Insuranceopedia Review for 2025 (Trustworthy Insurance Quotes?)

Our Insuranceopedia review shows it connects users with 100+ insurers for quick comparisons, expert-reviewed guides, and a helpful insurance dictionary. You can also get real-time insurance quotes in as little as 3 minutes, tailored to the coverage types you choose.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: May 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Our Insuranceopedia review finds that the platform partners with over 100 insurers to deliver fast, real-time quotes for home, renters, and car insurance.

Insuranceopedia Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.4 |

| Customer Support | 3.6 |

| Discount Clarity | 3.0 |

| Ease of Use | 3.2 |

| Educational Resources | 4.0 |

| Provider Network | 3.5 |

| Quote Accuracy | 3.1 |

| Quote Speed | 3.3 |

| Savings Potential | 3.0 |

It also features expert-reviewed guides, a glossary of insurance terms, and educational content. However, users must visit insurer websites to complete their purchases, and limited customer reviews make it harder to gauge service quality upfront.

- Insuranceopedia works with its 100+ provider partnerships for rate comparisons

- The platform offers unbiased quotes with no contractual ties to specific insurers

- Expert-reviewed content ensures accuracy, with clear labeling of sponsored material

If you’re looking to save more without the extra steps, AutoInsurance.org helps drivers save up to 40% more on average by comparing quotes in one place.

Looking for free insurance quotes? Enter your ZIP code to compare rates from top providers. Our tool delivers faster quote results in under 2 minutes.

Insuranceopedia Pros and Cons

| Pros/Cons | |

|---|---|

| ✅ Pros | • Compares quotes from over 100 insurers. • Offers real-time rate updates. • Provides expert-reviewed educational content. |

| ❌ Cons | • Final quotes may require visiting insurer websites. • Limited user reviews available. • Customer support options are minimal. |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Insuranceopedia’s Quote Tool Works

Insuranceopedia is a comparison platform that helps users compare online auto insurance companies by offering quotes from more than 100 providers in real-time. It’s easy to find insurance rates from Insuranceopedia. The interface is designed to be divided into 3 steps. Input your information, receive quotes, and choose your policy.

It starts by users entering personal and insurance information, so it can serve up personalized quotes from multiple companies. Because we believe in transparency, Insuranceopedia also provides expert-reviewed guides and tools, including thousands of terms, so you can make informed choices. This makes it easier to navigate unfamiliar topics while comparing providers.

Here’s what you will be asked to provide and how it influences your rates:

- ZIP Code: Determines state coverage requirements, local risk factors, and insurer availability.

- Demographics: Some insurers charge married drivers less than single ones, and premiums vary by gender and age.

- Insurance History: Rates may be affected by past coverage, past claims, or lapsed policies, and some insurers offer discounts for continuous coverage.

- Driving Record: Accidents, tickets, or DUIs influence quotes, as insurers assess risk based on past behavior.

- Vehicle Details: Make, model, and year affect rates since repair costs, safety features, and theft risk vary by car type.

Users can then compare coverage, pricing, and discounts side by side. After a user selects a policy, they are redirected to the insurer’s website to complete the purchase. However, your quotes may need more information, or you may be directed to the insurer’s site to finalize pricing. Users should also check the minimum auto insurance requirements by state, since coverage rules differ and can affect the quotes they get.

Insuranceopedia Reviews & User Ratings

Trustpilot reviews often highlight ease of use, transparency, and quote accuracy. Insuranceopedia rated 4.0 out of 5.0 from customer reviews on Trustpilot, indicating positive feedback from users who have used the platform.

Insuranceopedia Third-Party Platform Customer Ratings

| Review Platform | |

|---|---|

| 4.0 / 5.0 (4 reviews) |

Since Insuranceopedia works independently with over 100 insurers, it provides unbiased policy recommendations. Users can also get instant proof of their auto insurance policy online through certain providers, depending on the insurer’s digital capabilities.

