Farmers vs. Nationwide Auto Insurance in 2025 (Side-by-Side Review)

Farmers vs. Nationwide auto insurance are the top providers that offers rates at $76 and $63. Nationwide offers SmartRide for safe driving discounts and strong financial ratings. Farmers provide accident forgiveness and new car replacements. Compare the best deals to find the option for your driving needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,072 reviews

3,072 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsFarmers vs. Nationwide auto insurance offers different strengths depending on what you need. Farmers focuses on flexible coverage with options like accident forgiveness, rideshare protection, and new car replacement.

Farmers vs. Nationwide Insurance Rating

| Rating Criteria |  |

|

|---|---|---|

| Overall Score | 4.2 | 4.4 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.3 | 3.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.1 | 4.3 |

| Customer Satisfaction | 2.0 | 2.0 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.3 | 4.5 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 5.0 | 4.7 |

| Savings Potential | 4.5 | 4.7 |

| Farmers Review | Nationwide Review |

Nationwide leans into savings with SmartRide, solid multi-policy discounts, and strong financial backing. We’ll break down coverage, discounts, and claims service to help you figure out which company fits better.

- Farmers offer accident forgiveness and rideshare coverage at $76/month

- Nationwide provides SmartRide discounts & lower rates starting at $63/month

- Farmers include OEM parts coverage, while Nationwide excels in bundling

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

Farmers vs. Nationwide Auto Insurance: Rates, Coverage, and Market Comparison

Farmers vs. Nationwide car insurance rates shows you a clear cost difference, with Nationwide providing much lower premiums in every age group. A 16-year-old girl pays $1,156 with Farmers for the same policy but $586 with Nationwide.

