Best Illinois Auto Insurance in 2025 (Compare the Top 10 Companies)

The best Illinois auto insurance comes from State Farm, Chubb, and Allstate, with rates starting as just $40 per month. Drivers can get the best auto insurance in Illinois by taking advantage of discounts and UBI programs, and adding optional coverages from the top Illinois companies like roadside assistance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Jul 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Illinois

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 82 reviews

82 reviewsCompany Facts

Full Coverage for Illinois

A.M. Best

Complaint Level

Pros & Cons

82 reviews

82 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Illinois

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsState Farm, Chubb, and Allstate have the best Illinois auto insurance, especially if you’re a safe driver.

State Farm is our top choice for Illinois auto insurance, primarily because of its affordable rates, generous auto insurance discounts, and robust UBI program. Whether you want Illinois state minimum auto insurance or a full coverage policy, State Farm is a good choice.

Our Top 10 Company Picks: Best Illinois Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | B | Reliable Coverage | State Farm | |

| #2 | 12% | A++ | Affordable Rates | Chubb | |

| #3 | 25% | A+ | Comprehensive Plans | Allstate | |

| #4 | 12% | A+ | Customizable Policies | Progressive | |

| #5 | 20% | A | Customer Service | American Family | |

| #6 | 10% | A++ | Military Benefits | USAA | |

| #7 | 10% | A+ | Competitive Prices | Erie |

| #8 | 25% | A | Extensive Discounts | Liberty Mutual |

| #9 | 20% | A+ | Accident Forgiveness | Nationwide |

| #10 | 8% | A++ | Financial Stability | Travelers |

Read on to explore your options for the best Illinois car insurance. Then, enter your ZIP code into our free comparison tool to see the average car insurance cost in Illinois for you.

- Illinois drivers can find affordable car insurance by researching their options

- Many Illinois drivers choose add-ons like roadside assistance, which increases costs

- State Farm and Chubb are the best Illinois auto insurance companies

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Local Agents: State Farm maintains a strong network of local agents offering personalized service and support. See why that matters in our State Farm auto insurance review.

- Discounts for Safe Drivers: With multiple discounts for safe driving habits and vehicle safety features, State Farm makes it easy to find the cheapest auto insurance in Illinois.

- Comprehensive Coverage Options: Get affordable auto insurance in Illinois that covers everything you want with State Farm’s diverse coverage options.

Cons

- Higher Premiums: Despite being one of the best Illinois car insurance companies, State Farm can be more expensive, particularly for high-risk drivers.

- Customer Service Variability: Many customers report that the State Farm service experience can vary significantly by agent and location.

#2 – Chubb: Best for High-End Vehicle Insurance

Pros

- Comprehensive Coverage: Get the best Illinois vehicle insurance for your high-end car with Chubb’s excellent coverage options. Popular choices include agreed value coverage and extended rental car coverage.

- High Customer Service Ratings: Chubb offers quality service meant to match the high-end nature of the cars it insures. Learn more about high-end coverage in our Chubb auto insurance review.

- Tailored Policies: Chubb specializes in insurance for high-value homes and vehicles, which is beneficial for affluent drivers looking for quality Illinois auto insurance quotes.

Cons

- Higher Rates: Due to the nature of its coverage, Chubb is not a good option if you’re looking for the cheapest insurance in Illinois.

- Limited Discounts: Chubb offers fewer discount options compared to other insurers, which makes it harder to find Illinois cheap auto insurance.

#3 – Allstate: Best for Full Coverage Policies

Pros

- Drivewise: Save up to 40% on your insurance with Allstate’s usage-based insurance (UBI) program, Drivewise. If you’re a low-mileage driver, Milewise might be the better selection.

- Safe Driving Bonuses: Earn rewards for your safe driving habits, like Allstate discounts and cash bonuses.

- Full Coverage Policies: Allstate’s wide variety of coverage choices are tailored to Illinois drivers and make getting the best auto insurance in Illinois simple.

Cons

- Expensive Policies: Allstate is frequently one of the most expensive car insurance options on the market. See how much insurance might cost you in our Allstate auto insurance review.

