Best Salinas, California Auto Insurance in 2025

The cheapest Salinas, CA auto insurance is offered by GEICO, but rates will be different for every driver. However, low-income Salinas drivers may qualify for the California Low-Cost Auto program if they meet certain criteria. Salinas, CA auto insurance must meet the state minimum requirements of 15/30/5 in liability coverage, but drivers should consider additional coverages to be fully insured.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Sep 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Sep 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Geico has the cheapest auto insurance rates in Salinas, CA

- Salinas auto insurance is more expensive than the national average

- Low-income drivers may qualify for the California Low-Cost Auto program if they meet certain requirements

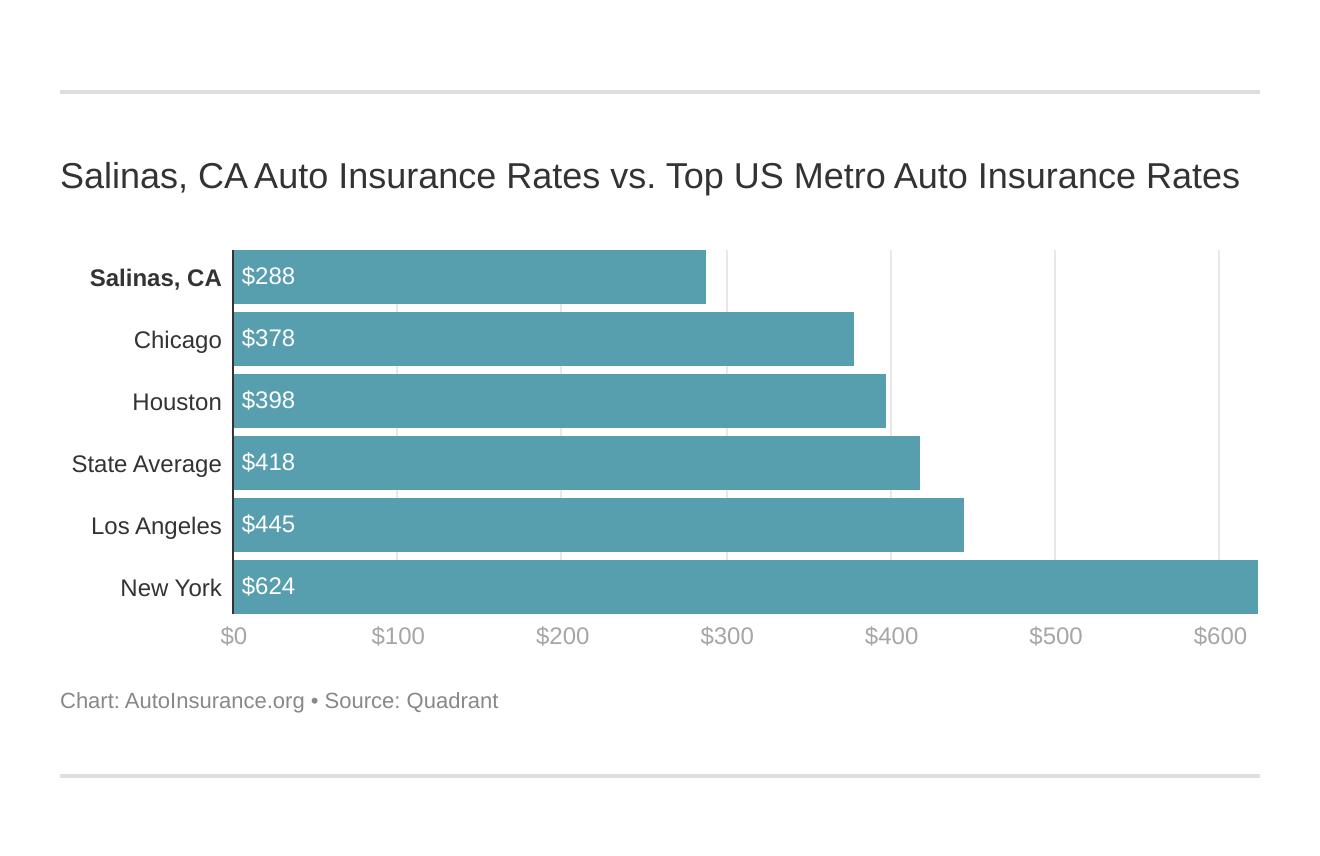

Although Salinas, CA auto insurance is more expensive than the national average, it is cheaper than the average California auto insurance rates.

