Best Toyota Sequoia Auto Insurance in 2025 (Check Out the Top 10 Companies)

Best Toyota Sequoia auto insurance starts at just $43 per month, with Geico, AAA, and Allstate leading the way. These top providers stand out for their affordability, reliable service and comprehensive coverage. Check Toyota Sequoia insurance monthly rates to find the best option for your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Toyota Sequoia

A.M. Best

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Toyota Sequoia

A.M. Best

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Toyota Sequoia

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews

When looking for the best Toyota Sequoia auto insurance, Geico, AAA, and Allstate offer competitive rates starting at $43 per month. Geico is the top pick for its superior coverage options. Check Toyota Sequoia auto insurance quotes to find the best coverage for your budget.

The article also explores whether auto insurance is a waste of money, emphasizing the value of coverage. It highlights how adequate insurance protects against potential losses and offers peace of mind, debunking the notion that it’s an unnecessary expense. Understanding these benefits can help you make informed decisions.

Our Top 10 Company Picks: Best Toyota Sequoia Auto Insurance

Company Rank Multi-policy Discount A.M. Best Best For Jump to Pros/Cons

#1 15% A++ Good Drivers Geico

#2 18% A Online Convenience AAA

#3 12% A+ Coverage Options Allstate

#4 10% A++ Cost Savings USAA

#5 14% A+ Add-on Coverages The Hartford

#6 17% A++ Safe-Driving Discounts Auto-Owners

#7 16% A+ Customizable Policies Dairyland

#8 13% A 24/7 Support The General

#9 19% A Policy Options Liberty Mutual

#10 11% A+ Multi-Policy Discounts Nationwide

Explore your auto insurance options by entering your ZIP code into our free comparison tool above today.

- Geico is the top pick for its comprehensive coverage options

- Discover Discounts available for Toyota Sequoia owners

- Learn Toyota Sequoia cost factors that can significantly impact rates

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Geico offers highly competitive rates at $114 per month, making it a cost-effective option for Toyota Sequoia owners looking to save on insurance without sacrificing coverage.

- Extensive Discount Options: As mentioned in our Geico auto insurance review, Geico provides various discounts for safe driving, multiple policies, and safety features, which can further reduce the cost of insuring your Toyota Sequoia.

- User-Friendly Digital Tools: Geico’s robust mobile app and online tools make managing your Toyota Sequoia insurance policy easy and convenient, allowing for quick claims processing and policy updates.

Cons

- Customer Service Limitations: While Geico is known for its affordability, some customers report less personalized service, which could be a downside for Toyota Sequoia owners seeking a more hands-on approach.

- Limited Local Agents: Geico primarily operates online and through call centers, which may be inconvenient for Toyota Sequoia owners who prefer in-person assistance with their insurance needs.

#2 – AAA: Best for Online Convenience

Pros

- Roadside Assistance: As outlined in our AAA auto insurance review, AAA offers exceptional roadside assistance, which is a significant advantage for Toyota Sequoia owners who value reliable support in case of vehicle breakdowns.

- Member Benefits: AAA members receive additional perks, such as discounts on travel and lodging, which can be beneficial for Toyota Sequoia owners who frequently travel.

- Comprehensive Coverage Options: AAA provides extensive coverage options, including comprehensive and collision coverage, ensuring Toyota Sequoia owners are well-protected in various scenarios.

Cons

- Higher Rates for Non-Members: While AAA offers competitive rates at $86 for members who owns Toyota Sequoia, non-members may find the premiums higher, which could be a drawback for those not interested in membership.

- Limited Availability: AAA insurance services may not be available in all areas, potentially limiting options for Toyota Sequoia owners depending on their location.

#3 – Allstate: Best for Coverage Options

Pros

- Strong Financial Stability: Allstate’s robust financial standing ensures that Toyota Sequoia owners can rely on the company to pay out claims promptly and efficiently. Learn more details in our page, Allstate auto insurance review.

- Accident Forgiveness: Allstate offers accident forgiveness, which prevents rates from increasing after the first accident, a valuable feature for Toyota Sequoia owners concerned about potential premium hikes.

- Comprehensive Coverage Options: Allstate provides extensive coverage options, including comprehensive and collision coverage, tailored to meet the specific needs of Toyota Sequoia owners.

