Best Auto Insurance for Pizza Hut Delivery Drivers in 2025 (Find the Top 10 Companies Here)

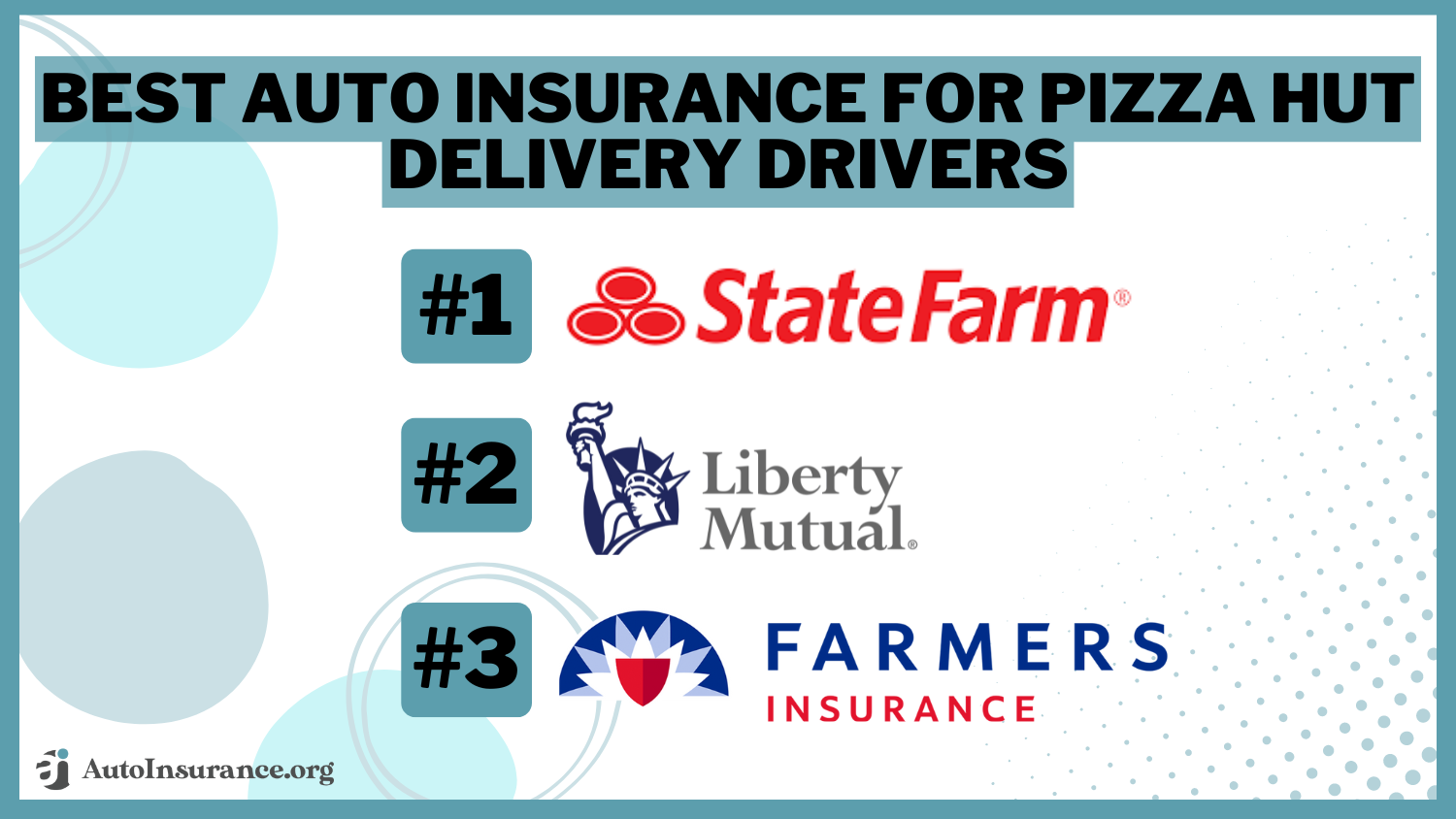

For the best auto insurance for Pizza Hut delivery drivers, State Farm, Liberty Mutual, and Farmers offer top coverage, with rates starting at $75 per month. These companies provide essential coverage specifically designed for Pizza Hut delivery drivers, guaranteeing comprehensive protection while on the job.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

UPDATED: Dec 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Pizza Hut Delivery Drivers

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Pizza Hut Delivery Drivers

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Pizza Hut Delivery Drivers

A.M. Best

Complaint Level

Pros & Cons

These providers stand out for their comprehensive policies, which include essential liability coverage and options to protect drivers while on the job.