Finding affordable Salinas, CA auto insurance is easy if you shop around. Compare quotes from multiple companies to see who can offer you cheap auto insurance that meets your coverage needs.

Monthly Salinas, CA Car Insurance Rates by ZIP Code

Check out the monthly Salinas, CA auto insurance rates by ZIP Code below:

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Salinas, CA Car Insurance Rates vs. Top US Metro Car Insurance Rates

You might find yourself asking how does my Salinas, CA stack up against other top metro auto insurance rates? We’ve got your answer below.

Enter your ZIP code now to compare Salinas, CA auto insurance quotes from multiple companies for free.

What is the cheapest auto insurance company in Salinas, CA?

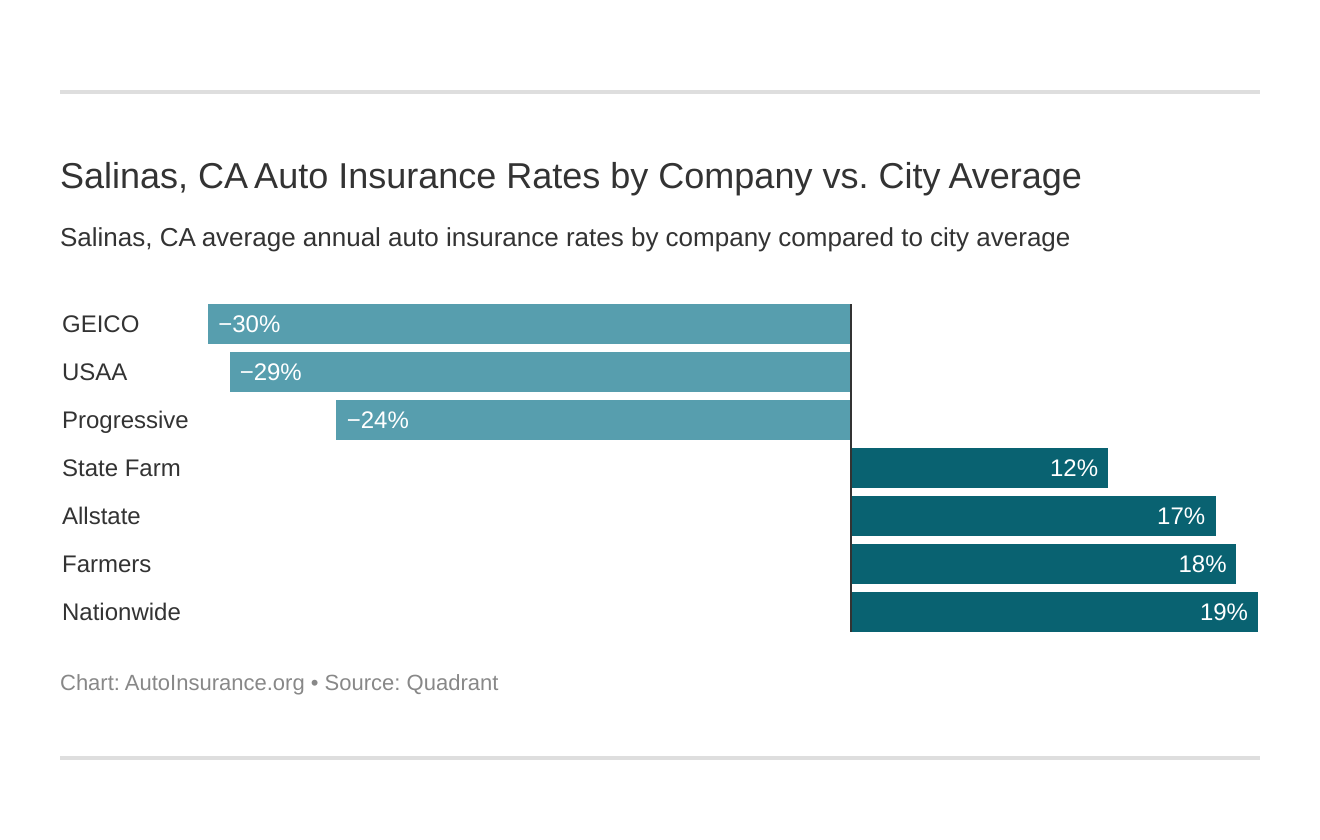

The cheapest auto insurance company on average in Salinas is Geico, but rates will vary by driver.

Which Salinas, CA auto insurance company has the cheapest rates? And how do those rates compare against the average California auto insurance company rates? We’ve got the answers below.

Here are the best auto insurance companies in Salinas, CA ranked from cheapest to most expensive:

