Best Hollywood, Florida Auto Insurance in 2025 (Compare the Top 10 Companies)

The best Hollywood, Florida auto insurance options include Geico, State Farm and Progressive, with rates starting as low as $105/mo. These providers offer competitive pricing, a variety of coverage options, and valuable discounts, making them ideal choices for drivers seeking affordable and reliable car insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Hollywood Florida

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Hollywood Florida

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Hollywood Florida

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best Hollywood, Florida auto insurance providers are Geico, State Farm, and Progressive, offering competitive rates starting at $105 per month.

Geico stands out for its affordable premiums and extensive discounts, making it the top pick for budget-conscious drivers. For further details, check out our in-depth “What is auto insurance?” article.

State Farm provides personalized service with flexible coverage options, while Progressive delivers innovative tools like Snapshot to help save more. For those in Hollywood, these three companies offer the best balance of price, coverage, and customer satisfaction.

Our Top 10 Company Picks: Best Hollywood, Florida Auto Insurance

| Company | Rank | UBI Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Affordable Plans | Geico | |

| #2 | 30% | B | Reliable Coverage | State Farm | |

| #3 | 30% | A+ | Flexible Options | Progressive | |

| #4 | 30% | A++ | Military Discounts | USAA | |

| #5 | 30% | A | Comprehensive Policies | Liberty Mutual |

| #6 | 30% | A | Customizable Packages | Farmers | |

| #7 | 30% | A++ | Competitive Rates | Auto-Owners | |

| #8 | 40% | A+ | Extensive Network | Nationwide |

| #9 | 30% | A++ | Multiple Discounts | Travelers | |

| #10 | 30% | A | Family-Oriented Service | American Family |

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

- Geico offers the lowest rates for Hollywood, Florida auto insurance at $105/mo

- State Farm provides personalized service with flexible coverage options

- Progressive features innovative tools like Snapshot for additional savings

#1 – Geico: Top Overall Pick

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pros

- Affordable Rates: Geico is a popular choice for affordable auto insurance in Hollywood, Florida, offering low premiums without sacrificing coverage, making it ideal for budget-conscious drivers.

- Online Tools: Geico offers Hollywood, Florida, drivers a user-friendly website and app, allowing easy management of policies, claims, and coverage adjustments—perfect for tech-savvy users.

- Discount Programs: According to Geico auto insurance review, drivers in Hollywood, FL, have discounts for safe driving. Additional savings apply to government employees, military, and students.

Cons

- No Gap Insurance: Geico’s lack of gap insurance can be a drawback for Hollywood, Florida, drivers with financed or leased cars, leaving them to cover the difference if their car is totaled.

- Rental Car Coverage: Geico’s rental car reimbursement in Hollywood, Florida, is limited, with daily caps that may not fully cover rental costs after an accident.

#2 – State Farm: Best for Coverage Options

Pros

- Coverage Options: Offers Hollywood, FL, drivers flexible coverage, including liability, add-ons like rental reimbursement, rideshare insurance, and roadside assistance, allowing customized policies.

- Young Drivers Discounts: State Farm helps young drivers in Hollywood, Florida, reduce premiums with discounts like good student rates and the Steer Clear program for safe driving under age 25.

- Bundling Discount: According to State Farm auto insurance review, Hollywood, FL drivers save by bundling auto and homeowners insurance, reducing costs on both for comprehensive coverage.

Cons

- Higher Premiums: Offers great service but may charge higher rates for Hollywood, Florida, drivers with average or below-average records compared to budget options like Geico or Progressive.

- Discount Opportunities: State Farm offers fewer discounts than other insurers in Hollywood, FL, so drivers qualifying for multiple discounts elsewhere may find less opportunity to lower their premiums.

#3 – Progressive: Best for Insurance Program

Pros

- Insurance Program: In Hollywood, FL, Progressive’s Snapshot program offers discounts for safe drivers who track their behavior via a mobile app or device, making it ideal for cautious motorists.

- Online Tools: App and web resources simplify insurance management for Hollywood FL drivers, allowing them to get estimates, compare policies, pay bills, and file claims easily from their devices.

