Best Farmers Auto Insurance Discounts in 2025 (Save 30% Today!)

Unlock savings with the best Farmers auto insurance discounts, featuring bundling, good student, and safe driver options to save up to 30%. While rates at Farmers can be pricy, Farmers' customers can apply several Farmers discounts to their auto insurance policies to maximize their savings.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Drivers who take advantage of the best Farmers auto insurance discounts can save up to 30% on their auto insurance premium.

Farmers has various ways for customers to save on their Farmers auto insurance policies, from good student to safe driver discounts.

Drivers who take advantage of several auto insurance discounts at the company can get many Farmers insurance policy perks.

Our Top 10 Picks: Best Farmers Auto Insurance Discounts

| Discount | Rank | Savings Potential | Description |

|---|---|---|---|

| Signal® Discount | #1 | 30% | Save by using the Signal® app to track safe driving habits. |

| Multi-Policy | #2 | 20% | Bundle auto with home or life insurance for savings. |

| Good Student | #3 | 15% | Students with good grades can receive this discount. |

| Multi-Car | #4 | 15% | Insure more than one vehicle to get this discount. |

| Homeowner Discount | #5 | 10% | Homeowners can save on their auto insurance. |

| Affinity Discount | #6 | 10% | Save if you belong to certain professional groups. |

| E-Pay Discount | #7 | 10% | Enroll in electronic payments to earn a discount. |

| Fuel Discount | #8 | 10% | Receive savings for driving a hybrid or electric vehicle. |

| Pay-in-Full | #9 | 8% | Pay your entire premium upfront to save money. |

| New Vehicle | #10 | 7% | Save on a newly purchased car within the first two years. |

Read on to learn about the best Farmers insurance discounts or read our Farmers review to learn more about the company. You can also get an insurance quote to determine if a potential insurer offers discounts and affordable car insurance for your budget. Compare rates now with our free tool.