- Geico – $2,557.28

- USAA – $2,595.91

- Progressive – $2,713.75

- Liberty Mutual – $2,809.47

- Travelers – $3,014.44

- State Farm – $3,905.85

- Allstate – $4,112.74

- Farmers – $4,145.31

- Nationwide – $4,181.87

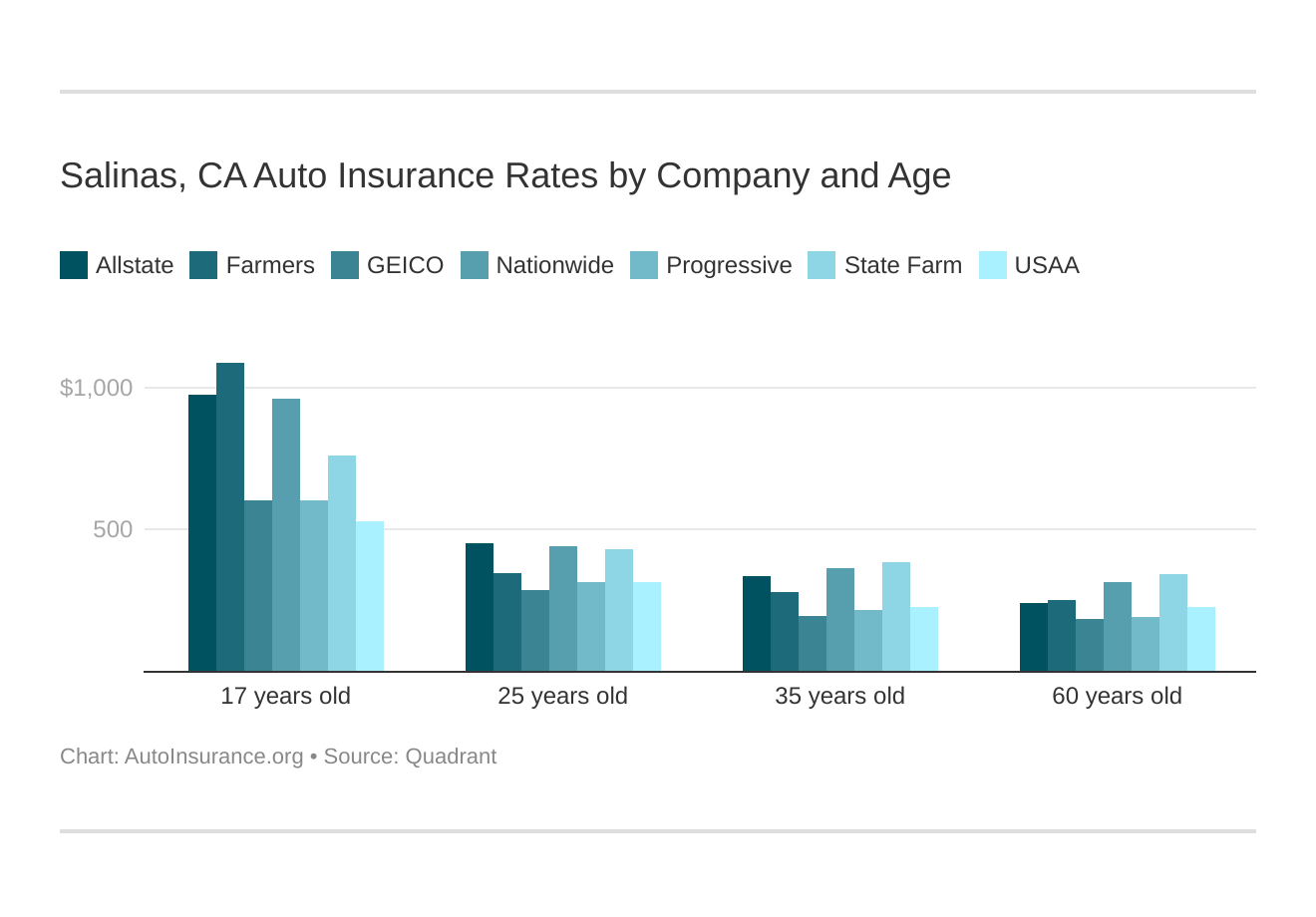

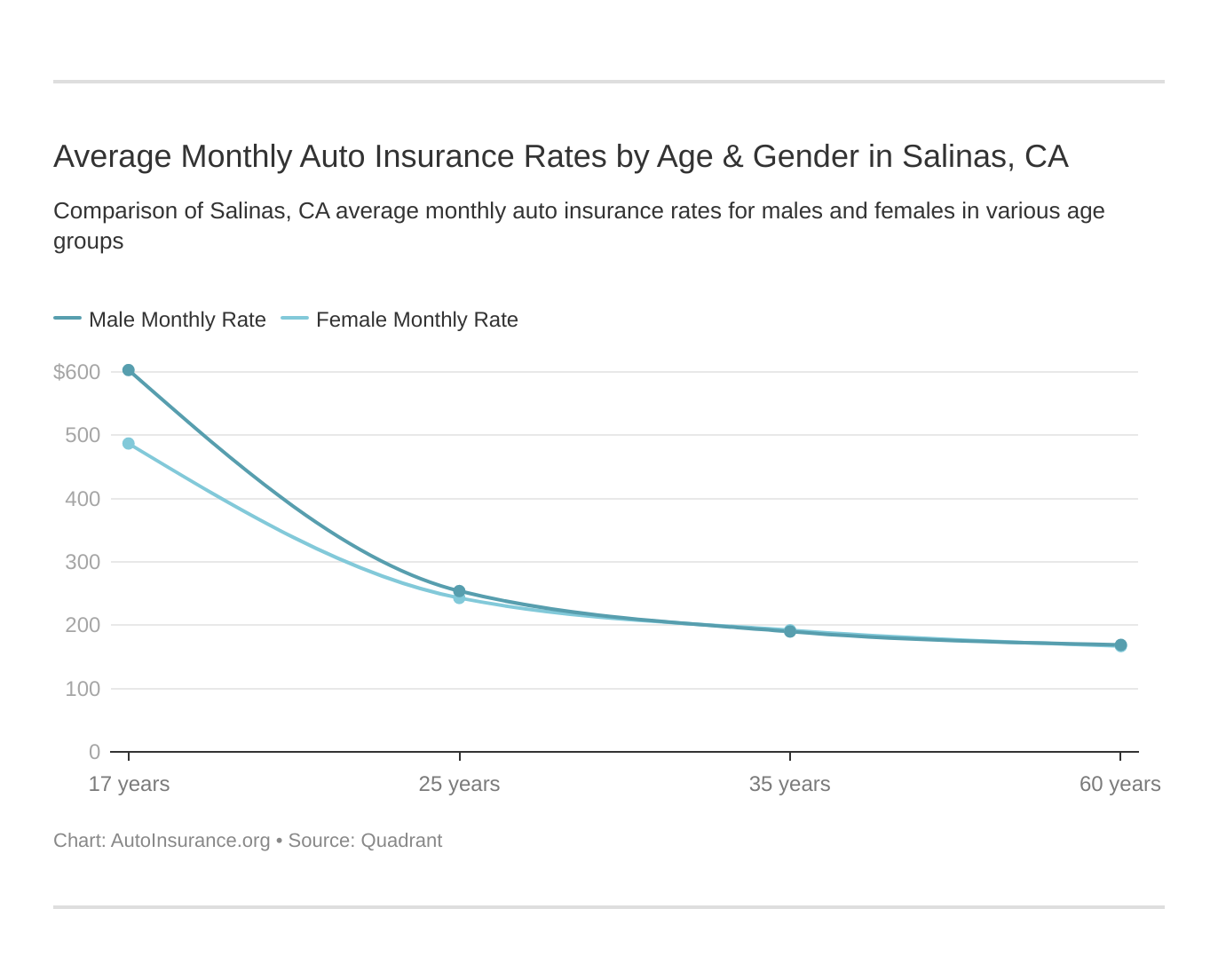

Many factors influence your auto insurance rates, including your age and driving record. California is one of the few states that does not allow insurance companies to use your gender when calculating your rates.

Where you live and the size of the city also affects your auto insurance rates. For example, although the cities are near each other, San Francisco auto insurance rates are much higher than rates in Salinas.

Also, low-cost auto insurance is available in California for low-income drivers. For drivers who meet such conditions, the California Low-Cost Auto (CLCA) program provides very low coverage.

