Best Auto Insurance for New Drivers in 2025 (Find the Top 9 Providers Here)

State Farm, Geico, and Progressive offer the best auto insurance for new drivers by providing young driver discounts, teen driving programs, and UBI plans. Average new driver car insurance quotes are $445 per month for minimum insurance, but our best insurance companies for new drivers can help you save.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jul 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

New Drivers Minimum Coverage

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

New Drivers Minimum Coverage

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

New Drivers Minimum Coverage

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsOur top picks for the best insurance for a new driver are State Farm, Geico, and Progressive. These companies combine affordability, stellar customer service, and excellent auto insurance discounts for young drivers.

State Farm is our top pick for car insurance for new drivers because it offers a variety of ways to help young people save on their insurance and improve their driving skills. For example, teens can save on their coverage by signing up for the State Farm Safe Driver training program.

Our Top 9 Company Picks: Best Auto Insurance for New Drivers

| Company | Rank | Safe Driving Discount | A. M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | B | Good Students | State Farm | |

| #2 | 26% | A++ | Low Rates | Geico | |

| #3 | 30% | A+ | Tight Budgets | Progressive | |

| #4 | 25% | A+ | Full Coverage | Allstate | |

| #5 | 30% | A++ | Military Families | USAA | |

| #6 | 40% | A+ | UBI Savings | Nationwide |

| #7 | 20% | A | Add-on Options | Liberty Mutual |

| #8 | 10% | A++ | Unique Coverage | Travelers | |

| #9 | 25% | A | Young Volunteers | American Family |

Read on to explore your options for the best auto insurance for new drivers. Then, enter your ZIP code into our free tool to start comparing new driver insurance costs today.

- Insurance for new drivers can be much higher than for older adults

- New drivers can save by qualifying for discounts

- State Farm, Geico, and Progressive have the best car insurance for new drivers

#1 – State Farm: Top Overall Pick

Pros

- Drive Safe and Save program: Save up to 30% on your policy by signing up for State Farm’s usage-based insurance (UBI) program, Drive Safe and Save.

- Safe driver training: Teens can lower their new driver insurance costs by completing the Steer Clear program.

- Good student discount: You have plenty of options to save with State Farm, but a popular choice for teens is the good student discount. Learn more about your discount options in our State Farm auto insurance review.

Cons

- Rates can be high: While State Farm offers the best car insurance for new drivers overall, it’s not always the cheapest. Make sure to compare rates in your area if you have a tight budget.

- Mixed reviews: It’s one of the best insurance companies for new drivers, but it’s not without complaints. State Farm struggles with its customer service ratings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordability

Pros

- Affordable rates for young drivers: Geico is often one of the cheapest options for car insurance, and that includes new driver insurance rates. Learn how much you might pay in our Geico auto insurance review.

- Ample discounts: Gieco offers plenty of ways to lower average new driver insurance costs with auto insurance discounts. Popular options for young drivers include good student and safe driving discounts. For the best car insurance for new drivers under 25, look at Geico’s student discounts.

- DriveEasy program: Safe drivers can save up to 25% by enrolling in the Geico UBI program DriveEasy.

Cons

- Limited local agents: Geico focuses more on its online insurance experience, which means there are fewer local agents. A lack of local agents can make it hard to get help when you’re learning how to get car insurance for the first time.

- Discounts vary by location: Like most insurance companies, Geico’s discount availability varies by state. Check with a representative to see what you’re eligible for.

#3 – Progressive: Best Budgeting Tools

Pros

- Snapshot program: Snapshot is Progressive’s UBI program, which can save you up to 30% on your policy. However, unsafe drivers might see their rates increase.

- Name Your Price tool: Enter your budget in the Name Your Price tool to see what your insurance options are. Learn more about this budgeting tool in our Progressive auto insurance review.

- Young driver discounts: Progressive offers a variety of discounts, including special savings just for having a teen driver on your policy.

Cons

- Higher rates after traffic violations: Most companies increase your rates after an accident or traffic violation, but Progressive’s rate increases can be particularly high.

- Rates can increase unexpectedly: Aside from increases after traffic violations, many customers also report that their Progressive premiums went up unexpectedly when their policy was renewed.