- Farmers offers both vehicle and policy discounts

- Farmers’ safe driving program may raise your insurance rates

- Safe driving will help lower your Farmers insurance cost

How to Get the Best Farmers Auto Insurance Discounts

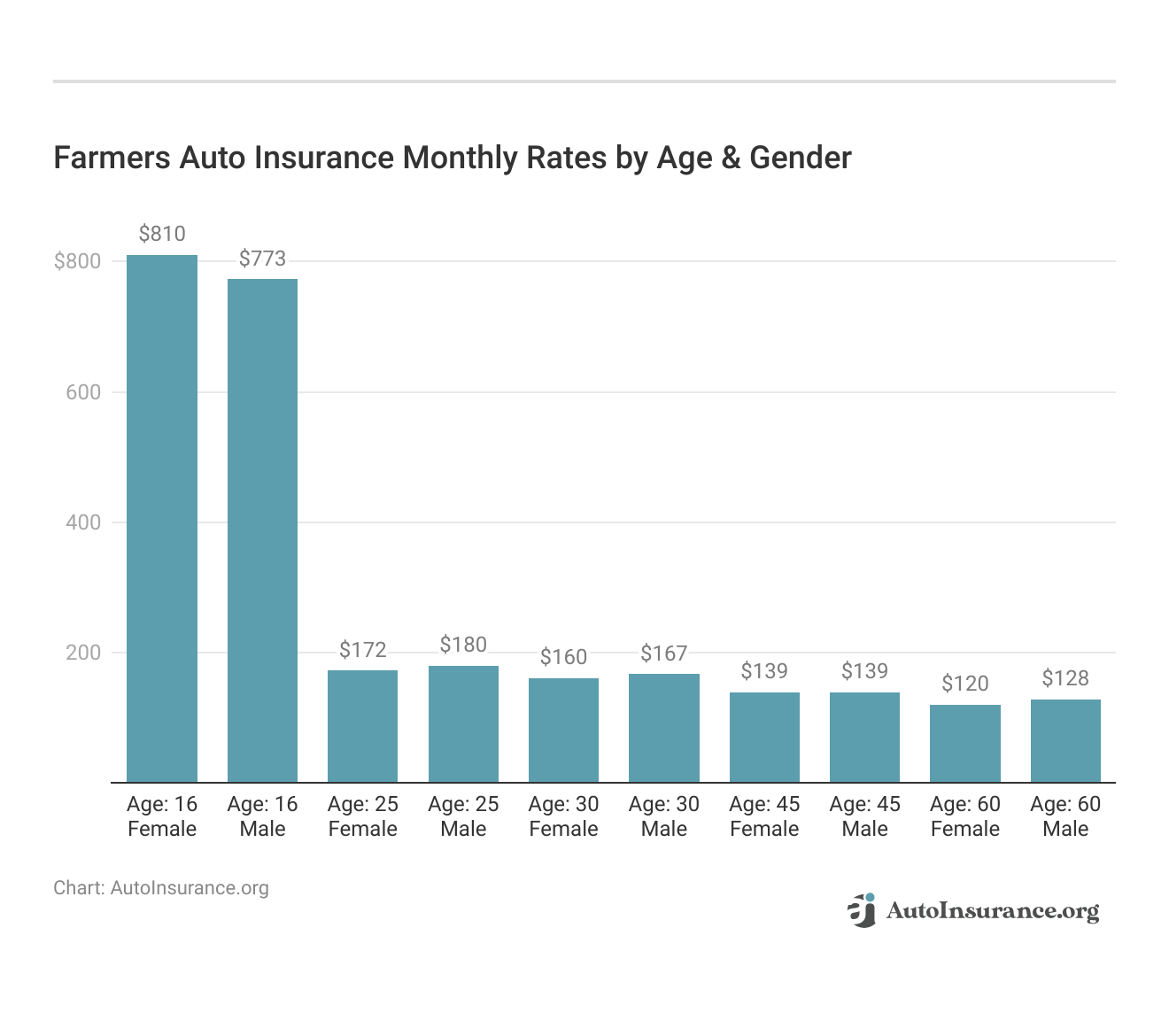

Knowing how to get as many discounts as possible will make Farmers more affordable. Farmers’ rates can be pricy, especially for young drivers, as you can see from the average rates below.

However, applying for discounts can lower your rates substantially. See how much Farmer’s discounts will save you on a minimum in the table below.

Best Farmers Auto Insurance Discounts: Min. Coverage Monthly Rates Before & After Discount

| Discount |  |

||

|---|---|---|---|

| New Vehicle | $24 | 7% | $23 |

| Pay-in-Full | $27 | 8% | $24 |

| Fuel Discount | $29 | 10% | $27 |

| E-Pay Discount | $33 | 10% | $29 |

| Affinity Discount | $36 | 10% | $33 |

| Homeowner Discount | $40 | 10% | $36 |

| Multi-Car | $48 | 15% | $40 |

| Good Student | $56 | 15% | $48 |

| Multi-Policy | $70 | 20% | $56 |

| Signal® Discount | $100 | 30% | $70 |

Ready to learn how to get these cost-saving discounts at Farmers and lower your auto insurance rates? We cover the top ten auto insurance discounts at Farmers, and the instructions for how to apply are below.

Farmers Signal Discount

Farmers Signal is an app that rewards drivers with a discount for safe driving by tracking their driving behaviors. It’s crucial to understand that although the Farmers Signal app serves as a discount initiative for responsible drivers, Farmers reserves the right to increase a driver’s insurance premiums if their performance on the app falls short.

To qualify for the safe driver discounts, you must also have no bodily injury points on your insurance, which are injuries caused to others in a crash you caused.

Learn More: Farmers Signal Review

Hence, familiarizing oneself with Signal before engaging in the discount program is essential, especially for individuals considering Farmers insurance member discounts or seeking information on Farmers car insurance discounts, including the Farmers Insurance affinity discount.

Unlike other companies, Farmers doesn’t have a safe driving course for senior drivers. For example, AAA offers its own AAA mature driver course, making it simple for drivers to participate. This is something to consider when comparing Farmers vs. AAA.

To explore eligibility for the senior discount at Farmers, you’ll need to connect with a representative to ascertain the approved courses for the discount. Following that, you’ll need to provide evidence of course completion. This process is similar to how Farmers handles inquiries regarding their military discount, low mileage discount, and multi-policy discount.

