Wisconsin Minimum Auto Insurance Requirements for 2025 (Basic WI Coverage Guide)

Wisconsin minimum auto insurance requirements are 25/50/10, which includes $25,000 for injury to one person, $50,000 for total injuries per accident, and $10,000 for property damage. Car insurance rates in Wisconsin begin at $16/month, and comparing quotes can lead to additional savings.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Feb 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Wisconsin drivers need to know the state’s minimum auto insurance requirements. They must have liability coverage of at least $25,000 for injury per person, $50,000 for total injuries in one accident, and $10,000 for property damage. This basic coverage helps pay for damages and injuries caused to others in an accident.

Prices start at just $16 per month, making it important for Wisconsin drivers to seek affordable insurance options. Top providers offering competitive rates in Wisconsin include USAA, State Farm, and American Family. Many insurers provide additional coverage options such as collision insurance, comprehensive, uninsured/underinsured motorist protection, and medical payments coverage.

Wisconsin Minimum Auto Insurance Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $10,000 per accident |

Exploring these coverages can help you stay protected in various accident scenarios. By comparing quotes and exploring available coverage and savings options, you can find the best car insurance policy that meets state requirements and fits your budget.

To lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool above to compare rates from top insurers.

- Wisconsin minimum auto insurance requires 25/50/10 liability coverage

- Drivers in Wisconsin should compare rates to find affordable coverage

- Understanding Wisconsin insurance requirements helps avoid penalties

Wisconsin Minimum Coverage Requirements & What They Cover

Wisconsin auto insurance laws require all drivers to have basic insurance to drive legally and cover costs if accidents happen. These rules help make sure drivers can pay for damages and injuries they cause in a crash.

- Bodily Injury Liability: Pays for injuries caused to other people if you’re at fault in an accident. This coverage is mandatory under Wisconsin car insurance law to protect others on the road.

- Property Damage Liability: Covers damage you cause to someone else’s vehicle or property, such as fences or mailboxes. This coverage is part of the Wisconsin car insurance requirements.

Under Wisconsin car insurance laws, drivers must carry at least the state’s minimum coverage, often called WI minimum car insurance coverage. This includes $25,000 per person and $50,000 per accident for bodily injury liability, which covers injuries caused to others in an accident. Additionally, drivers must have $10,000 in property damage liability to cover damages to another person’s property.

Wisconsin auto insurance laws also mandate uninsured motorist (UM) coverage to address accidents involving uninsured drivers. This includes $25,000 per person and $50,000 per accident for injuries caused by drivers without insurance. These minimum requirements ensure that drivers are protected even when the at-fault party lacks coverage.

Is car insurance mandatory in Wisconsin? Yes, all drivers must maintain at least the minimum required coverage to comply with state of Wisconsin auto insurance requirements. Driving without insurance in Wisconsin can lead to fines of up to $500, license suspension, and other penalties.

The state requires only basic insurance, but drivers are advised to get extra coverage like collision, comprehensive, and underinsured motorist (UIM) insurance. These optional coverages help pay for damage from accidents, theft, vandalism, and severe weather.

Understanding Wisconsin car insurance claim laws is important. These rules help drivers get paid fairly and quickly after accidents. Drivers should check their insurance plans often to make sure they have the right coverage.

By staying informed about Wisconsin car insurance laws and comparing policy options, drivers can avoid legal issues, secure better protection, and find affordable car insurance in Wisconsin that meets their needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Wisconsin

Getting cheap car insurance in Wisconsin can save you money while keeping you covered. The best way to find low-cost insurance is to compare prices from different companies that fit your driving needs.

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in Wisconsin

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage in Wisconsin

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 2,235 reviews

2,235 reviewsCompany Facts

Min. Coverage in Wisconsin

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviewsAccording to recent reviews, USAA offers the lowest auto insurance rates in Wisconsin, backed by high customer satisfaction and reliable claims service. State Farm is second, offering good prices and great customer service. American Family is third, with many policy choices made for Wisconsin drivers at budget-friendly rates.

