Best Murphy, North Carolina Auto Insurance in 2025 (Check Out the Top 10 Companies)

The leading providers for the best Murphy, North Carolina auto insurance are Allstate, Erie, and Amica offering rates as low as $47/month. Understand how your driving record and financial history influence your insurance premiums. Secure optimal coverage for your mountain journeys, regardless of your background.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Murphy North Carolina

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Murphy North Carolina

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Murphy North Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

Allstate, Erie, and Amica lead the pack for the best Murphy, North Carolina auto insurance, with rates starting at a wallet-friendly $47 per month.

Nestled in the heart of the Smoky Mountains, Murphy, NC offers more than just breathtaking views – it’s also home to some of the most competitive auto insurance quotes in Murphy. Whether you’re cruising down the winding roads or commuting to nearby towns, we’ve got the scoop on protecting your ride.

Our Top 10 Company Picks: Best Murphy, North Carolina Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A+ Financial Strength Allstate

#2 10% A+ Personalized Policies Erie

#3 25% A+ Customer Service Amica

#4 20% A Flexible Options Nationwide

#5 12% B Competitive Rates Progressive

#6 10% A++ Military Focus USAA

#7 20% A Reliable Claims State Farm

#8 20% A+ Numerous Discounts Liberty Mutual

#9 25% A+ AARP Benefits The Hartford

#10 20% A Personalized Service Auto-Owners

From auto insurance companies for married couples to single drivers, our guide breaks down the best rates and coverage options. Get started on comparing full coverage auto insurance rates by entering your ZIP code above.

- The average commute length in Murphy is 13.4 minutes

- The top auto insurance company in Murphy is Allstate

- Compare the rates for married couples and single individuals.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Allstate: Top Overall Pick

Pros

- Mountain Driving Specialist: Allstate in Murphy, NC offers tailored coverage for its mountainous terrain, addressing unique risks faced by local drivers navigating steep roads and challenging weather conditions in the Appalachian region.

- Small Town Rate Adjustment: Despite a higher-than-average $155 monthly premium, Allstate adjusts rates for Murphy’s lower population density and 13.4-minute average commute, potentially offering savings compared to larger North Carolina cities. Check out Allstate auto insurance review for an in-depth look at coverage options.

- Rideshare Coverage Pioneer: As Murphy embraces the gig economy, Allstate’s rideshare insurance fills a crucial gap for local Uber and Lyft drivers, ensuring proper protection during all phases of their work.

Cons

- Rural Coverage Gaps: Some Murphy policyholders report challenges with Allstate’s coverage for incidents on unpaved roads or remote areas common in Cherokee County, potentially leaving gaps in protection.

- Seasonal Rate Fluctuations: Murphy’s tourist influx during peak seasons may lead to unexpected rate adjustments with Allstate, impacting year-round residents’ ability to budget for consistent premiums.

#2 – Erie: Best for Personalized Policies

Pros

- Local Economy Champion: Erie’s competitive $130 monthly rate in Murphy reflects an understanding of the town’s economic landscape, offering affordable coverage that aligns with local income levels and cost of living.

- Small Town Specialist: Erie’s policies are tailored to Murphy’s unique needs, addressing risks associated with the town’s rural setting, from wildlife encounters to the challenges of limited emergency services in remote areas. Explore further in Erie auto insurance review for detailed policy insights.

- North Carolina Compliance Expert: Erie ensures Murphy drivers meet the state’s 30/60/25 minimum coverage requirements while offering options to exceed these limits for enhanced protection on local roads.

Cons

- Limited Rideshare Support: As Murphy’s gig economy grows, Erie’s lack of specialized rideshare coverage may disadvantage local drivers seeking to supplement their income through ride-hailing services.

- Minimal Local Office Presence: Erie’s limited physical presence in Murphy may frustrate residents who prefer face-to-face interactions for complex insurance matters, a common preference in tight-knit small towns.

#3 – Amica: Best for Customer Service

Pros

- Dividend Policy Innovator: Amica’s unique dividend-paying policies offer Murphy drivers the potential for annual returns, effectively lowering the $145 monthly premium and providing added value in a budget-conscious community.

- Customer-Owned Advantage: As a mutual company, Amica’s policyholder-first approach resonates with Murphy’s community-centric values, potentially leading to more favorable rates and policy terms for local drivers.