#4 – Allstate: Best for Full Coverage Policies

Pros

- Drivewise: Allstate has one of the best UBI discounts on the market — safe drivers can save up to 40% by enrolling in Drivewise. Learn more about Allstate’s telematics programs in our Allstate auto insurance review.

- Excellent customer service: When you need the best car insurance for a new driver, having good customer service representatives to help you is crucial. Allstate has an excellent reputation for its customer service.

- Diverse coverage options: If your budget has some wiggle room, Allstate has plenty of options to increase the coverage in your policy.

Cons

- Higher rates: No matter what type of driver you are, Allstate is consistently one of the most expensive options for insurance.

- Claims satisfaction: It has excellent customer service ratings, but Allstate struggles with its claims satisfaction ratings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Families

Pros

- Discounts for young drivers: USAA doesn’t offer as many discounts as some of its competitors, but it does have savings for young drivers. Explore your discount opportunities in our USAA auto insurance review.

- Affordability: No matter where you live, USAA almost always has the cheapest new driver car insurance quotes.

- Specialized coverage: USAA specializes in military coverage, meaning new drivers in military families will find insurance options that match their lifestyles.

Cons

- Eligibility requirements: Since it caters specifically to active or retired military members and their families, most new drivers are not eligible for USAA insurance.

- Limited physical locations: USAA has fewer brick-and-mortar locations than most larger companies, which can make finding help from a real person difficult.

#6 – Nationwide: Best for UBI Savings

Pros

- SmartRide program: When it comes to good insurance companies for new drivers, Nationwide makes its mark with its SmartRide program. Safe drivers can save up to 40% on their insurance with this UBI program.

- Excellent discount options: Nationwide offers 10 more discounts to help lower new driver car insurance costs. Read our Nationwide auto insurance review to learn more.

- Vanishing Deductible program: Enroll in Nationwide’s Vanishing Deductible program to save up to $500 for remaining claims-free.

Cons

- Limited availability: Despite its name, Nationwide is only available in 47 states.

- Average rates: Nationwide usually doesn’t have the most expensive car insurance rates, but it also doesn’t offer the cheapest.

#7 – Liberty Mutual: Best for Add-on Options

Pros

- Add-on opportunities: Liberty Mutual offers plenty of customization options, like new car replacement coverage and accident forgiveness. Explore Liberty Mutual’s add-on selection in our Liberty Mutual auto insurance review.

- Discounts for all drivers: With 17 discount options, Liberty Mutual makes it easy for all drivers to save on their insurance.

- RightTrack program: Get cheap insurance for new drivers by enrolling in RightTrack. Drivers who regularly practice safe driving habits can save up to 30%.

Cons

- Below average claims satisfaction: Liberty Mutual struggles with its claims satisfaction ratings, with many customers stating lengthy resolution wait times.

- Rates can be high: First-time driver insurance costs can be expensive, even with discounts. If getting the cheapest coverage possible is your goal, Liberty Mutual might not be the company for you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Unique Coverage

Pros

- IntelliDrive program: Save up to 30% on your insurance by enrolling in Travelers’ UBI program, IntelliDrive. Learn more about this program in our review of Travelers auto insurance.

- Unique coverage options: Add more coverage to your Travelers policy with options like roadside assistance and rental car reimbursement.

- Discount opportunities: Travelers offers 17 discount opportunities, including savings for being a good student or driving an electric vehicle.

Cons

- Coverage varies by location: Travelers offers some of the best auto insurance for young drivers, but coverage availability varies by state. For example, Travelers’ rideshare insurance is only available in two states.

- Rates tend to be higher: While it’s not the most expensive, you’ll likely find lower rates elsewhere.

#9 – American Family: Best for Young Volunteers

Pros

- KnowYourDrive program: Save up to 30% on your insurance by enrolling in KnowYourDrive, American Family’s UBI program.

- Teen Safe Driver program: The Teen Safe Driver program helps new drivers learn better driving habits. Complete the program and earn a small discount from American Family.

- Young people discounts: American Family offers some of the best car insurance for drivers under 25 with its young volunteer discount. If you’re under 25 and volunteer at least 40 hours annually, you might be eligible for this discount.