- Flexible Payment: Progressive offers Hollywood, Florida drivers flexible payment plans—monthly, quarterly, and annual—allowing customers to choose options that best fit their budgets.

Cons

- Higher Rates: Credit information is considered when calculating rates, so Hollywood, Florida drivers with bad credit may face higher premiums, making it less appealing for those struggling financially.

- Accident Forgiveness: Hollywood, FL, does not automatically include accident forgiveness, which could lead to higher rates after an at-fault collision, as noted in our Progressive auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Military Rates

Pros

- Military Rates: According to the USAA auto insurance review, military personnel and their families in Hollywood, FL, have affordable options for individuals in service with cheap rates.

- Generous Discounts: USAA is an affordable option for individuals who serve or have served because it provides military personnel and their families in Hollywood, Florida, with cheap rates.

- Military-focused Benefits: USAA offers benefits tailored for military members and their families in Hollywood, Florida, including coverage for military vehicles and deployment needs.

Cons

- Higher Premiums: Non-military drivers in Hollywood, Florida may find USAA’s rates less competitive since its pricing is tailored for military members.

- Limited Coverage: USAA’s coverage is tailored to military needs, which may not meet the requirements of non-military drivers in Hollywood, Florida, seeking more general options.

#5 – Liberty Mutual: Best for Customizable Coverage

Pros

- Customizable Coverage: According to Liberty Mutual auto insurance review, drivers in Hollywood, FL, can customize coverage, allowing policyholders to meet specific needs.

- Online Tools: Liberty Mutual’s website and app are user-friendly, enabling Hollywood, Florida drivers to manage their policies online, obtain quotes, file claims, and pay bills conveniently.

- Roadside Assistance: In an emergency, the company offers drivers in Hollywood, Florida, peace of mind with optional roadside help coverage.

Cons

- Policy Options: Liberty Mutual’s extensive coverage options can complicate plans, making it challenging for Hollywood, Florida drivers to navigate and select the right coverage.

- No Accident Forgiveness: For drivers in Hollywood, FL, Liberty Mutual does not offer accident forgiveness in their insurance; this could lead to increased premiums following an at-fault collision.

#6 – Farmers: Best for Coverage Options

Pros

- Coverage Options: Farmers offer additional coverage options, like new car replacement and no-deductible glass repair, which benefit Hollywood, Florida residents with specific needs.

- Bundle Discounts: Hollywood, Florida drivers can reduce premium costs by combining their auto and home insurance with Farmers’ attractive bundle discounts.

- Rental and Towing Coverage: The company provides affordable rental reimbursement and towing coverage, which is helpful for Hollywood, Florida, drivers who frequently travel or commute.

Cons

- Rate Increases: Some Hollywood, Florida drivers report rate increases after filing even minor claims, which may concern policyholders worried about rising premiums Farmers auto insurance review.

- Not for High-Risk Drivers: In Hollywood, Florida, Farmers may not be ideal for high-risk drivers, such as those with bad credit or collision histories, who might find better rates with specialized insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Auto-Owners: Best for Discounts for Bundling

Pros

- Discounts for Bundling: According to Auto-Owners auto insurance review, drivers in Hollywood, FL, can save money by offering discounts for combining auto insurance with life, home, or other products.

- Accident Forgiveness: Auto owners in Hollywood, Florida, provide accident forgiveness to their drivers, preventing rate increases following the initial at-fault accidents.

- Claims Processing: Auto-Owners is known for its efficient claims process, ensuring Hollywood, FL, drivers receive timely and fair settlements for quick vehicle repairs or replacements after an accident.

Cons

- No Direct-to-Consumer: Auto-Owners sell insurance exclusively through local agents, so Hollywood, FL drivers cannot buy policies online, which may inconvenience those seeking a self-service option.

- Insurance Options: Auto-Owners does not provide a usage-based insurance program; thus, Hollywood, Florida drivers looking to track habits for discounts may need to explore other options.

