheapest in those states as well.

#10 – Vermont

Monthly Cost for DUI insurance: $306

Number of High-Risk Providers: 14

SR-22 Filing Period Covered: 3 years

Cheapest Insurance Providers: USAA & Nationwide

Fall foliage, maple syrup, and affordable DUI auto insurance: Vermont really does have a lot to offer. At $306 a month, drivers with a DUI will still manage to pay less than a teenager for their insurance here, and additional discounts can qualify you for an even lower rate.

USAA is the cheapest option for Vermont auto insurance, but if you don’t qualify, Nationwide is a close second.

If you have a DUI you will have to file an SR-22 for three years, and that’s the average amount of time during which the insurance company will surcharge you. With just one DUI, you’ll have your pick of insurance companies, but if you have any other convictions you might need to look at high-risk companies. Vermont has 14 for you to choose from.

#9 – New Hampshire

Monthly Cost for DUI insurance: $305

Number of High-Risk Providers: 14

SR-22 Filing Period Covered: 3 years

Cheapest Insurance Provider: Geico

New Hampshire sneaks in just a bit higher on our list, barely beating Vermont for the average cost of DUI car insurance. New Hampshire law refers to a DUI as a DWI or Driving While Intoxicated. It’s a little easier to get cheap coverage from a big company here; rather than USAA, the cheapest coverage for a driver with a DWI is available from Geico.

If you don’t qualify for a standard company like Geico because of Geico DUI policy, there are other options. With 14 high-risk insurance companies to choose from, you can shop around to compare rates, even for high-risk DUI coverage.

#8 – Iowa

Monthly Cost for DUI insurance: $297

Number of High-Risk Providers: 22

SR-22 Filing Period Covered: 2 years

Cheapest Insurance Provider: Progressive

Iowa has a shorter SR-22 filing period than many other states. That doesn’t necessarily mean your Iowa auto insurance rates will go down after two years, but it does mean you won’t have to worry about the filing fees.

Needing an SR-22 doesn’t directly affect your car insurance costs; it’s the violation for which the SR-22 is required that causes your rates to go up.

In Iowa, the offense is called OWI (Operating While Intoxicated), and Progressive is the cheapest of the major insurance companies if have an OWI on your record. But if you need a high-risk insurance company, you have a lot of choices. There are 22 non-standard insurance companies offering high-risk coverage to drivers in Iowa.

#7 – Idaho

Monthly Cost for DUI insurance: 296

Number of High-Risk Providers: 14

SR-22 Filing Period Covered: 1-3 years

Cheapest Insurance Provider: State Farm

Idaho’s SR-22 filing requirements range from one to three years, but as we mentioned above, that doesn’t mean your rates will go down sooner. Insurance companies make their own determination regarding how long they will charge you for a DUI.

There are plenty of companies to choose from here if you need high-risk insurance, but if you only have one DUI, odds are good you can get coverage from State Farm. It’s the cheapest option for DUI auto insurance in Idaho and also the biggest insurance company in the country.

#6 – Washington

Monthly Cost for DUI insurance: $290

Number of High-Risk Providers: 19

SR-22 Filing Period Covered: 3 years

Cheapest Insurance Provider: State Farm

Washington state auto insurance rates for a DUI are relatively low. Of the top companies, your cheapest option here is State Farm. That’s good news since it’s a top-rated company. That said, if you have more than one DUI or other issues on your driving record, you’ll likely have to look to a non-standard insurance company.

There are 19 different options for high-risk insurance in Washington state. That makes it easier to shop around. While high-risk drivers pay expensive rates, the more competition there is for your business, the more likely you’ll be able to find a better rate.

#5 – Ohio

Monthly Cost for DUI insurance: $274

Number of High-Risk Providers: 26

SR-22 Filing Period Covered: 3-5 years

Cheapest Insurance Provider: American Family

Ohio auto insurance for a DWI (Ohio does not use the term DUI) is affordable with an average monthly rate of $274, and the cheapest option here is American Family. The SR-22 filing can be required for up to five years, but that doesn’t mean you will be charged extra on your rates for all of those years. That will depend on what is on your record and the insurance company.

