Best BMW X3 Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

State Farm, Progressive, and Geico offer the best BMW X3 auto insurance with rates at $123/month. State Farm is the top overall pick, Progressive excels in online convenience, and Geico is known for the cheapest rates. Compare these leading providers to secure affordable and reliable coverage for your BMW X3.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Apr 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for BMW X3

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for BMW X3

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for BMW X3

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe top picks overall for the best BMW X3 auto insurance are State Farm, Progressive, and Geico, offering comprehensive coverage at competitive rates around $123/month. State Farm stands out as the top overall choice for its reliable coverage and discounts for safe driving.

Progressive excels in online convenience, making it easy to manage policies and file claims. Geico is known for providing the cheapest rates without compromising on quality. Check out our guide “Geico Auto Insurance Discounts.”

Our Top 10 Company Picks: Best BMW X3 Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | B | Many Discounts | State Farm | |

| #2 | 15% | A+ | Online Convenience | Progressive | |

| #3 | 10% | A++ | Cheap Rates | Geico | |

| #4 | 13% | A+ | Add-on Coverages | Allstate | |

| #5 | 15% | A++ | Military Savings | USAA | |

| #6 | 10% | A | Student Savings | American Family | |

| #7 | 15% | A+ | Usage Discount | Nationwide |

| #8 | 10% | A | Customizable Polices | Liberty Mutual |

| #9 | 10% | A | Local Agents | Farmers | |

| #10 | 17% | A++ | Accident Forgiveness | Travelers |

BMW X3 insurance rates cost more than the average vehicle, but good drivers are eligible for a policy discounts by practicing safe driving habits. Let’s look at BMW X3 insurance rates, safety ratings, and more.

If you’re just looking for coverage to drive legally, enter your ZIP code above to compare cheap auto insurance quotes near you.

- State Farm is the top pick for the best BMW X3 auto insurance

- BMW X3 insurance rates vary based on driver age, location, and vehicle model year

- Safety features in the BMW X3 contribute to lower insurance premiums

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Many Discounts: State Farm offers numerous discounts, which can significantly lower the insurance costs for the BMW X3.

- Low Monthly Rates: State Farm auto insurance review provides competitive monthly rates at $31 for the BMW X3 with minimum coverage.

- Bundling Policies: State Farm auto insurance provides significant discounts for bundling multiple insurance policies, enhancing savings for BMW X3 owners.

Cons

- Limited Multi-Policy Discount: The multi-policy discount from State Farm is not as high compared to some competitors for the BMW X3.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels, potentially affecting BMW X3 owners.

#2 – Progressive: Best for Online Convenience

Pros

- Online Convenience: Progressive offers an excellent online platform for managing BMW X3 insurance policies, making it easy for users.

- Multi-Vehicle Discount: Progressive auto insurance review provides a 15% multi-vehicle discount, beneficial for BMW X3 owners with multiple cars.

- Customizable Policies: Progressive allows for highly customizable policies, ensuring BMW X3 owners get exactly the coverage they need.

Cons

- Claims Process: Some customers have reported a slower claims process with Progressive, which can be frustrating for BMW X3 owners needing quick resolutions.

- Rate Increases: Progressive’s rates may increase significantly after an accident or claim, affecting BMW X3 owners.

#3 – Geico: Best for Cheap Rates

Pros

- Cheap Rates: Geico is known for offering some of the cheapest rates for BMW X3 auto insurance.

- Easy Quotes: Geico’s online quote process is fast and easy, providing BMW X3 owners with quick rate comparisons.

- Safety Discounts: As mention in Geico auto insurance review, Geico offers discounts for BMW X3s equipped with advanced safety features.

Cons

- Customer Service: Geico’s customer service is not as highly rated compared to other insurers, which can be a drawback for BMW X3 owners.

- Coverage Options: Geico may offer fewer add-on coverage options compared to some competitors, limiting choices for BMW X3 owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Add-On Coverages

Pros

- Add-On Coverages: Allstate auto insurance review provides a wide range of add-on coverages, allowing BMW X3 owners to tailor their policies.

- New Car Replacement: Allstate offers new car replacement coverage, which is beneficial for new BMW X3 owners.

- Safe Driving Discounts: Allstate rewards safe driving habits with substantial discounts for BMW X3 owners.

