Cheap Auto Insurance for Teachers in 2025 (Top 8 Companies for Savings)

Safeco, Geico, and State Farm have the cheapest auto insurance for teachers, starting at $38/mo. Car insurance discounts for teachers also help lower rates even more. Below, we'll help you find the cheapest teacher car insurance rates from the top providers to find the best coverage for your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Apr 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,278 reviews

1,278 reviewsCompany Facts

Min. Coverage for Teachers

A.M. Best Rating

Complaint Level

Pros & Cons

1,278 reviews

1,278 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Teachers

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Teachers

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsSafeco, Geico, and State Farm have the cheapest auto insurance for teachers. The top pick for the cheapest teacher car insurance is Safeco, averaging $38 per month for minimum coverage.

Our Top 8 Company Picks: Cheap Auto Insurance for Teachers

| Company | Rank | Monthly Rates | Teacher's Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $38 | 15% | Diminishing Deductible | Safeco | |

| #2 | $43 | 12% | Cheap Rates | Geico | |

| #3 | $47 | 10% | Student Savings | State Farm | |

| #4 | $56 | 8% | Online Management | Progressive | |

| #5 | $63 | 7% | Many Discounts | Nationwide |

| #6 | $76 | 5% | Great Add-ons | Farmers | |

| #7 | $87 | 6% | Customer Service | Allstate | |

| #8 | $96 | 4% | Educator Coverage | Liberty Mutual |

Several different companies also offer auto insurance discounts for teachers and educators. Still, there’s a chance you could also save more money through other ways.

Educators should explore discounts, coverage options, customer reviews, and quotes before deciding on an auto insurance company.

- Safeco is our top pick for the cheapest teacher auto insurance company

- Teachers can pay as low as $38 per month for minimum coverage

- Some companies also offer teachers car insurance discounts

Read on to find out how to qualify for a teachers auto insurance discount. You can also enter your ZIP code above to compare teachers car insurance quotes from the top providers.

#1 – Safeco: Top Overall Pick

Pros

- Safe Driving Rewards: Safeco’s diminishing deductible lowers your auto insurance deductible for safe driving at each policy renewal.

- Usage-Based Program: Safeco RightTrack program offers a usage-based component for teachers looking to save.

- Online Policy Management: The company’s user-friendly online and mobile tools allow educators to conveniently manage their policies. (Read More: Safeco Auto Insurance Review)

Cons

- Low Customer Satisfaction: Safeco has poor claims satisfaction.

- Few Discounts: Compared to competitors, Safeco doesn’t offer as many discount opportunities.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Cheap Rates

Pros

- Cheap Rates: Geico has the cheapest auto insurance for all teachers. See if Geico offers affordable coverage for you in our Geico auto insurance review.

- Good Discounts: Get discount car insurance for teachers with Geico’s affinity car insurance discount, which may include educators.

- Online Tools: The company has user-friendly online resources for policy management and claims handling.

Cons

- Few Local Agents: Geico has limited local agents for teachers seeking face-to-face customer service.

- Limited Coverages: Educators can’t get rideshare or gap insurance with Geico.

#3 – State Farm: Best for Student Savings

Pros

- Many Savings: The company offers excellent young driver programs for young teachers or teachers with children.

- Good Customer Service: State Farm receives all-around excellent customer service ratings. See what customers think and more in our State Farm auto insurance review.

- Local Agents: State Farm offers an extensive agency network for educators who want in-person assistance.

Cons

- No Gap Insurance: Teachers can’t get gap insurance with State Farm.

- Discount Availability Varies: Availability and percentage amount of certain State Farm auto insurance discounts vary by location.

#4 – Progressive: Best for Online Management

Pros

- Pet Coverage: Collision auto insurance policy includes pet injury coverage.

- Rideshare Coverage: Progressive sells rideshare auto insurance.

- Offers Budgeting Tool: Progressive’s Name Your Price Tool allows educators to tailor coverage options to their budget for cheap teacher auto insurance rates. (Read More: Progressive Auto Insurance Review)

Cons

- Several Complaints: Progressive has poor customer satisfaction, as it receives a high volume of complaints.

- Expensive Accident Rates: You may see higher rates after an accident with Progressive. (Read More: Auto Insurance for Drivers With Accidents)

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Many Discounts

Pros

- Great Discounts: You can save on Nationwide car insurance for teachers with defensive driving, safe driver, Nationwide SmartRide, SmartMiles, accident-free, and multi-policy discounts. (Read More: Nationwide SmartRide Review)

- Vast Coverage Options: Nationwide’s coverage options allow teachers to find the best car insurance for them: roadside assistance, gap insurance, rental car expense, accident forgiveness, and a vanishing deductible.