A 4.0 rating suggests general satisfaction, but there are only four Insuranceopedia customer service reviews. Those considering it may find value in checking more reviews or firsthand experiences to get a fuller picture of its services.

The lack of customer reviews and dependence on third-party quote systems may be drawbacks for users comparing auto insurance companies.

Insuranceopedia vs. Competitors

Insuranceopedia is an independent site that makes no contractual deals with specific insurers that would influence comparisons. Founded in 2014 by Darrel Pendry and Cory Janssen, it offers expert-reviewed insurance insights, personalized policy recommendations, and detailed guides to help users choose the proper coverage.

Insuranceopedia Platform Overview

| Details | |

|---|---|

| Real-Time Quotes | Yes, offers real-time rate updates |

| Avg. Quote Time | 3–10 minutes. |

| Insurance Types Compared | Auto, home, renters, life, pet. |

| # of Providers Compared | 100+ insurers |

| Shares Contact Info | No, only with user consent |

| Customer Support | Online resources; limited direct support |

| Platform Focus | Insurance quotes & educational content |

Insuranceopedia’s quote tool personalizes recommendations based on ZIP code, demographics, insurance history, and vehicle type to assist users in securing policies that will suit their needs. Insuranceopedia simplifies the process for you by providing honest rate comparisons and industry knowledge for auto, home, and renters insurance.

Do you know the difference between collision and comprehensive car insurance?

Do you need gap coverage,or PIP?

Don’t know what we’re on about? Then check out our guide on the different types of car insurance to find out which one is right for you!https://t.co/ukTtjnVACG

— Insuranceopedia (@Insuranceopedia) October 10, 2023

What sets Insuranceopedia apart from others is the definition and explanation of insurance terms. A well-organized template of job files with obvious headers, prompts throughout for explanation, and a sidebar of insurance terms provides another key component of our mission to be an educational resource. You can also compare these features with the top competitors’ options below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Compare Insurance Sites Online

If you’re trying to figure out where to compare auto insurance rates, this side-by-side breakdown of Insuranceopedia, Insurify, and NerdWallet makes the decision easier. Insurify stands out with the highest savings potential at 30%, an average of $420 in annual savings, and the fastest quote time at just two minutes—all while comparing over 700 providers.

Insuranceopedia vs. Insurify vs. NerdWallet: Compare Top Insurance Sites

| Feature | |||

|---|---|---|---|

| Savings Potential | 17% | 30% | 20% |

| Annual Savings | $270 | $420 | $300 |

| Fastest Quote Time | 3 minutes | 2 minutes | 5 minutes |

| Providers Compared | 100+ | 700+ | 50+ |

| Customer Satisfaction | 85% | 94% | 74% |

That makes it a top choice if you want quick results and a broad range of options from a digital auto insurance broker. Insuranceopedia still offers a decent experience with 100+ provider comparisons and 85% customer satisfaction, but it trails in savings and speed.

NerdWallet comes in last here, with fewer providers (50+), a slower five-minute quote time, and lower satisfaction. So, if you’re looking for where to compare auto insurance rates efficiently, Insurify leads the pack, followed by Insuranceopedia for simpler needs.

Insuranceopedia vs. Insurify

Insuranceopedia falls short when compared to competitors like Insurify. The platform doesn’t have a presence on major review sites like the App Store, Google Play, Clearsurance, or WalletHub. Without customer ratings on major platforms, it’s hard to gauge Insuranceopedia’s user satisfaction.

Insuranceopedia vs. Insurify: Third-Party Customer Ratings

| Reviewer | ||

|---|---|---|

| NA | 3.4 / 5.0 (141 reviews) | |

| NA | A+ | |

| NA | 3.8 / 5.0 (130+ reviews) | |

| NA | 3.4 / 5.0 (141 reviews) | |

| 4.0 / 5.0 (4 reviews) | 4.7 / 5.0 (2k+ reviews) |

Insurify, on the other hand, has ratings across multiple platforms, including a 4.7/5 from over 2,000 Trustpilot reviews and a 4.1/5 on WalletHub from 70+ users. Insurify also holds an A+ rating with the Better Business Bureau, while Insuranceopedia isn’t listed.