- Platinum Choice Coverage: Amica’s premium Platinum Choice Auto package offers Murphy drivers enhanced protection, including new car replacement and identity fraud monitoring, addressing modern concerns in this evolving rural community. Find out more in our Amica auto insurance review for a comprehensive breakdown.

Cons

- Name Recognition Challenge: As a lesser-known provider in Murphy, Amica may struggle to compete with more established brands, potentially limiting its market share despite competitive offerings.

- Complex Quote Process: Some Murphy residents report difficulties obtaining accurate online quotes from Amica, complicating the comparison process in the local insurance market.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Flexible Options

Pros

- Accident Forgiveness Advocate: Nationwide’s accident forgiveness program provides peace of mind for Murphy drivers navigating challenging local terrain, protecting rates after a first-time incident. Dive into Nationwide auto insurance review for complete details on their policies.

- Farm Bureau Partnership: Nationwide’s collaboration with the North Carolina Farm Bureau offers specialized coverage and discounts for Murphy’s agricultural community, addressing unique rural insurance needs.

- Multi-Policy Discount Leader: Murphy residents can maximize savings by bundling auto insurance with other Nationwide policies, particularly beneficial in a town where many own both homes and vehicles.

Cons

- Limited Local Office Presence: Nationwide in Murphy, NC have smaller physical footprint in Murphy may frustrate residents who prefer face-to-face service, a common preference in close-knit small towns.

- Rural Coverage Limitations: Some drivers report challenges with Nationwide insurance in Murphy, NC, for incidents on unpaved roads or in remote areas, common scenarios in Cherokee County.

#5 – Progressive: Best for Competitive Rates

Pros

- Name Your Price Tool: Progressive’s unique Name Your Price tool allows Murphy drivers to find coverage that fits their budget, particularly valuable in a town with a diverse economic landscape. Get the full scoop in Progressive auto insurance review for a thorough overview.

- Snapshot Program Pioneer: Progressive’s usage-based insurance program is well-suited to Murphy’s driving patterns, offering potential savings for residents with typically short 13.4-minute commutes.

- Small Business Vehicle Expert: Progressive’s commercial auto coverage options cater to Murphy’s growing small business community, offering tailored protection for local entrepreneurs.

Cons

- Mixed Local Reputation: Progressive’s customer service experiences in Murphy vary, with some residents reporting challenges in claim resolution, particularly for incidents unique to rural mountain driving.

- Bundling Restrictions: Murphy residents looking to consolidate multiple insurance types may find Progressive’s bundling discounts less competitive compared to some local providers offering more comprehensive packages.

#6 – USAA: Best for Military Focus

Pros

- Competitive Local Pricing: USAA’s $125 monthly rate is the lowest among competitors in Murphy, providing exceptional value for eligible members while meeting North Carolina’s 30/60/25 coverage requirements.

- Deployment Consideration: USAA’s policies account for the realities of military life, offering flexible coverage options for Murphy-based service members facing deployment or relocation. Read USAA auto insurance review for a detailed look at what they offer.

- SafePilot Program: USAA’s usage-based insurance option is well-suited to Murphy’s driving patterns, offering potential savings for members navigating the town’s typically short 13.4-minute commutes.

Cons

- Digital Platform Limitations: While generally robust, USAA’s online tools may not fully address the unique needs of Murphy drivers, such as easily adding coverage for seasonal vehicles popular in the area.

- Limited Local Partnerships: USAA’s focus on military-specific services may result in fewer local business partnerships in Murphy, potentially limiting additional discount opportunities available through community connections.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – State Farm: Best for Reliable Claims

Pros

- Rideshare Coverage Option: As Murphy’s gig economy grows, State Farm’s rideshare insurance fills a crucial gap for local Uber and Lyft drivers, ensuring proper protection during all phases of their work. For an extensive guide, see State Farm auto insurance discounts for full coverage details.

- Accident-Free Discount: State Farm in Murphy, NC rewards safe drivers with substantial discounts for maintaining a clean record, particularly valuable given the challenging driving conditions in the Appalachian region.

- Emergency Road Service: Recognizing Murphy’s remote location, State Farm’s roadside assistance program provides crucial support for local drivers navigating challenging mountain terrain and isolated stretches of highway.

Cons

- Rural Coverage Limitations: Some State Farm policyholders in Murphy report issues with coverage for incidents on unpaved roads or in very remote areas, common scenarios in Cherokee County.

- Limited Digital Tools: While improving, State Farm’s online resources for Murphy policyholders may lag behind more tech-forward competitors, potentially frustrating younger, digitally-inclined residents.