#8 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: According to Nationwide Auto Insurance reviewHollywood, FL, drivers can lower their deductible through safe driving, potentially reducing out-of-pocket expenses after an accident.

- Online Tools: Hollywood, Florida drivers can lower their deductible with Nationwide’s vanishing deductible program through safe driving, potentially reducing out-of-pocket expenses after an accident.

- On Your Side Review: Provides Hollywood, FL drivers with an annual “On Your Side Review” consultation to help them assess their insurance needs and adjust coverage as circumstances change.

Cons

- Fewer Discounts: While Nationwide offers some discounts, its selection may be narrower than competitors in Hollywood, Florida, so drivers relying on discounts might find better options elsewhere.

- Usage-based Insurance: Compared to rivals, SmartRide may not be as comprehensive or accessible in Hollywood, Florida, which makes it less appealing to drivers who are tech-aware.

#9 – Travelers: Best for Coverage Options

Pros

- Coverage Options: Provides drivers in Hollywood, FL, with diverse coverage options, including liability, collision, comprehensive, and add-ons like gap and rideshare insurance for tailored policies.

- Discounts Options: Hollywood, Florida drivers can benefit from Travelers’ discounts for safe driving, bundling, full payment, and good credit, making insurance more affordable.

- Accident Forgiveness: Drivers in Hollywood, FL participating in an accident forgiveness program can avoid rate increases following their first at-fault collision, thereby preserving insurance expenses.

Cons

- Claims Processing: Certain Hollywood, Florida policyholders have observed delays in claims processing, which could be inconvenient in an emergency.

- Tech-Savvy Users: According to Travelers auto insurance review, some Hollywood, Florida drivers may find it less user-friendly and feature-rich than competitors’ apps, limiting their digital experience.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Comprehensive Coverage Options

Pros

- Coverage Options: Roadside assistance, ridesharing, and customizable add-ons like collision and liability are among the coverage options that American Family provides drivers in Hollywood, FL.

- Accident Forgiveness: According to the American Family auto insurance review, in Hollywood, FL, drivers keep premiums from rising after their first at-fault collision, protecting their insurance rates.

- DriveMyWay: DriveMyWay, American Family’s usage-based insurance, allows Hollywood, Florida drivers to save on premiums by rewarding safe driving habits.

Cons

- Higher Premiums: Younger drivers or those with past incidents in Hollywood, FL, may face higher premiums, making it less competitive compared to insurers that cater to those demographics.

- Digital Tools: While Hollywood, Florida drivers may find American Family’s web resources less user-friendly than those of competitors, this could disadvantage tech-savvy customers.

