Esurance Auto Insurance Review in 2025 (Rates & Customer Reviews)

Esurance auto insurance review reveals competitive rates starting at $114 per month for full coverage, with advanced digital tools for easy management. This review explores Esurance’s customer service, claims process, and available discounts to help you determine if it meets your insurance needs.

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Esurance

Average Monthly Rate For Good Drivers

$114A.M. Best Rating:

A-Complaint Level:

LowPros

- An easy process for buying a policy online

- A convenient, self-serve mobile app

- User-friendly digital tools

- Streamlined and responsive claims service

- Numerous discounts to reduce premiums

Cons

- Higher-than-average rates

- A significant number of customer complaints

- No accident forgiveness or new car replacement

- No local agents

Esurance auto insurance review highlights how the company offers competitive rates, focus on digital convenience, and efficient claims processing, including guidance on how to file an auto insurance claim.

Esurance provides a user-friendly online option for buying a policy and filing a claim. However, many customer complaints highlight issues with the Esurance auto claims process.

Esurance Auto Insurance Rating

Rating Criteria

Overall Score 4.3

Business Reviews 4

Claim Processing 4.5

Company Reputation 4

Coverage Availability 4.9

Coverage Value 4.1

Customer Satisfaction 4

Digital Experience 4.5

Discounts Available 5

Insurance Cost 4.2

Plan Personalization 4.5

Policy Options 3.8

Savings Potential 4.5

Before buying an Esurance auto policy, compare rates online. With Esurance’s competitive starting rate of $114 per month for full coverage, you can easily gauge the value against other companies.

Stop overpaying for auto insurance. Enter your ZIP code above to find out if you can get a better deal.

Understanding Esurance Auto Insurance Rates

Key to securing affordable auto Esurance is maintaining a pristine driving record. Drivers with few or no infractions typically benefit from the lowest premiums, reflecting their lower risk profile. To illustrate the potential costs, let’s explore the likely rates based on age, gender, and coverage level, which can influence the average auto insurance monthly cost.