If you do need high-risk insurance, Ohio is tied for the best place on our list for the selection of non-standard insurance companies. There are 26 available for you to choose from, making it easier to get a lower rate.

#4 – Wisconsin

Monthly Cost for DUI insurance: $273

Number of High-Risk Providers: 22

SR-22 Filing Period Covered: 3 years

Cheapest Insurance Provider: American Family

Wisconsin auto insurance is pretty similar to Ohio in terms of rates, but the length of the SR-22 filing requirement maxes out at three years here and Wisconsin calls the violation an OWI. American Family is the cheapest of the major companies here, much like in Ohio.

While there are fewer non-standard insurance companies in Wisconsin, 22 is still a long list of options. The more choice you have, the more competition, and the better your chances of getting an affordable DUI auto insurance rate.

#3 – Alaska

Monthly Cost for DUI insurance: $271

Number of High-Risk Providers: 10

SR-22 Filing Period Covered: 5 years

Cheapest Insurance Provider: State Farm

Alaska auto insurance rates are generally affordable, which means a lower cost of insurance even if you have a DUI. State law requires an SR-22 filing for five years on your first DUI (or DWI as it’s called in Alaska), which is a long time. That said, many insurance companies stop surcharging you after three years, so you may only have to pay the filing fee at that point.

In Alaska the requirement for an SR-22 filing gets longer with every subsequent conviction, and after a fourth conviction you will be required to carry it for life.

Alaska has fewer high-risk insurance companies operating, but there are fewer insurers in Alaska in general, so that’s not surprising. Along with the next state on our list, Alaska has high minimum coverage requirements at 50/100/25. That means even with a basic policy, you’re getting more for your money.

#2 – Maine

Monthly Cost for DUI insurance: $257

Number of High-Risk Providers: 15

SR-22 Filing Period Covered: 3 years

Cheapest Insurance Providers: USAA & State Farm

Maine auto insurance is the cheapest in the nation overall, so it’s not surprising that it’s also among the cheapest for DUI insurance, called OUI (Operating Under the Influence) here. As a bonus, Maine’s minimum car insurance requirements, which are the same as Alaska’s, are really high. So that low price you’re paying is actually buying you a pretty decent policy.

USAA is the cheapest car insurance company in Maine, but you have to be a member of the military or a veteran to qualify. State Farm DUI insurance provides the cheapest option if you don’t meet those requirements. And if you don’t qualify for standard insurance at all, there are 15 different high-risk companies to serve your needs.

#1 – Virginia

Monthly Cost for DUI insurance: $232

Number of High-Risk Providers: 26

SR-22 Filing Period Covered: 3 years

Cheapest Insurance Provider: State Farm

Virginia’s average monthly rate for auto insurance with a DWI (like other states, the term DUI is not used here) is only $212 a month. That’s pretty reasonable, and shopping around could get that down even more. You’ll need an SR-22 for three years here.

State Farm car insurance stands out among the top companies as the cheapest option for drivers with a DWI, but if you need to go with a non-standard company you have a lot to choose from. At 26 companies, Virginia ties with Ohio for the most high-risk auto insurance options.

Being convicted of a DUI is never a good thing, but if you have to pay DUI insurance rates, Virginia auto insurance is the cheapest.