Our Top 10 Company Picks: Best Auto Insurance for Pizza Hut Delivery Drivers

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 25% B Coverage Options State Farm

#2 20% A Versatile Coverage Liberty Mutual

#3 15% A Policy Options Farmers

#4 20% A+ Comprehensive Coverage Nationwide

#5 12% A+ Low Rates Progressive

#6 23% A+ Drivewise Program Allstate

#7 15% A++ Coverage Options Travelers

#8 22% A+ Discounts Offered The Hartford

#9 10% A++ Customizable Plans Auto-Owners

#10 27% A+ Competitive Pricing Erie

For Pizza Hut delivery drivers seeking reliable protection, these companies offer the most tailored and effective insurance solutions available. Explore discount options in our detailed guide titled “Best Delivery Driver Auto Insurance.”

Get fast and cheap auto insurance coverage today with our quote comparison tool above.

- State Farm is the top pick for comprehensive coverage for delivery drivers

- Pizza Hut delivery drivers need to meet state liability requirements

- Additional coverage is essential for full protection on the job

#1 – State Farm: Top Overall Pick

Pros

- Comprehensive Coverage Plans: State Farm offers a wide range of coverage options specifically designed to meet the needs of Pizza Hut delivery drivers, ensuring they have the necessary protection while on the job.

- High Bundling Discount: Pizza Hut delivery drivers can save up to 25% by bundling multiple policies with State Farm, making it easier to manage various insurance needs under one provider. See the reviews and rankings in our full State Farm auto insurance review.

- Robust Liability Protection: State Farm provides strong liability coverage, which is essential for Pizza Hut delivery drivers who need to meet state requirements and protect themselves against potential lawsuits.

Cons

- Restricted Coverage Availability: Certain specialized coverage options may not be available in all states, which could limit choices for Pizza Hut delivery drivers depending on their location.

- Less Advanced Digital Tools: State Farm’s mobile app and online tools may not offer the same level of functionality as competitors, which could be a drawback for tech-savvy Pizza Hut delivery drivers who prefer managing their policies online.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Liberty Mutual: Best for Versatile Coverage

Pros

- Flexible and Customizable Coverage: Liberty Mutual offers versatile insurance options that Pizza Hut delivery drivers can tailor to their specific needs, whether they require basic liability or comprehensive coverage.

- Better Car Replacement: This unique coverage option allows Pizza Hut delivery drivers to replace their vehicles with newer models if they are totaled in an accident, which can be particularly valuable for those relying heavily on their cars for work.

- Multi-Policy Discount: Liberty Mutual offers up to a 20% discount for bundling policies, helping Pizza Hut delivery drivers reduce their overall insurance costs while enjoying comprehensive protection. To see monthly premiums and honest rankings, read our Liberty Mutual auto insurance review.

Cons

- Higher Premiums for Full Coverage: Pizza Hut delivery drivers may find that the cost of full coverage options with Liberty Mutual is higher compared to other insurers, potentially making it less attractive for those on a tight budget.

- Limited Digital Support: While Liberty Mutual offers some online tools, they may not be as comprehensive or user-friendly as those provided by competitors, which could be a disadvantage for Pizza Hut delivery drivers who prefer digital management of their policies.

#3 – Farmers: Best for Policy Options

Pros

- Diverse Policy Choices: Farmers offers a wide variety of policy options, making it easier for Pizza Hut delivery drivers to select coverage that matches their specific needs, whether they’re looking for basic liability or more extensive protection.

- Financially Strong: Farmers holds an A rating from A.M. Best, assuring Pizza Hut delivery drivers of the company’s financial stability and its ability to handle claims efficiently. Find more details in our review of Farmers auto insurance.

- Affinity Discounts: Farmers offers discounts for members of certain organizations, which could benefit Pizza Hut delivery drivers who qualify, further lowering their insurance costs.

Cons

- Limited Bundling Savings: Pizza Hut delivery drivers might find Farmers’ 15% bundling discount less competitive compared to other insurers, which could limit the overall savings on their insurance premiums.