Esurance Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

Age & Gender Minimum Coverage Full Coverage

Age: 16 Female $258 $634

Age: 16 Male $300 $647

Age: 18 Female $154 $470

Age: 18 Male $164 $560

Age: 25 Female $133 $374

Age: 25 Male $143 $459

Age: 30 Female $99 $120

Age: 30 Male $119 $125

Age: 45 Female $40 $110

Age: 45 Male $49 $114

Age: 60 Female $39 $100

Age: 60 Male $45 $109

Age: 65 Female $37 $93

Age: 65 Male $40 $99

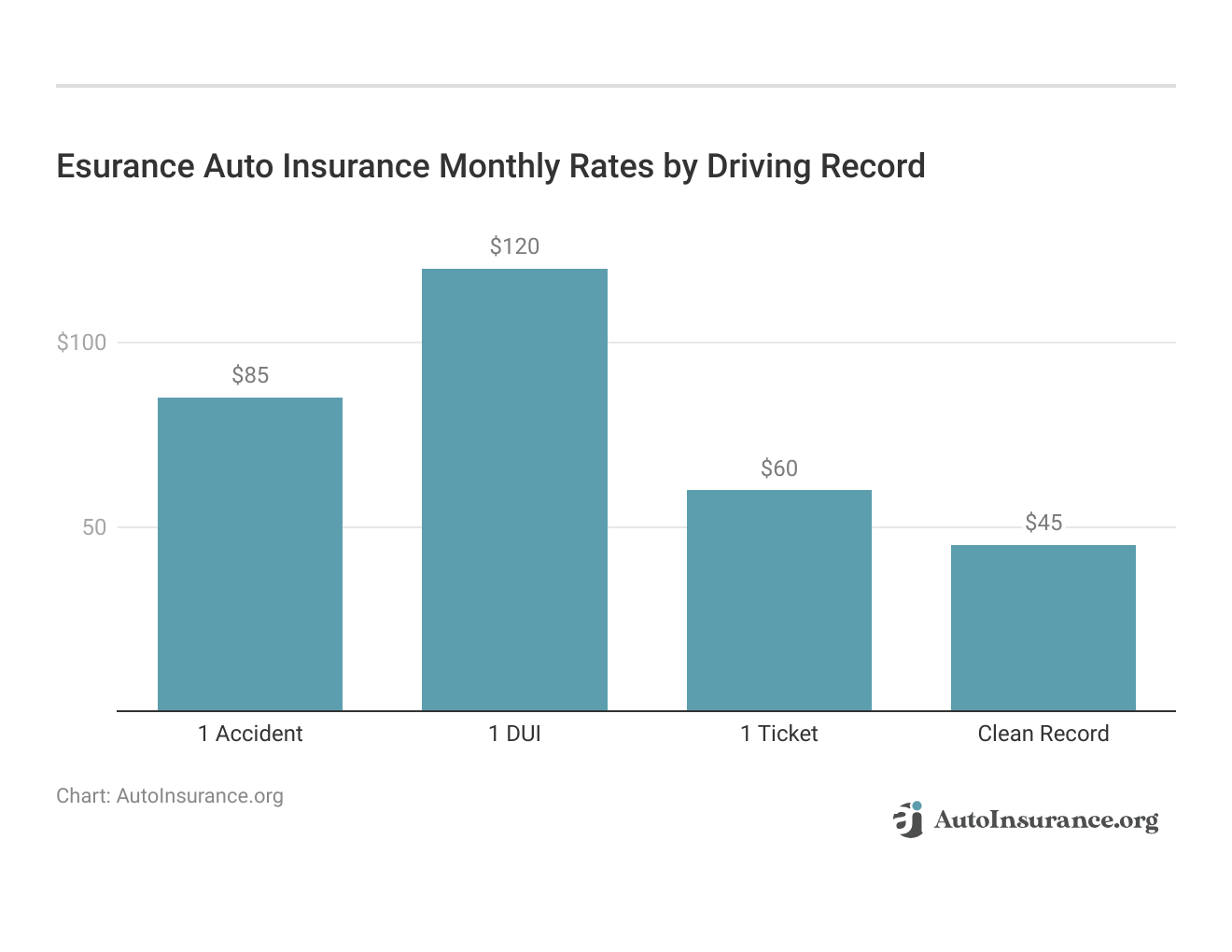

However, if your driving history includes infractions like accidents, DUIs, or traffic tickets, expect to see an increase in your insurance rates. These are some of the key factors that affect auto insurance rates. Here’s how these incidents might affect your Esurance costs:

Moreover, geographic location plays a significant role in determining your insurance rates with Esurance. For instance, in states like Michigan, where auto insurance Esurance rates are traditionally higher, premiums with Esurance might also be on the pricier side.

Esurance delivers competitive rates and top-notch digital tools, but be prepared for mixed reviews on customer service and claims handling.Brandon Frady Licensed Insurance Producer

Considering the influence of local factors is crucial when evaluating potential costs with Esurance, as rates can vary significantly between states, affecting the average auto insurance per month.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What You Should Know About Esurance, Inc.

The Esurance mobile app is highly-rated, offering features that other insurance companies don’t have on their apps. Still, Esurance auto insurance reviews suggest the company has work to do regarding customer service and claims handling.

Many customers say the Esurance claim payout process takes too long and often becomes confusing or incorrect. Many also say filing a claim with Esurance on the mobile app can be more complicated than the company implies.

If you’re considering an Esurance policy, do your homework beforehand and read customer reviews to see whether the company is right for you.

Esurance Pros and Cons

There are several Esurance benefits of purchasing a car insurance policy with Esurance, including:

- An easy process for buying a policy online

- A convenient, self-serve mobile app

- User-friendly digital tools

Still, there are some drawbacks to car insurance with Esurance, like:

- Higher-than-average rates

- No accident forgiveness or new car replacement

Weighing the pros and cons of insurers you’re considering is the best way to find a company offering the right coverage for you at an affordable rate.

Esurance, Inc. Insurance Coverage Options

Esurance auto insurance offers a range of coverages designed to protect you in various situations, including liability, collision, and comprehensive options. Whether it’s medical expenses, property damage, or protection from uninsured drivers, Esurance provides essential coverage to meet your needs on the road.