Before choosing a policy, review coverage limits, deductibles, and exclusions, and always check for available discounts to lower your premium.Dani Best Licensed Insurance Producer

This raises questions about Insuranceopedia’s reliability. Insurify reviews show real customer engagement, while Insuranceopedia doesn’t seem to have enough verified user feedback to support its claims.

Insuranceopedia vs. NerdWallet

Insuranceopedia isn’t as competitive as NerdWallet reviews. It does not have scores on major sites such as the App Store, the Google Play store, or the BBB, where NerdWallet receives excellent marks, including a 4.8 out of 5 based on more than 115,000 reviews on the App Store and 4.5 out of 5 on nearly 30,000 Google users.

Insuranceopedia vs. Insurify vs. NerdWallet: Third-Party Customer Ratings

| Review Platform | |||

|---|---|---|---|

| NA | 3.4 / 5 141 reviews | 4.8 / 5 115k+ reviews |

|

| NA | A+ | A+ | |

| NA | 3.8 / 5 130+ reviews | 4.5 / 5 29.9k reviews |

|

| NA | 3.4 / 5 141 reviews | 4 / 5 | |

| 4 / 5 4 reviews | 4.7 / 5 2k+ reviews | 3.7 / 5 3k+ reviews |

Insuranceopedia’s only filed rating is a 4.0/5 on Trustpilot, but since it has only four reviews, that does not earn much weight. NerdWallet is also rated by PC Magazine and WalletHub, while Insuranceopedia isn’t listed on either.

Even though NerdWallet’s WalletHub rating is low at 1.5/5, at least it has a presence there. Insuranceopedia is not well-known, so it’s difficult to assess its reliability.