Farmers vs. Nationwide Full Coverage Auto Insurance Monthly Rates

| Age & Gender |  |

|

|---|---|---|

| 16-Year-Old Female | $1,156 | $586 |

| 16-Year-Old Male | $1,103 | $680 |

| 30-Year-Old Female | $228 | $177 |

| 30-Year-Old Male | $239 | $194 |

| 45-Year-Old Female | $199 | $161 |

| 45-Year-Old Male | $198 | $164 |

| 60-Year-Old Female | $171 | $141 |

| 60-Year-Old Male | $183 | $149 |

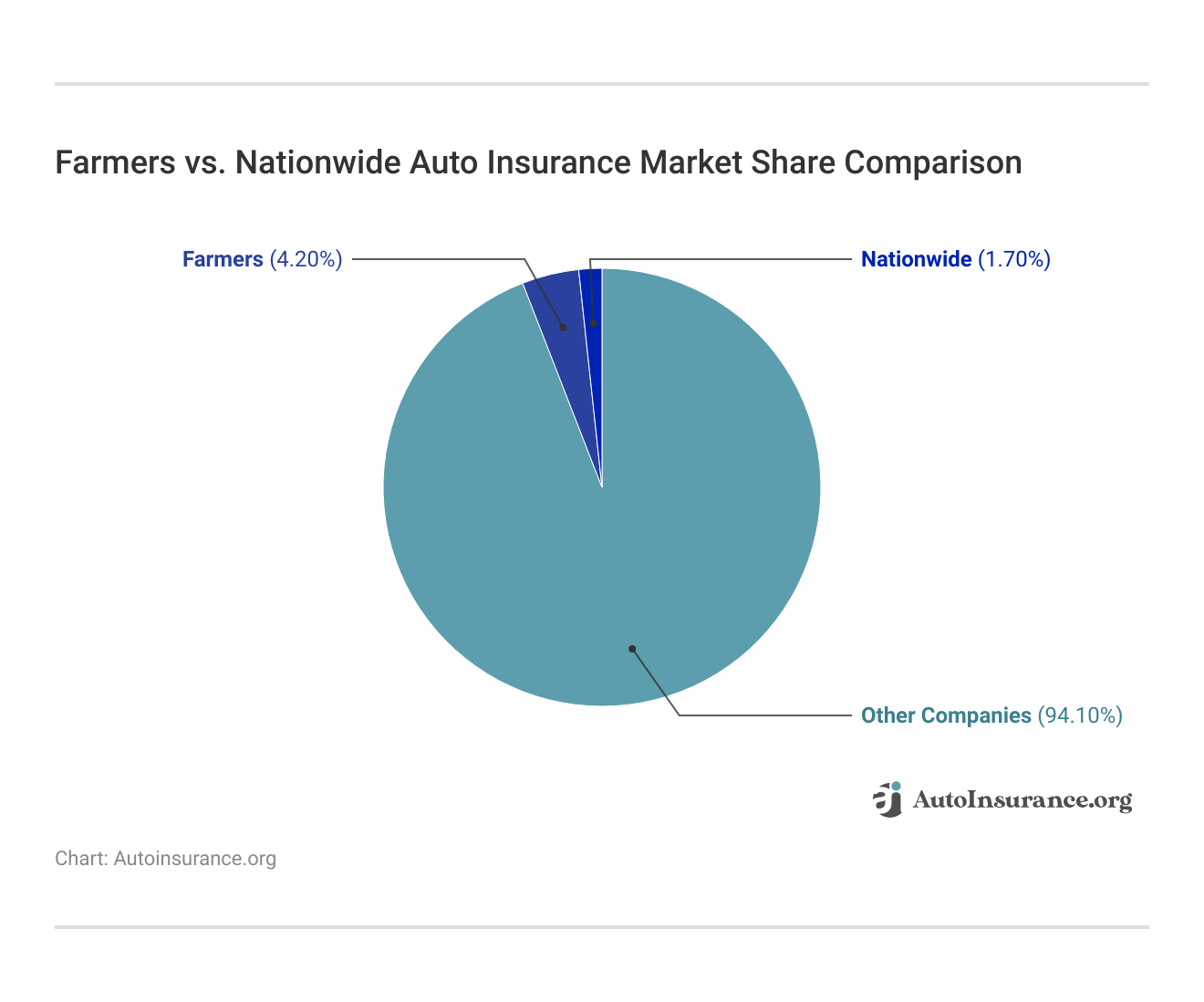

This trend continues across with Farmers consistently charging higher rates. Despite this, Farmers holds a larger market share at 4.2%, while Nationwide trails at 1.7%.

Nationwide’s lower premiums make it a more budget-friendly choice for drivers looking to save on full coverage auto insurance, while Farmers’ higher rates may be due to broader coverage options or additional policy benefits.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Farmers vs. Nationwide Auto Insurance Rates: Credit Score Impact on Monthly Costs

Farmers car insurance is substantially more expensive than Nationwide for drivers with all credit scores. The disparity is pronounced for those with bad credit, with Farmers billing $399 a month, over twice what Nationwide charges, $188. And Farmers’ rate of $199 is still $70 higher than that of Nationwide’s $129, even with good credit.

Farmers vs. Nationwide: Full Coverage Auto Insurance Monthly Rates by Credit Score

| Credit Score |  |

|

|---|---|---|

| Good Credit | $199 | $129 |

| Fair Credit | $243 | $149 |

| Poor Credit | $399 | $188 |

So if your credit isn’t great, switching to Nationwide could save you over $200 each month. It’s a clear example of how much your credit score can affect your auto insurance rates. Nationwide is the more affordable option, but some drivers might be willing to pay extra for the added coverage options and perks that come with a Farmers policy.

Farmers vs. Nationwide Auto Insurance Rates: How Driving Record Affects Monthly Costs

Nationwide usually has lower rates than Farmers for most driving records, except when it comes to drivers with a DUI or DWI.

Farmers vs. Nationwide Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record |  |

|

|---|---|---|

| Clean Record | $198 | $164 |

| Not-At-Fault Accident | $282 | $230 |

| Speeding Ticket | $247 | $196 |

| DUI/DWI | $275 | $338 |

In that case, Farmers is actually cheaper, charging about $275 per month compared to $338 from Nationwide. But for drivers with a clean record, Nationwide is the better deal at $164 per month, while Farmers costs $198.