Esurance Auto Insurance Coverages

| Coverage Type | What it Covers |

|---|---|

| Bodily Injury Liability | Pays for medical bills if someone else suffers an injury in an accident caused by you |

| Collision | Covers damage to your car after an accident |

| Comprehensive | Covers damage to your car when you’re not driving |

| Personal Injury Protection | Covers medical expenses for you and your passengers after an accident |

| Property Damage Liability | Liability coverage that covers the cost of any property damage you’ve caused in an accident |

| Uninsured/Underinsured Motorist | Covers the costs if you’re in an accident caused by a driver with little or no car insurance |

| Medical Payments Coverage | Covers medical costs caused by an accident regardless of who is at fault |

While Esurance offers specific add-ons like Esurance gap insurance, the company doesn’t have other coverage types, like new car replacements. So if you know there’s a particular type of auto insurance coverage you’re looking for, familiarize yourself with Esurance’s options before purchasing a policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How DriveSense by Esurance Can Lower Your Insurance Rates

DriveSense is Esurance’s usage-based auto insurance program. Policyholders can use the Esurance app to allow the company to monitor their driving habits to potentially lower their auto insurance rates. The Esurance DriveSense app tracks habits such as acceleration, braking, hard turns, and driving times. Then, insurance rates adjust based on the driver’s inherent risk.

Esurance, Inc. Insurance Rates Breakdown

Esurance offers various insurance rates that fluctuate based on different factors like driver demographics and driving history. Here’s a quick breakdown:

- Teen Drivers: Esurance rates for teens are higher, often exceeding $333 monthly.

- Young Adults: Drivers in their 20s can expect to pay around $1,500 more than the national average.

- Senior Drivers: Rates for seniors are approximately $600 above the national average.

- Drivers with a DUI: Expect a 2% increase, with rates around $950 more per year than competitors.

- Drivers with Poor Credit: Rates are about 7% higher than the national average.

Understanding these factors can help you make an informed decision on how to choose an auto insurance company when considering Esurance for your auto insurance needs.

Esurance Rates for Teen Drivers

Overall, teen drivers pay more for car insurance coverage, but rates with Esurance are overwhelmingly expensive. This table includes rates for teen drivers based on gender from the top insurance companies.

Teen Esurance Full Coverage Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male |

|---|---|---|---|---|

| $608 | $638 | $448 | $519 | |

| $414 | $509 | $305 | $414 | |

| $427 | $447 | $315 | $364 | |

| $634 | $647 | $470 | $560 | |

| $810 | $773 | $597 | $629 | |

| $298 | $312 | $220 | $254 | |

| $723 | $785 | $626 | $626 |

| $384 | $391 | $283 | $318 | |

| $411 | $476 | $303 | $387 |

| $801 | $814 | $591 | $662 | |

| $311 | $349 | $229 | $284 | |

| $719 | $910 | $530 | $740 | |

| $245 | $249 | $180 | $203 | |

| U.S. Average | $566 | $618 | $416 | $501 |

Female drivers pay 35% more than the national average for coverage, and males pay 27% more. USAA’s rates for teen drivers, who are also facing the challenges of how to help teen drivers get their first license, are around half what Esurance requires.

Esurance Coverage for Adult Drivers

Once people turn 25, they often notice a drop in car insurance costs. However, Esurance rates for young adults are still higher than the national average. Esurance rates are around $1,000 more than USAA’s rates.

Adults pay anywhere from 5% to 7% more than the national average for car insurance coverage with Esurance. Below is the average monthly full coverage insurance for adults.

Adult Esurance Full Coverage Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male |

|---|---|---|---|---|

| $168 | $176 | $162 | $160 | |

| $116 | $137 | $115 | $117 | |

| $98 | $103 | $89 | $87 | |

| $120 | $125 | $110 | $114 | |

| $160 | $167 | $139 | $139 | |

| $90 | $87 | $80 | $80 | |

| $174 | $200 | $171 | $174 |

| $87 | $91 | $78 | $77 | |

| $124 | $136 | $113 | $115 |

| $131 | $136 | $112 | $105 | |

| $94 | $103 | $86 | $86 | |

| $99 | $108 | $98 | $99 | |

| $74 | $79 | $59 | $59 | |

| U.S. Average | $128 | $139 | $119 | $119 |

In most cases, Esurance’s rates for adults, including those seeking auto insurance for single adults, are double USAA’s rates for similar coverage. Despite the higher costs, some drivers may find value in Esurance’s digital tools and customer service Esurance options.

Esurance Rates for Senior Drivers

Esurance car insurance rates for auto insurance for seniors are also higher than the national average. The table below shows the national average for senior drivers.