- Higher Costs for Customization: Customizing a policy with Farmers, while providing tailored coverage, can lead to higher premiums, which may be a concern for budget-conscious Pizza Hut delivery drivers.

#4 – Nationwide: Best for Comprehensive Coverage

Pros

- Extensive Coverage Options: Nationwide offers a wide array of comprehensive coverage plans, ideal for Pizza Hut delivery drivers who need thorough protection against a variety of risks. Explore more add-on options in our Nationwide auto insurance review.

- Vanishing Deductible Program: Nationwide’s vanishing deductible feature rewards safe Pizza Hut delivery drivers by reducing their deductible over time, leading to potential savings on out-of-pocket costs.

- SmartRide Program: The SmartRide program by Nationwide offers discounts for safe driving, making it an attractive option for Pizza Hut delivery drivers looking to lower their insurance premiums based on their driving habits.

Cons

- Higher Premiums: Pizza Hut delivery drivers may find that Nationwide’s premiums are higher compared to some other insurers, even when taking advantage of available discounts.

- Complex Discount Programs: Some of Nationwide’s discount programs, such as SmartRide, require tracking and active participation, which could be challenging for Pizza Hut delivery drivers with busy schedules.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Low Rates

Pros

- Competitive Premiums: Progressive is known for offering some of the lowest insurance rates in the market, making it an attractive option for cost-conscious Pizza Hut delivery drivers. Learn more about coverage options and monthly rates in our Progressive auto insurance company review.

- Snapshot Program for Savings: The Snapshot program allows Pizza Hut delivery drivers to potentially lower their premiums by tracking their safe driving habits, offering an incentive for careful driving.

- Diverse Coverage Options: Progressive offers a variety of coverage options, ensuring that Pizza Hut delivery drivers can find the protection they need, from basic liability to comprehensive plans.

Cons

- Limited Discounts Beyond Snapshot: While the Snapshot program offers savings opportunities, other discounts with Progressive may be less comprehensive compared to those offered by competitors, potentially limiting overall savings for Pizza Hut delivery drivers.

- Potential Rate Increases: Pizza Hut delivery drivers might experience rate increases after the initial policy period, particularly if they do not maintain the safe driving standards required by the Snapshot program.

#6 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: Allstate’s Drivewise program offers discounts for safe driving, making it ideal for Pizza Hut delivery drivers who maintain good driving habits.

- Customizable Policies: Allstate offers a range of customizable coverage options, allowing Pizza Hut delivery drivers to tailor their insurance to specific needs.

- Bundling Savings: Allstate provides up to a 23% discount for bundling policies, which can lead to significant savings for Pizza Hut delivery drivers. Read more about this provider in our Allstate auto insurance review.

Cons

- Drivewise Restrictions: The benefits of the Drivewise program may vary by state, and some Pizza Hut delivery drivers might not fully benefit from the program.

- Strict Eligibility for Discounts: Discounts like accident forgiveness come with strict eligibility criteria, which may limit access for some Pizza Hut delivery drivers.

#7 – Travelers: Best for Coverage Options

Pros

- Extensive Coverage Choices: Travelers offers a broad range of coverage options that can be tailored to the specific needs of Pizza Hut delivery drivers, ensuring comprehensive protection.

- Bundling Discount: Travelers offers up to 15% off for bundling policies, allowing Pizza Hut delivery drivers to save money while securing the coverage they need. Read more about Travelers’ ratings in our Travelers insurance review.

- Efficient Claims Process: Travelers is known for its smooth claims handling, which is crucial for Pizza Hut delivery drivers who depend on their vehicles for work.

Cons

- Higher Premiums: Pizza Hut delivery drivers might find Travelers’ full coverage options more expensive than those offered by some competitors, even with discounts.

- Basic Digital Tools: Travelers’ mobile app and online services are not as robust as those of competitors, possibly affecting Pizza Hut delivery drivers who prefer digital management.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – The Hartford: Best for Discounts Offered

Pros

- Strong Discount Programs: The Hartford offers up to a 22% discount for bundling, making it a cost-effective choice for Pizza Hut delivery drivers looking to save on multiple policies.

- A+ A.M. Best Rating: With an A+ rating, The Hartford ensures strong financial security, providing reliability for Pizza Hut delivery drivers. Our article, The Hartford auto insurance review, provides more detail about what this provider has to offer.