Salinas, CA auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

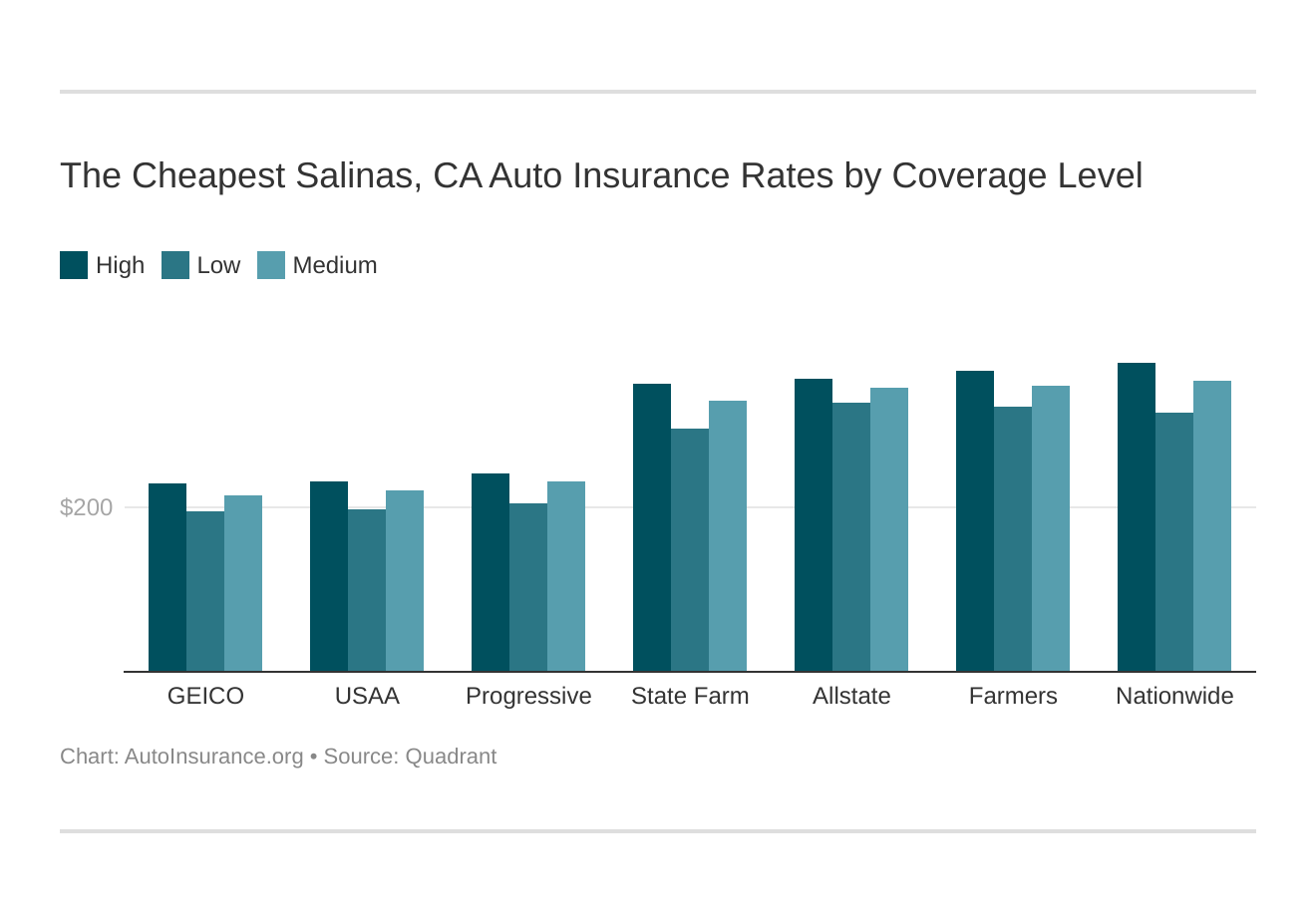

Your coverage level will play a major role in your Salinas auto insurance rates. Find the cheapest Salinas, CA auto insurance rates by coverage level below:

