Best Auto Insurance for Seniors in 2025 (Top 9 Companies Ranked)

AARP, Progressive, and Geico have the best auto insurance for seniors, with monthly rates starting at $42 a month. AARP offers personalized service and an extensive repair network, while Geico is the most affordable option for all drivers. Seniors can also save up to 30% with a defensive driving discount.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Jun 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

123 reviews

123 reviewsCompany Facts

Full Coverage for Seniors

A.M. Best

Complaint Level

Pros & Cons

123 reviews

123 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Seniors

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Seniors

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsAARP, Progressive, and Geico offer the best auto insurance for seniors, starting at just $42 a month. AARP offers personalized service, Progressive has multiple safe driving discounts, and Geico provides seniors with budget-friendly rates.

Our Top 9 Company Picks: Best Auto Insurance for Seniors

| Company | Rank | Defensive Driving | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 30% | A++ | Personalized Service | AARP | |

| #2 | 30% | A+ | Safe-Driving Discounts | Progressive | |

| #3 | 15% | A++ | Affordable Rates | Geico | |

| #4 | 15% | A++ | Many Discounts | State Farm | |

| #5 | 10% | A+ | Usage-Based Coverage | Nationwide |

| #6 | 10% | A+ | Infrequent Drivers | Allstate | |

| #7 | 10% | A | 24/7 Support | Liberty Mutual |

| #8 | 10% | A | Convenient Tools | Farmers | |

| #9 | 5% | A++ | Military Members | USAA |

As drivers age, insurance needs shift — for retirees, reduced commuting means fewer miles. These common changes affect coverage needs, and senior drivers should adjust their insurance accordingly at the best auto insurance companies to maintain cheap auto insurance rates.

Make sure you get the most out of your policy and enjoy affordable auto insurance for seniors.

- Senior drivers might face higher rates due to vision decline and slower reactions

- Seniors can get up to 25% off by bundling auto insurance with other policies

- USAA offers the cheapest full coverage for seniors

Enter your ZIP code to explore which companies have the cheapest auto insurance rates for you and compare quotes with our free tool.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare the Best Auto Insurance Rates for Seniors

Car insurance for older drivers may be pricy due to their higher risk of being in a crash. Declining vision, decreased reaction time, medication side effects, and more can all impact a senior driver’s risk of crashing and filing a claim. To offset that risk, most car insurance companies will increase insurance rates for drivers as they age.

Senior Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $78 | $113 | |

| $86 | $223 | |

| $75 | $194 | |

| $42 | $112 | |

| $95 | $243 |

| $62 | $160 | |

| $55 | $147 | |

| $47 | $120 | |

| $31 | $82 |

However, picking one of the best auto insurance companies with cheaper rates for senior drivers can help keep your car insurance rates low. Some insurers even offer special pricing on policies marketed as senior citizen car insurance or car insurance for elderly drivers. Scroll down to see how average auto insurance rates for senior drivers vary among insurance companies.

What is the cheapest car insurance for seniors? Geico auto insurance is one of the top choices for car insurance for seniors over 60, with the cheapest average rates for senior drivers. State Farm and Progressive also offer reasonable average rates for seniors.

Read More:

We recommend getting quotes from a few different insurance companies on this list, as rates can vary based on your personalized driving profile and coverage needs. However, these companies are a good starting point when searching for cheap senior car insurance.

Senior Citizen Auto Insurance Discounts

While companies may increase rates as drivers age, you can continue saving on senior car insurance by following our tips below. We’ve outlined the best auto insurance discounts and other ways to save on car insurance for senior drivers.

Bundle Your Insurance Policies

One way to save money is by bundling insurance policies. Buying more than just car insurance from one company can save you money. For example, if your car insurance company offers more than one type of insurance, you can bundle your auto policy with home, renters, or condo insurance.

Depending on where you shop, you may also be able to bundle auto insurance with motorcycle, RV, boat, life, or health insurance. Some insurers offer bundle discounts on top of already competitive rates for seniors, so it’s a good way to find cheap car insurance for seniors without sacrificing coverage.