- Included Roadside Assistance: The Hartford includes roadside assistance in many of its policies, which is particularly beneficial for Pizza Hut delivery drivers who may encounter issues while on the road.

Cons

- Higher Premium Costs: Pizza Hut delivery drivers may find The Hartford’s premiums higher than those of other insurers, particularly for comprehensive coverage options.

- Regional Restrictions: Some discounts and coverage options are limited to specific regions, which could affect availability for Pizza Hut delivery drivers in certain areas.

#9 – Auto-Owners: Best for Customizable Plans

Pros

- Highly Customizable Plans: Auto-Owners offers policies that can be extensively customized, allowing Pizza Hut delivery drivers to select coverage options that best fit their needs.

- A++ A.M. Best Rating: Auto-Owners holds an A++ rating, providing top-tier financial security, which is reassuring for Pizza Hut delivery drivers. Read our Auto-Owners auto insurance review to see if this provider is right for you.

- Bundling Discount: Auto-Owners provides a 10% discount for bundling policies, offering potential savings for Pizza Hut delivery drivers who need multiple types of insurance.

Cons

- Higher Costs for Customization: While offering extensive customization, Pizza Hut delivery drivers might find that tailoring a policy with Auto-Owners can lead to higher premiums.

- Limited Digital Offerings: Auto-Owners’ digital tools, including their mobile app, may be less advanced compared to competitors, affecting Pizza Hut delivery drivers who prefer managing their insurance online.

#10 – Erie: Best for Competitive Pricing

Pros

- Competitive Rates: Erie is recognized for offering some of the most competitive insurance rates, making it an attractive option for budget-conscious Pizza Hut delivery drivers.

- High Bundling Discount: Erie offers up to a 27% discount for bundling policies, providing significant savings for Pizza Hut delivery drivers who need multiple types of coverage.

- Efficient Claims Handling: Erie is known for a smooth and efficient claims process, which is essential for Pizza Hut delivery drivers who rely on their vehicles for their job. Compare Erie’s rates with top competitors in our review of Erie auto insurance.

Cons

- Less Comprehensive Add-On Options: Pizza Hut delivery drivers might find that Erie’s add-on coverage options are not as extensive as those offered by other insurers, requiring more purchases for complete protection.

- Higher Full Coverage Rates: Erie’s rates for full coverage options might be higher than expected, particularly for Pizza Hut delivery drivers seeking extensive insurance coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pizza Hut Delivery Driver Insurance Rates by Provider

When selecting the best auto insurance for Pizza Hut delivery drivers, it’s crucial to compare the monthly rates for both minimum and full coverage across different providers. This comparison helps drivers choose the most cost-effective option while ensuring they have the necessary protection on the road.

Pizza Hut Delivery Driver Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $88 $165

Auto-Owners $78 $159

Erie $77 $157

Farmers $90 $160

Liberty Mutual $85 $155

Nationwide $82 $158

Progressive $75 $145

State Farm $80 $150

The Hartford $85 $160

Travelers $80 $152

The table highlights monthly rates for Pizza Hut delivery driver insurance by provider. Progressive offers the lowest rates at $75 for minimum and $145 for full coverage. Erie and Auto-Owners also offer competitive rates, with Erie at $77 for minimum and $157 for full coverage.

On the higher end, Allstate charges $88 for minimum coverage and $165 for full coverage, reflecting a premium for its broader service offerings. Comparing these rates allows Pizza Hut delivery drivers to select a policy that balances cost with the level of protection they need. Find more information about Allstate’s rates in our guide titled “Allstate Drivewise Review.”

Understanding Pizza Hut’s Auto Insurance Options

Pizza Hut does not offer insurance coverage to its delivery drivers. While some companies, like Uber or Amazon, offer commercial coverage to employees while they’re on the job, Pizza Hut does not do the same. See other discounts you may qualify for in our guide titled “How to Get an Uber Driver Auto Insurance Discount.”

But the company website states that any person delivering menu items for Pizza Hut must carry a car insurance policy and have a valid driver’s license.

While Pizza Hut does not specify the necessary auto insurance type, anyone who drives a car must carry the state’s minimum liability coverage amount.

Determining Coverage for Pizza Hut Delivery Drivers

To deliver pizzas for Pizza Hut, you have to carry, at minimum, liability auto insurance coverage. The extent of the coverage and the amount of coverage will depend on where you live.