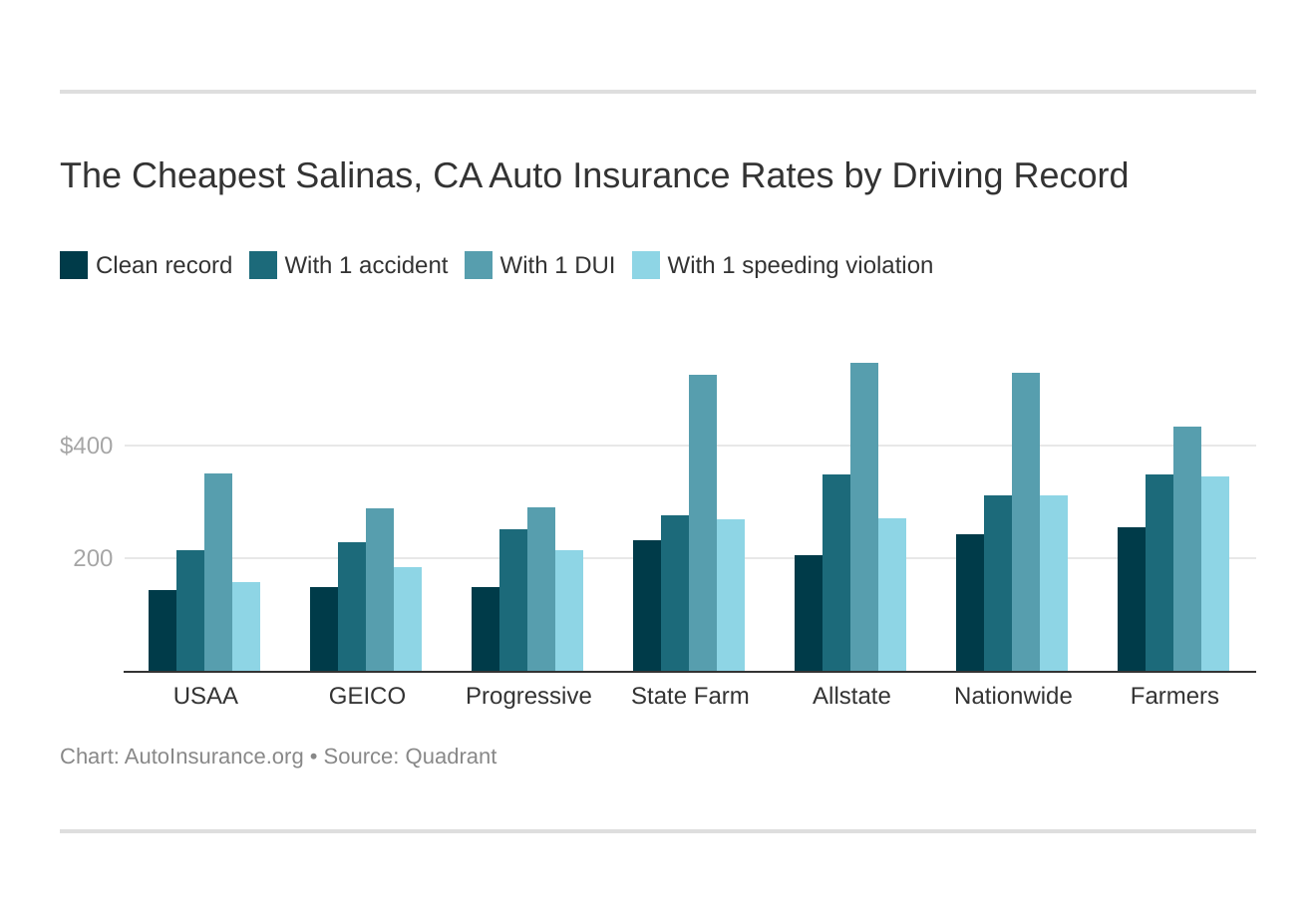

Your driving record will play a major role in your California auto insurance rates. For example, other factors aside, a Salinas, CA DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Salinas, CA auto insurance rates by driving record.