Farmers Multi-Policy Discount

Bundling other policies with your auto insurance — like home insurance — will earn you a Farmers insurance bundle discount. The multi-policy discount is a significant advantage for customers who choose Farmers for more than just Farmers vehicle insurance.

By bundling policies, customers can enjoy considerable savings. This benefit reflects Farmers’ appreciation for customer loyalty and the convenience of managing multiple policies under one roof.

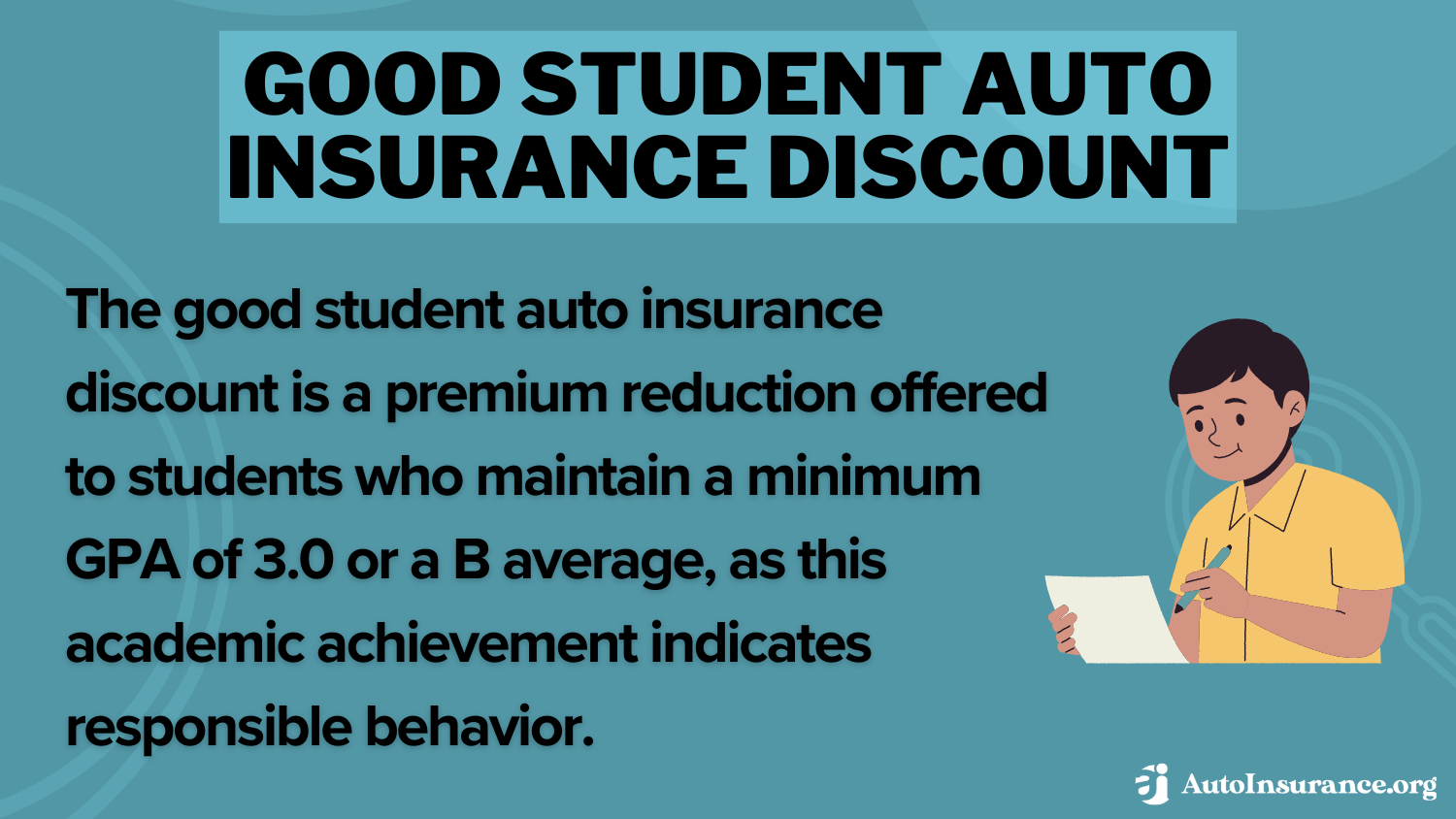

Farmers Good Student Discount

Farmers appreciates the dedication of students and acknowledges academic accomplishments with the Farmers student discount. Qualified high school and college students can enjoy this discount by upholding a commendable academic performance, typically achieving a B average or equivalent.