Read More: How To Save Money by Bundling Insurance Policies

Just consider the cost of the other types of insurance from your auto insurance company. Your insurance company may have cheap senior citizen auto insurance but expensive home insurance, making it more cost-effective to purchase home insurance elsewhere, even after the bundling discount.

Ask About All Available Discounts

Providers understand that many seniors are experienced drivers, who, depending on when they earned their driver’s license, may have been operating vehicles for decades. Most senior drivers have extensive experience driving in a variety of settings and weather conditions, and as a result, are typically considered competent drivers.

As a result, companies may offer discounts to attract business from drivers who are deemed safe and reliable.

Some insurance companies offer renewal discounts to loyal customers who’ve stayed with them for an extended period.Daniel Walker Licensed Auto Insurance Agent

Another way for retirees to get a discount and save on senior car insurance is to join an organization like the American Association of Retired Persons, which offers membership programs that include car insurance discounts.

Top Auto Insurance Discounts Available for Seniors

| Company | Anti-Theft | Bundling | Claims-Free | Loyalty | Safe Driver |

|---|---|---|---|---|---|

| 10% | 10% | 10% | 10% | 10% | |

| 10% | 25% | 10% | 15% | 10% | |

| 10% | 20% | 9% | 12% | 20% | |

| 25% | 25% | 12% | 10% | 15% | |

| 35% | 25% | 8% | 10% | 20% |

| 5% | 20% | 14% | 8% | 12% | |

| 25% | 10% | 10% | 13% | 10% | |

| 15% | 17% | 11% | 6% | 20% | |

| 15% | 10% | 20% | 11% | 10% |

In addition, some auto insurance companies also offer discounts to retired military veterans and personnel as a sign of appreciation for their service and commitment.