Full Results: All States Ranked by Cost for DUI Auto Insurance

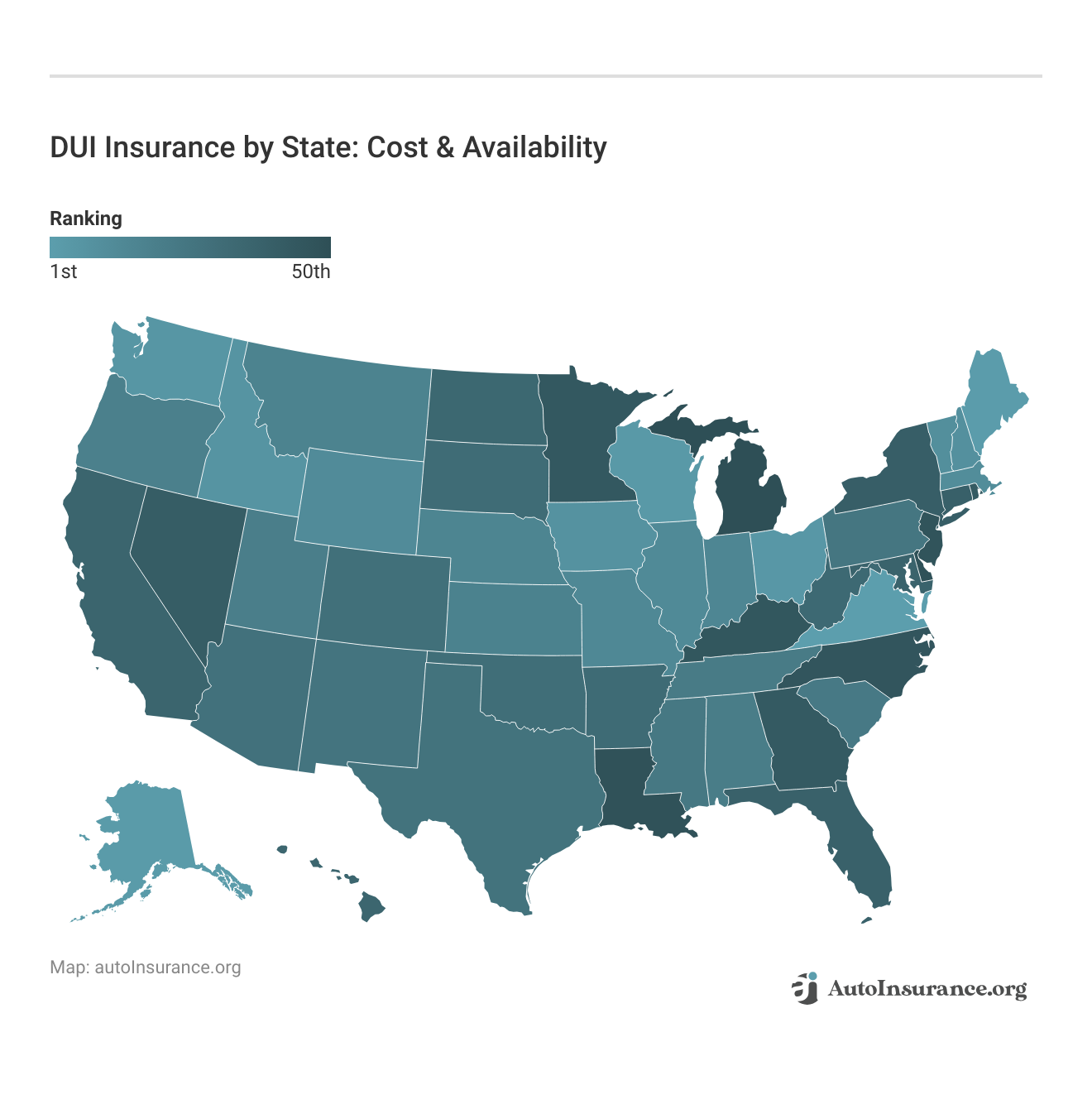

Where you live can have a big impact on your auto insurance rates after a DUI. Just how much does car insurance increase with DUIs? The map below shows the range of average DUI rates in every state.

It’s not at all surprising that Michigan is the most expensive state for a DUI. That’s because Michigan’s no-fault system and high personal injury protection (PIP) limits have made it the most expensive state overall for car insurance. Changes to the laws in the past few years have resulted in lower rates, but Michigan is still one of the most expensive states for drivers.

These numbers may have you wondering, “How can I lower my car insurance after a DUI?” You’re not alone. Estimates show that 1.5 million people are arrested for drinking and driving each year.