Cons

- Higher Premiums: Allstate’s premiums can be higher than average, particularly for BMW X3s.

- Claim Satisfaction: Some BMW X3 owners have reported lower satisfaction with Allstate’s claims process.

#5 – USAA: Best for Military Savings

Pros

- Military Savings: USAA offers significant discounts and benefits for military members and their families, making it an excellent choice for BMW X3 owners in the military.

- Customer Satisfaction: USAA consistently receives high marks for customer satisfaction, benefiting BMW X3 owners.

- Comprehensive Coverage: USAA auto insurance review provides extensive coverage options at competitive rates for the BMW X3.

Cons

- Eligibility: USAA is only available to military members and their families, limiting its availability to all BMW X3 owners.

- Limited Local Offices: USAA has fewer local offices, which might be inconvenient for BMW X3 owners who prefer in-person service.

#6 – American Family: Best for Student Savings

Pros

- Student Savings: American Family offers excellent discounts for students, benefiting young BMW X3 owners.

- Personalized Service: American Family is known for providing personalized customer service, enhancing the experience for BMW X3 owners.

- Bundling Discounts: American Family auto insurance review has substantial discounts for bundling home and auto policies, providing savings for BMW X3 owners.

Cons

- Availability: American Family’s insurance is not available in all states, limiting access for some BMW X3 owners.

- Premium Rates: American Family’s rates may not always be the lowest, which can be a concern for budget-conscious BMW X3 owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Usage Discount

Pros

- Usage-Based Discounts: Nationwide offers significant discounts for low-mileage drivers, which can benefit BMW X3 owners who drive less frequently.

- Vanishing Deductible: Nationwide auto insurance review provides a vanishing deductible program that rewards BMW X3 owners for safe driving.

- Comprehensive Coverage: Nationwide offers a broad range of coverage options, ensuring BMW X3 owners can find the protection they need.

Cons

- Rate Variability: Nationwide’s rates can vary widely depending on the location, which may affect BMW X3 owners in certain areas.

- Online Experience: Some users find Nationwide’s online experience less intuitive compared to competitors, which can be a drawback for BMW X3 owners who prefer managing their policies online.

#8 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual offers highly customizable policies, allowing BMW X3 owners to tailor their coverage.

- Accident Forgiveness: Liberty Mutual auto insurance review provides accident forgiveness, which can be a great benefit for BMW X3 owners.

- Safety Feature Discounts: Liberty Mutual offers discounts for vehicles equipped with advanced safety features, benefiting BMW X3 owners.

Cons

- Higher Premiums: Liberty Mutual’s premiums can be higher than average, which might be a concern for some BMW X3 owners.

- Customer Service: Some BMW X3 owners have reported mixed experiences with Liberty Mutual’s customer service.

#9 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers provides access to local agents who can offer personalized service and advice for BMW X3 owners.

- Comprehensive Coverage: Farmers offers extensive coverage options, ensuring BMW X3 owners can find suitable protection.

- Discounts for Bundling: Farmers auto insurance review provides discounts for bundling multiple policies, which can be advantageous for BMW X3 owners.

Cons

- Higher Rates: Farmers’ rates can be higher than some competitors, which might be a drawback for BMW X3 owners looking for cheaper options.

- Limited Online Tools: Farmers may have fewer online tools and resources compared to some competitors, which can be less convenient for BMW X3 owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers offers accident forgiveness, which can be a significant benefit for BMW X3 owners.

- Competitive Rates: Travelers Auto insurance review provides competitive rates for BMW X3 insurance, making it an attractive option.

- Discounts for Safety Features: Travelers offers discounts for BMW X3s equipped with advanced safety features.

Cons

- Claims Process: Some BMW X3 owners have reported slower claims processing times with Travelers.

- Customer Service: Travelers’ customer service ratings are mixed, which can be a drawback for BMW X3 owners seeking reliable support.

BMW X3 Insurance Cost

The insurance cost for a BMW X3 varies significantly based on the coverage level and the provider. For minimum coverage, monthly rates range from $24 with Allstate to $64 with Liberty Mutual. Full coverage auto insurance, on the other hand, sees a wider range with Allstate offering the lowest rate at $74 per month and Liberty Mutual the highest at $199 per month.

