Best Windshield Replacement Coverage in Colorado (Top 10 Companies in 2025)

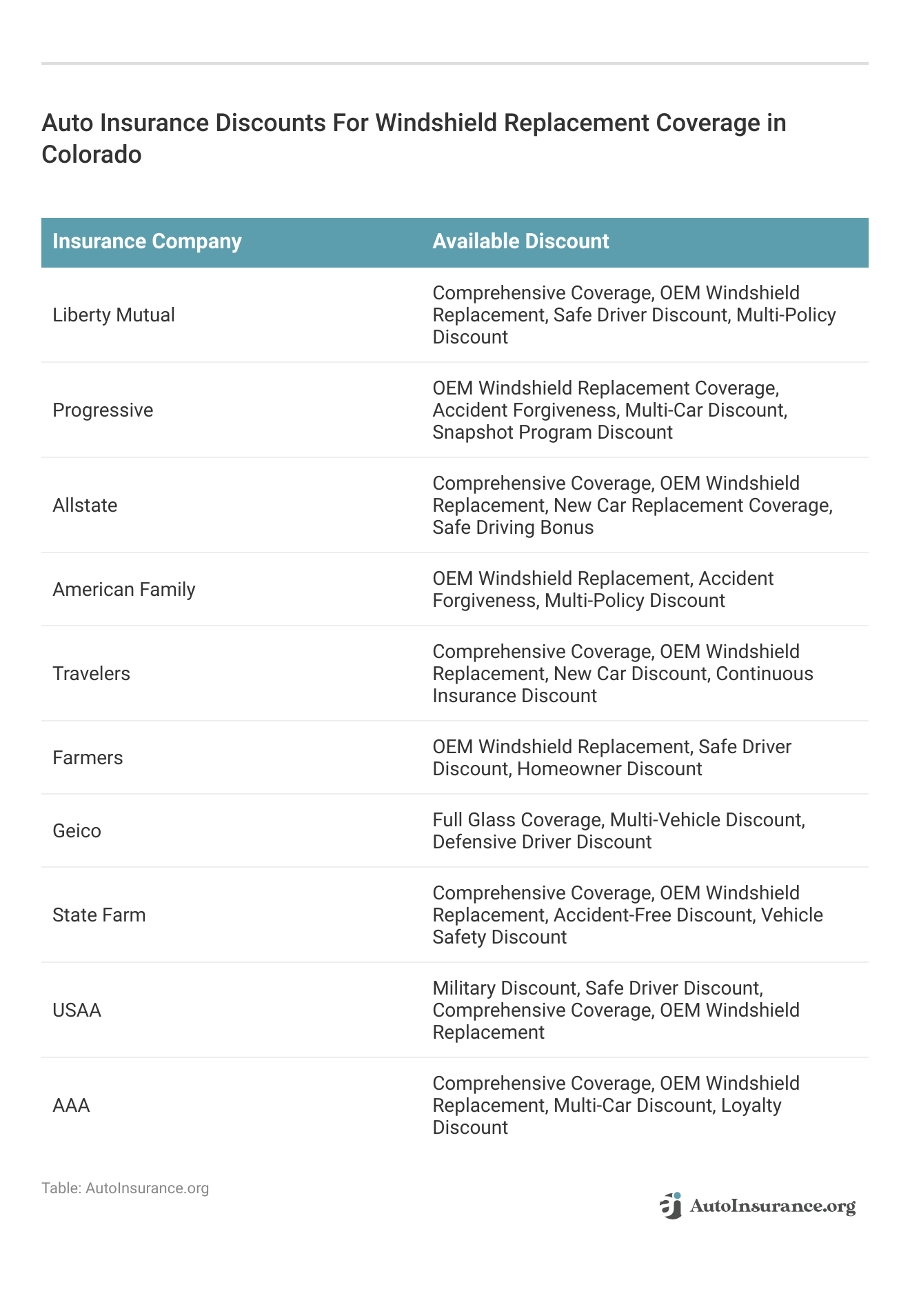

Liberty Mutual, Progressive, and Allstate provide the best windshield replacement coverage in Colorado, starting from only $55 per month. Our commitment lies in helping you compare quotes from these respected insurers, empowering you to secure the perfect coverage and capitalize on discounts for your vehicle.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Feb 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage Windshield Replacement in COe