Cons

- Higher Premiums: At $160 per month, Allstate’s rates are higher compared to other providers, which may be a significant consideration for Toyota Sequoia owners on a budget.

- Mixed Customer Reviews: Some Toyota Sequoia owners report varying experiences with Allstate’s customer service, indicating that service quality can be inconsistent.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Cost Savings

Pros

- Competitive Rates: USAA offers the most affordable rates at $59 per month, making it an excellent option for Toyota Sequoia owners looking for budget-friendly insurance.

- Excellent Customer Service: As outlined in our USAA auto insurance review, USAA is renowned for its top-notch customer service, providing Toyota Sequoia owners with reliable and supportive assistance.

- Military-Focused Benefits: USAA offers unique benefits for military members and their families, which can be advantageous for Toyota Sequoia owners with a military background.

Cons

- Eligibility Restrictions: USAA is only available to military members and their families, limiting its accessibility for many Toyota Sequoia owners.

- Limited Physical Locations: USAA’s physical presence is limited, which may be a drawback for Toyota Sequoia owners who prefer in-person interactions for their insurance needs.

#5 – The Hartford: Best for Add-on Coverages

Pros

- AARP Discounts: As outlined in The Hartford auto insurance review, The Hartford offers exclusive discounts for AARP members, making it an attractive option for senior Toyota Sequoia owners looking to save on insurance.

- RecoverCare: The Hartford’s RecoverCare coverage provides assistance with daily living activities after an accident, a valuable feature for Toyota Sequoia owners concerned about post-accident recovery.

- Good Customer Service: The Hartford is known for its responsive customer service, ensuring that Toyota Sequoia owners receive prompt and effective support.

Cons

- Higher Rates for Younger Drivers: The Hartford’s premiums can be higher for younger Toyota Sequoia owners, which may be a disadvantage for this demographic.

- AARP Membership Requirement: Some discounts and benefits are only available to AARP members, potentially limiting savings for Toyota Sequoia owners who are not eligible for AARP.

#6 – Auto-Owners: Best for Safe-Driving Discounts

Pros

- Strong Customer Service: As mentioned in our Auto-Owners auto insurance review, Auto-Owners is highly rated for customer service, providing Toyota Sequoia owners with reliable and personalized support.

- Variety of Discounts: Auto-Owners offers a range of discounts, including multi-policy and safe driver discounts, which can help Toyota Sequoia owners reduce their insurance costs.

- Comprehensive Coverage: Auto-Owners provides robust coverage options, ensuring Toyota Sequoia owners are well-protected in various scenarios, from accidents to natural disasters.

Cons

- Regional Availability: Auto-Owners insurance is not available in all states, which may limit options for some Toyota Sequoia owners depending on their location.

- Limited Online Tools: Compared to some competitors, Auto-Owners offers fewer digital tools, which may be less convenient for tech-savvy Toyota Sequoia owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Dairyland: Best for Customizable Policies

Pros

- Flexible Payment Options: Dairyland offers flexible payment plans, making it easier for Toyota Sequoia owners to manage their insurance payments.

- Specialized Coverage: Dairyland provides specialized coverage options for high-risk drivers, which can be beneficial for Toyota Sequoia owners with a less-than-perfect driving record.

- SR-22 Filing: As mentioned in our Dairyland auto insurance review, Dairyland assists with SR-22 filings, which can be essential for Toyota Sequoia owners who require this documentation for their insurance.

Cons

- High Premiums: At $237 per month, Dairyland’s rates are significantly higher, which may be a considerable drawback for Toyota Sequoia owners seeking more affordable insurance.

- Mixed Customer Reviews: Customer experiences with Dairyland vary, indicating that service quality can be inconsistent for Toyota Sequoia owners.

#8 – The General: Best for 24/7 Support

Pros

- Non-Standard Coverage: The General specializes in non-standard auto insurance, making it a viable option for Toyota Sequoia owners with high-risk profiles or poor driving records.

- Quick Quotes: The General offers fast and easy online quotes, providing Toyota Sequoia owners with a convenient way to obtain insurance information and rates.