Read More: Best Auto Insurance for Good Drivers

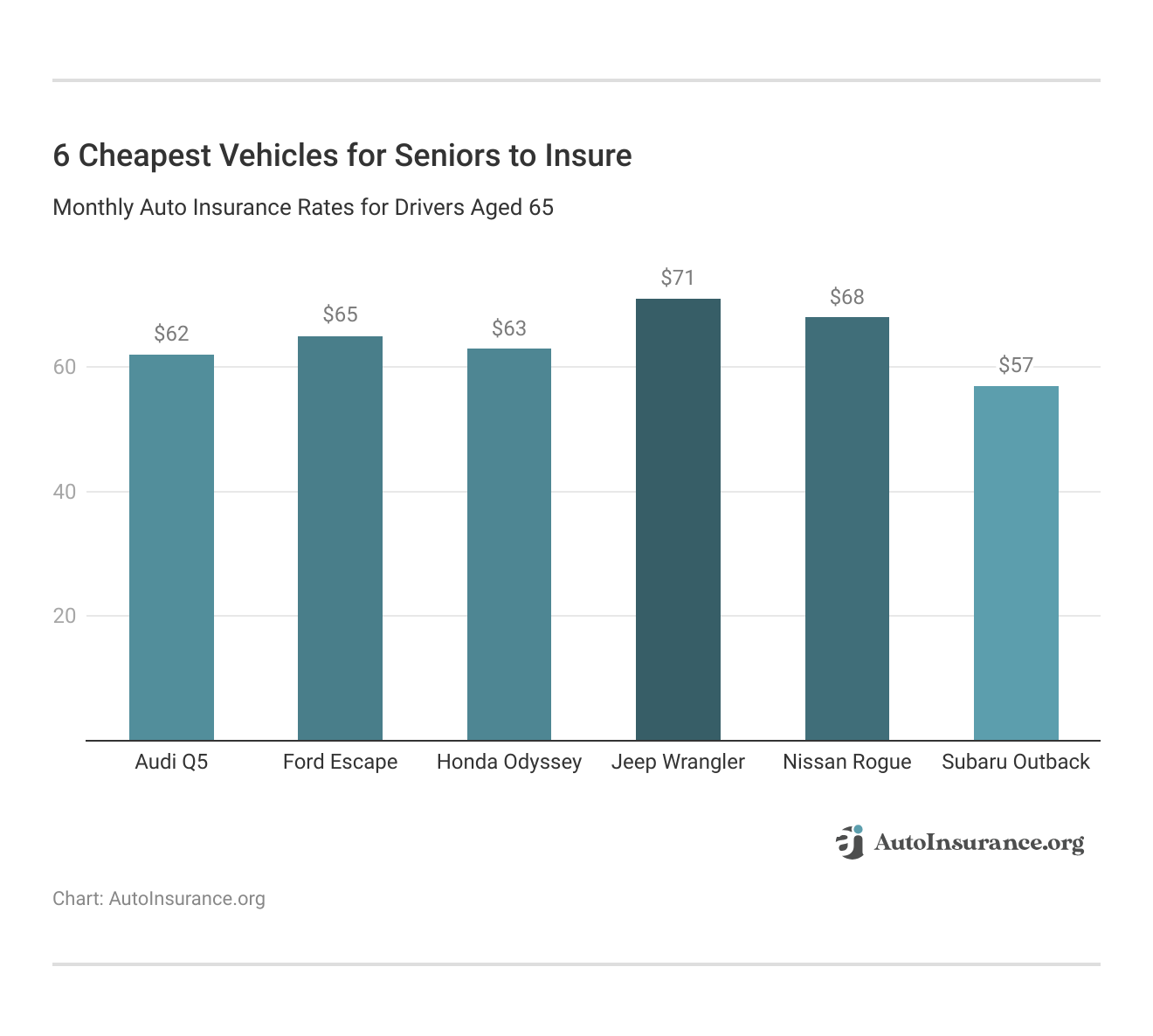

Choose Cheaper Cars

Some cars are significantly cheaper to insure. The cheapest cars to insure will have low repair costs and affordable replacement parts. Vehicles with great safety features that prevent crashes and protect passengers in crashes also come with lower auto insurance rates. Wondering which cars have the lowest auto insurance premiums?

Take a look at the top six cars for cheap senior car insurance rates below.

The Subaru Outback, Honda CR-V, and Toyota Rav-4 are usually cheaper to insure because they’re safe, reliable, and don’t cost a fortune to fix.

Whether you can afford to upgrade your current car to make it safer or buy a new vehicle altogether, insurance companies are more likely to offer lower rates if your car is equipped with modern safety features.

Some of these include airbags, crumple zones, safety cages, anti-lock braking systems, and parking sensors, among others.

My dad traded in his old Ford Taurus for a Honda CR-V, and his insurance went down by almost $40 a month.Laura Berry Former Licensed Insurance Producer

Research online or consult with an automotive dealer or insurance provider to determine which vehicles are best suited for senior drivers and may result in lower insurance rates for you.

Consider Pay-Per-Mile Car Insurance

If you find yourself driving less than 13,000 miles a year, it can be worth looking into pay-per-mile or pay-as-you-go auto insurance companies. With cheap usage-based auto insurance, you pay a daily set rate of a few dollars per day and then a few cents per mile driven. Pay-per-mile insurance could offer significant savings on insurance for seniors’ automobiles if you only make a few trips a week.

If you don’t want to switch to usage-based car insurance, you may still get a discount for driving less. Contact your insurance company and tell them about your new reduced mileage to see if they offer a low-mileage discount.

Read More: Best Low-Mileage Auto Insurance Discounts

After all, the less you are on the road, the less likely it is that you will get into a crash and file a claim.

Review Your Auto Insurance Policy

Review the policy you’re currently paying for to determine if your circumstances have changed. The amount and type of coverage you need may be different now from when you originally took out the policy. In other words, your current car insurance may no longer suit your driving habits.

Some of the things to consider when you review your current policy include:

- Are you driving your car as often?

- When are you typically driving the car?

- Do you drive in high-traffic areas more or less these days?

- Are you driving less often at night or traveling shorter distances?