- Discount Limitations: Although Allstate offers a decent number of discounts, they may not be available to every Illinois driver.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Online Policy Management

Pros

- Snapshot Program: Progressive’s UBI program Snapshot offers a maximum savings of 30%, which makes it easy for good drivers to keep Illinois car insurance costs low.

- Online Tools: You’ll get a variety of online tools to manage your policy and find cheap auto insurance in Illinois when you shop at Progressive.

- Wide Range of Coverage Options: Progressive offers extensive options for customizing policies in Illinois, no matter what your needs are.

Cons

- Mixed Reviews on Claims: Some customers report issues with the Progressive claims process. Explore how Progressive is tackling these issues in our Progressive auto insurance review.

- Potential for Rate Increases: Progressive rates can increase significantly after accidents or violations. Some drivers report that Progressive increased their rates even without a traffic violation.

#5 – American Family: Best for Fast Claims Service

Pros

- Extensive Network of Local Agents: American Family has a large network of local agents so all drivers can get one-on-one help with their auto insurance in Illinois.

- Unique Discounts: American Family offers unique discounts, such as those for young drivers and loyalty. Explore all your discount opportunities in our American Family auto insurance review.

- High Customer Satisfaction: Am Fam generally receives positive reviews for its customer service and claims handling process. Many drivers express being pleasantly surprised with how efficiently American Family handled their claims.

Cons

- Limited Availability: You can get car insurance quotes in Illinois from American Family, but some coverage options and discounts may be limited in certain areas.

- Digital Tools Lacking: American Family’s online and mobile tools could be more user-friendly and accessible.

# 6 – USAA: Best for Specialize Military Insurance

Pros

- Competitive Rates: USAA often has the lowest average cost of car insurance in Illinois per month. If you’re interested in how USAA keeps rates low, check out our USAA auto insurance review.

- Outstanding Customer Service: USAA has extremely high customer satisfaction ratings, particularly among Illinois drivers.

- Exclusive Discounts: Aside from standard car insurance savings, USAA stands out for its special savings for military members and their families.

Cons

- Eligibility Restrictions: Only military members, veterans, and their families are eligible for USAA auto insurance coverage.

- Limited Local Presence: USAA offers fewer local offices for in-person support. Instead, you’ll need to call the USAA customer service hotline.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Erie: Best Customer Service Experience

Pros

- High Customer Satisfaction: Erie sets itself apart as one of the best car insurance companies in Illinois by offering superior customer service. See what customers have to say in our Erie auto insurance review.

- Excellent Add-Ons: Gain access to a wide range of coverage options when you shop at Erie.

- Rate Lock Program: Add the Rate Lock add-on to your Erie policy to ensure your rates won’t increase in the future unless you make major policy changes.

Cons

- Higher Rates for Bad Credit: Erie is often a good choice for cheap car insurance in Illinois, it may not be the cheapest if you have a low credit score.

- Limited Digital Tools: As a smaller company, Erie has fewer online resources and tools compared to larger insurers.

#8 – Liberty Mutual: Best for Diverse Coverage Options

Pros

- Customizable Coverage: Make your Liberty Mutual car insurance policy your own by customizing your coverage with add-ons.

- Accident Forgiveness: Adding accident forgiveness to your Liberty Mutual policy helps avoid increases in your Illinois car insurance rates after an accident.

- RightTrack: Liberty Mutual offers savings of up to 30% to drivers who consistently practice safe habits behind the wheel. See if RightTrack fits your drive style in our Liberty Mutual auto insurance review.

Cons

- Higher Average Rates: Liberty Mutual isn’t usually the most expensive option, but it’s also rarely the cheapest car insurance in Illinois.

- Mixed Customer Service Reviews: Liberty Mutual has inconsistent service quality, as reported by customers.

#9 – Nationwide: Best for UBI Savings

Pros

- Vanishing Deductible: Signing up for Nationwide’s vanishing deductible program reduces your deductible for every year you spend claims-free. Learn how the vanishing deductible program works in our Nationwide auto insurance review.