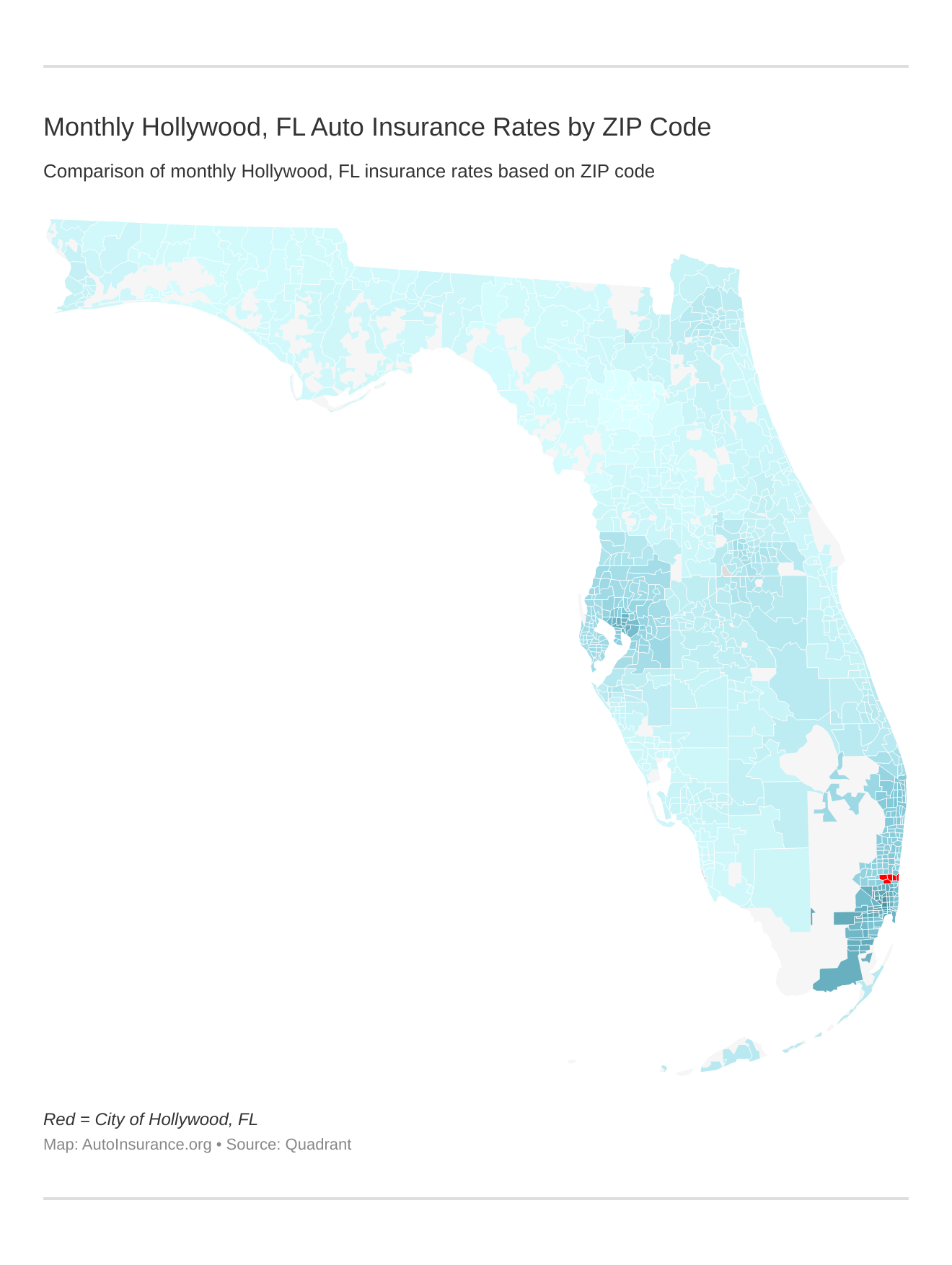

Monthly Hollywood, FL Car Insurance Rates by ZIP Code

Discover how car insurance rates vary across different ZIP codes in Hollywood, FL. This detailed guide breaks down monthly insurance costs, helping you understand how your location can impact your premiums.

Hollywood, Florida Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $141 | $290 | |

| $140 | $285 | |

| $145 | $295 | |

| $125 | $255 | |

| $150 | $305 |

| $136 | $275 |

| $135 | $280 | |

| $130 | $265 | |

| $146 | $296 | |

| $105 | $220 |

Whether you’re exploring new areas or just curious, this information will give you valuable insights into local insurance trends. Get more insights by reading our expert “Auto insurance rates by ZIP code” advice.

Auto Insurance Discounts From the Top Providers in Hollywood, Florida

Insurance Company Available Discounts

Early-Bird, Good Student, Multi-Vehicle, Low Mileage

Multi-Policy, Paid-in-Full, Safety Features, Paperless

Multi-Policy, Good Student, Homeowner, Safe Driver

Multi-Policy, Good Driver, Defensive Driving, Military

Multi-Policy, Early Shopper, Pay-in-Full, Vehicle Safety

SmartRide, Multi-Policy, Accident-Free, Good Student

Multi-Policy, Snapshot Program, Continuous Insurance, Homeowner

Safe Driver, Multi-Car, Good Student, Steer Clear

Multi-Policy, Hybrid/Electric Vehicle, Good Payer, Continuous Coverage

Military, Family Discount, Safe Driver, Loyalty

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by the ZIP code. Find more info about the monthly Hollywood, FL auto insurance rates by ZIP Code below:

Understanding the monthly car insurance rates by ZIP code in Hollywood, FL, empowers you to make informed decisions about your coverage. By comparing costs across different areas, you can find the most affordable insurance options tailored to your specific location.