The table below shows each state’s requirements for liability coverage in terms of bodily injury liability per person, bodily injury liability per accident, and property damage liability.

Liability Auto Insurance Requirements by State

State Requirement

Alabama 25/50/25

Alaska 50/100/25

Arizona 15/30/10

Arkansas 25/50/25

California 15/30/5

Colorado 25/50/15

Connecticut 25/50/20

Deleware 25/50/10

District of Columbia 25/50/10

Florida 10/20/10

Georgia 25/50/25

Hawaii 20/40/10

Idaho 25/50/15

Illinois 25/50/20

Indiana 25/50/25

Iowa 20/40/15

Kansas 25/50/25

Kentucky 25/50/25

Lousiana 15/30/25

Maine 50/100/25

Maryland 30/60/15

Massachusetts 20/40/5

Michigan 20/40/10

Minnesota 30/60/10

Mississippi 25/50/25

Missouri 25/50/25

Montana 25/50/20

Nebraska 25/50/25

Nevada 25/50/20

New Hampshire 25/50/25

New Jersey 15/30/5

New Mexico 25/50/10

New York 25/50/10

North Carolina 30/60/25

North Dakota 25/50/25

Ohio 25/50/25

Oklahoma 25/50/25

Oregon 25/50/20

Pennsylvania 15/30/5

Rhode Island 25/50/25

South Carolina 25/50/25

South Dakota 25/50/25

Tennessee 25/50/15

Texas 30/60/25

Utah 25/65/15

Vermont 25/50/10

Virginia 25/50/20

Washington 25/50/10

West Virginia 25/50/25

Wisconsin 25/50/10

Wyoming 25/50/20

As you can see, coverage requirements vary a great deal from one state to another. So depending on where you live, you may get away with carrying very little liability coverage.

But if you drive much for work, especially if you are a delivery driver, you should consider purchasing additional coverage for your vehicle. Liability coverage only protects the cars and people you injure — and only up to a certain dollar amount.

When you use your personal vehicle for your job, it’s a good idea to consider additional coverage through a commercial insurance policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Navigating Commercial Insurance Needs as a Pizza Hut Driver

You may find that you need commercial coverage to deliver food for Pizza Hut. And this will likely depend on your insurance company.

Some insurance companies might not cover your vehicle if you used it for work when you got in an accident. There can be exclusions on your insurance policy stating that your coverage will not extend to this type of scenario.