- SmartRide: Nationwide’s SmartRide program offers one of the largest safe driving discounts on the market, with a maximum discount of 40% available.

- Ample Coverage Options: Get the exact coverage you want with Nationwide’s diverse selection of coverage options available for Illinois drivers.

Cons

- Limited Digital Experience: Nationwide focuses more on a traditional experience, so its online tools and app features are less robust.

- Discount Variability: Nationwide’s discounts aren’t always available in Illinois. Make sure to check with a representative to see how you can save.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Personalized Service

Pros

- Wide Range of Discounts: There are 15 Travelers discounts to take advantage of, including for hybrid vehicles, which are popular in Illinois.

- Local Representatives: Get the help you need when you need it from any of Travelers’ numerous local agents.

- High Customer Satisfaction: Most drivers agree that Travelers provides a positive customer service experience. Read what customers have to say in our Travelers auto insurance review.

Cons

- Higher Premiums for High-Risk Drivers: Travelers may not be the best option for high-risk drivers, as its rates can be more expensive for drivers with violations or accidents.

- Limited Digital Tools: Some customers find Travelers’ digital experience less user-friendly and often report feeling disappointed by the online options.

Illinois Auto Insurance Rates

Whether you need to keep costs low with minimum insurance or want the maximum amount of coverage you can get, you’ll need to compare companies to find the lowest rates. Companies consider the same factors that affect auto insurance rates but use different formulas to craft quotes. This can lead to wildly different rates for the same driver.

Check below to see the difference between minimum and full coverage auto insurance from our top providers.

Illinois Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $109 | $285 | |

| $70 | $184 | |

| $75 | $200 | |

| $53 | $131 |

| $47 | $123 |

| $57 | $150 |

| $55 | $145 | |

| $40 | $104 | |

| $54 | $141 | |

| $38 | $101 |

The rates listed above are what the average Illinois driver pays. However, that might not reflect what you’ll pay, especially if you take the time to find the cheapest coverage possible.