BMW X3 Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

Notable mid-range options include American Family, Farmers, Geico, and Nationwide, whose full coverage rates hover between $118 and $147 per month. USAA and State Farm also provide competitive full coverage rates at $132 and $99, respectively.

BMW X3 Auto Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $130 |

| Discount Rate | $77 |

| High Deductibles | $262 |

| High Risk Driver | $277 |

| Low Deductibles | $164 |

| Teen Driver | $476 |

Travelers and Progressive offer similar rates, around $113 and $119. This variability underscores the importance of shopping around and comparing quotes to find the best insurance deal for the BMW X3.

Expensiveness of BMW X3 to Insure

BMW X3s are relatively expensive to insure compared to other SUVs. Insurance rates for the BMW X3 tend to be higher due to factors like repair costs, parts availability, and the vehicle’s overall value. When compared to SUVs such as the Ford Flex, Infiniti QX60, and Toyota Highlander, the BMW X3 often has higher insurance premiums.

BMW X3 Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| BMW X3 | $31 | $55 | $31 | $130 |

| Ford Flex | $28 | $47 | $33 | $121 |

| Infiniti QX60 | $34 | $63 | $31 | $140 |

| Toyota Highlander | $28 | $43 | $33 | $116 |

| Mercedes-Benz GLE 350 | $37 | $73 | $33 | $155 |

| Audi Q3 | $29 | $57 | $33 | $132 |

| Acura MDX | $31 | $47 | $31 | $122 |

This can be attributed to its luxury status and higher performance capabilities, which typically result in more costly repairs and maintenance. Therefore, while the BMW X3 offers a premium driving experience, potential buyers should be prepared for higher insurance costs. For a comprehensive analysis, refer to our detailed guide titled “Auto Insurance Discounts.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors That Impacts the Cost of BMW X3 Insurance

Age of the Vehicle

Insurance rates for the BMW X3 tend to be higher for newer models compared to older ones. This is primarily due to the increased value of newer vehicles, which makes them more expensive to repair or replace. Additionally, newer models often come equipped with advanced technologies and features that can be costly to fix.

BMW X3 Auto Insurance Monthly Rates by Model Year & Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 BMW X3 | $33 | $57 | $33 | $134 |

| 2023 BMW X3 | $33 | $57 | $32 | $133 |

| 2022 BMW X3 | $32 | $56 | $32 | $132 |

| 2021 BMW X3 | $32 | $56 | $31 | $132 |

| 2020 BMW X3 | $31 | $55 | $31 | $130 |

| 2019 BMW X3 | $30 | $53 | $33 | $128 |

| 2018 BMW X3 | $29 | $52 | $33 | $127 |

| 2017 BMW X3 | $28 | $51 | $35 | $126 |

| 2016 BMW X3 | $27 | $49 | $36 | $125 |

| 2015 BMW X3 | $25 | $47 | $37 | $122 |

| 2014 BMW X3 | $24 | $44 | $38 | $119 |

| 2013 BMW X3 | $23 | $41 | $38 | $116 |

| 2012 BMW X3 | $22 | $37 | $38 | $111 |

| 2011 BMW X3 | $21 | $34 | $38 | $106 |

| 2010 BMW X3 | $20 | $32 | $39 | $104 |

As the vehicle ages, its value depreciates, leading to lower insurance premiums. Therefore, while a brand-new BMW X3 may offer the latest in performance and safety, it will also come with higher insurance costs compared to an older model. Unlock details in our guide titled “What are the recommended auto insurance coverage levels?”

Driver Age

Driver age significantly impacts the cost of BMW X3 car insurance. Auto insurance for teens, particularly those under 25, generally face higher premiums due to their lack of driving experience and higher risk of accidents. As drivers age and gain more experience, their insurance rates typically decrease, reaching their lowest around middle age.

BMW X3 Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $808 |

| Age: 18 | $656 |

| Age: 20 | $225 |

| Age: 30 | $191 |

| Age: 40 | $178 |

| Age: 45 | $165 |

| Age: 50 | $157 |

| Age: 60 | $152 |

However, rates may start to rise again for senior drivers due to potential declines in reaction time and overall driving ability. Consequently, insurance companies adjust premiums based on age-related risk factors, making driver age a crucial determinant in the cost of insuring a BMW X3.

Driver Location

The location where a driver lives can significantly influence BMW X3 insurance rates. Urban areas, with higher traffic congestion and increased risk of accidents and theft, typically see higher premiums compared to rural areas.