Cons

- Limited availability: It’s one of our choices for the best car insurance companies for new drivers, but it only sells policies in 19 states. See if your state is eligible for coverage in our American Family auto insurance review.

- Above-average rates: American Family tends to run on the expensive side. If you’re looking for the best car insurance rates for new drivers, you’ll probably find cheaper options than American Family.

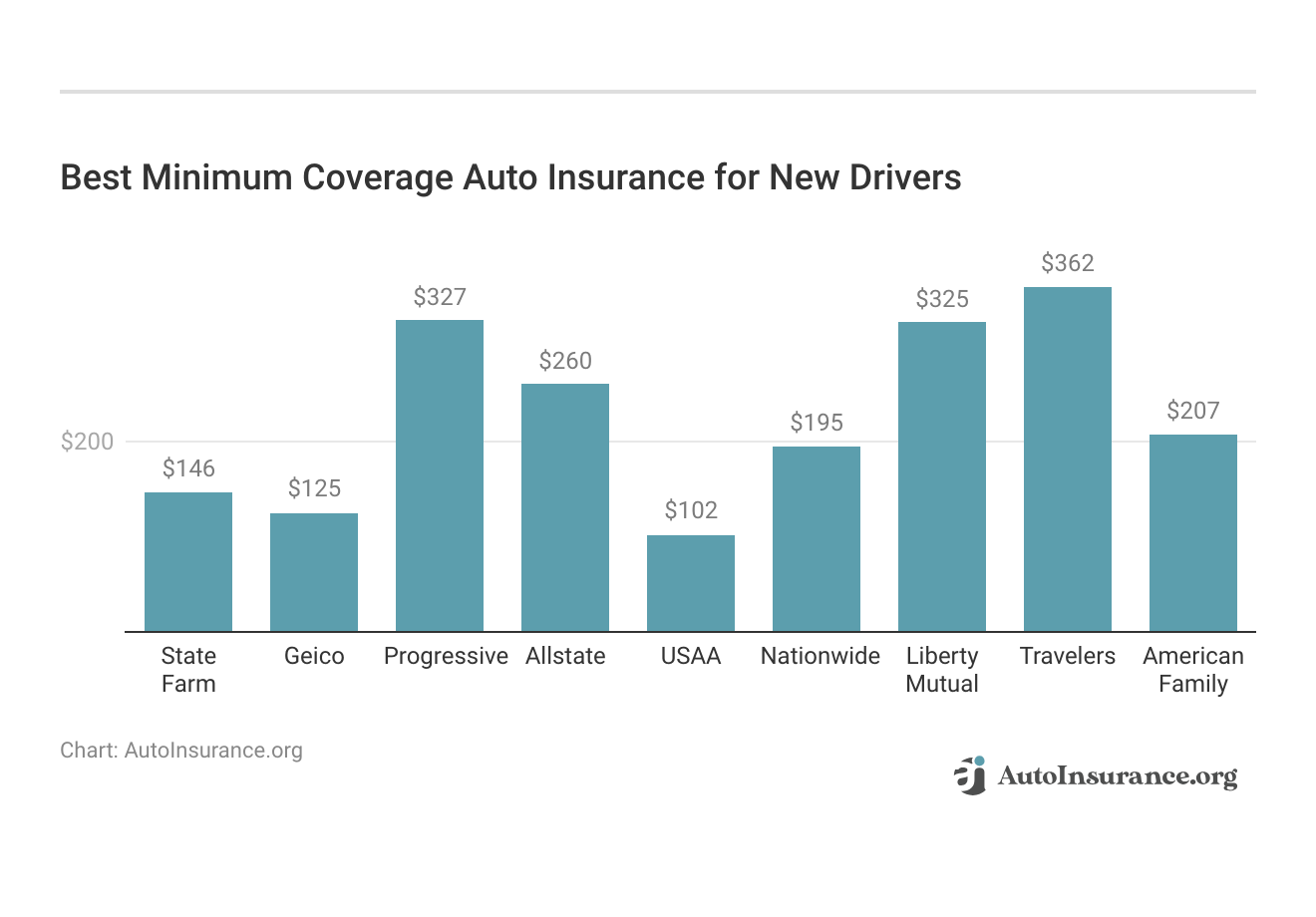

The Average Cost of Auto Insurance for First-Time Drivers

The most important factor when considering the average cost of auto insurance for first-time drivers is the person’s age. For example, the average price of a car insurance policy for a 16-year-old is around $3,400.