- Good Financial Strength: Nationwide has strong financial ratings. See how Nationwide stacks up against competitors in our Nationwide auto insurance review.

Cons

- Limited Availability: Despite its name, you can’t get Nationwide coverage in every state.

- Claims Handling: Nationwide has poor claims satisfaction.

#6 – Farmers: Best for Great Add-Ons

Pros

- Coverage Options: Teachers can benefit from a $0 glass deductible, accident forgiveness, and other cost-saving programs.

- Teacher Savings: Farmers has affinity, safe driver, and ePolicy discounts alongside its Farmers Signal program. (Read More: Farmers Signal Review)

- Good Customer Satisfaction: The company doesn’t have many customer complaints.

Cons

- Limited Availability: Farmers isn’t available in every region.

- Few Online Resources: Busy teachers looking for a convenient online interface for paying bills or managing their policy may be disappointed with Farmers, as the company lacks online tools. Read More: Farmers Auto Insurance Review

#7 – Allstate: Best for Customer Service

Pros

- Teacher Discounts: Allstate offers multiple discounts to help teachers get cheap car insurance: Drivewise, multiple policy, new car, and safe driving club discounts.

- Add-Ons: You can get many auto insurance coverage options for teachers: accident forgiveness, rideshare, and roadside assistance. See if Allstate offers the coverage you need by reading our Allstate auto insurance review.

- Claim Satisfaction Guarantee: Allstate gives its auto insurance policyholders a free claim satisfaction guarantee.

Cons

- Many Complaints: Allstate has various customer complaints.

- Not the Cheapest: Many other top providers offer cheaper rates and better financial ratings for teachers than Allstate.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Educator Coverage

Pros

- Teacher-Specific Coverage: Liberty Mutual offers vandalism loss protection and personal property coverage to teachers on school property or at school-related events. Learn about these coverages in our Liberty Mutual auto insurance review.

- $0 Deductible for School Business: You won’t pay a deductible if your car gets damaged in a collision while driving on school business.

- Customize Your Coverage: Liberty Mutual’s customizable policies could benefit teachers with certain coverage needs.

Cons

- Few Local Agents: You won’t find many local agents with Liberty Mutual.

- Varied Customer Reviews: Liberty Mutual has mixed claims handling and customer service ratings.

Auto Insurance Companies With Teacher or Occupation-Based Discounts

Do teachers get car insurance discounts? Yes, many of the best auto insurance companies offer discounts for teachers. For instance, Farmers offers a 10% discount for teachers and educators on their car insurance.

Check out the table below for a list of the best car insurance for teachers offering car insurance discounts:

Teacher Auto Insurance Discounts by Provider

| Insurance Company | Percentage Discount |

|---|---|

| 5%-15% | |

| 4%-12% | |

| 10% | |

| 8% | |

| 5% | |

| 10% |

| 6%-16% |

| 7%-17% | |

| 15% | |

| 12% | |

| 8%-18% | |

| 5%-15% |

Many of the top car insurance companies offer teachers insurance discounts to help them lower their rates. Certain conditions apply to qualify for a teacher or educator discount:

- You’re a teacher.

- You’re a staff member at a school or learning facility.

- You’re the child of a teacher and meet other age-based and living address criteria.

Additionally, you’ll need to provide documentation regardless of the insurance company you do business with. Acceptable forms of ID include your school ID, security badge, or a letter from the school proving employment.

Your children may qualify for discounts if they live at your address, but once they move out, removing them from your policy can save you money.Daniel Walker Licensed Auto Insurance Agent

Your children may also qualify for discounts regardless of age if they’re under your policy and live at your address. However, once they leave, they may no longer qualify, and you can save more money by removing them from your policy.

Other Auto Insurance Discounts for Teachers

As a teacher, you already know the value of research. When it comes to insurance, it’s important to hunt down auto insurance discounts when choosing a policy. Unfortunately, there isn’t an exact “Allstate teacher discount” for educators, but teachers can qualify for several Allstate car insurance discounts to drastically lower their premiums.

Here is a list of several other car insurance discounts for which teachers may qualify and save even more:

- Multi-Policy: You can receive a discount if you purchase multiple policies from the same insurer. Bundling policies with a single insurance company allows it to customize your specific needs and leverage your risk profile to save you money.

- Safe Driver: Motorists with a spotless record frequently receive discounts or cash back for safe driving.

- Good Student: Discounts on auto insurance are available for teachers who have a student with good grades listed on their policy.

- Discount for Defensive Driving: Gain a premium discount by taking a defensive driving course.

- Safety or Anti-Theft Devices: Insurance companies will lower your rates if your vehicle has anti-theft or safety-enhancing features like an alarm, air bags, or anti-lock brakes.

- Pay-in-Full: Instead of choosing monthly payments, policyholders who purchase their entire annual policy upfront may qualify for a discount.