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage Windshield Replacement in CO

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage Windshield Replacement in CO

A.M. Best

Complaint Level

Pros & Cons

- Liberty Mutual provides competitive rates starting from $135 per month

- Leading insurance providers offer opportunities to save on windshield replacements

- Various discount options are accessible for windshield replacement coverage

#1 – Liberty Mutual: Top Overall Pick

Pros

- Extensive Coverage Options: Liberty Mutual offers a wide range of insurance products, including auto, home, renters, and life insurance, providing customers with flexibility to meet their specific needs.

- Discount Programs: The company offers various discounts, such as multi-policy, safe driver, and student discounts, helping customers save money on their premiums. Read more through our Liberty Mutual auto insurance review for guide.

- Strong Financial Stability: Liberty Mutual has a solid financial standing, providing reassurance to policyholders that the company can fulfill its obligations even during challenging times.

Cons

- Higher Premiums: Liberty Mutual’s premiums can be relatively higher compared to some competitors, potentially making it less affordable for budget-conscious individuals.

- Mixed Customer Service Reviews: While some customers praise Liberty Mutual’s customer service, others have reported issues with claims processing and responsiveness, indicating inconsistencies in service quality.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Tight Budgets

Pros

- Innovative Technology: In our Progressive auto insurance review, Progressive is known for its use of technology, offering tools like Snapshot, which tracks driving behavior to potentially lower premiums for safe drivers, and a user-friendly mobile app for easy policy management.

- Wide Availability: Progressive operates in all 50 states, providing accessibility to customers across the country and offering consistent service regardless of location.

- Strong Online Presence: The company’s website and mobile app are well-designed and intuitive, making it convenient for customers to get quotes, manage policies, and file claims online.

Cons

- Average Customer Satisfaction Ratings: While Progressive’s technology and accessibility are commendable, some customers have expressed dissatisfaction with the company’s claims handling and customer service, leading to average or below-average ratings in customer satisfaction surveys.

- Limited Agent Interaction: Progressive primarily operates online and through phone support, which may not be ideal for customers who prefer face-to-face interactions with agents or need more personalized assistance.

#3 – Allstate: Best for Drivewise Program

Pros

- Multiple Policy Options: Allstate offers a wide array of insurance products, including auto, home, renters, and life insurance, allowing customers to bundle policies and potentially save on premiums.

- Excellent Financial Strength: Allstate boasts strong financial stability and high credit ratings, assuring policyholders of its ability to fulfill claims obligations, even in adverse economic conditions. Use our Allstate auto insurance review as your guide.

- Innovative Tools and Resources: The company provides helpful tools like the Allstate Mobile app and Drivewise program, which tracks driving habits to reward safe behavior and potentially lower premiums.

Cons

- Higher Premiums for Some Customers: Allstate’s premiums can be comparatively higher for certain demographics or regions, potentially making it less affordable for individuals seeking budget-friendly insurance options.

- Mixed Customer Service Reviews: While Allstate excels in some aspects, customer reviews regarding claims processing and overall service satisfaction vary, suggesting room for improvement in consistency and quality of customer support.

#4 – American Family: Best for Claims Service

Pros

- Personalized Service: American Family emphasizes personalized service, with local agents available to provide tailored insurance solutions and guide customers through the policy selection and claims process.

- Community Involvement: The company is actively involved in supporting local communities through various initiatives and sponsorships, fostering a positive reputation and strong relationships with customers.

- Innovative Offerings: American Family continually introduces new products and services to meet evolving customer needs, such as usage-based insurance options and smart home technology integration.

Cons

- Limited Availability: American Family operates primarily in the Midwest and Pacific Northwest, limiting its accessibility to customers in other regions of the United States. Use our American Family auto insurance review for your guide.

- Potential for Higher Premiums: While American Family prioritizes personalized service, some customers may find their premiums to be relatively higher compared to other insurers, particularly in regions where the company faces less competition.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Travelers: Best for Low-Mileage Drivers

Pros

- Comprehensive Coverage Options: Travelers offers a wide range of insurance products, including auto, home, renters, and business insurance, providing customers with comprehensive coverage options to protect their assets and livelihoods.