Fortunately, most drivers’ rates will drop by as much as 20% by age 25 if they maintain a good driving record. Check below to see how much minimum insurance for first-time drivers costs on average from our top companies.

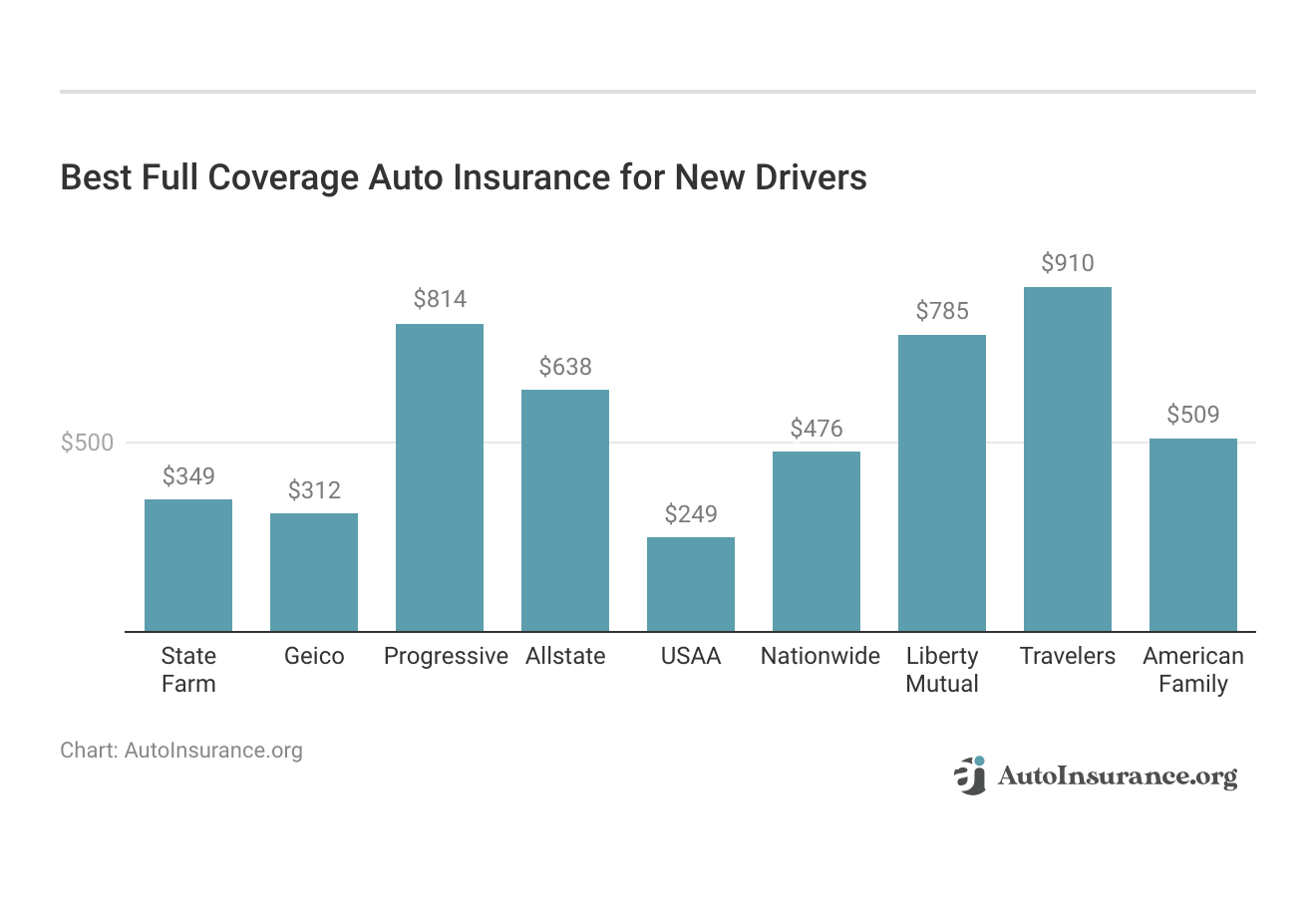

Minimum insurance is your cheapest option for coverage, but it offers very little protection for your vehicle. If you have space in your budget for more insurance, full coverage offers much better protection. See how much full coverage insurance might cost you below.