#8 – Liberty Mutual: Best for Numerous Discounts

Pros

- New Car Replacement: Liberty Mutual offers new car replacement coverage, particularly valuable for Murphy residents investing in vehicles capable of handling the region’s challenging terrain and unpredictable weather conditions.

- Lifetime Repair Guarantee: Liberty Mutual’s lifetime guarantee on repairs from approved shops provides peace of mind for Murphy residents, especially given the limited number of auto repair options in this rural mountain community. For a complete overview, read Liberty Mutual auto insurance review for detailed information.

- Home and Auto Bundling: Homeowners insurance in Murphy, NC can potentially secure significant discounts by combining their auto and home insurance with Liberty Mutual, maximizing savings in this cost-conscious community with a median income below the state average.

Cons

- Weather-Related Coverage Gaps: Given Murphy’s variable mountain climate, some Liberty Mutual policyholders report unexpected limitations for weather-related incidents, potentially leaving drivers vulnerable during severe conditions.

- Limited Specialized Vehicle Coverage: Murphy residents with ATVs, snowmobiles, or other recreational vehicles popular in the area may find Liberty Mutual’s coverage options for these specialized vehicles lacking compared to local competitors.

#9 – The Hartford: Best for AARP Benefits

Pros

- AARP Partnership: The Hartford’s collaboration with AARP offers specialized coverage and discounts for Murphy’s senior drivers, addressing the unique needs of the town’s significant retiree population.

- RecoverCare Coverage: The Hartford’s unique RecoverCare option provides essential assistance for daily tasks after an accident, particularly valuable in Murphy’s close-knit community where many seniors live independently.

- 12-Month Rate Protection: The Hartford’s 12-month rate protection provides budget stability for Murphy residents, particularly valuable in a town with seasonal economic fluctuations. For a detailed understanding, see our Amica auto insurance review. For a detailed understanding, see The Hartford auto insurance review.

Cons

- Age Restrictions: The Hartford’s focus on AARP members and older drivers may limit its appeal to younger Murphy residents, potentially excluding a significant portion of the local population.

- Above-Average Pricing: At $148 monthly, The Hartford’s rates in Murphy are higher than some competitors, which may deter cost-sensitive drivers in a town with a median income below the state average.

- Limited Local Presence: The Hartford’s smaller physical footprint in Murphy may frustrate residents accustomed to face-to-face interactions, a common preference in small, tight-knit mountain communities.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Auto-Owners: Best for Personalized Service

Pros

- Personal Service Focus: Auto-Owners’ emphasis on local car insurance agents in murphy, NC interactions aligns well with Murphy’s community-centric values, providing personalized service in this small mountain town. Find detailed information in Auto-Owners auto insurance review for a complete guide.

- TrueRide Program: Auto-Owners’ usage-based insurance option is tailored to Murphy’s driving patterns, offering potential savings for residents with typically short 13.4-minute commutes on local roads.

- Flexible Payment Options: Recognizing Murphy’s diverse economic landscape, Auto-Owners offers various payment plans, including pay-in-full discounts beneficial for the town’s seasonal workers.

Cons

- Restricted Availability: Auto-Owners’ coverage may not be universally available throughout Murphy, potentially limiting options for some residents in more remote areas of Cherokee County.

- Complex Claims Process: Some Murphy policyholders report challenges navigating Auto-Owners’ claims process, which can be particularly problematic in a small town with limited alternative transportation options.

Minimum Coverage Auto Insurance Costs in Murphy, NC

Looking for affordable auto insurance in Murphy, NC? Our detailed comparison of monthly rates for both minimum and full coverage from top providers highlights the best options to keep your vehicle protected while staying within budget. See which car insurance companies in Murphy, NC offer the best rates for your needs.

Murphy, North Carolina Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $68 $155

Amica $60 $145

Auto-Owners $54 $132

Erie $52 $130

Liberty Mutual $72 $160

Nationwide $65 $150

Progressive $58 $142

State Farm $55 $135

The Hartford $66 $148

USAA $47 $125

In Murphy, the monthly auto insurance rates are transparently presented, enabling you to effortlessly discern the best value tailored to your requirements. Whether you seek minimal coverage or comprehensive protection, there are options available to suit every need.