- Telematics Monitoring: Share your driving information with your insurance provider. The safer you drive, the greater your discount.

In addition to teacher-specific car insurance discounts, there are other ways for teachers to obtain inexpensive auto insurance. Scroll through the section below for helpful tips on how to find cheap car insurance for teachers.

Ways Teachers Can Get Cheaper Auto Insurance Rates

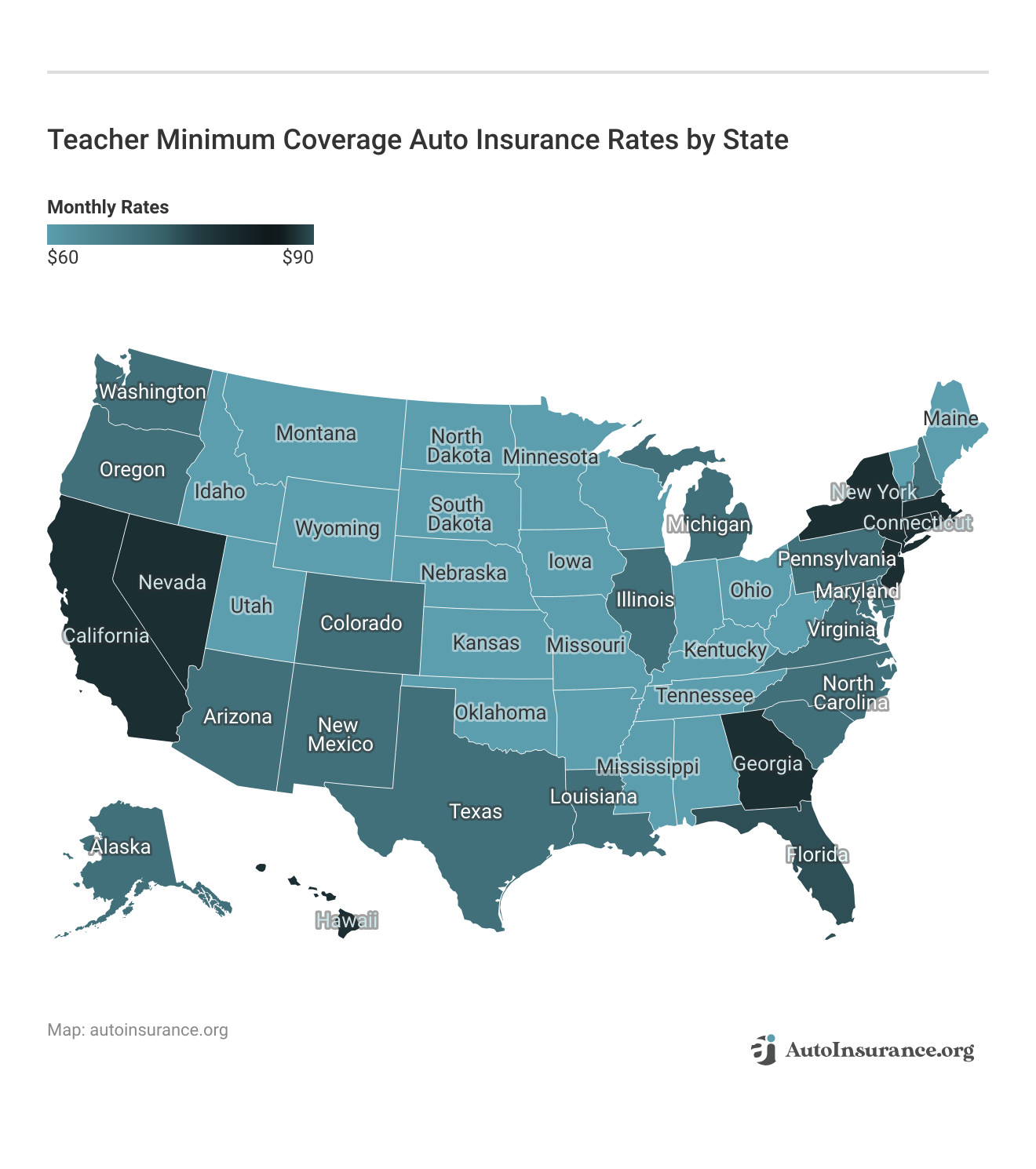

You don’t need an occupation-based discount to get cheap car insurance for teachers. Finding the best rates comes down to choosing the right coverage and comparing quotes from multiple companies to find the best one. Check out the map below to see how much teachers might pay for minimum coverage by state:

Only pay for what you need and weigh the benefits of lowering or raising your auto insurance deductible when appropriate. A low deductible means you’ll be paying more per month.

If you think you’ll run a very low risk of an accident or other vehicle damage, you might save money by raising your deductible.