As you can see, teen and young drivers pay significantly more for car insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Best Auto Insurance for New Drivers Under 25

Rates with Allstate are the cheapest among the best auto insurance companies for drivers under 25. The average rate with Allstate is just over $1,200 annually. But on average, new drivers pay around $2,750 for coverage.

For parents with young drivers, it may be cheaper to add your child to your policy instead of letting them get their own car insurance.

Teen Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $280 | $515 | |

| $260 | $495 |

| $290 | $520 | |

| $210 | $400 | |

| $270 | $505 |

| $250 | $480 | |

| $240 | $460 | |

| $225 | $450 | |

| $235 | $470 | |

| $195 | $390 |

New drivers who want a full coverage policy will likely find the most competitive rates with State Farm. The average cost for a full coverage policy is around $3,300 for people under 25.

Teens have some of the priciest insurance rates of any driver because of their risk factor.However, a guardian or parent can help teens save up to 50% on their insurance by adding them to an existing family policy.Scott W. Johnson Licensed Insurance Agent

Remember that rates will vary based on your personal circumstances, so it’s wise to get quotes from multiple companies.

The Best Auto Insurance for New Drivers Over 25

The best car insurance for new drivers over 25 may be with Allstate. The company offers the cheapest minimum coverage at under $400 per year, over 60% less than quotes from many other providers.

The cheapest full-coverage auto insurance policy for new drivers over 25 is with State Farm, with an annual rate of $1,398. Finding cheap auto insurance for new drivers over 20 can be difficult, but comparing rates with multiple companies can help.

The Best Auto Insurance Company for New Drivers on an Existing Policy

Rates for drivers added to an existing family policy are cheaper than new driver rates found elsewhere. For example, Allstate, Geico, and State Farm all offer new driver car insurance rates that are cheaper than average when a new car and driver are added to an existing policy.

Geico charges just over $1,400 on average for a year of coverage, but the company charges over $3,200 for a full coverage policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Who Needs New Driver Insurance

There is no specific subset of insurance called new driver auto insurance. Still, most new drivers fall into a particular category regarding different insurance providers. Insurance companies often consider the following individuals to be new drivers:

- Teens who recently received a driver’s license

- Adults who are driving for the first time

- Immigrants or foreign nationals who have never driven in the U.S.

- Individuals with a gap in driving or insurance coverage

Auto insurance for new drivers is often more expensive than coverage for other individuals. This is mostly because of the high risk of insuring a new driver. Company rates vary, so make sure to shop around for the cheapest high-risk auto insurance companies.

Auto Insurance for Teenagers

Most insurance companies charge the highest rates for teenage drivers. This is because of their lack of experience and because they are statistically more likely to get into an accident or cause damage than any other age group.

The best way for teenagers to find cheap auto insurance rates is if they are added to an existing policy. In most cases, this will be a parent, grandparent, or guardian’s auto insurance policy. One added benefit of this arrangement is the potential to qualify for a multi-car discount.

Some insurance companies offer additional auto insurance discounts for young drivers, such as safe driving, safety features, and a good student discount.

Auto Insurance for Immigrants and Foreign Nationals

Finding the best auto insurance for immigrants is different because regardless of your history of safe driving in other countries, U.S. insurance companies will still consider you a new driver if you don’t have a driving history available to access.

If you’re from another country and have moved to the United States, you will need a valid driver’s license to purchase a policy. Unfortunately, even with an international driver’s permit, you will have difficulty finding car insurance without a U.S.-issued license.