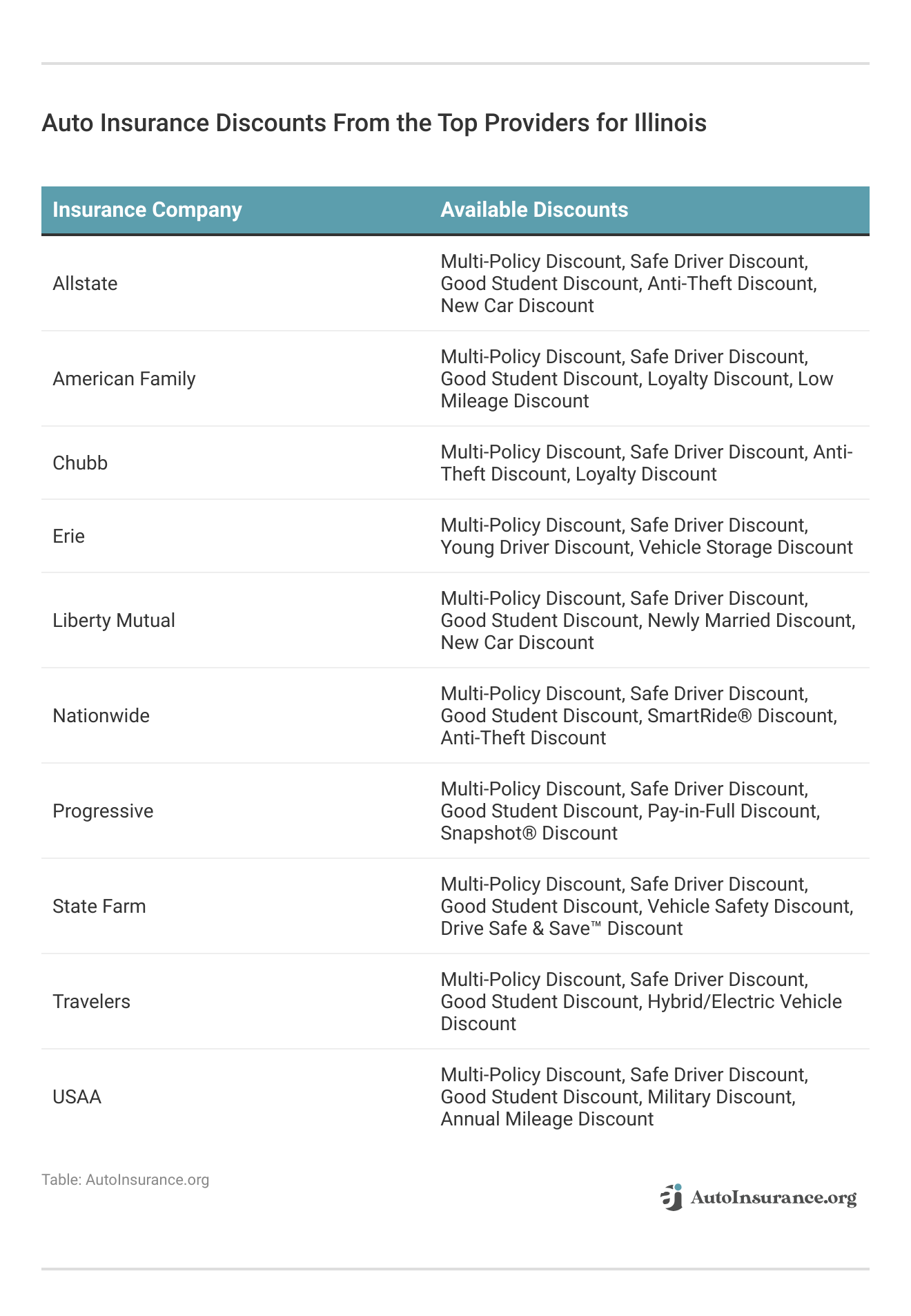

There are plenty of ways for you to lower your insurance costs in Illinois. The best place to start is to find the insurance company that has the most discounts you qualify for. Below, you can explore a selection of discounts from the top companies popular with Illinois drivers.

Discounts are a great first step in finding affordable coverage, but you shouldn’t stop there. Consider the following steps when you’re searching for affordable Illinois coverage:

- Keep your driving record clean

- Lower your coverage

- Raise your deductible

- Take a driving class

- Improve your credit score

If you do nothing else, however, you should make sure to compare quotes. Buying insurance from the first company you shop with almost guarantees that you’ll overpay for your insurance.

Luckily, comparing quotes online is easy. Most companies have request forms on their websites that require a bit of personal data and about 15 minutes to fill out.

If you don’t want to visit numerous websites and keep track of multiple quotes, you can also use an online tool to see prices from a variety of companies all at once.

Illinois Auto Insurance Rates by Credit Score

Most factors that affect your insurance rates are obvious, but one that often confuses people is credit scores. When it comes to auto insurance and credit scores, lower scores mean higher rates.

Your credit score can negatively impact your car insurance rates if you have bad credit. Studies have shown a correlation between low credit scores and an increased likelihood of filing a claim. Many insurance companies attempt to offset this possibility by charging people with bad credit higher rates for coverage.Chris Abrams Licensed Insurance Agent

In Illinois, you could pay up to 52% more on average for your car insurance if you have bad credit. Still, some insurance companies may offer you more reasonable rates with a low credit score.

Auto Insurance Full Coverage Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $190 | $230 | $340 | |

| $145 | $180 | $280 |

| $165 | $200 | $310 | |

| $110 | $140 | $250 | |

| $220 | $260 | $390 |

| $140 | $170 | $300 | |

| $135 | $165 | $280 | |

| $120 | $140 | $220 | |

| $130 | $160 | $270 | |

| $95 | $110 | $180 |

Illinois car insurance quotes can differ significantly from one company to the next. Therefore, you should always compare quotes from several companies before making any final decisions on car insurance coverage. Otherwise, you could pay more than you need for coverage.