Although some times are worse for drunk driving than others — such as the deadliest days for Halloween — drunk driving is a widespread problem that occurs all year. Some tips to lower your insurance rate after a DUI are:

- Keep a clean record as you wait out the DUI surcharge period

- Shop around for a better rate

We included the last tip because DUI auto insurance rates differ vastly from company to company.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions: Auto Insurance and DUIs

If you have further questions about car insurance for DUI offenders, take a look below for answers.

#1 – How do insurance companies find out about a DUI?

Your insurance company runs your driving record with the DMV on regular basis. If you’re considering not telling insurance about your DUI, unfortunately, it won’t do you much good. There’s no DUI insurance trick to prevent your insurance company from finding out and charging you, although researching the cheapest car to insure after a DUI or insurance discounts can help you save after a DUI charge.

#2 – How long does a DUI stay on your insurance record?

On average, your insurance company will charge you for a DUI for three years, but that can vary. It’s important to note that your rate increase usually starts on the first renewal after the DUI appears on your record, and will not fall off until the next renewal after the DUI is no longer chargeable.

That means the three-year anniversary of getting the DUI may not be the day your rates go down. How long a DUI stays on record also depends upon the local state laws, so if you are asking how long does a DUI affect your insurance in PA, CA, etc. the answer is that it depends.

#3 – Can you get commercial auto insurance with a DUI?

As with all auto insurance, there are generally ways to get covered even with a DUI. When it comes to commercial insurance, where rates are already higher than personal insurance, a DUI will have a big impact on rates.

#4 – What insurance companies cover DUIs?

If your insurance is paid up and in force at the time of your DUI, your insurance company will cover an accident that happens as a result. Whether an insurance company will continue to cover you depends on a lot of factors. Does Allstate drop you for DUI, for example? What about State Farm?

If it’s your first DUI, there was no claim (you were just pulled over) and you had a clean record before the conviction, probably not, but every situation is different.

Methodology: Ranking States by DUI Insurance Coverage

To rank the states based on the cost of DUI auto insurance, we started with the average rates for each state for drivers with a DUI. This data was provided by Quadrant Data Solutions. We also used this data to determine the cheapest car insurance company for a DUI in each state.

We then used the insurance company listings from Clearsurance to count the number of high-risk insurance companies in each state.

Finally, we looked at each state’s Department of Insurance and DMV pages to find out what the SR-22 requirements are in that state.

Even if you have received a DUI — or any other major driving infraction — there are still ways you can save on auto insurance rates. Discounts, raising deductibles, and reducing coverage are three ways to off-set the spike in your insurance rates if you had a major driving infraction.

The best ways to save is to compare auto insurance quotes from different companies. This ensures you’ll get the best deal, as you’ll see all of the options that are available.

Plug your ZIP code into our free online quote tool to do just that and find the best auto insurance quotes that meet your insurance and budget needs, especially if you have a DUI on your record.

Frequently Asked Questions

What are the best states for affordable DUI auto insurance in 2023?

The top states for affordable DUI auto insurance in 2023 are Virginia, Maine, Alaska, Wisconsin, Ohio, Washington, Idaho, Iowa, New Hampshire, and Vermont.

How long will a DUI affect my car insurance rates?

On average, a DUI can affect your car insurance rates for three years. However, it can vary depending on the insurance company and state laws.

Can I get car insurance after a DUI?

Yes, you can still get car insurance after a DUI. However, your rates will likely be higher, and you may need to obtain an SR-22 filing, which certifies that you have the required liability insurance.

What factors determine the cost of DUI auto insurance?

The cost of DUI auto insurance is influenced by various factors, including your driving record, location, age, vehicle type, and the insurance company you choose.

Which insurance companies offer the cheapest DUI auto insurance in different states?

The cheapest insurance companies for DUI auto insurance vary by state. Some examples include USAA and Nationwide in Vermont, Geico in New Hampshire, Progressive in Iowa, State Farm in Idaho and Washington, American Family in Ohio and Wisconsin, and State Farm in Alaska and Maine.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.