The easiest way to get a driver’s license as a foreign national or an immigrant is to go to the Department of Motor Vehicles (DMV) in your state and start the process. In most cases, you will have to take a written test and a driving test, and you will have to submit the proper paperwork.

Acquiring a driver’s license in the U.S. can take a while, and your immigration status could play a role in your driving eligibility. You can speak with a representative from DMV to learn more and see what your options are.

Once you get a driver’s license, you can assume your rates will be higher than average, but if you’re over 25 years of age, you will probably pay less for coverage than most teen drivers in your area.

Auto Insurance for People With a Coverage Gap

Buying car insurance for first-time drivers, while expensive, is relatively straightforward. But buying car insurance if you’ve allowed your insurance to lapse is an entirely different story.

Gaps in coverage indicate to insurance companies that you’re a risk. Because of this, some companies may charge you high rates, while others may be unwilling to offer coverage at all. If you find that it’s challenging to find proper coverage, you may want to consider searching for a non-standard insurance provider.

Non-standard car insurance companies offer auto insurance for first-time drivers and new drivers. Still, these companies also provide coverage to drivers with poor credit, negative driving histories, and more. So while you will still pay higher rates for coverage, you can rest easy knowing you have proper coverage and can drive legally.

Why Auto Insurance Rates are High for New Drivers

The golden rule in the insurance industry is, the higher the risk, the more you will pay for insurance premiums. This maxim is true when purchasing any kind of insurance but is especially relevant to automobile insurance.

New drivers, especially teenagers who are still in high school or college, are considered far greater insurance risks than individuals who are older and have more driving experience.

According to experts at the Insurance Institute for Highway Safety, IIHS, drivers at the age of 16 are six times more likely to get into an accident than drivers in the 30 to 59 age group.

According to the IIHS, car crashes are the single biggest killer of teenagers in America.

The IIHS website provides links to brochures, videos, and other useful information that can help prevent accidents while reducing fatalities and other serious injuries among teenage drivers.

It’s no wonder, then, that car insurance premiums are so much higher for younger, newer drivers.

While most insurance providers will charge significantly higher premiums for new drivers, the good news is that car insurance is readily available for new drivers and many companies will offer discounts to help ease the financial burden for newer drivers’ first few years on the road.

How Credit Scores Impact Auto Insurance Rates

Unfortunately, a low credit score can make your car insurance rates expensive. If possible, you should try to build good credit before purchasing auto insurance, as you will see a significant difference in how much you’ll pay.

Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $78 | $95 | $142 | |

| $65 | $79 | $118 |

| $70 | $85 | $127 | |

| $52 | $68 | $104 | |

| $88 | $105 | $156 |

| $66 | $80 | $122 | |

| $61 | $75 | $113 | |

| $59 | $72 | $109 | |

| $60 | $74 | $111 | |

| $48 | $58 | $87 |

There are several states that do not permit auto insurance companies to check your credit when assigning rates, so make sure to check your local laws. Finding the best auto insurance companies that don’t use credit scores can help you lower your rates if you have a bad credit score.

Get Cheap Auto Insurance Rates as a New Driver

Car insurance for a new driver may be expensive, but there are a few ways you can try to lower your monthly or annual rates.

Understand the Licensing Process

Today, new licensees in every state are required to go through a series of steps before receiving their permanent adult driver’s license. Graduated licenses help ease new drivers into the flow of becoming responsible motorists.

Each state differs as to the restrictions of new licensees, but most begin with learner’s permits that require a licensed adult be present.

The next step is usually a provisional license that limits the hours that a 16 or 17-year-old may drive without adult supervision. Finally, a permanent license is issued at the age of 18 or 19.

This process is beneficial for both new drivers and the community at large and guarantees that new drivers have met at least the minimum training, practice, and educational requirements for licensure.

Plan Ahead

By being proactive and planning ahead, new licensees can reap big dividends when it comes to shopping for auto insurance. Most states now require some form of driver training or other educational classes for new licensees.

However, there are always additional safety courses and training classes that can lead to auto insurance discounts.

It’s critical that you talk to your children in advance about the perils of driving under the influence of drugs or alcohol. While we know that drug use is illegal and that it is illegal for teens to drink in the United States, still many young people try alcohol or experiment with drugs.