- Have there been any changes in terms of who is driving your car?

The answers to these questions could determine the kind of insurance policy you need as a senior driver and help you get the best car insurance rates for seniors.

Due to the fact that many seniors are reliant upon fixed or diminished income, you will want to ensure you are protected from any costly accident damages.

While most states require you to have liability insurance to drive a car, you may want to explore additional coverage if you haven’t carried any for your vehicle in the past. You can drop non-essential insurance coverages to reduce your insurance rates.

For example, if you have rental car insurance but no longer drive much, you probably won’t need a rental car if your car needs to be repaired. You could also drop coverages like roadside assistance if your car is in good condition and you aren’t traveling long distances from home.

Read More: Does my auto insurance cover rental cars?

If your vehicle is older, you may also want to drop collision and comprehensive coverage if the annual cost is worth about 10% of your car’s total value. Otherwise, you may end up paying more for collision and comprehensive coverage than you would receive in an insurance claim payout.

Make sure to review your current car insurance and any new policy you’re considering carefully to ensure it provides coverage at a price you can afford.

Install Anti-Theft Devices

One way to reduce your car insurance costs for comprehensive insurance is to install anti-theft devices. Most insurance companies offer discounts for anti-theft devices, as they help lessen the likelihood of a car being broken into or stolen.

Common anti-theft devices include GPS trackers, VIN etching, and vehicle recovery devices.

Keep in mind that the anti-theft device discount usually only applies to your comprehensive auto insurance coverage. Because comprehensive insurance covers car theft and vandalism, anti-theft devices only reduce your risk of filing a comprehensive claim. If you don’t carry comprehensive coverage, then anti-theft devices may not reduce your monthly insurance rates.

Raise Your Auto Insurance Deductible

Your auto insurance deductible is the amount you agree to pay out-of-pocket for repairs on a covered claim. According to the Insurance Information Institute (III), raising your insurance deductible on some or all of your insurance coverages can reduce your auto insurance rates. This is because you assume more financial responsibility after a crash by agreeing to pay the higher deductible amount.

However, you should only raise your deductible if you can afford to pay the higher out-of-pocket amount. Otherwise, you may be unable to afford to get your car fixed after a covered claim.

For example, if you raise your deductible to $2,000 and your car needs $5,000 worth of repairs, your car insurance company will only give you $3,000. Unless you have $2,000 saved up, you won’t be able to get your car repaired until you can pay your deductible.

Shop Around for Auto Insurance Quotes for Seniors

We’ve saved our best tip for last — shop around for car insurance quotes for older drivers to find the best deal from different companies. Even if you’ve been with the same company for some time and are happy with the service they have provided, it doesn’t hurt to look around and see if more affordable and suitable policies are available.

Read More: How to Evaluate Auto Insurance Quotes

Whether it’s finding low-cost auto insurance for seniors or securing the best car insurance for elderly drivers, shopping around could save you some serious money.

Some providers will match or beat what another competitor is offering, which could be extremely useful if you decide to renew or change your policy.Kristen Gryglik Licensed Insurance Agent

If you’re living on a fixed income, researching what each insurance provider is offering for cheap car insurance over 80 or cheap car insurance over 60 could save you some serious money and will be well worth your time.

Because your insurance rates and needs change over time, getting car insurance quotes for senior citizens once or twice a year will ensure you are still getting the cheapest rates based on your individual needs. You can use an insurance broker, a free online quote comparison tool, or apply for seniors auto insurance quotes directly from an insurance company’s website to get multiple insurance quotes.

Improve Your Driving History

Although many insurance providers view seniors as reliable and safe drivers, the premiums elderly people pay to drive often increase as they grow older, particularly after the age of 65.

Drive a Subaru? They’re safe and reliable, so have been a favorite 🏆for decades. You might be overpaying for auto insurance, though. https://t.co/27f1xf1ARb has tips and tricks to help you save🤑. Check it out here👉: https://t.co/HDP8K2bnj0 pic.twitter.com/atZksUQD0O

— AutoInsurance.org (@AutoInsurance) December 3, 2023

As people age, their reflexes and overall health generally deteriorate, making them more likely to be involved in a car accident. Any documented health issues, particularly those that affect driving, such as poor eyesight, could also have an impact on the kind of insurance rates offered.