BMW X3 Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $223 |

| New York, NY | $206 |

| Houston, TX | $204 |

| Jacksonville, FL | $189 |

| Philadelphia, PA | $174 |

| Chicago, IL | $172 |

| Phoenix, AZ | $151 |

| Seattle, WA | $126 |

| Indianapolis, IN | $111 |

| Columbus, OH | $108 |

Additionally, regions with higher crime rates or severe weather conditions can also drive up insurance costs. Local laws, population density, and even the cost of medical care in the area are factors that insurers consider when setting rates. Therefore, the driver’s location plays a crucial role in determining the overall insurance expense for a BMW X3.

Your Driving Record

Your driving record significantly impacts the cost of insuring a BMW X3, particularly for younger drivers. Teens and drivers in their 20s experience the most substantial increases in insurance rates if they have violations on their record. Read thoroughly our guide on how credit scores affect auto insurance rates.

BMW X3 Full Coverage Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $327 | $490 | $660 | $415 |

| Age: 20 | $238 | $357 | $480 | $302 |

| Age: 30 | $148 | $222 | $298 | $187 |

| Age: 40 | $68 | $102 | $137 | $86 |

| Age: 50 | $65 | $98 | $132 | $83 |

| Age: 60 | $64 | $96 | $130 | $81 |

| Age: 50 | $60 | $89 | $120 | $75 |

| Age: 60 | $58 | $87 | $118 | $74 |

Insurance companies view these drivers as high-risk, resulting in higher premiums to compensate for the increased likelihood of claims. Maintaining a clean driving record is essential for securing lower insurance rates for a BMW X3, emphasizing the importance of safe driving habits.

BMW X3 Safety Ratings

Frequently Asked Questions

What factors affect the cost of auto insurance for a BMW X3?

The cost of auto insurance for a BMW X3 can be influenced by various factors, including the driver’s age, location, driving history, coverage options, auto insurance deductible amount, and the specific model and year of the BMW X3. Insurance providers also consider the cost of repairs and replacement parts for the BMW X3 when determining premiums.

Do I need a specific type of insurance for a BMW X3?