Illinois Auto Insurance Rates by Driving Record

Getting cheap Illinois car insurance may be difficult if you have an at-fault accident on your record. Insurance companies base their rates on several factors. One common factor that virtually every insurer considers is your driving record, and learning how insurance companies check your driving record is key to understanding why your rates might be higher.

With a clean driving record, you can get incredibly competitive coverage rates. But if you have an accident on your record, don’t be surprised if your rates are much higher than average.

For example, in Illinois, most people with an at-fault accident on their driving record pay around $678 more each year for coverage.

But even if you have one at-fault accident on your driving record, you can still shop online and compare quotes to see which insurance company in your area offers coverage at the price you’re looking for.

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| $122 | $189 |

| $225 | $363 | |

| $164 | $247 | |

| $138 | $196 | |

| $330 | $621 | |

| $106 | $153 | |

| $397 | $496 |

| $169 | $238 |

| $133 | $219 | |

| $162 | $254 | |

| $161 | $235 |

| $194 | $308 | |

| U.S. Average | $165 | $244 |

As you can see, rates differ significantly from one company to another regarding your driving record.

Don’t get discouraged if you are paying higher-than-average premiums for car insurance in Illinois because of your driving record. There may be some things you can do to lower your car insurance rates.

Some insurance providers allow policyholders to take safe driving or defensive driving courses to save money on premiums. You may also be eligible for certain discounts that help you lower your overall rates.Kristen Gryglik Licensed Insurance Agent

As your driving record improves, you should find that your car insurance rates automatically lower. It’s a good idea to shop online and compare quotes at least once a year so you can avoid paying too much for coverage as your driving record improves.

Illinois Auto Insurance Rates by Age

Drivers between 16 and 25 pay the most for car insurance coverage. This demographic is considered inexperienced, so finding the best auto insurance for teens can be difficult because most companies charge more for this age group.

Parents: here’s what you need to know before your teen gets behind the wheel. https://t.co/ybFeiiJHq6

— State Farm (@StateFarm) May 22, 2023

In Illinois, teen drivers pay more than three times as much for coverage as the statewide average. The average for teen and young adult car insurance coverage is $4,409 annually or $367 each month.

Teen Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male |

|---|---|---|---|---|

| $868 | $910 | $640 | $740 | |

| $452 | $456 | $333 | $371 | |

| $1,156 | $1,103 | $853 | $897 | |

| $425 | $445 | $313 | $362 | |

| $1,031 | $1,121 | $745 | $893 |

| $586 | $679 | $432 | $552 |

| $1,144 | $1,161 | $843 | $944 | |

| $444 | $498 | $327 | $405 | |

| $1,026 | $1,298 | $757 | $1,056 |

Teen drivers can save money with good student discounts or similar discounts on coverage. You may also be able to save by adding yourself to a parent or guardian’s insurance policy. As you get older, your car insurance rates should decrease. Shop online and compare quotes from multiple providers to avoid paying too much for coverage.

Illinois Auto Insurance Rates by City

Believe it or not, you will pay more or less for coverage depending on where you live in Illinois. Certain areas that see heavier traffic are likely to charge higher rates, while companies in cities that are considered more rural charge lower rates.

The cheapest auto insurance in Illinois is often found in Twin Grove, and the state’s most expensive auto insurance rates are often in Dolton. Chicago is also much more expensive than coverage in Naperville or Springfield. Still, you may be able to find cheap auto insurance in Chicago and other cities in Illinois by shopping online and comparing quotes from multiple providers.

DUI Laws in Illinois

Finding cheap auto insurance after a DUI conviction can be difficult in Illinois. A DUI conviction in Illinois can cause you to pay nearly $600 more annually for coverage. If you have a DUI on your driving record, it can be very difficult to find affordable coverage in Illinois or elsewhere in the U.S.

A DUI or DWI is a serious penalty, and insurance companies in Illinois consider a DUI a worse offense than an at-fault accident, speeding, or reckless driving.

How to Get Auto Insurance in Illinois With a DUI

You will likely find car insurance options in Illinois if you have a DUI on your driving record, but you will pay more for coverage than you would otherwise. Most companies in Illinois are likely to charge you significantly more for coverage if you’ve been convicted of a DUI.