In order to demonstrate to insurance providers that you continue to be a safe and competent driver, you may want to consider enrolling in driving lessons to improve your chances of receiving affordable car insurance.

Organizations like Safety Center Incorporated offer driving lessons that are specifically oriented toward drivers over the age of 55.

Courses like this help educate seniors about new safety issues and laws that some elderly people might not be familiar with and typically offer insights on how aging and various kinds of medication might affect someone’s driving. Seniors who have completed these lessons are more likely to receive lower car insurance rates as a result.

Some insurance companies offer seniors a pre-approved defensive driving course. It may be offered by the company or through a third party, such as AAA (Read More: How to Get a Defensive Driver Auto Insurance Discount).

Defensive driving classes must be successfully completed with a passing grade in order to receive the discount. The courses teach valuable information on safe driving techniques and habits, such as how medications may affect a senior’s driving ability.

#1 – AARP: Top Pick Overall

Pros

- Personalized Service: AARP offers tailored coverage and support to meet the unique needs of senior drivers.

- Wide Repair Network: The Hartford, through AARP, provides seniors access to a wide network of repair shops and guaranteed lifetime renewability.

- Senior-Friendly Claims Support: Claims agents are trained to work with older adults, making the process simpler and less stressful.

Cons

- AARP Membership Required: You’ll need to join AARP, though the senior membership is affordable and comes with other benefits

- Limited Availability: AARP senior membership is required to access coverage through The Hartford. You can learn more in our AARP auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Safe-Driving Discounts

Pros

- Safe Driver Discount: Progressive’s Snapshot program can benefit seniors by offering potential premium savings based on actual driving behavior. Learn more in our Progressive auto insurance review.

- Strong Online Support: Easy claims process and 24/7 customer service for seniors who prefer managing everything online.

- Convenient Tools: Progressive’s user-friendly website and mobile app make it easy for seniors to manage their policies and track potential discounts.

Cons

- Higher Rates: Progressive’s rates can be on the higher side for drivers looking for cheap car insurance for senior citizens, especially for basic coverage.

- Snapshot Can Backfire: If your driving habits as a senior don’t meet the app’s “safe” criteria, your rates may increase.

#3 – Geico: Best for Affordable Rates

Pros

- Competitive Rates: Geico typically offers competitive rates and easy online policy management, making it a popular choice for car insurance for senior drivers.

- Simple Mobile App: Geico’s mobile app and online tools make it easy to manage policies and file claims, even for those shopping for auto insurance for seniors over 80.

- Reliable Roadside Help: Covers lockouts, dead batteries, and other issues that older drivers might encounter. You can read more about Geico’s car insurance for seniors in our Geico auto insurance review.

Cons

- Limited Specialized Features: Geico might not offer as many specialized features or endorsements tailored specifically for seniors as other insurers.

- Varied Customer Service: Customer service quality can vary depending on the region, which may impact seniors who prefer personalized assistance.

#4 – State Farm: Best for Many Discounts

Pros

- Variety of Discounts: Seniors may qualify for multiple discounts, including safe driver, low-mileage, and defensive driving course savings, helping reduce overall premiums.

- Medical Coverage Option: Medical payment coverage helps with injury costs, regardless of fault, and is a smart add-on for senior drivers. You can learn more in our State Farm auto insurance review.

- Agent Network: State Farm’s extensive network of agents provides personalized support and can help seniors compare options to find the right senior car insurance quote.

Cons

- Higher Rates: State Farm’s rates may be higher compared to some other insurers, especially for seniors seeking minimum coverage.

- Limited Coverage Flexibility: State Farm offers fewer customizable add-ons than some competitors, which may not suit seniors with specific coverage needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Usage-Based Coverage

Pros

- SmartMiles Program Available: Seniors who drive less can save with this pay-per-mile option, which is perfect for retirement lifestyles.