It is imperative that young drivers understand that they must never get behind the wheel of a motor vehicle if they have been drinking, taking medications, or other drugs.

Not only is a driver under the influence at risk of serious injury or death, but the financial costs alone of a single DWI or DUI traffic violation can also amount to more than $10,000!

Parents should also discuss the dangers of texting, e-mailing and talking on the phone while driving.

The Automobile Club, AAA, discusses these issues in their recent article about distracted driving.

Studies conducted in the past year clearly demonstrate that drivers who use a cell phone or other handheld electronic device while driving are four times as likely to have an accident.

There are other distractions to avoid as well, such as smoking, eating, or playing with the car radio or CD player.

Compare Quotes Online

Each car insurance company decides on a person’s insurance rates differently. Because of this, you may find that some companies are willing to offer you auto insurance premiums that are a lot cheaper than other competitors.

Getting multiple auto insurance quotes online allows you to find the company that would work best for you based on the coverage you want and the policy’s price. You can enter your information site by site by filling out quote requests, as you can see above, or you can use our free comparison tool to see multiple quotes simultaneously.

Join an Existing Policy

If you’re a teen driver, see if your parents or grandparents can add you to their policy. While their rates will go up significantly, you’ll still save a lot more than if you were to purchase a policy on your own.

Adding your teen driver to an existing auto insurance policy can have several advantages. Long-term customers are likely to be eligible for many benefits and discounts that a new driver would not be able to get on their own.

Existing policies offer discounts on clean driving records and may even be willing to forgive a minor accident or traffic citation when it comes time for renewal.

Multi-policy discounts are also available to homeowners, renters, and those who purchase life, health, disability, or other types of insurance products from the same company.

Search for Discounts

Many insurance providers offer different auto insurance discounts on coverage to help policyholders save money on their insurance rates. Some of the most common discounts for auto insurance coverage include:

- Multi-vehicle

- Multi-policy

- Defensive driver

- Good student

- Safety equipment

- Occupation

If any of the above discounts apply to you, you can speak with an insurance company to see whether you’re eligible. Some discounts help policyholders save as much as 25% on their coverage.

Buy the Right Car and Ride With Your Teen

New, younger drivers are often encouraged to show off by their peers while driving. Research shows that teen drivers lack the maturity and judgment to make appropriate decisions at the moment as they are driving.

A sports car or luxury vehicle might represent too big a temptation for a teen driver.

Not only are family minivans and sedans more economical to insure, but they are also far safer to drive and present far fewer risks on the road.

Young drivers should be encouraged to take out the family wagon and abandon thoughts of driving a fast, sporty car for their own protection and yours.

Edmonds.com recommends that parents ride with their teenagers. Younger drivers need to build confidence and feel safe behind the wheel of an automobile.

Praise your new driver for following the rules of the road and engaging in safe driving practices.

Parents can also help new drivers positively adjust their habits while learning how to drive responsibly.

Choose a Lower Level of Coverage

It’s a good idea to purchase as much auto insurance coverage as you can to help keep yourself and your vehicle protected. Still, if you cannot afford a full coverage policy, you can save money on car insurance by choosing a lower level of coverage.

Choose a Higher Deductible

You can also save money on coverage by choosing a higher deductible. Unfortunately, this would mean you’d pay more out of pocket if you were involved in an accident. But it could help you save money on your monthly or annual auto insurance premiums.

Take a Class

The Automobile Club, AAA, sponsors many such classes for its members. Community colleges, public school districts, and other agencies also provide training for newer as well as older drivers who are more experienced.

Insurance companies know that educated drivers are better drivers and cause fewer accidents.

Speaking of education, most auto insurance companies offer discounts to student drivers who maintain at least a B average in school. Students with good grades get good rates as statistics show that better students tend to be better drivers.

Better students are apt to pay more attention while behind the wheel as well as follow motor vehicle laws and regulations.

Drive Safely

The best way to save money on coverage over time is by developing a superior driving record. If insurance companies can see that you drive safely and do not get involved in accidents, you will likely save a good bit of money on car insurance.

Read more: How do auto insurance companies check driving records?