This initiative is a testament to Farmers’ dedication to promoting both academic excellence and conscientious driving behaviors among young drivers. This commitment underscores the company’s distinct approach when comparing Farmers vs. Safe Auto and underscores the range of Farmers’ auto discounts available.

To qualify for good student auto insurance discounts at Farmers, students must have a GPA of at least 3.0, be on the Dean’s List, Honor Roll, or be in the top 20% of their class or standardized testing.

Students who live 100+ miles away from home and don’t use policy-covered family cars often could also be eligible for the distant student discount. It supports families with students attending school far from home, offering relief from standard rates given the reduced risk.

Farmers Multi-Car Discount

You qualify for a multi-car discount if you have more than one car on your insurance policy (Read More: Which car insurance companies have the biggest multi-car discounts?).

Farmers Homeowner Discount

Homeowners can earn a small discount at Farmers for being a homeowner. Owning a home affects auto insurance rates for the better, as homeowners are seen as more financially stable.

Farmers Affinity Discount

Farmers will give discounts to qualifying employees, members, or retirees of certain groups or businesses. Farmers also extends its gratitude to military personnel and first responders through a dedicated Farmers military discount.

The military discount and first responder discount are Farmers’ ways of thanking members of the armed forces and first responders for their service to the country and communities, offering them more affordable insurance options.

The affinity discount is available to members of certain professional groups and associations, emphasizing Farmers’ commitment to serving communities and professions.

Farmers E-Pay Discount

You can earn a small discount if you set up fully automatic monthly payments. Farmers will also give you a small discount for going entirely paperless.

Even though many discounts may seem insignificant individually, it's beneficial to utilize even the smallest ones, such as opting for paperless statements or demonstrating good payment habits, as they accumulate over time.Daniel Walker Licensed Auto Insurance Agent

This strategy is particularly advantageous when considering Farmers Insurance discounts like the first responder discount and the good student discount, as well as the student discount offered by Farmers Insurance.

Farmers Fuel Discount

This discount is only available in California, but you can earn Farmers auto discounts if you have an alternative fuel vehicle.

Farmers Pay-In-Full Discount

Depending on your policy details, you may save a few dollars here and there with discounts for paying in full. You can earn a small discount if you pay your entire auto insurance premium in full at the beginning of the term. You can also earn a small discount if you have no late fees within the last 12 months.

Farmers New Vehicle Discount

New vehicle owners can get a small discount for their new vehicle. This is because new vehicles are more likely to have the following safety features:

- Anti-Lock Brakes: Factory-installed anti-lock brakes.

- Anti-Theft Devices: Alarms and other protective devices.

- Daytime Running Lights: Improves visibility.

- Homing Devices: Makes it easier to recover stolen cars.

- Passive Restraint: Automatic seat belts and air bags.

Discounts for protective vehicle features aren’t available in all states. If you’re still on the fence about Farmers, read our review of the best auto insurance companies to learn more about how Farmers compares to other car insurance companies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Other Farmers Auto Insurance Discounts

Farmers has numerous discounts for drivers based on their driving habits and profiles. For example, drivers with a clean record or military service can earn a Farmers insurance discount. For those committed to driving safely, Farmers offers several discounts that acknowledge your efforts.

The Safe Driver Discount is available to drivers with a clean driving record, free from accidents and traffic violations over a specific period. Additionally, completing a Defensive Driving Course approved by Farmers can further reduce your premium, showcasing the insurer’s focus on road safety and continuous driver education.

Take a look at other Farmers’ discounts below.

- Senior Driver: Drivers must be over 55 and complete a safe driving course to get a Farmers defensive driving discount.