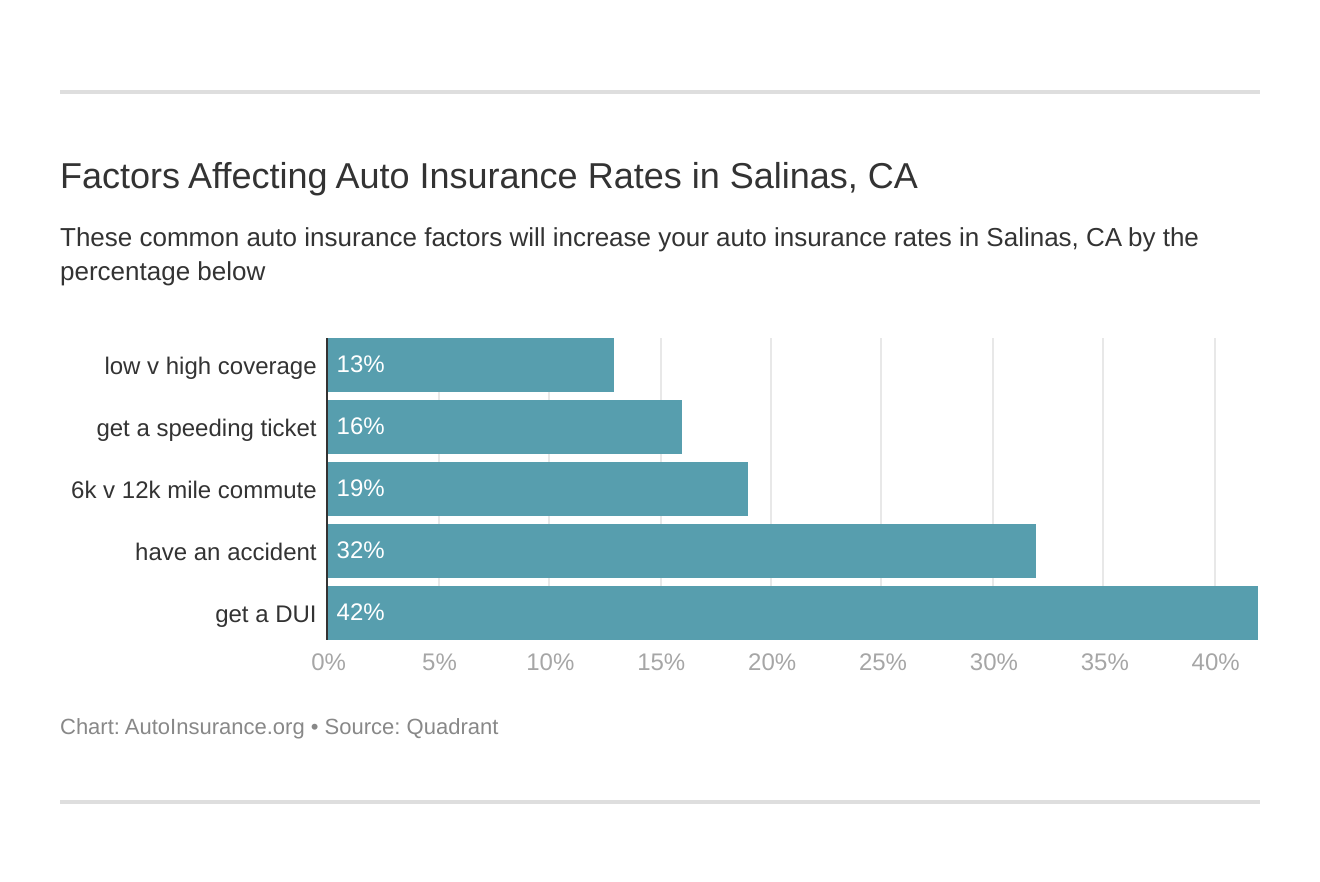

Factors affecting auto insurance rates in Salinas, CA may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Salinas, California auto insurance.

These states no longer using gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a significant factor because young drivers are often considered high-risk. California does use gender, so check out the average monthly auto insurance rates by age and gender in Salinas, CA.

What auto insurance coverage is required in Salinas, CA?

Most states, including California, require drivers to carry at least a minimum amount of auto insurance. Drivers in Salinas must carry:

- $15,000 per person and $30,000 per incident for bodily injury liability

- $5,000 per incident for property damage

These are very low minimums, and drivers should consider increasing them and adding additional coverages. These low minimums won’t completely protect you in a major accident, leaving you to pay out of pocket for everything not covered.

Consider adding collision and comprehensive insurance to your policy. Collision insurance assists in the payment of damages incurred as a result of an accident. Damages not caused by an accident, such as those caused by Salinas, CA weather, are protected by comprehensive insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What affects auto insurance rates in Salinas, CA?

Since more vehicles on the road equal a higher risk of an accident, traffic can also impact your auto insurance rates.

Although INRIX doesn’t have data for Salinas, it does rank nearby Monterey, CA as the 72nd-most congested city in the U.S.

City-Data reports that most drivers in Salinas have about a 25-minute commute, and most drivers commute alone, which drives up Salinas, CA car insurance rates for everyone.