- Flexible Payment Plans: As mentioned in our The General auto insurance review, The General provides flexible payment options, allowing Toyota Sequoia owners to choose a payment schedule that fits their budget.

Cons

- High Rates: At $232 per month, The General’s insurance rates are on the higher side, which may not be suitable for Toyota Sequoia owners looking for budget-friendly options.

- Customer Service Concerns: Some Toyota Sequoia owners have reported issues with The General’s customer service, suggesting that support may not always meet expectations.

#9 – Liberty Mutual: Best for Policy Options

Pros

- Comprehensive Coverage Options: Liberty Mutual offers a wide range of coverage options, ensuring Toyota Sequoia owners can customize their policies to fit their specific needs.

- Multi-Policy Discounts: Liberty Mutual provides discounts for bundling multiple policies, which can help Toyota Sequoia owners save on their overall insurance costs.

- Accident Forgiveness: As mentioned in our Liberty Mutual auto insurance review, Liberty Mutual’s accident forgiveness program prevents rates from increasing after the first accident, a valuable feature for Toyota Sequoia owners.

Cons

- Higher Premiums: At $174 per month, Liberty Mutual’s rates are higher compared to some competitors, which may be a consideration for Toyota Sequoia owners on a budget.

- Customer Service Variability: Customer service experiences with Liberty Mutual can vary, with some Toyota Sequoia owners reporting less satisfactory interactions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Nationwide: Best for Multi-Policy Discounts

Pros

- Vanishing Deductible: Nationwide offers a vanishing deductible program, which reduces the deductible amount for every year of safe driving, benefiting Toyota Sequoia owners.

- Comprehensive Coverage Options: Nationwide provides a wide range of coverage options, allowing Toyota Sequoia owners to tailor their insurance to their needs.

- Strong Financial Stability: Nationwide’s strong financial standing ensures Toyota Sequoia owners can trust the company to handle claims efficiently and effectively. For more information, read our Nationwide auto insurance review.

Cons

- Higher Rates for High-Risk Drivers: Nationwide’s premiums can be higher for high-risk Toyota Sequoia owners, which may be a disadvantage for those with poor driving records.

- Limited Discounts: Nationwide may offer fewer discounts than some competitors, which could affect potential savings for Toyota Sequoia owners.

Toyota Sequoia Insurance Cost

Always consider both minimum and full coverage options to ensure you have the right protection for your Toyota Sequoia. The table below compares monthly rates for minimum and full coverage car insurance for a Toyota Sequoia from various providers.

Toyota Sequoia Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $87 | $228 | |

| $47 | $124 | |

| $121 | $339 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $77 | $331 | |

| $61 | $161 |

| $32 | $84 |

By comparing these rates, you can find the most cost-effective insurance provider for your needs. Unlock details in our guide titled “What are the recommended auto insurance coverage levels?”

Geico is the top pick for its superior coverage options.Travis Thompson LICENSED INSURANCE AGENT

Comparing insurance rates for your Toyota Sequoia under different scenarios can help you understand how various factors impact your premiums. The chart below illustrates the insurance rates for different discount rates and driver situations.

Toyota Sequoia Auto Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $121 |

| Discount Rate | $71 |

| High Deductibles | $104 |

| High Risk Driver | $258 |

| Low Deductibles | $153 |

| Teen Driver | $443 |

This comparison shows how factors like deductibles and driver risk levels can affect your insurance costs. By understanding these variables, you can make informed decisions and potentially find ways to reduce your insurance expenses for your Toyota Sequoia.

Toyota Sequoias Insurance Expensiveness

The chart below details how Toyota Sequoia insurance rates compare to other SUVs like the BMW X3, Chevrolet Traverse, and Mercedes-Benz GLC 300.

Toyota Sequoia Auto Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Total |

|---|---|---|---|---|

| Toyota Sequoia | $28 | $47 | $33 | $121 |

| BMW X3 | $31 | $55 | $31 | $130 |

| Chevrolet Traverse | $28 | $39 | $26 | $105 |

| Mercedes-Benz GLC 300 | $34 | $68 | $33 | $148 |

| Buick Encore | $27 | $47 | $31 | $118 |

| BMW X5 | $37 | $63 | $31 | $144 |

| Mercedes-Benz GLE 350 | $37 | $73 | $33 | $155 |

However, there are a few things you can do to find the cheapest Toyota insurance rates online. Shopping around, comparing quotes from multiple providers, and considering factors like coverage options and auto insurance deductibles can help you secure the best rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Toyota Sequoia Insurance Cost Factors

The Toyota Sequoia trim and model you choose can impact the total price you will pay for Toyota Sequoia car insurance coverage.