Hollywood, FL Car Insurance Rates vs. Top US Metro Car Insurance Rates

Explore how car insurance rates in Hollywood, FL, stack up against those in major U.S. metro areas. This comparison highlights the differences in monthly premiums, offering insights into how local factors influence insurance costs.

Whether you’re a Hollywood resident or comparing with other cities, this guide provides a clear picture of your insurance landscape.

Hollywood, FL Auto Insurance Rates vs. Top US Metro Auto Insurance Rates

Location Rate

Chicago $378

Hollywood, FL $520

Houston $398

Los Angeles $445

New York $624

State Average $287

Comparing Hollywood, FL car insurance rates with those from top U.S. metros helps you gauge how your local premiums measure up. This insight can assist in evaluating your current coverage or finding better deals, ensuring you get the best value for your insurance. Expand your understanding with our thorough “Comparing Auto Insurance” overview.

Enter your ZIP code now to compare Hollywood, FL auto insurance quotes from multiple companies near you for free.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Discover the Cheapest Car Insurance Providers in Hollywood, FL

When searching for car insurance in Hollywood, FL, finding the most affordable option can significantly impact your budget.

Hollywood, Florida Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Uninsured Drivers Rate | C | Higher risk due to hurricanes and seasonal storms. |

| Weather-Related Risks | C | Higher-than-average rate of uninsured drivers, common in urban Florida areas. |

| Vehicle Theft Rate | C | Moderate vehicle theft rate, slightly above the national average. |

| Average Claim Size | B | Claims are generally average compared to other cities in Florida. |

| Traffic Density | B | Medium traffic density, with less congestion compared to nearby major cities. |

By exploring the cheapest car insurance providers in the area, you can ensure that you’re getting the best rates without compromising on essential coverage. Our guide highlights top companies offering competitive prices, helping you make an informed choice.

Hollywood, FL Auto Insurance Rates by Company vs. City Average

Insurance Company Difference

45%

-26%

13%

-2%

13%

-30%

-42%

Your car insurance rates are affected by many different factors, such as your age, gender, credit history, and driving record. For more information, explore our informative “Factors That Affect Auto Insurance Rates” page.

Where you live and the size of your city affects your rates also. Larger cities with more crime and traffic will pay more for car insurance. For example, auto insurance in Fort Lauderdale, FL is more expensive than coverage in Hollywood.

Hollywood, Florida car insurance costs by company and age is an essential comparison because the top car insurance company for one age group may not be the best provider for another age group.

Hollywood, FL Auto Insurance Rates by Company and Age

Insurance Company Age: 17 Age: 25 Age: 35 Age: 60

$227 $63 $64 $57

$77 $44 $39 $37

$129 $57 $51 $47

$116 $50 $44 $40

$145 $59 $48 $43

$93 $35 $31 $28

$89 $32 $24 $23

Your driving record will affect your Hollywood, FL car insurance costs. For example, a Hollywood, Florida DUI may increase your car insurance costs 40 to 50 percent. Find the cheapest Hollywood, Florida car insurance costs by driving record.

The Cheapest Hollywood, FL Auto Insurance Rates by Driving Record

Insurance Company Clean record One Accident One DUI One Ticket

$59 $72 $79 $66

$23 $30 $44 $36

$35 $46 $68 $49

$36 $40 $54 $40

$38 $58 $48 $52

$29 $35 $32 $32

$22 $28 $41 $23

Controlling these risk factors will ensure you have the cheapest Hollywood, Florida car insurance. Factors affecting car insurance rates in Hollywood, FL may include your commute, coverage level, tickets, DUIs, and credit.