- On-Your-Own: Young drivers under 29 who move into a new household may qualify for this discount.

- Youthful Driver: Drivers under 25 qualify for the youthful driver discount.

- Shared Family Car: You can get a shared family car discount when there are more active drivers than vehicles on a Farmers policy.

- Low Mileage: Farmers recognizes that less frequent drivers present a lower risk. The best low-mileage auto insurance discounts are tailored for those who drive fewer miles than the average, perhaps due to working from home or living close to their workplaces.

Safe driving also goes a long way for young drivers who want reasonable rates through Farmers. Farmers Insurance provides a wide array of discounts tailored to diverse drivers and households. Familiarizing yourself with these discounts can notably reduce your insurance costs while ensuring you maintain the necessary coverage.

This includes discounts like the Farmers Insurance safe driver discount and the Farmers Insurance 50% discount. The Farmers YES Program (You’re Essential to Safety) rewards drivers for participating in programs designed to monitor and improve driving habits through technology.

Comparing Farmers to the Competition

When evaluating companies like Farmers vs. Safe Auto, it’s essential to consider not only the range of discounts each offers but also the specific needs of your household, your driving habits, and what you value most in an insurance provider. Both companies provide competitive discounts, but the right choice depends on which discounts apply to you and the overall value you’re getting from your policy.

Learn More: How to Choose an Auto Insurance Company

See how Farmers compares to other top auto insurance providers below.

| Farmers vs. Other Top Auto Insurance Providers |

|---|

| Allstate vs. Farmers |

| Farmers vs. Geico |

| Farmers vs. Nationwide |

| Farmers vs. State Farm |

| Farmers vs. USAA |

Taking the time to compare auto insurance companies will help you pick the best auto insurance company for your individual needs.

How To Find Out Which Discounts You Qualify For

Finding out which discounts you qualify for with Farmers Insurance is a straightforward process designed to ensure you’re taking full advantage of the Farmers savings available to you. Here’s how to get started:

- Contact a Farmers Agent: The most direct way to discover which discounts you are eligible for is to speak with a Farmers insurance agent. Agents are well-versed in the ins and outs of discount qualifications and can provide personalized information based on your specific circumstances, including your driving record, the features of your vehicle, and your policy choices.

- Review Your Policy Online: If you already have a policy with Farmers, you can log in to your account on the Farmers website. Often, there are details about your current discounts and potentially other available discounts for which you might qualify based on your policy information.

- Explore Farmers’ Website: Farmers Insurance provides comprehensive details about discounts on their website. This resource can be incredibly useful for identifying discounts that may apply to you, such as the good student discount, multi-policy discount, or safe driver discount.

- Stay Updated: Insurance discounts and qualifications can change. It’s a good idea to regularly review your policy and touch base with your agent to ensure you’re not missing out on any new discounts that have become available.

- Provide Complete Information: When applying for insurance or updating your policy, giving complete and accurate information about your driving history, vehicle safety features, and any other factors can help ensure you’re receiving all the discounts for which you qualify.

To make the most of the Farmers policy perks and savings offered by Farmers, it’s wise to periodically assess your policy, stay in touch with your agent, and ask about any fresh discounts or initiatives that might be applicable.

Read More: How to Find Auto Insurance Agents in Your Area

Maintaining a spotless driving history, promptly informing your insurer about any notable shifts in your driving behaviors, and consolidating your policies can all lead to significant cost reductions over time, particularly when considering Farmers Insurance military discounts, Farmer auto insurance, participation in Farmers Insurance defensive driving courses, and bundling insurance with Farmers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Deciding if Farmers Insurance is Right for You

What discounts does Farmers Insurance offer? Farmers Insurance provides a range of Farmers car insurance discounts tailored to customers, with availability differing by state.

If you’ve utilized the best Farmers auto insurance discounts and still feel that your insurance premium is too costly, one effective method to discover a more budget-friendly insurance policy is by comparing quotes (Read More: How to Compare Auto Insurance Quotes).

Ready to shop for affordable auto insurance? Utilize our complimentary quote comparison tool to explore the most competitive auto insurance rates in your region.

Frequently Asked Questions

What are the different types of auto insurance discounts offered by Farmers?