Think About Your Claims

Sometimes, it’s best just to pay for minor repairs out of pocket, especially if the long-term financial picture warrants it. Relying on your comprehensive coverage seems fair at first, but insurance companies are still likely to raise your rates during the renewal period by 5%-8% even when you’re not at fault.

Progressive is proud to announce Cowboy Coverage, the first full length album from Flo. Get the party started at home or in your car with a collection of tracks that will insure you have a good time. Leave a comment to reserve your copy. pic.twitter.com/GDBxoKbFwX

— Progressive (@progressive) April 1, 2024

If your total repair costs are less than your deductible, then you might consider taking care of the repairs yourself. You could end up paying more unnecessarily over the coming years, assuming that your annual rates went up by an average of 10% after a claim.

Shop Around for the Best Rates

When underwriting your insurance policy, many factors are considered, and not all companies are equally adept at pulling off the invariable win-win. Because you can find vastly different coverage rates from company to company, you really will have to shop around to get the best deal.

Also, because purchasing a car is an integral part of the entire process, it’s great to look for dealerships and car makers that honor teachers and educators with a discount, as this will equally affect your overall savings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Teachers Can Buy Cheap Auto Insurance Coverage

Safeco, Geico, and State Farm provide cheap auto insurance for teachers, with Safeco offering the lowest rate at $38 per month and a decreasing deductible, Geico providing cheap rates with a 25% multi-policy discount, and State Farm providing solid student savings programs.

If you’re looking for car insurance with teacher discounts, make sure you know where to compare auto insurance rates, as many insurers offer car insurance deals for teachers to help lower insurance costs.

You can enter your ZIP code to shop around for cheap auto insurance rates from these companies and others.

Frequently Asked Questions

Do teachers get discounts on auto insurance?

Many companies consider a driver’s profession when determining their rates. Depending on their insurance company, teachers may be eligible for discounts on auto insurance. The best strategy for obtaining reasonable rates is to compare companies and request a discount.

Does Horace Mann insurance cover rental cars?

Vehicle rentals are covered by Horace Mann insurance. Owners of the policy can include rental reimbursement coverage, which will cover the cost of a rental vehicle while their own vehicle is being repaired.

Read More: Best Rental Auto Insurance That Covers Additional Drivers

What is the best insurance for teachers?

Certain insurance companies offer auto insurance specifically tailored to the needs of teachers. These companies include Liberty Mutual, Horace Mann, California Casualty, Meemic, and Plymouth Rock. However, different teachers have different coverage needs, and some may find their best rates with companies not included in this article.

Stop overpaying for auto insurance. Enter your ZIP code to find out if you can get a better deal.

Do teachers qualify for any additional insurance discounts?

In addition to potential teacher-specific insurance discounts, educators may be eligible for other general insurance discounts offered by insurance providers. These teacher car insurance discounts can include safe driver discounts, multi-policy discounts (bundling auto insurance with other policies), good student discounts (for dependents), or discounts for certain professional affiliations.

Are teachers considered lower risk by insurance companies?

Insurance companies may consider teachers to be lower risk due to factors such as stable employment, responsible behavior, and typically having shorter commutes. Insurance providers typically take into account various risk factors when determining premiums, and stable employment and responsible behavior can be viewed as positive factors in assessing risk.

Can teachers get group insurance rates for auto insurance?

Some educational institutions or teacher associations offer group insurance plans that provide discounted rates for various types of insurance, including auto insurance. These group plans can often provide more affordable rates compared to individual policies.

It’s recommended to check with your employer or professional organizations in the education field to see if group educator auto insurance options are available.

Can teachers get USAA insurance?

Teachers who served in the military or have an immediate family member who did can get USAA car insurance coverage.

Read More: USAA Auto Insurance Review

Does USAA offer a teacher discount?

No, USAA doesn’t have specific car insurance discounts for teachers.

Are there any teacher-specific auto insurance companies?

Some insurance companies only do business with educators and teachers. Since their creation in 1945, Horace Mann has been an educator-only insurance company. It offers specific benefits like transporting students or pets, reduced rates for vandalism on school property, and multi-discount stacking.

Teachers Insurance Co., a division of Horace Mann, is specifically suited to helping teachers get the best insurance deal. They also offer the ability to bundle with life, health, and other insurance policies.

Enter your ZIP code into our free quote tool below to instantly compare rates from the top providers for teachers near you.

Can teachers use their personal auto insurance for work-related driving?

Personal auto insurance policies typically do not cover work-related driving activities, especially if they involve transporting students or using a vehicle owned by the educational institution.

In such cases, the employer’s commercial auto insurance policy would generally be primary. Teachers should consult their employer’s policies and insurance guidelines to understand the coverage available for work-related driving.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.