Set a Good Example

Parents of young drivers can also be proactive by setting a good example when they are driving their youngsters from place to place. It’s not enough to teach new drivers proper road etiquette and the correct way to drive.

Older drivers should avoid displaying their own bad habits in front of younger, more impressionable drivers. In all cases, drivers should act responsibly and follow the rules of the road.

Teach new drivers to learn and obey all traffic regulations.

Ignorance of the law is never an acceptable excuse for a traffic infraction. According to automotive expert Edmonds.com, parents should try to make safe driving a family project.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Find the Best Auto Insurance for New Drivers Today

If you’re driving, you need car insurance. However, auto insurance for new and first-time drivers is more expensive than for other age groups and categories.

To find car insurance rates that work with your budget, you can shop online and compare quotes to see which companies might work best. Also, it’s a good idea to shop around and compare car insurance quotes at least once a year to ensure you’re not paying too much for your coverage over time. Use our free comparison tool below to see how much you might pay for new driver auto insurance in your area.

Frequently Asked Questions

Why is it important to have auto insurance for new drivers?

Auto insurance is necessary to protect new drivers, their passengers, and their vehicles in case of accidents or damages. It’s a legal requirement in most states and provides financial security in the event of unforeseen circumstances.

What do I need to buy a new car insurance policy?

- Vehicle information: Details about the car you want to insure, including the make, model, year, vehicle identification number (VIN), and current mileage.

- Personal information: Your full name, date of birth, address, and contact information.

- Driver’s license: You’ll need a valid driver’s license or learner’s permit to purchase car insurance.

- Driving history: Information about your driving history, including any accidents, tickets, or violations you’ve had in the past.

- Insurance history: Details of your previous insurance coverage, including the name of your previous insurance company, policy number, and expiration date, if applicable.

- Desired coverage options: Decide on the type and level of coverage you want for your new car. This may include liability coverage, collision coverage, comprehensive coverage, and any additional options you may want, such as roadside assistance or rental car reimbursement.

- Deductible amount: Determine the amount of deductible you are willing to pay in the event of a claim. The deductible is the amount you must contribute out of pocket before your insurance coverage kicks in.

Why is insurance so expensive for new drivers?

New driver insurance is expensive because, statistically, new drivers are more likely to be in a crash and file a claim than experienced drivers.

What is the best car insurance for new drivers?

New drivers should carry full coverage policies that include liability insurance, collision insurance, and comprehensive insurance. Because first-time drivers are more likely to be involved in an accident, carrying full coverage will better protect new drivers from financial issues after an accident.

How much does car insurance cost for a 16-year-old driver?

Insurance costs for 16-year-olds can range from a few hundred dollars a year to a few thousand a year. Costs depend on whether a 16-year-old joins their parent’s policy or purchases their own insurance policy.

How much does car insurance decrease when drivers turn 25?

Twenty-five-year-olds can expect rates to drop over 10% from the previous year’s rates. Generally, rates will decrease at least a few hundred dollars from when new drivers are teenagers to when they turn 25.

What should I know about the licensing process for new drivers?

The licensing process for new drivers varies by state but usually involves obtaining a learner’s permit, provisional license, and eventually a permanent adult driver’s license. It’s important to understand the specific requirements and restrictions in your state.

Can I add a new driver to my policy if they have a learner’s permit?

Yes, most insurance companies allow you to add a driver with a learner’s permit to your policy. However, it’s best to check with your specific insurance provider for their requirements and any potential changes in premiums.

Do new drivers with good grades qualify for any discounts?

Yes, many auto insurance companies offer discounts for student drivers who maintain good grades. It’s worth inquiring with your insurance provider about any available discounts for academic achievement.

How can I save money on auto insurance for a new driver?

In addition to comparing quotes from different insurance companies, you can save money by bundling multiple insurance policies, maintaining a good driving record, and exploring discounts specific to new drivers, such as safe driving courses or telematics programs.

Are there any specific insurance considerations for new drivers who will be driving for work purposes?

If the new driver will be using their vehicle for work-related purposes, it’s important to inform your insurance company. Depending on the nature of their work, additional coverage may be required, such as commercial auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.