Factors Affecting Auto Insurance Rates in Hollywood, FL

Label Change

6K vs. 12K Mile Commute 4%

Low vs. High Coverage 5%

Get a Speeding Ticket 16%

Get a DUI 42%

Have an Accident 32%

Good vs. Bad Credit 123%

Age is a significant factor for Hollywood, FL car insurance rates. Young drivers are often considered high-risk. This Hollywood, Florida does use gender as a car insurance factor, so check out the average monthly auto insurance rates by age and gender in Hollywood, FL.

Monthly Cost of Hollywood, Florida Auto Insurance by Age & Gender

Age Male Monthly Rate Female Monthly Rate

Age: 17 $804 $692

Age: 25 $260 $240

Age: 35 $216 $216

Age: 60 $204 $196

Choosing the right car insurance provider is crucial for both savings and protection. By considering the cheapest car insurance options in Hollywood, FL, you can secure a policy that fits your needs and budget. Explore your options today to find the best rates and ensure you’re covered on the road.

Required Auto Insurance Coverage for Drivers in Hollywood, FL

In Hollywood, FL, understanding the required auto insurance coverage is crucial for staying compliant with state laws and ensuring financial protection on the road. Drivers must meet specific minimum coverage levels to legally operate their vehicles and safeguard against potential liabilities.

This guide will break down the essential insurance requirements for Hollywood, FL residents, helping you make informed decisions about your auto insurance policy.

Most states require that drivers carry at least a minimum amount of auto insurance. Florida is no different. The minimum amount of auto insurance required for drivers in Hollywood, Florida is:

- $10,000 in personal injury protection (PIP) coverage.

- $10,000 for property damage liability (PDL).

Ensuring that you meet the required auto insurance coverage in Hollywood, FL is vital for legal compliance and personal protection. By understanding and adhering to these coverage requirements, you can drive confidently, knowing you have the necessary safeguards in place.

Hollywood, Florida Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Accidents per Year | 1,100 |

| Claims per Year | 850 |

| Average Claim Cost | $6,500 |

| Percentage of Uninsured Drivers | 17% |

| Vehicle Theft Rate | 320 thefts/year |

| Traffic Density | Medium |

| Weather-Related Incidents | High |

For further details or assistance in selecting the right policy, consult with a local insurance expert to ensure your coverage meets all legal and personal needs. Read our extensive guide on “Auto Insurance Coverage” for more knowledge.

The Elements That Determine Auto Insurance Rates in Hollywood, FL

Traffic congestion and theft rates are crucial factors influencing auto insurance rates in Hollywood, FL. High traffic volumes increase the likelihood of accidents, while theft statistics also play a role in determining premiums.

Despite INRIX not having specific data for Hollywood, nearby Miami ranks as a highly congested city, impacting regional insurance trends. Learn more by visiting our detailed “Where to Compare Auto Insurance Rates” section.

Understanding how traffic density and theft rates affect your insurance premiums can help you make informed decisions. With Hollywood’s significant commute times and notable theft statistics, it’s essential to consider these factors when evaluating your auto insurance options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Hollywood, FL Auto Insurance: Key Takeaways

When it comes to auto insurance in Hollywood, FL, understanding the key factors that influence rates can make a significant difference in your coverage choices. From local traffic patterns to specific coverage needs, knowing the bottom line helps you navigate the best options available.

With a wide range of discounts and digital tools, Geico offers great value without sacrificing coverage quality.Travis Thompson Licensed Insurance Agent

In summary, evaluating your auto insurance needs in Hollywood, FL involves considering various elements such as local traffic conditions and personal coverage requirements. Dive deeper into “How to Evaluate Auto Insurance Quotes” with our complete resource.

By focusing on these aspects, you can ensure you make informed decisions and secure the best value for your auto insurance. Enter your ZIP code now to compare Hollywood, FL auto insurance rates from companies near you for free.

Frequently Asked Questions

How much is normal car insurance in Hollywood, Florida?

Normal car insurance in Hollywood, Florida typically averages around $105 per month. This rate can fluctuate based on various factors such as your driving record, the type of vehicle you drive, and the level of coverage you select. It’s important to compare quotes from different providers to find the most cost-effective option for your specific situation.