Auto Insurance Full Coverage Monthly Rate Increases: One DUI

| Insurance Company | Clean Record | One DUI | Percent Increase |

|---|---|---|---|

| $228 | $385 | 68.9% | |

| $166 | $276 | 66.3% |

| $198 | $275 | 38.9% | |

| $114 | $309 | 171.1% | |

| $248 | $447 | 80.2% |

| $164 | $338 | 106.1% | |

| $150 | $200 | 33.3% | |

| $123 | $160 | 30.1% | |

| $141 | $294 | 108.5% | |

| $84 | $154 | 83.3% |

A DUI will eventually drop off your driving record, but it could take a while, and you’ll probably need high-risk auto insurance. In Illinois, a DUI will stay on your driving record for at least five years. Once it’s gone, you should notice your rates drop as well.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Laws in Illinois

You are required to purchase car insurance if you own and register a vehicle in Illinois. If you purchase just the state’s minimum coverage amounts, you can expect to pay around $516 per year or $43 monthly for car insurance if you purchase just the state’s minimum coverage amounts.

If you’re struggling to afford coverage, you may qualify for government assistance programs for low-income drivers in Illinois.

Illinois Auto Insurance Coverage Requirements

There are certain car insurance requirements you need to meet before you can drive legally in Illinois. According to the Illinois Department of Insurance, the required amounts of coverage include the following:

- $25,000 in bodily injury liability per person

- $50,000 in bodily injury liability per accident

- $20,000 in property damage liability per accident

- $25,000 in uninsured/underinsured coverage per person

- $50,000 in uninsured/underinsured coverage per accident

Mandatory car insurance is a necessary protection that helps keep drivers safe from the risks associated with operating a motor vehicle.

In addition to the state’s required types of coverage, you can also purchase additional coverage options, including:

- Comprehensive: Comprehensive auto insurance covers things like hail damage, theft, and vandalism.

- Collision: Collision insurance pays for repairs for your vehicle if you were involved in an accident, even if you were at fault.

- Gap Coverage: Gap coverage pays the difference between what you owe on your vehicle and what your car is worth based on its actual cash value.

- Medical and Funeral Services: Medical and funeral services pay for medical bills, hospital stays, or funeral fees.

- Rental Car Reimbursement: Rental car reimbursement pays you back if you have to rent a car while yours is being repaired after a covered event.

- Roadside Assistance: The best roadside assistance plans help if you are stranded on the road and need flat tire repair, lockout services, fuel services, or a tow.

Keep in mind that every coverage you add to your policy will likely cost you more in monthly or annual premiums. If you want additional coverage for peace of mind, you may be thankful to have it if you’re ever in trouble.

SR-22 Insurance in Illinois

Some Illinois drivers will need to buy SR-22 coverage due to their driving records. Typically, Illinois requires SR-22 insurance if you have a serious infraction on your record or a series of infractions that indicate an issue.

The most common reasons a person might need SR-22 coverage include:

- A DUI or DWI

- Multiple traffic violations

- Multiple speeding tickets

- One or more at-fault accidents

- A gap in auto insurance coverage

- Driving with a suspended or revoked license

- Failure to pay child support

SR-22 is not a type of insurance coverage. An SR-22 is a form that your car insurance company will submit on your behalf stating that you have adequate coverage and are financially responsible for anything that happens when you’re behind the wheel.

Finding coverage when you need an SR-22 can be tricky, but you should be able to locate a company willing to work with you.

If you have insurance with a company, it could be easy to file an SR-22. Speak with a representative from your insurance provider and ask whether this is a possibility. You may have to pay a small fee to have the company file an SR-22.

If you do not have an insurance company, getting an SR-22 may be a bit difficult. Call around and speak with different companies. Ask whether filing an SR-22 for a new policyholder is possible and answer any necessary questions. Compare quotes from several companies before making any final decisions.Jeff Root Licensed Insurance Agent

If you need SR-22 coverage but don’t own a car, you should probably purchase a non-owner policy with a company you know will file your SR-22. Because you’re less likely to be in an accident since you don’t drive a lot, you can save money with non-owner SR-22 insurance.