Age of the Vehicle

Understanding how the age of your Toyota Sequoia affects insurance costs can help you make more informed decisions. Older models generally cost less to insure due to their decreased market value and lower repair costs. For example, insurance for a 2018 Toyota Sequoia costs more than for a 2010 model, showing a significant difference.

Toyota Sequoia Auto Insurance Monthly Rates by Age of the Vehicle

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Toyota Sequoia | $29 | $48 | $34 | $123 |

| 2023 Toyota Sequoia | $29 | $48 | $34 | $123 |

| 2022 Toyota Sequoia | $28 | $48 | $34 | $123 |

| 2021 Toyota Sequoia | $28 | $47 | $34 | $122 |

| 2020 Toyota Sequoia | $28 | $47 | $33 | $121 |

| 2019 Toyota Sequoia | $27 | $47 | $33 | $121 |

| 2018 Toyota Sequoia | $28 | $47 | $33 | $121 |

| 2017 Toyota Sequoia | $27 | $46 | $35 | $121 |

| 2016 Toyota Sequoia | $26 | $44 | $36 | $119 |

| 2015 Toyota Sequoia | $24 | $43 | $37 | $117 |

| 2014 Toyota Sequoia | $24 | $40 | $38 | $114 |

| 2013 Toyota Sequoia | $23 | $37 | $38 | $111 |

| 2012 Toyota Sequoia | $22 | $33 | $38 | $106 |

| 2011 Toyota Sequoia | $20 | $31 | $38 | $102 |

| 2010 Toyota Sequoia | $20 | $29 | $39 | $100 |

Older vehicles not only come with lower insurance premiums but also offer the benefit of reduced depreciation costs. As you consider different model years, keep in mind how these factors can influence your overall expenses.

Driver Age

Driver age can significantly impact Toyota Sequoia car insurance rates. Younger drivers, especially teens, typically face higher premiums due to their lack of experience and higher risk of accidents.

Toyota Sequoia Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $808 |

| Age: 18 | $656 |

| Age: 20 | $206 |

| Age: 30 | $191 |

| Age: 40 | $121 |

| Age: 45 | $169 |

| Age: 50 | $157 |

| Age: 60 | $152 |

Older drivers tend to benefit from lower insurance costs as they gain more driving experience and establish a history of safe driving.

By maintaining a clean driving record and leveraging age-based discounts, drivers can reduce their insurance expenses over time.

Driver Location

Where you live can have a large impact on Toyota Sequoia insurance rates. For example, drivers in New York may pay more than drivers in Chicago.

Toyota Sequoia Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $207 |

| New York, NY | $191 |

| Houston, TX | $190 |

| Jacksonville, FL | $176 |

| Philadelphia, PA | $162 |

| Chicago, IL | $160 |

| Phoenix, AZ | $141 |

| Seattle, WA | $118 |

| Indianapolis, IN | $103 |

| Columbus, OH | $101 |

When shopping for insurance, consider how your location influences rates. Moving to a different area or even a different part of your city could result in significant savings on your car insurance premiums.

Your Driving Record

Your driving record can significantly affect the cost of Toyota Sequoia car insurance. Drivers with clean records pay less, while those with violations or accidents face higher premiums.

Toyota Sequoia Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $620 | $800 | $1,100 | $760 |

| Age: 18 | $443 | $600 | $850 | $520 |

| Age: 20 | $275 | $420 | $670 | $350 |

| Age: 30 | $127 | $190 | $310 | $170 |

| Age: 40 | $121 | $180 | $300 | $165 |

| Age: 45 | $116 | $175 | $290 | $160 |

| Age: 50 | $111 | $165 | $280 | $155 |

| Age: 60 | $108 | $160 | $270 | $150 |

Maintaining a clean driving record is essential for keeping insurance costs low. Safe driving habits not only reduce the risk of accidents but also help you qualify for good driver discounts and other incentives offered by insurance companies.