- Strong Financial Stability: With a long history and solid financial standing, Travelers instills confidence in policyholders that the company can meet its financial obligations, even in challenging economic environments.

- Global Presence: Travelers operates not only in the United States but also internationally, making it a viable option for individuals and businesses with global insurance needs.

Cons

- Higher Premiums for Some Policyholders: Our Travelers auto insurance review reveals that Travelers’ premiums may be relatively higher for certain demographics or regions, potentially making it less competitive in terms of pricing compared to some competitors.

- Limited Discounts: While Travelers offers various discounts, such as multi-policy and safe driver discounts, the availability and extent of discounts may be more limited compared to other insurers, potentially reducing savings opportunities for customers.

#6 – Farmers: Best for Signal App

Pros

- Wide Range of Coverage Options: Farmers provides diverse insurance products, including auto, home, life, business, and specialty insurance, giving customers the flexibility to tailor their coverage to their specific needs.

- Strong Agent Network: The company boasts a vast network of local agents who offer personalized assistance and guidance to customers, fostering strong relationships and ensuring personalized service.

- Innovative Programs: Farmers, as mentioned in our Farmers auto insurance review, offers innovative programs like Signal by Farmers, a usage-based insurance app that rewards safe driving behavior with potential discounts on premiums.

Cons

- Mixed Customer Service Reviews: While Farmers’ agent network is a strength, some customers have reported dissatisfaction with the claims handling process and overall customer service, indicating room for improvement in consistency and quality of service.

- Potential for Higher Premiums: Farmers’ premiums may be relatively higher for certain individuals or regions, potentially making it less competitive in terms of pricing compared to some competitors.

#7 – Geico: Best for International Shipping

Pros

- Competitive Pricing: Geico is known for offering affordable insurance premiums, often providing some of the most competitive rates in the industry, making it an attractive option for budget-conscious consumers.

- Convenient Online Experience: Geico’s user-friendly website and mobile app make it easy for customers to get quotes, manage policies, and file claims online, enhancing convenience and accessibility.

- Strong Financial Stability: As a subsidiary of Berkshire Hathaway, Geico benefits from the financial strength and stability of its parent company, providing reassurance to policyholders about its ability to fulfill claims obligations.

Cons

- Limited Agent Interaction: Geico primarily operates online and via phone support, which may not suit customers who prefer face-to-face interactions with agents or require more personalized assistance. Read more in our Geico auto insurance review.

- Mixed Customer Service Reviews: While Geico excels in pricing and online experience, some customers have reported dissatisfaction with the claims process and customer service, indicating room for improvement in service quality and consistency.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – State Farm: Best for Extensive Discounts

Pros

- Extensive Agent Network: State Farm boasts the largest agent network in the United States, providing customers with personalized assistance and guidance from local agents who understand their unique insurance needs. Find out more in our State Farm auto insurance review.

- Wide Range of Insurance Products: The company offers various insurance products, including auto, home, renters, life, and business insurance, allowing customers to bundle policies and potentially save on premiums.

- Strong Financial Stability: State Farm has a long history of financial stability and high credit ratings, ensuring policyholders that the company can fulfill its financial obligations, even in challenging economic conditions.

Cons

- Potentially Higher Premiums: State Farm’s premiums may be relatively higher for certain individuals or regions, potentially making it less competitive in terms of pricing compared to some competitors.

- Limited Online Experience: State Farm’s online platform and mobile app may not be as robust or user-friendly compared to some competitors, which could be a drawback for customers who prefer conducting transactions and managing their policies digitally.

#9 – USAA: Best for Customer Service

Pros

- Excellent Customer Service: USAA is renowned for its exceptional customer service, consistently earning high ratings in customer satisfaction surveys for its responsiveness, claims handling, and overall support.

- Financial Strength and Stability: With a strong financial standing and high credit ratings, USAA provides reassurance to policyholders that the company can fulfill its financial obligations, even in challenging economic times.

- Exclusive Membership Benefits: USAA offers exclusive benefits to its members, including discounts, competitive rates, and access to financial planning services, enhancing the overall value proposition for its customers.