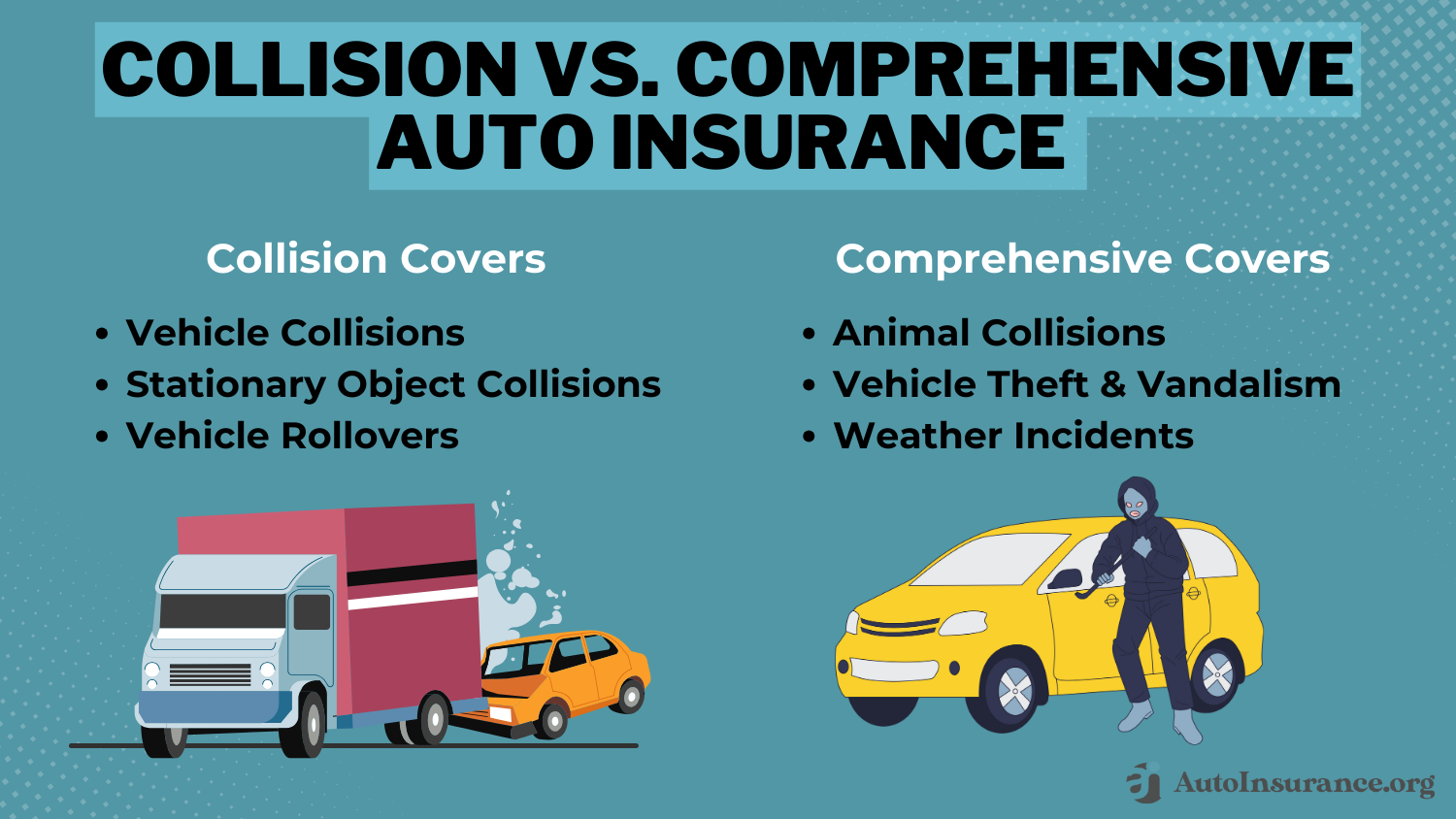

So even if you purchase a full coverage policy that includes both collision and comprehensive coverage, your claim after an accident could still be denied because you were driving for Pizza Hut when the accident occurred. Learn more in our guide titled “Collision vs. Comprehensive Auto Insurance Explained.”

You should check your policy to see whether there are any exclusions. If you are not sure whether your policy will cover you, you should call your insurance company and ask.

If you decide you need additional coverage, a commercial auto insurance policy is a great way to get the coverage you need on yourself and your vehicle. You will likely find that rates are significantly higher than what you’re used to, but the coverage also comes with much higher limits, ensuring you will not have to pay for damages or injuries out of pocket.

Factors Affecting Commercial Auto Insurance Rates for Delivery Drivers

The amount you will pay for a commercial car insurance policy will vary based on several factors, including the following:

- Age & Gender

- Driving Record

- Vehicle Make, Model, & Year

- Annual Mileage & Commute

- Location

The average monthly premium for commercial auto insurance in the U.S. is $145. As a result, commercial coverage rates could be over $83 more per month than your current car insurance.

If you think commercial coverage is too expensive, consider opting for business-use auto insurance. This is especially relevant for those considering Pizza Hut careers, Pizza Hut jobs, or Pizza Hut delivery jobs, where vehicle use for work is common.

Understanding Business-Use Auto Insurance

Some insurers offer an add-on for business-use coverage, providing extra protection with Pizza Hut driver insurance. Choose a trusted provider that meets your needs and budget, and compare quotes to find the best deal for your Pizza Hut minimum delivery requirements.

While adding business-use coverage to your policy will cost you more money, it will not cost as much as a commercial policy. But this type of auto insurance coverage will only help if you deliver food for Pizza Hut part-time. On the other hand, if you work close to full-time, your insurance company will probably require you to carry something like a commercial policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