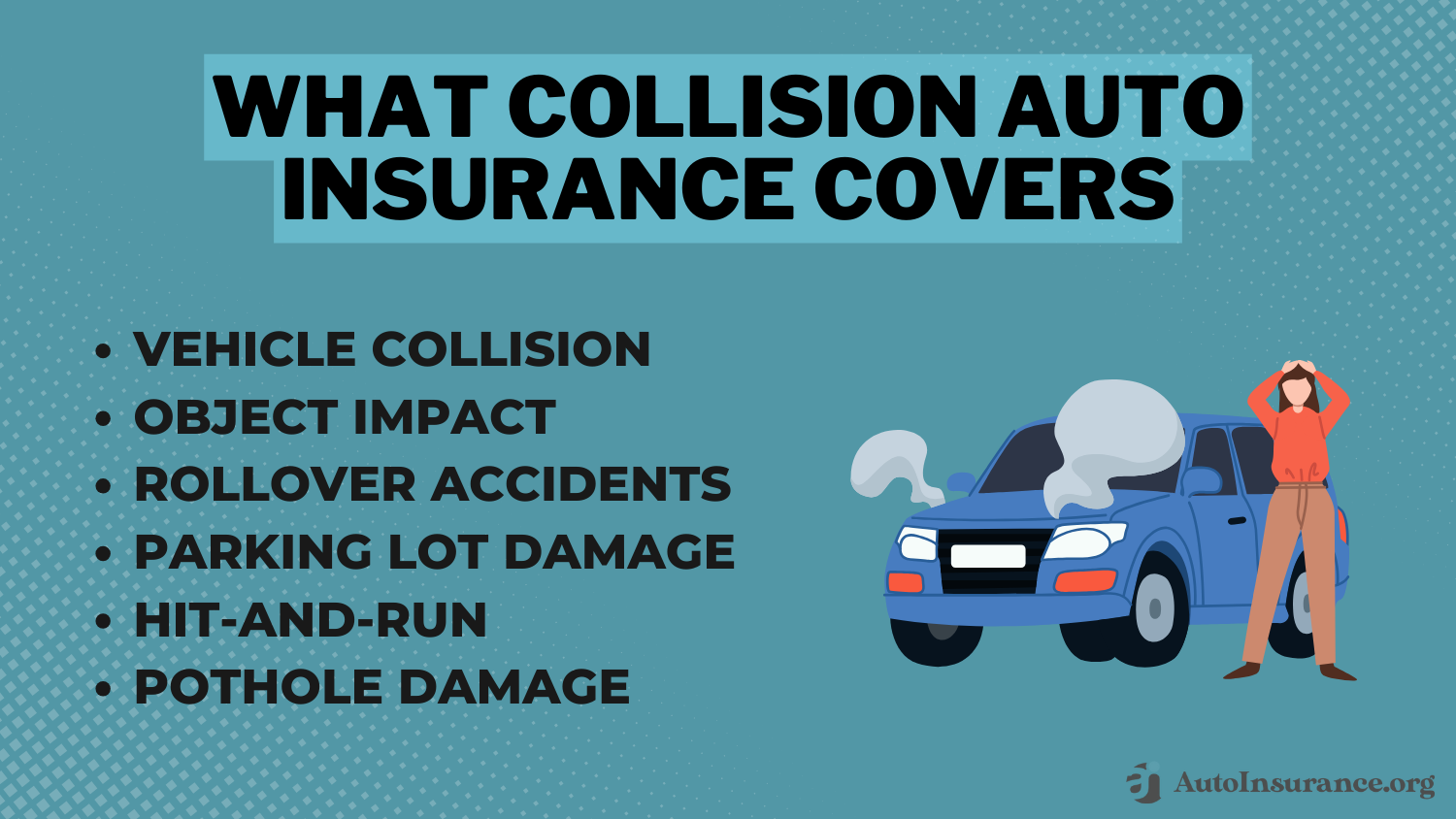

No, you don’t need a specific type of insurance for a BMW X3. However, it’s important to have adequate coverage that meets your needs and the requirements of your state. Common types of insurance coverage for a BMW X3 include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and personal injury protection (PIP) or medical payments coverage.

Are BMW X3 models more expensive to insure compared to other vehicles?

BMW X3 models tend to have higher insurance premiums compared to some other vehicles. This is because BMWs are typically considered luxury vehicles, and their repairs and replacement parts can be more costly. You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Can I get discounts on BMW X3 auto insurance?

Yes, there are various discounts that may be available to help reduce the cost of BMW X3 auto insurance. These can include discounts for being a safe driver, having multiple policies with the same insurance company, completing a defensive driving course, or having certain safety features on the vehicle, such as anti-theft systems or advanced driver assistance systems.

Check out our guide “Why You Should Take a Defensive Driving Class.”

How can I find the best insurance rates for my BMW X3?

To find the best insurance rates for your BMW X3, it’s recommended to shop around and compare quotes from multiple insurance companies. Consider contacting different insurers, using online comparison tools, or working with an independent insurance agent who can provide you with multiple options. Be sure to review the coverage limits, deductibles, and policy terms when comparing quotes.

Are there any specific maintenance or security measures that can help lower BMW X3 insurance costs?

Some insurance providers may offer discounts if you have certain security features installed on your BMW X3, such as an alarm system or tracking device. Additionally, keeping up with regular maintenance and repairs can help prevent accidents and maintain the value of your vehicle, potentially leading to lower insurance costs.

Should I choose a higher deductible to lower my BMW X3 insurance premiums?

Opting for a higher deductible can help lower your BMW X3 insurance premiums. However, it’s important to consider your financial situation and ability to pay the deductible amount in the event of a claim. Choose a deductible that you can comfortably afford in case of an accident or damage to your BMW X3.

Browse into our guide “How to File an Auto Insurance Claim.”

Can I transfer my existing auto insurance policy to a new BMW X3?

Yes, you can typically transfer your existing auto insurance policy to a new BMW X3. However, it’s important to inform your insurance company about the change in vehicle and update your policy accordingly. Depending on the specifics of your policy and the new BMW X3 model, your premiums may be adjusted accordingly.

What are the best companies for BMW X3 auto insurance?

State Farm, Progressive, and Geico are top choices for BMW X3 auto insurance, offering comprehensive coverage at competitive rates.

How much does BMW X3 auto insurance cost?

On average, BMW X3 auto insurance costs around $24 per month. Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.