Toyota Sequoia Crash Test Ratings

Good Toyota Sequoia crash test ratings indicate a safer vehicle, which can lead to cheaper car insurance rates. The table below shows the crash test ratings for various Toyota Sequoia models.

Toyota Sequoia Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Toyota Sequoia SUV 4WD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2024 Toyota Sequoia SUV 2WD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Toyota Sequoia SUV 4WD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Toyota Sequoia SUV 2WD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Toyota Sequoia SUV 4WD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Toyota Sequoia SUV 2WD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Toyota Sequoia SUV 4WD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Toyota Sequoia SUV 2WD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Toyota Sequoia SUV 4WD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Toyota Sequoia SUV 2WD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Toyota Sequoia SUV 4WD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2019 Toyota Sequoia SUV 2WD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2018 Toyota Sequoia SUV 4WD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2018 Toyota Sequoia SUV 2WD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2017 Toyota Sequoia SUV 4WD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2017 Toyota Sequoia SUV 2WD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2016 Toyota Sequoia SUV 4WD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2016 Toyota Sequoia SUV 2WD | 4 stars | 4 stars | 4 stars | 4 stars |

Choosing a vehicle with strong safety ratings can lower your insurance costs by reducing the likelihood of severe accidents and injuries. Always consider crash test ratings when selecting a new vehicle.

Toyota Sequoia Safety Features

Most drivers don’t realize that not only do Toyota Sequoia safety features play a vital role in keeping passengers safe in crashes, but they can also help lower Toyota Sequoia auto insurance rates. The Toyota Sequoia’s safety features include:

- Comprehensive Air Bag System: The Toyota Sequoia is equipped with multiple air bags including driver, passenger, front head, rear head, and front side air bags, ensuring all-around protection for all occupants.

- Advanced Braking Features: It includes 4-wheel ABS, 4-wheel disc brakes, and brake assist, enhancing stopping power and control during emergency situations.

- Enhanced Stability and Traction: Electronic stability control and traction control systems help maintain vehicle stability and grip, especially in adverse driving conditions.

- Safety for Children and Passengers: Child safety locks and front tow hooks are included, ensuring the safety of younger passengers and providing utility in towing situations.

- Modern Driver Assistance Technologies: The Sequoia features a blind spot monitor, lane departure warning, and cross-traffic alert, offering advanced driver assistance to prevent collisions and enhance overall safety.

By investing in a Toyota Sequoia with these comprehensive safety features, you not only ensure the safety of your passengers but also potentially reduce your insurance premiums. These features can lead to significant discounts on your auto insurance, making it a cost-effective choice for safety-conscious drivers.

Toyota Sequoia Insurance Loss Probability

The lower percentage means lower Toyota Sequoia auto insurance rates; higher percentages mean higher Toyota Sequoia car insurance rates. The Toyota Sequoia’s insurance loss probability varies for each form of coverage.

Toyota Sequoia Auto Insurance Loss Probability by Coverage Type

| Coverage | Loss |

|---|---|

| Collision | -30% |

| Property Damage | 3% |

| Comprehensive | -20% |

| Personal Injury | -43% |

| Medical Payment | 5% |

| Bodily Injury | 8% |

Understanding the Toyota Sequoia’s insurance loss probability can significantly impact your insurance costs. With a notable -30% loss rate for collision auto insurance, the Sequoia’s lower risk in this category can lead to reduced premiums.

Additionally, the -20% loss rate for comprehensive coverage and -43% for personal injury further contribute to potential savings, making the Sequoia an attractive option for cost-effective insurance. For more information, read our article titled “Is there a limit for auto insurance rate increases?”

Ways to Save on Toyota Sequoia Insurance

You have more options at your disposal to save money on your Toyota Sequoia car insurance costs. For example, try these five tips:

- Check the odometer on your Toyota Sequoia.

- Buy an older Toyota Sequoia. Learn more in our article titled “Cheap Auto Insurance for Older Vehicles“.

- Don’t skimp on Toyota Sequoia liability coverage.