Cons

- Limited Eligibility: USAA membership is restricted to military personnel, veterans, and their families, limiting its accessibility to a specific demographic and excluding potential customers who do not meet these criteria. Read more with our USAA auto insurance review.

- Availability Constraints: USAA operates primarily online and through phone support, with limited physical branch locations, which may not be convenient for customers who prefer face-to-face interactions or require in-person assistance.

#10 – AAA: Best for Roadside Assistance

Pros

- Member Benefits and Discounts: AAA offers a wide range of benefits and discounts to its members, including roadside assistance, travel services, insurance products, and savings on various goods and services, enhancing the overall value proposition for customers.

- Established Reputation: With a long history and established reputation for reliability and service excellence, AAA instills confidence in its members that they can rely on the organization for their automotive and insurance needs.

- Extensive Network: AAA boasts an extensive network of service providers and partners, providing customers with access to a wide range of resources and assistance, whether they’re on the road or at home. Use our AAA auto insurance review for your guide.

Cons

- Membership Fees: AAA membership requires an annual fee, which may deter some potential customers who are not interested in or cannot afford the membership dues, potentially limiting the organization’s customer base.

- Limited Insurance Offerings: While AAA offers various insurance products, including auto, home, and life insurance, its offerings may be more limited compared to dedicated insurance companies, potentially lacking some specialized coverage options or customization.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Colorado Windshield Full Coverage Auto Insurance

Colorado Windshield Auto Insurance Deductible

When it comes to glass damage, it’s also important to consider whether you have to pay a deductible. Some insurance companies may offer a zero-deductible benefit, but Colorado doesn’t require it. Before you decide to file a claim, look closely at your deductible amount to see whether it makes sense.

After all, some auto insurance deductibles can be $500 or more, and it may cost less than that to repair or replace your windshield. Additionally, it’s beneficial to understand “auto insurance deductible defined” to make informed decisions about your coverage. Enter your ZIP code now.

Colorado Windshield Insurance Replacement Laws

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Colorado Windshield Replacement With Aftermarket Glass

Full Glass Coverage Laws in Colorado

Frequently Asked Questions

Is windshield replacement covered by auto insurance in Colorado?

Yes, windshield replacement is typically covered by auto insurance in Colorado. It falls under the comprehensive coverage portion of your policy, which helps cover damages not caused by a collision.

Do I need to pay a deductible for windshield replacement in Colorado?

It depends on your auto insurance policy. Some policies have a separate deductible for windshield replacement, while others may waive the deductible for windshield repairs or replacements. Review your policy or contact your insurance provider to determine if a deductible applies in your case. Enter your ZIP code now to begin.

Can I choose any windshield repair or replacement shop in Colorado?

What if I choose a repair or replacement shop that is not approved by my insurance company?

If you select a repair or replacement shop that is not approved by your insurance company, you may be responsible for any additional costs beyond what your insurance covers. It’s essential to clarify this with your insurer beforehand to avoid any surprises.

Will filing a windshield replacement claim affect my insurance rates in Colorado?

Filing a windshield replacement claim typically does not affect your insurance rates in Colorado. Windshield claims are generally considered “no-fault” claims and are not counted against your policy. However, it’s always a good idea to check with your insurance provider to confirm their specific policy on this matter. Enter your ZIP code now.

Are there any limitations or restrictions on windshield replacement coverage in Colorado?

What does $500 deductible with full glass mean?

It means you have to pay the deductible before insurance will cover the rest of the amount for glass and car damages.

Is it illegal to drive with a cracked windshield in Colorado?

It is illegal to drive with a cracked windshield in Colorado if it obstructs your view of the road. Enter your ZIP code now to start comparing.

How do Liberty Mutual, Progressive, and Allstate compare in terms of windshield replacement coverage rates and offerings in Colorado?

What are the considerations and options for Colorado drivers regarding windshield replacement insurance, including deductible amounts and aftermarket glass coverage?

Colorado drivers have several factors to consider when it comes to windshield replacement insurance, including whether comprehensive and collision coverage is included in their policy, deductible amounts, and the type of glass used for replacements. Understanding these options can help drivers make informed decisions about their coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.