Monthly car insurance rates in Wisconsin can vary based on location. For example, average rates for minimum coverage in major cities are:

Wisconsin Min. Coverage Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Appleton | $65 |

| Beloit | $58 |

| Brookfield | $72 |

| Eau Claire | $64 |

| Fond du Lac | $59 |

| Green Bay | $70 |

| Janesville | $62 |

| Kenosha | $68 |

| La Crosse | $66 |

| Madison | $75 |

| Milwaukee | $80 |

| New Berlin | $71 |

| Oshkosh | $63 |

| Racine | $67 |

| Sheboygan | $61 |

| Stevens Point | $57 |

| Superior | $56 |

| Waukesha | $73 |

| Wausau | $60 |

| West Allis | $74 |

Understanding Wisconsin car insurance rates by city and comparing quotes from multiple insurers can help you find the best coverage at the lowest cost. Regularly reviewing your policy and exploring available discounts can reduce your premiums while keeping you fully protected.

Read more: Best Wisconsin Auto Insurance

Other Coverage Options to Consider in Wisconsin

Knowing Wisconsin car insurance requirements exceeds meeting the state’s minimum liability coverage. While WI auto insurance laws mandate basic coverage, adding extra coverage can give you better protection in unexpected situations. Whether you’re a new driver or updating your plan, knowing your options helps keep you secure.

Here are important coverages beyond the state’s minimum requirements to help you stay financially secure:

- Personal Injury Protection (PIP) / Medical Payments: Personal injury protection or MedPay covers medical expenses for you and your passengers, regardless of fault. This helps with hospital bills, lost wages, and essential services like home care.