What insurance company is usually the cheapest in Hollywood, Florida?

In Hollywood, Florida, Geico is often recognized as one of the cheapest insurance companies due to its competitive pricing structure. They frequently offer lower rates compared to other providers, thanks to their large customer base and efficient operations. However, individual rates can vary, so it’s wise to get quotes from multiple insurers.

Discover our comprehensive guide to “Cheapest Liability-Only Auto Insurance” for additional insights.

What is the number one car insurance in Hollywood, Florida?

Geico is frequently considered the number one car insurance provider in Hollywood, Florida due to its combination of affordable rates and comprehensive coverage options. Their extensive network and reputation for reliable customer service make them a top choice for many drivers in the area.

How much is monthly car insurance in Hollywood, Florida?

Monthly car insurance premiums in Hollywood, Florida generally start around $105. This cost can be influenced by factors such as the driver’s age, driving history, and the type of vehicle insured. It’s essential to assess various policies and providers to ensure you get the best value for your money.

Why is it hard to get insurance in Hollywood, Florida?

Getting insurance in Hollywood, Florida can be challenging due to several factors, including high traffic congestion, elevated accident rates, and increased crime levels. These elements contribute to higher insurance premiums and can make it more difficult to secure affordable coverage.

Explore our detailed analysis on “How to Find Auto Insurance Quotes Fast” for additional information.

Does Hollywood, Florida have an insurance problem?

Hollywood, Florida does face some insurance challenges, particularly related to high rates due to local traffic conditions and crime statistics. These issues can impact the overall affordability and availability of insurance in the area, making it a complex market for drivers.

Why is USAA car insurance so expensive in Hollywood, Florida?

USAA car insurance can be more expensive in Hollywood, Florida because it offers high coverage limits and extensive benefits that come at a premium. Their comprehensive policies and exceptional customer service contribute to higher costs, particularly in areas with elevated risk factors.

At what age is car insurance cheapest in Hollywood, Florida?

Car insurance is typically cheapest for drivers in their 30s and 40s in Hollywood, Florida. Drivers in this age group are often seen as less risky compared to younger drivers, which results in lower premiums. Insurance rates generally increase for drivers under 25 and can start to rise again for those over 65.

Continue reading our full “Companies With the Cheapest Teen Auto Insurance” guide for extra tips.

Who is the largest insurance company in Hollywood, Florida?

State Farm is often identified as the largest insurance company in Hollywood, Florida. With a wide array of coverage options and a substantial market presence, State Farm has established itself as a leading provider in the area.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Who offers the best auto insurance coverage in Hollywood, Florida?

Geico, State Farm, and Progressive are frequently noted for offering some of the best auto insurance coverage in Hollywood, Florida. Each of these companies provides comprehensive policies, a variety of coverage options, and strong customer service, making them top choices for many drivers.

Is Allstate insurance good in Hollywood, Florida?

Allstate is considered a good option for insurance in Hollywood, Florida due to its reliable coverage options and customer support. Although it may not always be the cheapest, Allstate is known for its extensive range of discounts and quality service.

Learn more by visiting our detailed “How do I compare auto insurance quotes?” section.

Is Geico more expensive in Hollywood, Florida?

While Geico is often known for its competitive rates, there can be cases where it may appear more expensive depending on the specifics of your policy and individual circumstances. However, Geico generally offers lower premiums compared to many other providers in Hollywood, Florida.

Why is Allstate more expensive in Hollywood, Florida?

Allstate may be more expensive in Hollywood, Florida due to its comprehensive coverage options and higher customer service standards. Their policies often include additional benefits and higher coverage limits, which can result in increased premiums compared to other providers.

Who is Geico’s biggest competitor in Hollywood, Florida?

In Hollywood, Florida, Progressive is one of Geico’s biggest competitors. Both companies offer similar coverage options and competitive pricing, making them direct rivals in the insurance market. Progressive is known for its flexible policies and competitive rates.

Expand your understanding with our thorough “Where can I compare online auto insurance companies?” overview.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.