- Work with a direct insurer instead of an insurance broker for your Toyota Sequoia.

- Install an aftermarket anti-theft device for your Toyota Sequoia.

Implementing these strategies can help you reduce your insurance costs while ensuring you maintain the necessary coverage for your Toyota Sequoia. Always compare quotes from different insurers and review your policy regularly to find additional savings opportunities.

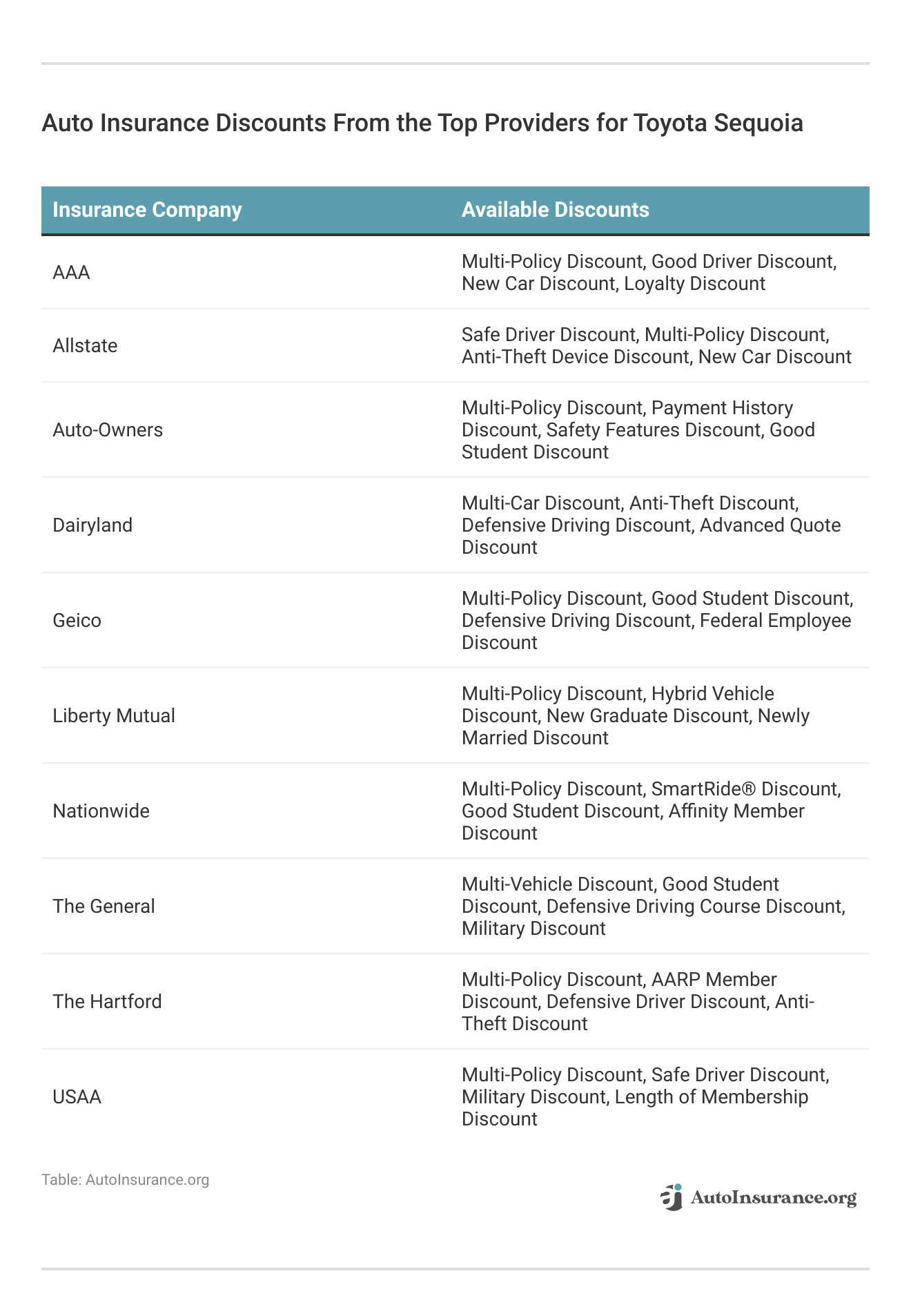

These discounts from top insurance providers for Toyota Sequoia offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Top Toyota Sequoia Insurance Companies

Who is the top auto insurance company for Toyota Sequoia insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Toyota Sequoia auto insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features that the Toyota Sequoia offers.