Theft can also cause your auto insurance rates to increase. According to the FBI, there were 1,242 motor vehicle thefts in Salinas in one year.

Salinas, CA Auto Insurance: The Bottom Line

Salinas auto insurance rates are more expensive than the national average, but low-income drivers may be able to take advantage of the CLCA program if they meet certain requirements.

Shop around to find the best deal before you buy Salinas, CA auto insurance. Each company will charge a different rate so compare quotes from multiple companies for the best deal.

Enter your ZIP code to compare Salinas, CA auto insurance rates from companies near you.

Frequently Asked Questions

What is the cheapest auto insurance company in Salinas, CA?

Geico is the cheapest auto insurance company on average in Salinas, CA, but rates vary by driver.

What auto insurance coverage is required in Salinas, CA?

Salinas drivers are required to carry the state minimum liability coverage of 15/30/5. However, it is recommended to consider additional coverages for full protection.

What factors affect auto insurance rates in Salinas, CA?

Factors that can affect auto insurance rates in Salinas, CA include your driving record, coverage level, commute distance, and the prevalence of theft in the area.

Are there any low-cost auto insurance options in California for low-income drivers?

Yes, low-income drivers in California may qualify for the California Low-Cost Auto (CLCA) program, which provides very low coverage at affordable rates.

How can I find affordable auto insurance in Salinas, CA?

To find affordable auto insurance in Salinas, CA, it’s recommended to shop around and compare quotes from multiple companies. Each company sets its own rates, so comparing options can help you find the best deal.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.