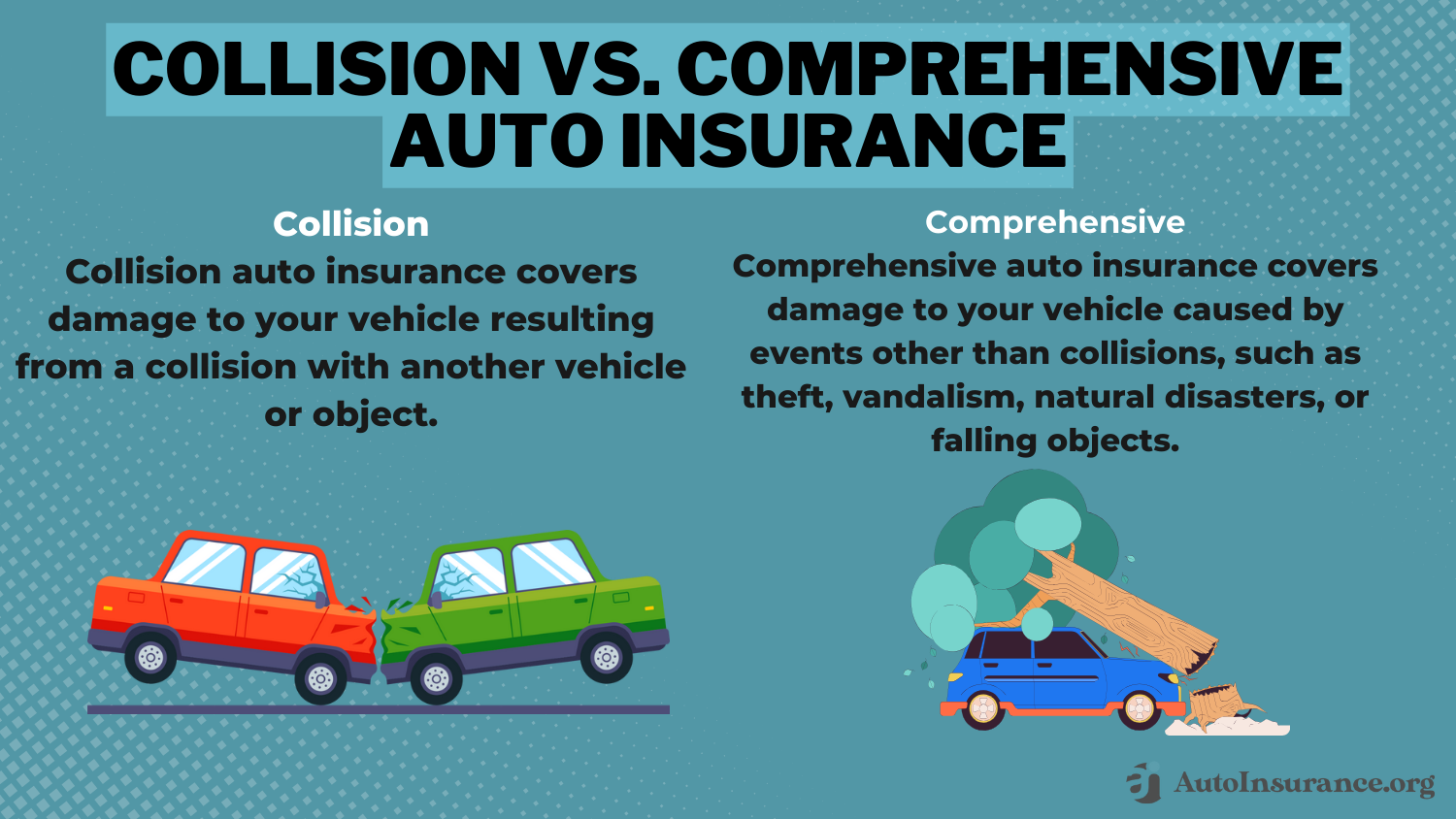

- Collision Coverage: Pays for repairs to your vehicle if you’re involved in an accident, even when you’re at fault. Collision coverage is not mandatory but is highly recommended under the Wisconsin auto insurance guide.

- Comprehensive Coverage: Protects against non-collision damage, such as theft, vandalism, severe weather, and animal strikes. Comprehensive coverage is often included in full insurance plans in auto insurance policies in Wisconsin.

- Uninsured/Underinsured Motorist Coverage: Wisconsin law mandates uninsured motorist coverage to protect you if an uninsured driver hits you. It also covers accidents involving hit-and-run drivers.

Although Wisconsin car insurance laws only require basic liability and uninsured motorist coverage, adding extra protections can save you from significant financial losses. Does Wisconsin require auto insurance beyond the minimums? Technically, no, but optional coverages like collision, comprehensive, and underinsured motorist protection can help you avoid costly out-of-pocket expenses after an accident.

Staying informed about Wisconsin property insurance laws and optional coverages ensures you’re prepared for unexpected incidents. For complete peace of mind, review your policy regularly and consider customizing your coverage according to your budget and driving needs.

Penalties for Driving Without Insurance in Wisconsin

Driving without insurance in Wisconsin can lead to severe penalties under the new Wisconsin auto insurance laws. The state requires all drivers to carry minimum liability coverage to ensure financial responsibility in case of an accident. Is auto insurance required in Wisconsin? Yes, every driver must have active auto insurance that meets the state’s minimum coverage requirements.

If caught operating a vehicle without insurance, driving without insurance in Wisconsin can lead to fines of up to $500. If you’re stopped by police and can’t show proof of insurance, the fine is $10. Using fake insurance papers is much more serious and can cost you up to $5,000. These rules help keep roads safe and make sure all drivers are responsible.

Penalties for Driving Without Auto Insurance in Wisconsin

| Offense | Penalty |

|---|---|

| Operating a vehicle without insurance | Fine of up to $500 |

| Failure to show proof of insurance | Fine of up to $10 |

| Providing fraudulent proof of insurance | Fine of up to $5,000 |

To reinstate your driving privileges after a violation, Wisconsin may require you to file an SR-22 form as proof of financial responsibility. The Wisconsin Department of Transportation typically receives SR-22 filings electronically from insurance providers within one or two days.