Farmers offers various auto insurance discounts to help customers save on their premiums. Some of the common discounts include multi-policy discounts, safe driver discounts, good student discounts, and discounts for vehicles with safety features.

What is a multi-policy discount?

A multi-policy discount is a discount offered by Farmers to customers who have more than one insurance policy with them. For example, if you have both auto insurance and homeowners insurance with Farmers, you may qualify for a discount on both policies.

How can I qualify for a safe driver discount?

To qualify for a safe driver discount, you generally need to have a clean driving record with no accidents or traffic violations within a certain period. The specific requirements for the best auto insurance discounts for good drivers may vary, so it’s best to check with Farmers to see if you meet the criteria.

Do they offer good student discounts?

Yes, Farmers offers good student discounts for eligible students. Typically, to qualify for this discount, the student must maintain a certain grade point average (GPA), usually a B average or higher. Proof of the student’s academic performance, such as a report card or transcript, may be required.

Can I combine multiple discounts?

Yes, in most cases, you can combine multiple discounts offered by Farmers, as long as you meet the eligibility criteria for each discount. Combining discounts can help you maximize your savings on your auto insurance premiums.

What are vehicle safety feature discounts?

Vehicle safety feature discounts are offered by Farmers to customers whose vehicles are equipped with certain safety features. These features may include anti-lock brakes, airbags, anti-theft devices, and more (Read More: How to Get an Anti-Theft Auto Insurance Discount). The discounts vary depending on the specific safety features installed in the vehicle.

How can I find out which discounts I qualify for?

The best way to find out which discounts you qualify for is to contact Farmers directly. Their representatives can provide you with detailed information about the available discounts and help you determine which ones you are eligible for based on your specific circumstances.

How does the Farmers good student discount work?

The Farmers good student discount is designed to reward students who maintain excellent academic performance. Eligible students, typically maintaining a B average or higher, can enjoy reduced premiums as recognition for their hard work and responsible behavior.

Can I combine the Farmers safe driver discount with other discounts?

Yes, the Farmers safe driver discount, awarded for maintaining a clean driving record, can often be combined with other discounts such as the multi-policy discount or the low mileage discount, allowing you to maximize your savings on your auto insurance premium.

Does Farmers offer a military discount, and who is eligible?

Yes, Farmers offers a military discount as a thank you to those who serve or have served in the armed forces. Active duty, veterans, and their families may qualify for this discount, depending on their state’s availability (Learn More: Best Auto Insurance for Military Families and Veterans). It’s best to speak with a Farmers agent to confirm eligibility and discount availability.

What is the Farmers affinity discount, and how do I qualify?

The Farmers affinity discount is offered to members of certain professional groups, organizations, or associations. To qualify, you need to be a member of an eligible group. Contact Farmers directly to see if your organization is part of their affinity program.

How can young drivers save on Farmers auto insurance?

Young drivers can save through the Farmers student discount by maintaining good grades and also by enrolling in the Farmers YES Program, which focuses on encouraging safe driving habits. Additionally, the distant student discount may apply if the young driver attends school far from home.

To find cheap auto insurance for young drivers, enter your ZIP in our free quote tool.

What discounts does Farmers offer for vehicle safety features?

Farmers rewards drivers whose vehicles are equipped with safety features such as anti-lock brakes, airbags, and anti-theft devices. These Farmers discounts acknowledge the reduced risk presented by vehicles equipped with features that can prevent accidents or deter theft.

How does the Farmers defensive driving discount work?

Enrolling in and completing a defensive driving course approved by Farmers can qualify you for a discount. This discount is Farmers’ way of encouraging and rewarding drivers who take proactive steps to improve their driving skills and road safety awareness (Learn More: Why You Should Take a Defensive Driving Class).

Is there a discount for low-mileage drivers with Farmers Insurance?

Yes, the Farmers low mileage discount is designed for drivers who clock fewer miles than the average, reflecting the decreased risk of accidents due to less time spent on the road. Eligibility criteria for this discount may vary, so it’s recommended to discuss your specific situation with a Farmers agent.

Can I get a discount on Farmers insurance if I bundle auto with home insurance?