- Property Damage Liability: $25,000 minimum

- Bodily Injury Liability: $30,000 per person and $60,000 per accident

Does auto insurance cover stolen vehicles? The answer is yes, but it depends on your policy. Comprehensive coverage, which is separate from your standard collision or general liability insurance in Murphy, NC, typically covers theft.

Adding anti-theft devices to your vehicle can also potentially lower your premiums, offering extra protection and possibly reducing your overall insurance costs.

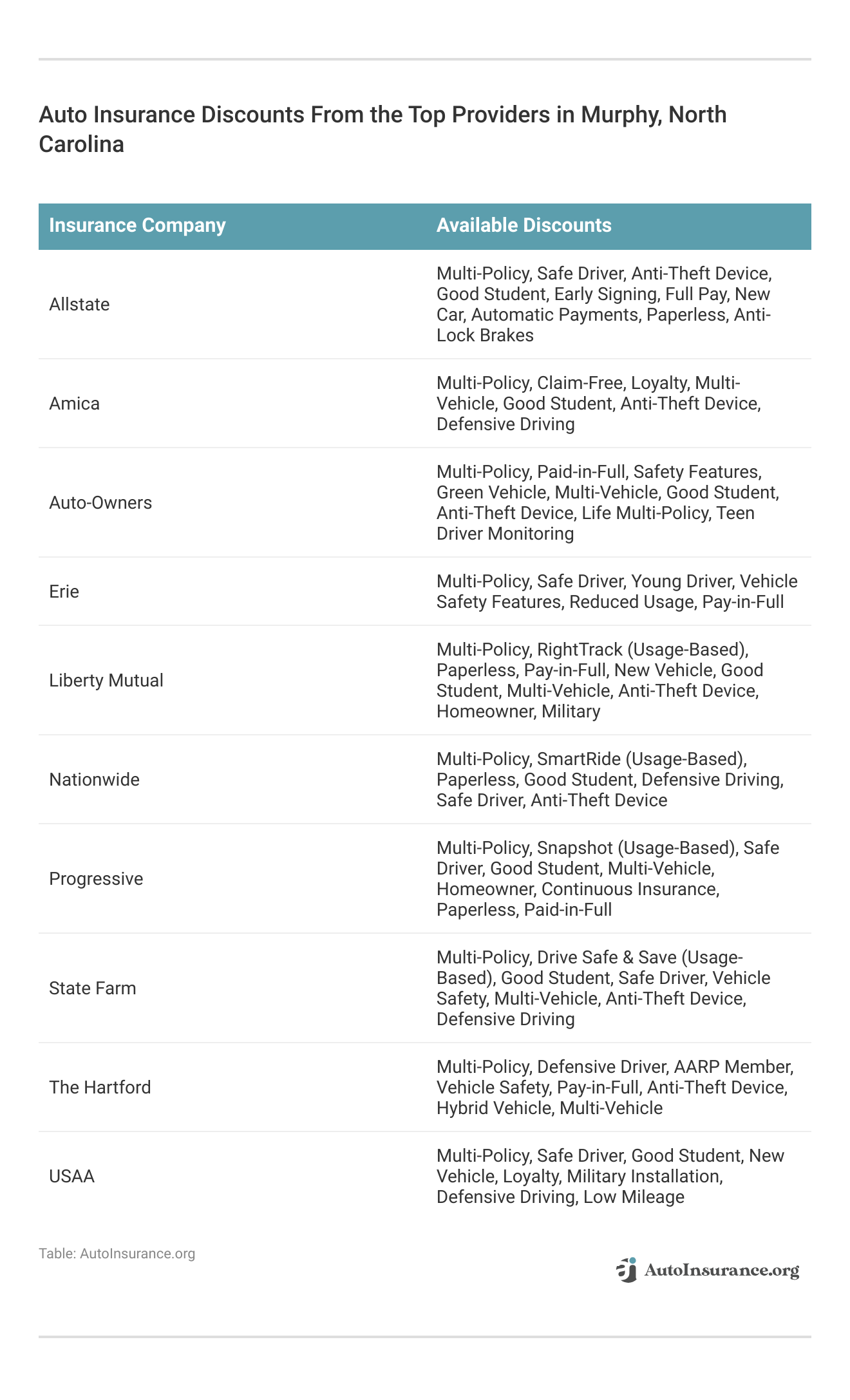

Unlock potential savings on your auto insurance in Fredericksburg with the right discounts. This table showcases the diverse range of discounts available from popular insurance providers, tailored to help you maximize your savings and get the best deal for your coverage needs in the local area.