- Vanishing Deductible: Nationwide’s Vanishing Deductible program can benefit seniors by reducing deductibles over time for safe driving. Learn more in our Nationwide auto insurance review.

- On Your Side Review: Annual policy check-ins help ensure your coverage still meets your needs as a senior driver.

Cons

- Fewer Senior Discounts: Unlike AARP or USAA, which rank among the best car insurance companies for senior citizens, Nationwide doesn’t offer retiree-specific savings.

- Discount Variability: Availability of discounts may vary depending on location, impacting seniors’ ability to get cheap car insurance rates.

#6 – Allstate: Best for Infrequent Drivers

Pros

- Great for Light Drivers: Seniors who drive less frequently can benefit from usage-based discounts and potentially lower premiums through Allstate’s mileage-sensitive programs.

- Convenient Tools: Allstate’s mobile app and online tools provide convenient policy management options for seniors (Read More: Allstate Drivewise review).

- Accident Forgiveness: Allstate’s accident forgiveness program can be beneficial for seniors concerned about potential rate increases after an accident.

Cons

- Not Ideal for Retirees: If you drive very little, other companies may offer cheaper auto insurance for senior citizens through low-mileage or usage-based plans.

- Monitoring Requirements: Some discounts offered by Allstate may require seniors to install tracking devices or participate in monitoring programs, which may not be appealing to all seniors.

#7 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Support: Liberty Mutual provides around-the-clock claims and customer service, which is helpful for seniors who value accessible assistance at any time.

- Defensive Driving Discount: Seniors in 34 states can earn savings by completing an approved defensive driving course.

- RightTrack Program: Eligible senior driver can receive discounts by allowing Liberty Mutual to monitor their driving habits via a mobile app or device. Learn more in our Liberty Mutual auto insurance review.

Cons

- Rates Can Vary: Liberty Mutual’s prices for basic coverage can depend on things like seniors’ driving records, where you live, and the coverage you choose.

- Discounts Aren’t Guaranteed: The discounts seniors receive may vary depending on their location and specific policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Convenient Tools

Pros

- Convenient Tools: Farmers offers convenient online tools and resources for seniors to manage their policies and access assistance.

- Senior Discounts: Farmers offers a range of discounts for seniors, such as those for safe driving habits or multiple policies (Read More: Farmers auto insurance review).

- Signal App With CrashAssist: The Signal app helps seniors save on car insurance rates by tracking safe driving and offers CrashAssist, which can alert emergency services in the event of an accident.

Cons

- Higher Premiums: Farmers’ rates may be higher for seniors seeking minimum coverage compared to some other insurers.

- Discount Availability: Availability of discounts may vary depending on location, impacting seniors’ ability to lower premiums.

#9 – USAA: Best for Military Members

Pros

- Exceptional Service: USAA’s exceptional customer service and claims handling can provide peace of mind for seniors and their families.

- Designed for Military Families: They focus on the needs of senior service members and their families, offering coverage and benefits made for those who have served and retired.

- Online Tools: USAA offers a range of online tools and resources for seniors to manage their policies and access support. You can learn more in our USAA auto insurance review.

Cons

- Limited Eligibility: USAA is only available to military members, veterans, and their families, limiting eligibility for seniors without military affiliation.

- Eligibility Requirements: USAA’s eligibility requirements may exclude some seniors from accessing its coverage options.

Finding the Best Auto Insurance for Seniors

Companies with the best auto insurance for seniors include AARP, Progressive, and Geico, with premiums as low as $31 a month. Finding the best auto insurance for senior citizens requires shopping around and comparing rates, as well as considering a senior driver’s new coverage needs and driving habits.

Read More: How much car insurance do I need?

Senior drivers can take advantage of senior car insurance discounts like defensive driving discounts, low-mileage discounts, insurance bundling, and more to score cheap car insurance for elderly drivers.

If you are a senior driver looking to reduce your insurance rates, start by comparing online quotes for auto insurance for seniors.