The same is valid for speeding tickets and not-at-fault accidents — Nationwide rates are $51 to $52 lower in both cases. So, for people who don’t have any tickets or have only minor violations, Nationwide is probably going to save you the most.

However, if you’ve experienced a major violation, such as a DUI, Farmers could be more affordable.

Farmers vs. Nationwide Auto Insurance Discounts: Comparing Savings and Benefits

Nationwide tends to offer better discounts than Farmers in the areas that matter most to drivers. For example, safe drivers can get up to 40% off with Nationwide, while Farmers caps that discount at 30%. Paying your policy in full gets you a 15% discount with Nationwide compared to 10% with Farmers.

Farmers vs. Nationwide: Auto Insurance Discounts

| Discount |  |

|

|---|---|---|

| Anti-Theft | 10% | 5% |

| Bundling | 20% | 20% |

| Driver Training | 11% | 12% |

| Good Driver | 30% | 40% |

| Good Student | 15% | 15% |

| Low Mileage | 10% | 20% |

| Membership | 10% | 15% |

| Multi-Car | 20% | 20% |

| New Car | 8% | 12% |

| Pay-in-Full | 10% | 15% |

Both companies match on bundling and multi-car discounts at 20%. But Nationwide pulls ahead with slightly better savings for things like new cars (12% vs. 8%) and driver training (12% vs. 11%). Farmers does offer a stronger anti-theft discount at 10% compared to Nationwide’s 5%, but Nationwide makes up for it with better low mileage and membership discounts.

Pick coverage by state rules, car value, and risk, and report claims with photos right away.Justin Wright Licensed Insurance Agent

If you’re a safe driver, bundle policies, or pay upfront, Nationwide will likely give you more value. But if anti-theft savings are a priority, Farmers might be worth a look. Overall, though, Nationwide comes out ahead with broader discount options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Farmers vs. Nationwide Auto Insurance: Consumer Ratings and Complaint Trends

Nationwide outperforms Farmers in most consumer satisfaction and complaint metrics. J.D. Power scores Nationwide at 728/1,000, indicating above-average customer satisfaction, while Farmers scores lower at 706/1,000. Nationwide also holds an A+ rating with the Better Business Bureau (BBB) for excellent business practices, compared to Farmers A rating.

Insurance Business Ratings & Consumer Reviews: Farmers vs. Nationwide

| Agency |  |

|

|---|---|---|

| Score: 706 / 1,000 Lower-Than-Average Satisafaction | Score: 728 / 1,000 Above Avg. Satisfaction |

|

| Score: A Good Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 82/100 High Customer Satisfaction | Score: 75/100 Positive Customer Feedback |

|

| Score: 1.70 More Complaints Than Avg. | Score: 0.78 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A+ Excellent Financial Strength |

When it comes to complaints, Farmers has a higher complaint index of 1.70, meaning more complaints than the industry average, while Nationwide’s 0.78 score indicates fewer complaints than average.

Nationwide’s A+ financial strength rating from A.M. Best also surpasses Farmers’ A rating, making it the more potent option in terms of reliability and claims payment ability.

Farmers score higher in Consumer Reports satisfaction with 82/100 compared to Nationwide’s 75/100. However, Nationwide offers a better overall customer experience with more substantial financial backing and fewer complaints. When comparing the best auto insurance companies, Nationwide stands out for its lower complaint index and reliability in handling claims.

Pros and Cons of Farmers Auto Insurance

Farmers auto insurance provides strong coverage options, including accident forgiveness, rideshare insurance, and new car replacement. But because of its higher rates and less competitive discounts, it might not suit every budget. Here’s a look at the pros and cons to help you determine if Farmers is for you.

Pros

- New Car Replacement Coverage: If your car is totaled within the first two model years and 24,000 miles, Farmers will replace it with a new one of the same make and model instead of paying out the depreciated value.

- Accident Forgiveness: Farmers offers accident forgiveness, meaning your rates won’t go up after your first at-fault accident if you qualify.