Optimizing your automobile insurance discounts in Fredericksburg can result in significant financial savings. Investigate these discount avenues to ensure you are capitalizing on all potential reductions in premiums while preserving the necessary coverage for your peace of mind while driving.

How Age, Gender, and Marital Status Influence Auto Insurance in Murphy, NC

Ever wondered how auto insurance rates shift in Fredericksburg for different drivers? The table below shows what you’ll pay based on age, gender, and whether or not you’re married. Evaluate and contrast the premiums offered by leading insurers to determine the option that best aligns with your needs.

Murphy, North Carolina Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $1,006 | $1,006 | $422 | $422 | $414 | $414 | $340 | $340 |

| Geico | $355 | $352 | $165 | $164 | $190 | $186 | $187 | $183 |

| Liberty Mutual | $230 | $230 | $129 | $129 | $129 | $129 | $134 | $134 |

| Nationwide | $295 | $295 | $173 | $173 | $173 | $173 | $173 | $173 |

| Progressive | $297 | $297 | $144 | $144 | $131 | $131 | $120 | $120 |

| State Farm | $259 | $259 | $217 | $217 | $176 | $176 | $152 | $217 |

| Travelers | $189 | $189 | $188 | $188 | $323 | $323 | $194 | $194 |

Gaining insight into how auto insurance premiums fluctuate in Fredericksburg can assist you in securing the optimal coverage tailored to your unique circumstances.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Costs in Murphy, NC by Driving Record

Take a look at this table. It shows how a clean record, a single accident, a DUI, or a speeding ticket can change your insurance costs with various providers. This will help you understand what you might pay based on how you drive.

Murphy, North Carolina Full Coverage Auto Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Accident | One Ticket | One DUI |

|---|---|---|---|---|

| Allstate | $296 | $518 | $400 | $967 |

| Geico | $124 | $181 | $167 | $418 |

| Liberty Mutual | $93 | $119 | $119 | $291 |

| Nationwide | $120 | $155 | $155 | $385 |

| Progressive | $82 | $120 | $116 | $374 |

| State Farm | $107 | $155 | $155 | $387 |

| Travelers | $131 | $176 | $171 | $417 |

This analysis shows how violations jack up your premiums with different insurers. It underscores the vital need to keep your driving record clean to get the best rates and avoid big hikes because of infractions.

Impact of a DUI on Auto Insurance Rates in Murphy, NC

Murphy locals, if you’ve found yourself with a DUI, you might be wondering how it affects your auto insurance rates. Dive into this table to see which insurers offer the most manageable rates and get the lowdown on navigating your insurance options right here in our beautiful mountain town.

Murphy, North Carolina DUI Full Coverage Auto Insurance Rates

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $967 |

| Geico | $418 |

| Liberty Mutual | $291 |

| Nationwide | $385 |

| Progressive | $374 |

| State Farm | $387 |

| Travelers | $417 |

In Murphy, dealing with the fallout of a DUI doesn’t have to be a solo journey. With this table in hand, you can compare how local and national insurers adjust their rates, helping you find a policy that won’t break the bank. Keep your insurance costs from soaring and stay on track, even after a bump in the road.

Murphy, NC Auto Insurance Pricing and Credit History

Residents of Murphy, NC, can use this table to see how their credit scores affect auto insurance rates. Whether your credit is poor, fair, or good, you can compare how different insurers adjust their rates.

Murphy, North Carolina Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Poor Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $738 | $480 | $418 |

| Geico | $242 | $222 | $205 |

| Liberty Mutual | $156 | $156 | $156 |

| Nationwide | $204 | $204 | $204 |

| Progressive | $193 | $169 | $157 |

| State Farm | $282 | $180 | $140 |

| Travelers | $240 | $217 | $213 |

Find an insurer with fair rates, so you can savor the beauty of our mountain town without emptying your pockets.

Find Cheap Auto Insurance Rates by ZIP Code in Murphy, NC

Exploring auto insurance rates in Murphy, NC, reveals hidden savings across the town’s diverse ZIP codes. In Murphy, full coverage auto insurance rates can be as low as $223 per month in ZIP code 28906. Take advantage of these deals while enjoying the charm of Murphy’s unique neighborhoods.

Affordable Auto Insurance in Murphy Based on Commute

Journeying through auto insurance rates in Murphy, North Carolina, reveals how commute lengths and annual mileage can impact your premiums. From a short 10-mile daily drive to a more extended 25-mile trek, each insurer has unique rate adjustments.