Use our free quote comparison tool below to find the best auto insurance for seniors from companies in your area. It will help you find coverage no matter where you live, whether you are shopping for car insurance for over 80 drivers or the cheapest car insurance for seniors over 60.

Frequently Asked Questions

How does age impact auto insurance rates?

Age always has an impact on car insurance rates, as there are different age-related risks throughout a driver’s life. For example, teenage drivers are charged more, as statistics show they are more likely to be involved in crashes due to their inexperience.

Who has the cheapest car insurance rates for senior drivers?

A common question we get is, “Who has the cheapest car insurance for seniors?” Well, which company is the cheapest for senior drivers depends on their individual driving records and car insurance needs. However, USAA usually has the cheapest senior car insurance rates, starting at $31 per month for senior drivers.

Can auto insurance rates increase for seniors?

Auto insurance rates can increase for seniors due to age-related factors like slower reflexes or health issues. Factors that affect auto insurance rates, such as driving record, claims history, vehicle type, and location, help determine premiums. Still, seniors with safe driving records may qualify for discounts to offset higher costs.

What are the best insurance discounts for senior drivers?

Some car insurance discounts senior drivers should consider include defensive driving, bundling, and safe driving discounts. Those who drive less can also benefit from usage-based programs. These options can help secure discount auto insurance for seniors.

Is car insurance higher for seniors?

Rates on the cheapest car insurance for seniors over 80 may increase slightly due to health issues like vision problems, but that’s not always the case. You can still find affordable options through car insurance discounts for seniors, such as safe driving or low mileage. In many cases, car insurance for people over 50 is cheaper than for younger drivers since they’re seen as lower risk.

Are there any age restrictions for getting auto insurance as a senior?

There are no age limits for senior auto insurance, but companies may have different rules. For example, car insurance for seniors over 70 may require extra info like medical exams or driving record checks, so check each insurer’s specific requirements.

Read More: Cheap Auto Insurance for Drivers Over 70

What is the best car insurance for senior veterans?

If you’re wondering, “What is the best car insurance for senior citizens?” AARP offers affordable rates and personalized service. Compare the best auto insurance for seniors reviews to determine which company best suits your situation.

Should seniors research insurance options before buying new coverage?

Yes, it is essential to research insurance options before buying new car insurance for older people. Be aware of cancellation policies if you decide to switch providers, and ensure that your new car insurance is in place when needed.

Read More: How to Buy Auto Insurance Online Instantly

Why is it important for seniors to compare insurance providers?

Comparing insurance providers allows seniors to find the most affordable and suitable policies for their needs. Even if you are satisfied with your current provider, exploring other options can potentially save you money on auto insurance as a senior.

What factors should seniors consider when searching for the best auto insurance?

When searching for the best car insurance for people over 50, seniors should consider coverage options, pricing, customer service, policy flexibility, available senior discounts, and the insurer’s financial strength.

Read More: How long does it take to compare auto insurance quotes?

Are there specific insurance companies known for providing excellent coverage for seniors?

AARP, Progressive, and Geico are top choices for seniors. To find the best fit, get a senior’s car insurance quote and compare coverage options by entering your ZIP code into our free quote tool.

Who has the cheapest car insurance in Florida for seniors?

Finding cheap auto insurance for senior citizens in Florida comes down to comparing rates. Many providers offer cheap car insurance for elderly drivers, with discounts for safe driving and bundling. Be sure to check options like car insurance for older people from Geico, State Farm, and others to find the cheapest and best auto insurance for seniors in Florida.

Can seniors qualify for any special discounts or benefits?

Yes, seniors often qualify for mature driver discounts and savings from completing defensive driving courses. Be sure to ask about discounts when looking for affordable car insurance for senior citizens.

Is there low-income auto insurance for seniors?

A few states do offer low-income assistance programs for car insurance, such as California, Hawaii, and New Jersey. If your state doesn’t have an assistance program, you can still find cheap insurance for seniors by shopping around for quotes.

Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.