Top 10 Toyota Sequoia Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

Choosing the right insurance company for your Toyota Sequoia involves considering various factors including coverage options, discounts, and customer service. Many of these top companies offer competitive rates and discounts for safety features, which can help lower your overall insurance costs.

Read More: Cheap Toyota Auto Insurance

You can start comparing quotes for Toyota Sequoia auto insurance rates from some of the best auto insurance companies by using our free online tool now.

Frequently Asked Questions

What factors can affect the cost of auto insurance for a Toyota Sequoia?

Several factors can impact the cost of auto insurance for a Toyota Sequoia. These factors include the driver’s age, location, driving record, the age of the vehicle, safety features, and the chosen coverage options. Additionally, the insurance loss probability and the vehicle’s crash test ratings can define insurance premiums.

Is the cost of auto insurance higher for a Toyota Sequoia compared to other vehicles?

The cost of auto insurance can vary depending on various factors, including the make and model of the vehicle. Generally, larger and more expensive vehicles like the Toyota Sequoia may have higher insurance premiums due to the potential cost of repairs or replacement. However, insurance rates can also be influenced by the vehicle’s safety features, crash test ratings, and theft rates.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Are there any specific safety features in the Toyota Sequoia that can help reduce insurance premiums?

Yes, the Toyota Sequoia is equipped with several safety features that may help lower insurance premiums. These features include advanced airbags, anti-lock brakes, stability control, and a rearview camera. Insurance providers often consider these safety features when determining rates, as they enhance the overall safety of the vehicle.

What type of coverage should I consider for my Toyota Sequoia?

The type of coverage you should consider for your Toyota Sequoia depends on your individual needs and preferences. It is generally recommended to have liability insurance, which is required by law in most states. Additionally, comprehensive and collision coverage can help protect your vehicle from damage or theft.

Can I get discounts on auto insurance for my Toyota Sequoia?

Yes, many insurance providers offer discounts that may be applicable to your Toyota Sequoia. Common discounts include multi-policy discounts, safe driver discounts, and discounts for having safety features on your vehicle. It’s recommended to inquire about available discounts from your insurance provider to maximize your savings.

How can I find the cheapest auto insurance rates for my Toyota Sequoia?

To find the cheapest auto insurance rates for your Toyota Sequoia, you can compare quotes from multiple insurance providers. Using online comparison tools can help you quickly and easily see different rates and coverage options. Additionally, consider factors like the level of coverage, deductibles, and any available discounts to find the best deal.

Does the age of my Toyota Sequoia affect the insurance premiums?

Yes, the age of your Toyota Sequoia can affect the insurance premiums. Older models generally cost less to insure compared to newer models. This is because the value of the vehicle decreases over time, leading to lower repair or replacement costs. For example, a 2010 Toyota Sequoia may have lower insurance premiums than a 2022 model.

How does my driving record impact the cost of insurance for my Toyota Sequoia?

Your driving record can significantly impact the cost of insurance for your Toyota Sequoia. Drivers with a clean record typically receive lower insurance rates compared to those with traffic violations or accidents. Insurance providers consider drivers with a history of violations as higher risk, which can result in higher premiums.

Do location and ZIP code influence Toyota Sequoia insurance rates?

Yes, your location and ZIP code can influence Toyota Sequoia insurance rates. Insurance providers consider factors such as local traffic, crime rates, and the frequency of accidents in your area. For instance, urban areas with higher traffic and crime rates may have higher insurance premiums compared to rural areas.

Read More: Do auto insurance companies check where you live?

What is the insurance loss probability for a Toyota Sequoia and how does it affect premiums?

The insurance loss probability for a Toyota Sequoia indicates the likelihood of insurance claims for the vehicle. A lower insurance loss probability generally means lower insurance premiums, as the vehicle is considered less risky to insure. For example, the Sequoia’s notable -30% loss rate for collision auto insurance can lead to reduced premiums.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.