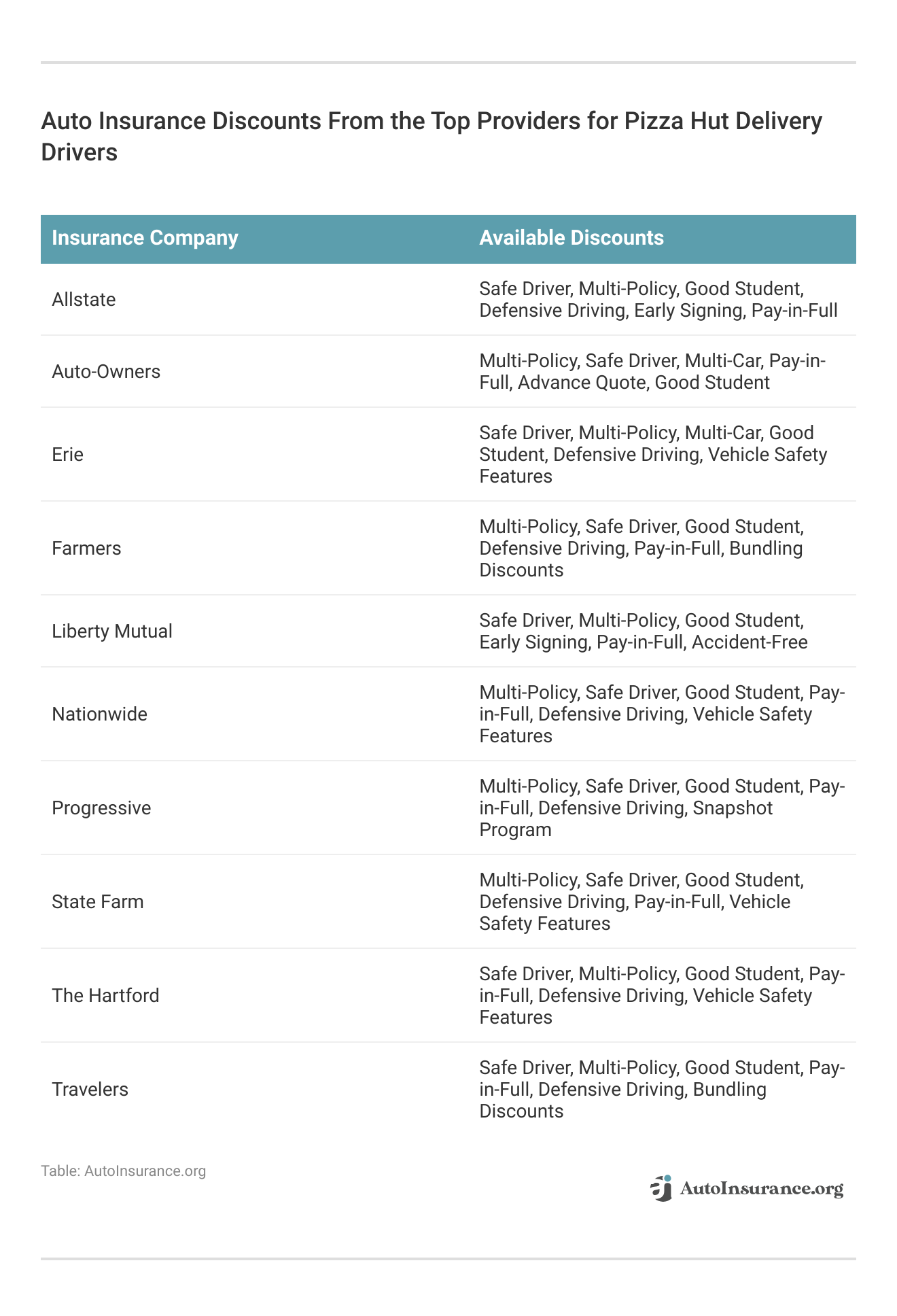

Top Insurance Providers for Pizza Hut Drivers

If you have a good driving record, most insurance companies are likely to offer coverage. When you mention that you work for Pizza Hut and use your personal vehicle for deliveries, one insurer might provide advice on coverage options that another may not.

Ultimately, the decision rests with you to select an insurance hut that you trust, offering the Pizza Hut insurance coverage you need at a reasonable price. It’s important to shop around for quotes if you’re seeking a new Pizza Hut delivery insurance policy.

Be sure to compare auto insurance rates from multiple auto insurance providers in your area. If you are seriously considering a specific company, call and speak to a representative to ensure you will be covered if you’re ever in an accident while driving for work.

Comprehensive Guide to Pizza Hut Auto Insurance

If you’re a Pizza Hut driver, liability insurance is required. However, many pizza delivery drivers opt for additional coverage to guarantee full protection.