- Rideshare Insurance: Farmers provides coverage for Uber and Lyft drivers, filling gaps between personal and commercial policies so drivers aren’t left exposed while waiting for ride requests.

Cons

- Higher Rates for Most Drivers: Farmers premiums are consistently more expensive than Nationwide’s, especially for younger drivers, those with clean records, and people with lower credit scores.

- Limited Availability of Discounts: While Farmers offers some discounts, they tend to be lower than Nationwide’s. For example, Farmers’ Good Driver discount caps at 30%, while Nationwide offers up to 40%.

Farmers stand out with unique perks like new car replacement and accident forgiveness, but their higher rates and smaller discounts might be dealbreakers for some. It might be worth it if you value coverage over cost, but getting quotes from other providers may turn up a better deal.

Farmers have many long-time customers, including those who have reviewed the insurance on Yelp, who specifically compliment the service they received and customers who got help from agents who provide personalized assistance and service.

Pros and Cons of Nationwide Auto Insurance

Nationwide auto insurance provides competitive rates, good discounts, and excellent financial stability, making it an appealing option for many drivers. Safe drivers can save even more with programs such as SmartRide and SmartMiles. Let’s parse through the key pros and cons to help you decide.

Pros

- Lower Rates for Most Drivers: Nationwide consistently offers lower premiums than many competitors, especially for drivers with good credit or clean records. Their full coverage rates are often cheaper than those of Farmers across different age groups.

- Strong Discount Programs: Nationwide provides a 40% discount for safe drivers through its SmartRide program, a 20% low-mileage discount, and better savings for paying in full compared to Farmers. These can significantly cut monthly costs.

- Better Complaint Ratings: With a lower complaint index than Farmers and an A+ BBB rating, Nationwide handles claims more smoothly and has fewer reported customer service issues.

Cons

- Higher Rates for High-Risk Drivers: While Nationwide is cheaper for most drivers, those with a DUI may pay more than they would with Farmers, making it a less competitive option for high-risk policies.

- Limited Availability for Some Programs: Nationwide’s usage-based programs, like SmartRide and SmartMiles, aren’t available in every state, which could limit potential savings depending on where you live.

Nationwide stands out for its affordable rates, especially for safe drivers, and its strong financial reputation. However, high-risk drivers may find better deals elsewhere, and some of its best discounts aren’t available in every state.

A Yelp reviewer appreciates Nationwide’s helpful service and ability to shop around for the best rates, making it a reliable choice for many policyholders. Before making a decision, compare quotes to see if Nationwide meets your needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Farmers vs. Nationwide Auto Insurance: Rates, Discounts & Coverage Compared

Nationwide offers lower rates across most categories, more substantial discount opportunities, and higher customer satisfaction ratings, making it the better choice for budget-conscious drivers. Its SmartRide program provides up to a 40% discount for safe driving, and it consistently beats Farmers on pricing for drivers with poor credit or clean records.

I saved 30% with SmartRide—safe driving cut my premium through a usage-based program.Tonya Sisler Insurance Content Team Lead

Farmers offer accident forgiveness, new car replacements, and a more competitive rate for drivers with a DUI. While both companies have strong financial ratings, Nationwide’s lower complaint index and better pricing structure make it the more appealing option for most drivers.

You can find affordable auto insurance, no matter your driving record, by entering your ZIP code into our free quote comparison tool.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Which car insurance company is better: Farmers or Nationwide?

Nationwide is often the better choice for price-conscious drivers. It offers lower average rates—$63 per month for minimum coverage compared to Farmers at $76—and stronger discounts like up to 40% off through SmartRide. Farmers stand out with extra features like accident forgiveness and new car replacement, which may appeal more to drivers prioritizing coverage over cost.

Is Nationwide good at paying claims?

Yes. Nationwide earns an A+ rating from A.M. Best and has a 0.78 complaint index, meaning it received fewer complaints relative to its size compared with the industry average. Policyholders typically say claims are processed quickly, and the settlement is fair. It also includes benefits such as the On Your Side Claims® Service, which provides dedicated support throughout the claims process.