Seniors Esurance Full Coverage Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 55 Female | Age: 55 Male | Age: 60 Female | Age: 60 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|

| $153 | $152 | $89 | $154 | $158 | $157 | |

| $109 | $111 | $104 | $105 | $113 | $114 | |

| $85 | $83 | $79 | $81 | $87 | $85 | |

| $108 | $110 | $102 | $104 | $110 | $112 | |

| $132 | $131 | $120 | $128 | $136 | $136 | |

| $76 | $76 | $73 | $74 | $78 | $78 | |

| $162 | $165 | $148 | $159 | $167 | $170 |

| $74 | $73 | $69 | $72 | $77 | $76 | |

| $107 | $109 | $99 | $104 | $111 | $112 |

| $106 | $100 | $92 | $95 | $109 | $103 | |

| $82 | $82 | $76 | $76 | $84 | $84 | |

| $93 | $94 | $89 | $90 | $96 | $97 | |

| $56 | $56 | $53 | $53 | $58 | $57 | |

| U.S. Average | $113 | $113 | $106 | $110 | $117 | $117 |

Rates with Esurance are around $600 higher than those with Geico. While Esurance offers robust digital tools and coverage options, it’s crucial for senior drivers to compare these rates with other insurers. Shopping around can help ensure you’re getting the most value for your money.

Esurance Car Insurance After a Speeding Ticket

Auto insurance rates after a speeding ticket with Esurance are around $500 more monthly than the national average, highlighting how long does a speeding ticket affect your auto insurance rates. You can compare the top insurance companies’ rates after a speeding ticket below.

Full Coverage Auto Insurance Monthly Rates by Provider: One Ticket vs. Clean Record

| Insurance Company | One Ticket | Clean Record |

|---|---|---|

| $188 | $160 | |

| $136 | $117 | |

| $105 | $87 | |

| $146 | $114 | |

| $173 | $139 | |

| $106 | $80 | |

| $212 | $174 |

| $95 | $77 | |

| $137 | $115 |

| $140 | $105 | |

| $96 | $86 | |

| $134 | $99 | |

| $67 | $59 | |

| U.S. Average | $147 | $119 |

State Farm offers rates around $1,000 lower than Esurance. While Esurance provides convenient online tools, it’s essential to consider these higher costs if you have a speeding ticket. Comparing quotes from multiple providers can help you find a better deal for your circumstances.

Esurance Coverage After a Car Accident

If you have an at-fault accident claim on your driving record, you can expect higher-than-average rates for coverage.

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | One Accident | Clean Record |

|---|---|---|

| $225 | $160 | |

| $176 | $117 | |

| $127 | $87 | |

| $180 | $114 | |

| $198 | $139 | |

| $132 | $80 | |

| $234 | $174 |

| $114 | $77 | |

| $161 | $115 |

| $186 | $105 | |

| $102 | $86 | |

| $139 | $99 | |

| $78 | $59 | |

| U.S. Average | $173 | $119 |

Still, Esurance car insurance quotes indicate the company’s rates are nearly 30% higher than the national average.

data-media-max-width=”560″>

Don’t ❌skip a step after a car accident. Checking off ✅each step on the list can help ensure a timely car insurance settlement. Get all the info you need here👉: https://t.co/L5WsoYyaNu pic.twitter.com/2DaOVHpB4N

— AutoInsurance.org (@AutoInsurance) July 31, 2024

For comparison, Esurance’s rates are nearly $1,200 higher than State Farm’s and double USAA’s. Despite Esurance offering convenient digital tools and strong coverage options, drivers with accidents may find better value with other insurers. Consider shopping around to find a more cost-effective option that suits your needs.

Esurance Car Insurance After a DUI

Esurance coverage after a DUI is only around 2% higher than the national average. Let’s take a look at the cost of car insurance after a DUI from the top insurance companies.

Esurance Full Coverage Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | One Accident | One Ticket | One DUI | Clean Record |

|---|---|---|---|---|

| $225 | $188 | $270 | $160 | |

| $176 | $136 | $194 | $117 | |

| $127 | $105 | $130 | $87 | |

| $180 | $146 | $209 | $114 | |

| $198 | $173 | $193 | $139 | |

| $132 | $106 | $216 | $80 | |

| $234 | $212 | $313 | $174 |

| $114 | $95 | $126 | $77 | |

| $161 | $137 | $237 | $115 |

| $186 | $140 | $140 | $105 | |

| $102 | $96 | $112 | $86 | |

| $139 | $134 | $206 | $99 | |

| $78 | $67 | $108 | $59 | |

| U.S. Average | $173 | $147 | $209 | $119 |

However, you’ll pay around $950 more per year for car insurance with Esurance than with State Farm. While Esurance offers some flexibility in coverage, the higher rates may deter budget-conscious drivers. It’s crucial to compare options to find the most affordable coverage after a DUI.