Commercial auto insurance policies can cost a great deal more than your average liability-only insurance coverage. Still, this type of policy will offer the kind of coverage you may need if you’re ever in an accident while delivering food for Pizza Hut. Explore more ways to save in our article titled “Cheap Auto Insurance After an Accident.”

State Farm is the top pick for Pizza Hut delivery drivers, offering robust coverage options with premiums as low as $80 per month.Justin Wright Licensed Insurance Agent

When looking for the best auto insurance rates, browse online and compare quotes from leading companies in your area. This approach should help you find competitive rates for insurance for pizza delivery drivers.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Frequently Asked Questions

Does Pizza Hut offer auto insurance?

No, Pizza Hut does not offer auto insurance. Pizza Hut is a restaurant chain and does not provide insurance services.

Where can I find auto insurance coverage?

To find auto insurance coverage, you can reach out to various insurance providers, including national and local insurance companies, independent agents, or utilize online platforms that offer insurance comparison services.

What factors affect auto insurance rates?

Several factors can affect auto insurance rates, including your age, driving history, location, type of vehicle, coverage options, and credit score. Insurance companies use these factors, among others, to determine the risk associated with insuring you and calculate your premium.

Access comprehensive insights into our guide titled “How Credit Scores Affect Auto Insurance Rates.”

How can I get a quote for auto insurance?

To get a quote for auto insurance, you can contact insurance companies directly, visit their websites to request a quote online, or use online insurance comparison platforms that provide quotes from multiple insurers. You will typically need to provide information such as your personal details, vehicle information, driving history, and desired coverage options.

What are the minimum auto insurance requirements?

The minimum auto insurance requirements vary by state. In most states, the minimum requirements include liability coverage for bodily injury and property damage. Some states may also require personal injury protection (PIP) or uninsured/underinsured motorist coverage. It’s important to check the specific requirements in your state to ensure compliance.

Discover more in our guide titled, “Personal Injury Protection Auto Insurance Defined.”

What is Pizza Hut delivery insurance?

Pizza Hut delivery insurance refers to the personal auto insurance that delivery drivers must carry, which should include coverage for commercial use.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

What insurance do I need for pizza delivery drivers?

Pizza delivery drivers need auto insurance that includes liability coverage and may need additional commercial or business-use coverage depending on their insurance provider.

How much does insurance cost for Pizza Hut delivery drivers in Florida?

Insurance for Pizza Hut delivery drivers in Florida varies but typically ranges from $75 to $165 per month, depending on coverage and provider.

Learn more by reading our guide titled “Cheap Auto Insurance in Florida.”

How can I find cheap Pizza Hut delivery drivers insurance?

To find cheap Pizza Hut delivery drivers insurance, compare quotes from multiple providers and consider options like Progressive and State Farm, known for competitive rates.

Do I need special insurance for Pizza Hut delivery drivers?

Yes, you need special insurance for Pizza Hut delivery drivers, typically a commercial or business-use policy, to ensure you’re covered while delivering.

What is the insurance cost for Pizza Hut delivery drivers in California?

The insurance cost for Pizza Hut delivery drivers in California typically ranges from $78 to $165 per month, varying by coverage level and provider.

To learn more, explore our comprehensive resource on our guide titled “Best California Auto Insurance.”

How much does insurance cost for Pizza Hut delivery drivers in Texas?

In Texas, insurance for Pizza Hut delivery drivers generally costs between $75 and $165 per month, depending on the chosen coverage and insurer.

What is the insurance cost for Pizza Hut delivery drivers in New Hampshire?

In New Hampshire, insurance for Pizza Hut delivery drivers usually costs between $75 and $160 per month, depending on the provider and coverage.

What is the insurance cost for Pizza Hut delivery drivers in Vermont?

For Pizza Hut delivery drivers in Vermont, insurance costs generally range from $75 to $160 per month, based on the coverage level and insurance provider.

Find out more in our guide titled, “Best Vermont Auto Insurance.”

What are the benefits of Progressive insurance for Pizza Hut delivery drivers?

Progressive insurance offers competitive rates, starting at $75 per month, with customizable coverage options ideal for Pizza Hut delivery drivers.

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Why choose State Farm insurance for Pizza Hut delivery drivers?

State Farm insurance provides comprehensive coverage and strong customer service, with rates as low as $80 per month, making it a top choice for Pizza Hut delivery drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.