Who is Farmers Insurance’s biggest competitor?

Nationwide is one of Farmers Insurance’s biggest competitors due to their similar product lines and national presence. Others include Geico, State Farm, and Progressive. Among these, Nationwide competes most closely with Farmers in terms of policy benefits, bundling options, and coverage features.

What insurance company is most reliable?

In terms of financial strength and low complaint ratios, Nationwide ranks higher. It holds an A+ from A.M. Best and has fewer consumer complaints than Farmers, which scores lower with a 1.70 complaint index. However, farmers receive higher customer service scores from consumer reports, giving them an edge in satisfaction for long-term clients.

Farmers Insurance vs. Nationwide: Which has lower rates?

Nationwide consistently beats Farmers in pricing. For example, drivers with good credit pay around $129 per month with Nationwide and $199 with Farmers. Even drivers with bad credit save over $200 monthly on average by choosing Nationwide.

Farmers vs. American Family: Which offers better discounts?

American Family typically provides better bundling discounts, often up to 29%, compared to Farmers’ 20%. However, Farmers provides solid perks such as rideshare insurance and accident forgiveness. If bundling and loyalty savings are at the top of your mind, American Family may be a better fit.

Nationwide and Farm Insurance Login: How do I access my policy?

You can access your Nationwide policy through their website or mobile app using your registered email and password. For Farmers, log in through Farmers.com or the Farmers mobile app. Both platforms allow you to view ID cards, pay bills, and manage claims, but Nationwide’s app includes real-time driving feedback if enrolled in SmartRide.

Farmers vs. Amica: Which has better customer satisfaction?

Amica ranks higher in overall customer satisfaction. It regularly scores at the top of J.D. Power’s ratings and has a strong reputation for personalized service. Farmers perform well in specific areas like agent interactions and policy options but see more complaints per policyholder.

Geico vs. Nationwide: Which is cheaper?

Geico generally offers lower base rates, especially for minimum coverage. Nationwide, however, provides better savings through usage-based programs like the Nationwide SmartRide App, which can lead to up to 40% off premiums. So, while Geico may be cheaper upfront, Nationwide can match or beat it for safe drivers who qualify for discounts.

Nationwide On Your Side: What does it mean?

“On Your Side” is Nationwide’s customer care approach. It includes an annual On Your Side® Review to reassess your policy needs, access to their trusted repair network, and claims assistance that aims to make the process easier and more transparent.

Nationwide Insurance Similar Companies: Who are its main competitors?

Nationwide competes most directly with State Farm, Geico, Progressive, Farmers, and Allstate. These companies all offer national coverage, online tools, discounts for safe driving, and multi-policy savings. Nationwide distinguishes itself with strong financial ratings and usage-based savings options.

Nationwide Vanishing Deductible: How does it work?

Nationwide’s vanishing deductible program reduces your collision deductible by $100 each year you drive accident-free, up to $500. For example, if you start with a $500 deductible, after five years without an accident, your deductible could be fully erased.

Which company has better bundling options: Farmers or Nationwide?

Nationwide offers stronger bundling discounts—up to 20% for combining home and auto. Farmers also provide bundling, but its discounts typically cap at around 17%. Nationwide’s bundling also includes more product lines like renters, life, and pet insurance, making it a better option for broader savings.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code into our comparison tool today.

Are Farmers or Nationwide better for drivers with poor credit?

Nationwide is an affordable option for low credit score drivers. Compared with the competition, drivers with low credit scores pay an average $188 per month with Nationwide. to $399 with Farmers. The gap is significant and makes Nationwide a better option for budget-conscious drivers.

Nationwide vs. Geico: Which is better for high-risk drivers?

Geico usually offers cheaper rates to high-risk drivers overall, but Nationwide may provide more value through coverage options. For example, drivers with a DUI pay $338 Nationwide and slightly less with Farmers at $275, but Geico can undercut both, depending on the state and violation. High-risk drivers should compare quotes closely.

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.