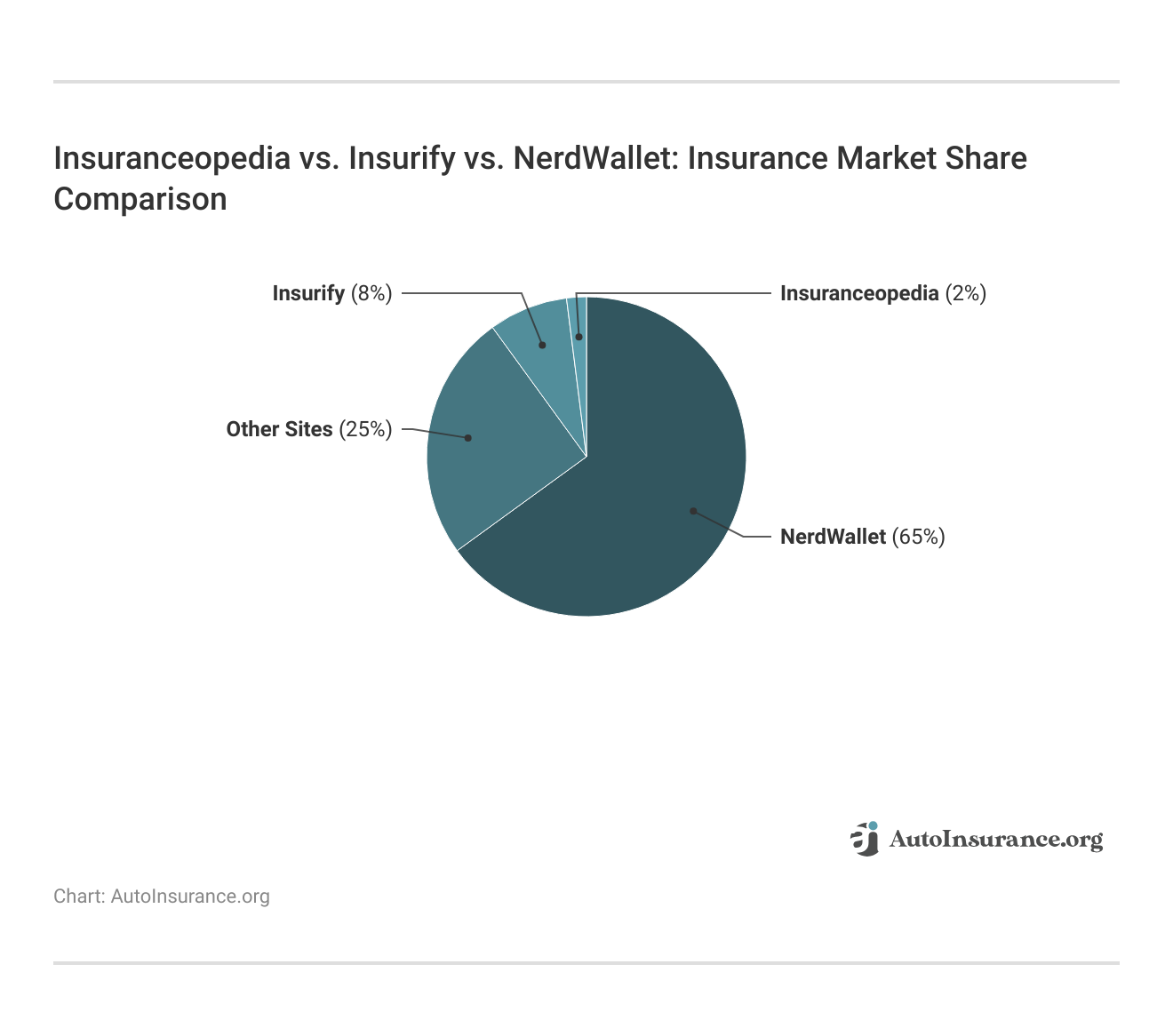

Insuranceopedia Market Share vs. Competitors

Looking at the market share comparison, it’s clear that Insuranceopedia is still growing, holding just 2% compared to NerdWallet’s 65% and Insurify’s 8%. But market share doesn’t always reflect value. Insuranceopedia still connects users with 100+ providers and helps them compare online auto insurance companies in real time.

Even lacking the kind of big-name recognition of the top two, it provides an easy-to-use interface, clear recommendations, and staff-reviewed content. If you’re more into clarity than hype when you’re partying in, where to compare auto insurance rates, Insuranceopedia remains a practical option.

Why AutoInsurance.org Outperforms Insuranceopedia

AutoInsurance.org stands out by providing access to over 60 top-rated insurance providers—more than most platforms in the industry. While Insuranceopedia connects users with around 100 carriers, many include smaller or niche providers. AutoInsurance.org focuses on established, highly rated insurers, making it easier for users to learn how to evaluate auto insurance quotes based on quality, coverage, and cost.

Use platforms with real-time quotes and satisfaction ratings—they cut the steps, save time, and help you avoid paying too much for coverage.Rachel Bodine Feature Writer

With real-time comparisons, a 98% user satisfaction rate, and average savings of $540 per year on full coverage, the platform offers a faster, more reliable way to compare options than Insuranceopedia, without added steps or redirects.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Insuranceopedia: A Trusted Tool for Comparing Insurance Quotes

Our Insuranceopedia reviews show that it lets users easily compare insurance quotes from trusted providers, with up-to-the-minute rates and expert-trusted insight. With fewer customer reviews, users have less feedback compared to larger competitors.

However, Insuranceopedia’s PolicyAI tool aims to bridge this gap by helping users identify missing coverage, overpayments, and ways to rectify them.

Those looking to research auto insurance companies should take advantage of our free quote comparison tool to compare rates from multiple providers without having to visit any provider websites.

Insuranceopedia offers a transparent, unbiased experience, but AutoInsurance.org offers 25% more coverage options per request. Enter your ZIP code to see better rates.

Frequently Asked Questions

What is Insuranceopedia?

Insuranceopedia is an online resource that provides detailed explanations of insurance terms, policies, and industry trends. It helps consumers and businesses understand how different types of insurance work, compare providers, and make informed decisions about coverage.