Absolutely. Farmers offers a multi-policy discount to customers who bundle their auto insurance with other policies like home or life insurance. This discount not only simplifies your insurance needs under one provider but also offers significant savings.

How can I lower my car insurance in NY?

You can get the best New York auto insurance rates by:

- Shopping around and comparing quotes from multiple insurers.

- Maintaining a clean driving record.

- Bundling your auto insurance with other policies.

- Opting for a higher deductible.

Make sure to also take advantage of available discounts, such as safe driver discounts or multi-policy discounts.

What is the process for applying Farmers insurance discount codes?

Farmers insurance discount codes or promotional offers can be applied during the quote process or by speaking directly with a Farmers agent. It’s important to mention any discount codes you have to ensure you receive the applicable savings on your policy.

Does Farmers offer a nurse discount?

Farmers Insurance doesn’t specifically advertise a nurse discount. However, it’s worth reaching out to them directly to inquire about any available discounts or offers for nurses.

Is Farmers Insurance available in Canada?

No, Farmers Insurance primarily operates in the United States. They do not offer insurance coverage in Canada.

Does USAA offer discounts for nurses?

USAA offers various discounts to its members, but whether they specifically offer discounts for nurses may vary. It’s recommended to contact USAA directly to inquire about the best auto insurance for nurses.

Does Avis give discounts to nurses?

Avis may offer discounts to certain groups, including healthcare professionals like nurses. It’s advisable to check Avis’s website or contact them directly to inquire about any available discounts for nurses.

What is the minimum auto insurance coverage in New York?

The minimum auto insurance coverage required in New York includes:

- $25,000 for bodily injury liability per person

- $50,000 for bodily injury liability per accident

- $10,000 for property damage liability per accident

- Personal Injury Protection (PIP) coverage

- Uninsured/Underinsured Motorist coverage

You must carry the required auto insurance in New York to drive.

How much is car insurance per month in NY?

The cost of car insurance in New York can vary widely depending on factors such as your age, driving record, the type of vehicle you drive, and the coverage options you choose. On average, however, car insurance in New York can range from $100 to $300 per month.

Who is the cheapest car insurance?

The cheapest auto insurance companies can vary depending on factors such as your location, driving history, and coverage needs. It’s best to compare quotes from multiple insurers to find the most affordable option for you.

How do you lower your car insurance?

You can lower your car insurance premiums by:

- Shopping around for quotes and comparing rates from multiple insurers.

- Maintaining a clean driving record.

- Bundling your auto insurance with other policies.

- Opting for a higher deductible.

- Taking advantage of available discounts, such as safe driver discounts or multi-policy discounts.

These steps will help you save on auto insurance.

What is insurance for farmers?

“Insurance for farmers” typically refers to insurance policies designed to protect farmers and their agricultural operations. These policies may include coverage for farm buildings, equipment, livestock, crops, and liability protection.

Do nurses get cruise discounts?

Some cruise lines and travel agencies may offer discounts or special deals for nurses as a form of appreciation. It’s worth researching specific cruise lines or reaching out to travel agencies to inquire about any available discounts for nurses.

Is Farmers auto insurance leaving California?

As of my last update in January 2022, there was no indication that Farmers auto insurance was leaving California. However, it’s always a good idea to check with the company directly or stay updated with recent news on the best California auto insurance for any changes.

Does AT&T have a nurse discount?

AT&T may offer discounts to certain groups, including healthcare professionals like nurses. It’s recommended to check AT&T’s website or contact them directly to inquire about any available discounts on auto insurance for nurses.

Does the Hilton offer discounts for healthcare workers?

Yes, Hilton does offer special discounts for healthcare workers as a gesture of appreciation for their hard work and dedication, especially during challenging times like the COVID-19 pandemic. Healthcare workers can take advantage of these discounts by providing valid identification or proof of employment in the healthcare sector.

Do nurses get discounts with T-Mobile?

T-Mobile occasionally offers special discounts and promotions for nurses and other healthcare professionals. These discounts may vary depending on the current offers available. Nurses interested in obtaining discounts with T-Mobile should check the company’s website or contact their customer service to inquire about any available promotions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.