Murphy, North Carolina Full Coverage Auto Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $545 | $545 |

| Geico | $223 | $223 |

| Liberty Mutual | $156 | $156 |

| Nationwide | $204 | $204 |

| Progressive | $173 | $173 |

| State Farm | $200 | $202 |

| Travelers | $224 | $224 |

Liberty Mutual’s steady pricing contrasts with Geico and Progressive’s consistent rates, making it easier to navigate your insurance options and hit the road with confidence.

Key Elements Affecting Auto Insurance Costs in Murphy, NC

In Murphy, North Carolina, your auto insurance rates can feel like a rollercoaster, influenced by local quirks like traffic patterns and the occasional uptick in vehicle theft. These unique factors, combined with the charm of our mountain town, play a big role in shaping what you pay.

From the serene drive through the Smokies to the bustling days in town, local elements cast long shadows over your insurance rates, making each policy a reflection of our vibrant community.

Murphy, NC Commute Insights

In towns where folks spend more time driving to work, insurance rates often rise. Take Murphy, North Carolina. The average drive here is 13.4 minutes, says City-Data. It’s a brief trip compared to big cities. But it plays a part in setting insurance costs.

Fewer minutes on the road mean fewer chances for accidents, which can keep premiums down.Jeff Root LICENSED INSURANCE AGENT

Yet, even in a quaint place like Murphy, these commute times affect your insurance, mirroring the local driving scene and its unique risks. Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool below.

Frequently Asked Questions

Can I get auto insurance with a suspended license in Murphy, NC?

Getting cheap auto insurance in Murphy, NC with a suspended license can be challenging, as most insurers require a valid license. Consider non-owner car insurance in Murphy, NC or discuss options with providers.

Does auto insurance cover damage from natural disasters in Murphy, NC?

Auto insurance policies usually cover damage from natural disasters, but review your policy for coverage limits and exclusions. Finding cheap auto insurance quotes in Murphy, NC can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Can I change my auto insurance policy in Murphy, NC at any time?

Generally, you can change your policy anytime, but review terms and potential penalties before making changes. For more information, read our article titled “How to Manage Your Auto Insurance Policy.”

What is uninsured/underinsured motorist coverage, and is it required in Murphy, NC?

Uninsured/underinsured motorist coverage protects against accidents with drivers lacking sufficient insurance. It’s not required by law but offered by insurers.

Can I bundle my auto insurance with other types of insurance in Murphy, NC?

Yes, bundling auto insurance with other policies like home or renters insurance in Murphy, NC can often lead to discounts. Consider getting a Murphy, NC renters insurance quotes to know the best bundles for your auto insurance. Read more in our article titled “How to Save Money by Bundling Insurance Policies.”

Does auto insurance cover rental cars in Murphy, NC?

Car rental in Murphy, NC, varies by policy, so review your insurance policy or contact your provider for details.

Can I get auto insurance if I have a poor credit score in Murphy, NC?

Yes, you can still obtain auto insurance if you have a poor credit score in Murphy, NC. However, it’s important to note that your credit score can significantly impact your insurance premiums. Insurers often consider credit history as a factor when determining rates, with lower scores typically leading to higher premiums. It’s advisable to compare car insurance quotes in Murphy, NC, from multiple providers to find the most affordable option available to you.

How does the terrain in Murphy, NC affect auto insurance rates?

The mountainous terrain and winding roads in Murphy, NC, can influence auto insurance rates. These geographical features may increase the risk of accidents, especially during adverse weather conditions, leading insurers to adjust premiums accordingly. It’s important to choose coverage that adequately protects you against potential hazards specific to the area, such as comprehensive coverage for incidents like landslides or falling debris.

Are there specific auto insurance discounts available for Murphy, NC residents?

Yes, many insurance companies offer specific discounts that Murphy, NC residents can take advantage of. These may include discounts for having a clean driving record, bundling auto insurance with home insurance, or installing safety features in your vehicle, such as anti-theft devices.

Read More: Auto Insurance Discounts to Ask for

What should I consider when choosing auto insurance coverage in Murphy, NC?

When choosing auto insurance coverage in Murphy, NC, consider factors such as the local driving conditions, your daily commute, and the value of your vehicle. It’s also important to assess the level of coverage you need, from minimum liability to comprehensive coverage, based on your financial situation and the specific risks associated with living in a mountainous area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.