How does Insuranceopedia work?

Insuranceopedia gathers and simplifies complex insurance information. It provides definitions, policy comparisons, and expert advice to help users make informed choices. While it doesn’t sell insurance directly, it connects users with insurance providers.

Is Insuranceopedia free to use?

Yes, Insuranceopedia is completely free to use. It has articles, glossaries, and comparisons, free of charge, so people can learn and understand insurance without having to pay a subscription fee. Find other ways to get free online auto insurance quotes.

How does AutoInsurance.org help users save on full coverage insurance?

AutoInsurance.org helps users save an average of $540 per year on full coverage by comparing personalized quotes from multiple top-rated insurers in real time. Instead of manually visiting each provider, users can view side-by-side pricing, coverage details, and discount options in under two minutes, making it easier to spot the most cost-effective policy without compromising on protection.

How does Insuranceopedia make money?

Insuranceopedia earns revenue through advertising, partnerships with insurance providers, and referral commissions when users click on links to insurers or request quotes. However, this does not impact the accuracy of the information it provides.

Are my details safe with Insuranceopedia?

Yes, Insuranceopedia does not collect or store personal insurance details. If you choose to get quotes through linked providers, your data is handled by those insurance companies, following their privacy policies. If you’re worried about your data online, learn how to get an auto insurance quote without giving personal information.

Is Insuranceopedia an insurance carrier?

No, Insuranceopedia is not an insurance carrier. It does not perform underwriting or issue policies. Rather, it is an education and comparison platform to help users gain an understanding of and compare insurance options.

Ready to find the perfect plan? Our free tool delivers instant quotes and maintains a 98% user satisfaction rate. Enter your ZIP code to compare top insurers now.

What does an insurance company do?

Insurance companies provide financial protection by offering policies that pay to cover potential losses, such as car accidents, healthcare treatment, or property damage. They collect premiums from policyholders and pay out claims when covered events occur, ensuring financial security for customers.

Does Insuranceopedia sell insurance?

No, Insuranceopedia does not sell insurance policies. It provides information to help users compare providers and explore coverage options. To purchase or manage your auto insurance policy, you’ll need to work directly with the insurer.

Where is Insuranceopedia headquartered?

Insuranceopedia HQ is in Dover, Delaware. For support or inquiries, users can contact Insuranceopedia at +1 780-702-1416 or via email at [email protected].

How long does it take to get quotes with Insuranceopedia?

Getting a quote takes about 3 to 5 minutes from start to finish. You’ll enter your ZIP code, vehicle or property details, and personal information. While Insuranceopedia shows initial rates quickly, you must visit the insurer’s website to finalize pricing and complete the application, which adds extra time compared to platforms like Insurify.

What are the benefits of having auto insurance?

What are the benefits of car insurance? Insurance provides financial coverage, risk management, and tackles unforeseen costs. It guarantees that if you have an accident, get sick, or suffer property damage, you won’t have to cover the full cost out of your own pocket. Many policies also provide liability coverage, protecting you against lawsuit claims.

Does Insuranceopedia work with all providers?

No. Insuranceopedia connects users with over 100 insurance companies, but it does not include all providers in the market. Major national carriers are often included, but the platform may exclude smaller regional insurers or specialized carriers. If you’re looking for quotes from a specific company, it’s best to confirm whether they’re listed during the quote process.

What insurance coverage types can Insuranceopedia help me with?

Insuranceopedia supports quote comparisons for auto, home, and renters insurance. Within these categories, users can compare standard policy options like liability, comprehensive, and collision coverage for auto insurance, or dwelling and personal property coverage for homeowners. It does not currently support life, health, or commercial insurance.

What is the simplest way to explain insurance?

Insurance is an agreement where you pay a monthly or yearly premium, and in return, the company helps cover financial losses based on your policy. If you’re in an at-fault accident, your coverage may pay for damages, medical expenses, or liability costs, depending on your policy terms.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.