Find the Best Illinois Auto Insurance Today

You need to buy auto insurance if you live and drive in Illinois. If you purchase your state’s minimum coverage amounts, you could get a policy for $500 or less per year. Still, car insurance in Illinois will cost more if you get a more robust policy that offers more protection if you’re ever in an accident. However, you should be able to find an affordable policy now that you know how to evaluate auto insurance quotes.

The best way to find affordable coverage is to compare car insurance quotes in Illinois from several providers. Compare multiple companies by entering your ZIP code into our free comparison tool below to find your cheapest Illinois car insurance.

Frequently Asked Questions

Who offers the cheapest auto insurance coverage in Illinois?

The cheapest coverage options in Illinois depend on several factors. Your ZIP code, credit score, driving history, and other non-driving factors affect your car insurance rates in Illinois. The best way to find cheap coverage in your state is to compare rates from multiple providers.

When you compare quotes, you can see which company will offer affordable coverage based on your unique situation. This will help you make an informed decision and avoid paying too much for coverage.

How much does auto insurance cost in Illinois?

If you live in Illinois, you probably pay around $116 per month for auto insurance. But you may find cheaper rates if you shop online and compare quotes from multiple companies in your city.

Some insurers charge more for individuals based on age, while others do not. The same is true for factors like your ZIP code or gender. You will never know how much you’ll pay for car insurance coverage in Illinois until you find and compare quotes from multiple providers.

What are the minimum insurance requirements in Illinois?

You’ll need a 25/50/20 plan that includes liability auto insurance and uninsured/underinsured motorist insurance to legally drive in Illinois.

What is the average cost of auto insurance in Illinois?

The average cost for car insurance in Illinois is $1,394 annually or $116 per month. If you’re looking for coverage that just meets your state’s minimum requirements, you’ll probably pay a good bit less.

Still, if you need additional coverage or if you have a poor driving record, you could easily pay twice the statewide average for car insurance. And teens and young adult drivers could pay up to four times more than a 30-year-old with a clean driving record.

Is Illinois an at-fault state?

Yes, Illinois is an at-fault state. This means that someone will be responsible for the damage if you’re in an accident. An insurance adjuster determines fault with the help of police records and other available details.

If you’re at fault in an accident, you will need additional coverage to help pay for damage you caused to other vehicles and your own car. In this case, a liability-only policy will not offer the type of coverage you need. You should consider purchasing a full coverage policy to adequately cover all costs after an at-fault accident.

What does liability insurance cover?

Liability insurance covers the damages or injuries you cause to others in an accident where you are at fault. It helps pay for the other party’s medical expenses, property damage, and legal fees if they decide to sue you.

Can you register a car in Illinois without car insurance?

According to Illinois state law, you cannot register a car without having car insurance. Proof of insurance is required at the time you want to register your vehicle. That can make it tricky to do things like register a vehicle you don’t own if you can’t get insurance on a car not in your name, but an insurance or DMV representative can help.

Can my auto insurance policy be canceled in Illinois?

Yes, your auto insurance policy can be canceled in Illinois under certain circumstances. Insurance companies can cancel your policy for reasons such as non-payment of premiums, providing false information, or having your driver’s license suspended or revoked. However, insurance companies must follow specific procedures and provide notice before canceling a policy.

Are there any penalties for driving without insurance in Illinois?

Yes, driving without insurance in Illinois can result in penalties. If you’re caught driving without insurance, you may face fines, license suspension, and potential vehicle impoundment. Additionally, it can make it more difficult and expensive to obtain insurance coverage in the future.

What are the best auto insurance companies in Illinois?

Our research shows that State Farm, Chubb, and Allstate are the best insurance companies in Illinois. However, you should still compare rates with other companies before you purchase a policy. The best company for you might be a different provider — enter your ZIP code into our free comparison tool to see which company offers the lowest rates for you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.