Choosing coverage beyond Wisconsin’s minimum limits can safeguard your finances against unexpected accident costs.Chris Abrams Licensed Insurance Agent

While maintaining minimum coverage is mandatory, the Wisconsin State Insurance Commissioner suggests contacting your insurer to adjust coverage temporarily if you’re not driving regularly. This can help reduce premiums while still keeping your policy active and compliant with Wisconsin auto insurance laws. Staying insured not only helps you avoid costly fines but also ensures peace of mind while on the road.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Understanding Wisconsin Auto Insurance Coverage and Requirements

Wisconsin’s minimum car insurance gives basic protection but might not cover all costs in a serious accident. The required $25,000 per person for injuries can run out fast with hospital bills or long-term care, leaving drivers to pay the rest.

If found at fault in a severe accident, drivers could face lawsuits resulting in the loss of savings, wages, or even their homes due to unpaid claims. Additionally, Wisconsin’s minimum coverage doesn’t include repairs to your vehicle unless you have optional collision or comprehensive insurance (Read more: Collision vs. Comprehensive Auto Insurance).

Does Wisconsin have uninsured motorist coverage? Yes, and is uninsured motorist coverage required in Wisconsin? Absolutely. It is mandatory to protect against uninsured or hit-and-run drivers. When selecting a policy, consider your vehicle’s value, financial situation, and coverage needs. Choosing more than the minimum can prevent costly bills and ensure greater financial security on Wisconsin’s roads.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code to find the most affordable quotes in your area.

Frequently Asked Questions

What are the minimum auto insurance requirements in Wisconsin?

Wisconsin requires drivers to carry minimum liability coverage of 25/50/10, which includes $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage. Additionally, uninsured motorist coverage of $25,000 per person and $50,000 per accident is mandatory.

Read more: Best Uninsured and Underinsured Motorist (UM/UIM) Coverage

Is auto insurance required in Wisconsin?

Yes, auto insurance is required in Wisconsin. Drivers must maintain active liability and uninsured motorist coverage to legally operate a vehicle on public roads. Failure to comply can result in fines, license suspension, and other penalties. Stop overpaying for auto insurance. Enter your ZIP code to find out if you can get a better deal.

Does Wisconsin have uninsured motorist coverage?

Yes, Wisconsin mandates uninsured motorist coverage. This coverage compensates for injuries if you are involved in an accident caused by an uninsured driver or a hit-and-run incident. Property damage caused by uninsured drivers is not included in the state’s minimum requirements.

Read more: Best Property Damage Liability (PDL) Auto Insurance Companies

What are the penalties for driving without insurance in Wisconsin?

Drivers caught without insurance can face fines of up to $500. Failing to provide proof of insurance when pulled over results in a $10 fine, while providing fraudulent insurance documents can lead to a $5,000 penalty.

What happens if I’m involved in an accident with an uninsured driver?

If you are hit by an uninsured driver, your uninsured motorist coverage will cover medical expenses and related costs, up to your policy’s limits. However, it won’t cover vehicle repairs unless you have collision coverage.

What types of additional coverage should Wisconsin drivers consider?

Drivers in Wisconsin should consider adding collision, comprehensive auto insurance, medical payments, and underinsured motorist coverage to ensure full protection. These options cover vehicle damage, weather-related incidents, theft, and injuries beyond the limits of basic policies.

How does Wisconsin handle SR-22 insurance filings?

If your license is suspended due to an insurance violation, you may need to file an SR-22 form as proof of financial responsibility. Insurance companies typically send this form electronically to the Wisconsin Department of Transportation.

What factors affect auto insurance rates in Wisconsin?

Factors like your driving history, vehicle type, location, credit score, and coverage limits impact auto insurance rates. Cities like Madison and Brookfield tend to have higher rates due to higher traffic density and accident risks.

Is uninsured motorist coverage required in Wisconsin for property damage?

No, Wisconsin’s uninsured motorist coverage requirement only applies to bodily injuries, not property damage. If you want property damage protection against uninsured drivers, consider adding uninsured motorist property damage (UMPD) coverage to your policy.

How can I find the cheapest car insurance in Wisconsin?

To find affordable auto insurance in Wisconsin, compare quotes from multiple providers like USAA, State Farm, and American Family. Consider bundling policies, maintaining a clean driving record, and asking about discounts such as safe driver, multi-policy, and good student discounts. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.