Esurance Rates for Drivers With Poor Credit

With a low credit score, you can expect to pay around 7% more than the national average with Esurance. This added cost reflects the higher risk associated with poor credit scores. To ensure you’re getting the best deal, compare auto insurance quotes Esurance from various providers and consider improving your credit score to lower your premiums.

Esurance Full Coverage Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Poor Credit | Fair Credit | Good Credit |

|---|---|---|---|

| $200 | $150 | $100 | |

| $190 | $140 | $95 | |

| $180 | $135 | $90 | |

| $195 | $145 | $95 | |

| $205 | $155 | $110 | |

| $170 | $130 | $85 | |

| $210 | $160 | $105 |

| $195 | $145 | $100 | |

| $200 | $150 | $95 |

| $185 | $140 | $90 | |

| $190 | $145 | $95 | |

| $195 | $150 | $100 | |

| $175 | $125 | $80 |

In comparing rates, it’s clear that while Esurance is competitive, other auto insurance companies for drivers with bad credit might offer more favorable rates. Make sure to evaluate multiple options to find the best coverage for your financial situation.

Esurance Minimum Coverage: Compare & Save

While minimum coverage can help people save money on their car insurance, minimum auto insurance requirements by state with Esurance are around 22% higher than the national average.

Liability Auto Insurance Rates by Provider

| Insurance Company | Monthly Rates |

|---|---|

| $61 | |

| $44 | |

| $33 | |

| $49 | |

| $53 | |

| $30 | |

| $68 |

| $29 | |

| $44 |

| $39 | |

| $33 | |

| $37 | |

| $22 | |

| U.S. Average | $45 |

Esurance rates are around $700 more than Geico’s rates for similar coverage. While Esurance provides user-friendly digital tools and a solid claims process, the higher cost might not justify the savings on minimum coverage. It’s worth comparing these rates with other providers to ensure you’re getting the best deal.

Unlock the Best Full Coverage Deals: See How Top Insurers Stack Up

Esurance full coverage costs nearly 27% more than the national average. We’ve put together a list of all the top insurance companies and their full coverage auto insurance defined rates for your comparison.

Full Coverage Auto Insurance Rates by Provider

| Insurance Company | Monthly Rates |

|---|---|

| $160 | |

| $117 | |

| $87 | |

| $114 | |

| $139 | |

| $80 | |

| $174 |

| $77 | |

| $115 |

| $105 | |

| $86 | |

| $99 | |

| $59 | |

| U.S. Average | $119 |

Geico offers full coverage for $800 less per year than Esurance. Esurance provides a comprehensive digital platform and various coverage options, but the higher costs might deter budget-conscious drivers. It’s essential to compare insurers to find the best rate that meets your needs, especially when considering the average car insurance cost full coverage.

Esurance, Inc. Discounts Available

Esurance offers several discounts to help lower your insurance premiums, although their list is not exhaustive. Exploring these car insurance discounts can be a great way to reduce your overall costs while maintaining quality coverage.

Esurance Auto Insurance Discounts

| Discount | Description |

|---|---|

| Bundling | Save money by insuring multiple policies, such as auto and home, with Esurance. |

| Car Safety Features | Vehicles equipped with advanced safety features, like airbags and anti-lock brakes, may receive lower rates. |

| Claim-Free | Enjoy savings if you've had no claims for a specified period, indicating safe driving. |

| Driver Safety Course | Completing an approved driver safety course can lead to discounts, promoting better driving habits. |

| Good Student | Students maintaining a B average or higher are eligible for reduced rates to reward academic success. |

| Homeowners | Homeowners receive a discount on their auto insurance policy as an additional perk. |

| Multi-Car | Lower your rate by insuring more than one vehicle on the same policy. |

| Online Quote | Receive a discount for starting your quote online, simplifying the insurance buying process. |

| Paid-In-Full | Get a discount for paying your entire premium in one lump sum instead of monthly installments. |

You may qualify for additional Esurance discounts, so it’s a good idea to explore your eligibility and potential savings. Make sure to review all available Esurance discounts to ensure you’re getting the most value from your policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Esurance Ratings Roundup: From Solid to Stellar

In the current competitive insurance market, Esurance distinguishes itself with a mix of notable and middling business ratings. Exploring the key metrics from reputable agencies can help us grasp where Esurance shines and where it could enhance its comprehensive auto insurance defined offerings.

Esurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 810 / 1,000 Avg. Satisfaction |

|

| Score: A Financial Strength |

|

| Score: 72/100 Mixed Customer Feedback |

|

| Score: 1.20 More Complaints |

|

| Score: A+ Superior Financial Strength |

As we’ve seen, Esurance showcases a spectrum of ratings, reflecting its strengths in financial stability and customer satisfaction to a certain extent. These insights provide a foundational perspective for potential customers weighing their options in the dynamic landscape of insurance providers.

Final Thoughts on Esurance

Esurance offers a modern, tech-savvy approach to auto insurance with competitive rates and a strong digital platform. However, potential policyholders should carefully weigh the pros and cons, especially considering customer service and claims handling issues reported by some users, as detailed in various Esurance reviews.

Before committing, it’s wise to explore various options and receiving and evaluating quotes to ensure you’re getting the best coverage at the most reasonable price. With the right approach, you can find an insurance policy that balances cost, coverage, and customer satisfaction effectively.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What other types of insurance does Esurance offer?

Esurance offers the following types of insurance:

- Home

- Renters

- Motorcycle

Esurance also offers additional options for coverage via Allstate — its parent company — and other affiliates, including:

- Commercial auto

- Umbrella

- Business

- Classic car

- Life

Esurance offers various insurance types to cover the needs of many policyholders.

Where does Esurance offer car insurance?

Esurance offers car insurance in every state except Alaska, Delaware, Hawaii, Montana, New Hampshire, Vermont, and Wyoming.

Who owns Esurance?

Allstate owns Esurance.

To broaden your understanding, explore our comprehensive resource on insurance coverage titled “How to Choose an Auto Insurance Company” and gain valuable insights.

How do you file a claim with Esurance?

The best way to file a claim with Esurance is to use the company’s mobile app. You can also call 800-378-7262 for assistance.

How do you cancel an Esurance policy?

You have to call Esurance at 800-378-7262 to cancel your policy, and you may have to pay a $50 cancellation fee.

What types of auto insurance coverage does Esurance offer?

Esurance provides various types of auto insurance coverage to meet the needs of different drivers. These include liability coverage, comprehensive coverage, collision coverage, uninsured/underinsured motorist coverage, personal injury protection (PIP), and medical payments coverage. You can choose the coverage options that best suit your requirements.

Enhance your understanding by consulting our detailed guide, “Types of Auto Insurance,” and discover more valuable insights.

How do you get an Esurance quote?

You can use the Esurance website to get a quote based on your unique information.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Can I manage my Esurance policy online?

Yes, Esurance offers an online platform where you can manage your policy conveniently. Through their website or mobile app, you can view your policy details, make payments, request changes to your coverage, file claims, and access other policy-related information.

What factors can affect the cost of my Esurance Auto Insurance premiums?

Several factors can influence the cost of your Esurance Auto Insurance premiums. These include your age, driving experience, location, type of vehicle, your driving record, and the coverage options you select. Additionally, factors such as your credit history, annual mileage, and the deductible amount you choose can also impact your premium.

Deepen your understanding by exploring our in-depth report, “Auto Insurance Premium Defined,” to gain further insights.

Does Esurance offer any discounts on auto insurance?

Yes, Esurance provides various discounts to help customers save on their auto insurance premiums. These discounts can be based on factors like safe driving habits, bundling multiple policies, having certain vehicle safety features, being a homeowner, paying in full, and more. Check with Esurance to see which discounts you may qualify for.

Does Esurance provide roadside assistance?

Yes, Esurance offers emergency roadside assistance as an optional add-on to your auto insurance policy. With this coverage, you can receive help for common issues like flat tires, dead batteries, lockouts, and towing services, ensuring peace of mind and quick road recovery.

Gain a comprehensive overview by consulting our detailed analysis, “Best Roadside Assistance Plans,” for more information.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Brian777

0 star

Neal_in_California

CAUTION - WATCH YOU BACK

Hicham

Don't go with them

Brb40par007_

Claims are not handled properly

Therep

Very Poor Claims Service

Mick3y

RUN! DONT INSURE YOUR CAR HERE.

Dana_Whicker

VERY poor customer service and communication.

gt080845

Claims adjusters never call or respond to messages

ghfdsdfhh

horrible customer service. will cancel with no notice.

Josepi

Buyer Beware!!